Market Overview

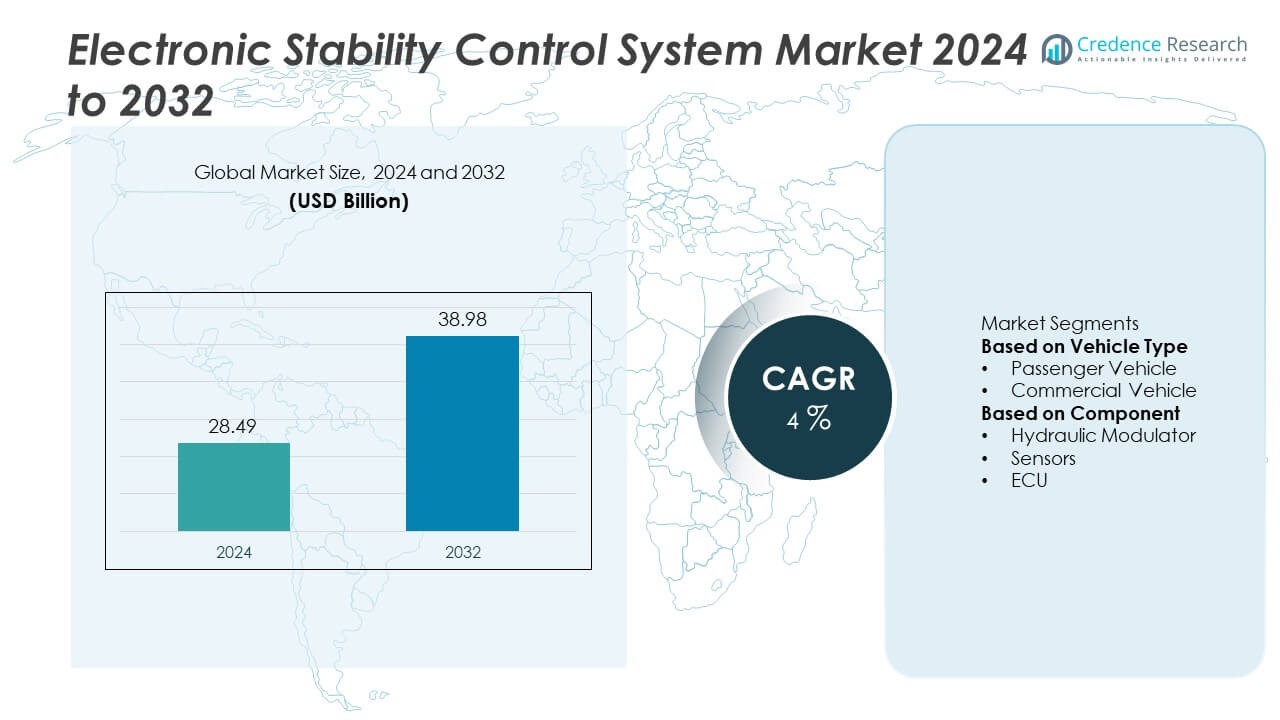

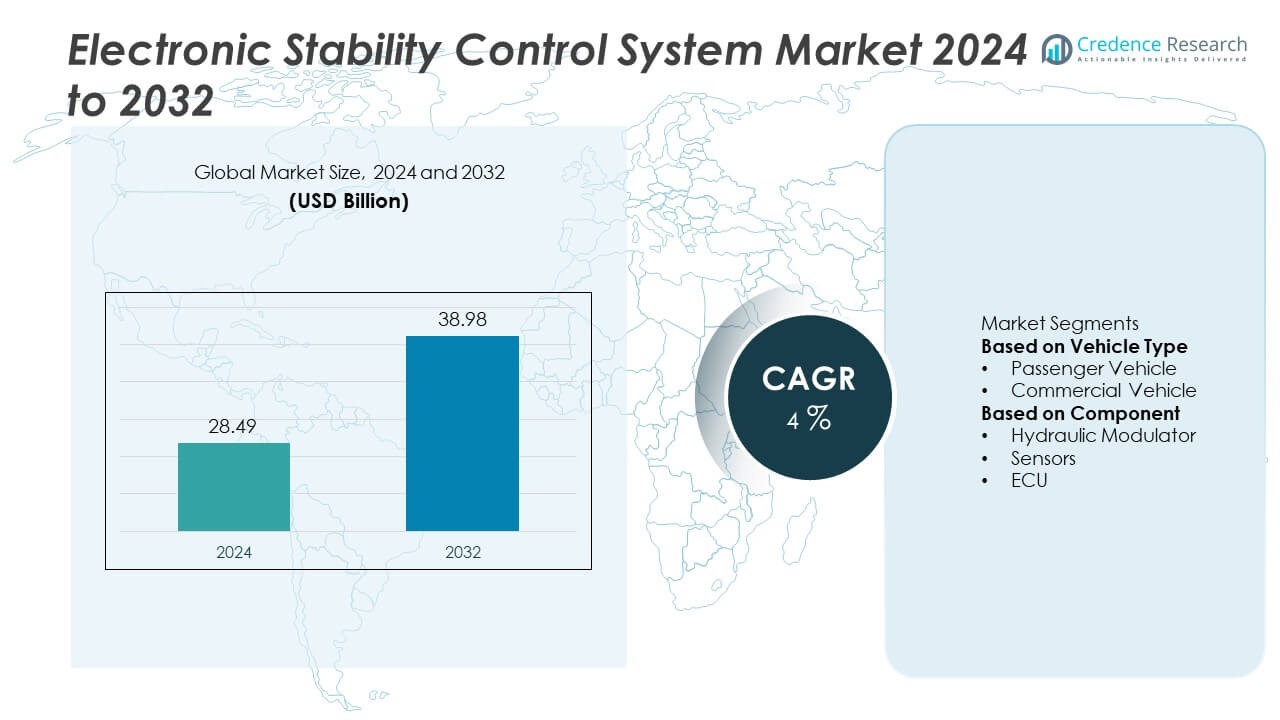

The global electronic stability control (ESC) system market was valued at USD 28.49 billion in 2024 and is projected to reach USD 38.98 billion by 2032, growing at a CAGR of 4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electronic Stability Control (ESC) System Market Size 2024 |

USD 28.49 Billion |

| Electronic Stability Control (ESC) System Market, CAGR |

4% |

| Electronic Stability Control (ESC) System Market Size 2032 |

USD 38.98 Billion |

The electronic stability control systems market is led by key players such as Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, Denso Corporation, Aptiv PLC, Hyundai Mobis Co., Ltd., Hitachi Astemo Ltd., Knorr-Bremse AG, WABCO Holdings Inc., and Autoliv Inc. These companies dominate through technological innovation, large-scale manufacturing, and strategic partnerships with global automakers. Asia-Pacific led the market in 2024 with a 31% share, driven by rapid vehicle production and expanding safety regulations in China and Japan. North America followed with a 32% share, supported by mandatory ESC installation and strong OEM presence, while Europe accounted for a 29% share, propelled by advanced automotive technologies and strict EU safety standards.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global electronic stability control systems market was valued at USD 28.49 billion in 2024 and is projected to reach USD 38.98 billion by 2032, growing at a CAGR of 4% during 2025–2032.

- Rising demand for vehicle safety technologies, supported by mandatory government regulations, is driving strong adoption of ESC systems across passenger and commercial vehicles.

- Key trends include the integration of ESC with ADAS and the development of AI-based sensor technologies to enhance vehicle control and stability.

- Leading players such as Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, and Denso Corporation are focusing on product innovation, automation, and collaboration with OEMs to strengthen global competitiveness.

- North America led the market with a 32% share, followed by Asia-Pacific at 31% and Europe at 29%, while the passenger vehicle segment dominated with a 67% share, driven by rising safety awareness and regulatory compliance.

Market Segmentation Analysis:

By Vehicle Type

The passenger vehicle segment dominated the electronic stability control systems market in 2024 with a 67% share, driven by rising safety awareness and stringent automotive safety regulations. Growing consumer demand for premium and mid-range vehicles equipped with advanced driver assistance systems is accelerating ESC adoption. SUVs led the passenger vehicle category due to their higher risk of rollover and widespread integration of electronic stability systems in both luxury and mass-market models. Expanding vehicle production in Asia-Pacific and mandatory ESC installation in Europe and North America further support the segment’s leadership.

- For instance, Robert Bosch GmbH developed the ESP9 Premium system capable of processing sensor data every 25 milliseconds to correct vehicle yaw deviations. The system controls up to 8 independent braking channels and integrates adaptive cruise and traction management modules.

By Component

The sensors segment held the leading position in 2024, accounting for a 43% share of the global electronic stability control systems market. These components are essential for monitoring vehicle dynamics, wheel speed, and steering angle to maintain stability during critical maneuvers. Growing integration of multiple sensor types—such as yaw rate and lateral acceleration sensors—enhances vehicle control accuracy. The demand for compact, high-precision sensors is increasing alongside electrification and ADAS adoption. Continuous innovations in sensor reliability and digital signal processing are strengthening this segment’s dominance across global automotive applications.

- For instance, Continental AG introduced the ARS 540 radar sensor, a 4D imaging radar that provides a 300-meter range by measuring distance, speed, azimuth, and elevation. This high-resolution data is fed into vehicle controllers to support automated driving and advanced driver assistance features, such as emergency braking.

Key Growth Drivers

Rising Vehicle Safety Regulations and Mandates

Stringent automotive safety regulations worldwide are driving the adoption of electronic stability control systems. Governments in regions such as Europe, North America, and Asia-Pacific have mandated ESC installation in new passenger and commercial vehicles to reduce road fatalities. These regulations push automakers to integrate ESC as a standard feature, enhancing vehicle safety and compliance. The growing emphasis on occupant protection, coupled with rising consumer awareness, continues to strengthen market demand across both developed and emerging economies.

- For instance, Hyundai Mobis developed its integrated electronic brake systems, such as its redundancy brake system for autonomous vehicles, to enhance safety and stability. These advanced systems combine control functions like ABS, TCS, and ESC within a single module to streamline performance and reduce complexity.

Increasing Production of Passenger and Commercial Vehicles

Global growth in automotive production is significantly boosting demand for ESC systems. Expanding urbanization, improved living standards, and rising disposable incomes are leading to higher passenger vehicle ownership. In parallel, logistics expansion and e-commerce growth are driving demand for light and heavy commercial vehicles equipped with safety technologies. Automakers are adopting ESC to enhance brand value and meet safety certifications, making it a vital component in next-generation vehicle platforms.

- For instance, ZF Friedrichshafen AG introduced its mBSP XBS braking control platform designed for trucks and buses, which manages ABS, EBS, brake blending, and advanced braking energy recuperation for hybrid and fully electric commercial vehicles. The scalable and highly integrated system features centralized intelligence in a single ECU and high-speed communication.

Integration with Advanced Driver Assistance Systems (ADAS)

The growing integration of electronic stability control with ADAS technologies is a major market driver. ESC systems now work alongside traction control, anti-lock braking, and lane-keeping assist to improve overall vehicle stability and control. Automakers are enhancing ESC algorithms to support semi-autonomous driving and predictive safety responses. This integration enables real-time monitoring of road conditions and vehicle dynamics, reducing collision risks. The trend toward connected and autonomous mobility continues to strengthen ESC adoption across all vehicle segments.

Key Trends & Opportunities

Adoption of Sensor Fusion and AI-Based Control Systems

Emerging sensor fusion and AI-based control technologies are revolutionizing electronic stability control systems. These innovations combine multiple sensor inputs—such as radar, lidar, and camera data—to deliver faster and more accurate vehicle stability responses. Artificial intelligence enhances predictive control, allowing ESC systems to anticipate skidding or rollover events. Manufacturers are investing in smart ECUs capable of processing large datasets in real time. This technological shift presents new opportunities for next-generation intelligent safety systems and autonomous vehicle integration.

- For instance, Denso Corporation has developed Advanced Driver Assistance (ADAS) ECUs that use AI to process information from various sensors, including cameras, LiDAR, and millimeter-wave radar, enabling the system to process data in milliseconds.

Growing Demand in Electric and Hybrid Vehicles

The rapid expansion of electric and hybrid vehicle production is creating new opportunities for ESC system manufacturers. These vehicles require specialized stability control to manage instant torque delivery and regenerative braking functions. ESC systems optimized for EV architectures help improve traction and vehicle balance. Automakers are increasingly integrating advanced ESC modules to ensure smooth power distribution and enhanced driving safety. This trend aligns with the global shift toward cleaner mobility, opening new growth avenues for ESC technologies.

- For instance, Hitachi Astemo developed a motor torque control technology to stabilize driving conditions during regenerative braking on slippery surfaces by coordinating motor and regenerative brake functions.

Key Challenges

High System Costs and Integration Complexity

The high cost of ESC components, including sensors and ECUs, poses a challenge for mass adoption in low-cost vehicles. Integrating these systems into compact models requires additional calibration and engineering, increasing production expenses. Smaller manufacturers in developing economies face cost barriers in implementing advanced ESC solutions. The need for extensive software validation and testing also adds complexity. Reducing component costs through modular designs and scalable manufacturing remains essential for expanding ESC accessibility across all vehicle categories.

Limited Consumer Awareness in Developing Regions

In developing markets, limited consumer awareness about vehicle stability technologies constrains growth. Many buyers prioritize affordability over safety features, leading to slower ESC penetration in entry-level vehicles. Additionally, weak enforcement of safety regulations in certain regions hampers adoption. Automotive OEMs and government bodies are increasingly focusing on education campaigns and incentive programs to promote safety technologies. Strengthening regulatory frameworks and increasing awareness of ESC’s role in accident prevention are critical to accelerating market growth in these regions.

Regional Analysis

North America

North America held a 32% share of the electronic stability control systems market in 2024, driven by stringent vehicle safety regulations and high consumer awareness. The U.S. dominates regional demand due to mandatory ESC installation in all new vehicles since 2012. Strong automotive production, coupled with widespread adoption of ADAS and connected safety technologies, supports continuous market growth. Leading manufacturers are integrating ESC with autonomous driving systems to enhance performance and reliability. The region’s focus on reducing road fatalities and promoting advanced vehicle safety technologies continues to sustain demand for ESC systems.

Europe

Europe accounted for a 29% share of the global electronic stability control systems market in 2024, supported by strict EU road safety mandates and widespread adoption of advanced braking technologies. Major automakers such as Volkswagen, BMW, and Mercedes-Benz have standardized ESC in most of their vehicle models. The region’s strong emphasis on sustainability and electrification also boosts integration of ESC in hybrid and electric vehicles. Germany, France, and the UK remain key markets, benefiting from strong R&D infrastructure and regulatory focus on reducing accident rates through intelligent vehicle safety systems.

Asia-Pacific

Asia-Pacific captured a 31% share in 2024, emerging as the fastest-growing region in the electronic stability control systems market. Rising vehicle production in China, India, Japan, and South Korea drives substantial demand. Increasing government safety initiatives, coupled with growing consumer preference for premium and mid-segment cars, is enhancing ESC adoption. China leads regional demand with strong automotive manufacturing and regulatory enforcement. India’s push toward vehicle safety standardization further accelerates adoption. Expanding EV production and the rise of domestic component suppliers are strengthening the region’s contribution to global ESC market growth.

Latin America

Latin America held a 5% share of the electronic stability control systems market in 2024, supported by progressive adoption of safety technologies. Brazil and Mexico lead the region due to evolving safety standards and increasing production of passenger and light commercial vehicles. Government initiatives to reduce traffic fatalities are encouraging automakers to integrate ESC systems into mid-range models. However, price sensitivity and limited awareness still challenge broader penetration. Ongoing foreign investments in automotive manufacturing and gradual implementation of ESC regulations are expected to stimulate regional growth over the forecast period.

Middle East & Africa

The Middle East & Africa accounted for a 3% share of the global electronic stability control systems market in 2024, characterized by steady demand from premium vehicle segments. The UAE and Saudi Arabia are leading adopters, driven by luxury car sales and growing road safety campaigns. In Africa, South Africa is advancing through government-led safety programs and international automotive partnerships. Although ESC penetration remains limited, increasing import of vehicles equipped with advanced safety features is expanding market reach. Ongoing infrastructure development and regulatory improvements are expected to support gradual market expansion.

Market Segmentations:

By Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

By Component

- Hydraulic Modulator

- Sensors

- ECU

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the electronic stability control systems market is defined by major players such as Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, Denso Corporation, Aptiv PLC, Hyundai Mobis Co., Ltd., Hitachi Astemo Ltd., Knorr-Bremse AG, WABCO Holdings Inc., and Autoliv Inc. These companies maintain strong market positions through advanced product innovation, large-scale production, and global distribution networks. Leading manufacturers are focusing on developing integrated ESC solutions that combine braking, traction, and stability functions with advanced driver assistance systems. Continuous investments in R&D, automation, and sensor fusion technologies are enabling improved vehicle safety and control. Strategic collaborations with OEMs and tier-1 suppliers are expanding technological reach, while mergers and acquisitions strengthen competitive advantage. The growing shift toward electrification and autonomous driving is further pushing companies to innovate adaptive ESC architectures compatible with EV and hybrid platforms.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- Denso Corporation

- Aptiv PLC

- Hyundai Mobis Co., Ltd.

- Hitachi Astemo Ltd.

- Knorr-Bremse AG

- WABCO Holdings Inc.

- Autoliv Inc.

Recent Developments

- In June 2025, Hyundai Mobis announced rear-safety control technology that uses rear-side radars and front cameras to warn a driver when a vehicle is approximately 10 meters behind, and then automatically increases speed to maintain a safe gap.

- In September 2024, Robert Bosch GmbH and Pirelli & C. S.p.A. announced a joint development agreement that will integrate tyre-sensor data to enhance the ESC system’s real-time vehicle stability processing.

- In 2024, Knorr‑Bremse AG presented its “Electronic Braking Control” system capable of activating each wheel brake individually, enabling advanced driving‐dynamics control in commercial vehicles.

- In 2023, Continental AG launched its MK 120 ESC system in series production for the Chinese market via partner Changan Automobile.

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Component and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with increasing adoption of vehicle safety technologies worldwide.

- Integration of ESC with ADAS and autonomous driving systems will become more widespread.

- Sensor fusion and AI-based control will enhance vehicle stability and predictive safety response.

- Electric and hybrid vehicles will drive new opportunities for ESC system integration.

- Governments will continue enforcing strict safety mandates across passenger and commercial vehicles.

- Automakers will focus on lightweight and modular ESC components to improve efficiency.

- Emerging markets will see rapid adoption as safety awareness and regulations strengthen.

- Continuous R&D investment will lead to more advanced and cost-efficient ESC solutions.

- Collaborations between OEMs and technology suppliers will expand system innovation.

- The demand for connected and intelligent braking systems will reshape the future of ESC technology.