Market Overview

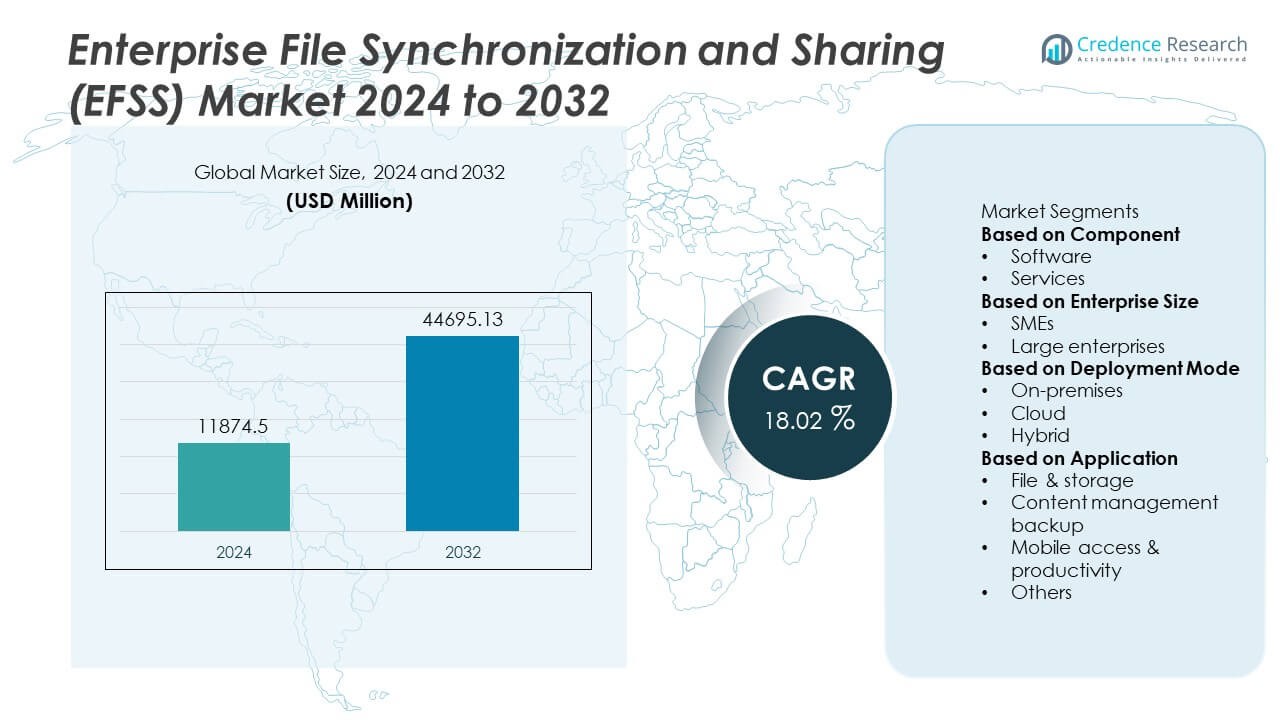

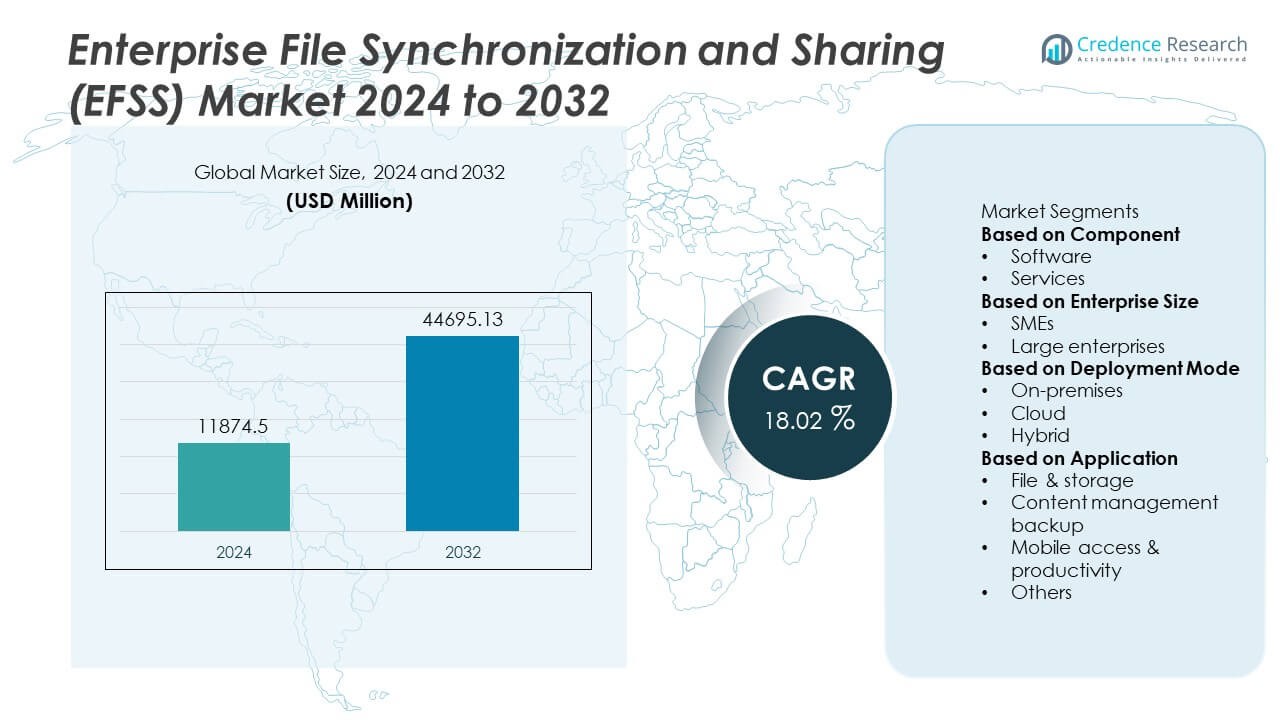

The enterprise file synchronization and sharing (EFSS) market size was valued at USD 11,874.5 million in 2024 and is projected to reach USD 44,695.13 million by 2032, growing at a CAGR of 18.02% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Enterprise File Synchronization and Sharing (EFSS) Market Size 2024 |

USD 11,874.5 Million |

| Enterprise File Synchronization and Sharing (EFSS) Market, CAGR |

18.02% |

| Enterprise File Synchronization and Sharing (EFSS) Market Size 2032 |

USD 44,695.13 Million |

The enterprise file synchronization and sharing (EFSS) market is led by top players including IBM, Dropbox, VMware, Box, Syncplicity, Citrix Systems, Microsoft, Google, Egnyte, and OpenText. These companies drive the market through secure collaboration platforms, cloud integration, and compliance-focused solutions. Microsoft and Google lead with productivity-driven ecosystems, while Dropbox and Box strengthen user-friendly, cloud-first adoption. IBM and OpenText emphasize enterprise compliance and data governance, while VMware and Citrix cater to secure hybrid models. Regionally, North America held 40% share in 2024, followed by Europe at 28% and Asia Pacific at 22%, while Latin America accounted for 6% and the Middle East & Africa together held 4%, reflecting widespread global adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The enterprise file synchronization and sharing (EFSS) market was valued at USD 11,874.5 million in 2024 and is projected to reach USD 44,695.13 million by 2032, growing at a CAGR of 18.02%.

- Growth is driven by rising demand for secure data sharing and compliance, with the software segment holding 67% share and services supporting integration and management.

- Cloud deployment accounted for 60% share in 2024, supported by remote work adoption and scalability, while on-premises and hybrid models serve industries with strict security needs.

- Key players such as Microsoft, Google, IBM, Dropbox, Box, OpenText, VMware, Citrix Systems, Egnyte, and Syncplicity dominate through innovation in AI-driven security, integration, and hybrid cloud offerings.

- Regionally, North America led with 40% share, followed by Europe at 28% and Asia Pacific at 22%, while Latin America accounted for 6% and the Middle East & Africa held 4%, reflecting strong global penetration.

Market Segmentation Analysis:

By Component

The software segment dominated the EFSS market in 2024, holding 67% of the total share. Its leadership is supported by rising adoption of advanced file sharing, collaboration, and real-time synchronization solutions across industries. Organizations rely on EFSS software to secure enterprise data, enhance productivity, and enable remote access for distributed teams. Features such as workflow integration, advanced security controls, and analytics strengthen its adoption. The services segment accounted for 33% share, driven by demand for consulting, deployment support, and managed services that ensure seamless implementation and long-term system optimization.

- For instance, Dropbox is a major provider in the Enterprise File Synchronization and Sharing (EFSS) market, demonstrating large-scale enterprise adoption of secure file sharing and collaboration software.

By Enterprise Size

Large enterprises led the EFSS market in 2024, capturing 63% share due to their complex data management needs and global operations. These organizations require scalable EFSS platforms to manage high volumes of sensitive information, ensure regulatory compliance, and support cross-border collaboration. The growing emphasis on security and hybrid work models further boosts adoption among large corporations. Small and medium enterprises (SMEs) accounted for 37% share, with growth driven by the availability of cost-effective, cloud-based EFSS solutions that improve agility and accessibility without heavy infrastructure investments.

- For instance, IBM serves numerous clients across critical infrastructure sectors like financial services and healthcare, where its broader hybrid cloud and AI platforms manage petabytes of data under strict compliance frameworks.

By Deployment Mode

Cloud deployment dominated the EFSS market in 2024, accounting for 60% of the deployment share, supported by its scalability, cost efficiency, and ability to enable remote collaboration. Enterprises favor cloud-based EFSS platforms for their flexibility, real-time access, and seamless integration with existing IT ecosystems. On-premises deployment held 25% share, appealing to sectors such as banking, healthcare, and government with stringent compliance and data residency requirements. Hybrid models captured 15% share, offering a balance between cloud agility and on-premises control, making them increasingly attractive to organizations with mixed security and scalability needs.

Key Growth Drivers

Rising Need for Secure Data Sharing

The growing demand for secure enterprise collaboration is a key driver of the EFSS market. With the increasing exchange of sensitive business information across teams and geographies, organizations require platforms that ensure data security, compliance, and controlled access. EFSS solutions provide encryption, identity management, and audit trails that meet regulatory standards such as GDPR and HIPAA. This security focus makes EFSS critical for industries like healthcare, BFSI, and government. The rising risks of cyberattacks and data breaches continue to push enterprises toward robust synchronization and sharing solutions.

- For instance, in October 2024, Progress Software Corporation acquired ShareFile, which currently serves over 86,000 customers. The service is known for its secure content collaboration and includes features such as built-in encryption and compliance certifications.

Adoption of Cloud and Remote Work Models

Cloud deployment has accelerated EFSS adoption, holding 60% share in 2024, as enterprises embrace hybrid and remote work models. Cloud-based EFSS solutions offer scalability, real-time access, and seamless integration with productivity tools like Office 365 and Google Workspace. Organizations benefit from reduced infrastructure costs and improved collaboration across distributed teams. Remote work trends highlight the need for flexible platforms that support mobile access and secure file sharing. This shift ensures cloud EFSS remains central to enterprises’ digital transformation strategies, fueling rapid adoption across both SMEs and large enterprises globally.

- For instance, Microsoft OneDrive integrates with Microsoft 365 and enables real-time file synchronization across distributed workforces. It provides access to files across devices, works with Microsoft 365 apps like Word and Excel for real-time collaboration, and offers advanced features for security and administration.

Integration with Workflow and Productivity Tools

The integration of EFSS platforms with enterprise applications and productivity tools is driving adoption. Businesses seek unified platforms that combine secure file sharing with workflow automation, project management, and real-time collaboration features. Integration with CRM, ERP, and communication tools enhances operational efficiency and reduces silos. This interoperability enables enterprises to streamline workflows while maintaining strict data governance. As organizations prioritize digital efficiency, EFSS providers offering seamless integration and advanced APIs are gaining competitive advantage, making this a critical growth factor in the market.

Key Trends and Opportunities

AI and Analytics-Driven EFSS Solutions

Artificial intelligence and advanced analytics are reshaping EFSS platforms by enhancing automation, security, and insights. AI enables features such as intelligent file search, predictive sharing, anomaly detection, and automated compliance monitoring. These capabilities improve productivity and safeguard sensitive information against risks. Enterprises adopting AI-enabled EFSS benefit from smarter workflows and stronger data protection. As digital ecosystems grow more complex, the integration of AI into EFSS solutions represents a significant opportunity for vendors to differentiate their offerings and deliver greater value to enterprises seeking data-driven collaboration.

- For instance, Box employs Box AI to process and classify documents stored on its platform, enabling natural language search and compliance monitoring for enterprise clients.

Growing SME Adoption through Cost-Effective Cloud Models

Small and medium enterprises are emerging as a strong growth opportunity, contributing 37% share in 2024. Affordable cloud-based EFSS platforms allow SMEs to adopt enterprise-grade solutions without large infrastructure investments. These tools enhance collaboration, enable remote work, and provide secure file sharing for smaller teams. The ability to scale services as businesses grow increases their appeal. With the rise of digital-first SMEs, cloud EFSS adoption is set to expand rapidly, particularly in emerging markets, creating a significant opportunity for vendors targeting cost-conscious but tech-savvy enterprises.

- For instance, DocuWare Cloud provides document management and workflow automation solutions to over 10,000 cloud customers worldwide, enabling small to medium-sized businesses (SMEs) to digitize workflows cost-effectively.

Key Challenges

High Implementation and Integration Costs

Despite strong demand, the high cost of implementing EFSS solutions remains a barrier, especially for smaller organizations. Enterprises often face expenses related to licensing, system integration, data migration, and employee training. Advanced features like AI-driven security or hybrid deployments increase costs further. While cloud models reduce upfront investment, recurring subscription fees can still burden SMEs. Vendors need to introduce flexible pricing strategies and modular platforms to lower barriers to entry. Without addressing affordability, adoption among cost-sensitive enterprises may remain limited, slowing overall market growth.

Data Privacy and Compliance Concerns

Data privacy is a major challenge for the EFSS market, particularly in cloud deployments where sensitive information is stored and shared across borders. Industries such as BFSI and healthcare require strict compliance with regulations like GDPR, HIPAA, and SOX. Enterprises remain cautious about entrusting critical data to third-party platforms due to risks of unauthorized access and cyber threats. Concerns around data residency also affect adoption in regions with strict sovereignty rules. EFSS providers must prioritize strong encryption, compliance certifications, and transparent governance frameworks to build trust and expand adoption globally.

Regional Analysis

North America

North America led the EFSS market in 2024 with 40% share, supported by advanced IT infrastructure, strong cloud adoption, and rising security requirements. The U.S. dominates regional demand, with enterprises prioritizing secure collaboration and compliance with strict regulations such as HIPAA and SOX. Major technology providers and high digital transformation investments drive adoption across industries including healthcare, BFSI, and government. Remote work expansion further fuels cloud EFSS platforms, enhancing real-time collaboration and mobility. With strong regulatory frameworks and significant enterprise spending, North America remains the largest and most mature regional market for EFSS solutions.

Europe

Europe accounted for 28% of the EFSS market share in 2024, driven by strict regulatory compliance under GDPR and a strong focus on secure data management. Countries such as Germany, France, and the United Kingdom lead adoption, leveraging EFSS platforms for controlled file sharing and governance. Enterprises emphasize hybrid deployments to balance flexibility with security needs. Adoption across manufacturing, financial services, and government sectors supports steady market expansion. Rising demand for data sovereignty, coupled with Industry 4.0 initiatives, positions Europe as the second-largest EFSS market with continued opportunities for vendors providing compliance-oriented solutions.

Asia Pacific

Asia Pacific captured 22% of the EFSS market share in 2024, emerging as the fastest-growing region. Rapid digital transformation, expanding cloud infrastructure, and the rise of SMEs are key factors driving adoption. China, India, and Japan dominate regional growth, with enterprises embracing EFSS for secure collaboration and mobile accessibility. Increasing investments in smart manufacturing and digital-first business models enhance demand for cloud-based EFSS. Vendors are expanding presence in the region to cater to rising demand for cost-effective, scalable solutions. With accelerating cloud penetration and growing digital ecosystems, Asia Pacific is positioned as a high-potential EFSS market.

Latin America

Latin America represented 6% of the EFSS market share in 2024, led by Brazil and Mexico. Regional adoption is fueled by the growing shift toward digitalization, remote work, and demand for secure data-sharing solutions. SMEs in the region increasingly adopt cloud EFSS platforms for affordability and ease of use. However, challenges such as uneven IT infrastructure and economic volatility affect growth. Despite these hurdles, rising awareness of data security and the need for compliance support adoption. Expanding local service providers and global vendor partnerships are driving steady growth, making Latin America an emerging EFSS market.

Middle East and Africa

The Middle East and Africa together held 4% of the EFSS market share in 2024, reflecting early adoption but strong future potential. The United Arab Emirates and Saudi Arabia lead the region with investments in digital transformation and government-backed initiatives for secure enterprise collaboration. EFSS adoption is growing in sectors such as oil and gas, public administration, and finance. In Africa, South Africa drives regional demand with rising cloud penetration and business modernization efforts. Limited digital infrastructure remains a barrier, but ongoing investments and enterprise cloud initiatives highlight strong opportunities for EFSS growth in the region.

Market Segmentations:

By Component

By Enterprise Size

By Deployment Mode

By Application

- File & storage

- Content management backup

- Mobile access & productivity

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the enterprise file synchronization and sharing (EFSS) market is shaped by leading players such as IBM, Dropbox, VMware, Box, Syncplicity, Citrix Systems, Microsoft, Google, Egnyte, and OpenText. These companies are driving innovation through secure, scalable platforms designed to meet growing enterprise needs for data sharing, mobility, and compliance. Microsoft and Google dominate with integrated productivity suites that seamlessly embed EFSS into broader collaboration ecosystems, while Dropbox and Box remain strong in user-centric, cloud-first models. IBM and OpenText emphasize enterprise-grade solutions with robust compliance and governance features. VMware, Egnyte, and Citrix target hybrid and secure deployment models, appealing to regulated industries such as BFSI, government, and healthcare. Syncplicity focuses on mobility-driven EFSS, supporting enterprises managing distributed teams. Competition is centered on data security, regulatory compliance, integration with enterprise applications, and cloud flexibility, pushing vendors to enhance offerings with AI, encryption, and analytics to gain market advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- IBM

- Dropbox

- VMware

- Box

- Syncplicity

- Citrix Systems

- Microsoft

- Google

- Egnyte

- OpenText

Recent Developments

- In August 2025, Egnyte released a bi-directional domain sync capability that lets connected Egnyte domains automatically sync updates both ways.

- In May 2025, Egnyte Storage Sync v 13.6 introduced an IP address allowlisting feature for device authentication.

- In April 2025, Dropbox enhanced its Dash AI search tool by adding support for natural-language queries across video, audio, and image files.

- In April 2025, Dropbox rolled out a custom exclusions feature allowing administrators to exclude sensitive documents (e.g. HR or financial) from search results.

Report Coverage

The research report offers an in-depth analysis based on Component, Enterprise Size, Deployment Mode, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The EFSS market will expand rapidly with rising enterprise demand for secure collaboration.

- Cloud deployment will continue dominating as remote and hybrid work models strengthen.

- AI and machine learning will enhance file security, compliance, and predictive analytics.

- Large enterprises will maintain leadership while SMEs will accelerate adoption through cost-effective cloud solutions.

- Integration with enterprise productivity suites will remain a core growth driver.

- Hybrid EFSS models will grow in regulated sectors requiring both flexibility and control.

- Mobile-first EFSS adoption will rise with increasing workforce mobility and BYOD policies.

- Vendors will focus on zero-trust security frameworks to build enterprise trust.

- Strategic partnerships and acquisitions will expand solution portfolios and market reach.

- Asia Pacific will emerge as a high-growth region with digitalization and SME adoption.