| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Enterprise Information Archiving Market Size 2024 |

USD 7,855.16 million |

| Enterprise Information Archiving Market, CAGR |

14.21% |

| Enterprise Information Archiving Market Size 2032 |

USD 22,638.20 million |

Market Overview:

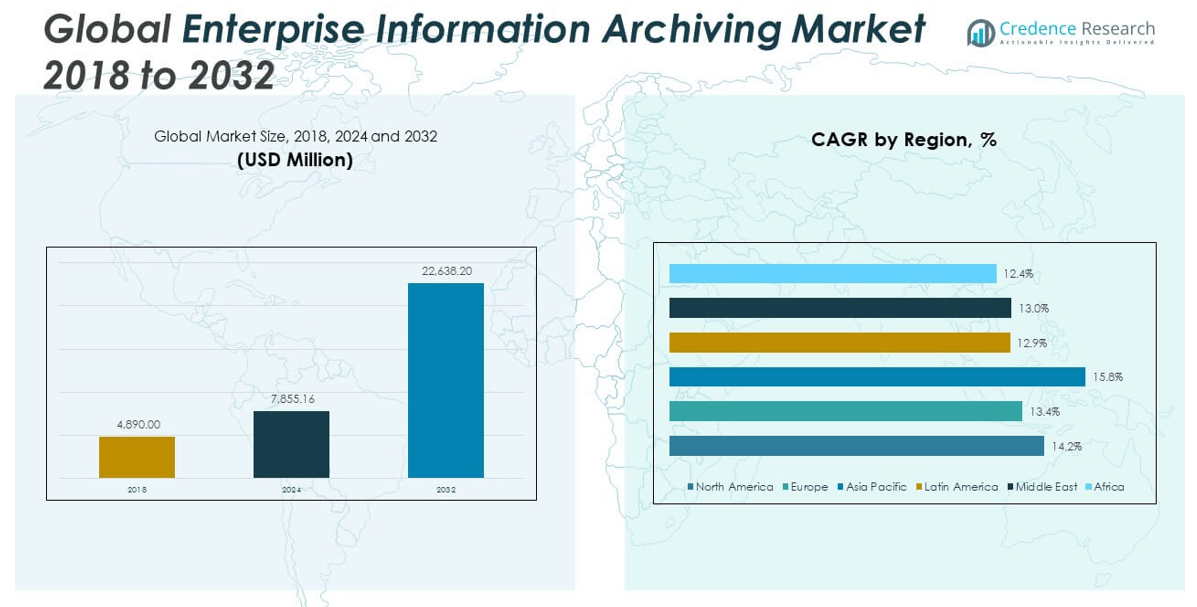

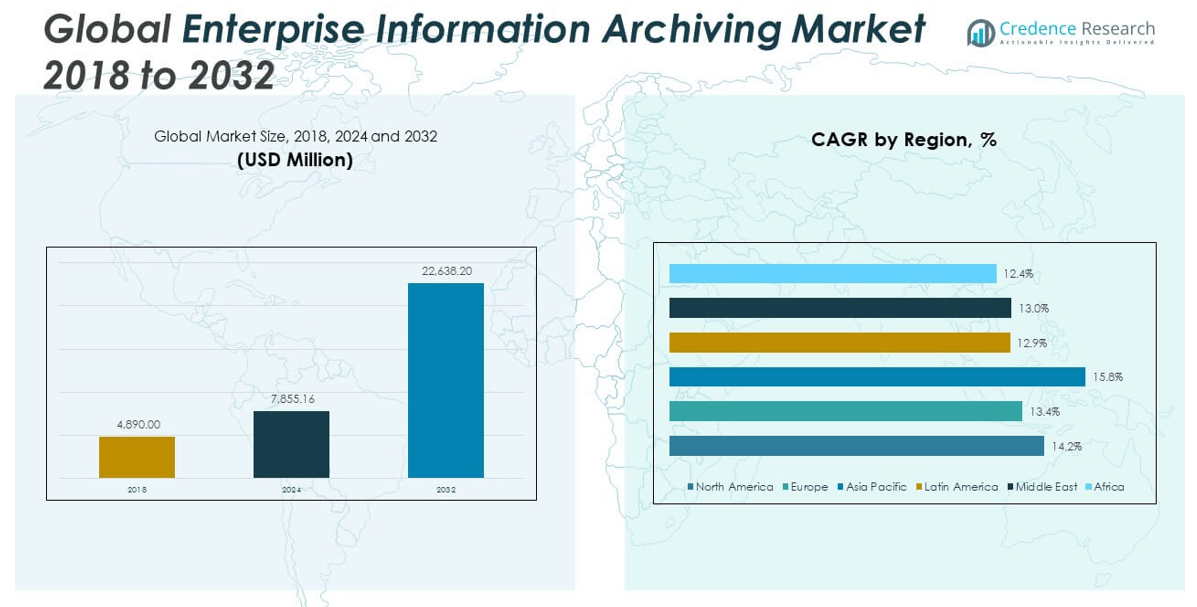

The Global Enterprise Information Archiving Market size was valued at USD 4,890.00 million in 2018 to USD 7,855.16 million in 2024 and is anticipated to reach USD 22,638.20 million by 2032, at a CAGR of 14.21% during the forecast period.

The market’s expansion is driven by several key factors, including the rapid increase in data generation, rising regulatory scrutiny, and growing reliance on digital platforms. Businesses are required to retain emails, communications, and digital records in alignment with regulations such as GDPR, HIPAA, and financial compliance mandates. Enterprise information archiving solutions help organizations mitigate legal risk by enabling secure, auditable, and searchable storage of critical data assets. At the same time, the shift toward cloud infrastructure supports remote work and streamlines access to archived content across locations. Technological advancements such as AI-based data classification, automated retention policy enforcement, and integrated analytics are enhancing the performance and value of EIA platforms. These capabilities enable proactive compliance and deliver operational efficiency, making archiving a core element of enterprise IT strategy.

North America dominates the enterprise information archiving market in terms of revenue share, led by the United States, where strict data protection laws and early technology adoption drive sustained demand. Large enterprises in finance, telecom, and healthcare sectors are key adopters of advanced archiving systems. The Asia-Pacific region is the fastest-growing market, fueled by accelerating digitalization, increasing cloud adoption, and rising awareness around data privacy in countries such as China, India, Japan, and South Korea. European countries remain key contributors, with strong uptake of archiving platforms to meet the legal requirements of the General Data Protection Regulation. Nations such as Germany, the United Kingdom, and France continue to invest in enterprise compliance technologies. Latin America and the Middle East & Africa represent emerging regions, with adoption supported by improvements in digital infrastructure and expanding regulatory frameworks focused on enterprise data governance.

Market Insights:

- The Global Enterprise Information Archiving Market grew from USD 4,890 million in 2018 to USD 7,855.16 million in 2024 and is projected to reach USD 22,638.20 million by 2032, driven by strong regulatory and operational demands.

- Regulatory mandates such as GDPR, HIPAA, and SOX are compelling enterprises to adopt secure and auditable archiving platforms to avoid legal penalties and ensure long-term data compliance.

- The market is benefiting from the rising complexity of digital content across email, messaging apps, video platforms, and social media, which demands unified and scalable archiving solutions.

- Cloud migration and hybrid deployment models are expanding adoption, offering flexible, cost-efficient options for organizations with distributed operations and data sovereignty requirements.

- AI-powered features such as auto-tagging, predictive insights, and sentiment analysis are transforming archiving from a storage function into a strategic tool for governance and analytics.

- Implementation costs and legacy system integration challenges continue to limit adoption in small and mid-sized enterprises, especially in regions with limited IT infrastructure.

- North America leads in revenue share due to early technology adoption and regulatory pressure, while Asia-Pacific is the fastest-growing region, supported by cloud growth and emerging data privacy laws.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Regulatory Mandates and Legal Compliance Fuel Adoption Across Regulated Sectors:

Strict data retention regulations and compliance mandates are major forces driving the Global Enterprise Information Archiving Market. Industries such as financial services, healthcare, and government face growing regulatory scrutiny, requiring them to preserve communications, transaction records, and internal documentation for extended periods. Regulations including GDPR, HIPAA, SEC Rule 17a-4, and SOX impose mandatory retention and audit requirements, creating demand for secure, searchable archiving platforms. It supports legal preparedness by simplifying e-discovery, enabling legal holds, and offering verifiable audit trails. Enterprises seek solutions that ensure full traceability of archived data and meet jurisdiction-specific requirements. Non-compliance with such regulations leads to significant financial penalties, reputational damage, and operational disruption. This drives enterprise-wide investment in purpose-built information archiving solutions.

- For instance, Smarsh’s Enterprise Archive platform provides petabyte-scale, SEC 17a-4 validated, tamper-proof storage, supporting sub-second searches across millions of records and is engineered to meet the compliance needs of top global enterprises.

Rising Data Volumes and Digital Content Complexity Accelerate Archiving Needs:

Organizations generate massive volumes of structured and unstructured data across channels, including email, instant messaging, video conferencing, and social media. The complexity and scale of this digital content make traditional storage methods inefficient, pushing businesses toward modern enterprise archiving systems. The Global Enterprise Information Archiving Market benefits from this shift as it enables organizations to offload inactive data to long-term repositories without losing accessibility or control. With growing focus on knowledge management, data classification, and retention policy enforcement, enterprises rely on archiving tools that streamline content lifecycle management. It also enhances data visibility and reduces storage costs by separating active and historical content. The ability to manage diverse data types in a unified platform strengthens operational agility and data governance.

- For instance, Mimecast Cloud Archive offers a highly secure and scalable cloud solution, providing a bottomless archive with 99-year retention, triplicate storage for redundancy, and industry-leading rapid search capabilities, enabling compliance and e-discovery for organizations worldwide.

Cloud Migration and Hybrid Infrastructure Expand Deployment Opportunities:

The widespread adoption of cloud services encourages organizations to implement scalable, flexible, and secure archiving platforms. The Global Enterprise Information Archiving Market is experiencing strong momentum from enterprises transitioning to hybrid or cloud-native infrastructure. Cloud-based archiving offers cost efficiency, simplified maintenance, and global access across distributed teams. It allows businesses to shift away from legacy on-premise solutions while retaining data control through customizable retention policies. Hybrid models appeal to firms that need to retain sensitive content on-premise while archiving less critical data in the cloud. This dual approach enhances system performance and meets data sovereignty requirements. Vendors offering secure, multi-cloud support and rapid deployment gain preference among enterprises with complex infrastructure needs.

Emergence of AI and Analytics Capabilities Drives Strategic Value:

The integration of artificial intelligence and advanced analytics transforms traditional archiving into a strategic data management function. The Global Enterprise Information Archiving Market benefits from platforms that go beyond storage to offer predictive insights, auto-tagging, and sentiment analysis. Enterprises leverage these capabilities to classify data, identify risks, and extract value from archived content. AI tools improve the accuracy of e-discovery, automate policy enforcement, and support compliance auditing. It also enables proactive identification of data anomalies and user behavior trends. As archiving evolves from a cost center to a value-generating asset, demand continues to grow for intelligent platforms that support decision-making and operational efficiency.

Market Trends:

Adoption of Unified Archiving Platforms Across Communication Channels Gains Momentum:

Enterprises are moving toward unified archiving solutions that consolidate multiple communication channels into a single platform. This trend reflects the growing need to archive not only emails but also instant messages, social media interactions, voice recordings, and video conferencing content. The Global Enterprise Information Archiving Market is witnessing a shift from siloed tools to integrated systems that support centralized data access, indexing, and retrieval. Unified platforms reduce complexity, enhance compliance tracking, and simplify policy management across diverse data types. It helps organizations maintain consistency in data retention and governance across various digital channels. Vendors offering comprehensive multi-channel archiving solutions are gaining traction in sectors with high compliance burdens and complex communication ecosystems.

- For instance, Proofpoint Enterprise Archive is a cloud-native solution used by top organizations globally, supporting fast, reliable search performance (averaging 20 seconds or less), comprehensive regulatory compliance supervision, and broad support for email, social, and collaboration data, backed by an industry-leading SLA.

Increased Focus on Long-Term Digital Preservation of Corporate Knowledge:

Organizations recognize the strategic value of preserving digital content for historical reference, operational continuity, and intellectual capital protection. Long-term archiving is evolving beyond compliance to support institutional memory, risk mitigation, and strategic planning. The Global Enterprise Information Archiving Market reflects this shift through growing demand for solutions that ensure data integrity, authenticity, and accessibility over decades. Enterprises seek platforms with advanced encryption, metadata tagging, and format preservation features to safeguard information against obsolescence. It enables organizations to maintain continuity during leadership transitions, legal disputes, or business restructuring. Long-term digital preservation is gaining relevance in sectors such as legal, media, education, and life sciences.

- For instance, OpenText InfoArchive provides a fully containerized, cloud-deployable platform supporting large-scale content archiving, advanced compliance dashboards, and cross-application searching, enabling organizations to maintain information integrity and accessibility over decades.

Demand for Mobile-Friendly and Remote-Access Archiving Capabilities Rises:

The rise in remote workforces and mobile-first enterprise environments is influencing product development in the archiving space. Enterprises now prioritize solutions that provide secure, real-time access to archived data from any device or location. The Global Enterprise Information Archiving Market is adapting to this trend with platforms that offer responsive web portals, mobile apps, and secure APIs. It supports mobile compliance by archiving SMS, mobile app messages, and voice calls in regulated industries. User-friendly interfaces and seamless integration with mobile collaboration tools are becoming standard features. This trend enhances productivity, enables faster information retrieval, and supports flexible work models.

Growth of Vertical-Specific Archiving Solutions Tailored to Industry Needs:

Vendors are developing industry-specific archiving solutions that align with unique regulatory, operational, and data management requirements. The Global Enterprise Information Archiving Market is seeing increased customization for sectors such as healthcare, finance, legal services, education, and energy. These vertical-focused platforms incorporate specialized compliance rules, terminology, and workflows. It allows organizations to deploy archiving systems with minimal configuration while ensuring adherence to industry mandates. Tailored solutions improve usability and reduce integration complexity, especially for highly regulated sectors. This trend supports market differentiation and strengthens vendor positioning in competitive industry segments.

Market Challenges Analysis:

High Implementation Costs and Legacy System Integration Limit Adoption in Cost-Sensitive Enterprises:

One of the major challenges in the Global Enterprise Information Archiving Market is the high initial investment required for deployment, customization, and integration. Many enterprises, particularly small and mid-sized businesses, face budget constraints that prevent adoption of advanced archiving platforms. Legacy infrastructure further complicates implementation, as older systems often lack compatibility with modern APIs, cloud environments, or real-time processing capabilities. The Global Enterprise Information Archiving Market must address these issues to support broader adoption across industries. It also faces resistance from organizations that fear data migration risks or service disruptions during system upgrades. The lack of in-house expertise to manage integration and change management adds complexity to deployment efforts. These barriers slow market penetration in price-sensitive and infrastructure-constrained regions.

Evolving Data Privacy Regulations and Cross-Border Compliance Add Operational Complexity:

The continuously shifting landscape of data privacy laws across jurisdictions poses a significant operational challenge for archiving solution providers. Regulations such as GDPR, CCPA, and country-specific data residency laws demand localized compliance capabilities and customizable retention policies. The Global Enterprise Information Archiving Market must accommodate region-specific requirements, including restrictions on where and how data is stored, processed, and accessed. It increases the need for configurable architectures, multi-tenant environments, and audit capabilities that meet varying legal frameworks. Ensuring compliance across multiple regulatory bodies while maintaining centralized control adds cost and administrative burden for global enterprises. Constant updates to laws and lack of regulatory harmonization make it difficult for vendors to deliver out-of-the-box compliance features that apply across all regions. This legal uncertainty challenges consistent product development and slows enterprise-wide rollout.

Market Opportunities:

Expansion into Emerging Markets with Growing Digital Infrastructure and Regulatory Evolution:

The Global Enterprise Information Archiving Market has significant growth opportunities in emerging regions where digital infrastructure and regulatory maturity are evolving rapidly. Countries in Asia-Pacific, Latin America, and the Middle East are experiencing increased adoption of cloud services, digital communications, and enterprise applications. It creates demand for scalable archiving solutions that support compliance, data security, and long-term retention. Local governments are introducing new data protection laws, prompting enterprises to adopt structured archiving frameworks. Vendors that offer cost-effective, regionally compliant solutions can strengthen their presence in these high-growth markets. Strategic partnerships with regional service providers will accelerate deployment and local integration.

Integration with Cybersecurity and Data Loss Prevention Systems Expands Value Proposition:

Enterprises seek unified platforms that address both information archiving and data protection needs. The Global Enterprise Information Archiving Market can grow by aligning more closely with cybersecurity and data loss prevention (DLP) ecosystems. It allows organizations to manage sensitive content while detecting risks, policy violations, and unauthorized access in archived data. Vendors that embed threat detection, anomaly analysis, and encryption management into archiving platforms will attract compliance-driven industries. The convergence of archiving with security strengthens its role in enterprise risk management strategies. This integration unlocks new use cases in regulated sectors, critical infrastructure, and high-sensitivity environments.

Market Segmentation Analysis:

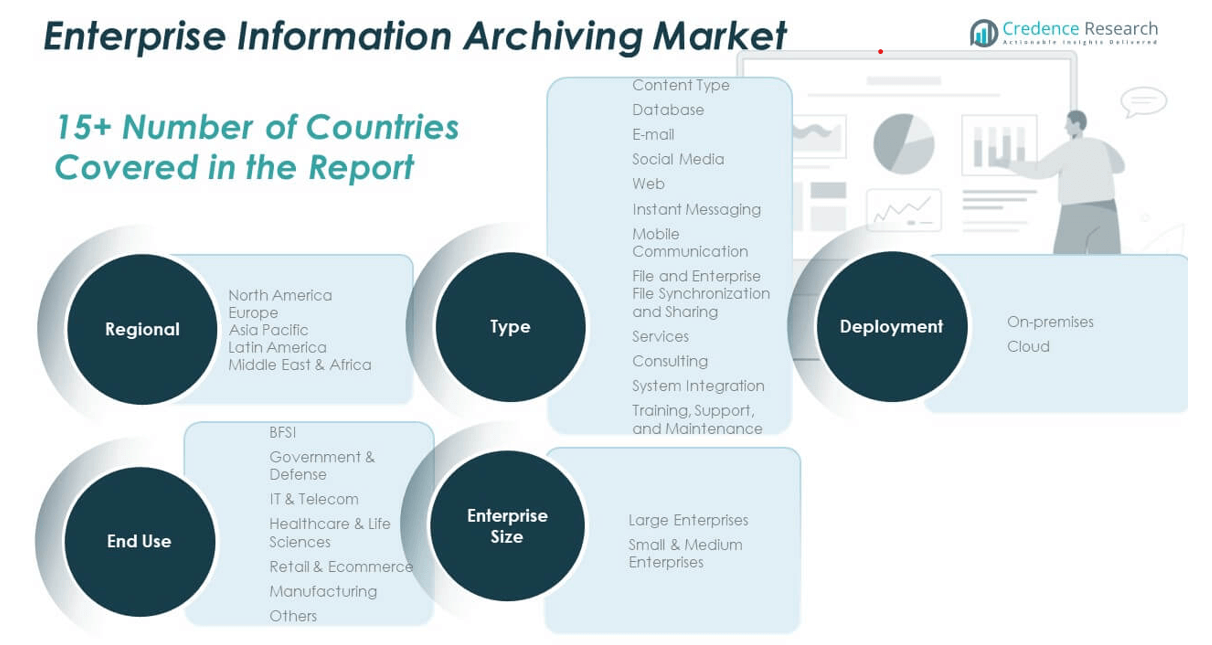

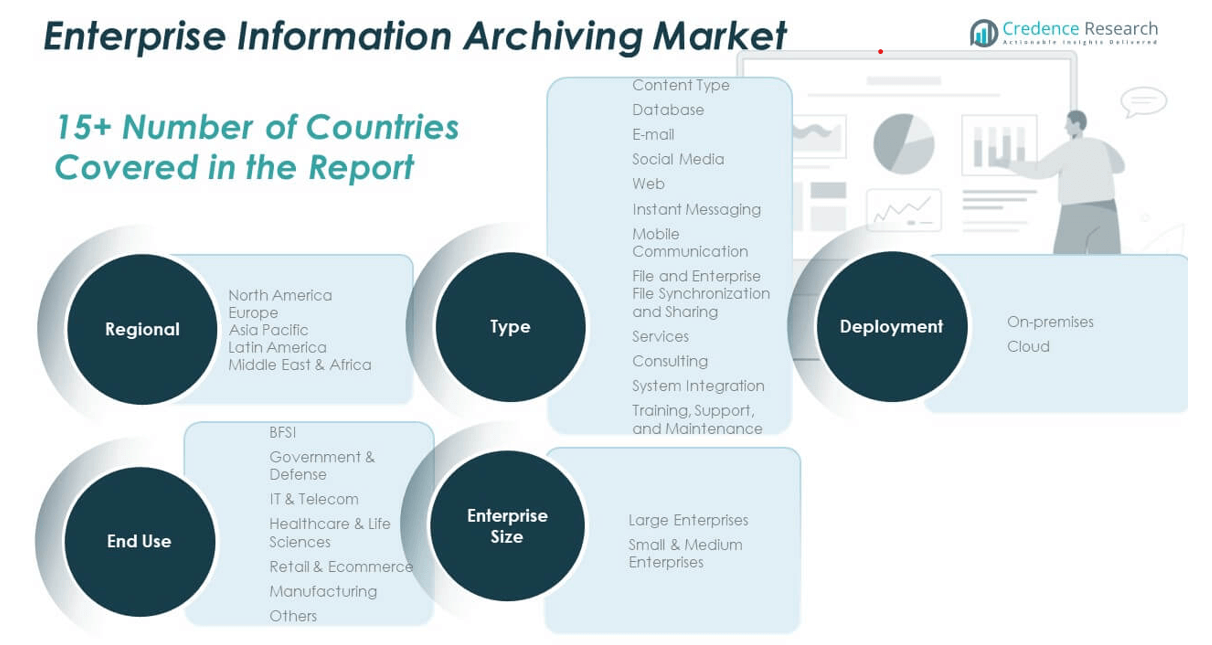

By Type

The Global Enterprise Information Archiving Market includes two key categories: content type and services. Under content type, e-mail, database, and instant messaging archiving lead adoption, especially in compliance-driven industries. Social media, mobile communication, web content, and file synchronization archiving are gaining relevance with the diversification of enterprise communication channels. In services, consulting, system integration, and training, support, and maintenance are critical to enable seamless deployment, compliance configuration, and ongoing optimization.

- For instance, Barracuda Networks’ Message Archiver and Cloud Archiving Service offer secure, immutable storage, granular retention policies, federated search, and legal hold capabilities, supporting compliance and e-discovery for organizations using Exchange, Office 365, and other services.

By Deployment

Deployment is divided into cloud and on-premises models. Cloud-based archiving is growing steadily due to lower capital costs, faster deployment, and high scalability. It appeals to organizations with remote or hybrid workforces. On-premises deployment remains significant among organizations with strict regulatory or internal data control requirements.

- For instance, Veritas Enterprise Vault offers flexible deployment options, including on-premises and cloud, with comprehensive planning, integration, and support services to meet enterprise-scale archiving needs.

By End-use

Key end-use industries include BFSI, government & defense, IT & telecom, and healthcare & life sciences. These sectors generate large volumes of sensitive data and face stringent regulatory oversight. Retail & e-commerce, manufacturing, and others are also adopting archiving solutions to improve operational visibility, reduce legal risk, and support digital content management.

By Enterprise Size

Large enterprises drive major demand, owing to their complex infrastructure and broader compliance responsibilities. Small and medium-sized enterprises are adopting flexible, cloud-based archiving platforms to meet growing data governance needs while managing cost constraints. The segment reflects increasing awareness of data retention and risk management across all organization sizes.

Segmentation:

By Type

- Content Type

- Database

- E-mail

- Social Media

- Web

- Instant Messaging

- Mobile Communication

- File and Enterprise File Synchronization and Sharing

- Services

- Consulting

- System Integration

- Training, Support, and Maintenance

By Deployment

By End-use

- BFSI

- Government & Defense

- IT & Telecom

- Healthcare & Life Sciences

- Retail & E-commerce

- Manufacturing

- Others

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Enterprise Information Archiving Market size was valued at USD 1,961.87 million in 2018 to USD 3,116.88 million in 2024 and is anticipated to reach USD 8,971.56 million by 2032, at a CAGR of 14.2 during the forecast period. North America holds the largest share of the Global Enterprise Information Archiving Market, contributing 39% of total revenue in 2024. The U.S. leads adoption due to strong regulatory frameworks and early deployment of digital infrastructure. Enterprises in finance, healthcare, and government invest heavily in advanced archiving solutions to meet legal and compliance requirements. It benefits from a mature cloud ecosystem and active vendor presence, including Microsoft, IBM, and Proofpoint. Organizations in the region prefer hybrid deployment models for flexibility and control. High volumes of enterprise communication data continue to drive innovation in archiving platforms.

Europe

The Europe Enterprise Information Archiving Market size was valued at USD 1,244.99 million in 2018 to USD 1,919.59 million in 2024 and is anticipated to reach USD 5,214.77 million by 2032, at a CAGR of 13.4 during the forecast period. Europe accounts for 24% of the Global Enterprise Information Archiving Market in 2024, supported by strong regulatory enforcement under GDPR. Demand is high in Germany, France, and the U.K., where data privacy and sovereignty drive platform selection. Enterprises across financial services, legal, and telecom sectors rely on secure, compliant solutions. It reflects steady adoption of multilingual and regionally hosted platforms. Hybrid deployment is preferred for balancing compliance with scalability. European firms are expanding use of archiving tools for governance and long-term digital preservation.

Asia Pacific

The Asia Pacific Enterprise Information Archiving Market size was valued at USD 1,058.69 million in 2018 to USD 1,785.84 million in 2024 and is anticipated to reach USD 5,745.59 million by 2032, at a CAGR of 15.8 during the forecast period. Asia Pacific holds a 23% market share and leads in growth rate across the Global Enterprise Information Archiving Market. Rapid digitalization, expanding cloud adoption, and rising regulatory activity across China, India, Japan, and South Korea are key drivers. Enterprises in this region demand archiving solutions that support localized compliance and multilingual features. It shows strong momentum in BFSI, IT services, and government applications. Local data center investments and public cloud partnerships boost accessibility. Vendors offering low-latency, scalable solutions are rapidly expanding their footprint.

Latin America

The Latin America Enterprise Information Archiving Market size was valued at USD 250.37 million in 2018 to USD 397.39 million in 2024 and is anticipated to reach USD 1,042.94 million by 2032, at a CAGR of 12.9 during the forecast period. Latin America contributes 5% of the Global Enterprise Information Archiving Market in 2024, with growing demand from Brazil, Mexico, and Argentina. Organizations across finance, education, and public sectors are adopting archiving solutions to meet compliance and security standards. It faces constraints due to limited IT infrastructure and budget sensitivity. Cloud-based deployments gain traction due to ease of integration and affordability. Vendors focusing on simplified platforms and regional partnerships see better traction. The market is evolving with rising data protection awareness and digital policy alignment.

Middle East

The Middle East Enterprise Information Archiving Market size was valued at USD 212.72 million in 2018 to USD 322.80 million in 2024 and is anticipated to reach USD 851.32 million by 2032, at a CAGR of 13.0 during the forecast period. Middle East holds a 4% share in the Global Enterprise Information Archiving Market, with major contributions from UAE, Saudi Arabia, and Israel. Enterprises in finance, energy, and public sectors invest in secure, compliance-driven archiving systems. It shows growing preference for hybrid cloud solutions to meet data residency and performance needs. Multilingual support and localized infrastructure are critical selection factors. Government-led digital transformation initiatives are accelerating demand. Vendors that offer compliance customization and regional data centers gain competitive advantage.

Africa

The Africa Enterprise Information Archiving Market size was valued at USD 161.37 million in 2018 to USD 312.67 million in 2024 and is anticipated to reach USD 812.02 million by 2032, at a CAGR of 12.4 during the forecast period. Africa contributes 4% of the Global Enterprise Information Archiving Market revenue in 2024, led by South Africa, Egypt, and Nigeria. The market is emerging, driven by growth in telecom, healthcare, and public services. It still faces infrastructure gaps and budget limitations but shows strong potential in cloud adoption. Regional enterprises prefer mobile-compatible, cost-efficient platforms with easy deployment. Governments are strengthening data protection laws, encouraging adoption of archiving tools. International vendors are targeting the region through strategic local partnerships.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Barracuda Networks, Inc.

- Commvault

- Dell Inc.

- Google LLC

- International Business Machines Corporation (IBM)

- Microsoft

- Mimecast Services Limited

- Proofpoint

- Smarsh Inc.

- Veritas Technologies LLC

Competitive Analysis:

The Global Enterprise Information Archiving Market features strong competition among established technology providers and specialized solution vendors. Major players such as Microsoft, IBM, Google, Dell, and Veritas Technologies lead through broad product portfolios and integrated cloud capabilities. It includes firms like Mimecast, Proofpoint, and Smarsh that focus on compliance-driven solutions for highly regulated sectors. Vendors compete on scalability, security, e-discovery features, and deployment flexibility. Cloud-native platforms with AI-based classification and real-time analytics gain preference among enterprise customers. Strategic partnerships, acquisitions, and regional data center expansions strengthen market presence. Companies invest in feature-rich platforms that address diverse data sources, including email, social media, mobile communication, and enterprise collaboration tools. The market shows increasing consolidation, with larger players acquiring niche providers to enhance capabilities and reach. Competitive differentiation relies on regulatory expertise, integration ease, and performance in hybrid or multi-cloud environments. Vendors offering customized industry solutions maintain a strong foothold in specialized verticals.

Recent Developments:

- In July 2025, Barracuda Networks launched Entra ID Backup Premium, a cloud-based SaaS solution designed to safeguard Microsoft Entra ID environments from accidental and malicious data loss. The solution integrates with the BarracudaONE platform, providing centralized visibility and management for backup status and data health across single and multi-tenant environments. This launch strengthens Barracuda’s offering in identity data protection and cyber resilience for enterprises.

- In June 2025, Mimecast released a major user interface update for its Personal Portal, offering a modernized, accessible design with improved navigation and screen reader support. Earlier in January 2025, Mimecast also enhanced its Incydr product with detection capabilities for DeepSeek GenAI, reflecting a shift toward advanced data compliance and governance features in its archiving and security portfolio.

- In June 2025, Google introduced new enterprise archiving features within Chrome Enterprise Core. Notably, an automated inactive profile deletion policy was rolled out, enabling administrators to configure the period after which inactive managed profiles are automatically deleted. The initial deletion wave began in July 2025, with ongoing deletions for profiles inactive beyond the set threshold, enhancing data lifecycle management for enterprise customers.

- In May 2025, Microsoft announced changes to its partner attestation process for customer agreements. Beginning October 7, 2025, Microsoft will require a new, more compliant API-based attestation method for partners, retiring the previous API and UX-based experiences. This update is aimed at improving compliance, security, and regulatory alignment for enterprise customers using Microsoft 365 and related archiving services.

- In May 2025, Proofpoint signed a definitive agreement to acquire Hornetsecurity Group, a leading provider of AI-powered Microsoft 365 security and compliance services. This acquisition, valued at over $1 billion, is set to close in the second half of 2025 and will significantly expand Proofpoint’s capabilities for managed service providers and SMB customers, particularly in cloud security and enterprise information archiving.

- In February 2025, Dell Technologies unveiled its updated 2025 Partner Program, focusing on AI, data protection, and sustainable growth. The program introduces new incentives for partners, including growth multipliers for AI networking and storage, enhanced training on Dell’s AI Factory, and expanded asset recovery services. These initiatives are designed to help partners capitalize on opportunities in AI-driven data management and archiving solutions.

Market Concentration & Characteristics:

The Global Enterprise Information Archiving Market exhibits moderate to high market concentration, with a few dominant players controlling a significant share. It includes global technology firms and specialized vendors that offer scalable, compliance-ready archiving solutions across industries. The market favors providers with integrated cloud infrastructure, AI capabilities, and strong regulatory alignment. Product differentiation is driven by data source coverage, search performance, e-discovery tools, and deployment flexibility. Enterprises prioritize solutions that support multi-format content, hybrid environments, and region-specific compliance mandates. The market continues to evolve with rising demand for unified platforms, security integration, and real-time analytics. Vendor consolidation and strategic acquisitions are shaping competitive dynamics, while new entrants target niche applications or regional gaps with cloud-native offerings.

Report Coverage:

The research report offers an in-depth analysis based on type, deployment, end-use, and enterprise size. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Cloud-native archiving platforms will dominate new deployments across industries due to scalability and cost efficiency.

- AI-driven classification, auto-tagging, and predictive insights will become standard in enterprise archiving solutions.

- Regulatory complexity across regions will drive demand for customizable compliance frameworks within archiving tools.

- Integration with cybersecurity and data loss prevention systems will enhance the strategic role of archiving in enterprise IT.

- Archiving platforms will expand coverage to include collaboration tools, mobile apps, and voice communication data.

- Small and medium enterprises will adopt lightweight, subscription-based solutions tailored to budget and compliance needs.

- Industry-specific platforms will gain traction in sectors such as healthcare, finance, education, and legal services.

- North America and Asia Pacific will remain key growth engines, driven by digital infrastructure investment and regulatory activity.

- Vendor consolidation will intensify, with larger firms acquiring niche players to broaden feature sets and market reach.

- Long-term data preservation and advanced search capabilities will be critical for supporting legal and operational continuity.