Market Overview:

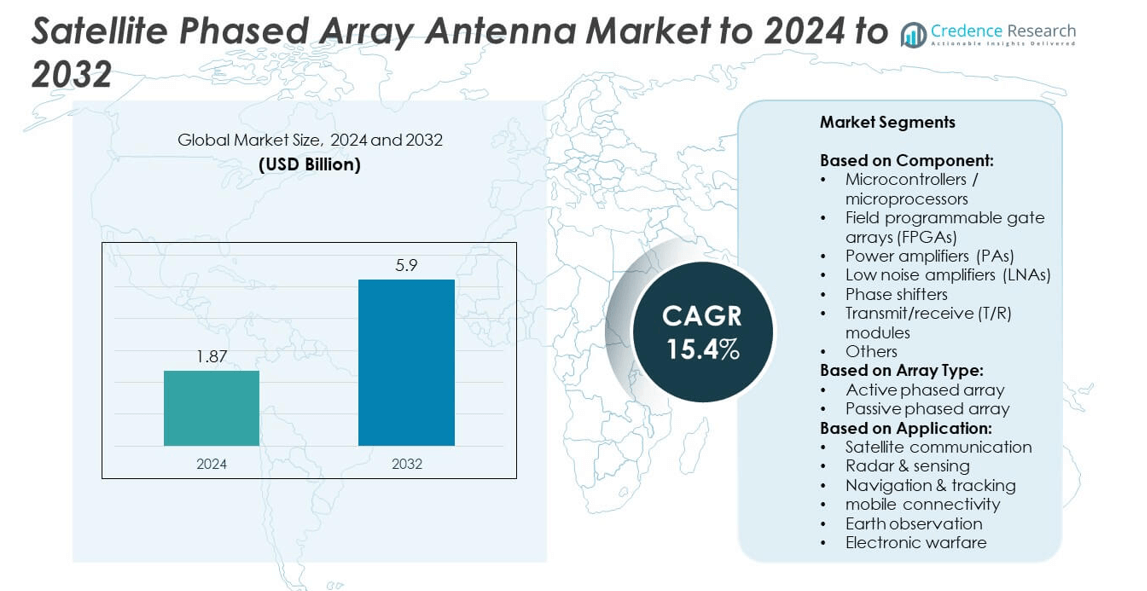

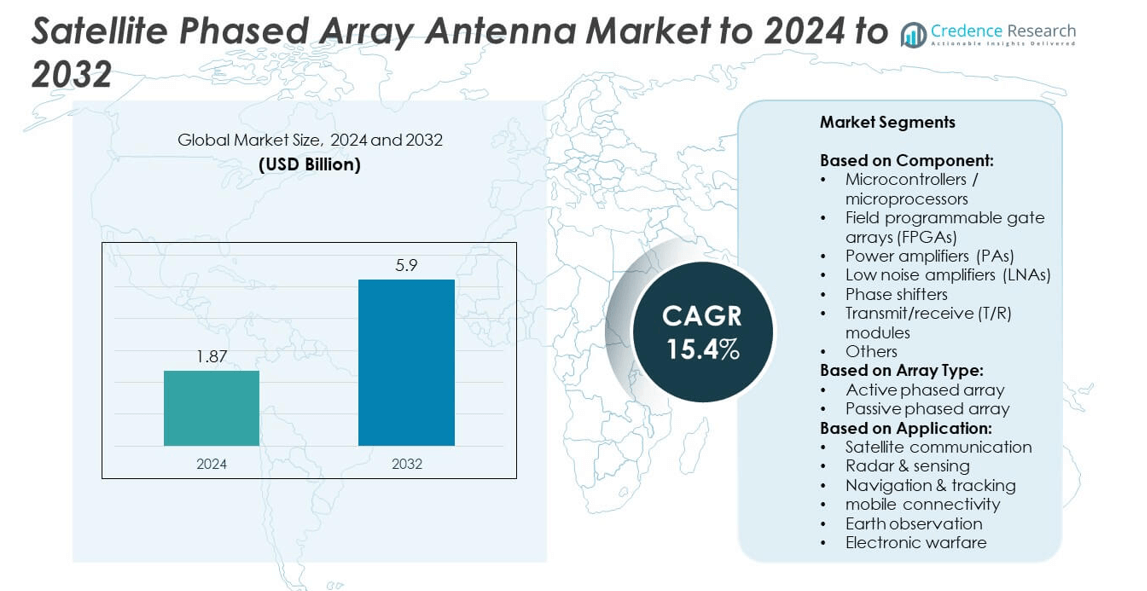

Satellite Phased Array Antenna Market size was valued USD 1.87 Billion in 2024 and is anticipated to reach USD 5.9 Billion by 2032, at a CAGR of 15.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Satellite Phased Array Antenna Market Size 2024 |

USD 1.87 Billion |

| Satellite Phased Array Antenna Market , CAGR |

15.4% |

| Satellite Phased Array Antenna Market Size 2032 |

USD 5.9 Billion |

The Satellite Phased Array Antenna Market is driven by leading companies such as Hanwha Phasor, Ball Aerospace, Honeywell, Thales Group, Intelsat, Raytheon Technologies (RTX), Kymeta, Lockheed Martin, and Northrop Grumman. These players are focusing on innovations in transmit/receive modules, active phased arrays, and miniaturized RF components to support advanced satellite communication and defense applications. Strategic partnerships with satellite operators and defense agencies further enhance their competitive positioning. Regionally, North America led the market in 2024 with a 36% share, supported by strong defense investments and commercial satellite programs, while Europe accounted for 27% and Asia Pacific held 25%, highlighting their growing influence in space and communication initiatives.

Market Insights

- The Satellite Phased Array Antenna Market was valued at USD 1.87 Billion in 2024 and is projected to reach USD 5.9 Billion by 2032, growing at a CAGR of 15.4%.

- Growth is fueled by rising demand for high-speed satellite broadband, expansion of LEO constellations, and defense modernization programs driving adoption across communication and surveillance systems.

- Active phased array antennas dominate the market with nearly 65% share in 2024, while transmit/receive (T/R) modules led the component segment with over 32% share, highlighting their critical role in beam steering and signal amplification.

- The competitive landscape is shaped by established aerospace leaders and innovative technology firms focusing on partnerships, advanced R&D, and cost-efficient designs to gain market advantage.

- North America led the market with 36% share in 2024, followed by Europe at 27% and Asia Pacific at 25%, while Latin America and Middle East & Africa held 7% and 5% respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The transmit/receive (T/R) modules segment held the largest share of over 32% in 2024, dominating the component category. T/R modules are essential in phased array antennas as they integrate multiple functions, including amplification, switching, and phase control, to enable precise beam steering. Their demand is fueled by growing adoption in high-throughput satellites and defense applications requiring advanced signal processing. Power amplifiers (PAs) and low-noise amplifiers (LNAs) also contribute significantly, driven by the need for enhanced signal strength and improved reception sensitivity in modern satellite networks.

- For instance, Analog Devices ADAR1000 is a 4-channel beamformer covering 8–16 GHz with 360° phase control and ≥31 dB gain adjustment.

By Array Type

Active phased array dominated the array type segment with nearly 65% market share in 2024. This dominance stems from their ability to electronically steer beams without mechanical movement, ensuring faster response times and higher reliability. Active arrays incorporate T/R modules that allow independent control of each antenna element, enabling enhanced precision and adaptability for dynamic environments. The rising use in defense radar systems, satellite broadband, and next-generation communication networks continues to drive growth. Passive arrays remain relevant for cost-sensitive applications but lack the flexibility and performance advantages of active systems.

- For instance, Raytheon AN/SPY-6(V)1 uses 4 array faces, each with 37 Radar Modular Assemblies (RMAs), delivering 360-degree coverage.

By Application

Satellite communication was the leading application, securing more than 40% market share in 2024. The segment’s dominance is fueled by the increasing demand for high-speed broadband connectivity, direct-to-home broadcasting, and secure government communication systems. Rising investments in LEO satellite constellations by companies and governments further accelerate adoption of phased array antennas. Radar and sensing applications follow, driven by defense modernization and earth monitoring programs. Navigation, mobile connectivity, and electronic warfare also show strong growth potential, supported by expanding requirements for precision tracking, secure communications, and tactical defense strategies.

Market Overview

Rising Demand for High-Speed Satellite Connectivity

The growing need for uninterrupted broadband connectivity has become the key growth driver of the Satellite Phased Array Antenna Market. Expanding Low Earth Orbit (LEO) satellite constellations by players like SpaceX and OneWeb require advanced phased array antennas to deliver faster data transfer and lower latency. Increasing use of satellite internet in remote areas, along with strong demand for secure government and military communications, further accelerates adoption. The integration of phased arrays into mobile platforms also supports real-time data transmission for both commercial and defense applications.

- For instance, OneWeb operates a constellation of 648 satellites in low Earth orbit.

Expansion of Defense and Aerospace Applications

Defense modernization programs worldwide are fueling strong demand for phased array antennas, as armed forces prioritize secure, resilient communication and radar technologies. These antennas provide superior beam steering, electronic warfare resilience, and multi-mission support, making them indispensable for modern warfare. Countries in North America, Europe, and Asia-Pacific are investing heavily in satellite-based radar, navigation, and surveillance systems. This expansion enhances situational awareness and supports real-time decision-making. Growing cross-border threats and defense budgets create strong opportunities for advanced phased array integration across land, air, and space platforms.

- For instance, Airbus was awarded a contract by Eutelsat in December 2024 to build 100 new satellites for the extension of the OneWeb low Earth orbit (LEO) constellation.

Technological Advancements in Antenna Design

Rapid progress in semiconductor technology and miniaturization of RF components is driving performance improvements in phased array antennas. Innovations in transmit/receive modules, phase shifters, and power amplifiers are enabling antennas to operate with higher precision, lower power consumption, and reduced weight. This enhances their suitability for small satellites, unmanned aerial vehicles, and mobile terminals. Technological advancements also reduce costs, making phased array solutions more viable for commercial applications. Continuous R&D investments from leading aerospace and communication companies ensure sustained development, strengthening long-term adoption across multiple industries.

Key Trends & Opportunities

Integration with 5G and Mobile Platforms

A major trend shaping the market is the integration of phased array antennas with 5G and satellite-enabled mobile communication systems. These antennas support seamless connectivity between terrestrial and satellite networks, ensuring global coverage for IoT devices, autonomous vehicles, and aviation. With growing demand for low-latency, high-capacity networks, phased array antennas are increasingly positioned as a bridge between 5G infrastructure and satellite constellations. This creates strong opportunities for telecom operators, equipment manufacturers, and satellite service providers to expand next-generation communication capabilities.

- For instance, HTC, in partnership with Qualcomm, developed the HTC 5G Hub, a portable hotspot that could achieve multi-gigabit throughput in 5G networks. This device utilized a Qualcomm Snapdragon 855 processor and a Snapdragon X50 5G modem, which supports mmWave and sub-6 GHz frequencies. The hub was able to provide high-speed mobile internet connectivity for up to 20 devices, demonstrating the potential for multi-gigabit throughput in a consumer-facing product.

Growth of LEO and MEO Satellite Constellations

Expanding deployment of Low Earth Orbit (LEO) and Medium Earth Orbit (MEO) satellites is a key opportunity for the phased array antenna market. These constellations require highly adaptive antennas capable of tracking multiple satellites simultaneously. The flexibility and beam-steering capabilities of phased arrays make them a critical enabler for broadband services, navigation, and earth observation missions. Increasing investments from both private players and government agencies are accelerating production and adoption, positioning phased arrays as a foundational technology for global connectivity projects in the coming years.

- For instance, SES expanded its O3b mPOWER constellation to 10 MEO satellites by July 2025.

Key Challenges

High Development and Implementation Costs

One of the key challenges restraining market growth is the high cost associated with phased array antenna development and deployment. Advanced transmit/receive modules, semiconductors, and integration processes make these systems expensive compared to traditional antenna solutions. This cost factor limits adoption in cost-sensitive markets and poses challenges for large-scale commercial rollouts. Small and medium enterprises, as well as developing countries, face budgetary constraints that restrict phased array adoption, creating a gap between technological potential and real-world application.

Thermal Management and Power Consumption Issues

Another key challenge is managing the thermal loads and power consumption of phased array antennas, especially in active systems. High-density electronic components generate significant heat, requiring advanced cooling technologies to maintain efficiency and reliability. This adds complexity and cost to the overall design. Additionally, power-hungry components strain satellite systems with limited onboard energy capacity. Addressing these technical barriers remains critical for ensuring long-term operational stability and expanding phased array antenna use in space and defense applications.

Regional Analysis

North America

North America led the Satellite Phased Array Antenna Market in 2024 with a market share of 36%. The region benefits from strong investments in defense modernization, satellite broadband, and commercial space programs. Key players and government agencies continue to expand satellite communication networks and radar systems to enhance national security and commercial connectivity. The presence of advanced aerospace infrastructure and major satellite operators also supports rapid adoption of phased array technologies. Growing demand for high-speed internet in remote areas further boosts deployments, positioning North America as the primary driver of market growth during the forecast period.

Europe

Europe accounted for 27% of the global Satellite Phased Array Antenna Market in 2024. The region’s growth is supported by increasing adoption in defense applications, space exploration projects, and satellite-based communication initiatives under the European Space Agency. Rising demand for secure communication and navigation systems strengthens the use of phased arrays across aerospace and defense sectors. European governments are investing in broadband connectivity through LEO satellite constellations, enhancing opportunities for advanced antenna technologies. Continuous research collaborations between universities, technology companies, and defense agencies further drive innovation and ensure Europe remains a key market contributor.

Asia Pacific

Asia Pacific held a 25% share of the Satellite Phased Array Antenna Market in 2024, driven by strong investments from China, Japan, and India in space and defense programs. The region is expanding satellite constellations to improve communication, navigation, and surveillance capabilities. Rapid urbanization and rising demand for mobile broadband connectivity fuel further adoption of phased array systems. Governments and private companies are increasingly investing in earth observation and regional navigation projects, strengthening market prospects. The growing emphasis on defense modernization and increasing satellite launches solidify Asia Pacific’s role as one of the fastest-growing regional markets.

Latin America

Latin America captured 7% of the Satellite Phased Array Antenna Market in 2024. The region is gradually adopting phased array technologies to expand satellite-based communication and improve connectivity in remote areas. Brazil and Mexico lead investments in satellite programs for defense, broadcasting, and broadband applications. Rising interest in space initiatives and public-private partnerships supports market penetration, although adoption is slower compared to developed regions. Increasing reliance on satellite services for disaster management and agricultural monitoring creates additional demand, while the push for rural broadband access further expands opportunities for phased array antenna deployment across the region.

Middle East and Africa

The Middle East and Africa accounted for 5% of the Satellite Phased Array Antenna Market in 2024. Defense and military modernization remain the primary growth drivers, with phased array antennas being deployed for secure communication and surveillance. Countries in the Gulf Cooperation Council are investing in satellite programs to diversify economies and strengthen national security. Africa is increasingly leveraging satellite communication for broadband connectivity in underserved areas, creating gradual demand growth. However, limited infrastructure and budget constraints slow widespread adoption, though rising government initiatives and regional partnerships are expected to boost future opportunities.

Market Segmentations:

By Component:

- Microcontrollers / microprocessors

- Field programmable gate arrays (FPGAs)

- Power amplifiers (PAs)

- Low noise amplifiers (LNAs)

- Phase shifters

- Transmit/receive (T/R) modules

- Others

By Array Type:

- Active phased array

- Passive phased array

By Application:

- Satellite communication

- Radar & sensing

- Navigation & tracking

- Mobile connectivity

- Earth observation

- Electronic warfare

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The Satellite Phased Array Antenna Market is shaped by leading players such as Hanwha Phasor (Hanwha Systems), Ball Aerospace, Honeywell, Thales Group, Intelsat, Raytheon Technologies (RTX), Kymeta, Lockheed Martin, and Northrop Grumman. These companies focus on advanced antenna design, beam steering precision, and integration of miniaturized RF components to strengthen their positions. Strategic collaborations with satellite operators, defense agencies, and telecom providers are enhancing adoption across communication, navigation, and sensing applications. Continuous R&D investment supports the development of lighter, more energy-efficient, and scalable phased arrays, ensuring compatibility with LEO constellations and next-generation networks. Competitive differentiation is also driven by cost efficiency, adaptability to mobile platforms, and meeting stringent defense requirements. The landscape reflects a mix of established aerospace leaders and innovative technology firms, creating a highly dynamic market where technological advancement and strategic partnerships remain the key factors defining future growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hanwha Phasor (Hanwha Systems)

- Ball Aerospace

- Honeywell

- Thales Group

- Intelsat

- Raytheon Technologies (RTX)

- Kymeta

- Lockheed Martin

- Northrop Grumman

Recent Developments

- In 2024, Hanwha Phasor (Hanwha Systems) announced the launch of its Phasor L3300B land antenna for commercial and military use.

- In 2023, Kymeta released the Peregrine u8 LEO terminal for maritime connectivity via the OneWeb LEO satellite network.

- In 2023, Ball Aerospace collaborated with Intelsat to develop a compact, software-defined ESA antenna for in-flight connectivity (IFC). The technology allows for seamless switching between GEO and LEO satellite networks.

Report Coverage

The research report offers an in-depth analysis based on Component, Array Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly with growing demand for satellite-based broadband services.

- Active phased array antennas will continue to dominate due to superior flexibility and performance.

- Defense modernization programs will drive steady adoption across radar, navigation, and surveillance systems.

- Integration with 5G networks will strengthen opportunities for mobile and IoT connectivity.

- LEO and MEO satellite constellations will fuel strong growth in communication applications.

- Miniaturization of components will make phased arrays viable for small satellites and UAVs.

- Partnerships between governments and private companies will accelerate large-scale deployments.

- Technological advancements in T/R modules will improve efficiency and reduce power consumption.

- Emerging markets will gradually adopt phased arrays to expand broadband access in remote areas.

- Ongoing R&D investments will ensure phased array antennas remain critical for space and defense innovation.