Market Overview:

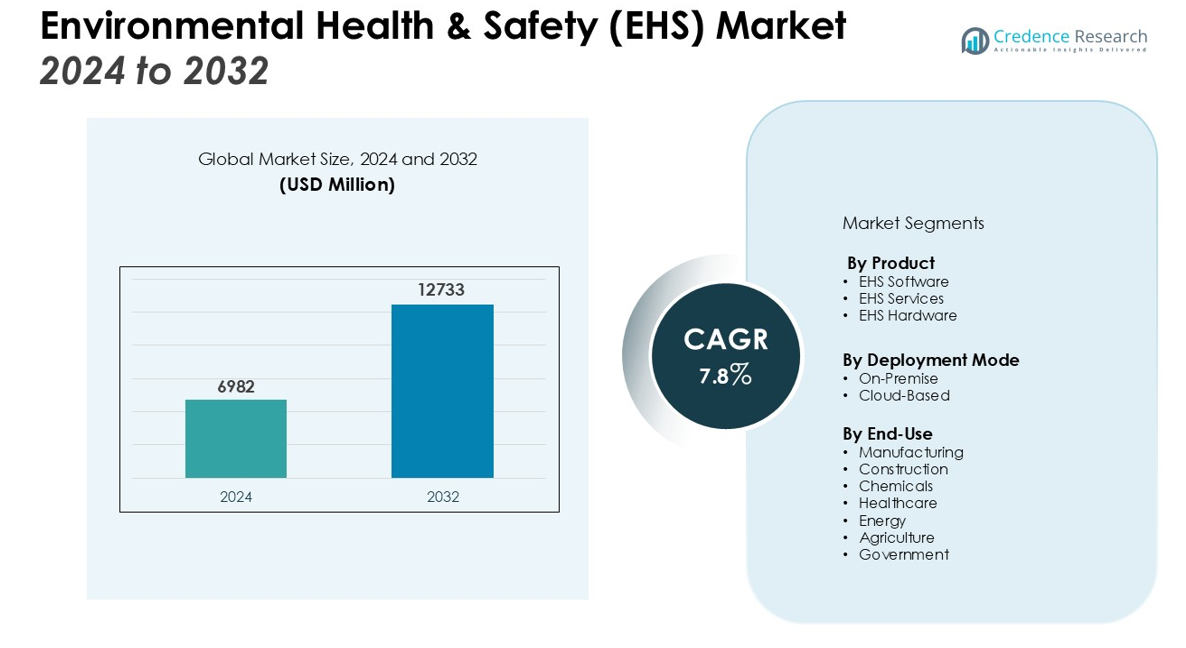

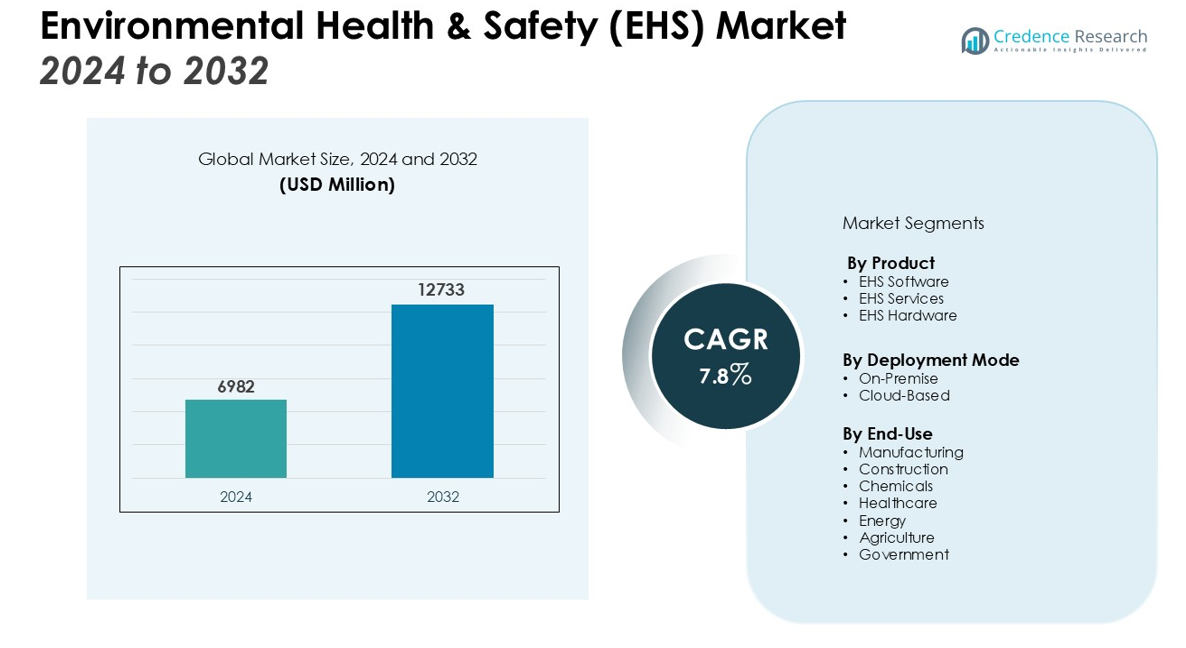

The Environmental Health & Safety (EHS) Market size was valued at USD 6982 million in 2024 and is anticipated to reach USD 12733 million by 2032, at a CAGR of 7.8% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Environmental Health & Safety (EHS) Market Size 2024 |

USD 6982 million |

| Environmental Health & Safety (EHS) Market, CAGR |

7.8% |

| Environmental Health & Safety (EHS) Market Size 2032 |

USD 12733 million |

Key drivers of market growth include stringent regulations related to environmental protection, health, and safety in various industries such as manufacturing, chemicals, and construction. The growing adoption of cloud-based EHS solutions, coupled with AI, IoT, and data analytics, is enhancing the effectiveness of safety management systems. Additionally, the increasing focus on employee wellness and sustainable business practices is pushing organizations to invest more in EHS programs. The integration of real-time monitoring and predictive analytics further supports proactive risk management, fostering a safer work environment.

Regionally, North America holds the largest share of the EHS market, owing to robust regulatory frameworks and advanced technological infrastructure. Europe follows closely, with governments enforcing strict EHS regulations. The Asia Pacific region is expected to witness the highest growth during the forecast period, driven by industrialization and increased focus on environmental protection in emerging economies such as China and India. Moreover, governments in the region are ramping up efforts to strengthen EHS standards, promoting market growth.

Market Insights:

- The Environmental Health & Safety (EHS) Market was valued at USD 6,982 million and is projected to reach USD 12,733 million, registering a CAGR of 7.8% during the forecast period.

- Stringent government regulations across industries such as manufacturing, chemicals, and construction remain a key growth driver for the market.

- The adoption of cloud-based EHS solutions integrated with AI, IoT, and data analytics is reshaping compliance management and risk assessment.

- Organizations are increasing investments in EHS programs to strengthen workplace safety and improve employee health and wellness standards.

- Real-time monitoring and predictive analytics are enhancing proactive risk management, enabling safer and more efficient work environments.

- North America leads with 35 percent share, supported by strict regulatory frameworks and advanced technological infrastructure, followed by Europe with 30 percent share.

- Asia Pacific holds 20 percent share and is forecasted to grow fastest, fueled by rapid industrialization and stronger environmental protection measures in emerging economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Strict Government Regulations and Compliance Requirements

The Environmental Health & Safety (EHS) market is primarily driven by stringent government regulations and compliance standards across various sectors. Governments worldwide are enforcing stricter laws related to occupational safety, environmental protection, and public health. Organizations must comply with these regulations to avoid penalties and maintain a good reputation. These regulations require businesses to continuously update and enhance their EHS programs, driving demand for advanced EHS solutions.

- For instance, Locus Technologies provides cloud-based software that helps organizations manage EHS compliance data for over 1,250,000 locations worldwide.

Increased Focus on Workplace Safety and Employee Health

Evolving awareness around workplace safety and employee health has led organizations to invest more in EHS programs. Companies are focusing on reducing workplace hazards and improving overall health standards to prevent accidents, injuries, and diseases. As businesses seek to provide safer environments, the need for comprehensive EHS management systems has surged, driving market growth. This trend is particularly strong in industries such as manufacturing, chemicals, and construction, where the risk of accidents is high.

- For instance, TMD Friction invests EUR 400,000 annually in its “Say No to Risk” program to identify and eliminate critical life risks, protecting its employees from harm.

Technological Advancements in EHS Solutions

Technological innovations in EHS solutions have significantly contributed to market expansion. The integration of AI, IoT, and data analytics into EHS platforms is enhancing the effectiveness of safety management systems. These technologies enable real-time monitoring, predictive analytics, and automated reporting, helping organizations identify and address potential risks before they escalate. The adoption of cloud-based solutions further boosts accessibility and scalability for businesses across different regions.

Growing Corporate Responsibility Towards Environmental Sustainability

Increasing pressure from stakeholders, including customers, investors, and regulatory bodies, has led organizations to prioritize environmental sustainability. Companies are adopting greener practices to minimize their environmental footprint and ensure compliance with EHS regulations. This growing emphasis on sustainability drives investments in EHS solutions, helping organizations mitigate environmental risks and manage waste, emissions, and other ecological impacts effectively.

Market Trends:

Adoption of Cloud-Based EHS Solutions and Advanced Technologies

A significant trend in the Environmental Health & Safety (EHS) market is the growing adoption of cloud-based EHS solutions. These platforms offer scalability, flexibility, and easy integration with other enterprise systems, making them increasingly attractive to businesses of all sizes. The integration of advanced technologies such as artificial intelligence (AI), machine learning, and the Internet of Things (IoT) enhances the capabilities of these systems, enabling real-time monitoring, data analytics, and automated risk management. This trend is reshaping the way organizations handle compliance, reporting, and safety management, providing more proactive and predictive solutions for EHS challenges.

- For instance, Locus Technologies, a provider of EHS software, utilizes automation and IoT to manage over 500,000,000 analytical records in real time for its clients.

Increased Focus on Employee Wellness and Sustainability

Another emerging trend in the EHS market is the increased emphasis on employee wellness and sustainable business practices. Companies are recognizing the long-term value of maintaining a healthy workforce, leading to the implementation of wellness programs that prioritize both physical and mental health. This focus aligns with the growing importance of sustainability, as organizations are adopting greener practices to meet environmental regulations and enhance their corporate reputation. The shift towards sustainability and wellness is influencing the demand for integrated EHS solutions that help organizations manage both environmental and human health risks effectively. As a result, organizations are investing in solutions that not only ensure compliance but also contribute to a safer, healthier, and more sustainable work environment.

- For instance, a long-term study of Johnson & Johnson’s wellness program found that the initiative resulted in savings of approximately $225 per employee per year in medical care costs.

Market Challenges Analysis:

Complexity of Compliance and Regulatory Changes

One of the primary challenges in the Environmental Health & Safety (EHS) market is the complexity of compliance with ever-changing regulations. Governments globally continue to update and introduce new regulations to ensure better environmental and workplace safety standards. Companies must continuously monitor and adapt their EHS strategies to remain compliant, often requiring significant resources and expertise. The variability in regional regulations adds another layer of complexity, making it difficult for global businesses to maintain uniformity in their safety and environmental management practices. Compliance violations can result in hefty fines, legal complications, and damage to brand reputation.

Integration and Data Management Issues

Another challenge in the EHS market is the integration of EHS systems with existing business operations. Many organizations face difficulties in consolidating data from different sources, especially when they use legacy systems or multiple software platforms. This can lead to inefficiencies, data silos, and missed opportunities for improvement. Furthermore, analyzing and leveraging vast amounts of EHS data for actionable insights remains a hurdle for businesses. The lack of skilled professionals to manage and interpret this data further compounds the issue, making it harder to implement effective EHS strategies.

Market Opportunities:

Growth of Sustainable and Green Initiatives

The growing focus on sustainability presents significant opportunities in the Environmental Health & Safety (EHS) market. As governments and organizations emphasize eco-friendly practices, businesses are investing in greener technologies and solutions to minimize their environmental impact. Companies that integrate sustainable practices into their operations can leverage EHS solutions to improve waste management, reduce carbon emissions, and enhance resource efficiency. The increasing consumer preference for eco-conscious brands further drives demand for EHS systems that align with sustainability goals, creating opportunities for market expansion.

Advancements in Technology and Data Analytics

Technological advancements, particularly in AI, IoT, and data analytics, open new opportunities for the EHS market. These technologies enhance the ability to monitor, track, and predict potential risks, helping organizations stay ahead of compliance requirements and improve workplace safety. The use of real-time monitoring systems allows for faster response times to hazardous situations, increasing operational efficiency. Furthermore, cloud-based platforms make it easier for businesses to scale their EHS solutions, offering enhanced accessibility and collaboration across various departments. These innovations position the market for continued growth and the development of smarter, more integrated EHS management systems.

Market Segmentation Analysis:

By Product

The product segment includes EHS software, services, and hardware solutions. EHS software dominates the market due to its ability to streamline compliance management, reporting, and risk assessment through automation and data analytics. Services, including consulting and system integration, hold a significant share, supporting businesses in the implementation and optimization of EHS systems. Hardware solutions, such as monitoring devices, contribute a smaller share but are crucial for real-time data collection and safety monitoring.

- For instance, Teck Coal utilizes 3M’s Safety & Inspection Manager (SIM) software to enhance its EHS program, achieving greater efficiency and insight into its safety operations.

By Deployment Mode

The market is divided into on-premise and cloud-based deployment models. Cloud-based EHS solutions are rapidly gaining traction due to their scalability, flexibility, and reduced upfront costs. This model allows businesses to access EHS systems remotely, facilitating real-time monitoring and updates. On-premise solutions continue to hold relevance for larger organizations with strict data security requirements, though cloud adoption is increasing.

- For instance, by implementing a cloud-based EHS solution across its sites, ArcelorMittal Construction saved an estimated 5,000 hours per year on audits alone.

By End-Use

The end-use segment of the Environmental Health & Safety (EHS) Market includes industries such as manufacturing, construction, chemicals, healthcare, and energy. Manufacturing and construction sectors are major contributors to market growth due to high regulatory compliance needs and safety concerns. The healthcare industry is witnessing a rising demand for EHS solutions focused on employee health and regulatory adherence. The energy sector is also adopting EHS systems to manage environmental risks and ensure workplace safety. Each end-use segment prioritizes tailored EHS solutions to address specific industry challenges.

Segmentations:

By Product

- EHS Software

- EHS Services

- EHS Hardware

By Deployment Mode

By End-Use

- Manufacturing

- Construction

- Chemicals

- Healthcare

- Energy

- Agriculture

- Government

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America: Leading Market with Stringent Regulations

North America holds the largest share of the Environmental Health & Safety (EHS) market, commanding 35% of the global market. This dominance is driven by stringent government regulations and a well-established industrial base, particularly in the U.S. and Canada. Robust regulatory frameworks require compliance with environmental, health, and safety standards across various sectors, including manufacturing, oil & gas, and construction. These regulations push companies to invest significantly in EHS solutions to ensure adherence and avoid penalties. The growing emphasis on employee wellness and the integration of advanced technologies further stimulate market expansion in this region.

Europe: Strong Regulatory Environment and Technological Growth

Europe holds a significant share of the EHS market, representing 30% of the global market. The region benefits from progressive EHS policies and strong industrial sectors, particularly in chemicals, automotive, and energy. European countries like Germany, France, and the UK enforce stringent EHS regulations that drive investments in safety and environmental solutions. The increasing demand for cloud-based EHS systems and advanced data analytics to manage compliance and risk further boosts market growth in Europe. The region’s focus on sustainability and worker safety positions it as a key player in the global EHS landscape.

Asia Pacific: High Growth Potential in Emerging Economies

Asia Pacific accounts for 20% of the global Environmental Health & Safety (EHS) market, with the highest expected growth rate during the forecast period. The region’s rapid industrialization, particularly in China, India, and Southeast Asia, creates a strong demand for advanced EHS solutions. Governments are implementing stricter EHS regulations to mitigate environmental and health risks associated with industrial growth. The expansion of manufacturing and energy sectors in emerging economies contributes to the increasing adoption of EHS technologies. This growth is further supported by the region’s evolving regulatory landscape and a growing focus on sustainability and safety.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Intelex Technologies

- Enablon

- AECOM

- Jacobs

- Tetra Tech, Inc.

- SAP SE

- Golder Associates

- Cority (Medgate)

- SGS SA.

- ERM Group, Inc.

- ETQ

- VelocityEHS

- John Wood Group PLC

- RPS Group

- Sphera

Competitive Analysis:

The Environmental Health & Safety (EHS) Market is highly competitive, driven by the presence of global players such as Intelex Technologies, Enablon, Sphera, SAP, and VelocityEHS, which are focusing on advanced technology integration and compliance-driven solutions. It is witnessing rapid adoption of cloud-based platforms that deliver scalability, real-time monitoring, and predictive analytics, enabling organizations to address safety and regulatory challenges effectively. Companies are pursuing mergers, acquisitions, and strategic collaborations to expand geographic reach and strengthen service portfolios. The demand for tailored EHS solutions suited to industry-specific requirements is intensifying competition, encouraging vendors to enhance customization and flexibility. It reflects a growing shift toward integrated, data-driven systems that not only support regulatory compliance but also align with corporate sustainability goals, giving an advantage to providers that can deliver both operational efficiency and long-term environmental responsibility.

Recent Developments:

- In July 2025, Intelex Technologies ULC announced its Q2 2025 product launch, introducing new risk management applications and platform enhancements for EHSQ operations.

- In July 2025, Tetra Tech announced its financial results for the third quarter of fiscal year 2025, reporting a total revenue of $1.37 billion and net revenue of $1.15 billion.

- In April 2025, Intelex announced its Q1 2025 product launch, which focused on improving user experience, expanding training capabilities, and strengthening environmental compliance tools.

Market Concentration & Characteristics:

The Environmental Health & Safety (EHS) Market demonstrates moderate concentration, with a mix of global leaders and regional players competing across industries. It is characterized by the dominance of established providers such as Intelex Technologies, Enablon, Sphera, SAP, and VelocityEHS, which control a significant portion of the market through advanced technology platforms and regulatory expertise. Smaller vendors also contribute by offering niche or industry-specific solutions, creating a balanced competitive environment. It shows strong reliance on innovation, with cloud deployment, IoT integration, and predictive analytics shaping adoption trends. The market is defined by strict regulatory influence, high compliance requirements, and a growing emphasis on sustainability, which drive both standardization and customization of solutions. It remains highly dynamic, with demand for scalable and flexible systems continuing to expand across industries and geographies.

Report Coverage:

The research report offers an in-depth analysis based on Product, Deployment Mode, End-Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for cloud-based EHS solutions will continue to grow as companies seek scalability and cost-effective compliance management.

- Integration of AI, IoT, and predictive analytics will enhance the capabilities of EHS systems, offering real-time monitoring and advanced risk management.

- Regulatory pressure will remain a key driver, prompting businesses to invest in EHS solutions to maintain compliance and mitigate penalties.

- Growing awareness of environmental sustainability will lead organizations to adopt greener practices, increasing the need for EHS systems focused on environmental risk management.

- Employee wellness initiatives will drive the adoption of EHS solutions that address health and safety concerns, particularly in high-risk industries.

- EHS platforms will evolve to incorporate more comprehensive data analytics, allowing businesses to make more informed decisions on risk management and compliance.

- Industries such as manufacturing, construction, and chemicals will continue to be major adopters of EHS solutions due to the high safety and environmental risks they face.

- Automation and digital transformation will drive the shift from manual processes to more efficient, integrated EHS management systems.

- The Asia Pacific region will experience the fastest growth due to industrialization and stricter regulatory frameworks in emerging economies.

- Companies offering customizable and industry-specific EHS solutions will gain a competitive edge in a rapidly evolving market.