| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Vehicle Plastics Market Size 2024 |

USD 4,600.0 million |

| Electric Vehicle Plastics Market, CAGR |

25.30% |

| Electric Vehicle Plastics Market Size 2032 |

USD 27,949.0 million |

Market Overview

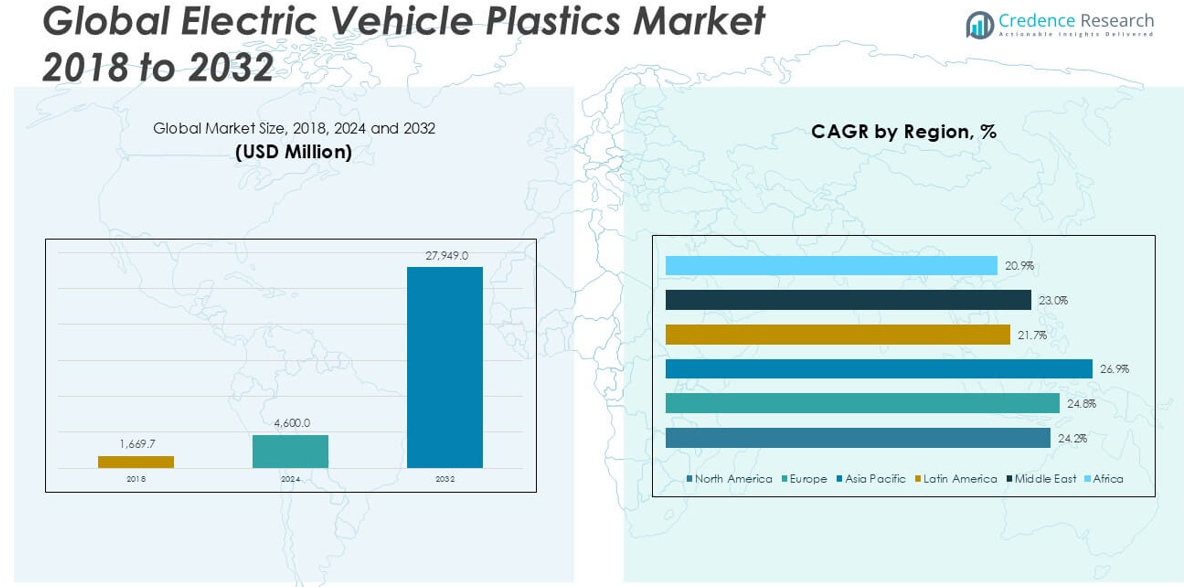

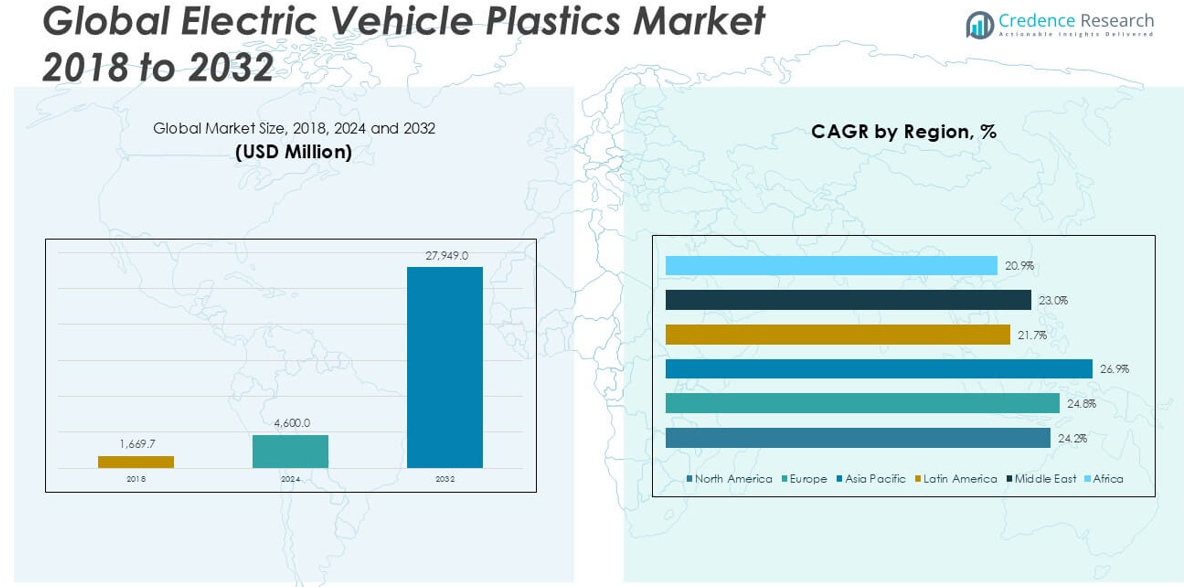

The Electric Vehicle Plastics market size was valued at USD 1,669.7 million in 2018, reached USD 4,600.0 million in 2024, and is anticipated to reach USD 27,949.0 million by 2032, at a CAGR of 25.30% during the forecast period.

The Electric Vehicle Plastics market is led by prominent players such as BASF SE, Covestro AG, SABIC, LG Chem, LyondellBasell Industries N.V., Dow Inc., and DuPont de Nemours, Inc. These companies dominate the market through extensive product portfolios, global manufacturing capabilities, and continuous innovation in lightweight and high-performance plastic solutions. Asia Pacific emerges as the leading region, commanding a 40.2% market share in 2024, driven by rapid electric vehicle production, strong government support, and the presence of major automotive hubs in China, Japan, and South Korea. Europe and North America follow, holding 28.2% and 21.9% market shares respectively, supported by stringent emission regulations and rising EV adoption rates. Key players focus on partnerships with automakers, material advancements, and expanding regional operations to sustain their competitive edge and capture growth opportunities across these dominant markets.

Market Insights

- The Electric Vehicle Plastics market was valued at USD 1,669.7 million in 2018, reached USD 4,600.0 million in 2024, and is expected to reach USD 27,949.0 million by 2032, growing at a CAGR of 25.30% during the forecast period.

- Increasing demand for lightweight vehicles to enhance electric vehicle efficiency and driving range is a major driver boosting the adoption of plastics across vehicle components.

- The market is witnessing trends such as growing use of bio-based and recyclable plastics, along with rising demand for customized and aesthetic vehicle interiors using advanced plastic materials.

- Key players like BASF SE, Covestro AG, SABIC, and LG Chem dominate the competitive landscape, focusing on product innovation, sustainable solutions, and collaborations with leading automakers.

- Asia Pacific holds the largest regional share at 40.2% in 2024, while polypropylene (PP) leads the material segment due to its lightweight, versatile applications in electric vehicle interiors and power systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

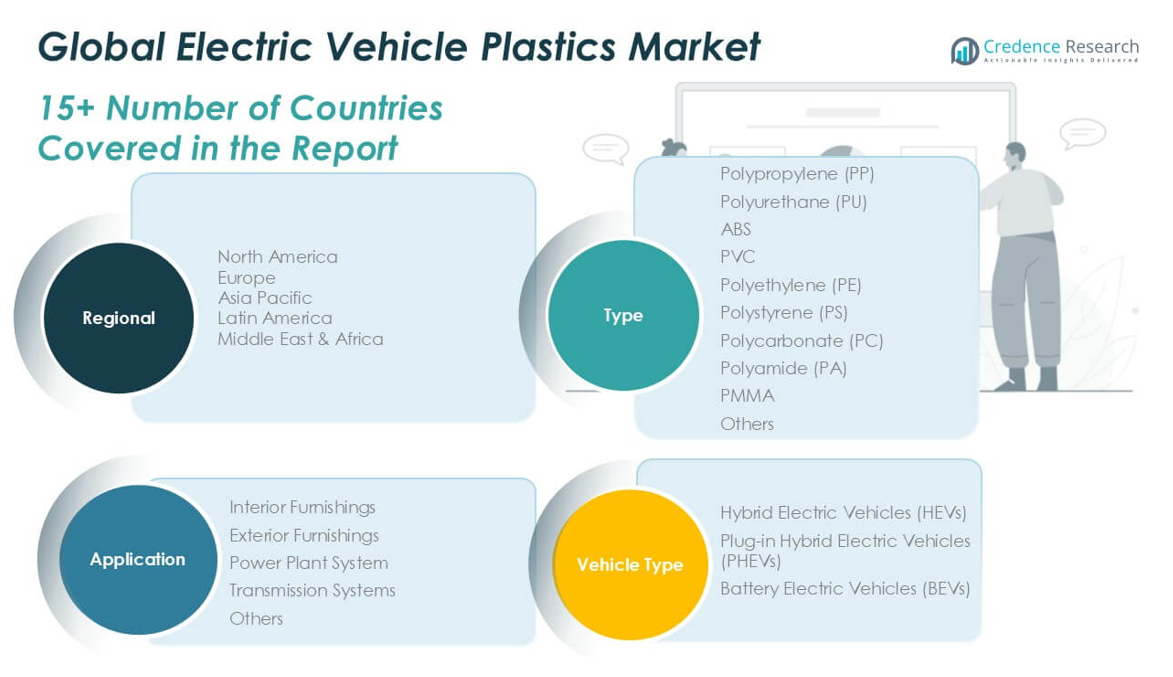

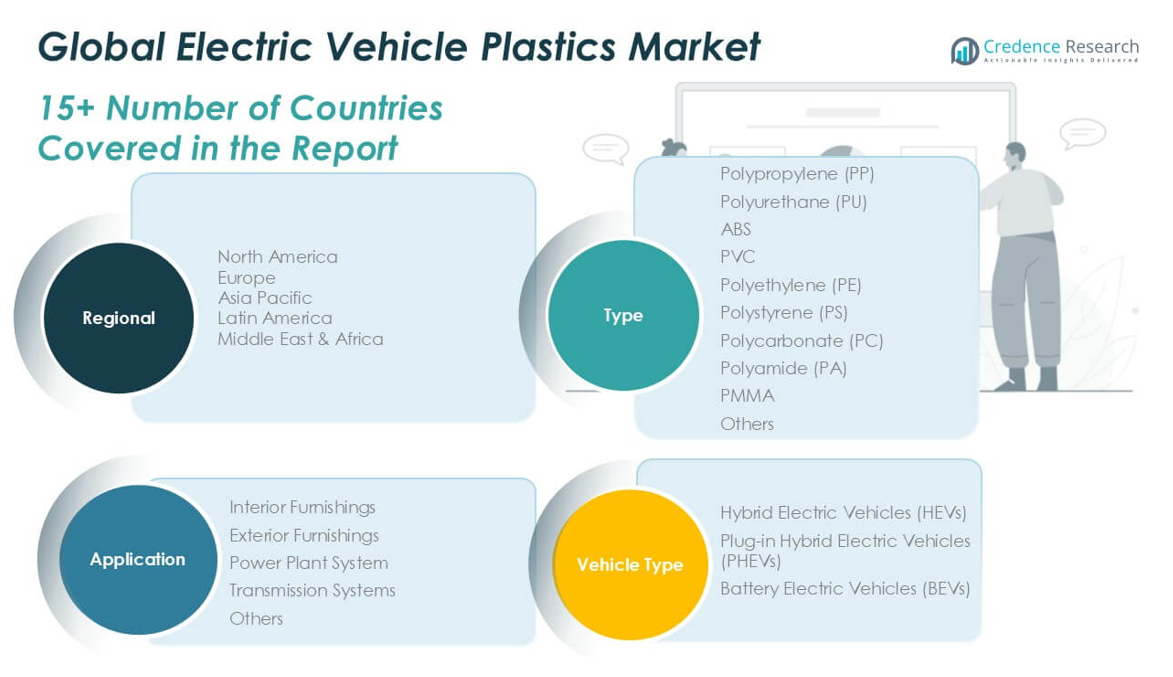

By Material Type

In the Electric Vehicle Plastics market, Polypropylene (PP) holds the largest market share among material types due to its excellent chemical resistance, lightweight properties, and cost-effectiveness. PP is widely used in interior components and battery casings, enhancing overall vehicle efficiency by reducing weight. The growing demand for electric vehicles with higher energy efficiency continues to drive the adoption of PP. Other materials such as ABS and Polyurethane (PU) are also gaining traction due to their durability and flexibility, but PP remains the dominant choice because of its versatile applications and superior weight-to-strength ratio.

- For instance, Borealis’s Daplen EE137AI PP compound used in dashboards and trim shows a density of 0.960 g/cm³ with a melt flow rate of 12 g/10 min, enabling strong surface finish and reduced weight

By Application

Interior Furnishings dominate the Electric Vehicle Plastics market by application, capturing the largest revenue share. Automakers increasingly focus on lightweight interiors to improve vehicle range and energy consumption, which boosts the demand for plastics in dashboards, door panels, and seat components. The use of plastic in interiors not only reduces weight but also allows for complex designs and improved aesthetics. Exterior furnishings and power plant systems follow, but interior applications remain the leading segment due to the growing consumer preference for enhanced vehicle comfort, functionality, and the customization potential offered by advanced plastic materials.

- For instance, Covestro’s Makrofol DE 1‑1 000000 polycarbonate film, at 300 µm thickness and density 1.20 g/cm³, supports high-optical-quality dashboards and backlit panels with tensile modulus ≥ 2200 MPa.

By Vehicle Type

Within the Electric Vehicle Plastics market, Battery Electric Vehicles (BEVs) represent the dominant vehicle type, holding the largest market share. The surge in BEV production, driven by strict emission regulations and increasing investments in battery technologies, significantly contributes to this growth. BEVs require extensive use of lightweight plastics to offset battery weight and maximize vehicle efficiency and range. Hybrid Electric Vehicles (HEVs) and Plug-in Hybrid Electric Vehicles (PHEVs) also contribute to the market, but BEVs lead due to their growing consumer adoption, expanded charging infrastructure, and strong policy support promoting zero-emission transportation.

Market Overview

Growing Demand for Lightweight Vehicles

The increasing need for lightweight vehicles to enhance energy efficiency and driving range is a significant growth driver in the Electric Vehicle Plastics market. Plastics substantially reduce vehicle weight compared to metals, allowing electric vehicles to achieve longer ranges per charge. Automakers are actively replacing traditional materials with high-performance plastics in both structural and aesthetic components. This shift aligns with global sustainability goals and regulatory pressures to lower carbon emissions, encouraging the widespread adoption of lightweight plastic materials across various electric vehicle platforms.

- For instance, Borealis increased polypropylene compound capacity at its Shanghai facility from 50,000 to 125,000 tonnes annually, supporting lightweight interior part production.

Rapid Expansion of Electric Vehicle Production

The global expansion of electric vehicle production directly fuels the demand for electric vehicle plastics. Leading automotive manufacturers are ramping up EV output to meet emission targets and consumer preferences for sustainable mobility. This production surge increases the need for plastic components in battery systems, interiors, exteriors, and powertrains. The versatility and cost-efficiency of plastics support large-scale manufacturing without compromising on safety and design. As EV adoption accelerates globally, the demand for advanced plastic solutions is expected to rise consistently throughout the forecast period.

- For instance, Borealis and Borouge’s joint venture boosted polypropylene compounding capacity in Taylorsville, USA, by 66 million pounds annually, responding to North American EV plant growth.

Advancements in Plastic Technologies

Innovations in plastic processing and material development contribute significantly to market growth. The introduction of high-performance engineering plastics that offer superior heat resistance, mechanical strength, and recyclability expands their application in critical EV components. Advanced composites and bio-based plastics are gaining attention for their environmental benefits and enhanced functional properties. These technological advancements enable the use of plastics in more demanding areas such as battery housings and under-the-hood components, driving broader material acceptance across the electric vehicle sector.

Key Trends & Opportunities

Shift Toward Bio-based and Recyclable Plastics

There is a growing trend toward the adoption of bio-based and recyclable plastics in the electric vehicle industry. Automakers and suppliers are focusing on sustainable materials to meet environmental regulations and consumer expectations for eco-friendly products. This shift presents an opportunity for plastic manufacturers to develop innovative, sustainable solutions that align with the automotive industry’s carbon-neutral goals. The increasing emphasis on circular economy practices further strengthens the demand for recyclable and renewable plastic materials in EV production.

- For instance, Borealis’ circular PP compounds like those with 10 % recycled post-consumer content maintain density around 0.960 g/cm³ while delivering similar mechanical properties to virgin grades.

Increased Focus on Aesthetic and Functional Customization

The rising demand for aesthetic appeal and functional customization in electric vehicles is creating opportunities for plastic applications. Plastics offer superior design flexibility, allowing manufacturers to deliver personalized interiors, integrated electronic systems, and complex geometries that enhance user experience. The ability to easily mold, color, and texture plastics supports the creation of unique, premium-feel components. This trend aligns with consumer preferences for smart, stylish, and ergonomic vehicle designs, further boosting the role of plastics in the EV market.

- For instance, Covestro’s Makrolon 3103 polycarbonate grade, featuring a density of 1.20 g/cm³, tensile strength of 63 MPa, and elongation at break of 125%, supports the creation of lightweight, UV-stable interior trims with integrated touch-sensitive features and complex curves.

Key Challenges

Volatility in Raw Material Prices

Fluctuating raw material prices pose a major challenge in the Electric Vehicle Plastics market. Plastics production heavily depends on petrochemical derivatives, which are sensitive to crude oil price variations. Sudden spikes in oil prices can significantly increase production costs, affecting profit margins for manufacturers and pricing stability across the supply chain. Managing this volatility requires robust procurement strategies and may necessitate a shift toward bio-based alternatives to mitigate long-term cost risks.

Stringent Environmental Regulations

The Electric Vehicle Plastics market faces increasing pressure from stringent environmental regulations concerning plastic waste and lifecycle emissions. Governments worldwide are imposing stricter recycling mandates and limiting single-use plastics, which may impact material selection and manufacturing processes in the automotive industry. Compliance with these evolving regulations demands significant investment in sustainable material development and recycling infrastructure, posing operational and financial challenges for plastic manufacturers and EV producers.

Performance Limitations Under Extreme Conditions

Despite their advantages, some plastic materials face performance limitations under extreme temperature and mechanical stress conditions, which can restrict their application in critical EV components. Issues such as thermal degradation, reduced impact resistance, and potential fire hazards can compromise safety and durability. Overcoming these material weaknesses requires continuous research and the development of high-performance, heat-resistant plastics that can meet the demanding requirements of modern electric vehicles without compromising reliability.

Regional Analysis

North America

North America accounted for approximately 21.9% market share in 2024, with the market growing from USD 392.4 million in 2018 to USD 975.2 million in 2024. It is projected to reach USD 5,142.6 million by 2032, registering a CAGR of 24.2% during the forecast period. The region’s growth is driven by strong government support for electric vehicle adoption and the presence of leading automotive manufacturers focusing on sustainability. Increasing investment in EV charging infrastructure and a rising consumer shift toward electric mobility further support the expansion of the electric vehicle plastics market in North America.

Europe

Europe captured around 28.2% market share in 2024, with the market size increasing from USD 484.2 million in 2018 to USD 1,278.8 million in 2024. The market is expected to reach USD 7,154.9 million by 2032, growing at a CAGR of 24.8%. The region benefits from stringent emission regulations, favorable EV policies, and significant advancements in lightweight vehicle technologies. European automakers’ strong focus on sustainability, coupled with rising consumer preference for electric vehicles, boosts the demand for electric vehicle plastics. Rapid innovation in recyclable and bio-based plastic materials also accelerates market growth across Europe.

Asia Pacific

Asia Pacific dominates the global market with a 40.2% market share in 2024, expanding from USD 637.8 million in 2018 to USD 1,849.2 million in 2024. It is projected to reach USD 12,381.4 million by 2032, at the highest CAGR of 26.9%. The region’s growth is driven by China, Japan, and South Korea, where electric vehicle production and consumption are rapidly increasing. Government subsidies, rising environmental awareness, and technological advancements in lightweight plastics support market expansion. Asia Pacific’s large manufacturing base and aggressive investments in electric mobility solidify its position as the leading region in the electric vehicle plastics market.

Latin America

Latin America holds around 3.0% market share in 2024, with the market growing from USD 33.4 million in 2018 to USD 138.0 million in 2024. It is forecasted to reach USD 1,062.1 million by 2032, at a CAGR of 21.7%. Market growth is supported by increasing government efforts to promote electric vehicle adoption and the gradual development of EV infrastructure in key countries such as Brazil and Mexico. Although the region lags in large-scale EV manufacturing, rising environmental concerns and supportive policies are expected to steadily boost the demand for electric vehicle plastics in the coming years.

Middle East

The Middle East represents approximately 6.3% market share in 2024, with the market size growing from USD 100.2 million in 2018 to USD 289.8 million in 2024. The market is expected to reach USD 1,872.6 million by 2032, growing at a CAGR of 23.0%. The region’s growth is supported by increasing diversification efforts away from oil dependency, government initiatives to introduce sustainable transportation, and rising consumer interest in electric vehicles. Countries such as the UAE and Saudi Arabia are leading in EV adoption, which positively influences the demand for lightweight plastic materials in the automotive sector.

Africa

Africa accounts for 1.5% market share in 2024, with the market expanding from USD 21.7 million in 2018 to USD 69.0 million in 2024. It is projected to reach USD 335.4 million by 2032, registering a CAGR of 20.9%. The market in Africa is at a nascent stage but shows potential growth driven by increasing awareness of sustainable transportation and government efforts to reduce carbon emissions. Limited EV infrastructure and affordability issues present challenges; however, international investments and partnerships are expected to gradually support the electric vehicle market, enhancing the demand for plastics in vehicle manufacturing.

Market Segmentations:

By Material Type

- Polypropylene (PP)

- Polyurethane (PU)

- ABS

- PVC

- Polyethylene (PE)

- Polystyrene (PS)

- Polycarbonate (PC)

- Polyamide (PA)

- PMMA

- Others

By Application

- Interior Furnishings

- Exterior Furnishings

- Power Plant System

- Transmission Systems

- Others

By Vehicle Type

- Hybrid Electric Vehicles (HEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

- Battery Electric Vehicles (BEVs)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Electric Vehicle Plastics market is characterized by the presence of several global players actively focusing on product innovation, strategic partnerships, and capacity expansion to strengthen their market position. Key companies such as BASF SE, Covestro AG, SABIC, LG Chem, and LyondellBasell Industries N.V. dominate the market with diverse product portfolios and strong regional footprints. These companies are investing heavily in developing high-performance, lightweight, and recyclable plastic materials to meet the rising demand for sustainable electric vehicle components. Collaborations with electric vehicle manufacturers and advancements in material technologies are central to their growth strategies. Players like Dow Inc., DuPont de Nemours, Inc., and Evonik Industries AG are also enhancing their capabilities to offer tailored solutions for interior, exterior, and powertrain applications. Competitive intensity is further driven by the entry of regional players and the growing focus on bio-based plastics, prompting key participants to continuously innovate and expand their global reach.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Covestro AG

- SABIC

- LG Chem

- LyondellBasell Industries N.V.

- Dow Inc.

- DuPont de Nemours, Inc.

- Evonik Industries AG

- Lanxess AG

- Borealis AG

- Celanese Corporation

- Asahi Kasei Corporation

- Mitsui Chemicals, Inc.

- DSM Engineering Materials

Recent Developments

- In June 2025, At the K 2025 trade fair, Covestro emphasized its commitment to circularity and climate neutrality, presenting high-performance, recyclable plastics for automotive and e-mobility applications. Innovations included a concept e-shuttle vehicle utilizing full polycarbonate glazing and lightweight, durable mono-materials like Arfinio® and TPU. Covestro’s new materials are designed to enable sustainable, high-performance automotive solutions and support digitalization in product development through tools like IMAGIO®, which allows digital sampling of materials.

- In May 2025, BASF showcased a comprehensive suite of innovative technologies for electromobility at The Battery Show Europe 2025. Their focus included advanced plastics for electrified powertrains and digital battery passports based on Catena-X, supporting sustainable automotive mobility. BASF highlighted its broad portfolio of tailor-made cathode active materials (CAM) for batteries—such as NCA, NCM, and LCO chemistries alongside battery recycling solutions and sustainable sourcing of base metals. These materials are designed to improve EV battery efficiency, reliability, and lifespan, while also supporting circularity in the automotive industry.

- In March 2025, BASF signed a long-term agreement with Braven Environmental for the supply of PyChem®, an advanced recycled feedstock produced from mixed plastic waste using proprietary pyrolysis technology. This feedstock will partially replace fossil resources in BASF’s ChemCycling® process, enabling the production of plastics with recycled content for demanding automotive applications, including EV components. The resulting products, labeled “Ccycled®,” offer identical properties to conventional plastics, facilitating their use in high-performance automotive parts

Market Concentration & Characteristics

The Electric Vehicle Plastics Market shows moderate to high market concentration, with several key global players holding significant market shares. It is characterized by the presence of well-established chemical companies that offer a broad range of high-performance plastic solutions tailored for electric vehicles. The market relies heavily on technological advancements to develop lightweight, durable, and heat-resistant plastics that support electric vehicle efficiency. Product differentiation, material innovation, and long-term partnerships with automotive manufacturers define the competitive landscape. It demonstrates strong entry barriers due to high initial investment costs, complex production processes, and the need for advanced R&D capabilities. Demand for recyclable and bio-based plastics is increasing, influencing product strategies across the industry. The market shows steady consolidation through mergers, acquisitions, and capacity expansions as companies aim to strengthen their global supply chains. It is driven by stringent environmental regulations and a growing consumer shift toward sustainable and energy-efficient vehicles, which directly shape its competitive dynamics.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Application, Vehicle Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Electric Vehicle Plastics Market is expected to grow steadily driven by rising electric vehicle production worldwide.

- Demand for lightweight plastic components will continue to increase to support vehicle range improvement.

- Bio-based and recyclable plastics will gain wider acceptance due to sustainability goals and regulatory pressures.

- Advanced plastics with improved heat resistance and mechanical strength will see growing application in battery and powertrain systems.

- Interior customization and demand for aesthetic vehicle designs will drive the use of versatile plastic materials.

- Asia Pacific will maintain its leading regional position supported by high electric vehicle adoption in China and Japan.

- Europe and North America will witness significant growth due to strict emission norms and strong consumer demand for electric vehicles.

- Key players will focus on research and development to create innovative materials and maintain competitive advantage.

- Strategic partnerships between plastic manufacturers and electric vehicle producers will increase to ensure supply chain efficiency.

- Investment in recycling infrastructure and circular economy practices will become a major priority for market participants.