Market Overview:

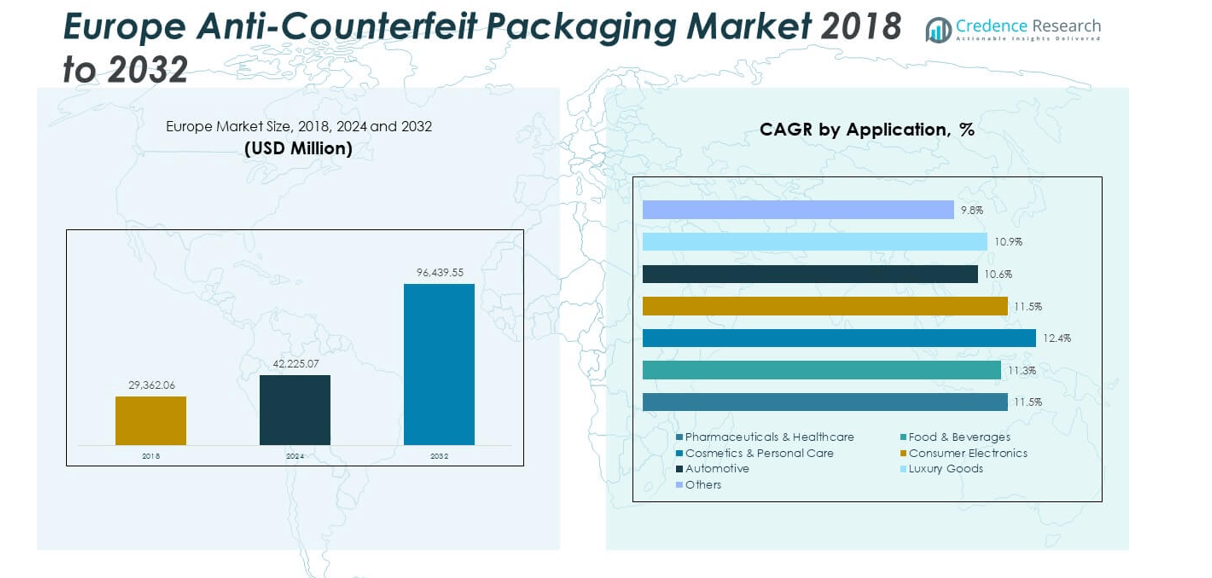

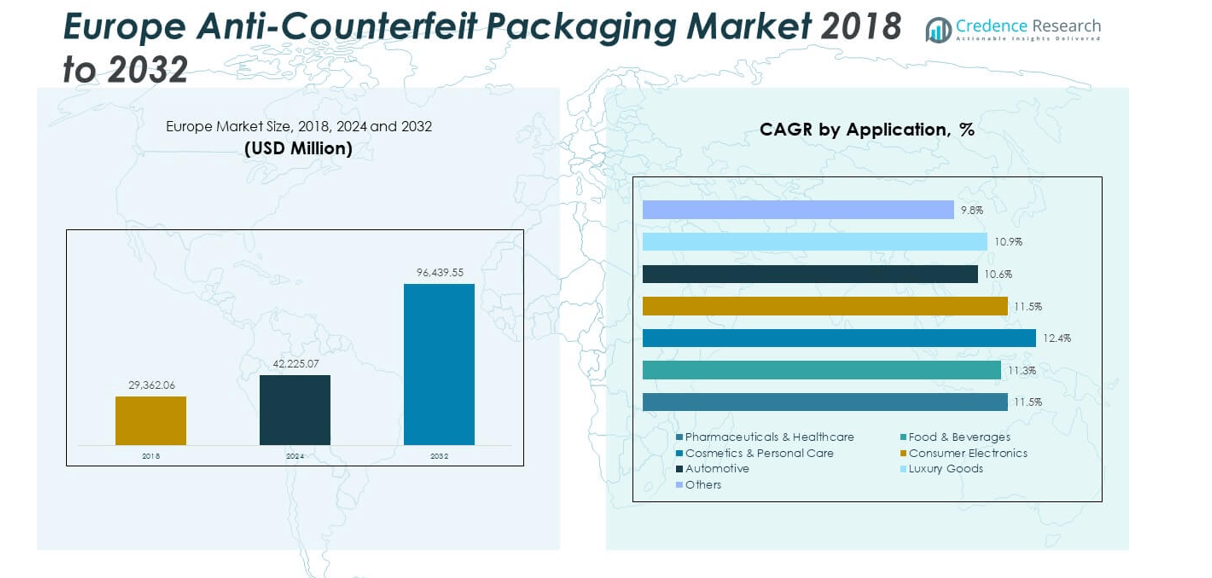

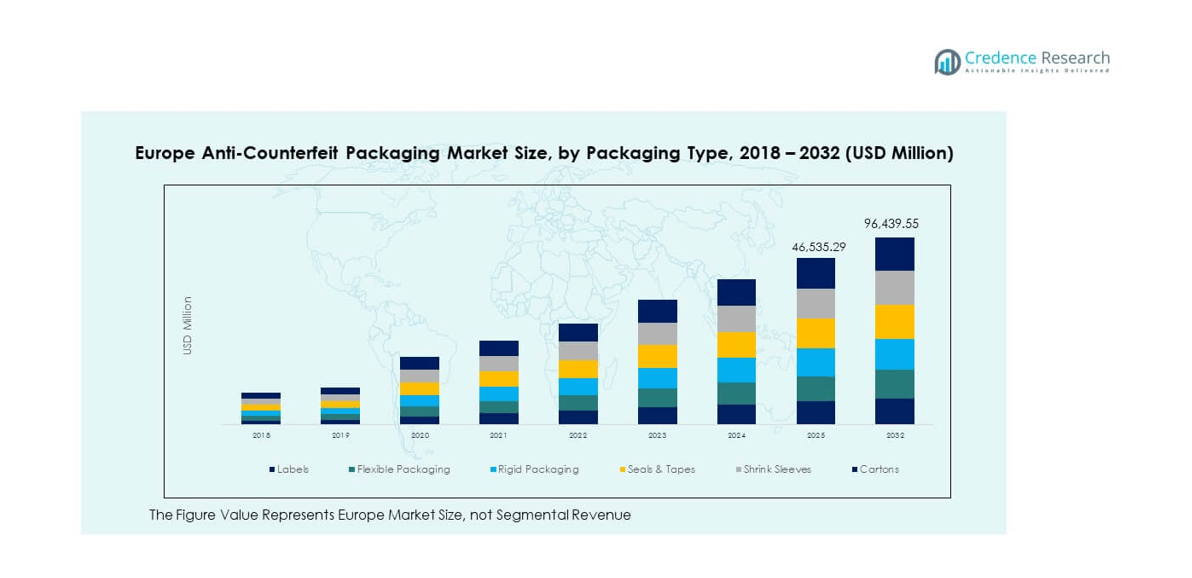

The Europe Anti-Counterfeit Packaging Market size was valued at USD 29,362.06 million in 2018 to USD 42,225.07 million in 2024 and is anticipated to reach USD 96,439.55 million by 2032, at a CAGR of 10.88% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Anti-Counterfeit Packaging Market Size 2024 |

USD 42,225.07 million |

| Europe Anti-Counterfeit Packaging Market, CAGR |

10..88% |

| Europe Anti-Counterfeit Packaging Market Size 2032 |

USD 96,439.55 million |

Growing awareness of counterfeit risks drives steady expansion across healthcare, electronics, FMCG and luxury goods. Companies invest in RFID systems, secure labels, QR-based verification and digital traceability platforms to limit product tampering. Regulators reinforce compliance norms that push industries to upgrade authentication methods. Retailers integrate scanning tools that help validate products at distribution and sale points. Manufacturers redesign packaging structures to support layered security. Strong brand-protection strategies motivate higher adoption of advanced solutions. Consistent concern for safety accelerates deployment across emerging digital channels.

Western Europe leads due to mature supply networks and strict oversight across sensitive product categories. Northern Europe holds steady interest thanks to strong policy focus and high consumer awareness. Southern Europe grows at a moderate pace as retail expansion raises the need for better traceability. Eastern Europe emerges quickly with rising industrial output and stronger trade monitoring systems. Countries with high regulatory maturity adopt sophisticated security platforms, while emerging markets rely more on visible and low-cost solutions. This broad regional mix supports sustained demand across the Europe Anti-Counterfeit Packaging Market.

Market Insights

- The Europe Anti-Counterfeit Packaging Market rose from USD 29,362.06 million in 2018 to 42,225.07 million in 2024 and is projected to reach 96,439.55 million by 2032, progressing at a 10.88% CAGR.

- Western Europe leads with 42% share due to strong regulatory enforcement, advanced supply networks, and higher adoption of secure packaging systems.

- Northern Europe holds 21% share supported by strong policy alignment, mature compliance frameworks, and high consumer awareness across sensitive product categories.

- Eastern Europe represents the fastest-growing area within the 37% combined Southern–Eastern share, driven by rising industrial output, stronger trade oversight, and broader adoption of digital traceability tools.

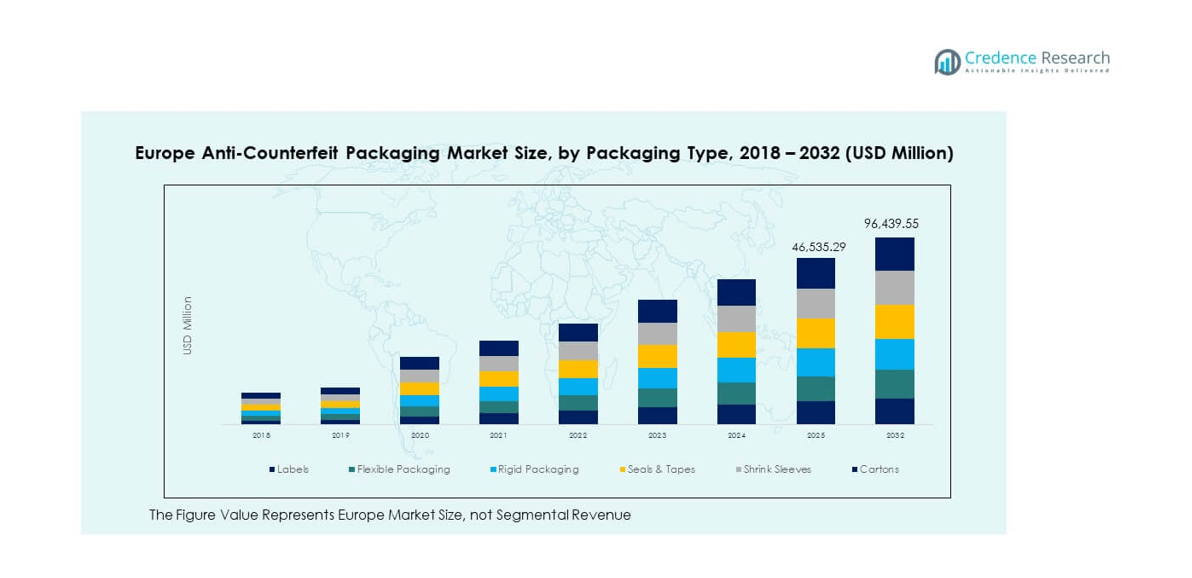

- Labels hold the largest packaging-type share at ~20%, while shrink sleeves follow at ~18%, reflecting their wide use across retail, FMCG, and healthcare authentication needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Enforcement Pressure and Rising Focus On Consumer Safety

The Europe Anti-Counterfeit Packaging Market gains strength through strict enforcement activities across key industries. Regulators push firms to adopt authentication tools that block circulation of unsafe products. Brands react with stronger security layers that help protect supply movement. Packaging leaders expand investments in traceability to keep goods verified across long routes. Buyers show higher concern about fake items that threaten daily safety. Distributors demand secure tracking models that support smooth monitoring. Retail networks adopt digital systems that reduce risks linked to tampered goods. Technology providers enhance security toolkits that allow cleaner verification. The market gains wider acceptance across sensitive segments. Safety priorities continue to shape long-term decisions.

Rising Adoption of Digital Verification Systems Across Consumer and Industrial Goods

The Europe Anti-Counterfeit Packaging Market benefits from quick adoption of digital checks that speed up product validation. Firms deploy serialization and codes to confirm product identity at every stage. Cloud tools help teams track batches with clean transparency across supply chains. Platforms guide inspectors to detect fake entries with faster reaction times. Retailers use scanners to simplify checks on shelves and warehouses. Vendors support data platforms that store verified records for audits. Manufacturers rely on seamless digital workflows that improve internal security habits. Online stores adopt strict verification rules to protect brand value. Counterfeit risks fall when digital layers operate across each product line. The region sees rising demand for smart tracing models.

Growing Need for Brand Protection Across High-Value and Everyday Consumer Goods

The Europe Anti-Counterfeit Packaging Market expands due to strong protection needs across premium and mass-use items. Luxury brands safeguard identity to avoid damage from rising imitation activities. Healthcare firms maintain strict packaging rules to protect patient safety. Electronics makers adopt multi-layer codes to prevent supply interference. FMCG brands roll out simple visual cues that keep buyers confident during purchases. Retail bodies integrate secure labels to confirm authenticity during returns. Logistics partners help manage controlled routes for sensitive goods. Protective packaging supports brand image across physical and digital points. High-value goods remain a top focus for targeted security upgrades.

- For instance, the innovative Needle-Trap Secu label by Schreiner MediPharm, winner of the 2024 World Label Award in the Innovation category, features an integrated needle protection system in the label itself that ensures syringe safety and irreversibility of first-opening indication.

Increasing Investments in Secure Materials and Advanced Printing Techniques

The Europe Anti-Counterfeit Packaging Market grows due to steady investment in stronger materials and high-grade printing. Firms adopt inks with unique identifiers that improve brand defense. Security printers design holograms with features that reduce copying attempts. Packaging makers align with chemical suppliers to create coatings with embedded markers. Teams use micro-patterns that reveal tampering during handling. Users trust physical layers that support long-term protection. Brands select premium substrates that help maintain clear signals over time. Retailers adopt visible cues that guide staff during quick inspections. Investments support long-term deployment of multi-layer protection.

- For instance, Schreiner Group produces optically variable device (OVD) elements and needle protection labels integrating micro-patterns and holographic seals that set new standards in counterfeit resistance and tamper evidence, backed by multiple innovation awards for their sustainable and high-tech packaging solutions.

Market Trends

Expansion of Smart Packaging with Integrated Digital Identities

The Europe Anti-Counterfeit Packaging Market shows strong movement toward smart packaging with embedded digital identities. Firms explore NFC and RFID models that support contactless checks. Retailers deploy smart shelves that read unique signals from secured items. Online platforms use digital access points to verify goods during delivery. Users scan codes to confirm product lineage before purchase. Brands maintain digital passports to track goods from source to customer. Logistics groups connect smart tags to wider traceability networks. Manufacturers link digital identity tools to automated lines. Adoption grows as firms shift toward data-driven authentication.

- For instance, Scantrust partnered with SCREEN Europe in September 2023 to deploy secure QR codes printed by SCREEN’s Truepress L350 label printer; the solution instantly authenticates items via smartphone and includes a patented copy-detection process.

Growth in Eco-Conscious Security Solutions Across Packaging Firms

The Europe Anti-Counterfeit Packaging Market sees rising demand for secure features aligned with sustainability goals. Packaging firms introduce recyclable substrates with built-in markers. Ink suppliers develop eco-safe coatings that maintain strong detection levels. Brands shift to low-footprint protection tools that work with green packaging plans. System integrators design security layers that avoid excess material usage. Retailers support methods that balance safety and environmental claims. Governments promote responsible adoption of safe materials within regulated sectors. Industry groups push for cohesive frameworks that merge security and sustainability. Adoption rises as market players align safety with eco goals.

- For instance, Tageos offers its EOS Zero™ range of plastic-free RFID inlays built on FSC®-certified paper substrates, designed for high sustainability performance. Several EOS Zero™ models are ARC-certified, confirming their compliance with global performance standards for item-level RFID applications. These inlays remove traditional plastic layers while maintaining strong read performance across major retail and logistics systems.

Integration Of AI-Driven Recognition Tools To Improve Verification Accuracy

The Europe Anti-Counterfeit Packaging Market adopts AI-supported systems that refine detection accuracy. Vision tools scan packs for micro-details that flag suspect units. Learning models compare product signatures with large verified databases. Mobile apps use AI cues to help buyers validate goods in real time. Logistic centers deploy automated scanners that filter high-risk entries. Auditors depend on AI-backed reports that highlight weak points in routes. Brands trust machine-driven analysis to manage big volumes of data. Research teams enhance AI models that support complex product categories. Adoption grows with wider digital transformation.

Rising Role Of Track-And-Trace Interoperability Across Supply Networks

The Europe Anti-Counterfeit Packaging Market moves toward strong interoperability between track-and-trace systems. Industry standards support clean data exchange across diverse networks. Logistics partners adopt aligned protocols for verified movement. Brands expand track-and-trace layers that connect across borders. Retailers depend on unified platforms that confirm entries across multiple nodes. Regulators promote frameworks that simplify oversight. Tech vendors develop scalable systems that manage large data flows. Interoperability strengthens security maturity across regions. Adoption grows with rising supply complexity.

Market Challenges Analysis

High Implementation Costs and Integration Barriers for Security Technologies

The Europe Anti-Counterfeit Packaging Market faces hurdles linked to heavy deployment costs across large and small firms. Many brands manage tight budgets that limit investment in complex layers. Integrating digital tools with older systems remains difficult for several manufacturers. Training staff creates extra operational costs across multiple points. Distributors handle added steps that extend handling time. Buyers face learning curves when new authentication tools enter the market. Technology upgrades demand strong capital planning. Firms struggle when supply networks lack unified digital standards. These issues slow adoption across competitive markets.

Limited Awareness Levels And Complex Regulatory Variations Across Subregions

The Europe Anti-Counterfeit Packaging Market experiences challenges linked to uneven awareness levels across subregions. Smaller retailers may lack exposure to advanced verification tools. Buyers in certain areas do not fully understand the risks tied to counterfeit goods. Firms face diverse regulatory models across Western, Northern, Southern, and Eastern Europe. Compliance teams manage unique rules for product categories. Logistics partners navigate varying enforcement intensity across borders. Consumer education remains weaker in specific markets. Teams require region-specific training to align processes. These constraints create gaps in broad-scale adoption.

Market Opportunities

Expansion of Digital Authentication Ecosystems Across Consumer-Focused Sectors

The Europe Anti-Counterfeit Packaging Market opens strong opportunities through digital ecosystems that enhance verification. Brands extend digital tools across e-commerce channels to protect online buyers. Platforms support quick checks through mobile scanning tools. Logistics firms link authentication steps to automated handling lines. Retail outlets deploy digital access points that improve store-level security. Vendors offer cloud services that store verified product histories. Growth emerges from rising trust in connected verification models. Digital ecosystems enable clean tracking and stronger brand protection.

Rising Demand For Multi-Layer Protection Across High-Risk Industries

The Europe Anti-Counterfeit Packaging Market gains opportunities from rising need for multi-layer protection. Healthcare firms demand strong packaging defense for regulated products. Electronics brands require secure labels that maintain signal clarity across supply lines. Luxury firms invest in unique identifiers that reinforce exclusivity. FMCG companies adopt low-cost protection tools that support wide distribution. Transport teams use durable features that avoid tampering during long movements. Makers promote new materials and embedded markers for stronger resilience. Multi-layer systems attract interest from several high-risk categories.

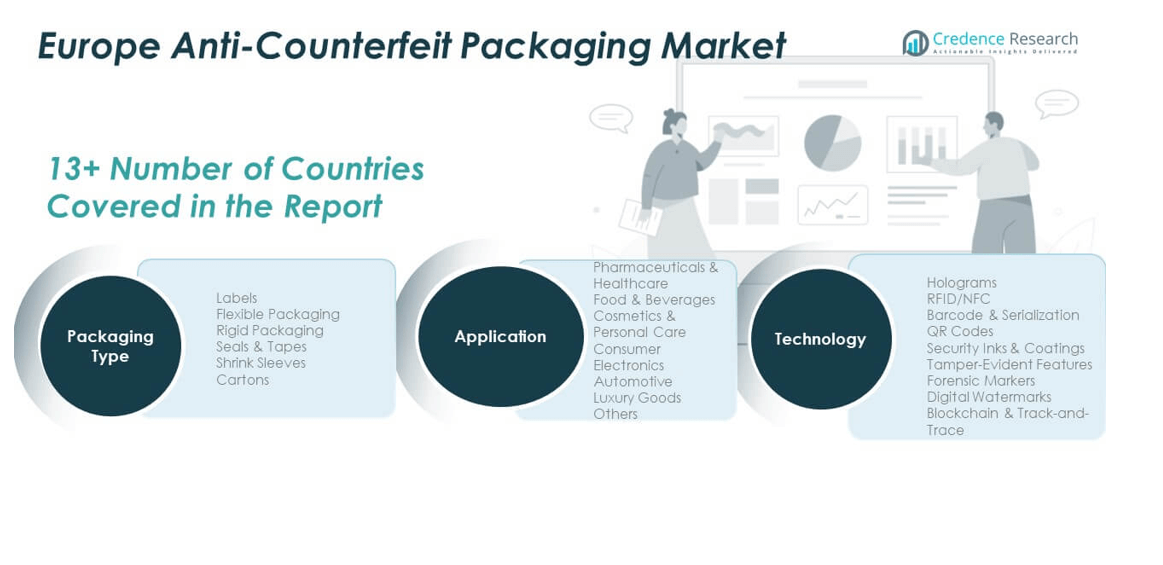

Market Segmentation Analysis

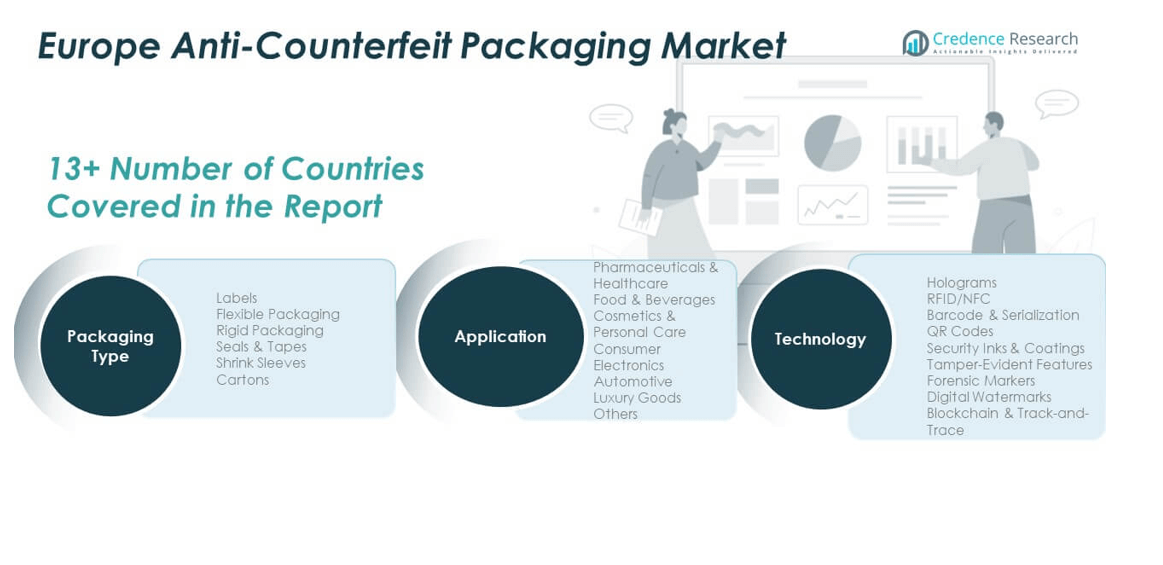

By Packaging Type

The Europe Anti-Counterfeit Packaging Market expands across labels, flexible packaging, rigid packaging, seals and tapes, shrink sleeves, and cartons. Labels dominate due to easy integration and low-cost authentication features. Flexible packaging gains traction due to rising adoption across FMCG and healthcare. Rigid packaging supports long routes due to strong durability. Shrink sleeves offer full-body coverage that increases visual protection. Cartons integrate digital and physical markers with high clarity. Seals and tapes support tamper resistance across retail and logistics points.

- For instance, CCL Label’s security labeling portfolio includes micro-optic features used in brand protection programs worldwide, with shrink-sleeve lines in commercial packaging environments running at several hundred containers per minute. These solutions support high-speed application while maintaining strong visual authentication performance.

By Application

The Europe Anti-Counterfeit Packaging Market covers pharmaceuticals and healthcare, food and beverages, cosmetics and personal care, consumer electronics, automotive, luxury goods, and others. Pharmaceuticals lead due to strict regulations and safety mandates. Food and beverages adopt secure layers to avoid contamination risks. Cosmetics and personal care rely on visible cues to maintain buyer trust. Electronics utilize digital identifiers to reduce gray market entry. Automotive parts integrate track-and-trace layers for clean supply movement. Luxury goods demand unique identifiers that reinforce exclusivity. Other categories adopt mixed tools based on risk levels.

- For instance, Avery Dennison integrates visible and covert security features such as randomized luminescent fibers, security threads, and invisible inks in pharmaceutical labels. Their solutions deliver unique, tamper-proof identifiers on individual medicine units, ensuring brand trust and regulatory compliance.

By Technology

The Europe Anti-Counterfeit Packaging Market features holograms, RFID/NFC, barcode and serialization, QR codes, security inks and coatings, tamper-evident features, forensic markers, and digital watermarks. Holograms remain common due to strong visual cues. RFID and NFC support contactless authentication across retail and logistics. Serialization forms the backbone of regulated tracking. QR codes enable fast consumer checks. Security inks and coatings embed features that deter copying. Tamper-evident tools expose unauthorized access quickly. Forensic markers support high-level investigations. Digital watermarks operate across digital and physical platforms to strengthen hidden security.

Segmentation

By Packaging Type

- Labels

- Flexible Packaging

- Rigid Packaging

- Seals & Tapes

- Shrink Sleeves

- Cartons

By Application

- Pharmaceuticals & Healthcare

- Food & Beverages

- Cosmetics & Personal Care

- Consumer Electronics

- Automotive

- Luxury Goods

- Others

By Technology

- Holograms

- RFID/NFC

- Barcode & Serialization

- QR Codes

- Security Inks & Coatings

- Tamper-Evident Features

- Forensic Markers

- Digital Watermarks

Regional Analysis

Western Europe holds the largest share of the Europe Anti-Counterfeit Packaging Market with nearly 42%, driven by strong regulatory enforcement and mature manufacturing networks. Germany, France, and the UK lead due to high adoption of authentication tools across healthcare, FMCG, and electronics. Brands in this subregion invest heavily in physical and digital security formats that secure product flow. Retailers apply strict verification norms that support traceability across long routes. Technology firms expand advanced printing, RFID, and secure label solutions. Western Europe sets the benchmark for compliance and digital integration across supply chains. The market builds momentum through strong awareness among buyers.

Northern Europe maintains a 21% share supported by a high preference for safe and traceable goods. Nordic countries deploy digital verification and strong serialization frameworks. Brands in this subregion adopt secure materials and tamper-evident features that protect sensitive goods. Retail networks use automated scanning tools that help identify counterfeits with clean accuracy. Governments reinforce strict product safety laws that shape industry decisions. Firms show interest in sustainability-linked secure packaging. The Europe Anti-Counterfeit Packaging Market gains stable demand from strong policy alignment in this area.

Southern and Eastern Europe together account for nearly 37%, with demand rising due to expanding retail networks and industrial activity. Southern Europe shows steady traction across food, beverage, and cosmetics brands that need simple but effective protection. Eastern Europe emerges fast as manufacturing bases adopt secure packaging formats to reduce illegal trade. Subregions improve enforcement practices that reduce circulation of unsafe goods. Local firms expand investments in serialization and visible security layers. Awareness programs improve buyer understanding of product authenticity. The Europe Anti-Counterfeit Packaging Market gains wider reach through consistent adoption across both subregions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SICPA (Switzerland)

- AlpVision (Switzerland)

- Atlantic Zeiser (Germany)

- Giesecke+Devrient (Germany)

- Tageos (France)

- Constantia Flexibles (Austria)

- Scantrust (Switzerland)

- De La Rue (UK)

- Essentra PLC (UK)

- Leonhard Kurz (Germany)

- Tesa Scribos (Germany)

Competitive Analysis

The Europe Anti-Counterfeit Packaging Market features a diverse competitive landscape shaped by strong technology providers, material suppliers, and packaging specialists. Leading companies such as SICPA, AlpVision, De La Rue, and Leonhard Kurz strengthen their presence through secure inks, holograms, and advanced markers. It benefits from rapid innovation in RFID, NFC, and serialization platforms that drive strong adoption across regulated sectors. Firms compete by offering integrated solutions that merge physical and digital protection. Security printers enhance micro-optic features that raise barriers for replication. Cloud-based verification and mobile authentication tools expand the competitive scope among digital service providers. Packaging converters adopt embedded features that support easy identification during distribution. Market participants focus on long-term partnerships with healthcare, electronics, and FMCG brands to secure recurring demand. Research teams invest in forensic markers and covert technologies that improve detection strength. Competitors aim to create scalable designs that function across varied product lines. Regional firms seek expansion across Western and Northern Europe due to strong compliance frameworks. Global leaders target Eastern and Southern Europe to capture new demand from growing industries.

Recent Developments

- In September 2024, kdc/one completed the acquisition of an Italian packaging specialist (S.r.l.) focused on cosmetics packaging to enhance its anti-counterfeit offerings in beauty and personal care.

- In April 2024, Avery Dennison Corporation announced the expansion of its AD Pure range of inlays and tags which are entirely plastic-free and utilize antenna manufacturing technology applied directly on paper.

Report Coverage

The research report offers an in-depth analysis based on packaging type, application, and technology segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for secure packaging will strengthen as industries increase focus on product authenticity and consumer safety.

- Digital verification tools will expand as brands shift toward connected authentication systems across supply chains.

- Growth in AI-supported detection platforms will enhance oversight and improve counterfeit identification accuracy.

- Track-and-trace integration will deepen as firms adopt unified monitoring frameworks for regulated product categories.

- Multi-layer protection systems will gain more interest from sectors that require strong brand integrity controls.

- Sustainable secure packaging solutions will rise as companies balance environmental goals with safety needs.

- Rapid adoption of RFID and NFC technologies will support smoother validation across logistics networks.

- Forensic security features will see higher adoption within high-risk product lines that demand deeper verification.

- Retailers will expand in-store and backend identification systems to strengthen shelf-level protection.

- Eastern Europe will accelerate modernization, adding new demand for digital traceability and secure material upgrades.