Market Overview:

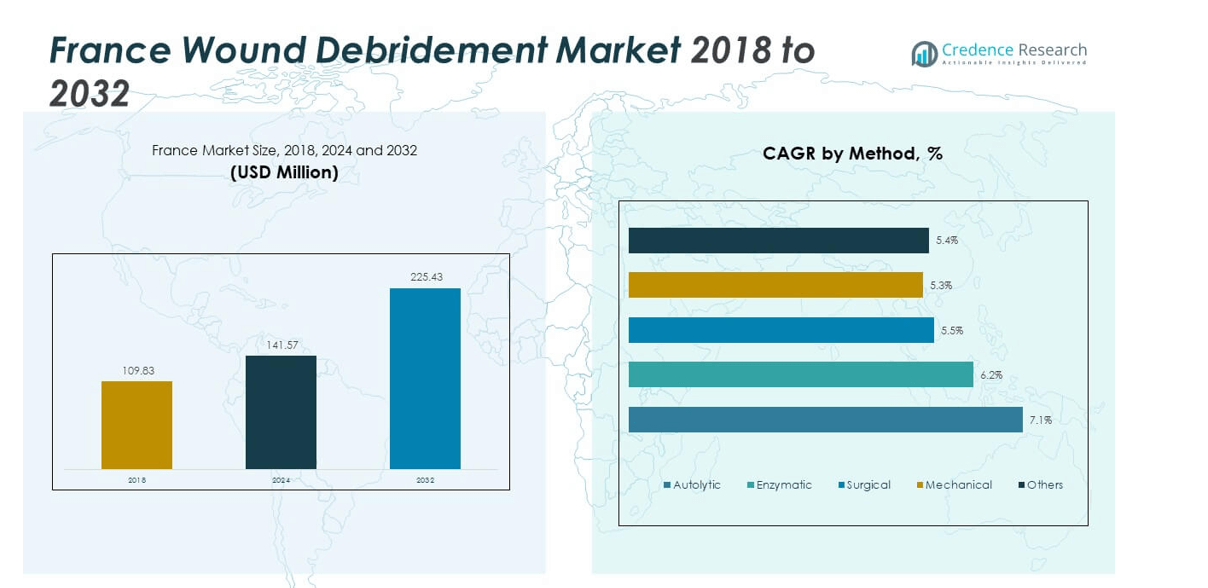

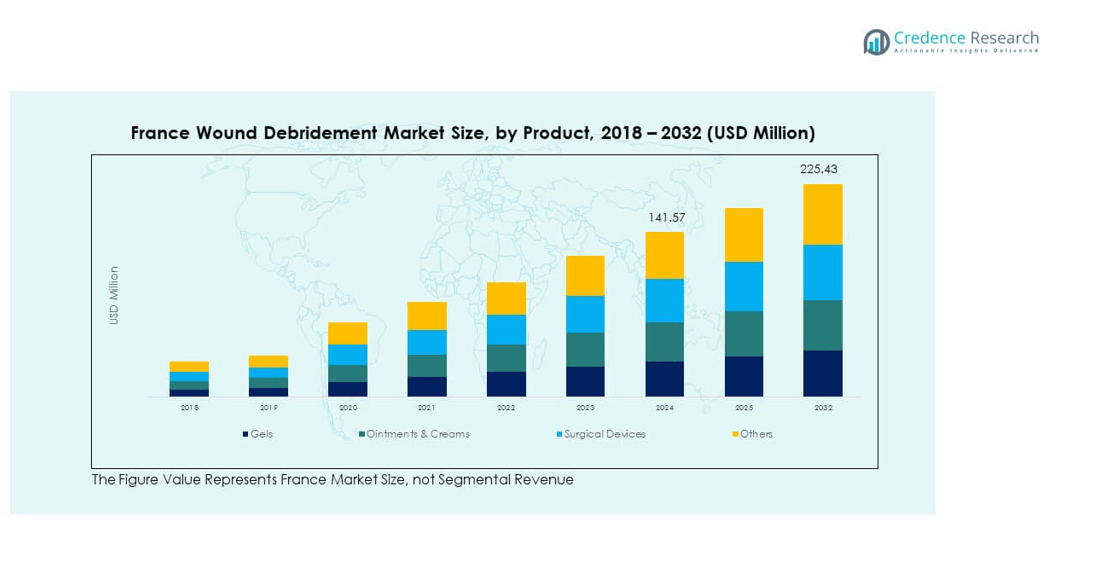

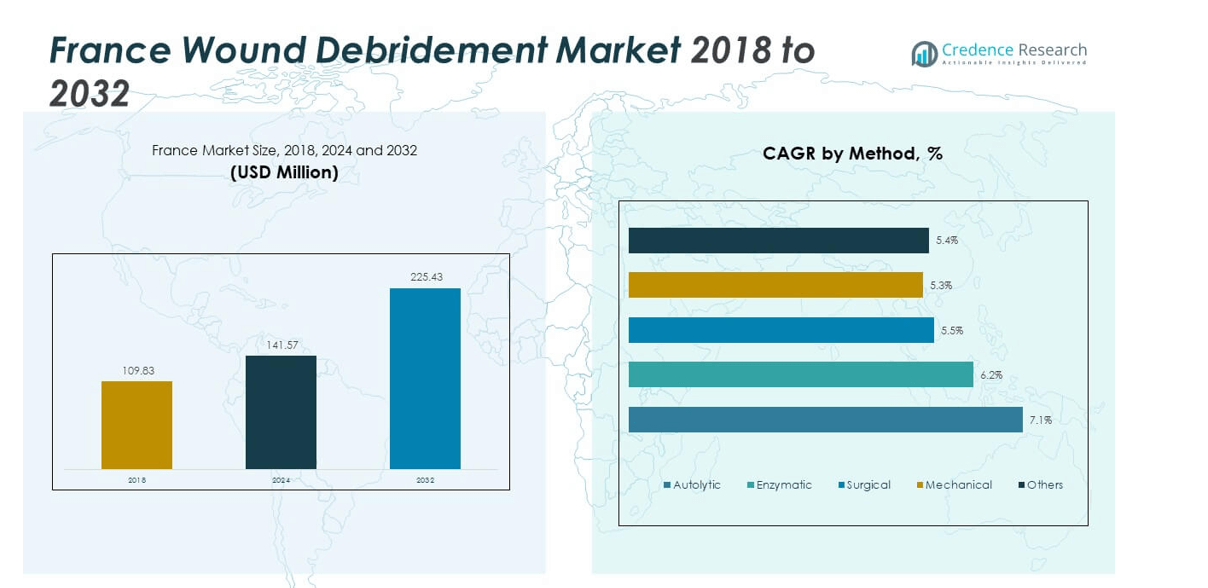

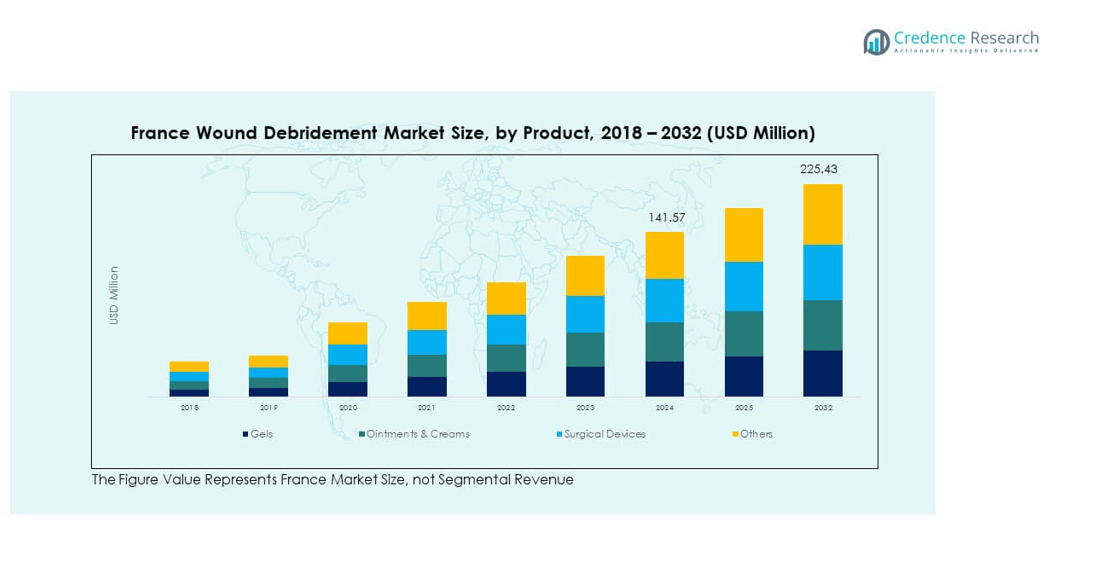

The France Wound Debridement Market size was valued at USD 109.83 million in 2018, reached USD 141.57 million in 2024, and is anticipated to attain USD 225.43 million by 2032, registering a CAGR of 5.99% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Wound Debridement Market Size 2024 |

USD 141.57 million |

| France Wound Debridement Market, CAGR |

5.99% |

| France Wound Debridement Market Size 2032 |

USD 225.43 million |

Growth in the France Wound Debridement Market is driven by the rising prevalence of chronic wounds, diabetic ulcers, and pressure injuries. Increasing geriatric population and higher hospital admissions for surgical procedures are supporting market expansion. Government focus on advanced wound care solutions and the availability of innovative debridement products also enhance adoption rates across healthcare facilities.

Regionally, urban areas such as Île-de-France and Auvergne-Rhône-Alpes dominate due to better healthcare infrastructure and higher patient awareness. Southern regions are witnessing growing adoption owing to expanding healthcare networks and increasing access to specialized wound care centers. Demand is also rising in smaller towns and rural areas, supported by telemedicine and expanding medical outreach programs.

Market Insights:

- The France Wound Debridement Market was valued at USD 109.83 million in 2018, reached USD 141.57 million in 2024, and is expected to attain USD 225.43 million by 2032, registering a CAGR of 5.99%.

- Île-de-France leads with 35% market share due to its advanced healthcare facilities and strong hospital networks. Auvergne-Rhône-Alpes holds 20%, supported by expanding clinical infrastructure, while Provence-Alpes-Côte d’Azur follows with 15% backed by private healthcare growth.

- Nouvelle-Aquitaine and Occitanie are the fastest-growing regions with a combined 18% share, driven by healthcare investments and improved access to specialized wound care.

- Gels dominate the product segment, accounting for approximately 30% of total sales, supported by their high efficiency in chronic wound management.

- Surgical devices and ointments collectively contribute around 40%, reflecting strong hospital demand and preference for multi-purpose wound healing solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Incidence of Chronic Wounds and Diabetic Ulcers

The France Wound Debridement Market is expanding due to the growing number of chronic wound cases and diabetic ulcers. Aging demographics and lifestyle-related conditions increase the risk of slow-healing wounds. Hospitals and clinics report rising admissions for diabetic foot ulcers and venous leg ulcers. This trend drives demand for advanced wound debridement solutions that promote faster healing. The availability of modern care technologies supports the shift toward minimally invasive wound management. Increasing awareness among patients and caregivers enhances product adoption. It benefits from government focus on reducing the healthcare burden linked to chronic wounds.

- For instance, studies published in 2025 highlight a significant risk of major amputation and mortality related to first-time diabetic foot ulcers in French hospital settings, emphasizing the need for improved debridement protocols.

Technological Advancements in Wound Debridement Procedures

Continuous innovation in mechanical, enzymatic, and autolytic debridement tools drives strong market expansion. Medical device manufacturers in France are developing products with enhanced precision and safety features. Smart wound care systems integrated with sensors allow better wound monitoring and treatment customization. The France Wound Debridement Market benefits from the adoption of advanced imaging and suction-assisted technologies. Hospitals prefer modern equipment to improve clinical outcomes and reduce recovery time. Training initiatives for healthcare professionals promote the use of new wound debridement techniques. This technological shift strengthens patient care standards and boosts overall treatment efficiency.

- For instance, clinical evaluations of URGO Medical’s Debrisoft Pad, as referenced in independent assessments and NICE guidance, have demonstrated more effective slough removal and faster treatment compared to standard hydrogels, supporting its adoption for chronic wounds in Europe

Government Support and Healthcare Infrastructure Development

France’s national healthcare policies promote advanced wound management practices. Public healthcare initiatives encourage hospitals to adopt innovative products for effective wound care. The France Wound Debridement Market gains support from reimbursement policies and standardized treatment protocols. Investments in hospital infrastructure and specialized wound care units enhance treatment accessibility. The government also supports awareness campaigns targeting chronic wound prevention. Collaboration between healthcare providers and research institutes promotes continuous product innovation. This structured policy framework supports long-term growth and strengthens the domestic market foundation.

Growing Adoption of Home-Based and Outpatient Wound Care Services

The shift toward home-based wound management is fueling market growth. Patients prefer convenient and cost-effective care outside hospital settings. The France Wound Debridement Market benefits from this change, supported by portable and easy-to-use devices. Manufacturers develop user-friendly solutions suited for outpatient clinics and home settings. The rising need to reduce hospital stay durations promotes home debridement adoption. Telemedicine and remote wound monitoring solutions further expand treatment reach. This evolving care model enhances patient comfort and lowers treatment costs.

Market Trends:

Integration of Digital Technologies in Wound Care Management

Digital transformation plays a vital role in shaping the France Wound Debridement Market. Advanced wound imaging, electronic health records, and AI-based assessment tools improve treatment efficiency. Smart dressings embedded with sensors track healing progress and detect infection. Hospitals are integrating digital wound care platforms to streamline documentation and monitoring. These systems enable remote consultations between patients and specialists. Growing preference for connected wound care devices improves clinical decision-making. It helps clinicians deliver personalized wound management plans.

- For instance, recent publications in 2025 detail the use of AI-powered wound assessment tools to improve accuracy and efficiency in chronic wound management protocols in European clinical settings.

Rising Popularity of Enzymatic and Autolytic Debridement Methods

Clinicians increasingly prefer enzymatic and autolytic methods for their precision and patient comfort. These techniques reduce pain and minimize tissue damage during wound cleaning. The France Wound Debridement Market is witnessing growth in demand for bioactive gels and dressings. Hospitals choose these methods for patients with fragile skin or chronic ulcers. Product innovations focus on faster enzyme action and infection control. Increased clinical trials support the effectiveness of enzymatic agents. This trend improves the acceptance of less invasive wound management techniques.

- For instance, international clinical reviews confirm the efficacy of Smith+Nephew’s Santyl (collagenase) ointment as an enzymatic debriding agent, supporting improved management for chronic wounds, including in France.

Expansion of Outpatient Wound Clinics and Specialized Centers

France is experiencing a steady rise in outpatient wound clinics and specialized treatment centers. These facilities offer targeted and efficient care for chronic wounds. The France Wound Debridement Market gains momentum through this decentralized treatment approach. Smaller clinics provide advanced tools and trained professionals for effective wound cleaning. This trend reduces hospital burden and improves accessibility for rural patients. Specialized centers also collaborate with suppliers for customized debridement products. The expanding clinic network enhances national wound care capacity.

Sustainability Focus and Eco-Friendly Product Development

Manufacturers are emphasizing eco-friendly wound care materials and packaging. The France Wound Debridement Market aligns with national sustainability goals promoting greener healthcare products. Companies invest in biodegradable dressings and recyclable components. Hospitals support procurement policies favoring sustainable wound care products. Research centers develop materials that reduce environmental waste. Consumer awareness also influences purchasing decisions in favor of sustainable brands. This eco-driven trend redefines the wound care market outlook.

Market Challenges Analysis:

High Treatment Costs and Reimbursement Limitations

The France Wound Debridement Market faces constraints due to high treatment costs and limited reimbursement coverage. Advanced debridement devices and bioactive products are expensive for smaller hospitals and clinics. Reimbursement policies often vary across regions, creating inconsistencies in patient access. Many patients still rely on conventional methods because of cost sensitivity. Private insurers impose restrictions on advanced wound care reimbursements. This economic burden slows technology adoption, especially in rural healthcare settings. It challenges market expansion and limits product penetration in low-income segments.

Limited Awareness and Shortage of Trained Professionals

The market also faces obstacles linked to insufficient awareness and training among medical professionals. Many general practitioners lack expertise in modern debridement techniques. The France Wound Debridement Market is affected by the uneven distribution of wound care specialists. Rural regions face difficulty accessing skilled personnel for complex wound cases. Educational initiatives are improving but remain insufficient to meet rising demand. Lack of consistent wound care education reduces treatment quality. This gap slows adoption of innovative technologies and affects patient outcomes.

Market Opportunities:

Increasing Demand for Advanced Wound Care Products

Rising cases of chronic wounds and post-surgical infections create strong product demand. The France Wound Debridement Market benefits from increased awareness of advanced wound care therapies. Hospitals and clinics are shifting toward enzyme-based, ultrasonic, and autolytic debridement systems. Product diversification allows firms to target different wound types and patient groups. Growing investments in research improve clinical performance of next-generation devices. Partnerships between global and domestic players enhance innovation potential. This shift offers opportunities for sustained market growth.

Expansion of Telemedicine and Remote Wound Management

The integration of telemedicine in wound care provides new growth avenues. Remote monitoring enables healthcare professionals to assess wounds efficiently. The France Wound Debridement Market is expanding with support from digital wound platforms and AI diagnostics. These technologies improve follow-up care and reduce hospital revisits. The trend aligns with France’s healthcare digitization initiatives. Manufacturers integrating digital capabilities into devices can reach broader user bases. It creates long-term opportunities for better patient engagement and service expansion.

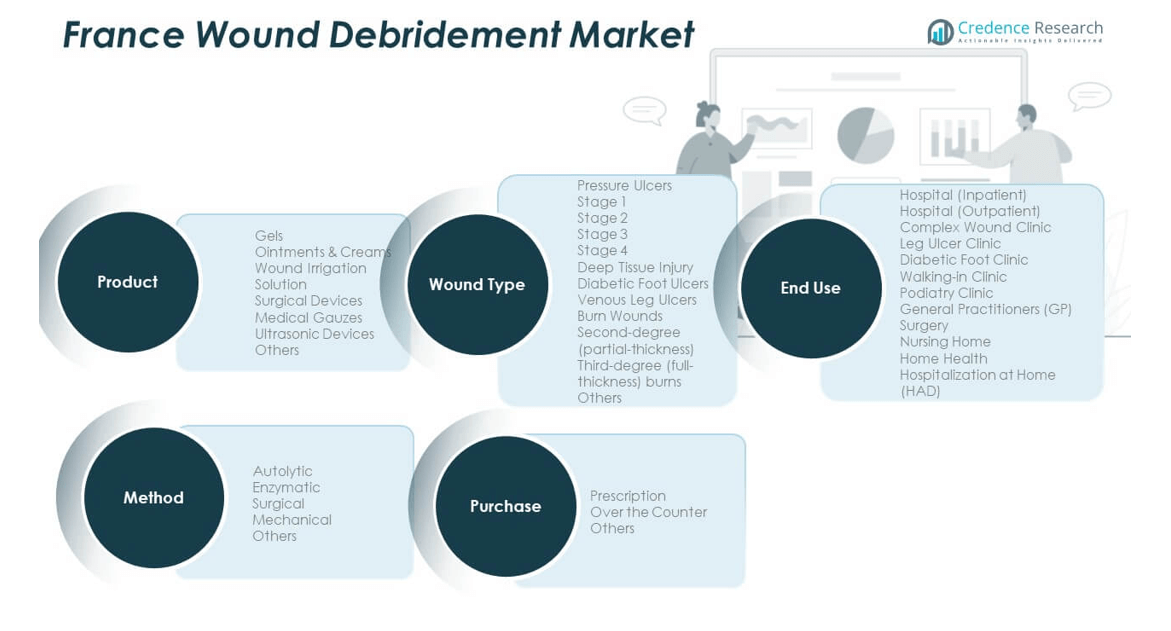

Market Segmentation Analysis:

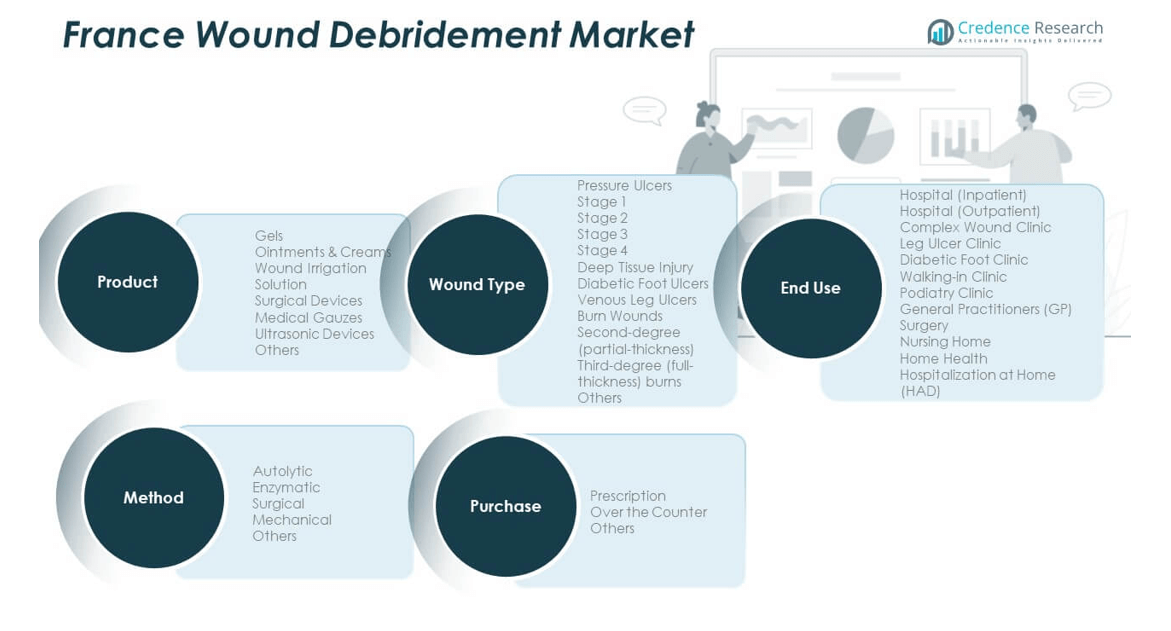

By Product Segment

The France Wound Debridement Market includes gels, ointments and creams, wound irrigation solutions, surgical devices, medical gauzes, ultrasonic devices, and others. Gels dominate due to their wide use in chronic wound management. Ointments and creams offer strong antimicrobial benefits and support healing. Surgical devices are gaining traction in hospital and clinical settings for precision treatments. Ultrasonic devices show growing adoption for complex wounds. Medical gauzes remain essential for post-debridement care and cost-effective applications.

- For instance, Hartmann’s HydroClean gel is recognized in clinical guides and supplier documentation for its role in wound irrigation and debridement for chronic wounds.

By Method Segment

The market is categorized into autolytic, enzymatic, surgical, mechanical, and others. Autolytic debridement holds a significant share due to its gentle, non-invasive nature. Enzymatic methods gain popularity for faster tissue breakdown and patient comfort. Surgical debridement remains critical for severe or infected wounds requiring rapid intervention. Mechanical methods maintain stable demand in outpatient and home settings. It continues to evolve with improved techniques enhancing wound healing efficiency.

- For instance, B. Braun’s Prontosan wound irrigation solution is widely applied in French and European clinics as part of autolytic debridement protocols to support healing and infection control in pressure ulcers.

By Wound Type Segment

Pressure ulcers, diabetic foot ulcers, venous leg ulcers, and burn wounds are the main categories. Pressure ulcers represent a major share, with higher prevalence in elderly and immobile patients. Diabetic foot ulcers are increasing with the rise in diabetes cases. Burn wounds, including second and third-degree types, require specialized debridement solutions. Venous leg ulcers drive product innovation in advanced dressings and gels.

By End-Use and Purchase Segment

Hospitals, clinics, home health, and nursing homes are key end users. Hospitals lead the market due to advanced infrastructure and skilled professionals. Home healthcare shows steady expansion supported by telemedicine. Prescription-based purchases dominate, while over-the-counter products grow in outpatient and self-care segments. The France Wound Debridement Market benefits from expanding clinical accessibility and home-care adoption.

Segmentation:

- By Product Segment

- Gels

- Ointments & Creams

- Wound Irrigation Solution

- Surgical Devices

- Medical Gauzes

- Ultrasonic Devices

- Others

- By Method Segment

- Autolytic

- Enzymatic

- Surgical

- Mechanical

- Others

- By Wound Type Segment

- Pressure Ulcers

- Stage 1

- Stage 2

- Stage 3

- Stage 4

- Deep Tissue Injury

- Diabetic Foot Ulcers

- Venous Leg Ulcers

- Burn Wounds

- Second-degree (partial-thickness)

- Third-degree (full-thickness) burns

- Others

- By End-Use Segment

- Hospital (Inpatient)

- Hospital (Outpatient)

- Complex Wound Clinic

- Leg Ulcer Clinic

- Diabetic Foot Clinic

- Walking-in Clinic

- Podiatry Clinic

- General Practitioners (GP) Surgery

- Nursing Home

- Home Health

- Hospitalization at Home (HAD)

- By Purchase Segment

- Prescription

- Over the Counter

- Others

Regional Analysis:

Dominance of Île-de-France Region

Île-de-France holds the largest share of the France Wound Debridement Market, accounting for around 35% of the national revenue. The region benefits from advanced healthcare infrastructure, high hospital density, and strong presence of medical device manufacturers. Major public and private hospitals in Paris drive early adoption of advanced wound care products. Government-funded health programs and specialized wound treatment centers contribute to regional growth. Increasing incidence of diabetic foot ulcers among the elderly population supports steady product demand. It remains the innovation hub for clinical trials and new product introductions in wound management.

Strong Growth Across Auvergne-Rhône-Alpes and Provence-Alpes-Côte d’Azur

Auvergne-Rhône-Alpes represents about 20% of the market share, supported by a growing number of healthcare facilities and specialized clinics. The region’s expanding hospital network improves accessibility to advanced wound care products. The France Wound Debridement Market benefits from regional medical research centers promoting technological integration in wound healing. Provence-Alpes-Côte d’Azur holds around 15% of the market, driven by strong private healthcare adoption and a growing elderly population. High incidence of chronic wounds and supportive insurance coverage enhance market opportunities. These regions collectively strengthen France’s clinical capacity and adoption of modern debridement technologies.

Emerging Potential in Nouvelle-Aquitaine and Occitanie

Nouvelle-Aquitaine and Occitanie together contribute approximately 18% of the total market share. Both regions show significant improvements in healthcare infrastructure and patient awareness. Government initiatives promoting home-based care drive product penetration in smaller towns. The France Wound Debridement Market is expanding here due to increasing investments in community healthcare and wound management training. Growing outpatient services and partnerships between hospitals and local clinics improve patient outcomes. Rising demand for cost-effective wound debridement products supports consistent growth momentum across these emerging regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- URGO Medical

- Baihe Medical Europe

- Coloplast Corp

- Smith & Nephew plc

- ConvaTec Group PLC

- 3M Company

- Braun SE

- Medline Industries

- Mölnlycke Health Care AB

- BD (Becton, Dickinson and Company)

- Johnson & Johnson

- Integra LifeSciences

- Advancis Medical

- Cardinal Health

- Lohmann & Rauscher

- Hartmann Group

- Paul Hartmann AG

- Renolit SE

- Mimedx Group Inc.

- Derma Sciences (Integra LifeSciences)

Competitive Analysis:

The France Wound Debridement Market is highly competitive, featuring both global and regional players. Companies such as URGO Medical, Coloplast Corp, Smith & Nephew, ConvaTec Group PLC, and Mölnlycke Health Care AB dominate due to strong product portfolios and extensive distribution networks. It is characterized by continuous innovation in enzymatic, surgical, and ultrasonic debridement solutions. Firms invest in R&D to enhance wound care efficacy and patient outcomes. Strategic collaborations between hospitals and manufacturers strengthen local market presence. The growing focus on home-based care and digital wound management platforms further intensifies competition.

Recent Developments:

- In September 2025, Smith & Nephew plc expanded its Advanced Wound Bioactives portfolio with the launch of the CENTRIO Platelet-Rich-Plasma (PRP) System, supporting healing for chronic wounds such as diabetic foot ulcers and venous leg ulcers; the US launch reflects ongoing portfolio development that impacts the European market through new clinical collaborations and evidence.

- In September 2025, B. Braun SE completed the full acquisition of True Digital Surgery (TDS), enhancing its capabilities in digital robotic-assisted 3D surgical microscopy, a move expected to accelerate advancements in microsurgery and digital wound care, including in the debridement segment.

- In August 2024, Medline Industries successfully acquired Ecolab Inc.’s global surgical solutions business, including the Microtek product lines, enriching Medline’s wound care portfolio with innovative sterile drape and surgical solutions for healthcare providers throughout France and Europe.

- In July 2024, Mölnlycke Health Care invested $15 million in MediWound Ltd., a next-generation company specializing in enzymatic wound debridement, and signed a collaboration agreement to strengthen wound care innovation and patient outcomes across Europe.

Report Coverage:

The research report offers an in-depth analysis based on product, method, wound type, end-use, and purchase segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increased focus on personalized and patient-centric wound debridement treatments.

- Expansion of digital wound care technologies across hospitals and home settings.

- Stronger government support for advanced chronic wound management programs.

- Growth in adoption of enzymatic and autolytic debridement products.

- Rising collaborations between medical institutions and device manufacturers.

- Continued innovation in bioactive and eco-friendly wound care materials.

- Higher penetration of ultrasonic and portable debridement devices.

- Expansion of outpatient and home health wound management services.

- Strengthening of distribution networks across secondary French regions.

- Greater integration of AI-based monitoring systems to optimize wound healing.