Market Overview:

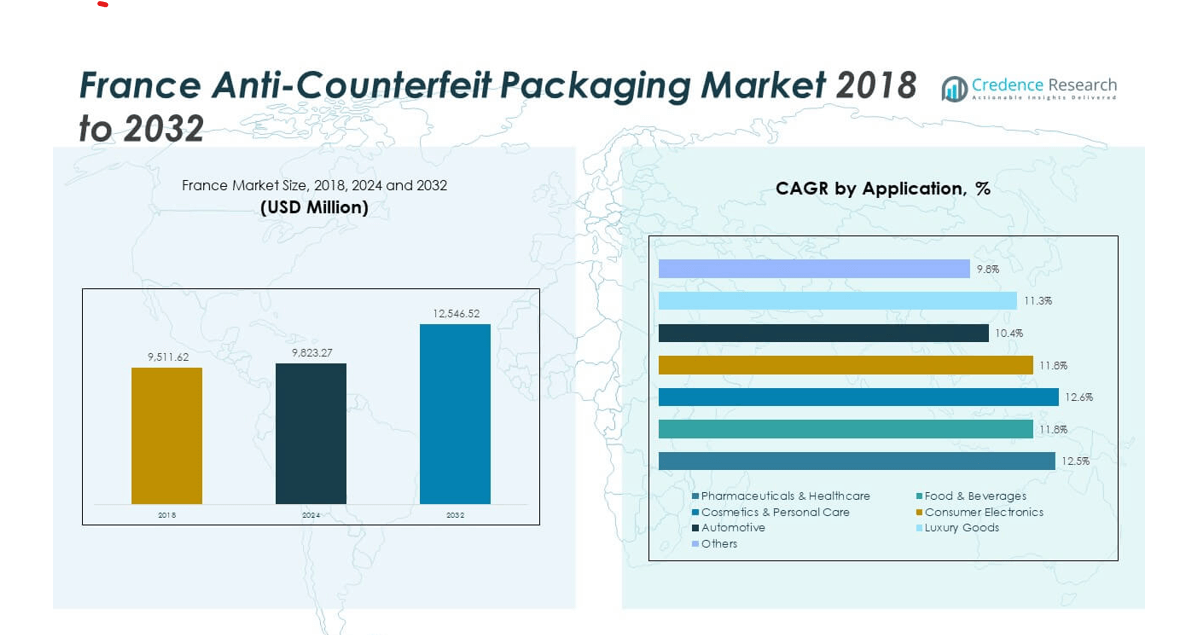

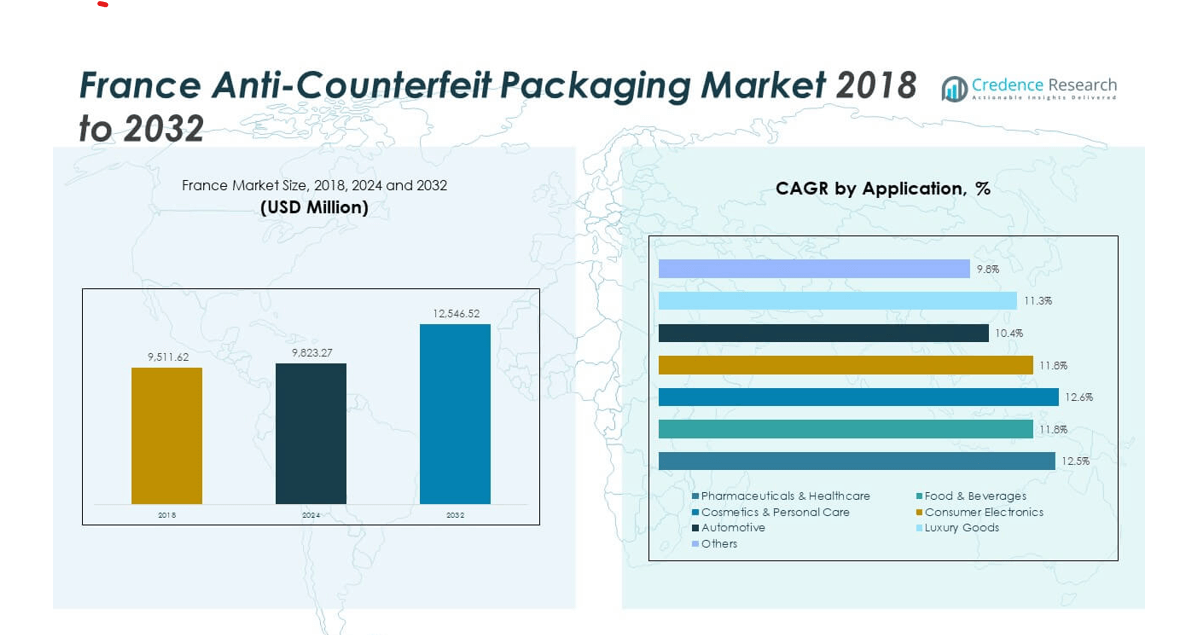

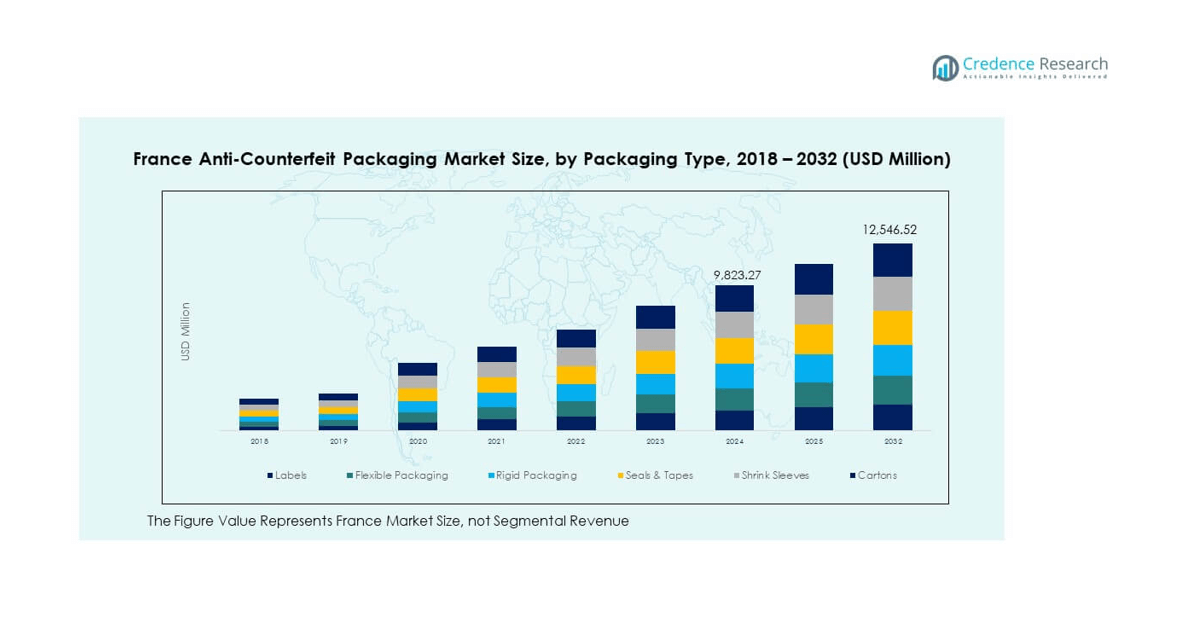

The France Anti-Counterfeit Packaging Market size was valued at USD 9,511.62 million in 2018 to USD 9,823.27 million in 2024 and is anticipated to reach USD 12,546.52 million by 2032, at a CAGR of 3.11% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Anti-Counterfeit Packaging Market Size 2024 |

USD 9,823.27 million |

| France Anti-Counterfeit Packaging Market, CAGR |

3.11% |

| France Anti-Counterfeit Packaging Market Size 2032 |

USD 12,546.52 million |

Strong regulatory enforcement and growing awareness among manufacturers drive the adoption of secure packaging solutions across France. The market expands through widespread integration of holograms, RFID tags, and tamper-evident features in pharmaceuticals, food, and luxury goods. Rising brand protection initiatives, government compliance programs, and technological advancements strengthen market demand. Increased collaboration between packaging suppliers and digital technology providers supports large-scale traceability improvements.

Northern France remains the dominant subregion with strong industrial infrastructure and leading pharmaceutical operations. Western France follows with high demand from food, beverage, and luxury product manufacturers focusing on brand protection. Southern and Central France are emerging areas driven by automotive and electronics packaging upgrades. Strong logistics networks and export-oriented industries across major cities continue to enhance packaging innovation and authentication adoption nationwide.

Market Insights

- The France Anti-Counterfeit Packaging Market was valued at USD 9,511.62 million in 2018, reached USD 9,823.27 million in 2024, and is projected to hit USD 12,546.52 million by 2032, growing at a CAGR of 3.11% during the forecast period.

- Northern France holds the largest regional share at 45%, supported by strong pharmaceutical production and logistics infrastructure. Western France follows with 33%, driven by food, beverage, and luxury packaging industries, while Southern and Central France contribute 22%, led by electronics and industrial sectors.

- The fastest-growing region is Western France, supported by export-oriented industries such as cosmetics, wines, and premium foods that rely heavily on digital authentication and traceable packaging.

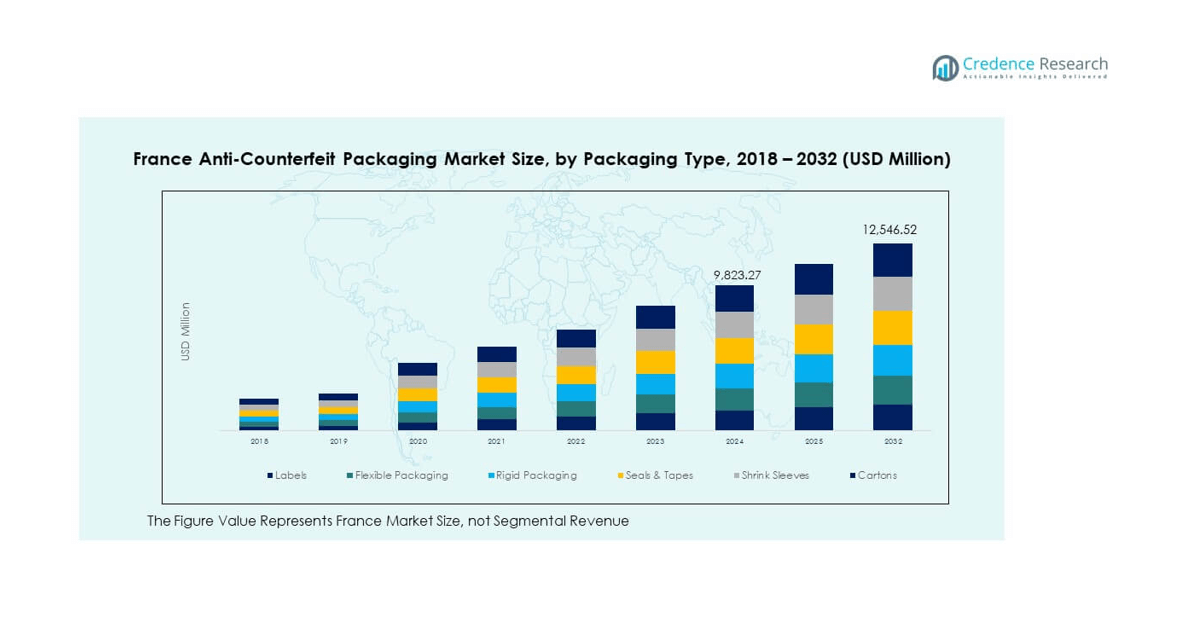

- By packaging type, labels account for 28%, followed by flexible packaging at 21%, rigid packaging at 18%, seals and tapes at 14%, shrink sleeves at 11%, and cartons at 8%, reflecting balanced adoption across packaging forms.

- Among applications, food & beverages lead with 12.6% CAGR, followed by luxury goods at 12.5%, consumer electronics at 11.8%, cosmetics & personal care at 11.3%, automotive at 10.4%, and pharmaceuticals & healthcare at 9.8%, highlighting strong authentication needs across consumer and export-driven categories.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Counterfeit Threats Across Pharmaceuticals and Luxury Goods

Counterfeit drugs, perfumes, and premium fashion goods continue to challenge French industries. The France Anti-Counterfeit Packaging Market strengthens as manufacturers prioritize brand safety and regulatory compliance. Strong enforcement by French health authorities encourages use of secure packaging identifiers. Luxury brands employ tamper-evident seals and holographic foils to protect exclusive collections. Pharmaceutical producers adopt unique serial codes to trace each batch. Digital monitoring systems support real-time authentication of packaging materials. It helps reduce infiltration of fake goods across legitimate channels. Strong consumer trust in certified labeling further amplifies market momentum.

- For instance, L’Oréal’s anti-counterfeiting management application, developed with ITEO, resulted in significant reductions in counterfeit levels and improved operational efficiency while enhancing customer experience.

Strict Regulatory Standards and Evolving Authentication Mandates

Government initiatives encourage companies to comply with EU Falsified Medicines Directive and related packaging norms. The France Anti-Counterfeit Packaging Market expands as compliance drives innovation in traceability and labeling design. Packaging suppliers collaborate with pharmaceutical and cosmetic brands to integrate digital markers. RFID and barcode systems enhance visibility and strengthen logistic monitoring. Authorities promote serial number verification to detect anomalies in product distribution. It pushes large-scale adoption of tamper-resistant materials across production units. Stricter laws encourage importers to adopt multi-layered protection solutions. Ongoing audits of supply-chain data improve transparency from factory to shelf.

Growing Digital Transformation and Use of Smart Packaging Systems

Automation, AI, and IoT technologies reshape packaging verification processes across France. The France Anti-Counterfeit Packaging Market benefits from fast integration of intelligent printing solutions. Companies deploy data-encoded holograms and scannable labels that enable consumer-level checks. Retailers and logistics partners access shared blockchain databases to confirm product origin. It supports instant verification during online and physical transactions. Digital watermarks help identify unauthorized reproductions more effectively. Manufacturers develop embedded chips that record environmental data for shipment integrity. Rising connectivity supports more reliable end-to-end product authentication.

Expanding Consumer Awareness and Demand for Authentic Products

Modern buyers demand proof of origin and material authenticity in daily purchases. The France Anti-Counterfeit Packaging Market gains traction from strong consumer push toward transparency. Firms invest in visible identifiers such as security inks and QR codes on retail packaging. It fosters confidence among customers purchasing high-value or healthcare items. E-commerce platforms use scannable features to confirm legitimacy before delivery. Awareness campaigns strengthen the perception of authenticity and promote ethical consumption. The retail shift toward digital platforms increases need for quick verification tools. Constant emphasis on trust and safety reinforces long-term adoption.

- For instance, Avery Dennison’s AD Pure range of plastic-free inlays and tags uses direct-on-paper antenna technology, supporting eco-compliant and traceable packaging for French retail and e-commerce brands.

Market Trends

Adoption of Blockchain-Based Traceability for Transparent Supply Chains

Blockchain platforms enhance accountability by enabling immutable data trails for packaged goods. The France Anti-Counterfeit Packaging Market integrates decentralized tracking tools to ensure secure supply flows. Luxury and healthcare sectors rely on blockchain to verify material origins and production history. Brands use encrypted tokens to link packaging units with verified transactions. It reduces errors linked to manual data handling. Logistics firms adopt permissioned blockchain systems to maintain compliance records. Integration with cloud analytics strengthens accuracy across multi-tier networks. This approach builds transparency and supports sustainable sourcing credentials.

- For instance, LVMH’s brands like Louis Vuitton and Hublot use Aura Blockchain to verify over 1 million luxury items annually via immutable digital identities linking each product to a blockchain-based provenance record.

Integration of Artificial Intelligence and Machine Vision in Verification

AI-powered visual inspection tools detect inconsistencies in labeling and code printing. The France Anti-Counterfeit Packaging Market experiences growth from AI algorithms improving detection precision. Machine vision systems scan holographic foils and micro-text identifiers during packaging runs. AI platforms learn from image databases to identify counterfeit cues quickly. It enables producers to maintain high quality assurance with fewer human checks. Automated verification accelerates large-scale packaging validation in high-speed production lines. Predictive analytics assist brands in monitoring regional counterfeit patterns. The convergence of AI and machine vision strengthens quality reliability.

- For instance, Cognex’s AI-powered systems, such as the In-Sight series, can inspect up to 12,000 packages per hour, detecting micro-text errors and hologram tampering during high-speed production, with over 98% accuracy.

Rising Popularity of Eco-Friendly and Recyclable Secure Materials

Sustainable packaging gains focus among French brands balancing security with environmental goals. The France Anti-Counterfeit Packaging Market adopts biodegradable films and eco-compliant inks in premium products. Producers develop water-based coatings that integrate hidden marks without harmful solvents. It reduces environmental load while maintaining high security standards. Regulatory pressure supports adoption of recyclable cartons and flexible wraps. Luxury brands use bio-based holograms to align with green image values. Circular economy principles influence material selection across printing lines. Eco-security integration reflects growing social and environmental accountability.

Emergence of Digital Consumer Engagement Platforms for Verification

Smartphones turn into authentication tools through mobile-accessible verification apps. The France Anti-Counterfeit Packaging Market embraces QR and NFC-based scanning for instant product validation. Brands create loyalty programs linked to genuine product scans. It strengthens post-purchase engagement and improves repeat buying behavior. Retailers use online dashboards to analyze scan activity patterns. Data from consumers guide anti-fraud campaigns and marketing strategies. Interactive packaging becomes a communication gateway between brand and buyer. This digital engagement trend enhances both trust and brand loyalty.

Market Challenges Analysis

High Implementation Costs and Complex Integration Across Value Chains

Deployment of anti-counterfeit technologies demands heavy financial investment and system reconfiguration. The France Anti-Counterfeit Packaging Market faces barriers when small and medium enterprises struggle to afford advanced tools. Integrating RFID, blockchain, or forensic markers with legacy systems raises complexity. It requires technical expertise and consistent software maintenance. Many suppliers resist upgrades due to cost and uncertain short-term returns. Diverse product categories complicate uniform adoption across industries. Training workforce to manage digital validation tools adds operational pressure. Balancing cost efficiency with technological precision remains a recurring challenge.

Fragmented Standards and Limited Interoperability Among Technologies

Lack of harmonized standards across authentication platforms hinders wide-scale deployment. The France Anti-Counterfeit Packaging Market encounters technical gaps when different systems fail to communicate effectively. It leads to fragmented data visibility across supply networks. Inconsistent regulations within EU trade zones add compliance confusion. Some industries prioritize proprietary encryption, restricting open-source collaboration. It restricts interoperability between labeling, serialization, and track-and-trace solutions. Vendors struggle to ensure compatibility with multiple scanning devices. Unifying standards under European guidelines could help reduce complexity.

Market Opportunities

Rising Export Growth Creating Need for Stronger Traceability Systems

Export-driven French brands increasingly demand packaging traceability to meet international compliance. The France Anti-Counterfeit Packaging Market finds opportunities in new traceable packaging for global shipments. It enables transparent trade between Europe, Asia, and North America. Customs authorities request detailed tracking information for authenticity verification. Growing exports in cosmetics, food, and wine create scope for digital verification adoption. Secure serialization tools strengthen country-of-origin labeling and reduce brand risk abroad. Rising foreign demand for certified goods boosts innovation in tamper-evident formats.

Emergence of Startups and Partnerships in Smart Authentication Solutions

Innovation-driven startups bring fresh capabilities to France’s secure packaging ecosystem. The France Anti-Counterfeit Packaging Market benefits from collaborations between material scientists and tech developers. Joint ventures launch integrated verification systems combining AI, NFC, and cloud analytics. It accelerates deployment of scalable smart labeling across varied industries. Investors show interest in platforms offering traceability-as-a-service for SMEs. Emerging alliances with digital identity providers expand value propositions. The ecosystem supports broader innovation across authentication and data-sharing domains.

Market Segmentation Analysis

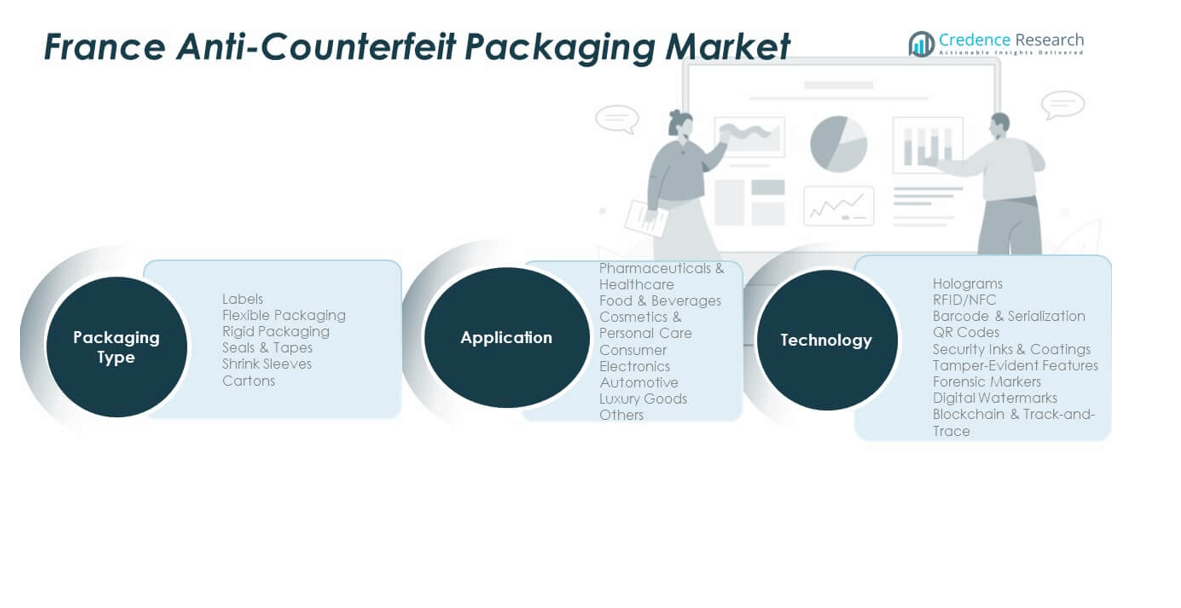

By Packaging Type

Labels dominate due to easy integration with existing printing processes and wide applicability. Flexible packaging supports customization across food and retail sectors. Rigid packaging ensures tamper-proof protection for pharmaceuticals and luxury items. Seals and tapes guarantee first-use visibility for medicines and industrial products. Shrink sleeves enable 360-degree branding with embedded security layers. Cartons integrate RFID tags for serialized tracking. The France Anti-Counterfeit Packaging Market gains from multi-layer packaging strategies improving end-user assurance.

- For instance, Schreiner Group produces pressure-sensitive security labels with embedded NFC chips that authenticate over 500 million pharmaceutical and industrial packages globally, including French supply networks.

By Application

Pharmaceuticals and healthcare lead due to strict compliance and safety obligations. Food and beverage brands use traceable packaging to maintain freshness and integrity. Cosmetics and personal care sectors rely on holographic labeling to protect brand image. Consumer electronics integrate NFC for device authenticity. Automotive parts include serialized codes for repair tracking. Luxury goods continue investing in premium security foils to maintain exclusivity. Other sectors implement smart seals for logistic control, strengthening trust in product quality.

By Technology

Holograms remain a visual deterrent with intricate design precision. RFID and NFC provide real-time item-level traceability. Barcode and serialization methods deliver scalable identification for mass production. QR codes simplify consumer-side validation using mobile scanning. Security inks and coatings embed invisible markers for layered defense. Tamper-evident features protect high-value containers from misuse. Forensic markers and digital watermarks enhance authentication under microscopic inspection. The France Anti-Counterfeit Packaging Market strengthens through diverse technology integration enabling high security and transparency.

- For instance, SICPA develops advanced security inks and traceability systems deployed in brand-protection and regulated packaging sectors, including tax-stamp and pharmaceutical applications in Europe.

Segmentation

By Packaging Type

- Labels

- Flexible Packaging

- Rigid Packaging

- Seals & Tapes

- Shrink Sleeves

- Cartons

By Application

- Pharmaceuticals & Healthcare

- Food & Beverages

- Cosmetics & Personal Care

- Consumer Electronics

- Automotive

- Luxury Goods

- Others

By Technology

- Holograms

- RFID/NFC

- Barcode & Serialization

- QR Codes

- Security Inks & Coatings

- Tamper-Evident Features

- Forensic Markers

- Digital Watermarks

Regional Analysis

Northern France – Industrial and Pharmaceutical Dominance (45% Market Share)

Northern France leads the France Anti-Counterfeit Packaging Market with nearly 45% market share due to its dense concentration of pharmaceutical plants and logistics hubs. Lille, Rouen, and Amiens host major drug production and distribution centers that require advanced serialization and labeling systems. Strong regional infrastructure supports digital tracking of medical and FMCG products. It benefits from close proximity to Belgium and the Netherlands, enabling streamlined export verification. Regional governments encourage traceability programs across medical and chemical sectors. Established packaging suppliers strengthen their presence through local partnerships and innovation clusters.

Western France – Food, Beverage, and Luxury Product Integration (33% Market Share)

Western France accounts for around 33% of the total market, driven by active food, beverage, and luxury goods industries. Bordeaux, Nantes, and Rennes lead in adopting anti-counterfeit solutions for wine, seafood, and cosmetics packaging. The France Anti-Counterfeit Packaging Market benefits from strong export networks in premium foods and wines. Producers incorporate QR-coded labels and NFC seals to ensure product origin and brand reliability. Regional chambers of commerce promote authenticity programs among artisanal and export-oriented businesses. It witnesses rising investment in recyclable holographic films to combine sustainability with security.

Southern and Central France – Emerging Adoption Across Industrial Goods (22% Market Share)

Southern and Central France hold about 22% share with growing interest in industrial, automotive, and electronics packaging authentication. Toulouse and Lyon act as industrial technology hubs integrating smart labeling and IoT-enabled packaging tools. Small and mid-sized enterprises in these areas adopt affordable barcode and serialization systems to meet compliance needs. It experiences steady expansion in contract packaging services that cater to domestic and export clients. Regional R&D facilities partner with technology providers for testing advanced security materials. Increasing government focus on countering illicit trade further drives adoption across new verticals.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The France Anti-Counterfeit Packaging Market features strong competition among global and regional suppliers focused on high-security printing and smart labeling. Key players include SICPA Holding SA, Avery Dennison Corporation, Zebra Technologies, Authentix Inc., and CCL Industries. It demonstrates steady innovation through partnerships and acquisitions aimed at expanding authentication portfolios. French packaging companies collaborate with IT developers to embed RFID and blockchain systems into their production lines. Startups entering the market provide digital watermark and mobile verification platforms for small producers. Established firms invest in sustainable packaging materials with integrated tamper indicators to meet environmental goals. Ongoing R&D in micro-printing and forensic taggants enhances product diversification, ensuring long-term leadership in secure packaging technologies.

Recent Developments

- In September 2024, kdc/one completed the acquisition of an Italian packaging specialist (S.r.l.) focused on cosmetics packaging to enhance its anti-counterfeit offerings in beauty and personal care.

- In April 2024, Avery Dennison Corporation announced the expansion of its AD Pure range of inlays and tags which are entirely plastic-free and utilize antenna manufacturing technology applied directly on paper.

Report Coverage

The research report offers an in-depth analysis based on packaging type, application, and technology segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The France Anti-Counterfeit Packaging Market will see strong growth driven by continuous regulatory reforms focused on pharmaceutical and luxury product authentication.

- Increasing digital adoption will push companies toward AI, blockchain, and IoT-based packaging solutions for end-to-end transparency.

- Consumer demand for traceable and verifiable goods will remain a major force shaping long-term investment strategies.

- Eco-friendly security materials will gain momentum, merging sustainability with high-performance packaging innovation.

- Cross-industry collaboration between packaging manufacturers and technology startups will drive faster implementation of smart authentication tools.

- Luxury brands will continue integrating embedded holograms and encrypted identifiers to safeguard product originality.

- Expanding exports in cosmetics and wine will generate opportunities for digital verification systems aligned with international standards.

- Ongoing standardization efforts across the EU will create a unified framework enhancing interoperability and compliance.

- The rise of e-commerce will heighten demand for QR-based and mobile-enabled verification technologies.

- Overall, the market will evolve toward hybrid security formats combining physical and digital identifiers to prevent counterfeiting.