Market Overview

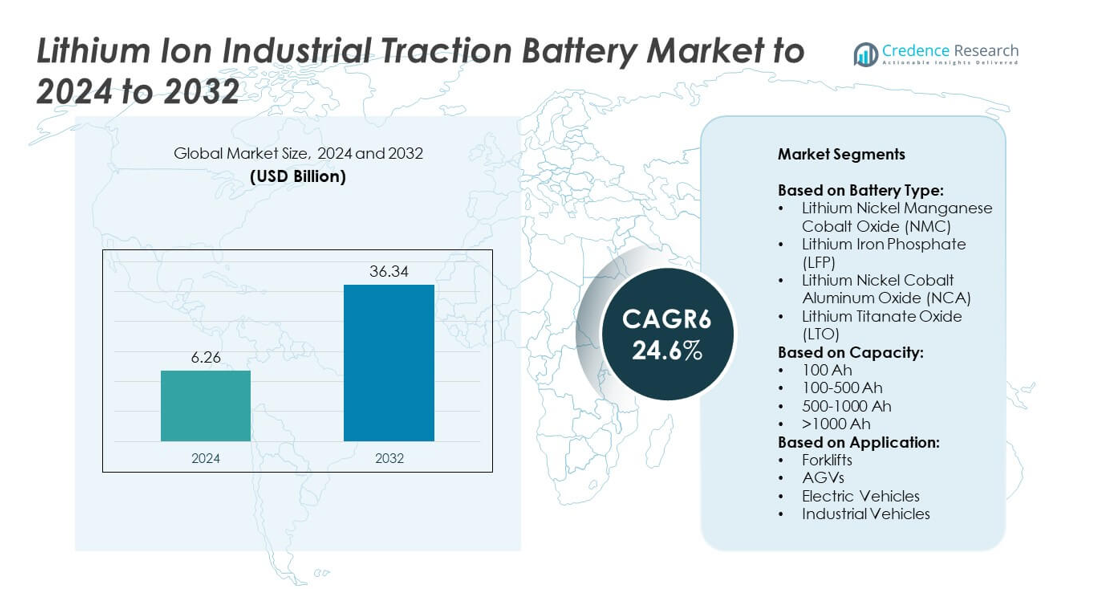

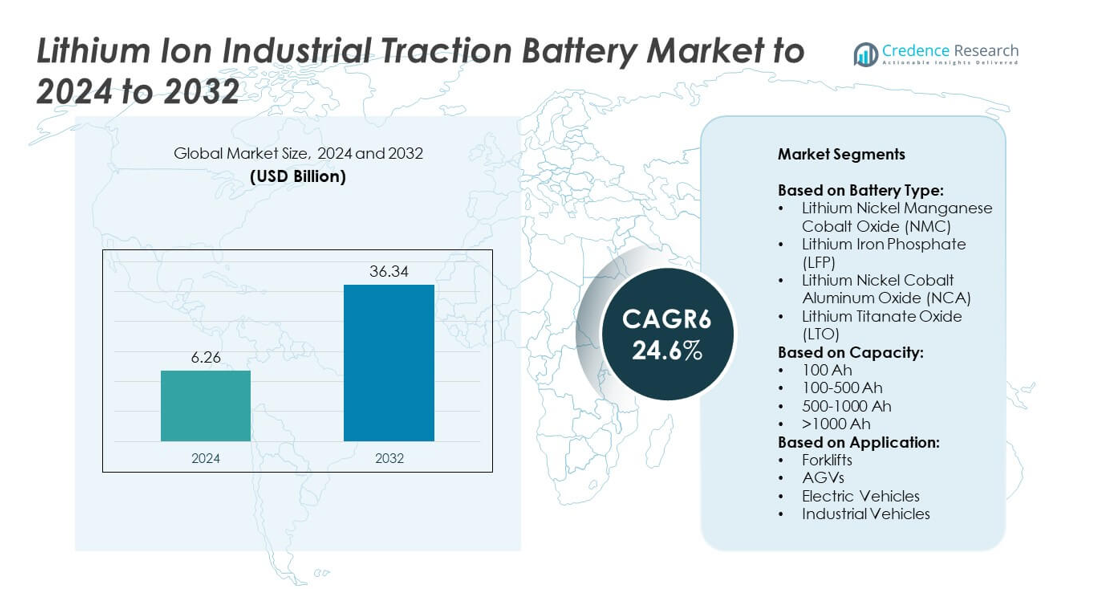

Lithium Ion Industrial Traction Battery Market size was valued USD 6.26 Billion in 2024 and is anticipated to reach USD 36.34 Billion by 2032, at a CAGR of 24.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Lithium Ion Industrial Traction Battery Market Size 2024 |

USD 6.26 Billion |

| Lithium Ion Industrial Traction Battery Market, CAGR |

24.6% |

| Lithium Ion Industrial Traction Battery Market Size 2032 |

USD 36.34 Billion |

The Lithium Ion Industrial Traction Battery Market is driven by leading players such as CATL, Exide Technologies, EnerSys, Samsung SDI, Panasonic, LG Energy Solution, BYD, Saft, and Clarios, which are focusing on scaling production, advancing chemistries, and strengthening partnerships with industrial vehicle and logistics sectors. These companies emphasize enhancing cycle life, energy density, and charging efficiency to meet rising industrial demand. Regionally, Asia Pacific dominated the market with a 35% share in 2024, supported by strong government incentives and large-scale manufacturing capacity, while North America and Europe followed with 28% and 25% shares respectively, driven by electrification policies and industrial automation initiatives.

Market Insights

- The Lithium Ion Industrial Traction Battery Market was valued at USD 6.26 Billion in 2024 and is projected to reach USD 36.34 Billion by 2032, growing at a CAGR of 24.6%.

- Growth is fueled by rising electrification of forklifts, AGVs, and industrial vehicles, supported by faster charging, longer cycle life, and lower maintenance than lead-acid alternatives.

- Key trends include integration of smart battery management systems, adoption of LFP batteries for safety and durability, and growing demand for high-capacity solutions in heavy-duty applications.

- Competition is strong with major players expanding capacity, investing in R&D for higher energy density, and forming partnerships with automakers, logistics companies, and equipment manufacturers to secure market leadership.

- Regionally, Asia Pacific led with 35% share in 2024, followed by North America at 28% and Europe at 25%, while Latin America and the Middle East & Africa accounted for 7% and 5% respectively, showing steady growth potential.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Battery Type

The Lithium Ion Industrial Traction Battery Market is segmented into NMC, LFP, NCA, and LTO chemistries. Among these, Lithium Iron Phosphate (LFP) held the dominant share in 2024, accounting for over 42% of the market. LFP batteries are favored for their longer cycle life, high thermal stability, and safety profile, making them suitable for demanding industrial applications. Growing demand in forklifts and industrial vehicles drives LFP adoption. Meanwhile, NMC batteries are gaining traction in applications requiring higher energy density, such as electric vehicles, while LTO is emerging in fast-charging systems.

- For instance, EVE Energy’s LF280K LFP cell is rated 280 Ah, 3.2 V, with ≥6,000 cycles at 0.5C/0.5C at 25 °C per the product spec.

By Capacity

Capacity segmentation includes 100 Ah, 100–500 Ah, 500–1000 Ah, and >1000 Ah ranges. The 100–500 Ah category led the market with around 38% share in 2024, driven by its widespread use in forklifts, AGVs, and industrial vehicles. These batteries balance energy storage with cost-effectiveness, making them highly preferred for material handling and warehouse operations. The >1000 Ah segment is witnessing faster growth as heavy-duty industrial equipment requires longer operational cycles, while lower-capacity ranges serve niche applications with limited runtime requirements.

- For instance, Flux Power’s 80 V G2 packs come in 210 Ah, 420 Ah, and 840 Ah versions, with max continuous charge currents of 125 A, 250 A, and 500 A respectively.

By Application

Applications of lithium ion industrial traction batteries span forklifts, AGVs, electric vehicles, and industrial vehicles. Forklifts dominated the segment, contributing nearly 46% of market share in 2024. This dominance is supported by rapid electrification of warehouses, logistics hubs, and manufacturing units that prioritize zero-emission and cost-efficient material handling. Growing e-commerce activity further boosts forklift demand. AGVs and industrial vehicles are expanding segments, driven by automation trends and Industry 4.0 adoption, while electric vehicles represent an emerging market within industrial traction, especially in specialized fleets and short-haul transport.

Key Growth Drivers

Rising Electrification of Industrial Vehicles

The growing adoption of electric-powered forklifts, AGVs, and industrial vehicles is a major driver. Companies are shifting from lead-acid to lithium-ion batteries to improve efficiency and reduce downtime. Lithium-ion traction batteries offer faster charging, longer life cycles, and lower maintenance, making them a preferred choice for warehouses and logistics operations. With e-commerce expansion and increased material handling needs, electrification of fleets continues to accelerate demand, positioning this as the leading growth driver in the market.

- For instance, Hyster-Yale reported in its 2023 Corporate Responsibility Report that lift truck shipments increased by 1.4% year over year in 2023.

Advancements in Battery Technology

Ongoing innovations in lithium-ion chemistries, particularly in LFP and NMC, are strengthening performance and cost-effectiveness. Manufacturers are developing batteries with higher energy density, improved safety, and enhanced cycle life. Fast-charging solutions and modular battery designs are further broadening adoption across diverse industrial applications. These advancements enable better operational reliability, reducing total cost of ownership for end-users. Continuous R&D investment by major players is driving the competitiveness of lithium-ion traction batteries, fostering wider penetration across global industrial sectors.

- For instance, in early 2024, Panasonic announced plans to produce an upgraded version of its 2170 cylindrical NCA cells for electric vehicles, focusing on improved capacity and productivity, with production starting in 2024 or 2025.

Supportive Sustainability and Regulatory Policies

Global decarbonization initiatives and stricter emission standards are supporting market expansion. Governments and industry regulators are encouraging electrification of industrial fleets to reduce carbon footprints. Incentives, subsidies, and sustainability targets are pushing industries to replace diesel and lead-acid systems with lithium-ion alternatives. The increasing pressure on companies to align with ESG goals further accelerates lithium-ion battery adoption. This regulatory backing enhances long-term growth opportunities and ensures steady demand across manufacturing, logistics, and material handling industries worldwide.

Key Trends & Opportunities

Integration of Smart Battery Management Systems

The growing use of intelligent battery management systems (BMS) is a significant trend. These systems provide real-time monitoring, predictive maintenance, and optimization of battery performance, reducing unexpected downtime. The integration of IoT and AI enhances operational efficiency, helping industries manage energy use effectively. This trend is opening opportunities for suppliers to differentiate with value-added digital features. The rising demand for connected solutions in smart warehouses and automated factories is driving strong adoption of BMS-integrated lithium-ion traction batteries.

- For instance, Analog Devices’ wBMS for GM Ultium removes up to 90% pack wiring and up to 15% pack volume.

Expansion of Automated Guided Vehicles (AGVs)

AGVs are witnessing rapid adoption in warehouses, manufacturing plants, and logistics centers. Their growing use is creating significant opportunities for lithium-ion traction batteries due to requirements for high efficiency, long runtime, and low maintenance. The scalability of AGV fleets and the push toward Industry 4.0 are fueling demand for reliable energy solutions. Lithium-ion batteries, with quick-charging capabilities, are perfectly aligned with these needs. As industries increase automation to reduce costs and enhance productivity, AGVs represent a strong growth opportunity.

- For instance, in 2023, KUKA delivered lithium-ion battery-powered mobile platforms, including the new KMP 600-S diffDrive generation.

Key Challenges

High Initial Investment Costs

The upfront cost of lithium-ion industrial traction batteries remains a key challenge for adoption. Despite offering lower lifecycle costs, many small and mid-sized enterprises find initial capital requirements restrictive. Price-sensitive markets often continue relying on traditional lead-acid batteries. Although total cost of ownership is favorable in the long run, the high acquisition cost limits faster penetration in emerging economies. Overcoming this barrier will require further cost reductions, financing models, or leasing solutions to make lithium-ion batteries more accessible.

Supply Chain and Raw Material Constraints

Supply chain volatility and raw material dependencies, particularly for lithium, cobalt, and nickel, pose significant challenges. Fluctuations in commodity prices increase production costs and limit affordability. Geopolitical issues and concentration of resources in specific regions add further risks of supply disruptions. These constraints directly affect manufacturers’ ability to meet rising demand. To address this challenge, companies are investing in recycling technologies, alternative chemistries like LFP, and securing long-term raw material contracts to ensure stable supply chains.

Regional Analysis

North America

North America accounted for around 28% of the lithium ion industrial traction battery market in 2024, supported by strong adoption in warehouses, logistics hubs, and automated industries. The United States is the primary growth contributor, driven by electrification of forklifts and AGVs, along with increasing demand from the automotive sector. Government incentives promoting clean energy technologies further boost adoption. Canada is also witnessing steady uptake in industrial vehicles as sustainability initiatives gain momentum. Advanced infrastructure, combined with presence of key manufacturers, positions North America as a leading regional market with consistent growth potential through 2032.

Europe

Europe held nearly 25% of the global lithium ion industrial traction battery market in 2024, supported by stringent environmental policies and rapid electrification. Countries such as Germany, France, and the UK are key markets, driven by advanced automotive and manufacturing sectors. Strong government backing for sustainable energy and circular economy practices encourages replacement of lead-acid with lithium ion batteries. The presence of advanced battery manufacturers and investments in gigafactories further enhance growth. Europe’s strong regulatory framework and increasing demand for AGVs and forklifts reinforce its position as one of the most competitive markets globally.

Asia Pacific

Asia Pacific dominated the market with 35% share in 2024, emerging as the fastest-growing region. China leads the market with large-scale adoption across automotive, logistics, and industrial vehicle applications, supported by strong government initiatives for electrification. Japan, South Korea, and India are also witnessing robust demand, driven by rapid industrialization and expansion of e-commerce sectors. Local manufacturers and investments in large-scale production facilities contribute to cost reductions, strengthening market penetration. Growing demand for high-capacity batteries in heavy-duty equipment ensures Asia Pacific’s continued dominance and positions the region as the central hub for future market expansion.

Latin America

Latin America represented about 7% of the lithium ion industrial traction battery market in 2024, driven by increasing adoption of electric forklifts and industrial vehicles. Brazil and Mexico lead regional growth due to their expanding manufacturing bases and rising logistics demand. Although market penetration is lower compared to advanced regions, declining battery costs and supportive clean energy policies are accelerating adoption. Limited domestic production capacity poses challenges, but rising imports and partnerships with international manufacturers are addressing supply gaps. The region is expected to record steady growth, particularly as sustainability initiatives and electrification targets expand.

Middle East and Africa

The Middle East and Africa accounted for nearly 5% of the global lithium ion industrial traction battery market in 2024, reflecting gradual adoption. Industrial vehicle electrification is gaining pace in countries like the UAE, South Africa, and Saudi Arabia, driven by modernization of logistics and infrastructure projects. Government initiatives to diversify energy sources and reduce emissions are further encouraging uptake. However, high upfront costs and limited local manufacturing capacity restrict faster penetration. Growing interest in renewable integration and industrial automation is expected to support future market growth, though expansion remains at an early stage compared to other regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Battery Type:

- Lithium Nickel Manganese Cobalt Oxide (NMC)

- Lithium Iron Phosphate (LFP)

- Lithium Nickel Cobalt Aluminum Oxide (NCA)

- Lithium Titanate Oxide (LTO)

By Capacity:

- 100 Ah

- 100-500 Ah

- 500-1000 Ah

- >1000 Ah

By Application:

- Forklifts

- AGVs

- Electric Vehicles

- Industrial Vehicles

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Lithium Ion Industrial Traction Battery Market is shaped by leading players including CATL, Exide Technologies, EnerSys, Hitachi Astemo, Samsung SDI, Leadshine Battery, NorthStar Battery, Saft, BYD, Panasonic, LG Energy Solution, Clarios, Trojan Battery, ATL, and Hawker Powersource. These companies focus on expanding manufacturing capacity, developing advanced chemistries, and enhancing battery safety to strengthen their market position. Strategic collaborations with automakers, logistics providers, and industrial vehicle manufacturers are driving innovation in battery design and integration. Many participants invest heavily in R&D to improve energy density, cycle life, and charging efficiency, aligning with rising demand for sustainable and high-performance solutions. Regional expansion strategies, such as building gigafactories and establishing partnerships in emerging markets, are helping companies secure supply chains and reduce production costs. Additionally, sustainability commitments and investments in recycling technologies are becoming central to long-term competitiveness, ensuring alignment with global decarbonization and circular economy goals.

Key Player Analysis

- CATL

- Exide Technologies

- EnerSys

- Hitachi Astemo

- Samsung SDI

- Leadshine Battery

- NorthStar Battery

- Saft

- BYD

- Panasonic

- LG Energy Solution

- Clarios

- Trojan Battery

- ATL

- Hawker Powersource

Recent Developments

- In 2025, BYD is set to launch its next-generation Blade Battery, with improvements designed to significantly boost range and performance.

- In 2024, Saft (a TotalEnergies company) Delivered innovative LTO traction batteries to power hydrogen trains

- In 2024, Exide Technologies launched its Solition Material Handling battery, an LFP battery designed for material handling fleets like forklifts and automated guided vehicles to improve reliability, safety, and reduce total cost of ownership.

Report Coverage

The research report offers an in-depth analysis based on Battery Type, Capacity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly with increasing electrification of industrial vehicles.

- Forklifts will remain the dominant application due to rising warehouse automation.

- Lithium iron phosphate batteries will continue leading due to safety and long cycle life.

- Demand for high-capacity batteries will grow in heavy-duty industrial equipment.

- Integration of smart battery management systems will enhance efficiency and monitoring.

- Asia Pacific will strengthen its dominance with large-scale production and adoption.

- Europe will grow steadily under strict emission regulations and sustainability goals.

- Supply chain localization and recycling initiatives will reduce raw material risks.

- Declining battery costs will improve adoption in emerging economies.

- Partnerships between automakers and battery producers will accelerate innovation and market growth.