Market Overview

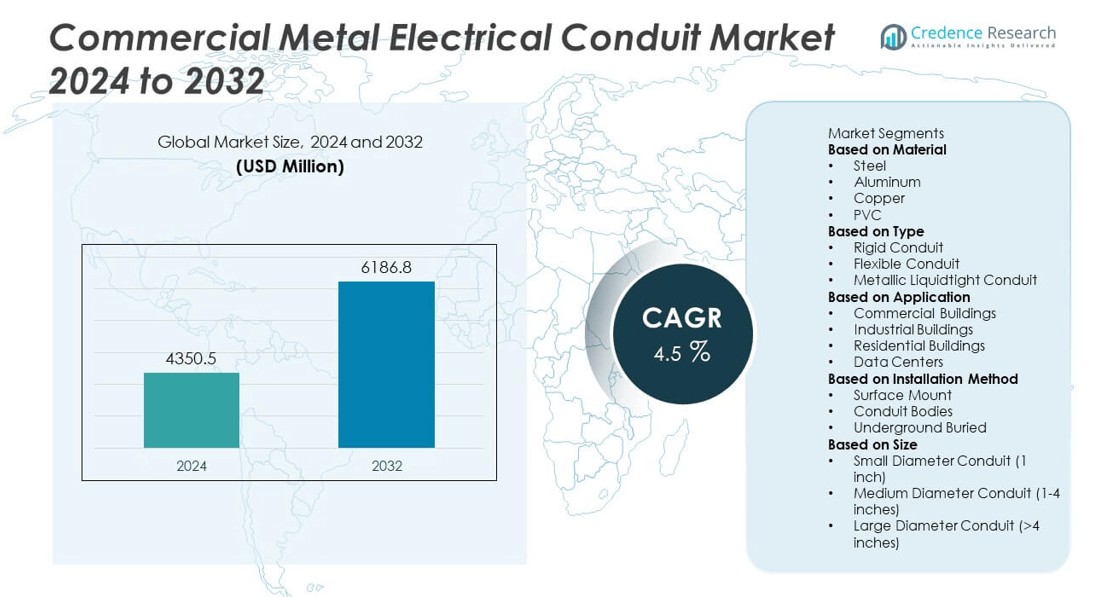

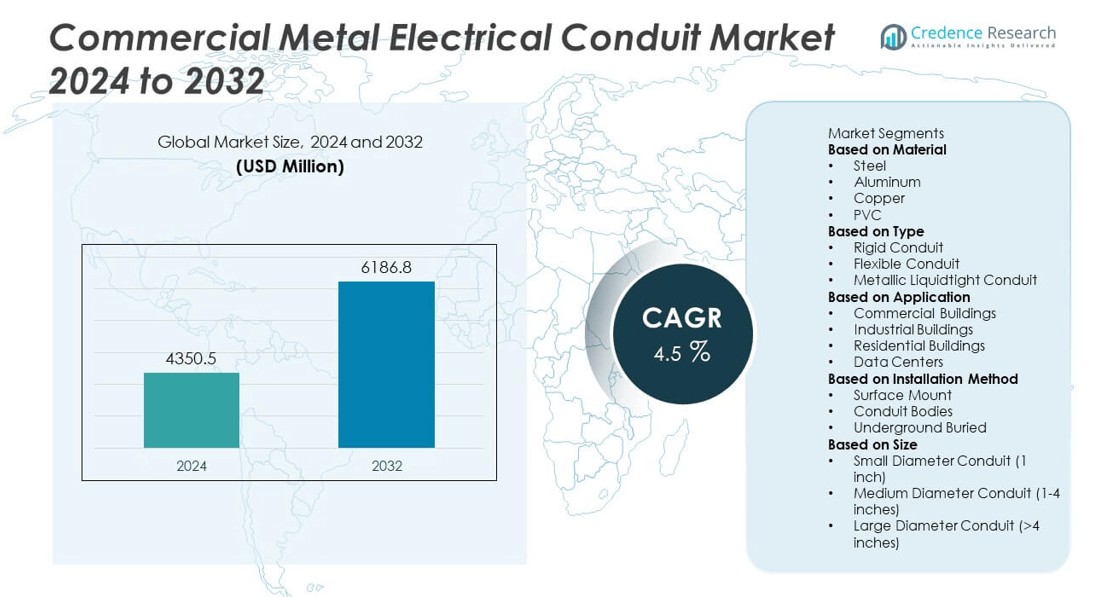

The Commercial Metal Electrical Conduit Market was valued at USD 4,350.5 million in 2024 and is projected to reach USD 6,186.8 million by 2032, growing at a CAGR of 4.5% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Commercial Metal Electrical Conduit Market Size 2024 |

USD 4,350.5 million |

| Commercial Metal Electrical Conduit Market, CAGR |

4.5% |

| Commercial Metal Electrical Conduit Market Size 2032 |

USD 6,186.8 million |

The Commercial Metal Electrical Conduit Market grows steadily, driven by rising commercial construction, strict safety regulations, and increasing demand for durable, fire-resistant electrical infrastructure. Expansion in smart buildings and data centers fuels the need for advanced conduit systems capable of supporting complex wiring and high-speed data networks. Technological advancements, including lightweight aluminum designs and corrosion-resistant coatings, enhance installation efficiency and longevity.

The Commercial Metal Electrical Conduit Market shows strong growth potential across diverse regions, driven by varying infrastructure needs and regulatory environments. Asia-Pacific leads in demand due to rapid urbanization, extensive commercial construction, and investments in smart city projects, particularly in China, India, and Japan. North America sees steady adoption, supported by strict electrical codes, large-scale retrofitting projects, and expansion in data centers. Europe focuses on sustainable building practices and modernization of commercial infrastructure, with strong demand in Germany, the UK, and France. The Middle East and Africa witness increased usage in large infrastructure and hospitality developments, while Latin America benefits from urban infrastructure upgrades. Key players shaping the market include Schneider Electric SE, Eaton Corporation plc, Nexans S.A., and Prysmian S.p.A., each leveraging innovation, material advancements.

Market Insights

- The Commercial Metal Electrical Conduit Market was valued at USD 4,350.5 million in 2024 and is projected to reach USD 6,186.8 million by 2032, growing at a CAGR of 4.5% during the forecast period.

- Rising commercial construction, infrastructure expansion, and strict electrical safety regulations drive market demand for durable, fire-resistant, and compliant conduit systems.

- The market trends toward lightweight aluminum conduits, corrosion-resistant coatings, and recyclable materials, aligning with green building practices and improving installation efficiency.

- Leading players such as Schneider Electric SE, Eaton Corporation plc, Nexans S.A., and Prysmian S.p.A. compete through innovation, advanced material development, and strategic partnerships to strengthen their market presence.

- High installation costs, material price volatility, and competition from non-metallic conduits restrain market growth, particularly in cost-sensitive projects.

- Asia-Pacific leads demand due to rapid urbanization, large-scale commercial projects, and smart city initiatives; North America grows with retrofits, data center construction, and strict NEC compliance.

- Europe focuses on sustainable building practices and modernization of commercial infrastructure, while the Middle East, Africa, and Latin America see growth from infrastructure investments and urban redevelopment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Increasing Construction Activities Drive Demand for Metal Electrical Conduits

The Commercial Metal Electrical Conduit Market benefits significantly from the surge in commercial construction projects worldwide. Rapid urbanization and infrastructure development in emerging economies boost the need for reliable electrical wiring solutions. Metal conduits offer durability and enhanced protection against mechanical damage, making them the preferred choice for commercial buildings. It supports stringent safety codes and electrical standards that require robust conduit systems to safeguard wiring. Growing investments in commercial real estate and smart building technologies further propel demand for advanced conduit products. The market gains momentum from the expansion of office complexes, retail centers, and industrial facilities.

- For instance, ANAMET Electrical’s Sealtite Type UA liquid-tight flexible metal conduit is a robust and versatile solution for protecting electrical wiring, certified for safety and durability. It’s UL 360 and CSA certified, achieving IP66/67 protection when paired with compatible fittings, and is available in sizes from 3/8″ to 4″.

Stringent Safety and Regulatory Standards Enhance Market Growth

Safety regulations and building codes play a pivotal role in shaping the Commercial Metal Electrical Conduit Market. Regulatory bodies mandate the use of metal conduits in many applications to prevent fire hazards and electrical faults. It ensures that electrical installations meet strict fire resistance and durability criteria, enhancing overall building safety. The market experiences rising adoption due to increasing awareness of electrical safety and compliance requirements across regions. Compliance with national and international standards encourages contractors and engineers to specify metal conduits in new and retrofit projects. This regulatory emphasis fosters market growth and innovation in conduit design.

- For instance, Wheatland Tube’s SmartCompression™ EMT conduit complies with UL-797 and UL-514B, follows ANSI C80.3 standards, and delivers precise mechanical specifications—its 2-inch EMT features a 0.065-inch wall thickness, 2.197-inch outer diameter, 2.067-inch inner diameter, and a nominal weight of 1.400 lb per foot (a 500-foot master bundle weighs 723 lb).

Technological Advancements in Conduit Manufacturing Boost Market Appeal

Technological improvements in manufacturing processes increase the efficiency and performance of metal electrical conduits. The Commercial Metal Electrical Conduit Market benefits from innovations such as corrosion-resistant coatings, lightweight alloys, and modular conduit systems. These advancements reduce installation time and maintenance costs while enhancing longevity and resistance to harsh environmental conditions. It supports evolving commercial infrastructure demands that require flexible and durable wiring solutions. Manufacturers continue to invest in R&D to introduce conduits with superior mechanical strength and ease of handling. Such innovations strengthen the market’s competitive edge.

Growing Demand for Energy-Efficient and Sustainable Solutions

The shift toward sustainable construction practices influences the Commercial Metal Electrical Conduit Market. Energy-efficient building designs incorporate metal conduits to support advanced electrical and communication systems. It offers recyclability and environmental benefits compared to plastic alternatives, aligning with green building certifications. The market witnesses increased adoption of eco-friendly conduit materials and manufacturing methods. Demand rises from commercial projects aiming to reduce carbon footprints and comply with environmental regulations. Sustainable solutions in conduit systems contribute to long-term operational efficiency and lower environmental impact, encouraging wider market acceptance.

Market Trends

Rising Adoption of Lightweight and Corrosion-Resistant Metal Conduits

The Commercial Metal Electrical Conduit Market experiences a shift toward lightweight materials and corrosion-resistant coatings to meet evolving construction demands. Manufacturers develop aluminum and stainless-steel conduits that offer enhanced durability while reducing overall system weight. It supports easier installation and lowers transportation costs, benefiting large-scale commercial projects. The trend reflects industry efforts to improve conduit lifespan in harsh environments, including coastal and industrial areas. Growing preference for maintenance-free solutions drives innovation in protective finishes and material blends. This movement strengthens the market’s appeal among contractors and engineers focusing on long-term operational efficiency.

- For instance, Wheatland Tube’s Rigid Aluminum Conduit (RAC) delivers the same protective strength as steel yet weighs just one‑third as much per unit length, significantly easing lifting and handling during installation.

Integration of Smart Technologies and IoT in Electrical Infrastructure

Smart building initiatives fuel demand for advanced conduit systems capable of supporting sophisticated wiring and sensor networks. The Commercial Metal Electrical Conduit Market adapts to increased requirements for IoT-enabled devices and automation within commercial facilities. It accommodates complex electrical architectures by providing reliable pathways for data and power cables. Manufacturers focus on conduits compatible with high-speed communication lines and flexible configurations. The trend enhances building safety, energy management, and operational control. Market players invest in designing conduits that integrate seamlessly with smart systems, catering to modern infrastructure needs.

- For instance, Legrand’s Wiremold® OFR Series Overfloor Raceway offers a four‑channel configuration for power, communications, and A/V connectivity in a low‑profile, ADA‑compliant format, enabling rapid configuration changes in commercial workspaces.

Growth of Prefabricated and Modular Conduit Solutions

Prefabrication and modular construction methods influence the Commercial Metal Electrical Conduit Market by promoting faster installation and reduced on-site labor. It benefits from preassembled conduit sections and modular fittings that simplify complex wiring layouts. This trend aligns with the construction industry’s push toward efficiency, cost control, and improved project timelines. Prefabricated conduit systems offer consistent quality and reduce errors during installation. The market witnesses increased collaboration between conduit manufacturers and construction firms to develop tailored modular products. Such innovations boost acceptance in commercial projects with tight schedules and demanding specifications.

Expansion of Retrofitting and Renovation Projects in Commercial Buildings

The Commercial Metal Electrical Conduit Market sees growing activity in retrofitting older commercial structures to comply with updated electrical codes and safety standards. It addresses the need to upgrade legacy wiring systems with modern conduit solutions that improve fire resistance and durability. Retrofitting supports the integration of energy-efficient lighting, HVAC, and security systems in existing buildings. Market participants develop flexible conduit designs that adapt to confined spaces and complex layouts typical in renovation projects. The trend underscores the importance of extending building lifecycles while enhancing electrical infrastructure performance. Increasing urban redevelopment drives steady demand in this segment.

Market Challenges Analysis

High Installation Costs and Complex Handling Limit Market Growth

The Commercial Metal Electrical Conduit Market faces challenges related to the high installation costs associated with metal conduits compared to non-metal alternatives. Metal conduits require specialized tools and skilled labor for cutting, bending, and fitting, which increases overall project expenses. It complicates installation in tight or confined spaces, leading to longer project timelines and higher labor costs. The weight of metal conduits also demands more robust support structures, further adding to costs. These factors discourage some contractors from opting for metal solutions, especially in projects with tight budgets or fast schedules. Overcoming these installation complexities remains a key challenge for wider market adoption.

Competition from Non-Metallic Conduits and Material Availability Concerns

The Commercial Metal Electrical Conduit Market contends with strong competition from plastic and composite conduits that offer lightweight, corrosion-resistant, and cost-effective alternatives. It limits growth potential, particularly in applications where corrosion resistance is prioritized over mechanical strength. Fluctuations in raw material prices, especially steel and aluminum, create uncertainty in production costs and supply chain stability. This volatility impacts pricing strategies and profitability for manufacturers. Furthermore, regulatory changes promoting sustainable materials encourage the use of non-metallic conduits in some regions. Addressing these challenges requires metal conduit producers to innovate and improve cost efficiency while maintaining performance standards.

Market Opportunities

Rising Demand for Sustainable and Recyclable Materials in Electrical Infrastructure

The Commercial Metal Electrical Conduit Market finds substantial opportunity in the growing emphasis on sustainability within the construction sector. It benefits from metal conduits’ recyclability and environmental advantages over plastic alternatives, aligning with green building certifications such as LEED and BREEAM. Increasing adoption of eco-friendly construction materials encourages architects and contractors to specify metal conduits in new commercial projects. The market can leverage this trend by developing conduits with higher recycled content and lower carbon footprints. This focus on sustainability supports long-term growth while meeting regulatory and client demands for environmentally responsible infrastructure solutions.

Expansion of Smart Buildings and Advanced Commercial Facilities

The shift toward smart buildings equipped with integrated automation and IoT systems creates significant growth avenues for the Commercial Metal Electrical Conduit Market. It supports the complex wiring and data transmission needs of intelligent lighting, HVAC controls, security, and communication networks. Demand rises for conduits designed to accommodate fiber optic cables and high-speed data lines. The market can capitalize on this by innovating modular and flexible conduit systems tailored for smart commercial environments. Collaborations with technology providers to create conduit solutions compatible with emerging building automation standards open new revenue streams and market segments.

Market Segmentation Analysis:

By Material

The Commercial Metal Electrical Conduit Market segments by material into steel, aluminum, and others such as stainless-steel alloys. Steel conduits hold a prominent share due to their high mechanical strength, durability, and cost-effectiveness in heavy-duty applications. Galvanized steel options provide corrosion resistance, extending service life in demanding environments. Aluminum conduits gain traction for their lightweight nature, which simplifies handling and reduces installation time without compromising strength. It supports projects where weight reduction is critical, such as high-rise commercial buildings. Stainless steel conduits, though costlier, offer superior corrosion resistance and are used in environments with extreme conditions, including coastal facilities and chemical plants. The variety of material options allows the market to cater to diverse project requirements and environmental conditions.

- For instance, Wheatland Tube’s 2-inch galvanized steel RMC, manufactured per ANSI C80.1, features a 0.146-inch wall thickness, 2.375-inch OD, and weighs 3.632 lb/ft, offering both high mechanical protection and tested corrosion resistance exceeding 650 hours in ASTM B117 salt spray testing.

By Type

By type, the Commercial Metal Electrical Conduit Market includes rigid metal conduit (RMC), intermediate metal conduit (IMC), and electrical metallic tubing (EMT). RMC is the heaviest and thickest option, offering maximum protection for wiring against physical damage and environmental exposure. IMC provides a lighter yet strong alternative, often chosen to reduce installation costs while maintaining high performance. EMT, known for its thin walls and easy bending capability, is widely used in indoor commercial installations where flexibility and quick assembly are priorities. It allows faster project completion without sacrificing compliance with electrical codes. Each type serves a distinct function, enabling contractors to select the most suitable option for project-specific needs.

- For instance, Wheatland Tube’s 1-inch EMT, certified to UL-797 and manufactured to ANSI C80.3, features a 0.057-inch wall thickness, 1.163-inch outside diameter, and weighs 0.675 lb/ft, with a 10-ft length bundle weighing 6.75 lb—specifications that ensure both mechanical integrity and ease of bending for rapid commercial installations.

By Application

The Commercial Metal Electrical Conduit Market serves applications in commercial buildings, industrial facilities, infrastructure projects, and others such as data centers and transportation hubs. Commercial buildings, including offices, shopping complexes, and hotels, rely on metal conduits for safe, concealed wiring that meets fire and safety codes. Industrial facilities use heavy-duty conduits to protect electrical systems from mechanical damage, moisture, and corrosive substances. Infrastructure projects such as airports, railways, and stadiums require robust conduit networks to handle high power loads and complex wiring layouts. It also supports specialized environments like data centers, where secure and organized cable management is essential. The diversity of applications reflects the market’s adaptability to both conventional and high-tech commercial installations.

Segments:

Based on Material

- Steel

- Aluminum

- Copper

- PVC

Based on Type

- Rigid Conduit

- Flexible Conduit

- Metallic Liquidtight Conduit

Based on Application

- Commercial Buildings

- Industrial Buildings

- Residential Buildings

- Data Centers

Based on Installation Method

- Surface Mount

- Conduit Bodies

- Underground Buried

Based on Size

- Small Diameter Conduit (1 inch)

- Medium Diameter Conduit (1-4 inches)

- Large Diameter Conduit (>4 inches)

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

Asia-Pacific

Asia-Pacific holds the largest share of the Commercial Metal Electrical Conduit Market, accounting for approximately 38% of global demand. Rapid urbanization, large-scale infrastructure projects, and expansion in commercial real estate across China, India, Japan, and Southeast Asian nations drive strong demand for durable and safe electrical conduit systems. The region benefits from high investments in smart city developments, transportation infrastructure, and industrial facilities, all of which require advanced electrical installations. It gains momentum from stringent safety regulations in countries like Japan and Australia, which mandate the use of fire-resistant and corrosion-protected conduit systems in commercial applications. Growing adoption of sustainable materials, combined with the rise in modular and prefabricated construction, further boosts the demand for metal conduits in the region.

North America

North America accounts for around 25% of the Commercial Metal Electrical Conduit Market. The United States and Canada lead demand, supported by ongoing upgrades to commercial infrastructure and strong adherence to National Electrical Code (NEC) requirements. High adoption of advanced conduit materials, such as stainless steel and aluminum, supports energy-efficient and sustainable building practices. It benefits from steady investments in renovation and retrofitting projects across offices, retail complexes, and educational institutions. Growth in data center construction, driven by increasing digitalization, fuels demand for secure cable management solutions. The presence of leading conduit manufacturers in the region ensures consistent product innovation and high-quality standards.

Europe

Europe holds about 20% of the Commercial Metal Electrical Conduit Market share. Strict enforcement of EU building regulations and fire safety standards promotes the use of high-quality metal conduits in commercial and industrial projects. Countries such as Germany, the United Kingdom, and France lead market demand, with significant investments in energy-efficient commercial buildings and public infrastructure. It benefits from the adoption of corrosion-resistant and recyclable conduit materials that align with the region’s sustainability goals. The growing emphasis on modernizing historical commercial structures also creates steady opportunities for retrofit projects. Europe’s advanced manufacturing base ensures the availability of precision-engineered conduit solutions tailored to regional needs.

Middle East & Africa

The Middle East & Africa collectively contribute around 10% to the Commercial Metal Electrical Conduit Market. Rapid development of commercial hubs in the UAE, Saudi Arabia, and South Africa drives demand for robust electrical conduit systems capable of withstanding extreme environmental conditions. Large-scale projects, including airports, hotels, and business districts, require heavy-duty conduits for safety and durability. It benefits from government-led infrastructure investment programs and rising adoption of international safety standards. The market also sees potential in retrofitting older commercial spaces to improve electrical safety.

Latin America

Latin America represents approximately 7% of the Commercial Metal Electrical Conduit Market. Brazil, Mexico, and Argentina lead demand, supported by expanding commercial real estate and modernization of urban infrastructure. It benefits from regulatory measures that encourage safer electrical installations in public and private commercial spaces. Growth in manufacturing and logistics facilities further increases the need for reliable conduit solutions. Rising foreign investments in commercial projects across key cities accelerate the adoption of durable, fire-resistant, and environmentally friendly conduit systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- NIBE Industrier AB

- Eaton Corporation plc

- Luvata Oy

- Legrand S.A.

- Anamet Electrical Inc.

- Prysmian S.p.A.

- Orbis Corporation

- Schneider Electric SE

- Nexans S.A.

- TE Connectivity Ltd.

Competitive Analysis

The competitive landscape of the Commercial Metal Electrical Conduit Market includes leading players such as Orbis Corporation, Anamet Electrical Inc., Schneider Electric SE, Nexans S.A., TE Connectivity Ltd., NIBE Industrier AB, Luvata Oy, Prysmian S.p.A., Eaton Corporation plc, and Legrand S.A. These companies compete by leveraging advanced manufacturing capabilities, global distribution networks, and product innovations to meet diverse commercial and industrial requirements. Schneider Electric SE and Eaton Corporation plc focus on expanding their conduit portfolios with high-performance, corrosion-resistant, and energy-efficient solutions that align with modern building codes and sustainability goals. Nexans S.A. and Prysmian S.p.A. emphasize their expertise in cable and wiring infrastructure, offering integrated conduit and cabling systems for streamlined installations. TE Connectivity Ltd. and Anamet Electrical Inc. deliver specialized conduit systems designed for high-demand environments, such as industrial facilities and data centers, ensuring durability and compliance. NIBE Industrier AB and Luvata Oy focus on material advancements, introducing conduits with improved mechanical strength and recyclability. Legrand S.A. and Orbis Corporation strengthen their positions through strategic acquisitions, product diversification, and innovation in modular and prefabricated conduit systems.

Recent Developments

- In May 2025, Schneider Electric, in collaboration with Microsoft, unveiled its industrial “copilot” powered by Generative AI at Automate 2025. This AI assistant, integrated with the EcoStruxure Automation Expert platform, aims to improve system agility, simplify application development, and boost productivity.

- In April 2025, Eaton finalized its acquisition of Fibrebond, a move aimed at bolstering its presence in the growing multi-tenant data center market.

- In February 2025, Eaton Corporation plc announced a major investment of $340 million to establish a new state-of-the‑art transformer manufacturing facility in Jonesville, South Carolina, slated to open in 2027 and create 700 local jobs.

Market Concentration & Characteristics

The Commercial Metal Electrical Conduit Market exhibits a moderately concentrated structure, with a mix of global leaders and regional manufacturers competing on product quality, innovation, and compliance with safety standards. It features strong participation from established players with extensive distribution networks, advanced manufacturing capabilities, and diversified product portfolios catering to commercial, industrial, and infrastructure projects. Market competition is driven by technological advancements, such as lightweight aluminum conduits, corrosion-resistant coatings, and modular installation systems, which enhance durability and installation efficiency. Stringent regulatory requirements for fire safety, mechanical strength, and environmental compliance influence design and material choices. The market’s characteristics include high entry barriers due to certification standards, significant capital investment for production facilities, and the need for technical expertise in conduit manufacturing. It benefits from steady demand across construction, renovation, and retrofitting projects, supported by long replacement cycles and the durability of metal products. The combination of regulatory compliance, innovation, and project-specific customization shapes the competitive dynamics of this market.

Report Coverage

The research report offers an in-depth analysis based on Material, Type, Application, Installation Method, Size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise with ongoing commercial construction and infrastructure expansion.

- Adoption of corrosion-resistant and recyclable conduit materials will increase.

- Smart building projects will drive the need for advanced wiring protection systems.

- Modular and prefabricated conduit solutions will gain greater market penetration.

- Retrofitting projects in older commercial spaces will create consistent opportunities.

- Manufacturers will invest in lightweight designs to reduce installation time and costs.

- Integration with IoT-enabled electrical systems will become more common.

- Regulatory updates will push higher safety and environmental compliance standards.

- Asia-Pacific will maintain its position as the fastest-growing regional market.

- Strategic partnerships and acquisitions will strengthen competitive positioning.