| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Special Graphite Market Size 2024 |

USD 1,299.62 million |

| Special Graphite Market, CAGR |

5.29% |

| Special Graphite Market Size 2032 |

USD 2,022.47 million |

Market Overview

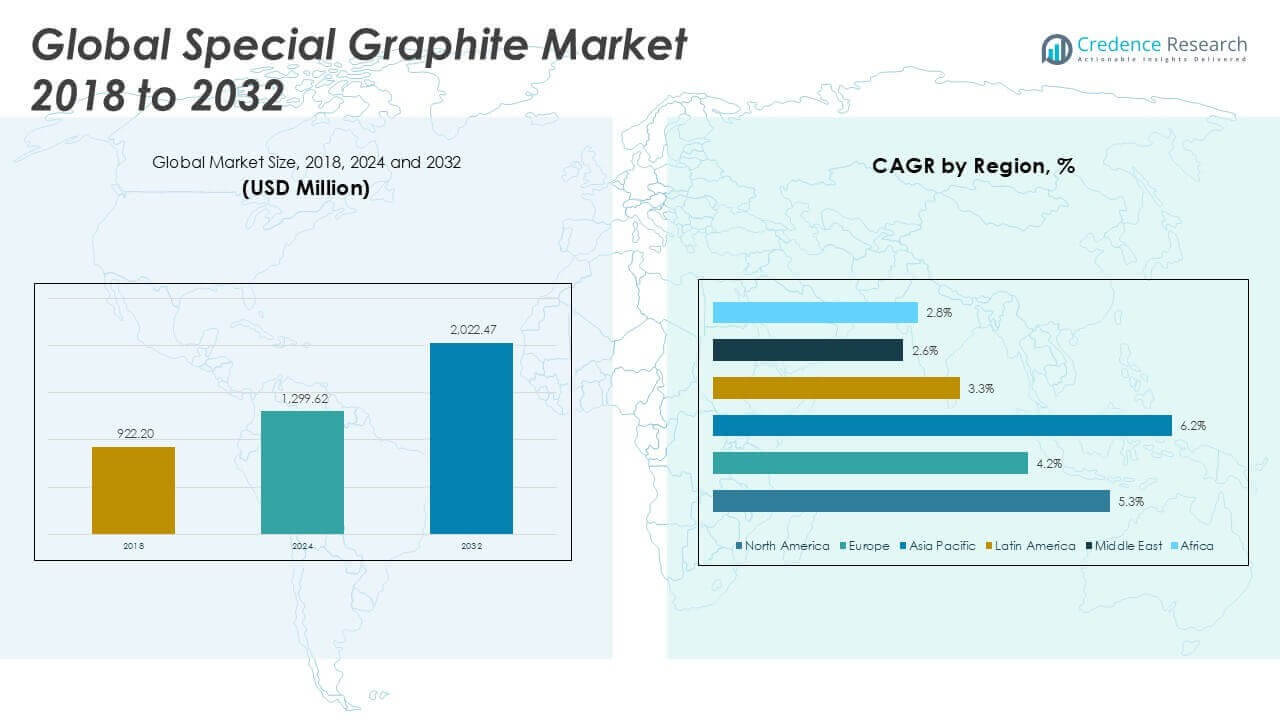

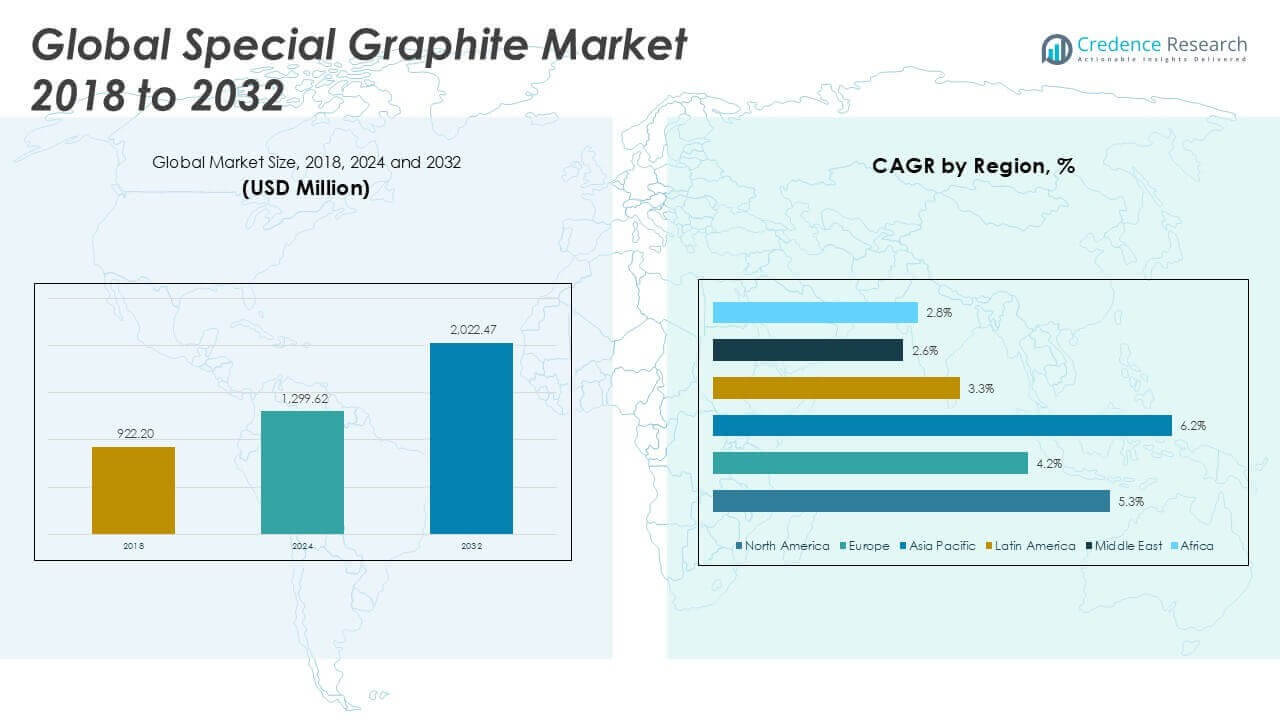

Special Graphite Market size was valued at USD 922.20 million in 2018 to USD 1,299.62 million in 2024 and is anticipated to reach USD 2,022.47 million by 2032, at a CAGR of 5.29% during the forecast period.

The Special Graphite market is experiencing robust growth driven by increasing demand from industries such as electronics, metallurgy, energy, and automotive. The rising adoption of electric vehicles and renewable energy technologies has accelerated the need for high-performance graphite components in batteries and fuel cells. Advancements in semiconductor manufacturing and the expansion of solar photovoltaic installations are also fueling market expansion. Manufacturers benefit from graphite’s superior thermal stability, electrical conductivity, and resistance to chemicals, making it essential for high-tech applications. Ongoing trends include the development of ultra-high purity graphite for next-generation electronics, growing investments in research and development, and the integration of automation in production processes to ensure consistent quality. The market is further bolstered by the global shift toward energy efficiency and sustainability, prompting companies to focus on environmentally friendly production methods and recycling. These factors collectively position special graphite as a critical material in emerging and established industries alike.

The Special Graphite Market demonstrates strong growth across major regions, with Asia Pacific leading expansion due to robust manufacturing activity in China, Japan, and South Korea, while North America and Europe maintain steady demand driven by advancements in electronics, energy storage, and industrial applications. Latin America, the Middle East, and Africa are emerging as growth areas as investments in infrastructure and technology adoption increase. The market benefits from ongoing innovation and rising applications in electric vehicles, semiconductors, and photovoltaics. Leading companies such as SGL Carbon, Tokai Carbon Co., Ltd., and Mersen SA play pivotal roles by offering high-quality graphite products and expanding their global reach through strategic partnerships and technological advancements. These key players focus on research, tailored solutions, and sustainability initiatives to strengthen their positions and capture new opportunities within the rapidly evolving landscape of special graphite applications.

Market Insights

- The Special Graphite Market was valued at USD 922.20 million in 2018, reached USD 1,299.62 million in 2024, and is projected to hit USD 2,022.47 million by 2032 at a CAGR of 5.29%.

- The market is witnessing robust growth due to increasing demand from electronics, energy storage, and automotive sectors, where special graphite’s superior thermal and electrical properties are essential for innovation.

- Trends highlight rising integration of special graphite in high-performance battery technologies for electric vehicles and renewable energy storage, as well as the emergence of ultra-high purity grades for advanced electronics and semiconductors.

- Key players such as SGL Carbon, Tokai Carbon Co., Ltd., and Mersen SA are focusing on technological advancements, global expansion, and sustainable manufacturing practices to secure competitive advantage.

- The market faces restraints from raw material price volatility, supply chain disruptions, and high capital investment requirements for advanced processing and quality control.

- Regionally, Asia Pacific leads market growth due to strong manufacturing activity in China, Japan, and South Korea, while North America and Europe continue to advance through innovation in electronics and renewable energy sectors.

- The market benefits from steady adoption in emerging regions such as Latin America, the Middle East, and Africa, where infrastructure development and technology investments drive incremental demand for special graphite applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Expanding Applications in Electronics and Semiconductors Fuel Market Growth

Rising adoption of advanced electronics and semiconductor devices is propelling the Special Graphite Market forward. Miniaturization of consumer electronics, increasing use of high-performance computing, and rapid growth in smartphone production require reliable thermal and electrical conductivity. Special graphite, with its superior properties, serves as a key material for heat sinks, substrates, and other crucial components in this sector. It plays a vital role in supporting the ongoing innovation in microelectronics manufacturing. The growing complexity and integration of electronic systems elevate demand for high-purity and consistent-quality graphite materials. Market participants continue to invest in refining product specifications to address these evolving technological requirements. This focus on electronics ensures a steady expansion path for the industry.

- For instance, special graphite is widely used in semiconductor manufacturing, including silicon wafer production and LED chip fabrication, due to its superior thermal and electrical conductivity.

Surge in Demand from Energy Storage and Electric Vehicle Sectors

Energy storage technologies and electric vehicles are driving strong momentum in the Special Graphite Market. The global shift toward electric mobility and renewable energy sources increases the need for advanced battery solutions, particularly lithium-ion batteries. Special graphite functions as a crucial anode material, offering high conductivity, stability, and efficiency. The expansion of EV infrastructure and growing preference for sustainable transportation directly translate to heightened graphite consumption. Manufacturers focus on optimizing graphite grades to enhance battery performance and lifespan. Research and partnerships targeting improved electrochemical properties ensure the market remains closely aligned with the future of energy storage. The continued rise of clean energy initiatives supports positive long-term prospects.

- For instance, lithium-ion battery manufacturers rely on special graphite as a key anode material, ensuring high conductivity and stability in energy storage applications.

Growth in Metallurgy and High-Temperature Industrial Processes

Industrial sectors such as metallurgy and foundry operations rely heavily on special graphite due to its resistance to high temperatures and chemical corrosion. The steel industry, non-ferrous metal production, and glass manufacturing utilize graphite for components including electrodes, crucibles, and molds. It provides reliability and longevity in harsh environments where alternative materials fail. Technological advancements in metal processing and the push for greater operational efficiency elevate the relevance of graphite-based solutions. Companies invest in custom-engineered graphite to meet strict process requirements and quality standards. The integration of automation in manufacturing workflows further enhances productivity and quality consistency. Metallurgical applications remain a key pillar of market demand.

Sustainability Initiatives and Regulatory Compliance Shape Market Direction

Environmental sustainability and regulatory compliance are shaping the strategic direction of the Special Graphite Market. Companies face increasing pressure to reduce emissions, conserve resources, and implement environmentally friendly production methods. Focus on recycling and reclaiming graphite from used batteries and industrial products is strengthening, driven by both policy requirements and cost efficiency goals. Firms prioritize investment in cleaner technologies, circular economy initiatives, and supply chain transparency. The adoption of international standards for quality and environmental management reinforces market credibility. Regulatory support for green energy projects and responsible material sourcing continues to open new opportunities. Sustainability-driven innovation positions the industry for resilient and responsible growth.

Market Trends

Integration of Special Graphite in High-Performance Battery Technologies

A significant trend in the Special Graphite Market centers on the integration of advanced graphite materials in battery manufacturing, particularly for electric vehicles and renewable energy storage systems. It meets the demand for high conductivity, long lifecycle, and efficiency, positioning itself as the preferred material for anode components in lithium-ion batteries. Battery manufacturers increasingly partner with graphite producers to develop specialized grades tailored to performance needs. Innovation focuses on improving energy density and charging capabilities, supporting the transition to sustainable energy solutions. These partnerships accelerate product development and commercial adoption, helping the market capture new opportunities. Growth in battery applications sustains robust market expansion.

- For instance, China accounted for around 95% of the world’s graphite anode supply for batteries in 2024, highlighting the material’s critical role in energy storage.

Emergence of Ultra-High Purity Graphite for Electronics and Semiconductors

Rising requirements for purity and consistency in electronic components drive a strong trend toward ultra-high purity graphite within the Special Graphite Market. It serves critical functions in semiconductors, LEDs, and advanced microelectronic systems, enabling precise performance and reliability. Manufacturers invest in purification technologies and process optimization to deliver materials that meet stringent industry standards. Collaborations with technology firms support the ongoing evolution of electronic products. Product differentiation relies on purity levels and tailored solutions for specialized applications. The market witnesses continuous advancements in both quality control and application scope.

- For instance, companies are developing synthetic analogs to natural graphite to address uniformity and purity challenges in semiconductor applications.

Shift Toward Sustainable and Circular Production Models

The Special Graphite Market embraces sustainability by transitioning toward circular production models and responsible sourcing practices. It reflects growing awareness of resource efficiency, carbon footprint reduction, and regulatory compliance across the value chain. Companies deploy recycling methods to reclaim graphite from used batteries and manufacturing waste, promoting resource conservation. Investments in cleaner production processes and renewable energy integration gain traction among leading players. Supply chain transparency and traceability become central considerations for stakeholders. These initiatives help the market align with evolving environmental expectations.

Automation and Digitalization in Graphite Manufacturing Processes

Automation and digitalization trends reshape production and quality control in the Special Graphite Market. It drives improvements in manufacturing efficiency, consistency, and scalability by implementing smart factories and data-driven process management. Companies adopt advanced monitoring systems, robotics, and real-time analytics to ensure precision and reduce operational risks. Digital transformation supports rapid adaptation to shifting customer requirements and market dynamics. Process automation also enhances sustainability by minimizing waste and energy consumption. The market benefits from greater flexibility and competitiveness through these technological advancements.

Market Challenges Analysis

Volatility in Raw Material Supply and Price Fluctuations Impact Market Stability

The Special Graphite Market faces persistent challenges from volatile raw material supply and fluctuating input prices. It relies on consistent availability of high-quality graphite ore, yet geopolitical tensions, mining restrictions, and limited reserves often disrupt the supply chain. These factors lead to unpredictable cost structures for manufacturers, affecting profitability and long-term planning. Price fluctuations in energy and logistics further complicate production economics, pushing companies to seek alternative sourcing strategies or vertical integration. Supply instability can delay project timelines and constrain the ability to meet growing market demand. The industry must focus on risk management and strategic resource partnerships to navigate these ongoing disruptions.

- For instance, geopolitical tensions and export restrictions on graphite from major suppliers like China have led to supply chain disruptions, affecting global availability.

Technological Complexity and Stringent Quality Requirements Constrain Growth

Increasing technological complexity and strict quality standards present significant challenges in the Special Graphite Market. It serves applications where precision, purity, and performance are critical, leaving little margin for error. Manufacturers must invest heavily in advanced processing technologies and quality assurance systems to comply with the rigorous requirements of end-use industries. High capital expenditure, lengthy development cycles, and evolving customer expectations elevate barriers to entry and limit flexibility. Any deviation in quality can result in costly recalls or lost business, reinforcing the need for continuous innovation and process improvement. These demands create a challenging environment for new and existing market participants alike.

Market Opportunities

Expansion in Electric Vehicles and Energy Storage Systems Creates New Growth Prospects

The Special Graphite Market stands to benefit significantly from rising investment in electric vehicles and advanced energy storage systems. It supplies essential materials for lithium-ion batteries, supercapacitors, and fuel cells, all of which are critical components in the transition to cleaner transportation and grid-scale energy solutions. The ongoing global shift toward decarbonization and adoption of renewable energy expands the market’s addressable scope. Battery manufacturers and automakers increasingly seek specialized graphite solutions to improve energy density and operational efficiency. Partnerships and joint ventures between graphite producers and technology firms can accelerate product development. These dynamics position the market to capture significant value from future advancements in e-mobility and sustainable energy.

Innovation in High-Purity and Specialty Grades Unlocks New End-Use Applications

Innovation in high-purity and specialty grades of graphite presents new opportunities across electronics, aerospace, and advanced manufacturing sectors. The Special Graphite Market can leverage its expertise in processing and material science to develop products for next-generation semiconductors, solar panels, and high-temperature industrial applications. Demand for ultra-high purity graphite enables entry into niche markets with stringent performance requirements. Investments in research and development facilitate product differentiation and help secure long-term supply agreements with leading technology companies. Expanding the portfolio of specialized solutions supports broader market penetration and sustains competitive advantage for industry leaders.

Market Segmentation Analysis:

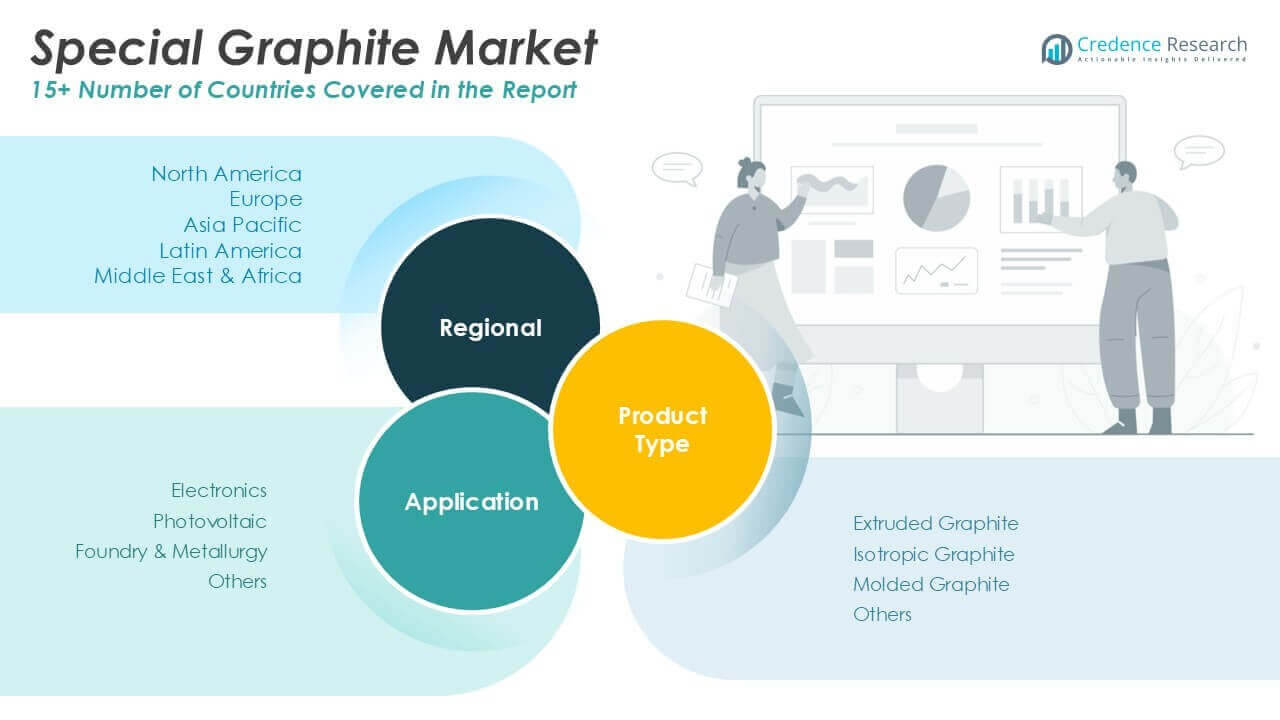

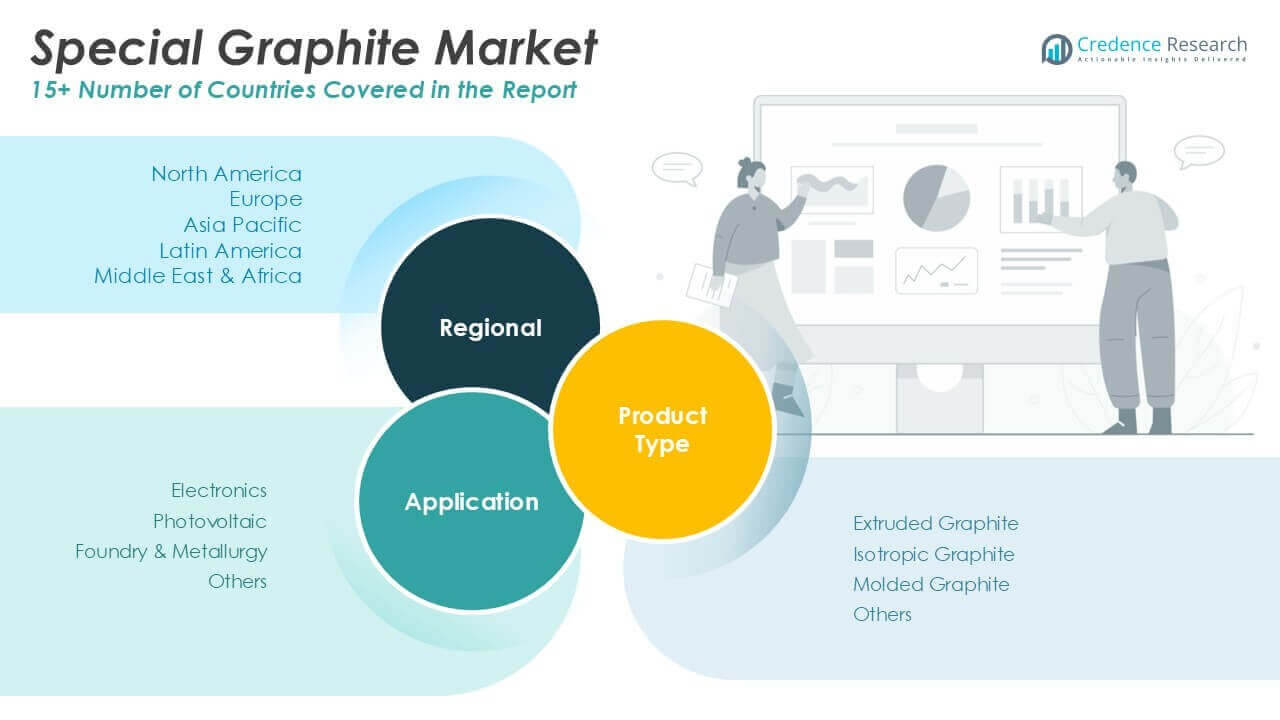

By Product Type:

The Special Graphite Market features a diverse product portfolio, with segment analysis highlighting the unique roles and value propositions of each product type. Extruded graphite represents a significant share, driven by its excellent machinability, thermal conductivity, and cost-effectiveness. It serves various applications across metallurgy, electrical discharge machining, and chemical industries, offering versatility in both standard and custom specifications. Isotropic graphite commands strong demand in high-tech sectors due to its uniform structure, superior strength, and resistance to thermal shock. Manufacturers rely on it for applications in semiconductors, electronics, and solar photovoltaic industries where precision and material consistency are critical. Molded graphite stands out for its exceptional density and mechanical properties, making it a preferred choice for high-temperature furnaces, continuous casting, and advanced material processing. Its robust performance under extreme conditions secures its place in specialized industrial applications. The services segment complements the core product offerings, providing machining, purification, and technical support to maximize product efficiency and end-user satisfaction.

By Application:

The Special Graphite Market demonstrates a strong presence in electronics, reflecting the material’s role in heat management, battery production, and precision components. It supports the growing trend toward miniaturization and enhanced performance in consumer electronics and semiconductor manufacturing. The photovoltaic segment leverages special graphite for its role in producing high-purity silicon wafers, which are essential to efficient solar panel manufacturing. Its stability at elevated temperatures and ability to maintain structural integrity make it vital in these high-demand processes. Foundry and metallurgy remain core markets, with special graphite’s resistance to thermal stress and chemical corrosion enabling it to deliver reliable performance in casting, molding, and refractory operations. The “Others” category encompasses emerging and niche applications, including aerospace, medical devices, and high-temperature lubricants, where innovation continues to unlock new use cases for special graphite materials. The market’s balanced distribution across these segments reflects its adaptability and relevance to both established and evolving industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segments:

Based on Product Type:

- Extruded Graphite

- Isotropic Graphite

- Molded Graphite

- Services

Based on Application:

- Electronics

- Photovoltaic

- Foundry & Metallurgy

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Special Graphite Market

North America Special Graphite Market grew from USD 293.28 million in 2018 to USD 407.41 million in 2024 and is projected to reach USD 636.44 million by 2032, reflecting a compound annual growth rate (CAGR) of 5.3%. North America is holding a 31% market share. The United States and Canada lead regional demand, driven by strong activity in the electronics, electric vehicle, and metallurgical sectors. Investment in advanced battery manufacturing and renewable energy technologies supports expansion. The presence of established graphite processors and innovation hubs enhances market development. High-quality standards and regulatory compliance remain priorities for regional manufacturers. North America continues to set benchmarks for technological adoption and process automation in the Special Graphite Market.

Europe Special Graphite Market

Europe Special Graphite Market grew from USD 200.35 million in 2018 to USD 269.06 million in 2024 and is forecast to reach USD 386.35 million by 2032, posting a CAGR of 4.2%. Europe holds a 21% market share, with Germany, France, and the United Kingdom as the primary contributors. Industrial automation, energy efficiency, and the growth of photovoltaic installations drive demand. The market benefits from collaborations between graphite suppliers and the automotive, aerospace, and semiconductor industries. Sustainability goals and a focus on circular economy principles shape investment decisions. Europe’s emphasis on innovation and environmental responsibility fosters stable growth in the Special Graphite Market.

Asia Pacific Special Graphite Market

Asia Pacific Special Graphite Market grew from USD 353.73 million in 2018 to USD 519.47 million in 2024 and is anticipated to reach USD 864.30 million by 2032, achieving a CAGR of 6.2%. Asia Pacific commands a leading 40% market share. China, Japan, South Korea, and India anchor the region, supported by rapid expansion in electronics, renewable energy, and industrial production. Demand for high-purity graphite and advanced materials accelerates regional investment. Local manufacturers benefit from proximity to raw materials and growing R&D capabilities. Policy support for electric mobility and solar energy adoption further boosts market prospects. Asia Pacific remains the growth engine for the global Special Graphite Market.

Latin America Special Graphite Market

Latin America Special Graphite Market grew from USD 36.12 million in 2018 to USD 50.14 million in 2024 and is projected to reach USD 67.18 million by 2032, posting a CAGR of 3.3%. Latin America accounts for 4% of the market share. Brazil and Mexico lead consumption, supported by the metallurgical, automotive, and electronics industries. Infrastructure modernization and foreign investment stimulate regional activity. Market participants focus on quality upgrades and local supply chain development. Regulatory improvements and trade partnerships attract new entrants. Latin America shows steady potential for growth in special graphite applications.

Middle East Special Graphite Market

Middle East Special Graphite Market grew from USD 21.91 million in 2018 to USD 27.75 million in 2024 and is set to reach USD 35.10 million by 2032, recording a CAGR of 2.6%. The Middle East holds a 2% market share. Key markets include Saudi Arabia and the United Arab Emirates, where demand centers on energy, foundry, and chemical processing. Industrial diversification strategies and infrastructure projects underpin market demand. Regional firms explore technology transfers and partnerships to strengthen capabilities. Limited local production presents opportunities for import growth. The Middle East market gradually advances, with emphasis on quality and reliability.

Africa Special Graphite Market

Africa Special Graphite Market grew from USD 16.81 million in 2018 to USD 25.79 million in 2024 and is forecast to reach USD 33.10 million by 2032, achieving a CAGR of 2.8%. Africa accounts for 2% of the market share. South Africa and Egypt represent the leading consumers, focused on mining, metallurgy, and emerging manufacturing sectors. Investment in infrastructure and local processing facilities supports growth. Policy reforms target resource development and industrialization. The region’s potential lies in untapped graphite reserves and expanding downstream industries. Africa’s Special Graphite Market continues to gain momentum through strategic development initiatives.

Key Player Analysis

- SGL Carbon

- Pingdingshan City Kaiyuan Specialty Graphite Ltd.

- Yichang Xincheng Graphite Co., Ltd.

- SEC CARBON, LIMITED.

- Fangda Carbon New Material Technology Co., Ltd

- IBIDEN

- Graphite India Limited

- Entegris, Inc.

- Mersen SA

- Nippon Carbon Co Ltd.

- Morgan Advanced Materials

- Tokai Carbon Co., Ltd.

- Toyo Tanso Co., Ltd.

- Schunk Carbon Technology

Competitive Analysis

The Special Graphite Market features a competitive landscape shaped by leading players such as SGL Carbon, Tokai Carbon Co., Ltd., Mersen SA, Fangda Carbon New Material Technology Co., Ltd, Morgan Advanced Materials, Toyo Tanso Co., Ltd., SEC CARBON, LIMITED., IBIDEN, Entegris, Inc., Graphite India Limited, Pingdingshan City Kaiyuan Specialty Graphite Ltd., Yichang Xincheng Graphite Co., Ltd., Nippon Carbon Co Ltd., and Schunk Carbon Technology. These companies maintain strong positions through diversified product portfolios, advanced manufacturing capabilities, and global distribution networks. They invest in research and development to create high-purity, specialty grades tailored for demanding applications in electronics, semiconductors, and energy storage. Strategic alliances, joint ventures, and acquisitions help them expand their technological base and address evolving customer requirements worldwide. Leading players emphasize quality control, process innovation, and sustainable practices to comply with regulatory standards and enhance operational efficiency. Expansion into emerging markets supports long-term growth, while partnerships with technology firms and end users accelerate product development and commercialization. Competitive dynamics are defined by ongoing innovation, responsiveness to market trends, and a commitment to delivering value-added solutions across established and high-growth industries.

Recent Developments

- In July 2024, the AMG subsidiary Graphit Kropfmühl and BASF signed a ground-breaking agreement on product carbon footprint reduction. Under the agreement, BASF will provide renewable energy certificates for Graphit Kropfmühl’s production site based in Hauzenberg, Germany. BASF will use the reduced PCF graphite to manufacture Neopor with a reduced product carbon footprint.

- In March 2023, SGL Carbon signed a cooperation agreement to Supply Key Graphite Components for Wolfspeed Silicon Carbide Production Facilities. It is a supply agreement. SGL Carbon will be supplying graphite components to the global leader in Silicon Carbide technology, Wolfspeed, for its US production facilities.

- In October 2022, SGL Carbon will significantly expand capacities for producing graphite products for the semiconductor industry at the sites Shanghai (China), St. Marys (USA), and Meitingen (Germany). In the North American site in St. Marys and the Chinese site in Shanghai, capacities for purification and for high-precision, computer-controlled processing of graphite components and felts are being extended. At Meitingen, Germany, a new plant for producing carbonized and graphitized soft felt is currently under construction.

- In May 2022, Resonac Holdings Co., Ltd. agreed on an absorption-type company split with its wholly owned subsidiary, Shinshu Showa K.K., over the graphite electrode business. The content of the company split and utilization for the common ground of global operation is globalization of the controlling company by Shinshu Showa. It will accelerate decision-making and further stabilize, optimize, and strengthen our graphite electrode business.

Market Concentration & Characteristics

The Special Graphite Market exhibits moderate to high market concentration, with a few multinational companies holding significant shares due to advanced technology, broad product offerings, and strong global distribution networks. It is characterized by high entry barriers stemming from substantial capital requirements, technical expertise, and stringent quality standards demanded by end-use industries such as electronics, semiconductors, and energy storage. Leading players leverage integrated supply chains, proprietary manufacturing processes, and continuous innovation to maintain competitive advantage. The market values reliability, product customization, and consistent quality, given the critical nature of special graphite in demanding applications. Regional clusters in Asia Pacific, North America, and Europe drive technological advancements, while regulatory compliance and sustainability initiatives shape operational strategies. It remains dynamic, adapting to new technological trends and shifting industry requirements, which sustains long-term growth and reinforces the importance of trusted supplier relationships.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Special Graphite Market is projected to grow steadily, driven by increasing demand from electronics, energy storage, and automotive sectors.

- Rising adoption of electric vehicles and renewable energy solutions is boosting the need for high-performance graphite components in batteries and fuel cells.

- Technological advancements in semiconductor manufacturing and solar photovoltaic installations are contributing to market expansion.

- Leading companies are focusing on developing ultra-high purity graphite for next-generation electronics and investing in research and development to meet evolving industry standards.

- The market faces challenges such as raw material price volatility and supply chain disruptions, prompting companies to explore alternative sourcing strategies.

- Asia Pacific remains the largest and fastest-growing regional market, supported by robust manufacturing activities in countries like China, Japan, and South Korea.

- North America and Europe continue to show steady demand, driven by advancements in electronics, energy storage, and industrial applications.

- Emerging regions like Latin America, the Middle East, and Africa are witnessing gradual growth due to infrastructure development and increased technology adoption.

- Sustainability initiatives and regulatory compliance are shaping the strategic direction of the market, with companies focusing on environmentally friendly production methods and recycling.

- The market’s adaptability and relevance to both established and evolving industries position it for continued growth in the coming years.