Market Overview

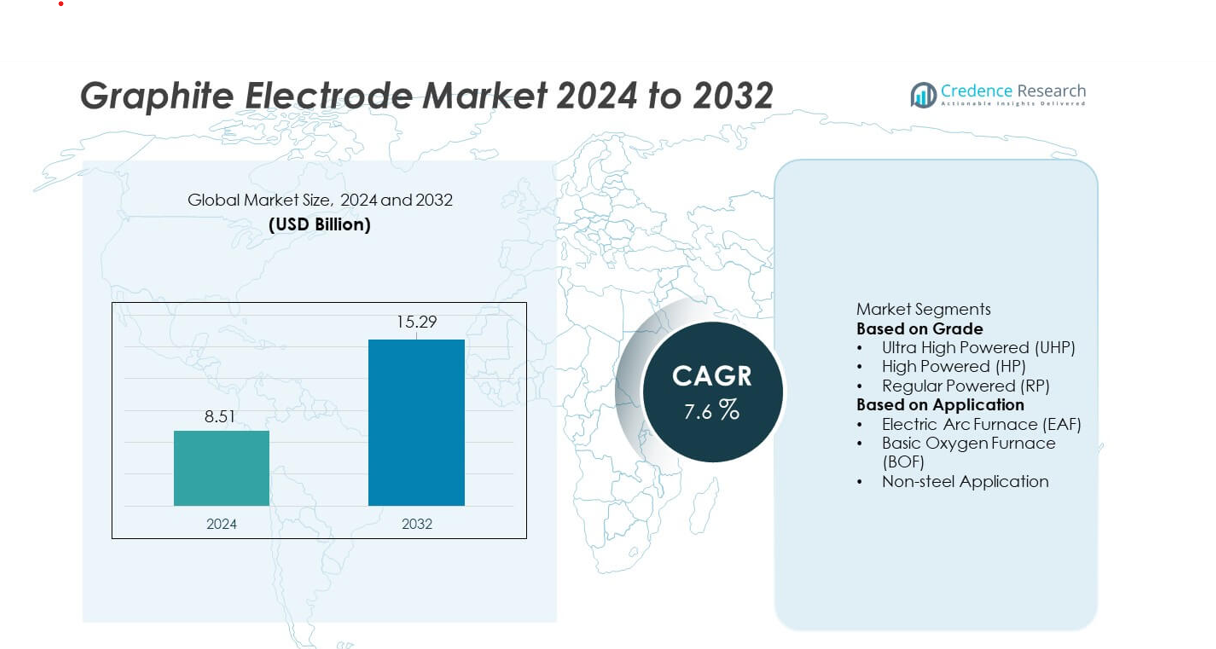

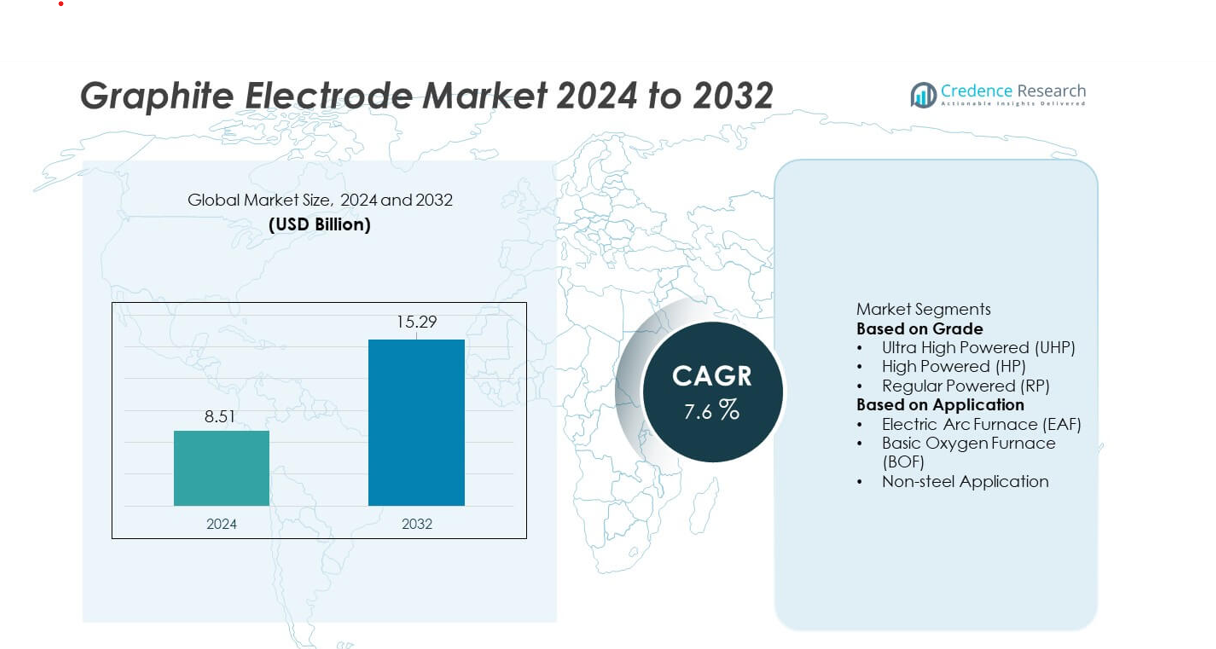

The Graphite Electrode market reached USD 8.51 billion in 2024 and is projected to grow to USD 15.29 billion by 2032, registering a CAGR of 7.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Graphite Electrode Market Size 2024 |

USD 8.51 billion |

| Graphite Electrode Market, CAGR |

7.6% |

| Graphite Electrode Market Size 2032 |

USD 15.29 billion |

The Graphite Electrode market is driven by key players such as GrafTech International Ltd., Showa Denko K.K. (Resonac Holdings Corporation), HEG Ltd., Tokai Carbon Co., Ltd., SEC Carbon, Ltd., SGL Carbon SE, Nippon Carbon Co., Ltd., Fangda Carbon New Material Co., Ltd., Jilin Carbon Co., Ltd., and AmeriCarbon Products LLC, all of which focus on producing high-performance UHP and HP electrodes to support the growing shift toward electric arc furnace steelmaking. These companies enhance production efficiency through improved needle coke sourcing, advanced graphitization technologies, and large-scale manufacturing capabilities. Asia Pacific leads the market with a 41% share, driven by expanding steel capacity, followed by North America at 28%, supported by strong EAF adoption, while Europe holds 22%, reflecting its focus on green steel and recycling-based production.

Market Insights

- The Graphite Electrode market reached USD 8.51 billion in 2024 and will grow at a CAGR of 7.6% through 2032, driven by rising demand from electric arc furnace steelmaking.

- Growing EAF adoption and increasing scrap-based steel production boost market growth, with Ultra High Powered (UHP) electrodes holding a 58% share due to their superior performance in high-temperature operations.

- Advancements in electrode durability, improved graphitization processes, and innovations in oxidation control shape major trends as manufacturers enhance efficiency for large steel mills.

- Key players such as GrafTech, Showa Denko, HEG, and Tokai Carbon increase competition through expanded capacity and improved needle coke sourcing, while raw material price volatility remains a major restraint.

- Regionally, Asia Pacific leads with a 41% share, followed by North America at 28% and Europe at 22%, supported by expanding EAF installations, strong steel recycling activity, and growing investment in green steel technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Grade

Ultra High Powered (UHP) electrodes dominate the Graphite Electrode market with a 58% share, driven by their essential role in high-temperature electric arc furnace operations used for melting scrap steel. UHP electrodes offer superior thermal resistance, higher electrical conductivity, and improved durability, making them the preferred choice for large-scale steel producers aiming for faster melting cycles and higher productivity. High Powered (HP) electrodes maintain steady demand across medium-capacity EAF plants, while Regular Powered (RP) electrodes remain relevant for non-ferrous and smaller foundry applications. Growing global steel recycling and rising adoption of EAF routes support strong UHP consumption worldwide.

- For instance, GrafTech International operates a production line designed for UHP electrodes rated up to 800 mm diameter and supports furnace currents above 90,000 amperes.

By Application

Electric Arc Furnace (EAF) applications hold a 71% share, supported by the rapid shift toward scrap-based steelmaking and increasing global EAF capacity. EAF facilities rely heavily on graphite electrodes for efficient melting, high energy transfer, and reduced operational downtime. Basic Oxygen Furnaces (BOF) use fewer electrodes but show limited growth due to the global trend favoring cleaner, energy-efficient steel production. Non-steel applications—such as silicon metal, ferroalloys, and smelting operations—contribute steady demand as industrialization expands in Asia and Latin America. Rising environmental regulations and growing steel recycling reinforce the dominance of EAF applications in the global market.

- For instance, Tokai Carbon supplies electrodes for large EAF units that operate at power inputs above 150 megavolt-amperes and consume electrode columns of 600–800 mm diameter.

Key Growth Drivers

Rising Adoption of Electric Arc Furnaces (EAF) in Steelmaking

Global steel manufacturers increasingly shift toward EAF-based production due to lower emissions, energy efficiency, and strong support for recycled steel. This transition boosts demand for graphite electrodes, which are essential for high-temperature melting processes. Growing steel scrap availability and stricter environmental regulations further accelerate EAF installations in Asia, Europe, and North America. UHP and HP electrodes benefit most as large mills upgrade furnace capacity. As countries promote green steel initiatives, EAF-based production continues to expand, strengthening long-term demand for graphite electrodes.

- For instance, ArcelorMittal’s EAF unit in the United States operates a furnace with an annual scrap melting capacity of 1.5 million tons.

Growing Demand for Ultra High Power (UHP) Electrodes

UHP electrodes gain strong traction as modern EAFs require high-performance materials capable of handling extreme temperatures and electrical loads. Their superior durability, low consumption rates, and high conductivity make them the preferred choice among major steel manufacturers. Rising investments in high-capacity furnaces in China, India, and the Middle East further fuel uptake. Technological improvements in needle coke sourcing and electrode manufacturing enhance product efficiency. As steelmakers push for faster melting cycles and productivity gains, UHP electrodes continue to dominate market growth.

- For instance, HEG Ltd. manufactures UHP electrodes up to 800 mm diameter and reported electrode output exceeding 80,000 metric tons from its Mandideep plant.

Expansion of Non-Steel Metallurgical Applications

Graphite electrodes see rising usage beyond steelmaking in sectors such as silicon metal, ferroalloys, phosphorus, and titanium dioxide production. Rapid industrial growth in developing economies increases demand for smelting and refining processes that rely heavily on graphite electrodes. Expansion of solar-grade silicon and specialty alloy manufacturing also boosts consumption. These non-steel applications offer steady demand even during steel market fluctuations, supporting market stability. Growing electrification of industrial processes further enhances the relevance of graphite electrodes across multiple metallurgical industries.

Key Trends & Opportunities

Rising Investments in Green Steel and Recycling Technologies

Countries accelerate efforts to decarbonize steelmaking, creating strong opportunities for EAF growth and graphite electrode adoption. Recycling-focused steel plants rely heavily on electrodes for efficient scrap melting and reduced emissions. Manufacturers invest in low-emission electrode production, energy-efficient furnaces, and improved quality control. Needle coke alternatives and synthetic graphite innovations also gain attention as companies aim to lower carbon footprints. This shift positions graphite electrodes as a critical component of sustainable steel production.

- For instance, SGL Carbon has implemented advanced process optimization in its specialty graphite production, focusing on energy-efficient equipment and process improvements to continuously reduce global energy consumption and lower CO2 emissions.

Technological Advancements in Electrode Manufacturing

Continuous improvements in electrode machining, baking, and graphitization processes enhance product durability and performance. Manufacturers adopt advanced quality-control systems and automated production lines to reduce impurities and increase conductivity. Innovations in ultra-high-density electrodes reduce consumption rates per ton of steel, appealing to cost-sensitive steel mills. Growing focus on high-temperature resistance and oxidation control creates opportunities for next-generation electrodes. These advancements support higher furnace productivity and longer electrode life.

- For instance, Tokai Carbon utilizes technology for heat treatment during the manufacturing process where temperatures can reach as high as 3,000 degrees Celsius.

Key Challenges

Volatility in Needle Coke Supply and Pricing

Graphite electrode manufacturing depends heavily on needle coke, a petroleum-derived raw material with supply fluctuations tied to oil refining and battery demand. Rapid growth in lithium-ion battery production intensifies competition, driving up needle coke prices. Supply constraints directly increase electrode costs and reduce producer margins. Steelmakers face higher operational expenses, which may slow procurement cycles. This volatility remains a major challenge for long-term stability in the electrode supply chain.

Environmental and Energy-Intensive Production Processes

Electrode manufacturing involves high-temperature graphitization, significant energy consumption, and emissions, creating regulatory challenges for producers. Stricter environmental requirements in Europe, China, and North America increase compliance costs and compel investment in cleaner technologies. Smaller manufacturers struggle to upgrade facilities, reducing market competitiveness. Energy price fluctuations also impact production economics. These challenges require continuous innovation and sustainable manufacturing practices to ensure industry resilience.

Regional Analysis

North America

North America holds a 28% share of the Graphite Electrode market, driven by strong adoption of electric arc furnace (EAF) steelmaking and growing demand for high-quality UHP electrodes. The United States leads regional consumption due to its expanding scrap-based steel production and increasing emphasis on low-carbon steel. Investments in furnace modernization and recycling infrastructure further support electrode demand. The region benefits from established electrode manufacturers and advanced technological capabilities. Rising industrial production and continued shift toward sustainable steel processes reinforce North America’s stable market position.

Europe

Europe accounts for a 22% share, supported by rapid expansion of green steel initiatives and strong regulatory pressure to reduce carbon emissions. Countries such as Germany, Italy, and France increasingly adopt EAF technology, boosting demand for UHP and HP graphite electrodes. The region’s well-developed steel recycling ecosystem strengthens long-term consumption. Investments in renewable energy and low-emission metal processing enhance electrode usage across metallurgical industries. Although energy price fluctuations pose challenges, Europe’s focus on sustainability continues to drive steady market growth.

Asia Pacific

Asia Pacific dominates the market with a 41% share, fueled by large-scale steel production and rapid industrialization across China, India, Japan, and South Korea. China remains the leading consumer due to its expanding EAF installations and significant presence of electrode manufacturers. Growing infrastructure development and rising demand for ferroalloys, silicon metal, and specialty steel strengthen regional growth. Government initiatives promoting cleaner steelmaking accelerate EAF adoption, increasing UHP electrode consumption. Asia Pacific’s robust manufacturing base ensures strong long-term market expansion.

Latin America

Latin America holds a 6% share, driven by rising steel production in Brazil and Mexico and growing demand for EAF-based steelmaking. Investments in infrastructure, construction, and automotive sectors increase electrode consumption. Regional steel producers gradually shift toward scrap-based furnaces to reduce operating costs, supporting the uptake of UHP and HP electrodes. Although economic fluctuations influence short-term demand, expanding industrial activities and modernization of steel plants contribute to steady market growth. Increased interest in ferroalloy production further supports consumption.

Middle East & Africa

The Middle East & Africa region accounts for a 3% share, supported by expanding steel capacity in Gulf countries and rising EAF installations in Turkey, Saudi Arabia, and the UAE. Infrastructure development and industrial diversification boost demand for graphite electrodes, especially UHP variants. Africa shows gradual growth as nations invest in new steel mills and metal processing facilities. Challenges such as limited manufacturing presence and fluctuating raw material availability persist, but increasing regional investments and modernization efforts support long-term market potential.

Market Segmentations:

By Grade

- Ultra High Powered (UHP)

- High Powered (HP)

- Regular Powered (RP)

By Application

- Electric Arc Furnace (EAF)

- Basic Oxygen Furnace (BOF)

- Non-steel Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape features leading companies such as GrafTech International Ltd., Showa Denko K.K. (Resonac Holdings Corporation), HEG Ltd., Tokai Carbon Co., Ltd., SEC Carbon, Ltd., SGL Carbon SE, Nippon Carbon Co., Ltd., Fangda Carbon New Material Co., Ltd., Jilin Carbon Co., Ltd., and AmeriCarbon Products LLC, all of which play a major role in shaping the Graphite Electrode market. These manufacturers focus on enhancing electrode performance through advancements in ultra-high-power (UHP) and high-power (HP) grades to meet the demands of modern electric arc furnaces. Companies invest heavily in securing high-quality needle coke supply, improving graphitization processes, and expanding production capacity to address rising global steel recycling trends. Strategic partnerships with steel producers strengthen long-term demand stability. Continuous R&D supports reduced electrode consumption, improved oxidation resistance, and enhanced thermal stability. As EAF steelmaking expands worldwide, competition intensifies around product efficiency, cost optimization, and environmental compliance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GrafTech International Ltd.

- Showa Denko K.K. (Resonac Holdings Corporation)

- HEG Ltd.

- Tokai Carbon Co., Ltd.

- SEC Carbon, Ltd.

- SGL Carbon SE

- Nippon Carbon Co., Ltd.

- Fangda Carbon New Material Co., Ltd.

- Jilin Carbon Co., Ltd.

- AmeriCarbon Products LLC

Recent Developments

- In July 2025, GrafTech International Ltd. published its second-quarter 2025 results confirming its large ultra-high power (UHP) graphite electrode manufacturing capacity.

- In June 2025, GrafTech International Ltd. published its 2024 Sustainability Report, emphasising its commitment to sustainable steel-making supply chains.

- In 2025, HEG Ltd. announced plans to add 15,000 tonnes per annum (TPA) to its graphite electrode and related products capacity.

Report Coverage

The research report offers an in-depth analysis based on Grade, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for graphite electrodes will rise as EAF steelmaking continues to expand globally.

- Ultra High Powered electrodes will gain stronger adoption due to higher furnace capacities.

- Manufacturers will invest in advanced graphitization technologies to improve product durability.

- Needle coke supply optimization will remain a strategic priority for electrode producers.

- Green steel initiatives will accelerate electrode consumption in recycling-based steel plants.

- Non-steel applications such as silicon metal and ferroalloys will contribute to stable demand.

- Regional production capacity will expand to reduce dependence on imported electrodes.

- Technological innovation will focus on reducing electrode consumption per ton of steel.

- Environmental regulations will push producers to adopt cleaner and energy-efficient manufacturing processes.

- Strategic partnerships between steelmakers and electrode manufacturers will strengthen long-term supply security.