Market Overview

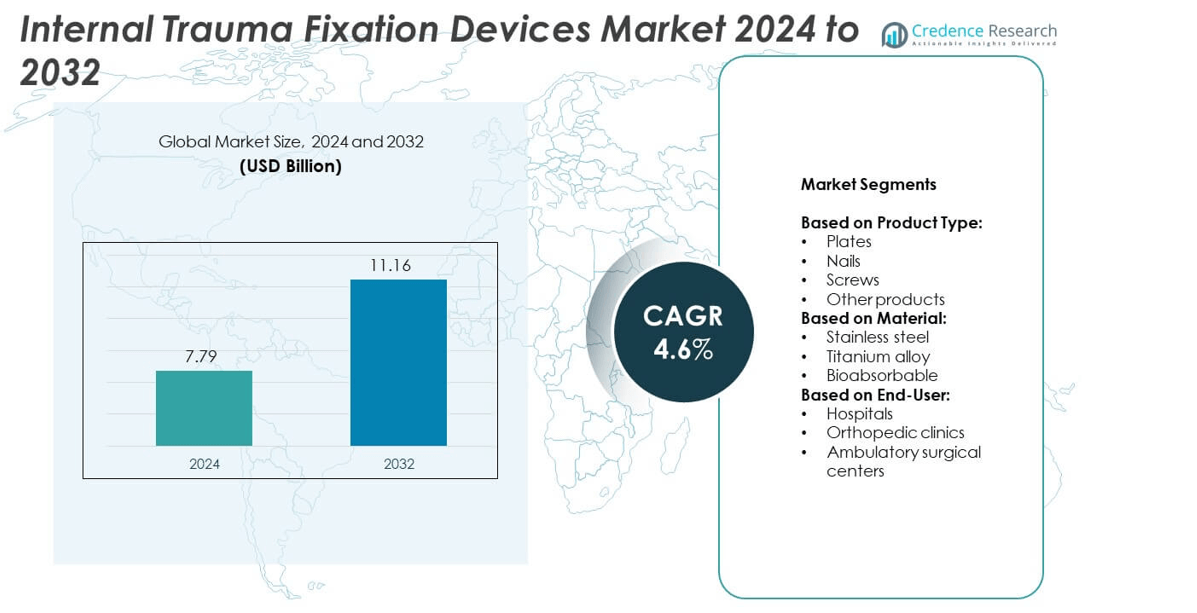

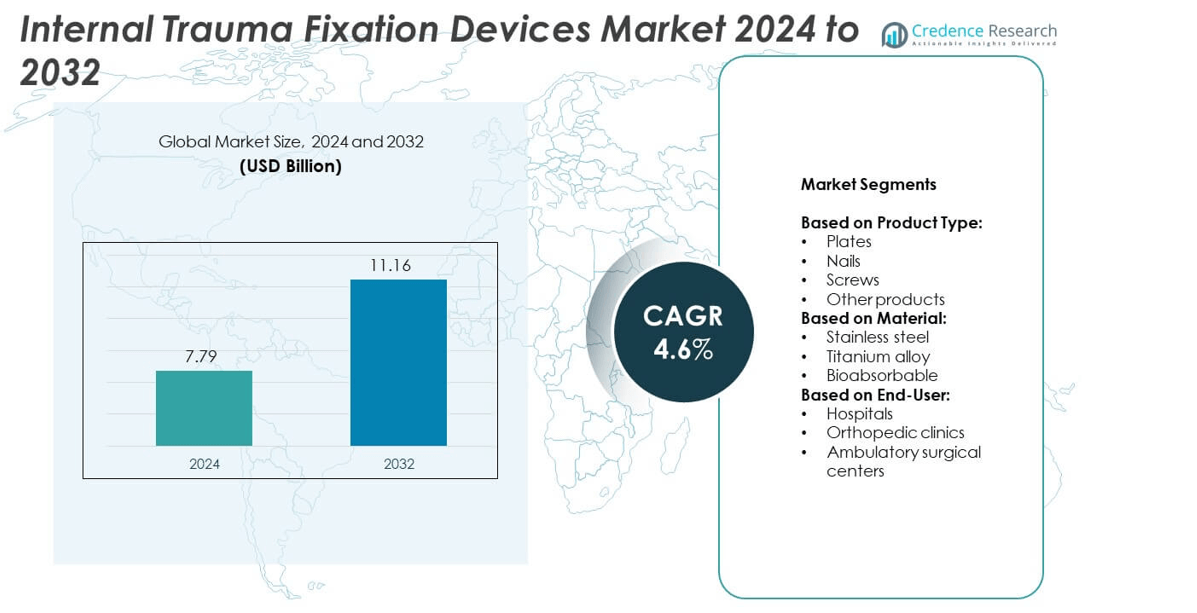

Internal Trauma Fixation Devices Market size was valued at USD 7.79 Billion in 2024 and is projected to reach USD 11.16 Billion by 2032, growing at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Internal Trauma Fixation Devices Market Size 2024 |

USD 7.79 Billion |

| Internal Trauma Fixation Devices Market, CAGR |

4.6% |

| Internal Trauma Fixation Devices Market Size 2032 |

USD 11.16 Billion |

The Internal Trauma Fixation Devices market is driven by rising fracture cases from accidents, sports injuries, and aging populations. Demand for minimally invasive surgical solutions is increasing to enable faster recovery and reduced hospital stays. Technological innovations, including bioabsorbable materials and 3D-printed implants, enhance patient outcomes and reduce revision surgeries. Growing healthcare infrastructure and favorable reimbursement policies support higher adoption rates. Surgeons benefit from training programs that improve procedural success, further boosting device utilization across hospitals, orthopedic clinics, and ambulatory surgical centers worldwide.

North America leads the Internal Trauma Fixation Devices market due to advanced healthcare infrastructure and high adoption of innovative implants. Europe follows with strong demand driven by road accident cases and a skilled surgical workforce. Asia-Pacific is the fastest-growing region, supported by expanding hospital networks and rising trauma cases. Key players driving growth include Smith+Nephew, Johnson & Johnson, Zimmer Biomet, and Stryker Corporation, who focus on innovation, strategic partnerships, and expanding distribution networks to strengthen their global presence.

Market Insights

- The Internal Trauma Fixation Devices market was valued at USD 7.79 Billion in 2024 and is projected to reach USD 11.16 Billion by 2032, growing at a CAGR of 4.6% during 2025–2032.

- Rising fracture cases from road accidents, sports injuries, and aging populations are driving steady demand for fixation devices.

- Minimally invasive surgical techniques and adoption of bioabsorbable and 3D-printed implants are reshaping treatment approaches.

- The market is highly competitive with major players like Smith+Nephew, Johnson & Johnson, Zimmer Biomet, and Stryker Corporation focusing on R&D and global reach.

- High cost of implants and limited access in rural and low-income regions restrain market expansion.

- North America leads due to advanced healthcare systems, while Asia-Pacific shows fastest growth with increasing healthcare investments and rising patient awareness.

- Digital technologies, patient-specific implants, and partnerships between hospitals and manufacturers present significant opportunities for innovation and market penetration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Incidence of Fractures and Trauma Cases

The Internal Trauma Fixation Devices market is driven by increasing road accidents, sports injuries, and falls. Growing geriatric population is more prone to bone fractures, especially hip and spine. It is fueling demand for reliable fixation solutions that offer stability and quicker recovery. Hospitals and trauma centers are adopting advanced devices to improve surgical outcomes. Rising awareness of timely fracture treatment is encouraging early intervention. This trend is expanding procedure volumes globally.

- For instance, Promimic AB sold 45,000 HAnano Surface screws over 18 months after launch, with no replacements needed according to their clinical results.

Technological Innovations and Product Advancements

Manufacturers focus on developing devices with improved biocompatibility and mechanical strength. The Internal Trauma Fixation Devices market benefits from titanium and bioabsorbable materials that reduce revision surgeries. It supports patient comfort through minimally invasive systems and customized implants. Integration of 3D printing allows production of patient-specific fixation plates. Robotic-assisted surgery adoption improves precision and healing rates. New product launches strengthen industry competitiveness.

- For instance, AAP Implantate AG sells its LOQTEQ anatomical plate system and cannulated screws in around 25 countries internationally.

Supportive Healthcare Infrastructure and Insurance Coverage

Governments invest in trauma care centers and orthopedic facilities to handle rising injury cases. The Internal Trauma Fixation Devices market gains from favorable reimbursement policies supporting fracture surgeries. It encourages patients to undergo early treatment without high financial burden. Expansion of private hospitals in emerging economies improves access to advanced implants. Training programs for surgeons enhance expertise and procedural success. Improved logistics ensure timely availability of critical devices.

Rising Adoption in Emerging Economies and Urban Areas

Urbanization and industrial activity increase workplace injuries and accident-related fractures. The Internal Trauma Fixation Devices market experiences strong growth in Asia-Pacific and Latin America. It is supported by expanding healthcare budgets and better distribution networks. Manufacturers target these regions with cost-effective devices to meet affordability needs. Awareness campaigns promote early fracture management and rehabilitation. Market penetration is expected to strengthen further with ongoing infrastructure upgrades.

Market Trends

Growing Shift Toward Minimally Invasive Surgical Techniques

The Internal Trauma Fixation Devices market is witnessing a strong move toward minimally invasive procedures. Surgeons prefer smaller incisions that reduce blood loss and post-operative pain. It helps patients recover faster and lowers hospital stay duration. Advanced fixation systems are designed for easier insertion and reduced tissue disruption. Demand for minimally invasive implants is growing across trauma and orthopedic departments. This trend is reshaping product development strategies for leading manufacturers.

- For instance, Stryker trains 5,000+ clinicians yearly and manages 20,000+ SKUs in Trauma. Its team counts 750+ people.

Rising Use of Biodegradable and Bioabsorbable Materials

Manufacturers focus on bioabsorbable plates, screws, and pins to avoid secondary surgeries. The Internal Trauma Fixation Devices market benefits from materials that degrade naturally after healing. It reduces patient discomfort and risk of implant-related infections. Surgeons adopt these solutions for pediatric and small-bone fractures. Research initiatives aim to enhance strength and controlled degradation rates. Growing preference for these devices is driving regulatory approvals globally.

- For instance, As reported in its Annual Report and other official documents, Medartis employs approximately 950 people, operates across 13 sites, and sells its products in over 50 countries.

Integration of Digital and Smart Technologies in Fixation Systems

Smart implants with embedded sensors are entering clinical practice to monitor bone healing. The Internal Trauma Fixation Devices market supports innovations that transmit data to surgeons for follow-up care. It improves treatment planning and early detection of complications. IoT-based platforms enhance post-surgery tracking and patient engagement. Companies invest in connected orthopedic devices to differentiate offerings. These digital solutions are gaining acceptance in technologically advanced markets.

Increasing Focus on Patient-Specific and Customized Implants

3D printing and computer-assisted design enable development of patient-matched implants. The Internal Trauma Fixation Devices market sees rising demand for customized plates and nails for complex fractures. It improves surgical accuracy and long-term outcomes. Hospitals collaborate with manufacturers for on-demand production of personalized devices. Customization is especially valuable in trauma cases with unique anatomical requirements. Wider adoption of such solutions is expected with cost reductions and faster production times.

Market Challenges Analysis

High Cost of Devices and Limited Access in Low-Income Regions

The Internal Trauma Fixation Devices market faces challenges due to high implant and surgery costs. Many patients in developing nations cannot afford advanced fixation solutions. It limits adoption and delays treatment for fracture cases. Public healthcare budgets are often insufficient to subsidize expensive procedures. Small hospitals struggle to maintain inventory of specialized implants. Lack of insurance coverage in rural areas further restricts patient access. This cost barrier slows market penetration in price-sensitive regions.

Risk of Post-Surgical Complications and Device Failures

Infection, implant loosening, and non-union of fractures remain significant concerns for surgeons. The Internal Trauma Fixation Devices market is affected when patients require revision surgeries. It increases hospital expenses and prolongs recovery time. Product recalls or failures can damage manufacturer reputation. Strict regulatory approvals also slow introduction of new devices. Skilled surgeon availability is uneven across regions, impacting consistent outcomes. These factors collectively create obstacles for market growth and wider acceptance.

Market Opportunities

Expansin of Healthcare Infrastructure and Trauma Care Facilities

he Internal Trauma Fixation Devices market has significant growth opportunities through rising hospital infrastructure investments. Governments are building specialized trauma centers to manage road accident and workplace injury cases. It improves availability of advanced surgical equipment and trained professionals. Private healthcare providers expand orthopedic departments to meet growing demand. Emerging economies focus on improving rural healthcare access, creating new patient pools. This expansion strengthens device adoption and supports higher surgical procedure volumes.

Advancement in Materials and Personalized Treatment Solutions

Innovations in titanium alloys, bioabsorbable composites, and 3D printing open new opportunities. The Internal Trauma Fixation Devices market benefits from patient-specific implants that enhance recovery outcomes. It supports customized solutions for complex fractures and rare anatomical cases. Digital planning tools combined with robotics improve accuracy and shorten surgery time. Manufacturers investing in R&D gain a competitive edge with differentiated offerings. Growing preference for smart and connected devices also unlocks premium market segments.

Market Segmentation Analysis:

By Product Type:

Plates hold the largest share due to their wide use in fracture fixation. The Internal Trauma Fixation Devices market benefits from their ability to stabilize complex fractures in long bones. It supports rapid healing and offers high compatibility with different anatomical sites. Nails are gaining traction for load-bearing bone injuries, especially femur and tibia fractures. Screws remain essential for small-bone and craniofacial fixation, ensuring precise stabilization. Other products, including wires and pins, serve niche applications in pediatric and temporary fixation cases.

- For instance, DePuy Synthes VA-LCP distal radius plates list head/shaft hole counts, the VA-LCP Two-Column Volar Distal Radius 2.4 Narrow plate is available in a 42–72 mm range, confirming that some plates are offered in a similar length range.

By Material:

Stainless steel dominates due to its strength and cost efficiency. The Internal Trauma Fixation Devices market sees rising adoption of titanium alloys for their lightweight nature and excellent biocompatibility. It reduces allergic reactions and provides better fatigue resistance for long-term implants. Bioabsorbable materials are emerging as a promising alternative, eliminating the need for implant removal surgeries. Surgeons favor them in pediatric and sports injury cases where secondary interventions are risky. Growing research in bioresorbable composites is expected to accelerate this shift.

- For instance, Orthofix Fragment Fixation System wires are 120 mm long, with multiple shaft/thread combinations.

By End-User:

Hospitals account for the largest revenue share with their advanced infrastructure and surgical capacity. The Internal Trauma Fixation Devices market is supported by increasing orthopedic and trauma admissions in these facilities. It enables faster access to operating rooms and specialized equipment. Orthopedic clinics provide focused care for fracture treatment and rehabilitation, driving demand for standardized devices. Ambulatory surgical centers contribute to growth through cost-effective outpatient fracture fixation procedures. Expanding availability of such centers strengthens patient access and boosts procedural volumes globally.

Segments:

Based on Product Type:

- Plates

- Nails

- Screws

- Other products

Based on Material:

- Stainless steel

- Titanium alloy

- Bioabsorbable

Based on End-User:

- Hospitals

- Orthopedic clinics

- Ambulatory surgical centers

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Internal Trauma Fixation Devices market with 38% share in 2024. The region benefits from a well-established healthcare infrastructure and high healthcare spending. It supports adoption of advanced implants and minimally invasive trauma fixation solutions. Growing prevalence of osteoporosis-related fractures in the aging population drives procedure volumes. Favorable reimbursement policies encourage patients to undergo timely surgeries without major financial concerns. Presence of leading manufacturers ensures a steady supply of innovative devices. Continuous investment in research and development further strengthens the region’s dominance and supports strong clinical outcomes.

Europe

Europe accounts for 27% of the Internal Trauma Fixation Devices market, supported by a mature healthcare system and skilled surgical workforce. High incidence of road accidents and sports injuries creates steady demand for fixation devices. It benefits from government initiatives to reduce surgical backlogs and improve trauma care facilities. Adoption of bioabsorbable and titanium implants is growing rapidly in Germany, France, and the UK. Training programs for orthopedic surgeons improve procedural accuracy and success rates. Presence of strong regulatory frameworks ensures product quality and patient safety, which boosts confidence among healthcare providers. Expansion of ambulatory surgical centers supports shorter hospital stays and higher procedure throughput.

Asia-Pacific

Asia-Pacific represents 22% of the Internal Trauma Fixation Devices market and is the fastest-growing region. Rising urbanization and industrialization contribute to higher rates of workplace injuries and road accidents. It benefits from expanding hospital networks and government spending on trauma care infrastructure. Growing middle-class population with improved access to healthcare fuels elective fracture treatments. Medical tourism in countries like India and Thailand attracts international patients seeking affordable orthopedic surgeries. Manufacturers target this region with cost-effective devices to meet local affordability needs. Rapid adoption of digital health solutions is also transforming surgical planning and patient follow-up care.

Latin America

Latin America holds 8% share of the Internal Trauma Fixation Devices market, driven by rising investments in healthcare infrastructure. Public health initiatives in Brazil, Mexico, and Argentina support expansion of orthopedic services. It benefits from growing availability of specialized trauma centers in urban regions. Demand for cost-effective fixation devices remains strong due to economic constraints. International manufacturers collaborate with local distributors to improve market penetration and device accessibility. Training programs for orthopedic surgeons are improving surgical outcomes and patient safety. Growing awareness campaigns are encouraging early treatment for fracture cases, boosting procedural volume.

Middle East and Africa

Middle East and Africa contribute 5% to the Internal Trauma Fixation Devices market, with demand concentrated in Gulf Cooperation Council countries and South Africa. Governments invest in modernizing healthcare facilities to manage increasing trauma cases from traffic accidents. It benefits from partnerships with global device manufacturers who provide advanced implants. Limited access in rural areas remains a challenge, but mobile healthcare initiatives are improving outreach. Rising medical tourism in the UAE and Saudi Arabia boosts adoption of premium implants. Expansion of private hospitals and orthopedic centers supports procedure growth. Growing focus on training local surgeons is expected to enhance surgical success rates over the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Smith+Nephew

- Orthofix US LLC

- Johnson & Johnson

- Wright Medical Group N.V.

- Integra LifeSciences Holdings Corporation

- Zimmer Biomet

- Implanet SA

- Stryker Corporation

- CONMED Corporation

- evonos GmbH & Co. KG

- KLS Martin Group

- Braun SE

- Acumed LLC

- Medicon eG

- Arthrex, Inc.

Competitive Analysis

The Internal Trauma Fixation Devices market is highly competitive with key players such as Smith+Nephew, Orthofix US LLC, Johnson & Johnson, Wright Medical Group N.V., Integra LifeSciences Holdings Corporation, Zimmer Biomet, Implanet SA, Stryker Corporation, CONMED Corporation, evonos GmbH & Co. KG, KLS Martin Group, B. Braun SE, Acumed LLC, Medicon eG, and Arthrex, Inc. These companies focus on innovation and expanding their product portfolios to strengthen their market presence. Competition centers on the development of advanced fixation systems, including plates, nails, and bioabsorbable implants that improve surgical outcomes. Leading players invest in research and development to integrate new materials such as titanium alloys and bioresorbable composites, offering lighter and safer devices. Strategic acquisitions and partnerships enable companies to expand distribution networks and gain access to new markets. Digital solutions, such as smart implants and 3D-printed patient-specific devices, are becoming key differentiators. Strong focus on surgeon training and clinical education programs helps build brand loyalty and ensure device adoption. The market is expected to see further competition as regional manufacturers introduce cost-effective solutions, especially in emerging economies. This competitive landscape drives continuous innovation and price competitiveness across global markets.

Recent Developments

- In 2025, Smith+Nephew launched the TRIGEN MAX Tibia Nailing System, the only system offering side-specific nails for anatomic screw trajectories, improving fixation and minimizing soft tissue irritation.

- In 2025, Orthofix US LLC received FDA 510(k) clearance and CE Mark for the TrueLok Elevate Transverse Bone Transport System aimed at limb preservation and diabetic foot ulcer care.

- In 2024, Johnson & Johnson unveiled the VOLT Plating System, combining dynamic compression with variable-angle locking for musculoskeletal patient care.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily with rising trauma and fracture cases worldwide.

- Adoption of minimally invasive fixation devices will continue to increase across hospitals and clinics.

- Bioabsorbable implants will gain traction, reducing the need for secondary removal surgeries.

- Integration of smart sensors in implants will improve post-surgical monitoring and patient outcomes.

- 3D printing will enable production of customized plates and nails for complex fractures.

- Emerging economies will drive demand with expanding healthcare infrastructure and better access to care.

- Training programs for surgeons will enhance procedural efficiency and success rates globally.

- Manufacturers will focus on cost-effective devices to penetrate price-sensitive markets.

- Collaborations between hospitals and device makers will support faster innovation and clinical adoption.

- Growing geriatric population will remain a key driver for hip, spine, and long-bone fixation devices.