Market Overview

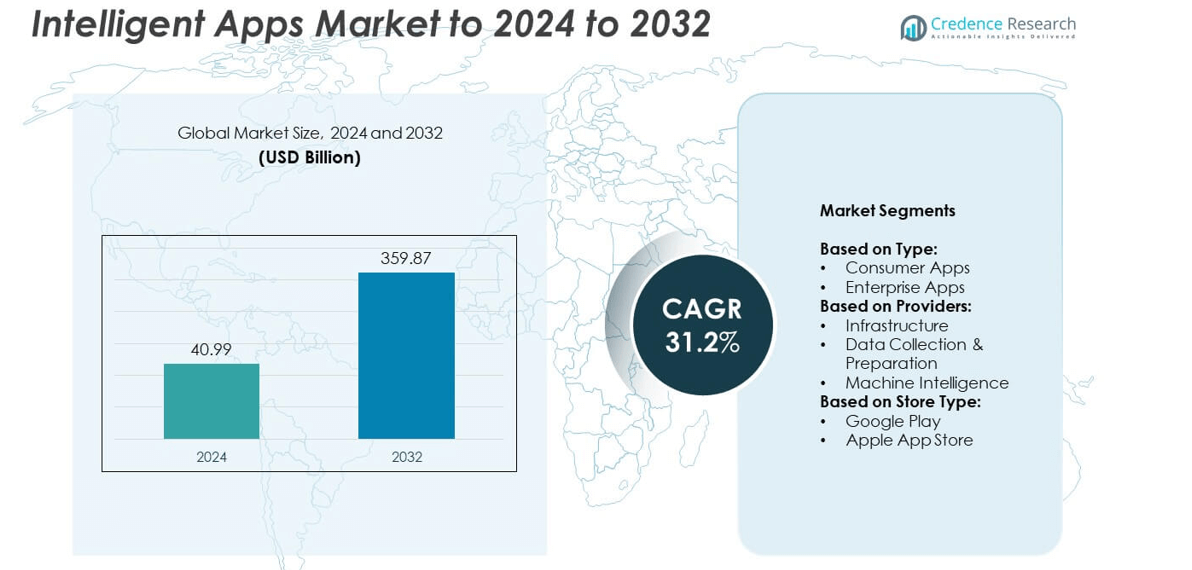

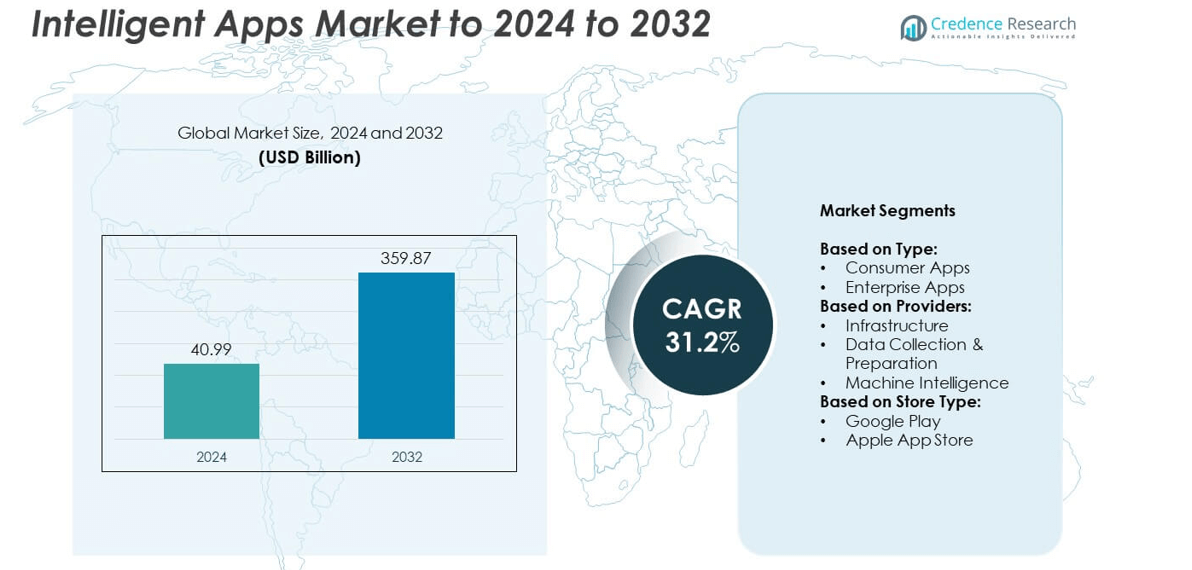

Intelligent Apps Market size was valued at USD 40.99 billion in 2024 and is anticipated to reach USD 359.87 billion by 2032, at a CAGR of 31.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Intelligent Apps Market Size 2024 |

USD 40.99 billion |

| Intelligent Apps Market, CAGR |

31.2% |

| Intelligent Apps Market Size 2032 |

USD 359.87 billion |

The intelligent apps market is led by major players including Intel Corporation, Salesforce.com, Inc, Apple Inc, SAP SE, ServiceNow, Google LLC, Microsoft, Oracle Corporation, Amazon Web Services Inc, Baidu Inc, and International Business Machines Corporation. These companies drive innovation through artificial intelligence, machine learning, and cloud-based platforms, offering advanced solutions across consumer and enterprise segments. North America emerged as the leading region in 2024, capturing nearly 38% of the global market share. Strong infrastructure, high smartphone penetration, and rapid enterprise adoption of intelligent technologies position the region as the central hub for intelligent app development and deployment.

Market Insights

- The intelligent apps market was valued at USD 40.99 billion in 2024 and is projected to reach USD 359.87 billion by 2032, expanding at a CAGR of 31.2% during 2025–2032.

- Key growth is fueled by increasing adoption of AI and machine learning, rising smartphone penetration, and strong enterprise focus on digital transformation across industries such as healthcare, finance, and retail.

- Market trends highlight growing integration with IoT and edge computing, expansion in healthcare and education sectors, and rising demand for personalized, real-time user experiences across consumer and enterprise applications.

- Competition is intense, with global technology leaders investing heavily in R&D, cloud platforms, and partnerships to strengthen market presence, while smaller players face challenges from high development and integration costs.

- North America led the market with 38% share in 2024, followed by Europe at 27% and Asia Pacific at 24%, while consumer apps dominated the type segment with over 58% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The Intelligent Apps market is segmented into consumer apps and enterprise apps, with consumer apps holding the dominant share of over 58% in 2024. Consumer apps lead due to their widespread adoption in social media, e-commerce, personalized recommendations, and virtual assistants. The rapid rise of smartphone penetration and growing user demand for personalized digital experiences drive this dominance. Enterprise apps are also expanding, supported by demand for workflow automation and predictive analytics, but consumer-focused intelligent apps continue to command the majority of market growth and revenue contribution.

- For instance, Microsoft disclosed over 400 million paid Office 365 seats in 2024.

By Providers

Among providers, the machine intelligence segment accounted for the largest market share of nearly 50% in 2024. This dominance stems from the integration of AI, deep learning, and natural language processing to deliver advanced app functionalities. Growing reliance on intelligent algorithms for personalization, fraud detection, and real-time decision-making has positioned machine intelligence as the primary driver of adoption. Infrastructure and data collection segments play supporting roles, but the value generated by machine learning and AI-powered insights ensures that machine intelligence remains the leading provider category in this market.

- For instance, OpenAI announced 100 million weekly active users and 2 million developers in 2023.

By Store Type

The Google Play store emerged as the leading distribution channel in 2024, holding around 60% share of the intelligent apps market. Its dominance is driven by the global reach of Android devices, particularly in emerging markets, coupled with a diverse app ecosystem. Google’s AI integration across apps and its wide developer base strengthen its leadership. The Apple App Store continues to grow, especially in North America and Europe, due to its strong user base and high monetization rates, but Google Play’s larger market coverage ensures its top position in intelligent app distribution.

Market Overview

Rising Adoption of Artificial Intelligence and Machine Learning

The integration of AI and machine learning stands as the most significant driver of the intelligent apps market. These technologies enable advanced personalization, predictive analytics, and real-time decision-making, making applications more responsive and user-centric. Industries such as healthcare, retail, and finance are rapidly deploying AI-powered apps to enhance efficiency and customer engagement. With growing demand for automation and predictive capabilities, AI and machine learning remain at the core of intelligent app innovation, setting the pace for market expansion.

- For instance, NVIDIA held a dominant position in the data center GPU market in 2024, with its market share widely reported to be around 92%, similar to 2023. This dominance was primarily fueled by the strong demand for its GPUs in AI workloads and its established CUDA software ecosystem.

Increasing Smartphone Penetration and App Usage

The rapid surge in smartphone penetration globally fuels the demand for intelligent apps. With billions of users accessing digital platforms daily, the need for personalized and intelligent user experiences is growing. Mobile-first economies in Asia-Pacific and Africa are particularly driving downloads and usage. Consumers increasingly seek convenience and customization in entertainment, retail, and lifestyle applications, pushing app developers to embed intelligence. This shift highlights how smartphones act as the critical channel through which intelligent apps gain mass adoption and sustained revenue growth.

- For instance, Xiaomi shipped 42.4 million smartphones in Q2 2025, reflecting the massive scale at which AI-ready devices are entering consumer markets

Enterprise Digital Transformation Initiatives

Businesses across industries are embracing intelligent apps to streamline operations and improve productivity. Enterprises are integrating intelligent apps for use cases such as predictive maintenance, workflow optimization, and customer engagement. Cloud adoption, coupled with advanced analytics, supports scalable enterprise app deployment. The growing emphasis on digital transformation strategies, especially post-pandemic, has positioned enterprise apps as crucial tools in achieving efficiency and competitive advantage. As organizations continue prioritizing digital-first models, demand for enterprise-focused intelligent apps is expected to accelerate over the forecast period.

Key Trends & Opportunities

Integration with IoT and Edge Computing

A major trend in the intelligent apps market is the integration of IoT and edge computing. Intelligent apps are increasingly being developed to process data locally on connected devices, reducing latency and enhancing real-time decision-making. Industries such as smart homes, manufacturing, and healthcare benefit from this shift, as IoT-powered apps deliver immediate insights. The combination of edge computing with intelligent apps opens opportunities for low-latency, secure, and scalable applications, strengthening their value proposition in next-generation connected ecosystems.

- For instance, Teladoc’s overall US Integrated Care membership has expanded significantly. By the end of 2024, this membership had reached 93.8 million lives, reflecting a much broader adoption of its virtual care offerings.

Expansion in Healthcare and Education Sectors

Healthcare and education represent significant opportunities for intelligent app adoption. In healthcare, intelligent apps support telemedicine, remote monitoring, and patient management, enhancing accessibility and outcomes. Similarly, in education, intelligent learning apps provide personalized lessons and adaptive content, expanding access to digital learning platforms worldwide. Both industries face growing digital demand, fueled by rising global investment in smart healthcare and e-learning infrastructure. This expansion ensures that intelligent apps move beyond consumer and enterprise usage to become essential in critical service sectors.

- For instance, The augmented reality game Pokémon GO maintained a large user base under developer Niantic, with third-party market data from 2023 suggesting around 70 to 80 million monthly active users.

Key Challenges

Data Privacy and Security Concerns

One of the primary challenges limiting the intelligent apps market is data privacy and security risks. Intelligent apps depend heavily on user data for personalization, raising concerns about misuse, breaches, and non-compliance with regulations. Stricter global laws such as GDPR and CCPA intensify the pressure on developers to ensure secure data practices. Balancing personalized experiences with user trust remains difficult, as security lapses can damage brand reputation and adoption rates. Addressing this challenge requires robust data governance and transparent privacy policies.

High Development and Integration Costs

The development and integration of intelligent apps involve high costs, creating a challenge for smaller firms and startups. Embedding AI, machine learning, and natural language processing requires specialized talent, infrastructure, and continuous updates. Many businesses face barriers in scaling due to limited budgets, while large enterprises can absorb these costs more effectively. This cost factor slows down adoption among small and medium enterprises, which could otherwise benefit from intelligent apps. Reducing costs through cloud-based solutions and open-source frameworks remains vital to overcome this barrier.

Regional Analysis

North America

North America held the largest share of the intelligent apps market in 2024, accounting for nearly 38%. The region benefits from strong adoption of AI technologies, advanced infrastructure, and high smartphone penetration. Enterprises across finance, healthcare, and retail drive demand for intelligent apps to enhance operational efficiency and customer engagement. Leading providers and app developers in the United States contribute significantly to innovation, with investments in AI, cloud platforms, and IoT integration. Government support for digital transformation further accelerates adoption, positioning North America as the primary hub for intelligent app development and deployment.

Europe

Europe captured around 27% share of the intelligent apps market in 2024, supported by strong enterprise adoption and regulatory-driven innovation. Countries such as Germany, the UK, and France are at the forefront, emphasizing digital transformation in sectors like manufacturing, healthcare, and education. European enterprises increasingly integrate intelligent apps for compliance, predictive analytics, and personalized services. The presence of leading global technology companies alongside regional innovators enhances the competitive landscape. Growth is also supported by expanding 5G networks and smart city projects, making Europe a key contributor to market expansion while focusing on data security and transparency.

Asia Pacific

Asia Pacific accounted for nearly 24% of the intelligent apps market in 2024, driven by rapid smartphone adoption and growing internet penetration. Countries such as China, India, Japan, and South Korea are key growth engines, with strong demand for consumer and enterprise apps. The rise of e-commerce, digital payments, and mobile-first platforms contributes to strong adoption of AI-enabled applications. Governments in the region actively promote digital initiatives, including smart city projects and industry automation. Local startups and global tech companies collaborate to expand offerings, positioning Asia Pacific as the fastest-growing market for intelligent apps worldwide.

Latin America

Latin America represented about 6% of the intelligent apps market in 2024, with growth supported by increasing smartphone penetration and rising interest in digital transformation. Brazil and Mexico lead regional adoption, particularly in consumer-facing apps such as e-commerce, financial services, and entertainment. Enterprises in the region are gradually adopting intelligent apps to improve operations and enhance customer experiences. Infrastructure challenges and budget limitations slightly slow progress, but improving internet connectivity and growing investment in AI solutions create opportunities. With a young, tech-savvy population, Latin America continues to emerge as an important growth frontier for intelligent apps.

Middle East and Africa

The Middle East and Africa collectively held around 5% share of the intelligent apps market in 2024, reflecting early-stage but promising growth. The UAE, Saudi Arabia, and South Africa are leading adopters, investing heavily in smart city initiatives, digital health, and financial apps. The growing use of intelligent apps in banking and government services highlights expanding opportunities. Although challenges such as limited infrastructure and lower enterprise readiness remain, increasing smartphone usage and strategic government initiatives fuel momentum. The region is expected to gradually increase its share, supported by ongoing investments in AI and digital transformation projects.

Market Segmentations:

By Type:

- Consumer Apps

- Enterprise Apps

By Providers:

- Infrastructure

- Data Collection & Preparation

- Machine Intelligence

By Store Type:

- Google Play

- Apple App Store

By Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

Intel Corporation, Salesforce.com, Inc, Apple Inc, SAP SE, ServiceNow, Google LLC, Microsoft, Oracle Corporation, Amazon Web Services Inc, Baidu Inc, and International Business Machines Corporation dominate the competitive landscape of the intelligent apps market. These companies leverage advanced artificial intelligence, machine learning, and cloud-based platforms to deliver innovative solutions across consumer and enterprise applications. Their strategies emphasize large-scale integration of predictive analytics, natural language processing, and automation to enhance customer experience and operational efficiency. Strategic investments in research and development, partnerships, and acquisitions further strengthen their offerings and expand their global reach. With a focus on personalization, scalability, and security, the leading vendors continue to shape the market by introducing intelligent applications that cater to industries ranging from healthcare and finance to retail and education. The competitive environment is defined by constant innovation and technological advancements, ensuring sustained growth opportunities throughout the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Intel Corporation

- Apple Inc

- SAP SE

- ServiceNow

- Google LLC

- Microsoft

- Oracle Corporation

- Amazon Web Services Inc

- Baidu Inc

- International Business Machines Corporation

Recent Developments

- In 2024, Microsoft expanded its Copilot suite, embedding Generative AI assistance across its Microsoft 365, Dynamics 365, and Power Platform to automate tasks, generate content, and accelerate development for both business users and professional developers.

- In 2024, Salesforce, Inc. focus included introducing concepts like Agentforce, using autonomous AI agents to perform complex, multi-step customer engagement tasks without continuous human interaction, and integrating Data Cloud for real-time unified data to power hyper-personalization.

- In 2024, IBM released a family of Granite models into open source and launched InstructLab, a first-of-its-kind capability, in collaboration with Red Hat

Report Coverage

The research report offers an in-depth analysis based on Type, Providers, Store Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The intelligent apps market will grow rapidly with strong adoption across industries.

- AI and machine learning will remain the core technologies driving innovation.

- Consumer apps will continue leading adoption, fueled by personalization demands.

- Enterprise-focused apps will expand as digital transformation accelerates.

- Healthcare and education will emerge as high-potential growth sectors.

- Integration with IoT and edge computing will enhance real-time capabilities.

- Data privacy and security regulations will shape app development strategies.

- Cloud-based deployment will lower costs and increase scalability for businesses.

- Asia Pacific will register the fastest growth due to rising smartphone penetration.

- Strategic partnerships between tech giants and startups will strengthen market competitiveness.