Market Overview

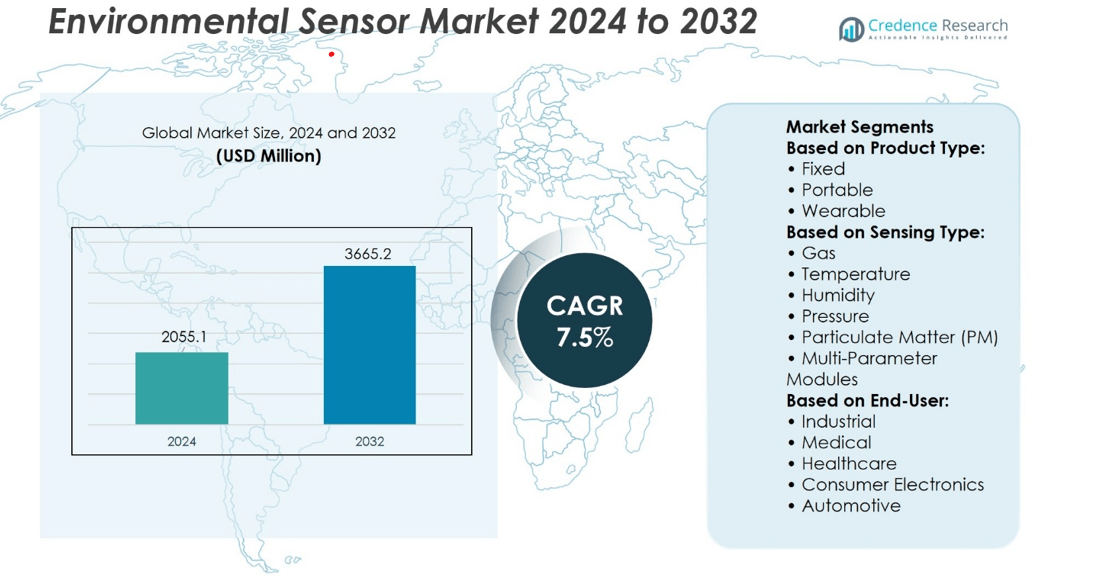

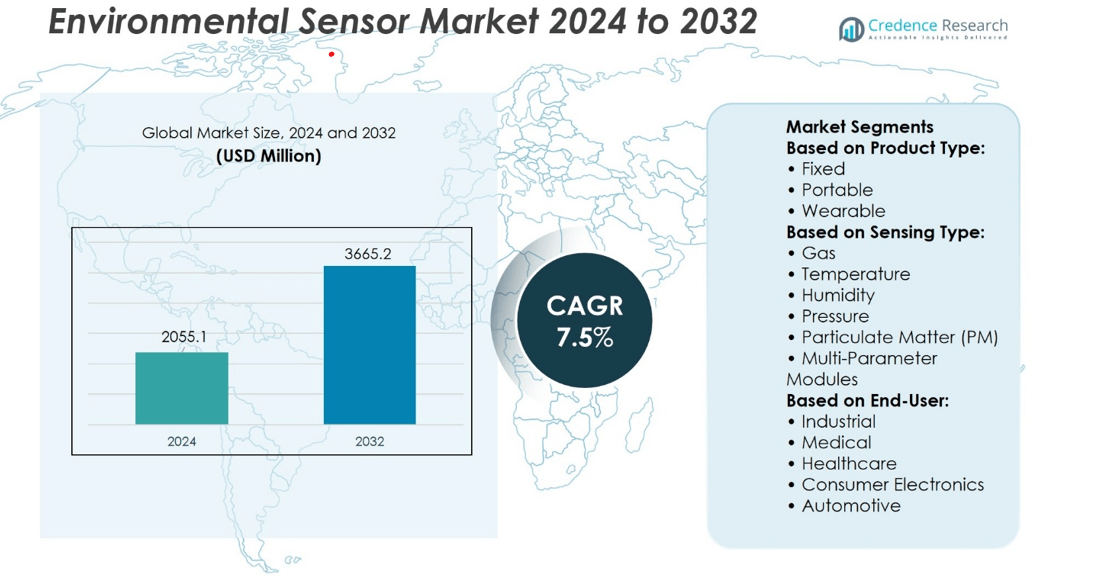

Environmental Sensor Market size was valued at USD 2055.1 million in 2024 and is anticipated to reach USD 3665.2 million by 2032, at a CAGR of 7.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Environmental Sensor Market Size 2024 |

USD 2055.1 million |

| Environmental Sensor Market, CAGR |

7.5% |

| Environmental Sensor Market Size 2032 |

USD 3665.2 million |

The Environmental Sensor Market grows through rising demand for accurate and real-time monitoring across industrial, healthcare, and urban infrastructure applications. Stricter environmental regulations and sustainability goals drive adoption in air quality, water purity, and climate monitoring systems. Technological advancements in IoT connectivity, miniaturization, and multi-parameter sensing enhance operational efficiency and expand deployment possibilities. It benefits from increasing integration into smart city frameworks, precision agriculture, and consumer electronics. Growing public awareness of environmental health issues supports continuous innovation in sensor accuracy, durability, and energy efficiency, positioning environmental sensors as critical tools for regulatory compliance, resource management, and proactive environmental protection.

The Environmental Sensor Market shows strong presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with Asia-Pacific leading due to rapid industrialization and large-scale environmental monitoring programs. North America and Europe follow closely, driven by stringent regulations and advanced infrastructure. Key players include Texas Instruments Incorporated, STMicroelectronics, Raritan Inc., OMRON Corporation, Schneider Electric, IDT, Honeywell International Inc., ABB Ltd., Siemens AG, and Sensirion AG, all focusing on innovation, product diversification, and global expansion strategies.

Market Insights

- Environmental Sensor Market size was valued at USD 2055.1 million in 2024 and is anticipated to reach USD 3665.2 million by 2032, at a CAGR of 7.5%.

- Rising demand for accurate and real-time monitoring in industrial, healthcare, and urban infrastructure applications drives market growth.

- Increasing integration of IoT connectivity, miniaturization, and multi-parameter sensing shapes market trends.

- Competition intensifies as leading companies focus on innovation, product diversification, and strategic global expansion.

- High costs of advanced sensor technologies and maintenance requirements act as restraints in price-sensitive markets.

- Asia-Pacific leads due to rapid industrialization and large-scale monitoring programs, followed by North America and Europe with strong regulatory support.

- Growing public awareness of environmental health issues and adoption in smart city frameworks and precision agriculture enhance long-term market potential.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Increasing Regulatory Standards and Environmental Compliance Requirements

The Environmental Sensor Market grows through stricter environmental regulations and compliance frameworks worldwide. Governments enforce policies on air quality, water purity, and soil health to safeguard public health and ecosystems. Industries integrate advanced sensors to meet emissions limits and reporting obligations. Compliance-driven adoption fuels demand for high-precision sensing technologies capable of detecting multiple parameters simultaneously. It prompts investment in research to improve sensitivity, calibration accuracy, and long-term stability. These developments position environmental sensors as critical tools for achieving regulatory adherence in multiple sectors.

- For instance, Aclima and Google’s Project Air View collected a dataset comprising 42 million hyperlocal air pollution and greenhouse gas measurements.

Rising Industrialization and Need for Pollution Monitoring in Urban Areas

Rapid urbanization and industrial expansion create greater demand for real-time environmental monitoring solutions. Manufacturing hubs, transportation networks, and power plants require sensors to track pollutants and maintain operational safety. The Environmental Sensor Market supports municipalities in deploying sensor networks for continuous air and water quality assessment. It enables early detection of hazardous conditions, facilitating timely mitigation actions. High-density monitoring systems in cities help authorities manage pollution sources more effectively. This trend strengthens the role of environmental sensors in sustainable urban management strategies.

- For instance, IQAir’s global monitoring network processes 1.2 million real-time air quality data points daily from industrial and urban locations across more than 100 countries, enabling precise pollution source tracking and compliance reporting.

Technological Advancements in Sensor Miniaturization and Integration

The miniaturization of sensing components combined with IoT integration expands the application range of environmental sensors. Compact designs allow deployment in handheld devices, wearables, and distributed sensor grids. It enhances mobility and flexibility in environmental data collection across remote and constrained spaces. Integration with wireless communication protocols improves data transmission efficiency. Advanced analytics platforms process sensor data in real time for actionable insights. These capabilities strengthen market competitiveness by addressing diverse industrial, commercial, and research needs.

Growing Public Awareness and Corporate Sustainability Initiatives

Public concern over climate change, air pollution, and resource depletion increases demand for transparent environmental data. Corporations adopt sensors to monitor their ecological footprint and support sustainability reporting. The Environmental Sensor Market benefits from rising environmental stewardship programs in energy, agriculture, and logistics sectors. It provides accurate data that informs corporate decision-making and resource optimization. Continuous monitoring enables proactive measures that reduce environmental impact. This alignment between business objectives and environmental responsibility drives consistent sensor adoption.

Market Trends

Expansion of IoT-Enabled Environmental Monitoring Networks

The integration of IoT platforms with sensor technologies drives large-scale deployment of environmental monitoring systems. Networked sensors transmit continuous data to centralized platforms for real-time analysis and visualization. The Environmental Sensor Market leverages IoT connectivity to enhance scalability and remote accessibility. It supports smart city initiatives by enabling centralized oversight of air, water, and soil quality parameters. These networks improve the ability to detect anomalies and initiate corrective measures promptly. Adoption grows in sectors where decentralized monitoring ensures operational efficiency and regulatory compliance.

- For instance, Libelium’s Smart Environment PRO IoT network in Spain processes over 2.5 million environmental data readings daily from connected air quality, noise, and meteorological sensors, enabling automated alerts and high-resolution pollution map.

Adoption of AI and Predictive Analytics for Environmental Data Interpretation

Artificial intelligence and predictive analytics transform raw sensor readings into actionable insights. Machine learning algorithms process large datasets to identify pollution trends, seasonal variations, and emerging risks. It enhances decision-making in environmental management and resource allocation. The Environmental Sensor Market benefits from AI-driven predictive capabilities that forecast environmental changes with high accuracy. Advanced analytics also optimize sensor calibration schedules, reducing maintenance costs. This trend strengthens the role of environmental sensors in proactive planning and risk mitigation.

Development of Multi-Parameter and Hybrid Sensor Solutions

Manufacturers design multi-parameter sensors capable of measuring several environmental variables simultaneously. Hybrid configurations combine chemical, physical, and optical sensing methods for broader data coverage. It reduces the need for multiple devices and streamlines installation in field applications. The Environmental Sensor Market sees growing demand for compact, multifunctional units in industrial, commercial, and municipal projects. These solutions improve operational efficiency by providing a complete environmental profile from a single deployment. Their versatility supports a wider range of environmental management programs.

- For instance, Sensirion’s environmental sensor platforms capture 2.8 million multi-parameter data readings daily across industrial, commercial, and smart city deployments, enabling comprehensive environmental monitoring from a single integrated module.

Rising Demand for Portable and Wearable Environmental Monitoring Devices

The trend toward mobility in data collection fuels demand for portable and wearable environmental sensors. Lightweight and compact designs enable deployment in personal health devices, field research kits, and mobile inspection units. It extends environmental monitoring beyond fixed infrastructure into on-the-go applications. The Environmental Sensor Market gains traction in consumer health, occupational safety, and disaster response contexts. Wearable devices empower individuals and workers to track personal exposure to environmental hazards in real time. This shift toward mobility reflects growing interest in personalized environmental awareness.

Market Challenges Analysis

High Costs of Advanced Sensor Technologies and Deployment

The adoption of sophisticated environmental sensing solutions is limited by high initial costs and ongoing operational expenses. Advanced multi-parameter and high-precision sensors require specialized components and calibration processes that increase manufacturing costs. The Environmental Sensor Market faces slower penetration in price-sensitive regions where budget constraints impact large-scale deployment. It must also address the financial burden of installing dense monitoring networks that require reliable connectivity and power infrastructure. Limited funding in municipal and rural projects reduces opportunities for widespread adoption. Cost-effective innovations and scalable manufacturing processes are necessary to expand accessibility and accelerate market growth.

Data Accuracy, Calibration Complexity, and Environmental Interference

Ensuring data accuracy in diverse environmental conditions remains a significant operational challenge. Sensors deployed in harsh or variable climates often face drift, contamination, or signal interference that compromise readings. The Environmental Sensor Market must address the complexity of frequent calibration to maintain measurement reliability over time. It also contends with integrating data from heterogeneous sensor types into unified analytical platforms without loss of fidelity. Environmental factors such as humidity, temperature fluctuations, and chemical exposure increase maintenance demands. These technical hurdles highlight the need for robust designs and advanced filtering algorithms to ensure consistent and actionable environmental data.

Market Opportunities

Integration with Smart City and Sustainable Infrastructure Projects

The global shift toward smart city development presents significant growth prospects for advanced environmental sensing solutions. Urban planners integrate sensor networks into transportation systems, waste management, and energy grids to monitor environmental health in real time. The Environmental Sensor Market benefits from rising investments in infrastructure projects designed to enhance urban sustainability and resilience. It enables continuous tracking of air and water quality, noise pollution, and microclimate variations across densely populated areas. Data-driven insights from these systems support policy implementation and public awareness initiatives. Expanding adoption in smart city ecosystems strengthens the role of environmental sensors in long-term urban planning strategies.

Expansion into Precision Agriculture and Climate Resilience Programs

Precision agriculture and climate adaptation initiatives open new applications for high-performance environmental sensors. Agricultural operations use these systems to monitor soil moisture, nutrient levels, and microclimatic conditions to optimize crop yields. The Environmental Sensor Market finds strong potential in supporting early warning systems for extreme weather events and resource management. It delivers accurate data that informs irrigation schedules, pest control, and harvest timing. Governments and private enterprises invest in sensor-enabled climate resilience programs to mitigate the impact of environmental changes. These opportunities position environmental sensors as essential tools in protecting food security and community well-being.

Market Segmentation Analysis:

By Product Type

The Environmental Sensor Market divides into fixed, portable, and wearable formats, each addressing distinct operational needs. Fixed sensors dominate in industrial and municipal applications where continuous, stationary monitoring ensures long-term data accuracy. Portable units support field inspections, environmental surveys, and mobile research tasks that require flexibility in location and deployment. Wearable sensors gain traction in personal health monitoring and occupational safety, enabling real-time tracking of individual exposure to environmental hazards. It benefits from miniaturization and low-power designs that allow integration into consumer devices. Each format targets different market priorities while contributing to a broader environmental data ecosystem.

- For instance, Teledyne API’s fixed air quality monitoring stations collectively process 4.6 million pollutant concentration measurements daily across networks in multiple metropolitan regions, enabling precise compliance tracking and long-term trend analysis.

By Sensing Type

Product capabilities span gas, temperature, humidity, pressure, particulate matter (PM), and multi-parameter modules. Gas sensors monitor pollutants such as CO₂, NOx, and volatile organic compounds, addressing industrial safety and air quality mandates. Temperature and humidity sensors play a critical role in climate control, agriculture, and logistics. Pressure sensors find use in weather forecasting, HVAC systems, and industrial process monitoring. PM sensors detect airborne particles in urban, indoor, and industrial environments, supporting health risk assessments. Multi-parameter modules combine several measurements in one device, reducing installation complexity and enabling comprehensive environmental profiling. It offers broad sensing versatility for complex monitoring needs.

- For instance, Aeroqual’s industrial gas sensor networks capture 5.4 million pollutant concentration readings daily across manufacturing facilities.

By End-User

Key end-user sectors include industrial, medical and healthcare, and consumer electronics. Industrial applications focus on compliance with environmental standards, workplace safety, and process optimization. Medical and healthcare sectors deploy sensors to ensure air and water quality in patient care environments and to support medical device functionality. The Environmental Sensor Market serves consumer electronics through integration in smartphones, smart home devices, and wearables that enhance user experience with environmental awareness features. It aligns with growing consumer interest in personal health, safety, and sustainability. End-user demand reflects both regulatory obligations and lifestyle-driven adoption, creating a diverse and resilient market base.

Segments:

Based on Product Type:

Based on Sensing Type:

- Gas

- Temperature

- Humidity

- Pressure

- Particulate Matter (PM)

- Multi-Parameter Modules

Based on End-User:

- Industrial

- Medical

- Healthcare

- Consumer Electronics

- Automotive

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 32.4% of the Environmental Sensor Market, driven by advanced regulatory frameworks and high adoption across industrial, healthcare, and smart city sectors. Stringent environmental laws from agencies such as the U.S. Environmental Protection Agency (EPA) and Environment Canada encourage the deployment of fixed and portable monitoring systems. The region benefits from strong integration of environmental sensors in energy, transportation, and industrial safety applications. It also sees substantial demand from consumer electronics manufacturers incorporating air quality and temperature sensors into smart devices. Investments in research and development by U.S.-based companies strengthen innovation in multi-parameter and IoT-enabled solutions. The presence of a mature infrastructure for data analytics and connectivity enhances the effectiveness of sensor networks in urban and industrial settings.

Europe

Europe accounts for 27.8% of the market, supported by rigorous environmental policies such as the European Green Deal and stringent emissions regulations. Governments and private enterprises invest in air and water quality monitoring systems to meet EU directives and national climate commitments. The Environmental Sensor Market in this region benefits from widespread adoption in industrial manufacturing, precision agriculture, and municipal monitoring projects. Leading economies like Germany, the United Kingdom, and France spearhead smart city initiatives that integrate advanced sensor networks. Consumer awareness regarding environmental health further drives demand for wearable and home-based environmental sensors. The region’s strong engineering base supports continuous development of high-accuracy and low-maintenance devices.

Asia-Pacific

Asia-Pacific holds 28.6% of the market, led by rapid industrialization, urbanization, and government-led environmental monitoring programs. Countries such as China, Japan, South Korea, and India implement large-scale sensor networks to address pollution control and resource management. The Environmental Sensor Market in this region benefits from extensive use in manufacturing hubs, agricultural monitoring, and public health initiatives. Rising demand for portable and wearable devices among consumers in densely populated cities accelerates market penetration. The region’s strong electronics manufacturing capabilities support cost-efficient production of advanced sensors, enabling both domestic use and export growth. Public-private partnerships in environmental research enhance the deployment of innovative sensor solutions across diverse applications.

Latin America

Latin America captures 6.4% of the market, with adoption driven by environmental monitoring needs in mining, agriculture, and urban air quality programs. Countries such as Brazil, Mexico, and Chile deploy environmental sensors to address deforestation, water contamination, and industrial emissions. The Environmental Sensor Market in this region is supported by international funding for climate resilience and environmental management projects. Growing smart agriculture initiatives integrate humidity, temperature, and soil quality sensors to improve productivity. Urban areas are adopting air quality monitoring stations to address public health concerns linked to pollution. Limited infrastructure challenges are being addressed through portable and solar-powered sensor deployments.

Middle East & Africa

The Middle East & Africa region holds 4.8% of the market, with growth fueled by water scarcity monitoring, industrial safety requirements, and urban development projects. Gulf nations integrate environmental sensors into smart city frameworks to monitor air quality, temperature, and particulate levels. The Environmental Sensor Market benefits from investments in oil and gas safety systems where gas detection sensors are critical. African nations adopt portable and fixed sensors for agricultural optimization and climate adaptation initiatives. Rising awareness of environmental health issues supports adoption in healthcare and education sectors. Efforts to localize sensor production and integrate renewable-powered systems are helping overcome infrastructure and cost barriers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Environmental Sensor Market features include Texas Instruments Incorporated, STMicroelectronics, Raritan Inc., OMRON Corporation, Schneider Electric, IDT, Honeywell International Inc., ABB Ltd., Siemens AG, and Sensirion AG. The Environmental Sensor Market is characterized by intense competition, driven by continuous technological innovation, product differentiation, and application-specific customization. Companies focus on enhancing sensor accuracy, miniaturization, and multi-parameter capabilities to meet diverse requirements in industrial, healthcare, and consumer sectors. Advancements in IoT integration, wireless connectivity, and real-time data analytics strengthen market positioning, enabling seamless deployment in smart city projects, precision agriculture, and environmental compliance monitoring. Strategic initiatives such as R&D investments, cross-industry collaborations, and global distribution network expansions are central to sustaining market presence. Vendors increasingly address demand for energy-efficient, low-maintenance, and cost-effective solutions that operate reliably in varied environmental conditions. The competitive landscape also reflects a growing emphasis on sustainability, with manufacturers aligning product development with environmental regulations and corporate responsibility goals.

Recent Developments

- In May 2025, Santa Clara County approved deployment of AI-equipped smoke sensors for wildfire early detection, following similar implementations in Oakland, Palo Alto, and Stanford University, with sensors.

- In April 2025, TI unveiled a portfolio of automotive lidar, radar, and clock chips including a new mmWave radar sensor (AWR2944P), with improvements in detection range, signal-to-noise ratio, and embedded AI hardware accelerators, furthering sensor capabilities for vehicle safety and autonomy.

- In March 2025, TI announced new power management chips including the TPS1685, the first 48V integrated hot-swap eFuse with power-path protection, aimed at data center applications but relevant to advanced sensor ecosystems needing reliable power.

- In January 2025, Texas Instruments Incorporated launched the industry’s first single-chip 60GHz millimeter-wave (mmWave) radar sensor (AWRL6844) with edge AI capabilities for in-cabin sensing applications, including occupancy monitoring and intrusion detection, enhancing safety and automation in vehicles.

Market Concentration & Characteristics

The Environmental Sensor Market displays a moderately concentrated structure, with a mix of multinational corporations and specialized sensor manufacturers competing for market share. Leading players maintain strong positions through advanced R&D capabilities, broad product portfolios, and established global distribution networks. It demonstrates high entry barriers due to the technical expertise, precision manufacturing, and compliance certifications required for production. Product differentiation focuses on accuracy, durability, and multi-parameter sensing capabilities tailored to diverse industrial, healthcare, and consumer applications. Market characteristics include rapid adoption of IoT-enabled devices, integration with AI-driven analytics, and demand for compact, energy-efficient designs that operate reliably in varied environmental conditions. Competitive dynamics are shaped by strategic partnerships, acquisitions, and expansion into emerging sectors such as smart cities and precision agriculture. The sector benefits from regulatory support, growing environmental awareness, and technological innovation, ensuring sustained demand for high-performance sensing solutions across global markets.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Sensing Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for IoT-enabled environmental sensors will increase across smart city projects and industrial automation.

- Adoption of multi-parameter sensing solutions will expand in healthcare, agriculture, and energy sectors.

- Integration with AI and machine learning will enhance predictive environmental monitoring capabilities.

- Portable and wearable environmental sensors will gain traction in personal health and occupational safety applications.

- Regulatory requirements for environmental compliance will drive upgrades in sensing accuracy and reliability.

- Growth in renewable energy projects will create new opportunities for environmental monitoring systems.

- Miniaturization of sensor components will enable broader deployment in consumer electronics and mobile devices.

- Public and private investments in climate resilience initiatives will boost demand for advanced monitoring technologies.

- Wireless communication advancements will improve real-time data transmission from remote and challenging locations.

- Collaboration between sensor manufacturers and analytics providers will strengthen value-added service offerings.