Market Overview

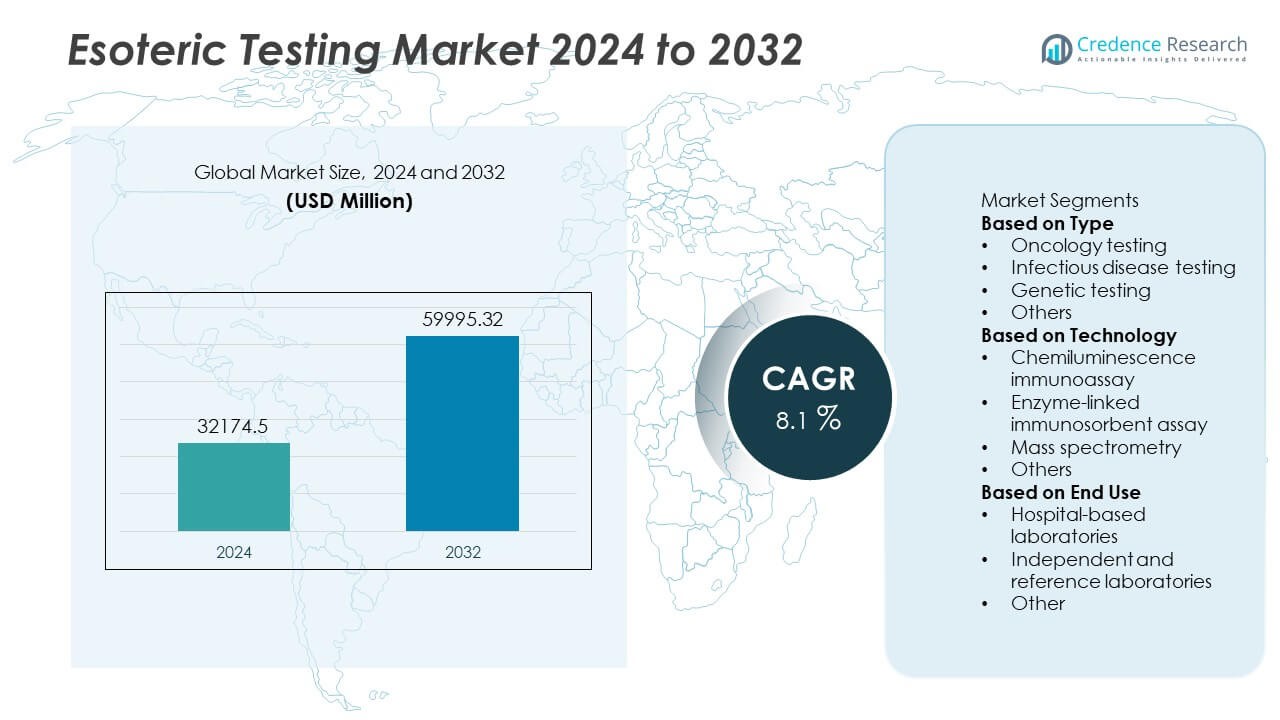

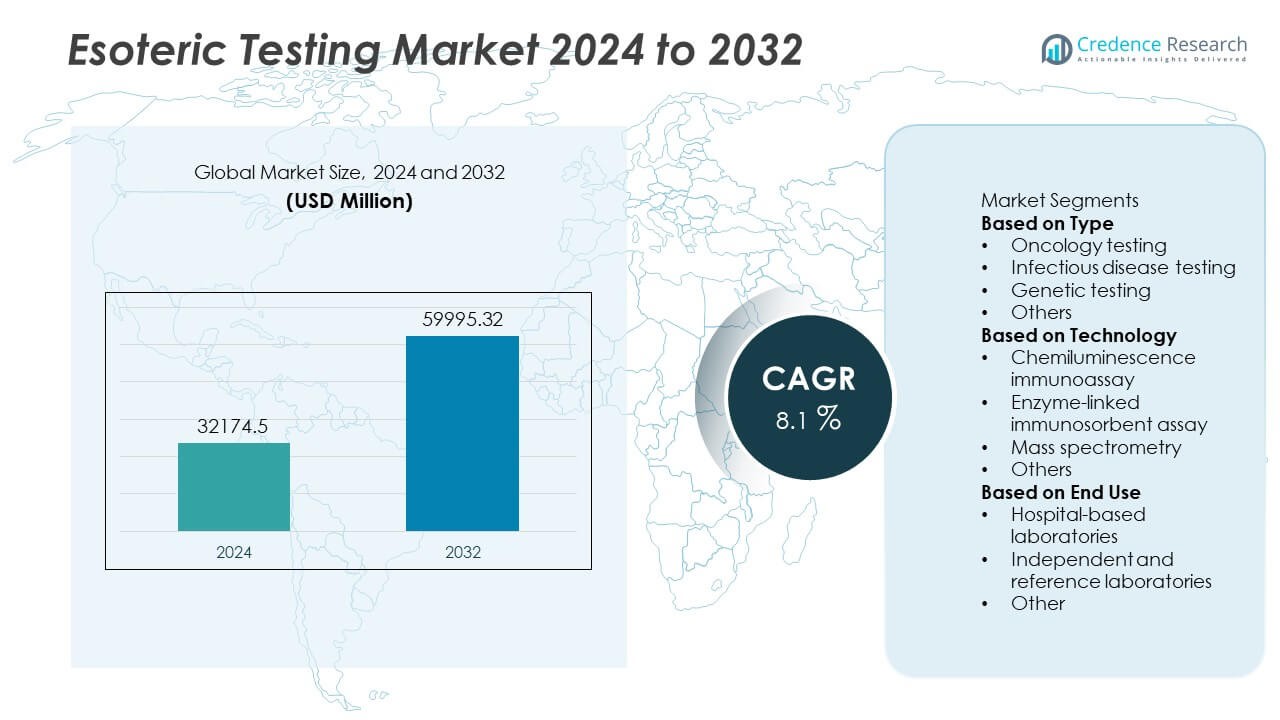

The Esoteric Testing market size was valued at USD 32,174.5 million in 2024 and is projected to reach USD 59,995.32 million by 2032, growing at a CAGR of 8.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Esoteric Testing Market Size 2024 |

USD 32,174.5 Million |

| Esoteric Testing Market, CAGR |

8.1% |

| Esoteric Testing Market Size 2032 |

USD 59,995.32 Million |

The esoteric testing market is driven by key players including ARUP Laboratories, Quest Diagnostics Incorporated, Athena Esoterix, Labcorp, Sonic Healthcare Limited, Stanford Health Care, Kindstar Globalgene Technology Inc., Mayo Foundation for Medical Education and Research, OPKO Health Inc., and H.U. Group Holdings Inc. These companies focus on expanding specialized testing services in oncology, genetic, and infectious disease diagnostics, supported by advanced technologies like next-generation sequencing and mass spectrometry. North America led the market in 2024 with 42% share, supported by strong healthcare infrastructure and high adoption of precision diagnostics. Europe followed with 30% share, driven by robust cancer and genetic testing demand, while Asia-Pacific held 18% share, reflecting rapid adoption supported by growing healthcare investments and population needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The esoteric testing market was valued at USD 32,174.5 million in 2024 and is projected to reach USD 59,995.32 million by 2032, growing at a CAGR of 8.1% during the forecast period.

- Rising prevalence of cancer, genetic disorders, and infectious diseases is driving demand for specialized diagnostics, with oncology testing leading the market at over 40% share in 2024.

- Advancements in genomics, next-generation sequencing, and molecular diagnostics are shaping key trends, alongside opportunities in personalized medicine and automation-enabled laboratory workflows.

- Leading players such as ARUP Laboratories, Quest Diagnostics, Labcorp, and Sonic Healthcare are strengthening competitiveness through innovation, acquisitions, and expansion of reference laboratory networks.

- North America led with 42% share in 2024, followed by Europe with 30% and Asia-Pacific with 18%, while independent and reference laboratories dominated the end-use segment with over 55% market share due to their advanced infrastructure and testing capacity.

Market Segmentation Analysis:

By Type

Oncology testing dominated the esoteric testing market in 2024, holding over 40% of total share. Its leadership is driven by the rising global cancer burden, increasing demand for early detection, and precision medicine advancements. Oncology testing supports biomarker identification, personalized treatment decisions, and targeted therapy monitoring, which has expanded adoption across clinical settings. Genetic testing is also gaining strong traction with the rise of hereditary disease screening, while infectious disease testing remains critical in managing outbreaks. However, oncology’s expanding role in individualized treatment continues to secure its dominant position in the segment.

- For instance, Labcorp performs more than 700 million tests annually for patients around the world, and supports early detection and precision diagnostics through its extensive oncology portfolio, which was expanded in 2025.

By Technology

Chemiluminescence immunoassay accounted for the largest share, representing around 35% of the esoteric testing market in 2024. This dominance stems from its high sensitivity, rapid turnaround, and widespread use in hormone testing, oncology markers, and infectious diseases. The technique’s reliability and cost-effectiveness make it a preferred choice in both hospital and reference laboratories. Mass spectrometry is steadily expanding due to its precision in toxicology, genetic, and metabolic disorder testing. Enzyme-linked immunosorbent assay (ELISA) continues to play a role in infectious disease diagnostics, though chemiluminescence leads due to efficiency and broader clinical application.

- For instance, ARUP Laboratories does use chemiluminescence immunoassays (CLIA) for a wide variety of tests. Its Immunology Division performs over 500 immunologic tests, with methodologies that include chemiluminescent assays for autoimmune and infectious disorders.

By End Use

Independent and reference laboratories led the esoteric testing market in 2024, capturing over 55% of total share. Their dominance is linked to advanced testing infrastructure, high testing volumes, and the ability to offer a wide range of specialized diagnostics unavailable in routine hospital labs. Hospital-based laboratories, while significant, mainly focus on supporting in-patient and immediate clinical needs. Reference labs benefit from centralization, economies of scale, and strategic collaborations with healthcare providers. As the demand for highly specialized and complex testing grows, independent laboratories continue to strengthen their role in driving the market forward.

Key Growth Drivers

Rising Prevalence of Chronic and Rare Diseases

The growing incidence of cancer, infectious diseases, and rare genetic disorders is driving demand for esoteric testing. These conditions often require specialized diagnostics beyond standard laboratory tests, such as oncology biomarkers, molecular assays, and genetic panels. Aging populations and lifestyle-related diseases are further increasing reliance on advanced diagnostics. Healthcare providers depend on esoteric testing to deliver accurate, early detection and to guide targeted therapies. This steady increase in disease burden ensures continuous market expansion and establishes disease prevalence as a major long-term driver.

- For instance, Quest Diagnostics provides a wide range of specialized and complex esoteric tests, including numerous assays in oncology and infectious disease. Quest Diagnostics is a major player in the esoteric testing market.

Advancements in Genomics and Molecular Diagnostics

Rapid progress in genomics and molecular testing technologies is fueling the adoption of esoteric testing. Next-generation sequencing, molecular assays, and biomarker-based tests enhance diagnostic accuracy and support personalized medicine approaches. Genetic profiling allows clinicians to identify hereditary risks and design patient-specific therapies. Precision oncology, in particular, relies heavily on these innovations to predict treatment outcomes. With the integration of advanced molecular diagnostics into mainstream healthcare, esoteric testing has become indispensable, improving patient outcomes while reinforcing its role in modern clinical practices.

- For instance, Labcorp offers a variety of next-generation sequencing (NGS) assays for conditions in oncology and rare diseases. The company provides NGS panels for hematologic cancers like leukemia and lymphoma, as well as liquid biopsy tests for solid tumors.

Growing Reliance on Specialized Laboratories

Independent and reference laboratories are becoming key growth engines for the esoteric testing market. These labs manage large volumes of complex tests with advanced infrastructure, automation, and specialized expertise. Hospitals increasingly outsource esoteric testing to these centralized labs to access wider diagnostic capabilities and faster turnaround times. Strategic collaborations with healthcare providers and insurers expand accessibility and efficiency. This shift enhances the overall reliability of diagnostics and strengthens the position of reference laboratories as critical partners, ensuring steady demand for specialized testing services worldwide.

Key Trends and Opportunities

Integration of Automation and Artificial Intelligence

Automation and artificial intelligence are transforming esoteric testing workflows. Automated analyzers reduce turnaround times, minimize human error, and improve operational efficiency. AI-driven platforms interpret complex genetic data, biomarkers, and molecular patterns, providing actionable insights for clinicians. These advancements allow laboratories to handle higher volumes of tests while improving accuracy. As healthcare systems advance digital transformation, AI-driven esoteric testing is set to become more integrated into diagnostic practices, presenting strong opportunities for vendors to deliver innovative and efficient solutions to the global market.

- For instance, BioReference (an OPKO Health subsidiary, which retains core clinical testing and its 4Kscore test) and Labcorp (which acquired BioReference’s oncology and related clinical testing assets) both utilize automated molecular workflows to ensure faster turnaround and scalability in laboratory testing.

Expansion of Genetic and Molecular Testing

Genetic and molecular testing continues to emerge as one of the most promising opportunities in esoteric diagnostics. Demand for hereditary disease testing, pharmacogenomics, and oncology-related molecular assays is steadily rising. These tests support personalized medicine and improve clinical decision-making. Molecular diagnostics also play a vital role in infectious disease detection, especially in identifying resistant pathogens. The growing popularity of direct-to-consumer genetic testing is further expanding adoption. As awareness of genetic health increases, laboratories and diagnostic firms are positioned to capitalize on this strong growth opportunity.

- For instance, Kindstar Globalgene Technology in China offers over 3,800 specialized testing items, serving more than 3,000 hospitals, including over 1,000 of China’s top hospitals, with hereditary cancer and rare disease diagnostics.

Key Challenges

High Cost and Limited Accessibility

The cost-intensive nature of esoteric testing remains a significant challenge. Advanced technologies, expensive reagents, and skilled professionals make these services costly, limiting access in developing regions. Inconsistent reimbursement policies further discourage adoption in certain markets, creating barriers for patients and providers. Without more affordable, scalable testing models, access to these advanced diagnostics will remain unequal across geographies. Addressing cost-related challenges through innovative pricing strategies and broader insurance coverage is crucial for ensuring wider market penetration and equity in healthcare outcomes.

Regulatory and Standardization Barriers

Regulatory complexity and lack of standardization hinder the expansion of esoteric testing. Differing approval frameworks, accreditation processes, and diagnostic protocols across regions delay technology adoption. The absence of harmonized standards, especially in genetic and molecular testing, reduces result comparability across laboratories. These limitations slow innovation and undermine confidence in advanced diagnostics. Overcoming regulatory and standardization barriers is essential to ensure reliability, facilitate global adoption, and accelerate the integration of esoteric testing into mainstream healthcare systems worldwide.

Regional Analysis

North America

North America held the largest share of the esoteric testing market in 2024, accounting for 42% of total revenue. The dominance of the region is driven by high healthcare expenditure, advanced laboratory infrastructure, and early adoption of specialized diagnostics. The United States leads with strong demand for oncology, genetic, and infectious disease testing, supported by favorable reimbursement policies and a large patient pool. Canada contributes with growing investment in molecular diagnostics and personalized medicine. Established reference laboratories and technological innovation further strengthen North America’s position as the leading market for esoteric testing.

Europe

Europe accounted for 30% of the esoteric testing market share in 2024, supported by robust healthcare systems and regulatory emphasis on advanced diagnostics. Countries such as Germany, the United Kingdom, and France lead adoption, particularly in oncology and genetic testing. Rising cancer incidence, aging populations, and the integration of genomics into healthcare systems are fueling growth. The region also benefits from strong collaborations between research institutes and diagnostic providers. With increasing demand for personalized medicine and precision diagnostics, Europe remains a key growth hub, reinforcing its role as the second-largest market globally.

Asia-Pacific

Asia-Pacific captured 18% of the esoteric testing market share in 2024, reflecting rapid healthcare modernization and rising demand for advanced diagnostics. Countries such as China, Japan, and India are expanding molecular and genetic testing capabilities to address large patient populations. Growing investment in healthcare infrastructure and rising awareness of precision medicine are driving adoption. Japan leads in oncology-related testing, while China is strengthening genomic research and clinical laboratory services. Affordable, cloud-based platforms are also supporting adoption among smaller healthcare providers. Asia-Pacific is projected to be the fastest-growing regional market over the forecast period.

Latin America

Latin America represented 6% of the esoteric testing market share in 2024, with Brazil, Mexico, and Argentina driving most of the regional demand. The growth is linked to rising cancer incidence, increased infectious disease testing, and expanding access to advanced diagnostics. Brazil is leading in adoption due to improved laboratory networks and regulatory support, while Mexico and Argentina are strengthening investments in precision medicine. Limited infrastructure in smaller economies constrains broader adoption. However, the increasing role of private laboratories and expanding insurance coverage are expected to enhance growth opportunities for esoteric testing in the region.

Middle East & Africa

The Middle East & Africa accounted for 4% of the esoteric testing market share in 2024, emerging as a developing but important region. The Gulf Cooperation Council (GCC) countries, particularly Saudi Arabia and the UAE, are investing heavily in healthcare diversification and advanced diagnostics. South Africa leads within Africa, with growing demand for oncology and infectious disease testing. Limited infrastructure and affordability remain barriers across parts of the region, yet rising government focus on healthcare modernization and partnerships with global laboratories are creating growth potential. Cloud-based testing models are also supporting accessibility in underserved markets.

Market Segmentations:

By Type

- Oncology testing

- Infectious disease testing

- Genetic testing

- Others

By Technology

- Chemiluminescence immunoassay

- Enzyme-linked immunosorbent assay

- Mass spectrometry

- Others

By End Use

- Hospital-based laboratories

- Independent and reference laboratories

- Other

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the esoteric testing market is defined by leading players such as ARUP Laboratories, Quest Diagnostics Incorporated, Athena Esoterix, Labcorp, Sonic Healthcare Limited, Stanford Health Care, Kindstar Globalgene Technology Inc., Mayo Foundation for Medical Education and Research, OPKO Health Inc., and H.U. Group Holdings Inc. These companies focus on expanding their specialized test portfolios across oncology, genetic, and infectious disease diagnostics to meet rising global demand. Strategic initiatives such as collaborations with healthcare providers, acquisitions, and investments in advanced technologies like next-generation sequencing and mass spectrometry are strengthening their market positions. Reference and independent laboratories are enhancing accessibility by offering high-volume, cost-efficient services that support hospitals and clinics. Innovation in molecular diagnostics, precision medicine, and digital platforms further fuels competition. As regulatory frameworks tighten and demand for personalized healthcare increases, these players are expected to accelerate advancements, shaping a highly competitive and innovation-driven esoteric testing market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ARUP Laboratories

- Quest Diagnostics Incorporated

- Athena Esoterix

- Sonic Healthcare Limited

- Stanford Health Care

- Kindstar Globalgene Technology, Inc.

- Mayo Foundation for Medical Education and Research

- OPKO HEALTH, INC.

- U. Group Holdings, Inc.

Recent Developments

- In September 2025, Quest Diagnostics announced an industry-first Epic integration to streamline ordering and results across U.S. health systems, delivering the most comprehensive lab–EHR connectivity by a national lab provider.

- In February 2025, ARUP Laboratories partnered with Tasso Inc. to validate several assays (e.g. rheumatoid factor, high-sensitivity CRP, creatinine, and high-sensitivity DNA tests) using capillary microsamples collected remotely, to support decentralized clinical research.

- In January 2025, ARUP Laboratories launched an assay to detect and subtype influenza A (H5), expanding national capacity for H5N1 testing through its Salt Lake City reference lab.

- In 2025, OPKO Health via its diagnostics division continues expansion, and its subsidiary BioReference Laboratories was part of an acquisition by Labcorp, transferring oncology and clinical testing assets.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The esoteric testing market will expand steadily with growing demand for advanced diagnostics.

- Oncology testing will remain the dominant segment supported by rising cancer incidence.

- Genetic and molecular testing will gain strong momentum with precision medicine adoption.

- Independent and reference laboratories will continue to lead due to high-volume capabilities.

- Cloud-based platforms and automation will improve testing efficiency and reduce turnaround times.

- Asia-Pacific will record the fastest growth, driven by healthcare investments and rising patient volumes.

- North America and Europe will sustain leadership with advanced infrastructure and regulatory support.

- Companies will focus on expanding specialized test portfolios through innovation and acquisitions.

- AI integration will enhance data interpretation and support personalized treatment decisions.

- Accessibility challenges and high costs will encourage development of scalable, cost-efficient testing models.