Market Overview:

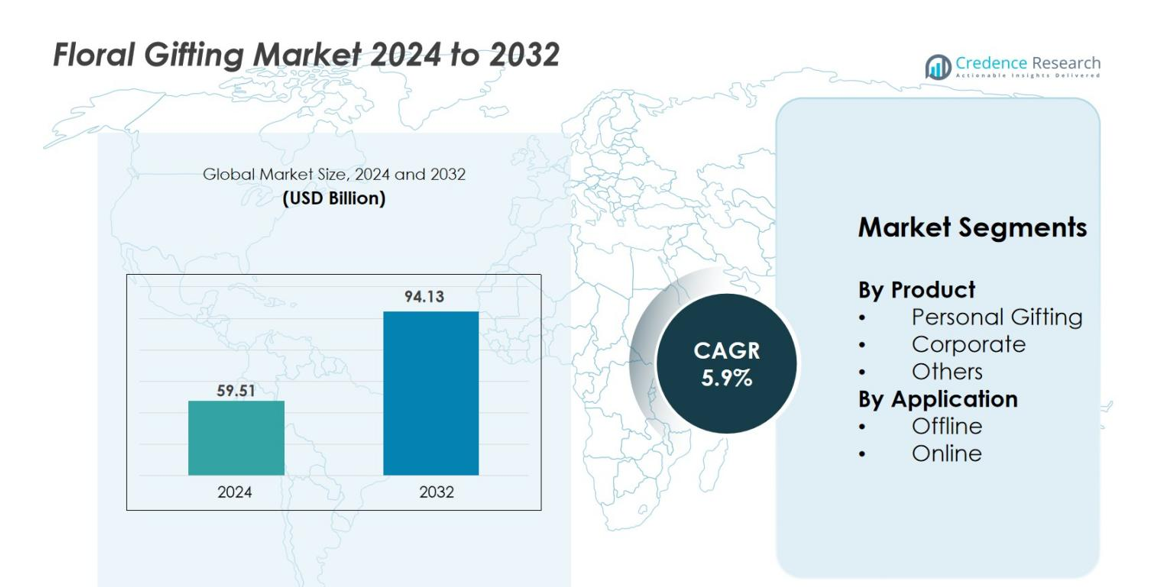

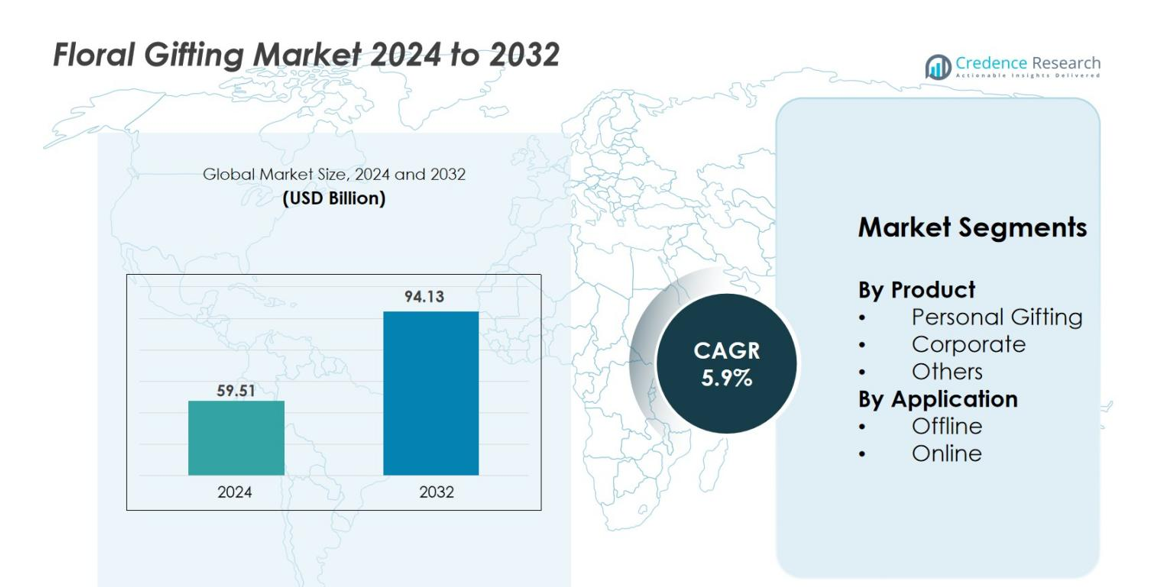

The Floral Gifting Market size was valued at USD 59.51 Billion in 2024 and is anticipated to reach USD 94.13 Billion by 2032, at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Floral Gifting Market Size 2024 |

USD 59.51 Billion |

| Floral Gifting Market, CAGR |

5.9% |

| Floral Gifting Market Size 2032 |

USD 94.13 Billion |

Floral Gifting Market features a competitive mix of established floral delivery platforms and regional specialists, with key players including From You Flowers, Avas Flowers, BloomNation, Blooms Today, Farmgirl Flowers, Flora2000, Flowerbud, Flowerpetal, Just Flowers, and KaBloom. These companies compete through personalized bouquets, same-day delivery, curated gifting themes, and strong online service capabilities. Regionally, North America leads the market with 32.6% share, supported by high gifting frequency and premium floral demand. Europe follows with 28.4% share, driven by strong cultural traditions, a developed horticulture sector, and well-established florist networks.

Market Insights

- The Floral Gifting Market was valued at USD 59.51 Billion in 2024 and is projected to reach USD 94.13 Billion by 2032, growing at a CAGR of 5.9% during the forecast period.

- The market is driven by rising demand for personalized gifting, increasing use of flowers in celebrations, and the rapid expansion of online delivery platforms that offer convenience, customization, and timely fulfillment.

- Key trends include the growing popularity of sustainable floral packaging, eco-friendly bouquets, premium designer arrangements, and the adoption of digital tools such as AI-based recommendations and subscription-based floral services.

- Competitive intensity remains high, with players like From You Flowers, Avas Flowers, BloomNation, Blooms Today, Farmgirl Flowers, Flora2000, Flowerbud, Flowerpetal, Just Flowers, and KaBloom focusing on logistics efficiency, curated offerings, and strong digital presence; however, fluctuating flower supply and high perishability restrain market growth.

- Regionally, North America leads with 32.6% share, followed by Europe at 28.4% and Asia-Pacific at 24.7%, while segment-wise, Personal Gifting dominates with 62.4% share and Offline Channels lead with 58.7% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Product

The Floral Gifting Market shows strong performance across personal and corporate categories, with Personal Gifting emerging as the dominant sub-segment, holding 62.4% market share in 2024. This leadership is driven by increasing demand for customized bouquets, themed arrangements, and occasion-specific gifting. Emotional value associated with flowers for birthdays, anniversaries, and festive celebrations strengthens the segment’s appeal. Expanded product creativity, curated designs, and premium packaging offered by florists further enhance consumer preference, positioning personal gifting as the most influential contributor to market growth.

- For instance, Interflora strengthened its personalization capability by integrating advanced floral logistics software that now supports delivery coordination across more than 58,000 affiliated florists globally, enabling faster fulfillment of custom bouquet orders.

By Application

In terms of application, Offline Channels lead the market with a 58.7% share in 2024, driven by customers’ preference for physically inspecting flowers, personalized service, and immediate availability. Florist shops and specialty stores see strong demand during peak seasons and event-based purchases, ensuring consistent dominance. Although online platforms are gaining momentum due to convenience, wider assortments, and fast delivery options, offline channels maintain leadership because of trust, experiential buying, and quality assurance, making them the primary choice for floral gifting.

- For instance, Japan’s Hibiya-Kadan operates more than 190 physical stores, where offline bouquet customization sessions served over 320,000 customers in a single year, supported by design studios that maintain an offline inventory of over 1,400 SKUs of seasonal stems and decorative accessories.

Key Growth Drivers

Rising Demand for Personalized and Occasion-Based Gifting

The Floral Gifting Market is significantly driven by the increasing consumer preference for personalized and occasion-centric gifting. Events such as birthdays, anniversaries, weddings, corporate celebrations, and festive holidays continue to elevate demand for curated floral arrangements. Consumers now seek emotion-driven gifting experiences, prompting florists to offer customized bouquets, thematic floral boxes, and premium arrangement services. Seasonal flowers, subscription-based gifting plans, and designer collections further strengthen market momentum. Additionally, the growing influence of social media aesthetics and influencer-driven floral trends encourages consumers to purchase visually appealing floral products. Online platforms have intensified personalization options by providing custom design tools, AI-powered recommendations, and virtual previews. This shift toward expressive gifting, combined with the sentimental value attached to flowers, drives consistent and repeat purchases across both personal and corporate settings. As gifting behavior continues to evolve toward more meaningful experiences, the demand for personalized floral solutions is expected to remain robust.

- For instance, Aoyama Flower Market in Japan (operated by Park Corporation) promotes the concept of ‘living with flowers everyday’ through its around one hundred boutique stores located in Japan and internationally. The company offers a wide range of personalized and themed arrangements, particularly during peak celebration periods, as part of its strategy to make flowers a ‘private and daily’ item rather than just for special occasions.

Expansion of Online Floral Delivery Platforms

The rapid expansion of online floral gifting platforms serves as a major growth driver, fueled by rising digital adoption, mobile app usage, and demand for convenience. Consumers increasingly prefer online ordering due to broad product choices, transparent pricing, and advanced delivery capabilities such as same-day, midnight, and express services. E-commerce platforms provide access to diverse flower types, international bouquets, multi-tier arrangements, gift combos, and seasonal offers, making them highly attractive to users. Integration of AI, chatbots, and real-time tracking enhances customer experience by simplifying selection and ensuring timely delivery. Subscription models, loyalty rewards, and personalized recommendations further strengthen customer retention. Additionally, partnerships between florists, courier services, and digital marketplaces expand geographic reach, enabling cross-border gifting and international delivery. The accelerating shift toward digital gifting ecosystems positions online channels as a critical growth catalyst, particularly among urban millennials and corporate buyers seeking efficiency and customization.

- For instance, Interflora U.K. enhanced its digital fulfilment capability by integrating over 900 florist partners into a unified ordering and tracking platform, enabling precise delivery coordination across thousands of daily orders.

Growing Use of Flowers in Corporate and Event-Based Gifting

Corporate gifting has emerged as a powerful growth driver in the Floral Gifting Market, supported by expanding business celebrations, employee recognition programs, and event-based floral décor. Companies increasingly incorporate floral arrangements into conferences, product launches, award functions, and brand promotion activities. Flowers serve as premium, elegant, and universally accepted gifts, making them ideal for client appreciation, festive greetings, and milestone celebrations. Demand is particularly strong for branded floral boxes, luxury bouquets, and custom-designed centerpieces crafted to align with corporate themes. Event management companies, hotels, and banquet operators continuously require large floral installations, enhancing market volume. Corporate subscription services, bulk-order discounts, and long-term vendor agreements further strengthen the segment’s stability. With rising emphasis on workplace culture and relationship management, businesses continue integrating floral gifting as part of their engagement strategies, reinforcing consistent demand throughout the year and contributing substantially to overall market growth.

Key Trends & Opportunities

Rise of Sustainable and Eco-Friendly Floral Solutions

Sustainability is emerging as a major trend, presenting strong opportunities for market players to differentiate through eco-conscious offerings. Consumers increasingly seek biodegradable packaging, locally sourced flowers, pesticide-free blooms, and sustainable floral foam alternatives. Florists adopting eco-friendly practices—including recyclable wrapping materials, organic growing techniques, and low-carbon delivery methods—gain stronger brand loyalty among environmentally aware buyers. Demand for “farm-to-vase” concepts and traceable supply chains continues to grow as customers look for ethical sourcing transparency. Additionally, preserved flowers and long-lasting arrangements are gaining momentum due to their extended shelf life and reduced waste. Brands that emphasize sustainability certifications, carbon-neutral operations, and reduced water consumption appeal strongly to modern consumers. As environmental awareness accelerates globally, sustainable floral gifting emerges as a high-potential growth avenue, enabling players to innovate while aligning with evolving regulatory frameworks and consumer expectations for greener lifestyles.

- For instance, Bloom & Wild reported eliminating 40 tonnes of single-use plastic from its packaging operations after redesigning its letterbox flower boxes, as documented in its sustainability impact report.

Technological Innovation in Floral Design, Logistics, and Customer Experience

Advancements in technology are creating new opportunities across the Floral Gifting Market, transforming both operations and customer engagement. AI-driven personalization tools now allow users to visualize bouquets, customize arrangement elements, and receive tailored recommendations. Augmented reality (AR) features enhance buyer confidence by enabling virtual previews of floral designs. In logistics, tech-driven cold-chain systems, real-time tracking, and automated inventory solutions ensure freshness and timely delivery. Additionally, e-commerce integration enables access to global floral varieties, broadening selection for consumers. Florists are increasingly leveraging data analytics to predict demand, optimize procurement, and eliminate wastage. Subscription automation, chatbot assistance, and digital payment innovations further streamline transactions. The integration of advanced design software and floral robots also expands creative possibilities for intricate arrangements. As digital transformation accelerates, technology emerges as a key opportunity for enhancing differentiation, scalability, and customer satisfaction.

- For instance, Teleflora’s cloud-based order routing system connects over 10,000 florist partners and processes upwards of 30,000 delivery assignments per day using automated distance-optimization logic.

Key Challenges

Supply Chain Instability and Perishable Nature of Flowers

One of the most significant challenges in the Floral Gifting Market is supply chain instability combined with the highly perishable nature of flowers. Fluctuations in weather patterns, transportation delays, and seasonal availability directly impact pricing and product consistency. Flowers require temperature-controlled environments throughout harvesting, storage, and delivery—any deviation leads to rapid spoilage, reduced freshness, and customer dissatisfaction. High dependency on cold-chain logistics increases operational costs, especially for long-distance and international delivery. Global supply disruptions, fuel price volatility, and environmental constraints further complicate sourcing activities. Additionally, local florists face challenges in maintaining adequate inventory levels without incurring waste. Unpredictable availability of premium varieties during peak seasons can affect order fulfillment and revenue stability. Overcoming these supply chain complexities requires strategic collaborations with growers, investment in cold-chain optimization, and demand forecasting to reduce losses and improve delivery reliability.

Intense Competition and Price Sensitivity Among Consumers

The Floral Gifting Market faces strong competitive pressure due to the presence of numerous local florists, online platforms, global players, and boutique designers. With low entry barriers, new vendors continuously emerge, intensifying price competition and reducing margins for established businesses. Consumers often compare prices across multiple platforms, leading to heightened price sensitivity and frequent switching behavior. Promotions, discounts, and bundled offers further compress profitability for retailers. Differentiating floral products becomes challenging as many arrangements appear similar across providers, making innovation essential for maintaining market relevance. Rising customer expectations for premium packaging, on-demand delivery, and personalized services add operational pressure. Moreover, online marketplaces amplify competition by offering region-wide access to florists at competitive prices. To sustain profitability, players must invest in brand differentiation, quality consistency, customer loyalty programs, and superior service models that justify premium pricing while meeting evolving consumer expectations.

Regional Analysis

North America

North America dominates the Floral Gifting Market with 32.6% market share, supported by strong spending on personalized gifts and frequent use of flowers for birthdays, anniversaries, and corporate occasions. The U.S. leads consumption due to high purchasing power and the popularity of curated bouquets. Growth in online delivery platforms offering same-day and subscription services further strengthens regional performance. Increasing preference for eco-friendly packaging, premium floral assortments, and visually appealing arrangements contributes to sustained market momentum across both personal and corporate gifting categories.

Europe

Europe holds 28.4% market share, driven by long-standing cultural traditions of floral gifting and strong demand during seasonal events and festivals. Countries such as the U.K., Germany, France, and the Netherlands significantly influence regional sales. Europe benefits from a well-established horticulture sector, ensuring a diverse supply of fresh flowers. Rising adoption of sustainable packaging, ethically sourced blooms, and premium bouquet designs supports market expansion. The digitalization of floral retail, combined with strong offline florist networks, helps maintain Europe’s position as a mature and steadily evolving market.

Asia-Pacific

Asia-Pacific accounts for 24.7% market share and is one of the fastest-growing regions due to rising disposable incomes, rapid urbanization, and increasing acceptance of floral gifting for personal and corporate occasions. Countries including China, Japan, India, and South Korea exhibit strong demand, supported by online platforms offering affordable bouquets and timely delivery. Weddings, festivals, and social celebrations contribute significantly to volume growth. The region’s sizeable flower cultivation base ensures broad product variety at competitive prices, strengthening its long-term growth prospects and attracting both domestic and international players.

Latin America

Latin America represents 8.6% market share, driven by cultural affinity for flowers and strong production capabilities in countries like Colombia, Brazil, and Mexico. Celebrations such as Mother’s Day, Valentine’s Day, and regional festivals elevate floral demand across consumer groups. Increasing online floral platform adoption and collaborations with local florists improve accessibility in major cities. While price sensitivity persists, premium bouquets and event-based floral décor are gaining popularity, particularly among younger consumers seeking modern and aesthetically appealing arrangements. The region’s strong flower export industry also indirectly supports market stability.

Middle East & Africa

The Middle East & Africa region accounts for 5.7% market share, supported by growing floral gifting adoption in urban centers such as the UAE, Saudi Arabia, and South Africa. Demand is fueled by luxury preferences, weddings, hospitality events, and large-scale corporate gifting. Boutique floral studios and online delivery services are expanding rapidly, especially in Gulf markets. Despite strong premium segment demand, reliance on imported flowers increases costs and limits mass-market penetration. Nonetheless, rising disposable incomes, tourism growth, and expanding retail networks continue to support steady regional market development.

Market Segmentations

By Product

- Personal Gifting

- Corporate

- Others

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Floral Gifting Market is shaped by a diverse mix of global delivery platforms, regional florists, boutique studios, and online marketplaces competing through product variety, service quality, and delivery efficiency. Key players such as From You Flowers, Avas Flowers, BloomNation, Blooms Today, Farmgirl Flowers, Flora2000, Flowerbud, Flowerpetal, Just Flowers, and KaBloom are expanding their digital capabilities and enhancing customer experience through same-day delivery, subscription-based gifting, and personalized bouquet designs. Companies increasingly focus on sustainable packaging, curated floral themes, and premium arrangements to differentiate themselves. Strengthening logistics networks and partnering with local florists help broaden service coverage and maintain freshness. Competitive pricing, festive promotions, and tailored corporate gifting solutions further intensify competition. As consumer expectations evolve, market players continue investing in technology, AI-driven personalization, and diverse product portfolios to retain loyalty and sustain long-term growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Flora2000

- KaBloom

- Farmgirl Flowers

- From You Flowers

- Just Flowers

- Flowerbud

- Blooms Today

- Flowerpetal

- Avas Flowers

- BloomNation

Recent Developments

- In November 2025, Delaware Valley Floral Group, LLC announced the acquisition of Marvin’s Flower Gardens, Inc., expanding its service into the Midwest.

- In November 2025, Petal Group secured US$ 18 million investment from Quintas Capital to support expansion across the UAE and Ireland within the floral gifting and e-commerce space.

- In December 2024, Singapore Flower Delivery Pte Ltd acquired Singapore Florist, a 37-year-old local florist, and launched a new website.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady expansion as personalized and occasion-based floral gifting continues to gain popularity across consumer groups.

- Online floral delivery platforms will strengthen their dominance with improved logistics, faster delivery, and wider product accessibility.

- Sustainability will become a core focus, driving demand for eco-friendly packaging, ethically sourced flowers, and long-lasting arrangements.

- Technological adoption, including AI-enabled personalization and virtual bouquet previews, will elevate customer experience.

- Corporate gifting and event-based floral décor will contribute significantly to recurring revenue streams.

- Premium and luxury floral collections will see growing demand among urban and high-income consumers.

- Partnerships between florists, e-commerce platforms, and logistics providers will expand service reach and delivery reliability.

- Subscription-based floral services will gain traction as consumers seek convenience and regular home décor enhancements.

- Expanding social media influence will continue to shape floral aesthetics, boosting demand for visually appealing designs.

- Emerging markets in Asia-Pacific and Latin America will offer significant growth opportunities due to rising incomes and cultural adoption of gifting trends.