Market Overview

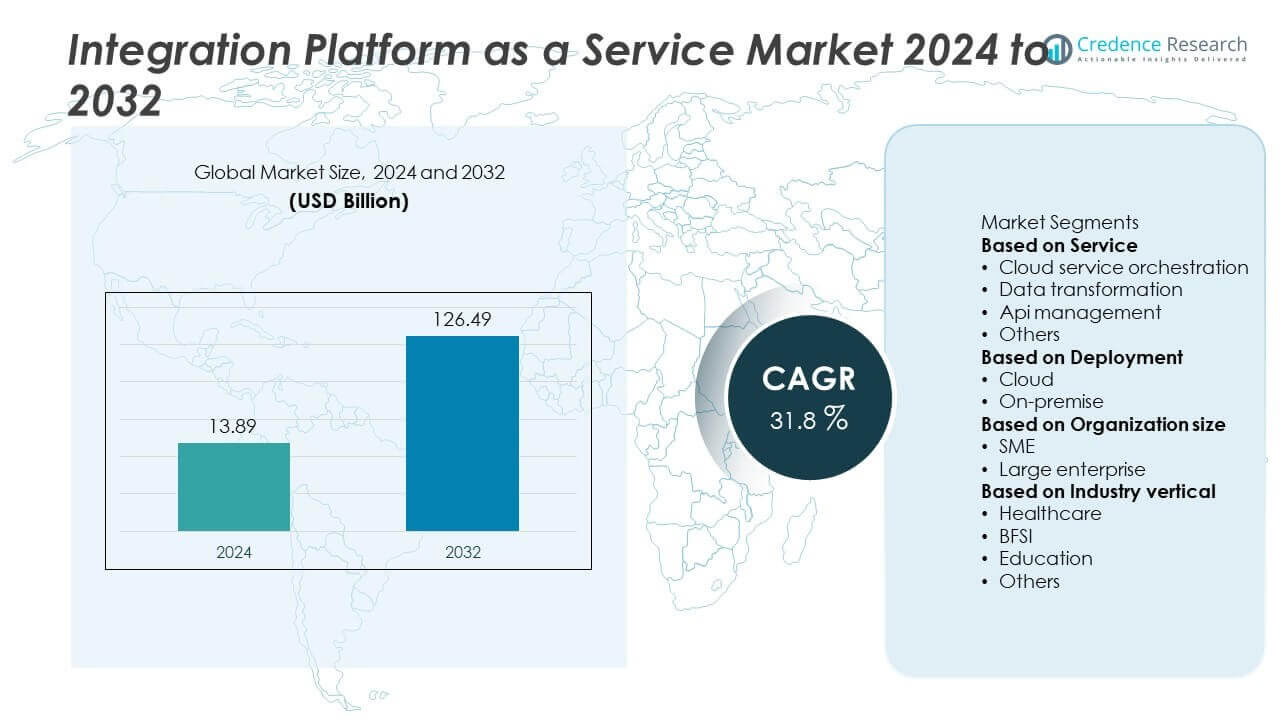

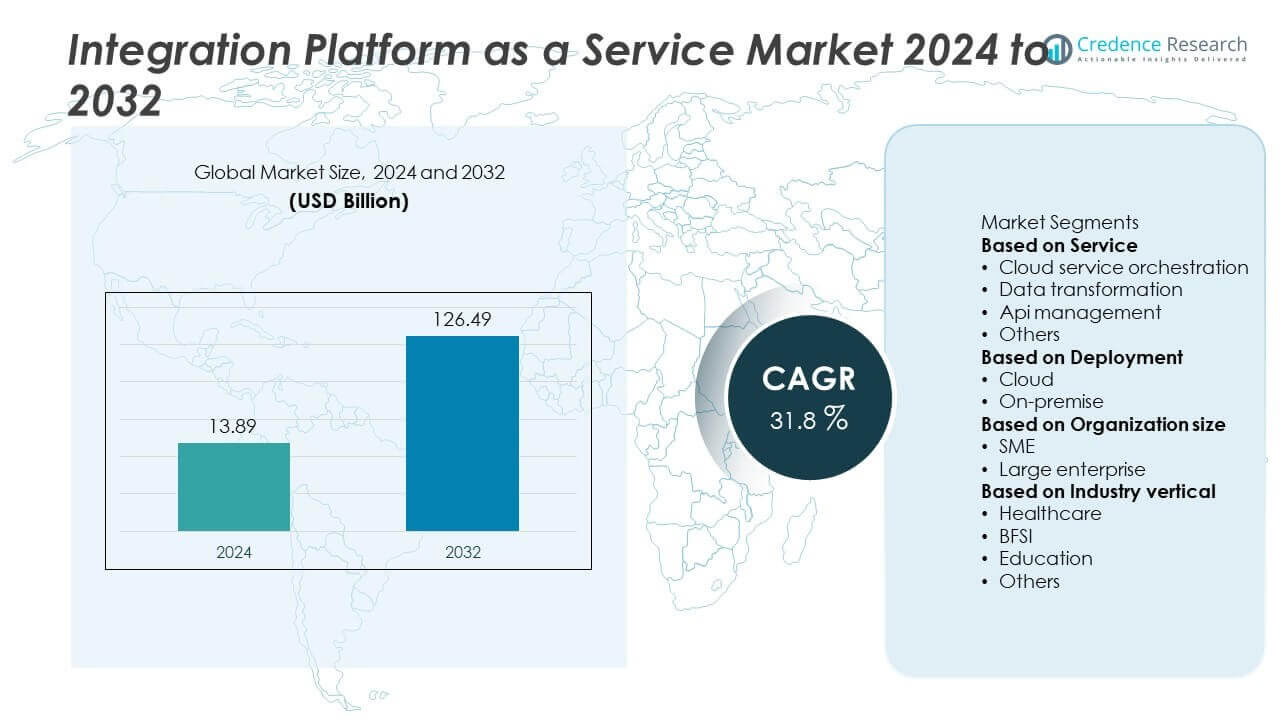

The Integration Platform as a Service (iPaaS) market was valued at USD 13.89 billion in 2024. It is projected to reach USD 126.49 billion by 2032, registering a strong CAGR of 31.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Integration Platform as a Service (iPaaS) Market Size 2024 |

USD 13.89 Billion |

| Integration Platform as a Service (iPaaS) Market, CAGR |

31.8% |

| Integration Platform as a Service (iPaaS) Market Size 2032 |

USD 126.49 Billion |

The Integration Platform as a Service market is highly competitive, with leading players including Oracle Corporation, Boomi, Inc., IBM Corporation, Workato, Microsoft Corporation, Informatica, Salesforce, SnapLogic, MuleSoft, and TIBCO Software. These companies drive innovation through advanced cloud integration, API management, and AI-enabled orchestration tools to address diverse enterprise needs. Regional analysis highlights North America as the leading market with 39% share in 2024, supported by strong cloud adoption and robust IT infrastructure. Europe follows with 27% share, driven by stringent data compliance requirements, while Asia Pacific holds 23% share, emerging as the fastest-growing region due to rapid digital transformation and SME expansion.

Market Insights

Market Insights

- The Integration Platform as a Service market was valued at USD 13.89 billion in 2024 and is projected to reach USD 126.49 billion by 2032, growing at a CAGR of 31.8%.

- Rising cloud adoption and growing demand for real-time data integration act as key market drivers, enabling enterprises to streamline workflows and improve connectivity across diverse systems.

- Major trends include the expansion of the API economy, increased adoption of AI-driven integration, and rising uptake among SMEs seeking cost-effective, scalable solutions.

- The competitive landscape is led by Oracle, Boomi, IBM, Workato, Microsoft, Informatica, Salesforce, SnapLogic, MuleSoft, and TIBCO Software, with players focusing on innovation, acquisitions, and multi-cloud support.

- Regionally, North America dominated with 39% share in 2024, followed by Europe at 27% and Asia Pacific at 23%, while API management services led the market by service type with 38% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Service

In 2024, API management held the dominant share of the Integration Platform as a Service market, accounting for nearly 38%. The leadership is attributed to the growing need for seamless connectivity between applications, systems, and devices in digital ecosystems. Enterprises rely on API management to streamline integration, secure data exchange, and enable real-time communication across cloud and legacy platforms. Rising adoption of microservices and SaaS-based business models continues to drive demand for scalable API solutions, reinforcing API management as the leading service segment in the market.

- For instance, Kong Inc. reports handling over 400 billion API requests per day across its global managed service, Kong Konnect, enabling enterprises to achieve high availability with a 99.95% SLA for Dedicated Cloud Gateways (and up to 99.99% for multi-region deployments) while providing robust, dynamic API traffic management and security for mission-critical applications.

By Deployment

The cloud deployment segment accounted for the largest share, capturing over 70% of the iPaaS market in 2024. Its dominance is fueled by the scalability, cost efficiency, and agility of cloud-hosted platforms compared to on-premise systems. Enterprises increasingly adopt cloud-based integration for faster implementation, remote accessibility, and enhanced collaboration across distributed teams. Cloud-first strategies by organizations and growing preference for subscription-based models further strengthen this segment’s leadership. Expanding reliance on hybrid and multi-cloud ecosystems ensures sustained demand for cloud deployment over the forecast period.

- For instance, MuleSoft’s Anypoint Platform supports integrations for thousands of customers globally, processing vast numbers of API calls monthly. Its scalable architecture can be deployed in the cloud, on-premises, or in hybrid environments, and includes features like auto-scaling and spike control policies that dynamically adjust resources to meet demand.

By Organization Size

Large enterprises led the iPaaS market in 2024, holding around 60% of the share. Their dominance stems from complex integration needs across diverse business units, global operations, and advanced digital transformation initiatives. Large organizations prioritize integration to improve customer engagement, streamline workflows, and enhance data-driven decision-making. Investments in AI-driven integration and compliance-focused solutions further support large enterprise adoption. While SMEs are rapidly adopting iPaaS for cost-effective scalability, the extensive budgets, high transaction volumes, and focus on IT modernization among large enterprises maintain their market leadership.

Key Growth Drivers

Rising Cloud Adoption

The rapid shift toward cloud-first strategies serves as a key driver for iPaaS growth. Enterprises increasingly deploy hybrid and multi-cloud architectures to gain flexibility and scalability. iPaaS enables seamless data integration across diverse platforms, reducing operational silos and improving efficiency. With over 70% of enterprises adopting cloud-based solutions in 2024, demand for integration platforms continues to rise. Cloud-native capabilities such as automated scaling, subscription models, and simplified management strengthen adoption, making cloud integration central to enterprise digital transformation initiatives.

- For instance, Boomi’s cloud-native iPaaS platform supports over 25,000 global customers and has recently achieved significant transaction milestones.

Demand for Real-Time Data Integration

The growing emphasis on real-time data sharing and analytics fuels iPaaS adoption. Organizations need instant insights to support customer personalization, predictive analytics, and efficient workflows. iPaaS solutions simplify data transformation and synchronization between on-premise and cloud systems, enabling smooth operations. In 2024, real-time integration accounted for a significant share of deployments in sectors like finance and retail. This demand is further reinforced by IoT applications and API-led ecosystems, where continuous data flow is critical for decision-making and maintaining competitive advantage.

- For instance, SnapLogic’s iPaaS platform has processed trillions of documents and billions of pipelines per month for its customers, supporting streaming analytics and real-time operational dashboards used by global enterprises for immediate decision-making and customer engagement optimization.

API Economy Expansion

The expansion of the API economy has emerged as a major growth driver for iPaaS. Modern enterprises rely on APIs to connect applications, foster innovation, and unlock new revenue streams. API management services held nearly 38% of the iPaaS market in 2024, highlighting their importance. Businesses increasingly adopt iPaaS platforms to manage, secure, and scale APIs across ecosystems. This demand is strengthened by microservices-based architectures, mobile-first applications, and SaaS adoption. As enterprises prioritize agility and interoperability, API-driven integration continues to accelerate iPaaS market expansion.

Key Trends & Opportunities

Adoption of AI-Driven Integration

AI-driven integration is becoming a transformative trend in the iPaaS market. Vendors embed artificial intelligence to automate workflows, enhance predictive analytics, and improve error detection. This reduces manual intervention and accelerates integration efficiency across enterprise systems. With enterprises seeking intelligent data orchestration, AI-enabled platforms present strong opportunities for differentiation. As AI capabilities advance, iPaaS providers are developing tools for automated mapping, anomaly detection, and performance optimization. This evolution positions AI-driven integration as a strategic opportunity for future platform growth.

- For instance, APPSeCONNECT’s AI iPaaS platform employs machine learning to automate data mapping and detect anomalies, and the company claims to handle billions of integration transactions annually with high data accuracy, which reportedly helps reduce manual configuration time and error rates.

Rising SME Adoption

Small and medium enterprises represent a growing opportunity in the iPaaS landscape. SMEs seek cost-effective, scalable integration solutions that enable digital transformation without heavy infrastructure investments. In 2024, SMEs accounted for nearly 40% of deployments, reflecting accelerating adoption. Subscription-based iPaaS models allow SMEs to compete with larger players by streamlining processes and enhancing agility. As globalization and e-commerce expand, SMEs are increasingly integrating cloud applications, CRMs, and ERP systems. This trend highlights a strong opportunity for vendors targeting flexible, SME-focused integration offerings.

- For instance, Aonflow’s iPaaS platform allows businesses of all sizes, including SMEs, to automate workflows using its low-code/no-code visual interface based on pre-built connectors and a drag-and-drop workflow designer.

Key Challenges

Data Security and Compliance Concerns

Data security remains a critical challenge for iPaaS adoption, particularly in regulated industries. Integrating sensitive data across multiple environments raises risks of breaches and non-compliance. Enterprises must adhere to GDPR, HIPAA, and other regional data protection frameworks, making security features a top priority. Inconsistent compliance across global cloud providers further complicates integration strategies. Concerns about unauthorized access, API vulnerabilities, and third-party risks limit adoption in some sectors. Vendors must strengthen encryption, identity management, and compliance support to address these barriers effectively.

Integration Complexity in Hybrid Environments

The increasing adoption of hybrid and multi-cloud ecosystems poses integration challenges for enterprises. Connecting legacy on-premise systems with modern SaaS platforms requires advanced orchestration capabilities. Many organizations face difficulties in managing diverse APIs, data formats, and application lifecycles. This complexity increases implementation costs and delays, especially for large enterprises with global operations. In 2024, over 60% of enterprises reported challenges in scaling hybrid integration strategies. Addressing this issue requires enhanced interoperability, low-code tools, and pre-built connectors to simplify deployment and reduce complexity.

Regional Analysis

North America

North America dominated the Integration Platform as a Service market in 2024, accounting for 39% share. The region’s leadership stems from strong cloud adoption, advanced IT infrastructure, and high enterprise digitalization. Large-scale investments by U.S. enterprises in API-driven integration and hybrid cloud platforms support growth. The presence of leading vendors and early adoption of AI-enabled orchestration tools further strengthen regional demand. Industries such as finance, healthcare, and retail drive adoption to streamline workflows and enhance real-time data management. Regulatory compliance frameworks and innovation-focused enterprises continue to position North America as the leading regional market.

Europe

Europe held a significant 27% share of the Integration Platform as a Service market in 2024. Growth is driven by stringent data protection regulations such as GDPR, which push enterprises to adopt secure integration platforms. European enterprises invest in iPaaS to unify cloud and legacy systems while ensuring compliance. Rising demand across manufacturing, BFSI, and telecom sectors supports expansion. Strong adoption of multi-cloud strategies in countries like Germany, the UK, and France contributes to regional growth. Vendor partnerships with European firms to deliver localized, compliance-focused integration services enhance Europe’s role in the global market.

Asia Pacific

Asia Pacific captured 23% share of the Integration Platform as a Service market in 2024, reflecting the fastest growth rate among all regions. The surge is driven by rapid cloud adoption, expanding SME base, and rising investments in digital transformation across China, India, and Japan. Enterprises in the region increasingly rely on iPaaS solutions to integrate e-commerce platforms, CRMs, and ERP systems. Government-led initiatives supporting Industry 4.0 and smart manufacturing also boost demand. The expansion of mobile-first applications and API-driven ecosystems further accelerates adoption, making Asia Pacific a key growth hotspot for iPaaS vendors.

Latin America

Latin America accounted for 6% share of the Integration Platform as a Service market in 2024. The region is witnessing growing demand for digital integration as businesses modernize IT systems and embrace cloud solutions. Brazil and Mexico lead adoption, driven by banking, retail, and telecommunications sectors. Rising investment in e-commerce platforms also supports demand for API-driven integration. However, challenges such as limited infrastructure and cybersecurity concerns restrict broader uptake. International vendors expanding partnerships with regional enterprises aim to address these barriers, while increasing SME adoption highlights growth potential in Latin America’s evolving digital economy.

Middle East & Africa

The Middle East & Africa represented 5% share of the Integration Platform as a Service market in 2024. Enterprises across the region are gradually adopting iPaaS to support digital transformation initiatives in banking, energy, and government sectors. The UAE and Saudi Arabia lead in deployment, driven by national strategies promoting cloud adoption and smart city projects. While market penetration remains lower compared to other regions, rising investment in cloud infrastructure and IT modernization is creating opportunities. Vendors focusing on localized solutions and data security compliance are expected to accelerate regional growth over the forecast period.

Market Segmentations:

By Service

- Cloud service orchestration

- Data transformation

- Api management

- Others

By Deployment

By Organization size

By Industry vertical

- Healthcare

- BFSI

- Education

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Integration Platform as a Service market is shaped by key players such as Oracle Corporation, Boomi, Inc., IBM Corporation, Workato, Microsoft Corporation, Informatica, Salesforce, SnapLogic, MuleSoft, and TIBCO Software. These companies focus on enhancing integration capabilities through advanced cloud-based platforms, API management, and AI-driven orchestration tools. Strategic investments in multi-cloud support, low-code solutions, and industry-specific integration frameworks help them address diverse enterprise requirements. Partnerships, acquisitions, and continuous product innovation remain central to strengthening market presence. Vendors are also prioritizing compliance-focused solutions to meet strict regional regulations, particularly in Europe and North America. With enterprises accelerating digital transformation, competition intensifies as players expand service portfolios to capture opportunities in fast-growing markets such as Asia Pacific and Latin America. This dynamic environment fosters innovation while pushing vendors to deliver scalable, secure, and cost-effective integration solutions tailored to organizations of all sizes.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, Workato’s integration role was cited in a Forbes article about data fabric and integrating AI & data pipelines.

- In May 2025, Oracle was named a Challenger in the Gartner Magic Quadrant for Integration Platform as a Service (iPaaS).

- In February 2025, IBM introduced AI Integration Services to support agentic AI in business process workflows.

- In March 2024, Oracle was named a Leader in Gartner’s Magic Quadrant for iPaaS—for the 7th consecutive year.

Report Coverage

The research report offers an in-depth analysis based on Service, Deployment, Organization size, Industry vertical and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding rapidly with strong double-digit growth through the forecast period.

- Cloud deployment will remain the preferred choice, driving scalability and agility for enterprises.

- API management will sustain its dominance as businesses adopt microservices and SaaS platforms.

- AI-driven integration will gain momentum, automating workflows and enhancing real-time data orchestration.

- SMEs will increasingly adopt iPaaS solutions to support digital transformation and competitiveness.

- Large enterprises will invest heavily in advanced integration to manage complex global operations.

- Security and compliance-focused solutions will remain critical to meet regulatory demands.

- Vendors will expand partnerships and acquisitions to strengthen market presence and service portfolios.

- Asia Pacific will emerge as the fastest-growing region with rising adoption across industries.

- The market will shift toward low-code and no-code integration platforms to simplify deployment.

Market Insights

Market Insights