Market Overview

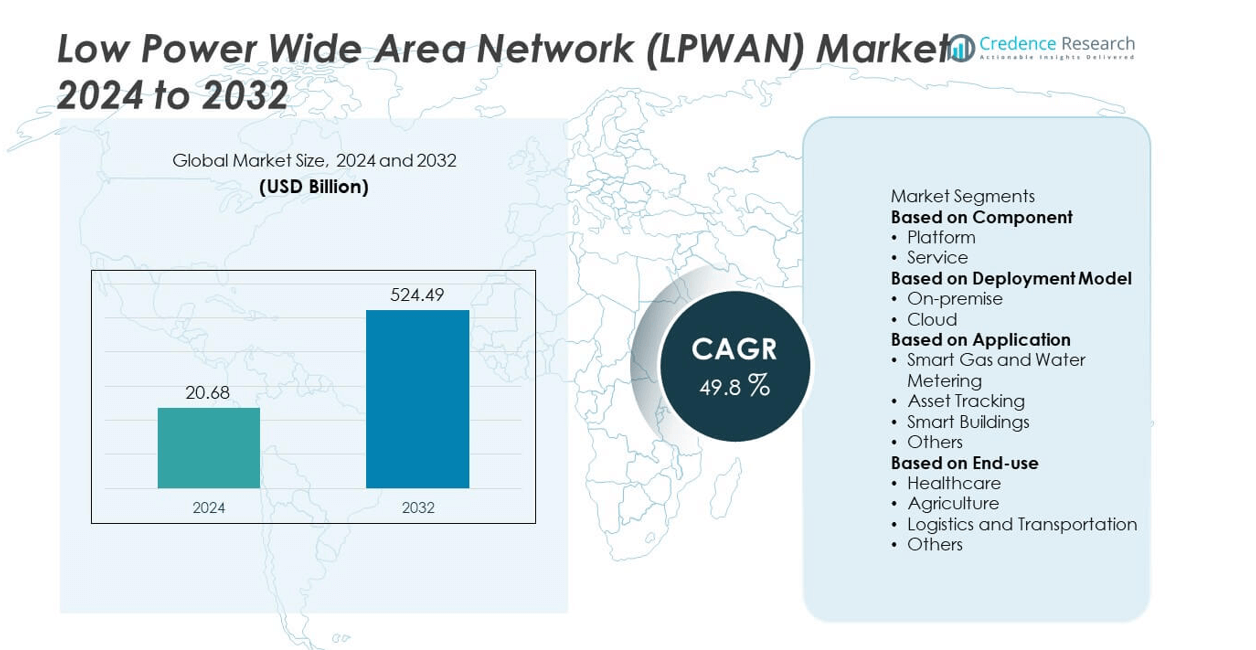

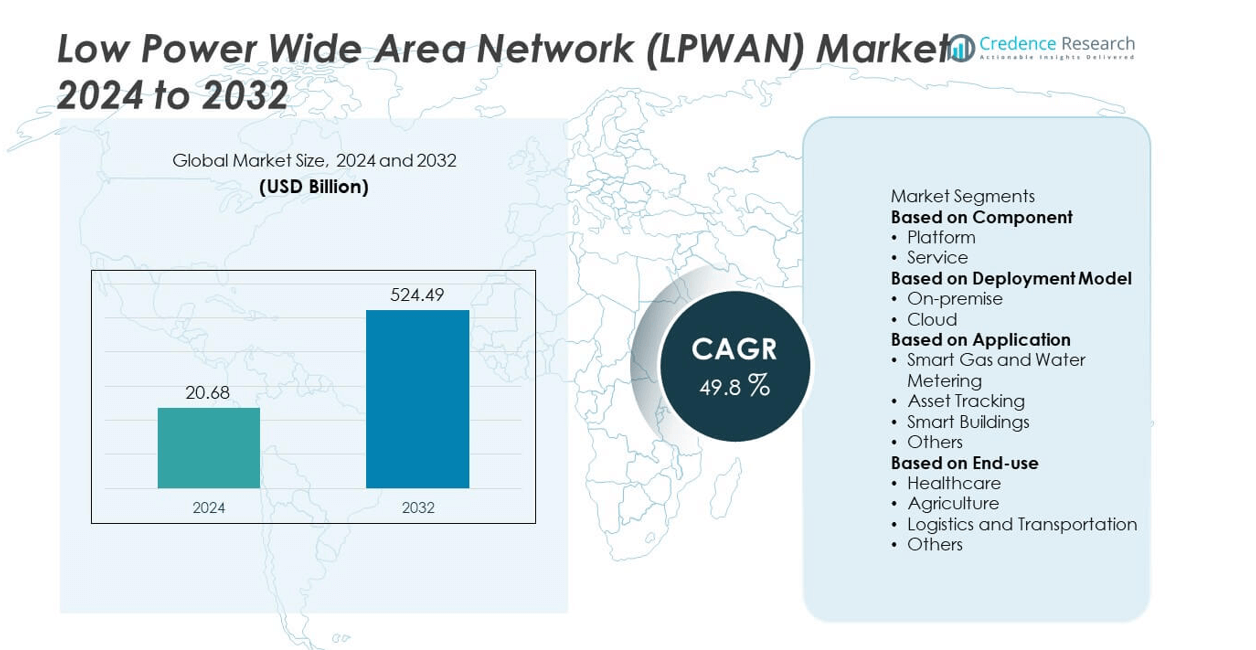

Low Power Wide Area Network (LPWAN) Market size was valued at USD 20.68 billion in 2024 and is projected to reach USD 524.49 billion by 2032, growing at a CAGR of 49.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Low Power Wide Area Network (LPWAN) Market Size 2024 |

USD 20.68 billion |

| Low Power Wide Area Network (LPWAN) Market, CAGR |

49.8% |

| Low Power Wide Area Network (LPWAN) Market Size 2032 |

USD 524.49 billion |

The Low Power Wide Area Network (LPWAN) Market grows through rising IoT adoption across industries, expanding demand for smart city solutions, and increasing need for cost-efficient connectivity in rural and urban areas. Enterprises deploy LPWAN for asset tracking, smart metering, and predictive maintenance, benefiting from its low power use and wide coverage.

The Low Power Wide Area Network (LPWAN) Market demonstrates strong global presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads adoption with advanced telecom infrastructure, rapid deployment of IoT devices, and strong investments in smart city projects. Europe follows with emphasis on sustainability, digital transformation, and regulatory support for smart utilities and industrial IoT. Asia-Pacific grows rapidly, driven by urbanization, government-backed smart initiatives, and cost-effective deployments in China, India, and Japan. Latin America and the Middle East & Africa show gradual adoption supported by agriculture, utilities, and rural connectivity programs. Key players influencing the market include Huawei Technologies Co., Ltd., Cisco Systems, Inc., Actility, and Vodafone Group Plc, all of which focus on expanding LPWAN coverage, developing hybrid connectivity models, and forming strategic partnerships.

Market Insights

- The Low Power Wide Area Network (LPWAN) Market was valued at USD 20.68 billion in 2024 and is projected to reach USD 524.49 billion by 2032, growing at a CAGR of 49.8%.

- Rising IoT adoption across industries such as utilities, logistics, agriculture, and healthcare drives strong demand for LPWAN due to its wide coverage and low power consumption.

- Key trends include hybrid connectivity models, energy-efficient protocols, and growing integration of LPWAN in consumer IoT, smart cities, and industrial automation.

- Leading players such as Huawei Technologies Co., Ltd., Cisco Systems, Inc., Actility, Vodafone Group Plc, and Qualcomm Technologies, Inc. dominate the competitive landscape, focusing on partnerships, network expansion, and R&D investment.

- Market restraints include fragmented standards, interoperability issues, and security concerns, which limit adoption across enterprises requiring consistent and secure large-scale solutions.

- North America leads adoption with strong infrastructure and smart city projects, Europe emphasizes sustainability and industrial IoT, while Asia-Pacific emerges as the fastest-growing region with government-backed initiatives and large-scale deployments.

- Long-term opportunities lie in rural connectivity, precision agriculture, environmental monitoring, and digital inclusion programs across Latin America and the Middle East & Africa, ensuring sustainable growth and wider LPWAN adoption globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for IoT Connectivity Across Industries

The Low Power Wide Area Network (LPWAN) Market grows with rising adoption of IoT devices across industries. Utilities, agriculture, healthcare, and logistics deploy IoT to monitor assets, automate operations, and improve efficiency. LPWAN provides long-range connectivity with low power consumption, making it suitable for sensors and devices operating in remote areas. Companies seek cost-efficient communication networks that balance scalability and coverage. The ability of LPWAN to support large device volumes strengthens its relevance in industrial IoT ecosystems. It ensures LPWAN remains a key enabler of IoT-driven digital transformation.

- For instance, Vodafone IoT supports over 215 million global IoT connections across more than 180 countries, using NB-IoT and LTE‑M technologies under a unified IoT platform.

Strong Adoption in Smart City Projects and Infrastructure Development

The Low Power Wide Area Network (LPWAN) Market benefits from rapid growth in smart city initiatives worldwide. Governments and municipalities implement LPWAN-based solutions for smart lighting, waste management, traffic control, and environmental monitoring. The technology supports low-cost deployment and long battery life, aligning with citywide infrastructure requirements. Smart energy grids also leverage LPWAN for real-time data collection and demand management. Vendors collaborate with public authorities to expand coverage and optimize urban infrastructure. It reinforces LPWAN’s role in building smarter, sustainable cities.

- For instance, Actility’s ThingPark platform powers national-scale smart city networks such as the one used by Swiss Post in Switzerland, which is operated by Swisscom. The network supports devices with battery life extending beyond 10 years per sensor and offers a communication range exceeding 15 km in suburban areas.

Expansion of Industrial Automation and Asset Tracking Solutions

The Low Power Wide Area Network (LPWAN) Market advances with growing demand for industrial automation and asset tracking. Manufacturing plants adopt LPWAN-enabled sensors for predictive maintenance and process optimization. Logistics and supply chain operators use it for real-time tracking of shipments and fleet management. Energy companies deploy LPWAN in remote monitoring of pipelines and utility infrastructure. Long-range communication with low power needs reduces costs in industries with dispersed assets. It accelerates adoption across enterprises seeking operational efficiency.

Cost-Effective Connectivity for Emerging Markets and Rural Applications

The Low Power Wide Area Network (LPWAN) Market expands with demand for affordable connectivity in emerging economies. Rural areas require long-range communication for agriculture, water management, and remote healthcare applications. LPWAN provides cost-effective solutions compared to cellular networks, making it attractive for underserved regions. Telecom operators and startups invest in LPWAN infrastructure to capture new markets. Governments support initiatives aimed at digital inclusion and rural development. It creates significant opportunities for LPWAN deployment in low-infrastructure regions.

Market Trends

Growing Integration of LPWAN in Smart Devices and Consumer Applications

The Low Power Wide Area Network (LPWAN) Market shows strong integration into smart devices and consumer applications. Wearables, connected appliances, and personal health trackers rely on low-power networks for efficiency. LPWAN extends battery life while ensuring reliable connectivity, supporting mass adoption in cost-sensitive markets. Vendors design compact modules to simplify integration into consumer products. Expanding use of smart homes and connected lifestyles reinforces this trend. It positions LPWAN as a vital backbone for consumer IoT ecosystems.

- For instance, NB‑IoT standards—supported by Vodafone—are engineered to support battery life beyond 10 years for IoT devices, based on optimized uplink single-tone transmission and power-saving modes.

Expansion of Hybrid Connectivity Models

The Low Power Wide Area Network (LPWAN) Market evolves with rising adoption of hybrid connectivity models. Enterprises combine LPWAN with cellular, Wi-Fi, and satellite technologies to address varied coverage needs. Hybrid solutions enable seamless transition between networks, enhancing reliability for mission-critical applications. Industrial sectors value hybrid deployments to manage both urban and remote operations. Operators invest in multi-network platforms to meet customer demand for flexibility. It strengthens LPWAN’s role as part of a broader, integrated connectivity landscape.

- For instance, LEO satellite networks deliver latency as low as 20–50 milliseconds, which is comparable to terrestrial fiber for certain long-distance scenarios. The integration of LEO satellites with Low-Power Wide-Area Network (LPWAN) technologies for hybrid communication architectures is accurate, particularly for extending IoT connectivity into remote areas.

Rising Deployment in Agriculture and Environmental Monitoring

The Low Power Wide Area Network (LPWAN) Market benefits from deployment in precision agriculture and environmental monitoring. Farmers use LPWAN-enabled sensors for soil health, irrigation, and livestock tracking. Environmental agencies adopt it for monitoring air quality, water levels, and natural resources. Low power consumption and wide coverage support long-term outdoor deployments. These solutions improve decision-making and reduce resource wastage. It highlights LPWAN as a scalable technology for sustainable agriculture and environmental protection.

Focus on Energy Efficiency and Long-Term Device Lifecycle

The Low Power Wide Area Network (LPWAN) Market advances with focus on energy efficiency and extended device lifecycle. Developers design solutions capable of supporting devices for up to ten years without battery replacement. Energy-efficient protocols enhance the appeal of LPWAN in industries seeking long-term cost savings. Enterprises reduce maintenance costs while improving device reliability. This trend aligns with sustainability targets by minimizing electronic waste. It ensures LPWAN maintains a competitive advantage in large-scale IoT deployments.

Market Challenges Analysis

Interoperability Issues and Fragmented Standards

The Low Power Wide Area Network (LPWAN) Market faces challenges from fragmented standards and interoperability concerns. Multiple technologies such as LoRaWAN, Sigfox, and NB-IoT compete, creating uncertainty for enterprises choosing long-term solutions. Lack of standardization limits seamless integration across devices and platforms. Companies deploying LPWAN infrastructure often face compatibility issues that increase costs and delay projects. Smaller enterprises may hesitate to invest without assurance of scalability and cross-platform functionality. It creates a barrier to widespread adoption across industries with diverse connectivity requirements.

Security Concerns and Limited Data Capacity

The Low Power Wide Area Network (LPWAN) Market also encounters challenges linked to security and data handling capabilities. LPWAN technologies prioritize low power and wide coverage, but often compromise on encryption and real-time data transfer. Vulnerabilities in authentication and network access expose enterprises to cyber risks. Limited bandwidth and data capacity restrict LPWAN use in applications that require high-speed or large-volume transmission. These technical limitations reduce adoption in sectors with critical data requirements. It highlights the need for continuous improvements in network security and performance optimization.

Market Opportunities

Expansion Through Smart Infrastructure and Industrial IoT

The Low Power Wide Area Network (LPWAN) Market offers strong opportunities through smart infrastructure and industrial IoT adoption. Smart cities, utilities, and logistics industries increasingly deploy LPWAN to support large networks of connected devices. Governments invest in LPWAN-enabled solutions for smart metering, traffic control, and waste management. Industrial automation benefits from long-range, low-power connectivity for predictive maintenance and asset monitoring. Vendors that deliver scalable and secure solutions gain a competitive advantage. It positions LPWAN as a key enabler of next-generation digital infrastructure.

Growth Potential in Rural Connectivity and Emerging Economies

The Low Power Wide Area Network (LPWAN) Market also benefits from rising demand in rural areas and emerging markets. Agriculture, healthcare, and water management rely on LPWAN for cost-effective, long-distance communication. Telecom operators expand infrastructure in underserved regions to capture new users and address the digital divide. Governments promote digital inclusion programs that leverage LPWAN as an affordable alternative to cellular networks. Startups in emerging economies adopt LPWAN to develop localized IoT solutions for community needs. It creates sustainable opportunities by ensuring accessible connectivity in low-resource environments.

Market Segmentation Analysis:

By Component

The Low Power Wide Area Network (LPWAN) Market divides into hardware, services, and connectivity. Hardware, including gateways, modules, and sensors, holds a significant share due to increasing IoT deployments across industries. Connectivity solutions grow steadily as operators expand LPWAN infrastructure to support rising data traffic. Services such as consulting, integration, and managed solutions gain traction among enterprises seeking efficient deployments. Vendors focus on offering end-to-end solutions that combine devices, connectivity, and support. It ensures comprehensive adoption of LPWAN across multiple industries.

- For instance, Cisco’s 8-channel LoRaWAN gateway (model IXM-LPWA-800-16-K9) is powered via PoE+ or 48 VDC and operates with a maximum power draw of 30 Watts while delivering receiver sensitivity up to –139.5 dBm.

By Deployment Model

The Low Power Wide Area Network (LPWAN) Market operates through public, private, and hybrid deployment models. Public networks dominate due to wide coverage and cost advantages, making them suitable for large-scale smart city projects. Private networks expand quickly as enterprises demand greater control, security, and customization. Hybrid models emerge as flexible solutions that combine public reach with private reliability. These deployment models address diverse requirements ranging from consumer IoT to industrial automation. It strengthens LPWAN’s position in supporting both mass-market and enterprise applications.

- For instance, Actility’s ThingPark Enterprise All-in-One (TAO) gateway supports up to 300 devices in autonomous deployments, with seamless migration capability to full-scale ThingPark Enterprise environments.

By Application

The Low Power Wide Area Network (LPWAN) Market demonstrates wide application across smart cities, industrial IoT, agriculture, healthcare, logistics, and utilities. Smart cities represent a major segment, with LPWAN supporting solutions in lighting, traffic, and waste management. Industrial IoT applications adopt LPWAN for predictive maintenance, asset tracking, and process monitoring. Agriculture benefits from cost-effective monitoring of soil, crops, and livestock in remote areas. Healthcare adopts LPWAN for patient tracking, telemedicine, and remote diagnostics. Utilities leverage it for smart metering and grid management to enhance efficiency. Logistics firms rely on LPWAN for supply chain visibility and fleet tracking. It ensures adoption across diverse sectors seeking reliable long-range and low-power connectivity.

Segments:

Based on Component

Based on Deployment Model

Based on Application

- Smart Gas and Water Metering

- Asset Tracking

- Smart Buildings

- Others

Based on End-use

- Healthcare

- Agriculture

- Logistics and Transportation

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Low Power Wide Area Network (LPWAN) Market, accounting for 35% in 2024. The region benefits from advanced telecom infrastructure, early adoption of IoT technologies, and significant investments in 5G and LPWAN integration. The United States drives demand through widespread deployment in smart city projects, logistics, and industrial IoT. Canada contributes with strong adoption in utilities and agriculture, where LPWAN supports smart metering and precision farming. Regulatory support and collaboration between telecom operators and technology providers accelerate infrastructure development. It positions North America as a leader in deploying LPWAN for large-scale IoT ecosystems.

Europe

Europe represents the second-largest region in the Low Power Wide Area Network (LPWAN) Market, with a 30% share in 2024. Strong regulatory frameworks, environmental goals, and smart city initiatives drive deployment across the region. Countries such as Germany, the United Kingdom, and France lead adoption, focusing on logistics, utilities, and connected healthcare. The European Union’s emphasis on digitalization and sustainability enhances LPWAN demand for energy management and environmental monitoring. Partnerships between operators and public agencies expand coverage and accelerate innovation. Eastern Europe also shows steady growth as industries modernize and adopt IoT-driven solutions. It reinforces Europe’s position as a hub for LPWAN innovation and deployment.

Asia-Pacific

Asia-Pacific accounts for 25% of the Low Power Wide Area Network (LPWAN) Market in 2024 and emerges as the fastest-growing region. Rapid urbanization, rising disposable incomes, and large-scale IoT adoption fuel expansion across China, India, Japan, and South Korea. China leads with strong government support for smart city projects and industrial automation. India demonstrates significant potential through rural connectivity programs and agriculture-focused deployments. Local telecom operators and startups drive competitive growth by offering cost-efficient LPWAN solutions. The region’s strong manufacturing base supports large-scale adoption of LPWAN-enabled devices. It establishes Asia-Pacific as a critical growth engine for global LPWAN adoption.

Latin America

Latin America contributes 6% share to the Low Power Wide Area Network (LPWAN) Market in 2024. Brazil and Mexico dominate regional adoption, with growing use in utilities, agriculture, and logistics. Governments implement digital inclusion initiatives that encourage LPWAN deployment in rural and underserved areas. Expansion of e-commerce and digital banking increases demand for secure and scalable connectivity. Economic constraints limit adoption in some countries, but partnerships with global operators support gradual infrastructure development. It creates opportunities for steady growth in both urban and rural applications across the region.

Middle East & Africa

The Middle East & Africa region holds 4% of the Low Power Wide Area Network (LPWAN) Market in 2024. Gulf countries such as the UAE and Saudi Arabia lead with strong investments in smart city projects and industrial IoT. Africa demonstrates rising demand for LPWAN in agriculture, healthcare, and water management applications. Limited infrastructure challenges adoption, but mobile-first economies create opportunities for affordable LPWAN deployments. Governments support digital transformation initiatives that strengthen long-term growth potential. It highlights the region as an emerging market with steady expansion in both enterprise and public applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

Competitive landscape of the Low Power Wide Area Network (LPWAN) Market is shaped by Huawei Technologies Co., Ltd., Cisco Systems, Inc., Actility, Vodafone Group Plc, AT&T Inc., Orange Business Services, Qualcomm Technologies, Inc., Avnet, Inc., LORIOT.IO, and WavIoT. These companies drive market growth through large-scale infrastructure investments, strategic partnerships, and technology innovations. They focus on expanding LPWAN coverage for smart cities, industrial IoT, and rural connectivity by offering scalable, low-cost solutions. Innovation in hybrid models that integrate LPWAN with cellular and satellite networks strengthens reliability for mission-critical applications. Vendors also invest in energy-efficient protocols and security enhancements to address interoperability and data protection concerns. Strategic collaborations with governments and enterprises accelerate adoption in agriculture, utilities, healthcare, and logistics. Competitive intensity remains high as global players expand through mergers, acquisitions, and joint ventures, while regional startups introduce cost-effective deployments. It ensures continuous innovation and positions LPWAN as a critical foundation for next-generation IoT ecosystems.

Recent Developments

- In May 2025, Actility released ThingPark Network Coverage Tool v2.1, enhancing LoRaWAN RF planning. Users can now add gateways directly on a map, activate gateways for simulation, and leverage terrain-aware modeling to identify coverage gaps.

- In November 2024, AT&T announced it would decommission its NB‑IoT network in early 2025, pausing new device certifications and moving enterprise IoT connectivity to LTE‑M networks instead.

- In April 2024, Huawei entered a global licensing agreement with EDMI, granting access to cellular IoT standard-essential patents (SEPs) including NB-IoT, LTE-M, and LTE Cat 1, supporting broader LPWAN deployment.

- In October 2023, Avnet was named the master distributor for Kerlink in Asia-Pacific, empowering system integrators to deploy full LoRaWAN solutions or build/manage their own networks

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment Model, Application, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of LPWAN will expand with rapid IoT deployment across industries.

- Smart city projects will drive large-scale demand for LPWAN-enabled infrastructure.

- Hybrid connectivity models combining LPWAN with cellular and satellite will gain momentum.

- Agriculture will see broader adoption of LPWAN for precision farming and livestock monitoring.

- Industrial IoT will rely on LPWAN for predictive maintenance and asset management.

- Energy-efficient protocols will enhance device lifecycle and reduce operational costs.

- Asia-Pacific will remain the fastest-growing region with strong government-backed initiatives.

- Security enhancements will become a priority to address vulnerabilities in LPWAN networks.

- Rural connectivity programs will accelerate adoption in underserved regions.

- Continuous innovation by global and regional players will expand LPWAN applications.