Market Overview

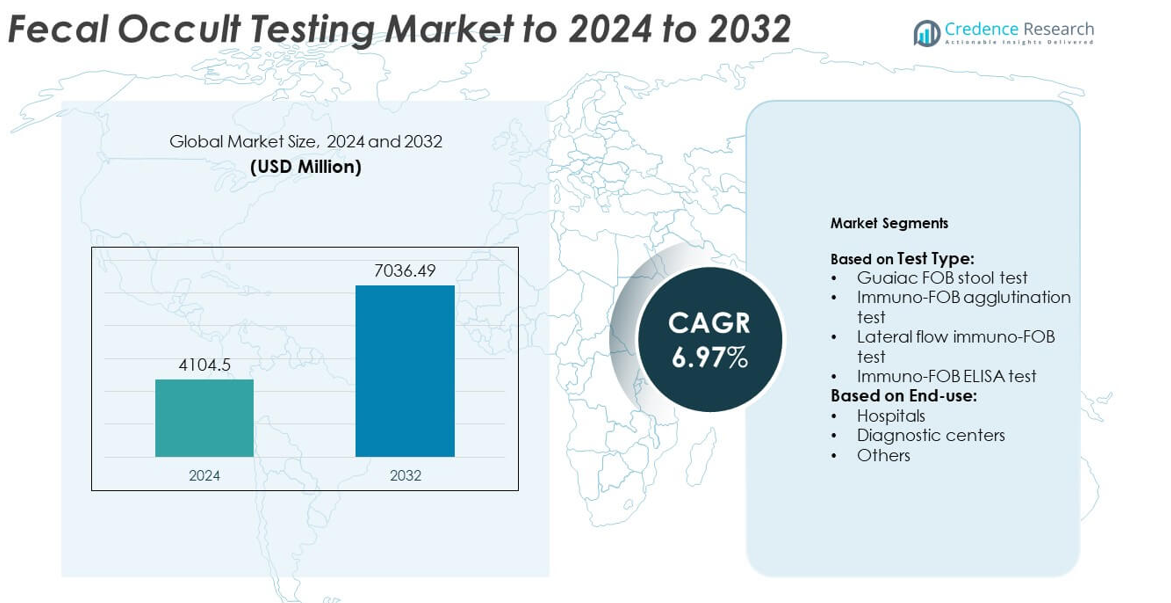

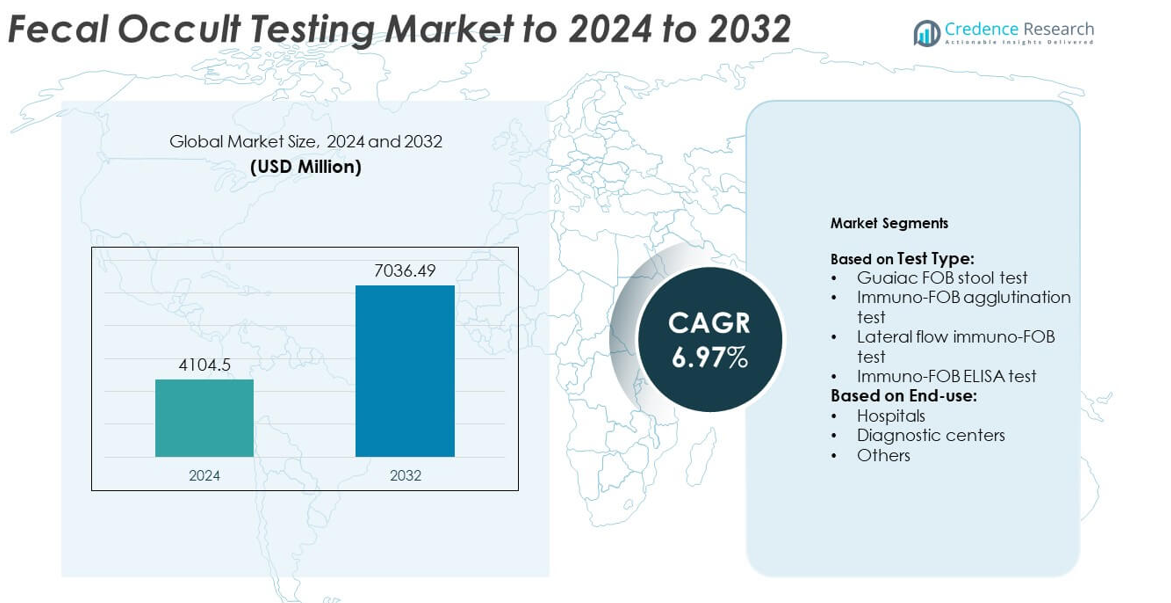

The Fecal Occult Testing market size was valued at USD 4,104.5 million in 2024 and is anticipated to reach USD 7,036.49 million by 2032, at a CAGR of 6.97% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fecal Occult Testing market Size 2024 |

USD 4,104.5 million |

| Fecal Occult Testing market, CAGR |

6.97% |

| Fecal Occult Testing market Size 2032 |

USD 7,036.49 million |

The fecal occult testing market is highly competitive, with key players such as Quidel Corporation, CERTEST BIOTEC, Siemens Healthcare GmbH, Exact Sciences Corp., HUMASIS.COM, and Wondfo driving growth through advanced diagnostic solutions and global distribution networks. These companies focus on enhancing test accuracy, expanding non-invasive screening options, and strengthening collaborations with healthcare providers. Regional dynamics highlight North America as the leading market, commanding nearly 38% of the global share in 2024, supported by strong screening programs and high colorectal cancer prevalence. Europe followed with about 30% share, driven by government-backed initiatives and widespread adoption of immunoassay-based tests.

Market Insights

- The fecal occult testing market was valued at USD 4,104.5 million in 2024 and is projected to reach USD 7,036.49 million by 2032, growing at a CAGR of 6.97%.

- Growth is fueled by rising colorectal cancer prevalence, supportive government screening programs, and the shift toward early detection practices across healthcare systems.

- Market trends include increased adoption of immunoassay-based tests such as ELISA for higher accuracy, alongside growing demand for at-home testing kits supported by digital reporting solutions.

- The competitive landscape features global players focusing on product innovation, partnerships, and regional expansion, with emphasis on accuracy, affordability, and patient compliance.

- North America led with 38% share in 2024, followed by Europe with 30%, while Asia-Pacific accounted for 22%. By test type, guaiac FOB stool test dominated with over 40% share, whereas hospitals remained the largest end-use segment, driven by higher patient volumes and advanced diagnostic infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Test Type

The fecal occult testing market by test type is led by the guaiac FOB stool test, accounting for over 40% of the share in 2024. Its dominance is supported by low cost, ease of availability, and widespread use in population-level screening programs. While newer immunochemical tests offer higher sensitivity and specificity, guaiac-based testing remains popular in developing regions due to affordability and simpler processing. The immuno-FOB ELISA and lateral flow immuno-FOB tests are gaining momentum, driven by rising awareness of early colorectal cancer detection and the shift toward more accurate diagnostic technologies.

- For instance, Eiken Chemical’s OC-SENSOR PLEDIA analyzer processes up to 320 FIT tests per hour with 200 samples loaded at once, ensuring efficiency in population screening programs

By End-use

Hospitals held the dominant share of more than 45% in the fecal occult testing market in 2024, supported by large patient inflows and established laboratory infrastructure. Hospitals are preferred for colorectal screening due to advanced diagnostic setups and immediate access to follow-up procedures. Diagnostic centers are expanding their role, especially in urban regions, where demand for cost-effective, rapid testing is high. The “others” category, including research and small clinics, maintains a smaller share but contributes to early adoption of advanced immunoassay-based methods. Rising colorectal cancer screening campaigns strengthen hospital-led dominance.

- For instance, Sysmex SENTiFIT 800 delivers up to 550 immunochemical FOB tests per hour, while SENTiFIT 270 handles 270 tests per hour, enabling hospitals to manage high-volume screening workflows

Key Growth Drivers

Rising Colorectal Cancer Prevalence

The growing prevalence of colorectal cancer remains the key growth driver for the fecal occult testing market. With colorectal cancer ranking among the top causes of cancer-related deaths globally, early detection has become a medical priority. Governments and healthcare organizations are increasing investments in screening programs to reduce mortality rates. The guaiac FOB and immunochemical tests are widely integrated into screening initiatives due to their effectiveness and affordability. Rising patient awareness and proactive health check-ups further strengthen market adoption, especially in high-burden regions.

- For instance, Polymedco’s OC-Auto collection devices maintain sample stability for 15 days at room temperature and 30 days refrigerated, which supports timely large-scale cancer screening

Government Screening Programs and Guidelines

The expansion of government-led colorectal cancer screening programs is another major driver of market growth. Many developed nations have introduced mandatory fecal occult testing for individuals over a certain age, boosting adoption rates. Clear clinical guidelines from bodies such as the American Cancer Society and European health authorities have further standardized the use of FOBT. Subsidized testing, insurance coverage, and awareness campaigns are expanding access to early detection tools, making screening more routine across both urban and rural populations.

- For instance, Clinical Genomics’ InSure ONE is a fecal immunochemical test (FIT) that requires 2 water-based samples to be collected from a single bowel movement using a long-handled brush.

Technological Advancements in Testing Methods

Technological advancements, particularly in immunoassay-based tests such as ELISA and lateral flow, drive improved accuracy and convenience. These newer tests reduce false positives while enhancing sensitivity, making them suitable for large-scale screening. Automation in diagnostic laboratories further accelerates test processing and ensures higher reliability. As patients and clinicians shift preference toward non-invasive and accurate screening methods, demand for advanced fecal occult testing grows. The integration of digital reporting and point-of-care solutions is expected to further strengthen adoption, creating long-term growth opportunities.

Key Trends & Opportunities

Shift Toward Non-Invasive Screening

A key trend in the fecal occult testing market is the shift toward non-invasive, at-home screening methods. Patients prefer these tests as they are less intrusive and more convenient compared to colonoscopies. Companies are investing in home-based FOB test kits supported by digital platforms for easy result tracking and follow-up care. This trend improves compliance rates and broadens screening coverage, particularly among populations hesitant to undergo invasive diagnostic procedures. As awareness grows, at-home kits present a significant opportunity for market expansion.

- For instance, QuidelOrtho’s QuickVue iFOB requires only 1 specimen and provides results without dietary restrictions.

Rising Adoption in Emerging Economies

The increasing adoption of fecal occult testing in emerging economies presents a major opportunity for growth. Rising healthcare expenditure, improved laboratory infrastructure, and growing awareness of preventive healthcare support this expansion. Governments in Asia-Pacific and Latin America are introducing screening programs to address the rising incidence of colorectal cancer. Lower-cost guaiac tests remain dominant in these markets, while gradual adoption of immunoassay-based tests indicates growing demand for advanced diagnostics. This regional expansion opens new avenues for both global and local players.

- For instance, Alpha Labs’ HM-JACKarc analyzer runs up to 200 samples per hour with first results in 5.6 minutes and subsequent results every 18 seconds, supporting adoption in growing Asian screening programs

Integration with Digital Health Solutions

Digital health integration represents another emerging trend, enabling improved accessibility and efficiency in fecal occult testing. Mobile health apps, telemedicine platforms, and cloud-based result management systems are increasingly linked to FOB tests, particularly at-home kits. This allows seamless patient follow-up and better engagement between healthcare providers and patients. With governments and health systems promoting digital health adoption, integrating fecal occult testing into connected health platforms enhances efficiency, reduces delays, and ensures timely interventions, creating strong future opportunities.

Key Challenges

Low Patient Compliance Rates

A major challenge for the fecal occult testing market is low patient compliance with regular screening schedules. Despite awareness campaigns, many individuals avoid testing due to discomfort, fear, or lack of understanding of colorectal cancer risks. Missed screenings reduce early detection opportunities, impacting the effectiveness of national programs. Healthcare providers face the task of improving patient education and addressing psychological barriers. Without increased compliance, the market’s growth potential may face limitations despite the availability of reliable test options.

Competition from Alternative Screening Methods

Competition from advanced screening methods such as colonoscopy and DNA-based stool tests poses a significant challenge. Colonoscopy is often regarded as the gold standard for colorectal cancer detection due to its higher accuracy and ability to detect polyps. Similarly, DNA-based stool tests are gaining attention for their advanced sensitivity. While fecal occult tests are cost-effective, their reliance on multiple testing cycles and occasional false positives makes them less competitive. This ongoing challenge could hinder long-term adoption in advanced healthcare markets.

Regional Analysis

North America

North America dominated the fecal occult testing market in 2024, holding nearly 38% of the global share. The region’s leadership stems from high colorectal cancer prevalence, advanced healthcare infrastructure, and robust government-led screening programs. The United States contributes the largest portion due to wide insurance coverage and strong awareness initiatives. Canada also supports growth with nationwide screening policies. Increasing adoption of advanced immunoassay-based tests further strengthens market presence. Continued emphasis on preventive healthcare and the integration of digital screening platforms ensure North America maintains its leading role in the forecast period.

Europe

Europe accounted for around 30% of the fecal occult testing market in 2024, supported by established colorectal cancer screening initiatives across several countries. Nations such as the United Kingdom, Germany, France, and Italy have introduced national programs, ensuring broad patient participation. The region shows strong demand for immuno-FOB ELISA tests, favored for accuracy and early cancer detection. Government regulations, aging demographics, and high awareness levels contribute to growth. While cost-sensitive countries still prefer guaiac tests, Europe’s shift toward advanced testing methods highlights its robust market outlook, strengthening its position as the second-largest regional contributor.

Asia-Pacific

Asia-Pacific captured nearly 22% of the fecal occult testing market in 2024, driven by a rising colorectal cancer burden and expanding healthcare infrastructure. Countries like Japan, China, and India are seeing increased demand due to growing awareness of early cancer detection. Government investments in screening programs and improving diagnostic centers fuel regional adoption. Japan leads in advanced immunoassay-based tests, while developing nations rely more on guaiac testing for cost-effectiveness. Rising disposable income, urbanization, and population growth support future opportunities, making Asia-Pacific the fastest-growing region in the forecast period with strong expansion potential.

Latin America

Latin America held about 6% of the fecal occult testing market in 2024, with growth supported by improving access to diagnostic services and government-led awareness campaigns. Brazil and Mexico lead adoption due to expanding healthcare systems and targeted colorectal screening programs. Affordability plays a major role, keeping guaiac tests the dominant choice, though immunochemical tests are gradually gaining traction. Limited infrastructure in rural areas remains a barrier, yet increasing urban demand and partnerships with international diagnostic companies support market growth. Rising investment in healthcare reforms is expected to expand regional screening participation.

Middle East & Africa

The Middle East & Africa accounted for nearly 4% of the fecal occult testing market in 2024, representing the smallest regional share. Limited screening awareness, weak healthcare infrastructure, and economic challenges restrict widespread adoption. However, affluent countries in the Gulf, such as Saudi Arabia and the UAE, are investing in modern diagnostic centers and cancer awareness programs. In Africa, adoption remains low but gradually increasing with international aid and healthcare initiatives. Although the market share is small, rising investments in healthcare modernization and growing emphasis on preventive care provide gradual growth opportunities in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Test Type:

- Guaiac FOB stool test

- Immuno-FOB agglutination test

- Lateral flow immuno-FOB test

- Immuno-FOB ELISA test

By End-use:

- Hospitals

- Diagnostic centers

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the fecal occult testing market is shaped by leading players such as Quidel Corporation, CERTEST BIOTEC, Jant Pharmacal Corporation, Cenogenics Corporation, Siemens Healthcare GmbH, HUMASIS.COM, Wondfo, CTK Biotech, Inc., Alfa Scientific Designs, Inc., Exact Sciences Corp., Biopanda Reagents Ltd, and Biohit Oyj. These companies compete through product innovation, expanded distribution networks, and advancements in diagnostic technologies. The market is characterized by a mix of established global corporations and emerging regional firms, each focusing on improving test accuracy, reducing false positives, and enhancing user convenience. Strategic collaborations with healthcare providers, investments in automation, and the introduction of non-invasive, rapid screening solutions have strengthened their market positions. Expansion into developing regions, supported by awareness campaigns and government-backed screening programs, remains a key growth strategy. Continuous R&D efforts targeting more sensitive and cost-effective testing solutions are likely to intensify competition and drive the market forward.

Key Player Analysis

- Quidel Corporation

- CERTEST BIOTEC

- Jant Pharmacal Corporation

- Cenogenics Corporation

- Siemens Healthcare GmbH

- COM

- Wondfo

- CTK Biotech, Inc.

- Alfa Scientific Designs, Inc.

- Exact Sciences Corp.

- Biopanda Reagents Ltd

- Biohit Oyj

Recent Developments

- In 2024, Exact Sciences Corp. In collaboration with The Blue Hat Foundation and basketball star Jamal Mashburn, launched the “Box Out Colon Cancer” campaign in March for Colorectal Cancer Awareness Month to encourage screening among those 45 and older.

- In 2024, Biohit updated the product manual for its ColonView® quick test, which aids in the diagnosis of lower gastrointestinal disorders by detecting human hemoglobin and hemoglobin/haptoglobin complex.

- In 2023, Alfa Scientific continued to sell its Instant-view® Fecal Occult Blood (FOB) rapid tests, including “at-home” kits, through channels like Amazon, highlighting ease of use and rapid results.

Report Coverage

The research report offers an in-depth analysis based on Test Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with growing demand for early colorectal cancer detection.

- Immunoassay-based tests will see faster adoption due to higher accuracy and sensitivity.

- Home-based fecal occult test kits will gain popularity for convenience and compliance.

- Government-led screening initiatives will continue to drive widespread adoption.

- Digital integration with mobile health platforms will improve reporting and patient follow-up.

- Emerging economies will present strong growth opportunities with rising healthcare investments.

- Hospitals will remain the primary end-use segment, supported by advanced infrastructure.

- Diagnostic centers will grow rapidly due to cost-effective and accessible testing.

- Competition from DNA-based stool tests and colonoscopy will influence market positioning.

- Rising awareness campaigns will boost compliance and strengthen overall screening coverage.