Market Overview

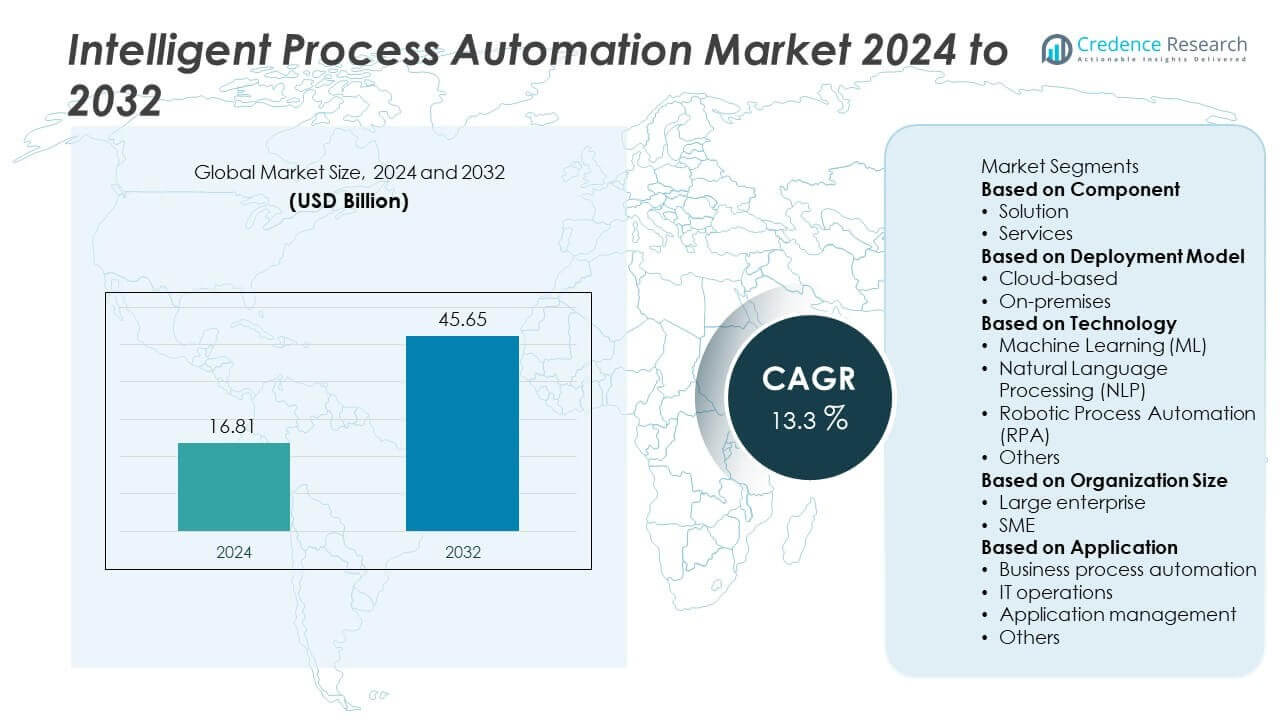

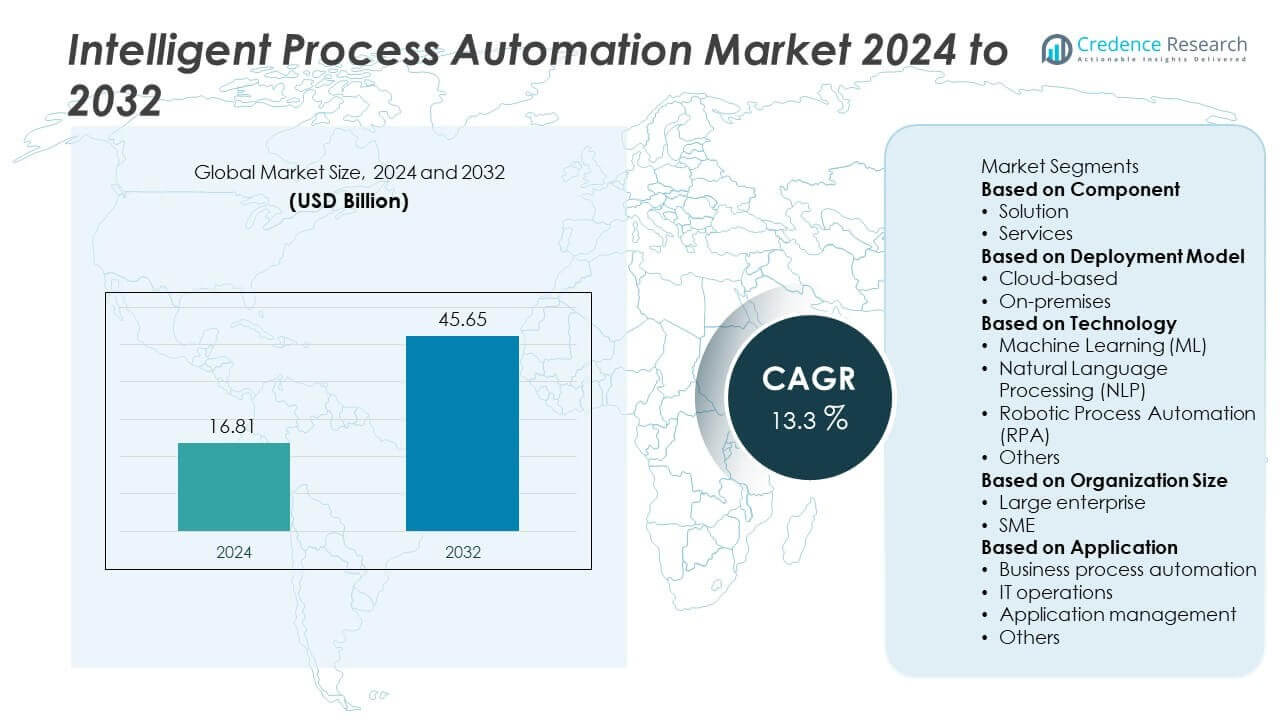

The Intelligent Process Automation Market was valued at USD 16.81 billion in 2024 and is projected to reach USD 45.65 billion by 2032, growing at a CAGR of 13.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Intelligent Process Automation Market Size 2024 |

USD 16.81 Billion |

| Intelligent Process Automation Market, CAGR |

13.3% |

| Intelligent Process Automation Market Size 2032 |

USD 45.65 Billion |

The Intelligent Process Automation market is shaped by top players including SAP SE, Blue Prism, Appian, UiPath, Pegasystems, Kofax, WorkFusion, IBM, Automation Anywhere, and Microsoft. These companies lead through innovations in robotic process automation, AI-driven solutions, and cloud-based platforms that support large-scale enterprise adoption. Regionally, North America dominated the market in 2024 with 38% share, supported by early adoption and strong vendor presence. Europe followed with 28%, driven by strict compliance requirements and digitalization initiatives, while Asia-Pacific accounted for 24%, emerging as the fastest-growing region due to rapid enterprise automation and government-led digital transformation programs.

Market Insights

Market Insights

- The Intelligent Process Automation market was valued at USD 16.81 billion in 2024 and is projected to reach USD 45.65 billion by 2032, growing at a CAGR of 13.3% during 2024–2032.

- Rising demand for operational efficiency and compliance management drives adoption, with solution components leading at 65% share, supported by cloud-based deployment holding 58% share.

- Key trends include increasing integration of AI, machine learning, and natural language processing, while robotic process automation remained dominant with 47% share in 2024.

- The market is competitive with major players such as SAP SE, Blue Prism, Appian, UiPath, Pegasystems, Kofax, WorkFusion, IBM, Automation Anywhere, and Microsoft focusing on product innovation, cloud expansion, and strategic partnerships.

- Regionally, North America led with 38% share, followed by Europe at 28% and Asia-Pacific at 24%, while Latin America and Middle East & Africa accounted for 6% and 4%, respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The solution segment dominated the Intelligent Process Automation market in 2024, holding nearly 65% of the share. Its leadership stems from strong demand for AI-powered platforms that integrate robotic process automation, cognitive tools, and advanced analytics. Enterprises prioritize solutions to improve operational efficiency, reduce manual errors, and optimize decision-making. The services segment, while smaller, is expanding steadily due to rising demand for consulting, system integration, and managed services that support large-scale deployments. The growing focus on automation-driven digital transformation keeps the solution segment at the forefront of this market.

- For instance, In 2024, IBM’s finance team launched the Jobotx initiative, expanding RPA automation capabilities using IBM watsonx Orchestrate™ and IBM Apptio™ Enterprise Business Management (EBM).

By Deployment Model

Cloud-based deployment led the market with over 58% share in 2024, supported by enterprises’ shift toward scalable and cost-efficient automation frameworks. Cloud models reduce infrastructure costs, ensure faster updates, and enable integration across distributed systems, which is critical for large organizations. Vendors emphasize cloud-native IPA platforms to deliver flexibility and rapid implementation. On-premises deployment retains relevance in highly regulated sectors like banking and government, where data security and compliance remain critical. However, the cloud-based model’s scalability and support for hybrid workflows sustain its dominance.

- For instance, Automation Anywhere reported strong financial and performance results for fiscal year 2024, driven by its AI-powered cloud platform. In March 2024, the company announced a record fourth quarter and a strong fiscal year 2024, highlighting its momentum with large enterprise customers and strong customer retention.

By Technology

Robotic Process Automation (RPA) emerged as the dominant technology, accounting for nearly 47% of the market share in 2024. RPA adoption is driven by its ability to automate repetitive, rule-based tasks across finance, HR, and customer service operations, significantly reducing costs and boosting efficiency. Machine Learning (ML) and Natural Language Processing (NLP) are gaining traction as enterprises seek cognitive capabilities for predictive insights and conversational AI. Although “others” include niche tools like computer vision, RPA’s proven return on investment and enterprise-wide applicability ensure its continued leadership.

Key Growth Drivers

Rising Demand for Operational Efficiency

The need to streamline workflows and cut manual effort is a major driver of the Intelligent Process Automation market. Organizations across industries adopt IPA to automate repetitive tasks, reduce errors, and accelerate process execution. This shift enhances productivity while lowering operating costs. Enterprises also leverage automation to manage high-volume transactions and optimize resource allocation. As digital transformation accelerates globally, the pressure to improve efficiency keeps demand for IPA solutions strong, making it a central driver of market expansion.

- For instance, Persistent Systems was recognized as a leader in Intelligent Automation Services in 2024, delivering AI-powered automation through the integration of RPA, low-code, and GenAI technologies. These solutions have delivered significant client outcomes, such as reducing manual billing processing time by 40% for a healthcare client and improving other key metrics in banking and healthcare workflows.

Integration of AI and Advanced Analytics

The integration of Artificial Intelligence and advanced analytics within automation frameworks fuels growth in the IPA market. AI technologies such as machine learning and natural language processing enhance IPA systems with predictive insights, decision-making support, and intelligent task handling. Enterprises value these capabilities for improving customer experiences, detecting anomalies, and enabling data-driven strategies. As organizations focus on unlocking value from big data, the demand for AI-driven automation continues to expand, ensuring stronger adoption of IPA platforms across sectors such as finance, healthcare, and retail.

- For instance, Capgemini’s IPA solutions have reduced finance transaction times by 95% and enabled real-time anomaly detection across supply chains, processing millions of data points per day to optimize decision-making.

Growing Adoption Across Regulated Industries

Heavily regulated industries, including banking, insurance, and healthcare, increasingly adopt Intelligent Process Automation to meet compliance requirements while reducing costs. IPA ensures adherence to strict reporting standards, maintains audit trails, and minimizes compliance risks. Organizations benefit from automating documentation, claims processing, and regulatory filings, which enhances transparency and accuracy. Governments and regulators also encourage digital compliance frameworks, further supporting adoption. With rising scrutiny and stricter laws worldwide, regulated industries serve as a strong driver for the widespread deployment of IPA solutions.

Key Trends & Opportunities

Shift Toward Cloud-Based IPA Platforms

Cloud deployment of Intelligent Process Automation is becoming a key trend, offering enterprises scalability, faster deployment, and reduced infrastructure costs. Businesses increasingly prefer cloud-native platforms for seamless integration across global operations and hybrid work models. Vendors are enhancing their offerings with cloud-driven IPA suites that allow real-time collaboration and monitoring. This transition also aligns with the growing need for business agility and resilience. As more organizations embrace digital-first strategies, the adoption of cloud-based automation solutions presents significant opportunities for vendors.

- For instance, Nividous deployed cloud-based Intelligent Automation (IPA) solutions for manufacturing clients, including one high-tech manufacturer for whom it automated over 20 business processes. The manufacturer saw a 40% reduction in operating costs and a 60% acceleration in turnaround time, while other clients achieved significant process efficiency improvements, such as an 85% improvement in accounts payable.

Expansion into Cognitive and Hyperautomation

The market is witnessing strong momentum toward cognitive automation and hyperautomation. Enterprises are combining RPA with AI, NLP, and process mining to achieve end-to-end automation. Hyperautomation enables organizations to go beyond simple task automation and integrate decision-making and predictive capabilities. This trend creates opportunities for companies to scale automation across multiple functions, from finance to supply chain management. Vendors investing in cognitive technologies are well-positioned to capture demand, as enterprises increasingly seek holistic automation frameworks to remain competitive.

- For instance, Google Cloud’s AI-powered automation framework supports enterprises by processing more than 15 billion data points daily, enabling real-time process mining, anomaly detection, and predictive analytics to optimize supply chain and finance operations.

Key Challenges

High Implementation Costs and Complexity

Despite its benefits, Intelligent Process Automation often requires significant upfront investment in software, integration, and training. The complexity of aligning IPA tools with existing IT systems poses a barrier for small and mid-sized enterprises. Additionally, scaling automation beyond pilot projects can demand extensive customization and skilled resources. These factors slow adoption rates in cost-sensitive organizations. While long-term savings are clear, the initial financial and technical burden remains a key challenge restraining broader IPA implementation, especially among resource-constrained businesses.

Workforce Resistance and Skill Gaps

A major challenge in IPA adoption is resistance from employees who fear job displacement. Many workers perceive automation as a threat, leading to reluctance in adoption and reduced collaboration. Furthermore, organizations face skill gaps in managing and deploying advanced automation tools. The lack of trained professionals in AI, RPA, and analytics hinders effective implementation. Without proper change management and workforce upskilling, organizations struggle to realize the full potential of IPA investments. Overcoming this challenge requires a balanced approach between automation and human capital development.

Regional Analysis

North America

North America held the largest share of the Intelligent Process Automation market in 2024, accounting for 38% of global revenue. The region benefits from early adoption of advanced automation technologies and strong presence of key vendors. Enterprises in the U.S. and Canada leverage IPA to enhance efficiency across banking, insurance, healthcare, and retail sectors. Supportive investments in AI, cloud infrastructure, and robotic process automation also strengthen adoption. Rising demand for customer experience optimization and compliance management continues to drive IPA deployment, making North America the leading market.

Europe

Europe accounted for 28% share of the Intelligent Process Automation market in 2024, driven by strict regulatory frameworks and digital transformation initiatives. Countries such as Germany, the UK, and France prioritize IPA to meet compliance requirements under GDPR and enhance operational transparency. The region also emphasizes automation in banking, insurance, and government sectors, where efficiency and accuracy are vital. Vendors are increasingly offering tailored IPA solutions for European enterprises, aligning with data sovereignty needs. Strong investment in AI and analytics integration supports further market expansion across the region.

Asia-Pacific

Asia-Pacific captured 24% of the Intelligent Process Automation market in 2024, with rapid growth expected during the forecast period. Enterprises in China, India, and Japan are accelerating automation adoption to enhance productivity and manage large-scale operations. Government initiatives promoting digital transformation and AI integration strengthen the adoption of IPA solutions across industries. Cost-efficient cloud-based deployment models appeal to both large enterprises and SMEs. The expansion of IT services, combined with rising investments in automation capabilities, positions Asia-Pacific as the fastest-growing regional market for IPA solutions.

Latin America

Latin America represented 6% of the Intelligent Process Automation market in 2024, supported by increasing demand for process automation in banking, retail, and telecom sectors. Countries such as Brazil and Mexico are leading adoption, driven by the need for efficiency and reduced operating costs. Growing investments in cloud technologies and digital infrastructure encourage IPA deployment across enterprises. While adoption rates remain moderate compared to developed markets, the rising focus on operational optimization and compliance standards drives steady market penetration, offering growth opportunities for global and regional vendors.

Middle East & Africa

The Middle East & Africa accounted for 4% share of the Intelligent Process Automation market in 2024, with adoption concentrated in financial services, energy, and government sectors. Enterprises in the UAE, Saudi Arabia, and South Africa invest in automation to streamline workflows and support digital transformation goals. Governments actively promote AI adoption through national strategies, further encouraging IPA integration. Limited technical expertise and budget constraints slow adoption across smaller enterprises, but strong demand for compliance and efficiency solutions sustains steady growth potential in the region.

Market Segmentations:

By Component

By Deployment Model

By Technology

- Machine Learning (ML)

- Natural Language Processing (NLP)

- Robotic Process Automation (RPA)

- Others

By Organization Size

By Application

- Business process automation

- IT operations

- Application management

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Intelligent Process Automation market features leading players such as SAP SE, Blue Prism, Appian, UiPath, Pegasystems, Kofax, WorkFusion, IBM, Automation Anywhere, and Microsoft. These companies compete by offering advanced automation platforms integrating robotic process automation, machine learning, and natural language processing to deliver end-to-end solutions. Market leaders focus on expanding cloud-native platforms, enhancing AI-driven capabilities, and forming strategic partnerships to strengthen global presence. Continuous investment in product innovation and acquisitions enables them to address diverse industry needs, from finance and healthcare to manufacturing and retail. Vendors also emphasize security, scalability, and compliance-focused features to attract regulated industries. With rising enterprise demand for hyperautomation and cognitive automation, competition is intensifying, pushing players to differentiate through service quality, integration support, and pricing strategies. This dynamic environment fosters rapid innovation while ensuring businesses access robust solutions tailored to digital transformation goals.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- SAP SE

- Blue Prism

- Appian

- UiPath

- Pegasystems

- Kofax

- WorkFusion

- IBM

- Automation Anywhere

- Microsoft

Recent Developments

- In August 2025, Appian released AI enhancements: semantic smart search, autoscaling data fabric, and FedRAMP support.

- In 2025, SAP added embedded AI in SAP Build to auto-generate workflows, code, and tests.

- In November 2024, SAP emphasized its Build Process Automation framework to simplify end-to-end process automation.

- In August 2024, Gartner named Blue Prism a leader alongside UiPath, Microsoft, Automation Anywhere in the RPA / automation space.

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment Model, Technology, Organization Size, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly as enterprises scale automation across industries.

- Cloud-based deployment will strengthen its lead with rising demand for flexible and scalable platforms.

- Robotic process automation will continue as the dominant technology in enterprise adoption.

- AI-driven tools such as machine learning and NLP will gain stronger integration into automation platforms.

- Vendors will focus on hyperautomation strategies to deliver end-to-end process optimization.

- Regulated industries like banking and healthcare will drive adoption for compliance and reporting needs.

- Workforce upskilling programs will grow to address automation-related skill gaps.

- Strategic partnerships and acquisitions will increase as vendors compete to expand capabilities.

- Asia-Pacific will emerge as the fastest-growing regional market with government-led digital initiatives.

- Security, governance, and data privacy will remain priorities in intelligent automation deployments.

Market Insights

Market Insights