Market Overview:

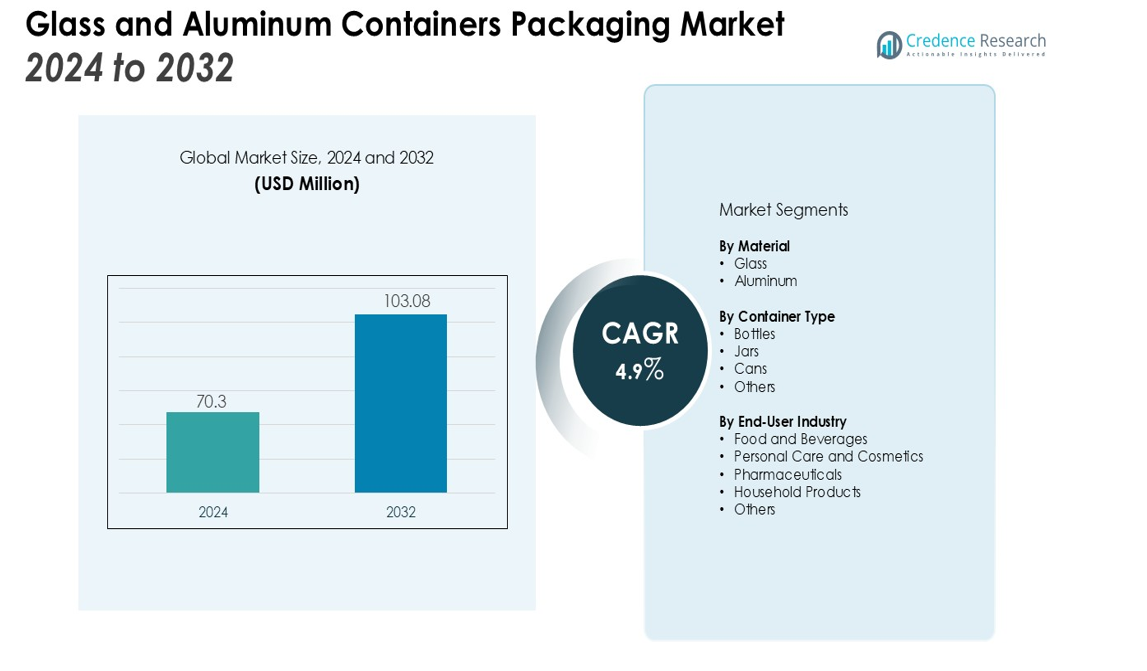

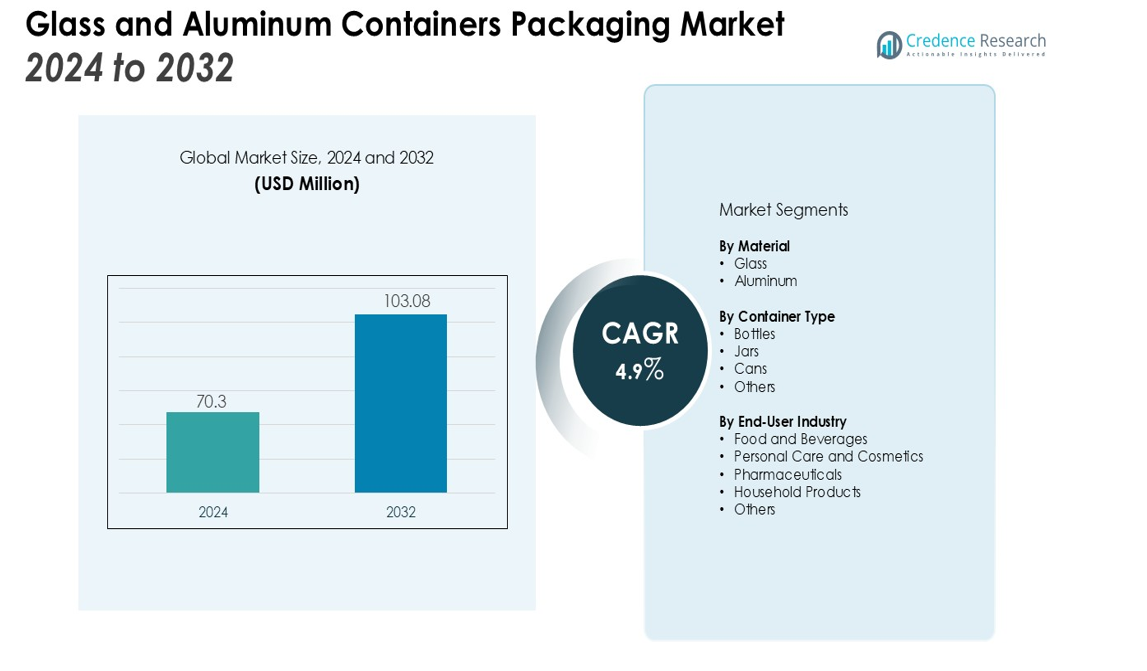

The Glass and Aluminum Containers Packaging Market size was valued at USD 70.3 million in 2024 and is anticipated to reach USD 103.08 million by 2032, at a CAGR of 4.9% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Glass and Aluminum Containers Packaging Market Size 2024 |

USD 70.3 million |

| Glass and Aluminum Containers Packaging Market, CAGR |

4.9% |

| Glass and Aluminum Containers Packaging Market Size 2032 |

USD 103.08 million |

Market expansion is driven by stricter global regulations on plastic packaging, growing consumer preference for eco-friendly alternatives, and advances in lightweight glass and high-recycled-content aluminum. The rise of premium packaging in beverages and personal care, along with innovations in barrier coatings and smart labeling, further supports market development. Increasing brand commitments toward carbon neutrality also encourage large-scale adoption of recyclable containers.

Europe leads the market due to strong sustainability mandates and well-established recycling infrastructure. Asia Pacific is witnessing the fastest growth, supported by rapid industrialization, rising disposable incomes, and government efforts to minimize plastic waste. North America continues to show steady expansion driven by modernization in packaging production, greater focus on circular economy goals, and corporate initiatives to reduce single-use plastics.

Market Insights:

- The Glass and Aluminum Containers Packaging Market was valued at USD 70.3 million in 2024 and is projected to reach USD 103.08 million by 2032, driven by sustainability-focused innovations and consumer preference for recyclable materials.

- Strict environmental regulations and global bans on single-use plastics are accelerating the shift toward glass and aluminum packaging, strengthening their demand across food, beverage, and personal care industries.

- Continuous advancements in lightweight design, high-strength materials, and smart labeling improve production efficiency, enhance product preservation, and reduce overall material use.

- Growing demand for premium packaging solutions in cosmetics, beverages, and health products boosts adoption due to the visual appeal, durability, and safety of glass and aluminum containers.

- High energy consumption and fluctuating raw material costs remain key challenges, pushing manufacturers to adopt renewable energy and energy-efficient production methods.

- Europe leads the global market with a 34% share, supported by robust recycling infrastructure and strong policy frameworks, while Asia Pacific follows with 30%, driven by industrial growth and sustainability initiatives.

- North America maintains a 27% share, focusing on advanced recycling systems, smart packaging adoption, and corporate sustainability commitments that enhance market resilience and technological progress.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Sustainable and Recyclable Packaging Solutions

The Glass and Aluminum Containers Packaging Market is driven by the global shift toward sustainable materials. Consumers and industries increasingly favor packaging that reduces environmental impact and supports circular economy principles. Glass and aluminum are fully recyclable and retain their quality after multiple recycling cycles, making them preferred over single-use plastics. Governments and organizations promoting plastic reduction policies continue to strengthen demand for these materials. This trend positions glass and aluminum containers as key enablers of long-term sustainability goals.

- For instance, Penrhos Spirits demonstrated a commitment to sustainable packaging by replacing its 750-gram glass bottle with an 80-gram version made from recycled aluminum.

Stringent Environmental Regulations and Plastic Reduction Policies

Stringent global regulations on plastic usage encourage industries to transition to eco-friendly alternatives. Packaging producers are investing in recyclable materials to comply with policies targeting carbon emissions and landfill waste reduction. The Glass and Aluminum Containers Packaging Market benefits from bans on single-use plastics across Europe, North America, and parts of Asia. These initiatives drive manufacturers to enhance recyclable content and optimize production efficiency. It strengthens market growth by aligning packaging materials with international sustainability standards.

- For instance, Unilever addressed plastic reduction goals with its Dove Body Wash Reusable Bottle, which uses concentrated refills that are 4 times more potent than the standard body wash, thereby reducing the volume of shipped materials.

Technological Advancements in Container Design and Production

Technological progress in container design enhances durability, weight reduction, and cost efficiency. The Glass and Aluminum Containers Packaging Market witnesses innovations such as lightweight glass bottles and high-strength aluminum cans that lower material use while maintaining safety. Modern barrier coatings improve product preservation, reducing spoilage across beverages, pharmaceuticals, and cosmetics. Automated forming and digital printing technologies streamline production, improving customization and brand visibility. It enables manufacturers to meet growing demand for premium and sustainable packaging.

Growing Consumer Preference for Premium and Safe Packaging

Consumers are increasingly conscious of packaging quality, safety, and aesthetics. The Glass and Aluminum Containers Packaging Market benefits from rising demand for premium packaging in beverages, personal care, and food sectors. Glass and aluminum offer superior protection from contamination and UV exposure, enhancing product shelf life. Their visual appeal and premium finish elevate brand perception, driving adoption in luxury product categories. It strengthens the position of glass and aluminum packaging as symbols of safety, quality, and sustainability.

Market Trends:

Integration of Smart and Digital Packaging Technologies

The Glass and Aluminum Containers Packaging Market is evolving through the integration of smart and digital technologies that enhance functionality and consumer engagement. Brands are adopting QR codes, NFC tags, and embedded sensors to provide product authenticity, recycling information, and traceability. It helps companies strengthen transparency and improve post-purchase experiences while supporting sustainability tracking. Smart labeling also assists logistics providers in monitoring temperature-sensitive goods such as pharmaceuticals and beverages. The growing demand for interactive packaging aligns with consumer expectations for connected and informative product experiences. Companies investing in digital packaging solutions achieve higher brand differentiation and operational efficiency. It reflects a broader industry transition toward intelligent and technology-driven packaging ecosystems.

- For instance, during August 2024, Diageo enabled visitors at its Johnnie Walker location in Edinburgh to co-create a personalized, batch-size-of-one label for whisky bottles using generative AI, with the unique design being printed in just minutes.

Emphasis on Lightweight Materials and Circular Manufacturing Practices

Manufacturers are prioritizing lightweight glass and aluminum innovations to reduce material use and carbon emissions. The Glass and Aluminum Containers Packaging Market benefits from advanced production processes such as thin-wall glass molding and alloy optimization in aluminum cans. These innovations maintain structural integrity while lowering transportation costs and improving recyclability rates. It supports global sustainability goals by promoting reduced energy consumption and waste generation. Circular manufacturing models are gaining traction, where recycled content becomes the primary raw material for new containers. Brands are partnering with recycling facilities to create closed-loop systems that ensure material reuse at scale. It demonstrates the market’s commitment to resource efficiency and environmental responsibility while meeting consumer and regulatory expectations.

- Market Challenges Analysis:

High Production Costs and Energy-Intensive Manufacturing Processes

The Glass and Aluminum Containers Packaging Market faces cost challenges due to energy-intensive production processes. Melting glass and refining aluminum require significant heat and electricity, increasing operational expenses for manufacturers. It impacts profit margins, especially during periods of volatile energy prices. The cost of raw materials, including silica and bauxite, further contributes to pricing pressures. Smaller producers find it difficult to compete with large firms that benefit from economies of scale. Investments in renewable energy sources and efficiency upgrades help mitigate some costs but demand high initial capital. It remains a critical challenge for maintaining competitive pricing in the global market.

Supply Chain Limitations and Recycling Infrastructure Gaps

Supply chain inefficiencies and recycling system limitations hinder the full potential of sustainable packaging. The Glass and Aluminum Containers Packaging Market depends on consistent collection and processing of recyclable materials. It often faces disruptions in material recovery due to poor waste segregation and inadequate logistics. Emerging economies struggle to establish robust recycling networks, slowing circular production goals. Transportation of heavy glass containers also increases emissions and costs. Fluctuating scrap metal availability can delay production schedules and affect supply reliability. It requires coordinated policy support and infrastructure development to strengthen recycling and distribution efficiency.

Market Opportunities:

Expansion in Sustainable Packaging and Circular Economy Initiatives

The Glass and Aluminum Containers Packaging Market presents strong opportunities through sustainability-driven innovations and circular economy programs. Global brands are prioritizing reusable, recyclable, and refillable container models to reduce waste generation. It encourages partnerships between manufacturers and recycling organizations to increase material recovery rates. Growing consumer awareness of eco-friendly packaging supports demand for low-carbon and high-recycled-content products. Governments are providing incentives and stricter regulations that favor recyclable materials over plastics. This shift creates long-term opportunities for companies investing in advanced recycling infrastructure and green manufacturing. It enables stronger brand positioning in environmentally conscious markets.

Rising Adoption in Emerging Markets and Premium Product Segments

Emerging economies in Asia, Latin America, and the Middle East offer new growth avenues due to expanding urbanization and lifestyle changes. The Glass and Aluminum Containers Packaging Market benefits from increasing demand for premium beverages, cosmetics, and health supplements. It aligns with rising consumer preference for aesthetically appealing and safe packaging formats. Growth in e-commerce also expands opportunities for durable and lightweight container solutions. Companies are launching localized production facilities to meet regional sustainability mandates and cost efficiency targets. The growing middle-class population supports higher consumption of packaged goods and sustainable packaging formats. It provides strong potential for manufacturers to expand global market reach and revenue.

Market Segmentation Analysis:

By Material

The Glass and Aluminum Containers Packaging Market is segmented into glass and aluminum. Glass leads the market due to its chemical stability, aesthetic appeal, and ability to be recycled endlessly without losing quality. It remains the preferred choice for beverages, cosmetics, and pharmaceutical applications requiring product integrity. Aluminum shows significant growth driven by its lightweight strength, corrosion resistance, and high recyclability. It attracts global manufacturers seeking to reduce transportation costs and carbon emissions while supporting sustainability targets.

- For instance, O-I Glass advanced the sustainability of its core material by recycling more than 400 metric tons of glass through its U.S. community programs in 2025, which was used to create new containers.

By Container Type

The market is categorized into bottles, jars, cans, and others. Bottles hold the dominant share, supported by strong demand in beverages, fragrances, and healthcare packaging. Cans are expanding quickly due to their convenience, durability, and protection against contamination. It benefits from innovations in barrier coatings and smart labeling that improve shelf life and traceability. Manufacturers focus on design flexibility and enhanced product security to meet consumer expectations.

By End-User Industry

The market serves food and beverages, personal care, pharmaceuticals, and household goods. The food and beverage sector leads, driven by high consumption of recyclable containers and eco-conscious brand strategies. Personal care and pharmaceutical industries also show solid growth through the adoption of premium and safe packaging formats. It highlights a broader industry movement toward sustainable, high-quality packaging that enhances both brand value and consumer trust.

- For instance, to improve circularity for the food and beverage industry, O-I Glass expanded its glass collection infrastructure to support 21 community recycling programs in the U.S. as of 2025.

Segmentations:

By Material

By Container Type

By End-User Industry

- Food and Beverages

- Personal Care and Cosmetics

- Pharmaceuticals

- Household Products

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Europe’s Leadership in Sustainable Packaging and Recycling Infrastructure

Europe held a 34% share of the Glass and Aluminum Containers Packaging Market in 2024, leading globally due to strong regulatory frameworks and recycling capacity. The region benefits from EU packaging waste directives and producer responsibility mandates that promote high recycling rates. It leverages well-developed collection systems and consumer participation in sustainability programs. Manufacturers in Germany, France, and Italy focus on lightweight glass and high-recycled-content aluminum innovations. Demand for premium beverages, cosmetics, and pharmaceuticals strengthens market growth. It highlights Europe’s continued leadership in advancing circular economy practices.

Asia Pacific’s Rapid Industrialization and Expanding Consumer Base

Asia Pacific accounted for 30% of the Glass and Aluminum Containers Packaging Market in 2024, emerging as the fastest-growing regional segment. It experiences strong momentum driven by industrial expansion, rising disposable incomes, and urbanization. Government initiatives in China, India, and Japan support plastic reduction and promote sustainable packaging production. The region invests heavily in advanced manufacturing and recycling infrastructure to meet global sustainability standards. Growth in food, beverage, and personal care sectors fuels large-scale adoption of recyclable containers. It positions Asia Pacific as a dominant production hub for sustainable packaging solutions.

North America’s Steady Growth Supported by Technological Innovation

North America captured a 27% share of the Glass and Aluminum Containers Packaging Market in 2024, maintaining stable progress through technology-led sustainability initiatives. The region benefits from advanced recycling technologies and strong corporate commitments to environmental compliance. It emphasizes smart packaging integration and closed-loop recycling systems for improved material efficiency. Manufacturers in the United States and Canada focus on eco-friendly container production using renewable energy sources. Expanding beverage and food industries drive steady product demand. It reinforces North America’s position as a technologically advanced and sustainability-driven packaging market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Ardagh Group S.A.

- Owens-Illinois, Inc.

- Amcor plc

- Ball Corporation

- Crown Holdings, Inc.

- Verallia Group

- Gerresheimer AG

- Vidrala S.A.

- Stolzle Glass Group

- Toyo Seikan Group Holdings, Ltd.

- Consol Glass (Pty) Ltd.

- Hindustan National Glass & Industries Ltd.

Competitive Analysis:

The Glass and Aluminum Containers Packaging Market is highly competitive, characterized by global players investing in sustainable production and product innovation. Companies such as Ardagh Group, Owens-Illinois, Amcor, Ball Corporation, and Crown Holdings focus on expanding manufacturing capacity and adopting energy-efficient technologies. It emphasizes lightweight designs and recycled content to meet environmental standards and consumer demand for eco-friendly solutions. Firms like Verallia, Gerresheimer, and Vidrala enhance competitiveness through product customization, premium finishes, and digital printing integration. Regional producers, including Stolzle Glass Group and Hindustan National Glass, strengthen their presence through partnerships and supply chain optimization. It reflects a strong focus on balancing performance, aesthetics, and sustainability to secure long-term market positioning.

Recent Developments:

- In September 2025, Ardagh Glass Packaging-North America expanded its portfolio by adding new 12oz Heritage glass beer bottles.

- In July 2025, O-I Glass announced the discontinuation of its MAGMA glass manufacturing technology development and operations.

Report Coverage:

The research report offers an in-depth analysis based on Material, Container Type, End-User Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Glass and Aluminum Containers Packaging Market will continue advancing through sustainability-led innovations and recyclable material adoption.

- Manufacturers will increase investments in energy-efficient production technologies to lower carbon emissions and operational costs.

- Demand for lightweight containers will rise, supporting reduced transportation impact and improved resource efficiency.

- Smart and digital packaging integration will expand, enabling traceability, authenticity verification, and consumer engagement.

- Collaboration between brands and recycling companies will strengthen circular economy models and material recovery systems.

- Growth in premium beverages, cosmetics, and pharmaceuticals will drive higher usage of glass and aluminum packaging.

- Governments will reinforce environmental regulations, creating new opportunities for recyclable and low-waste packaging solutions.

- Advanced coating and finishing technologies will improve durability, product protection, and shelf appeal.

- Expanding e-commerce channels will boost demand for sturdy, tamper-resistant, and sustainable packaging formats.

- The market will experience increased regional manufacturing localization to reduce logistics costs and enhance supply chain resilience.