Market Overview

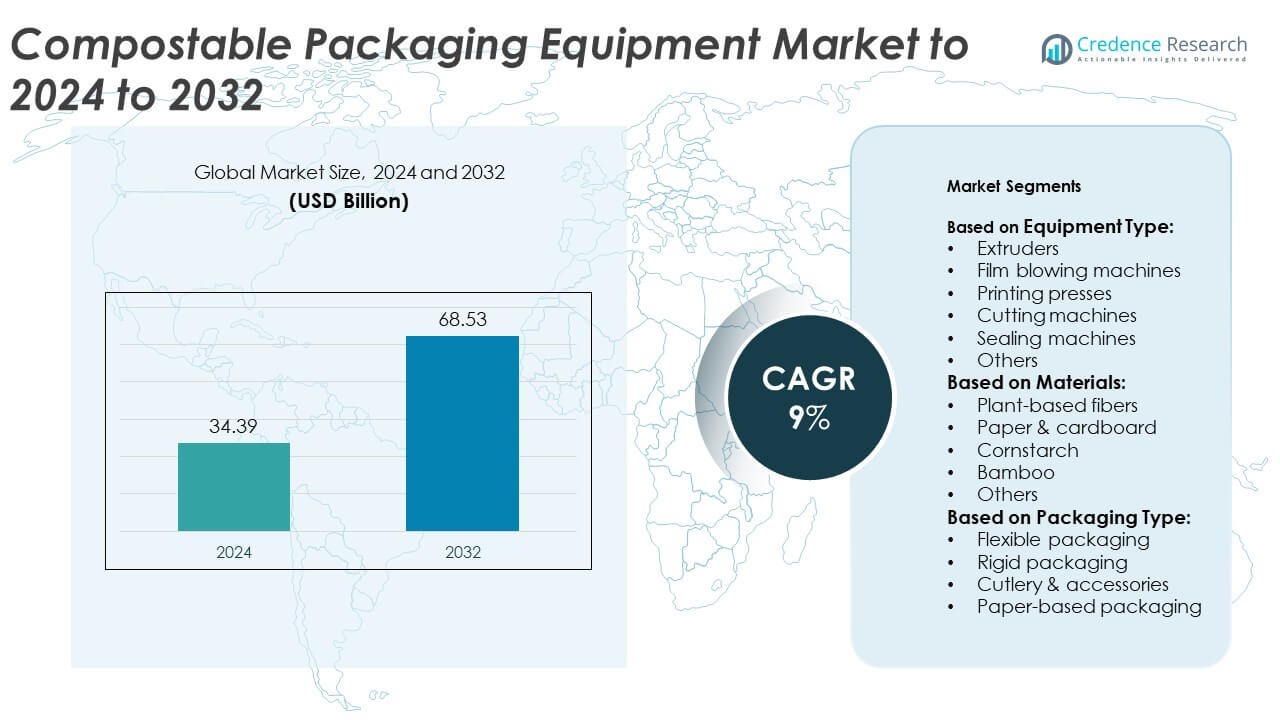

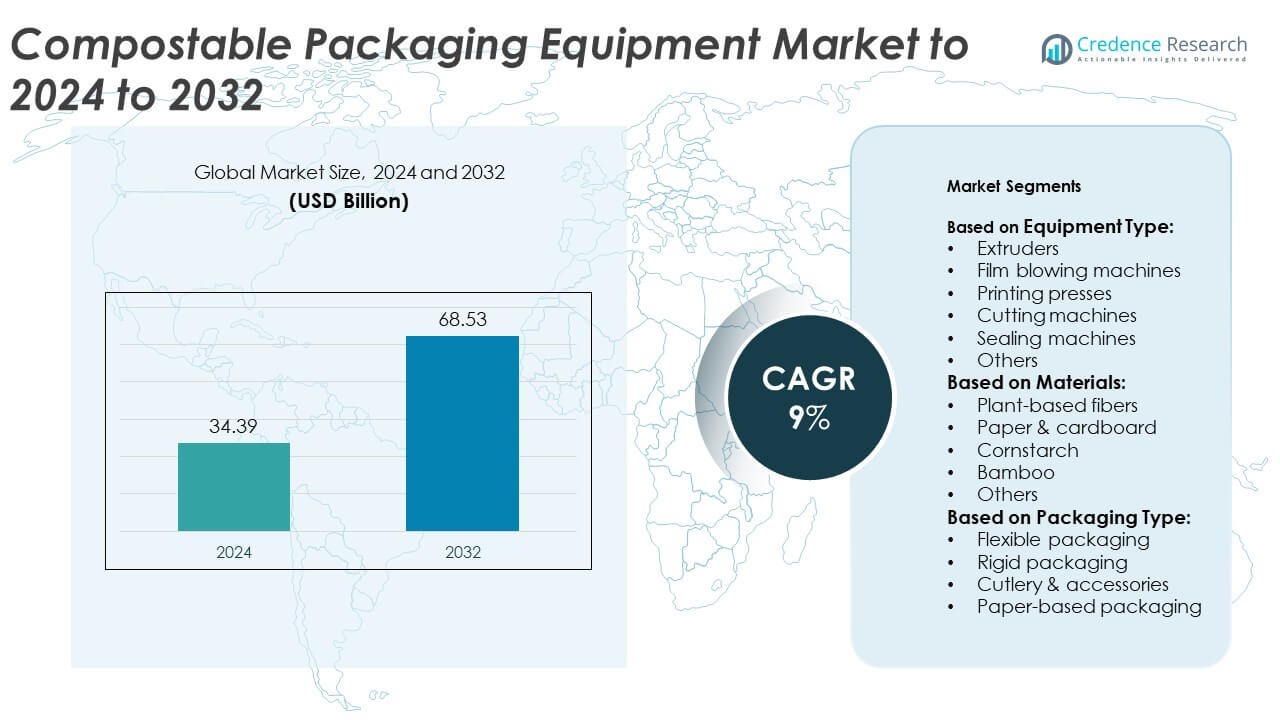

Compostable Packaging Equipment Market size was valued at USD 34.39 billion in 2024 and is anticipated to reach USD 68.53 billion by 2032, at a CAGR of 9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Compostable Packaging Equipment Market Size 2024 |

USD 34.39 Billion |

| Compostable Packaging Equipment Market, CAGR |

9% |

| Compostable Packaging Equipment Market Size 2032 |

USD 68.53 Billion |

The Compostable Packaging Equipment Market is led by major players such as Smurfit Kappa, BASF, Amcor, Tetra Pak, Mondi, Berry Global, Corbion, and Braskem. These companies dominate through strong R&D capabilities, expansion of biopolymer-compatible machinery, and strategic partnerships focused on sustainable manufacturing. They invest in advanced extrusion, sealing, and printing technologies to meet global demand for eco-friendly packaging. North America held the leading regional position in 2024 with a 34% share, driven by stringent environmental regulations, strong industrial infrastructure, and early adoption of compostable packaging technologies across food, retail, and e-commerce sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Compostable Packaging Equipment Market was valued at USD 34.39 billion in 2024 and is projected to reach USD 68.53 billion by 2032, growing at a CAGR of 9%.

- Rising environmental awareness and strict government bans on single-use plastics are driving strong demand for compostable packaging solutions globally.

- Automation and biopolymer-compatible machinery are key trends, enabling efficient production of eco-friendly packaging for food, retail, and e-commerce sectors.

- The market is moderately competitive, with leading players focusing on advanced extrusion and sealing technologies to gain a technological edge.

- North America led the market with a 34% share in 2024, followed by Europe at 30% and Asia-Pacific at 26%, while the extruders segment dominated with nearly 32% share across the global equipment landscape.

Market Segmentation Analysis:

By Equipment Type

Extruders dominated the Compostable Packaging Equipment Market in 2024, accounting for around 32% of the total share. Their leadership stems from high versatility in processing biodegradable polymers and producing films, sheets, and molded products. Extruders enable consistent material flow and improved energy efficiency, making them vital for compostable packaging production. The growing demand for bioplastic-based films in food and beverage applications further boosts this segment. Film blowing machines and sealing machines also show strong growth as industries shift toward sustainable, automated packaging lines to replace conventional plastics.

- For instance, Windmöller & Hölscher’s VAREX II blown-film line is designed for outputs up to 1,500 kg/h, supporting compostable film runs on industrial lines.

By Materials

Plant-based fibers held the dominant share of approximately 38% in 2024. Their biodegradability, strength, and compatibility with large-scale manufacturing processes make them the preferred choice across packaging producers. Materials such as sugarcane bagasse, hemp, and jute are widely adopted for trays, containers, and wrapping applications. Rising bans on single-use plastics and corporate sustainability commitments drive the adoption of plant-based fibers. Paper and cardboard follow closely, supported by established recycling infrastructure and growing use in retail and e-commerce packaging.

- For instance, Stora Enso doubled formed-fiber capacity at Hylte; the site rose from 50 million to ~115 million units/year after the expansion.

By Packaging Type

Flexible packaging led the market in 2024, capturing nearly 41% of the total share. Its dominance is driven by lightweight design, lower material usage, and adaptability for food, cosmetic, and pharmaceutical packaging. Compostable flexible films are replacing conventional polyethylene pouches due to high sealing strength and moisture resistance. Increased consumer preference for sustainable single-serve packs and easy disposability enhances segment growth. Rigid packaging and cutlery & accessories are also expanding, supported by demand in quick-service restaurants and takeaway food sectors focused on eco-friendly solutions.

Key Growth Drivers

Rising Demand for Sustainable Packaging Solutions

The increasing awareness of environmental sustainability is a key growth driver for the compostable packaging equipment market. Governments and corporations are moving away from single-use plastics, boosting investments in eco-friendly materials and production systems. Consumers prefer compostable alternatives that reduce landfill waste and carbon footprint. This shift compels packaging manufacturers to adopt extrusion, sealing, and molding machines designed for biodegradable materials, driving strong equipment demand globally.

- For instance, Amcor reported 90% of its FY23 portfolio was designed to be recycled, reusable, or compostable, aligning with brand sustainability targets.

Regulatory Support and Ban on Plastic Packaging

Government regulations restricting non-biodegradable plastics accelerate market adoption. Policies in the EU, North America, and Asia-Pacific promote compostable packaging manufacturing through subsidies and tax incentives. For example, the European Green Deal encourages bio-based alternatives and circular packaging systems. These supportive frameworks increase equipment installations among producers, ensuring compliance with waste reduction mandates. Manufacturers benefit from clear policy direction that enables scaling of compostable packaging production capacities.

- For instance, Stora Enso and Tetra Pak backed a Polish beverage-carton line with 50,000 t/year fiber-recycling capacity, supporting circular-packaging compliance.

Advancements in Biopolymer Processing Technologies

Ongoing technological progress in biopolymer processing remains a strong driver. Equipment manufacturers are developing machines compatible with plant-based fibers, PLA, and PHA materials. Enhanced temperature control and extrusion precision improve the quality and performance of compostable films and containers. Automation and digital monitoring reduce waste and boost productivity, making eco-friendly packaging more cost-competitive with traditional plastics. This technological edge fosters large-scale production of sustainable packaging solutions.

Key Trends & Opportunities

Integration of Smart and Automated Production Lines

Automation is a key trend transforming the compostable packaging equipment market. Smart extruders and sealing systems enable real-time process control, predictive maintenance, and energy efficiency. Manufacturers integrating IoT-based automation achieve consistent material output and reduced downtime. These innovations not only enhance productivity but also support compliance with environmental standards. The trend positions automated systems as critical to scaling global compostable packaging operations efficiently.

- For instance, Ishida’s integrated Inspira system achieves ~200 bags/min on snacks, showing how high-speed sealing.

Expansion of Foodservice and E-commerce Applications

Growing adoption of compostable packaging across foodservice and online retail offers major opportunities. Quick-service restaurants, catering providers, and e-commerce brands increasingly use compostable films, trays, and wrappers to meet sustainability targets. Equipment demand surges as producers need scalable, high-speed machinery for flexible and rigid packaging. Rising disposable incomes and consumer preference for eco-labeled packaging accelerate equipment investments, especially in North America and Europe.

- For instance, Huhtamaki notes the fiber in its paper cups can be recycled up to 7 times, supporting high-turnover foodservice demand with circular inputs.

Key Challenges

High Initial Investment and Operational Costs

High equipment setup costs remain a primary challenge for small and medium manufacturers. Machines designed for compostable materials often require specialized components and higher maintenance compared to traditional plastic packaging systems. These costs delay adoption in developing markets where budget constraints persist. Limited financing options and lack of technical expertise further restrict market entry for smaller firms, slowing large-scale equipment deployment.

Material Performance and Supply Constraints

Variability in biopolymer performance and limited raw material availability challenge consistent production. Compostable materials such as PLA or bamboo fibers require precise temperature control during processing, increasing operational complexity. Seasonal fluctuations in plant-based raw material supply affect pricing and machine utilization rates. Ensuring stable quality across diverse bio-based inputs remains a key concern for manufacturers aiming for high throughput and uniform packaging standards.

Regional Analysis

North America

North America dominated the compostable packaging equipment market in 2024 with a 34% share. The region’s leadership stems from strong regulatory support for sustainable packaging and the early adoption of biodegradable materials. The U.S. drives most demand, supported by corporate sustainability initiatives and rising consumer preference for compostable food packaging. Equipment manufacturers are investing in automated extrusion and sealing systems to meet the expanding production of compostable films and trays. Continuous innovation in biopolymer processing technologies and increased investment in eco-friendly packaging production facilities strengthen regional growth.

Europe

Europe held around 30% of the global compostable packaging equipment market in 2024. The European Green Deal and extended producer responsibility policies accelerate the shift toward compostable packaging production. Countries such as Germany, France, and the Netherlands lead due to strong enforcement of plastic waste directives and investment in biodegradable packaging technologies. Equipment upgrades for extruders and film blowing machines are increasing among packaging producers. Sustainable manufacturing incentives and a mature recycling infrastructure further enhance Europe’s position as a key regional hub for compostable packaging equipment.

Asia-Pacific

Asia-Pacific accounted for nearly 26% of the market share in 2024, driven by rapid industrialization and growing environmental awareness. China, Japan, and India are expanding domestic production capacities for compostable packaging materials and equipment. Government initiatives promoting plastic waste reduction encourage investments in extrusion and sealing machinery compatible with biodegradable materials. Rising food delivery and retail packaging demand contribute to equipment adoption across the region. The growing presence of international equipment manufacturers and local partnerships is improving access to affordable compostable packaging technologies.

Latin America

Latin America captured about 6% of the compostable packaging equipment market in 2024. The region is witnessing gradual adoption, led by Brazil and Mexico, where sustainability programs are gaining traction. Food and beverage industries are key adopters of compostable materials to meet regional environmental standards. Manufacturers are investing in film blowing and sealing equipment for flexible packaging applications. Although limited infrastructure and higher costs hinder large-scale expansion, increasing export-oriented production and rising eco-conscious consumer behavior are expected to support long-term market growth.

Middle East & Africa

The Middle East & Africa region held a 4% share of the global market in 2024. The growth remains modest but is strengthening with increasing investment in sustainable packaging production facilities. South Africa and the United Arab Emirates are leading regional markets, driven by retail and foodservice sectors transitioning to eco-friendly packaging. Rising awareness of plastic waste reduction and import substitution policies are encouraging local manufacturing of compostable packaging machinery. However, high import dependency and limited technical expertise continue to restrict market scalability across several nations.

Market Segmentations:

By Equipment Type:

- Extruders

- Film blowing machines

- Printing presses

- Cutting machines

- Sealing machines

- Others

By Materials:

- Plant-based fibers

- Paper & cardboard

- Cornstarch

- Bamboo

- Others

By Packaging Type:

- Flexible packaging

- Rigid packaging

- Cutlery & accessories

- Paper-based packaging

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The compostable packaging equipment market is shaped by leading companies such as Smurfit Kappa, BASF, Amcor, Tetra Pak, Mondi, Berry Global, Corbion, Braskem, Ball, WestRock, BioBag, EcoEnclose, Biome Bioplastics, Placon, TIPA, and International Paper. These players are focusing on expanding their production capacities, developing biopolymer-compatible machinery, and integrating advanced automation technologies to enhance efficiency. The market is witnessing increased collaboration between material innovators and equipment manufacturers to improve product quality and scalability. Strategic mergers, partnerships, and R&D investments are enabling faster commercialization of new compostable packaging solutions. Companies are prioritizing regional expansion to meet the growing demand from food, beverage, and retail sectors. Continuous focus on reducing carbon emissions, improving recycling compatibility, and complying with environmental regulations remains a key competitive factor. Innovation in smart extrusion, sealing, and cutting technologies continues to define market leadership and strengthen global sustainability initiatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, TIPA collaborated with Fresh-Lock to create a home-compostable, resealable pouch for True.ApS’s True Dates product line.

- In 2025, BASF announced a partnership with an AI startup to use machine learning to create new blends of bioplastics, aiming to reduce R&D time for compostable packaging films by 20%.

- In 2025, Braskem is highlighting its bio-based polyethylene materials, which are used to produce sustainable packaging options, At K 2025.

Report Coverage

The research report offers an in-depth analysis based on Equipment Type, Material, Packaging Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth due to rising demand for sustainable packaging solutions.

- Advancements in biopolymer processing will enhance machine efficiency and material compatibility.

- Automation and digital monitoring will become standard in compostable packaging equipment operations.

- Manufacturers will invest more in localized production facilities to reduce dependency on imports.

- Government bans on single-use plastics will continue driving adoption across multiple industries.

- Equipment customization for diverse biodegradable materials will increase production flexibility.

- Foodservice and e-commerce sectors will remain major consumers of compostable packaging.

- Partnerships between material developers and machinery manufacturers will accelerate innovation.

- High initial investment costs will gradually decline as production scales up globally.

- Asia-Pacific will emerge as the fastest-growing regional market due to rapid industrialization and policy support.