Market Overview

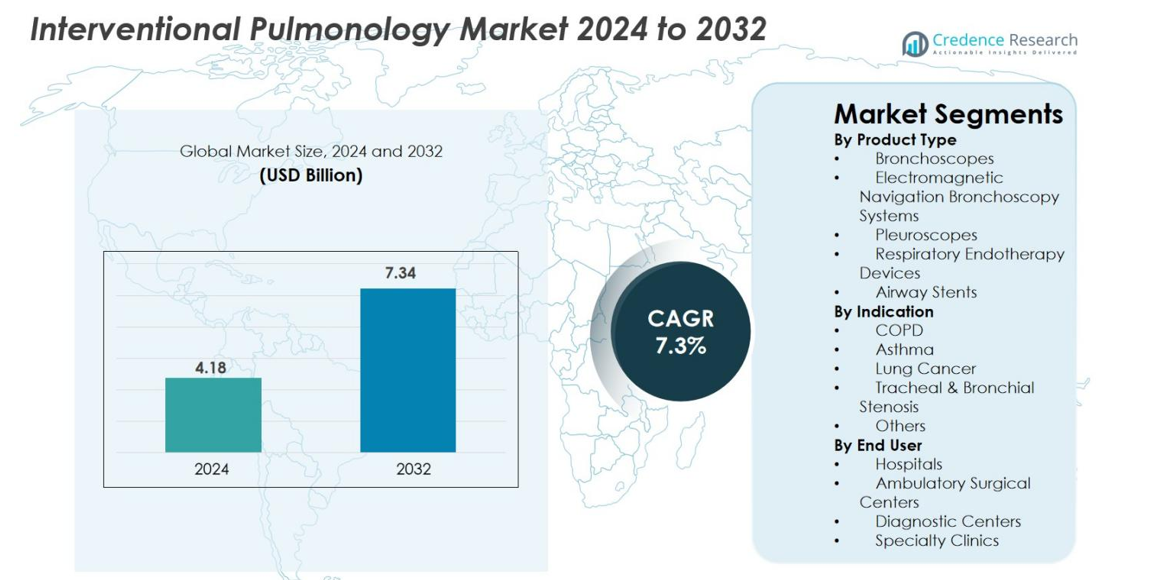

Interventional Pulmonology Market size was valued at USD 4.18 Billion in 2024 and is anticipated to reach USD 7.34 Billion by 2032, at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Interventional Pulmonology Market Size 2024 |

USD 4.18 Billion |

| Interventional Pulmonology Market , CAGR |

7.3% |

| Interventional Pulmonology Market Size 2032 |

USD 7.34 Billion |

Interventional Pulmonology Market is shaped by leading players such as Medtronic Plc, Boston Scientific Corporation, Olympus Corporation, FUJIFILM Corporation, Becton, Dickinson and Company, Smith’s Group Plc, Cook Medical, Vygon, Clarus Medical LLC, and Huger Medical Instrument Co. Ltd, all of which focus on advancing bronchoscopic imaging, navigation platforms, and minimally invasive therapeutic tools. North America led the market with 38.6% share in 2024, driven by high adoption of robotic bronchoscopy, ENB systems, and disposable scopes. Europe followed with 27.4%, supported by strong hospital networks and early diagnostic programs, while Asia Pacific grew rapidly with 23.1%, fueled by expanding healthcare infrastructure and rising lung cancer prevalence.

Market Insights

- Interventional Pulmonology Market was valued at USD 4.18 Billion in 2024 and is projected to reach USD 7.34 Billion by 2032, registering a CAGR of 7.3%.

- Rising prevalence of lung cancer and COPD drives strong demand for bronchoscopes, navigation systems, and airway stents, with bronchoscopes holding the largest product share at 38.5% in 2024.

- Key trends include rapid adoption of robotic bronchoscopy, AI-enabled imaging, and disposable scopes that enhance diagnostic accuracy and infection control across high-volume centers.

- Major players such as Medtronic Plc, Boston Scientific, Olympus, FUJIFILM, and BD strengthen market presence through product innovation, procedural efficiency, and expanded global distribution networks.

- North America led the market with 38.6% share in 2024, followed by Europe at 27.4% and Asia Pacific at 23.1%, while hospitals dominated the end-user segment with 52.7% share, supported by advanced infrastructure and higher procedure volumes.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Product Type

The Interventional Pulmonology Market is dominated by bronchoscopes, accounting for 38.5% share in 2024, driven by their essential role in diagnostic and therapeutic procedures, including biopsy, airway inspection, and minimally invasive interventions. Advanced video bronchoscopes, disposable bronchoscopy systems, and flexible platforms further accelerate adoption across hospitals and specialty centers. Growing utilization of electromagnetic navigation bronchoscopy and increasing preference for minimally invasive lung cancer diagnostics support segment expansion. Airway stents and respiratory endotherapy devices are also gaining traction as chronic respiratory diseases rise globally, strengthening overall market demand.

- For instance, in August 2021, Boston Scientific received U.S. FDA 510(k) clearance for its EXALT Model B single-use bronchoscope, specifically designed for bedside procedures in intensive care units and operating rooms.

By Indication

Lung cancer held the dominant share of 41.2% in 2024, primarily due to rising global incidence and the expanding use of bronchoscopy-guided diagnostic and therapeutic procedures. Technologies such as ENB, cryobiopsy, and endobronchial ultrasound (EBUS) significantly enhance early detection and staging accuracy, driving broader clinical adoption. COPD and asthma applications continue to grow as minimally invasive interventions support advanced airway management. Increased reliance on interventional pulmonology for addressing tracheal and bronchial stenosis further reinforces demand across high-risk patient groups.

- For instance, Olympus launched its EVIS X1 endoscopy system in Europe and parts of Asia in April 2020, along with compatible bronchoscopes that enable Endobronchial Ultrasound (EBUS) procedures. This system and its compatible tools offer enhanced ultrasound imaging for lymph node assessment in lung cancer staging

By End User

The hospital segment commanded the largest share, contributing 52.7% in 2024, supported by high procedure volumes, access to advanced imaging systems, and availability of skilled pulmonologists. Hospitals increasingly adopt robotic bronchoscopy, ENB platforms, and disposable scopes to improve diagnostic yield and reduce cross-contamination risks. Ambulatory surgical centers show rising uptake due to cost-efficient outpatient procedures, while diagnostic centers and specialty clinics expand their capabilities for early lung cancer detection and chronic respiratory disease management. Growing investments in minimally invasive infrastructure continue to strengthen segment leadership.

Key Growth Drivers

Rising Burden of Lung Cancer and Chronic Respiratory Diseases

The increasing global incidence of lung cancer, COPD, and asthma stands as a primary growth catalyst for the Interventional Pulmonology market. Rising exposure to air pollution, tobacco consumption, occupational hazards, and lifestyle changes drives a steady increase in respiratory disease prevalence. This trend accelerates demand for advanced diagnostic and therapeutic tools such as bronchoscopes, airway stents, ENB systems, and endobronchial ultrasound-guided biopsy technologies. Early detection initiatives and screening programs further expand procedural volumes across hospitals and specialty centers. As health systems prioritize minimally invasive interventions to reduce procedural risks and improve patient outcomes, interventional pulmonology solutions gain wider adoption. The shift toward precision diagnostics, including cryobiopsy and image-guided navigation, enhances diagnostic accuracy and speeds clinical decision-making. Moreover, aging populations across major regions elevate the need for sophisticated airway management and lesion-access technologies, reinforcing sustained market expansion.

- For instance, Olympus received FDA 510(k) clearance for its BF-H190 bronchoscopes, featuring improved imaging to support early detection of lung lesions.

Technological Advancements in Bronchoscopy and Navigation Systems

Rapid advancements in visualization technologies, robotics, and navigation platforms significantly propel market growth by enabling earlier, safer, and more accurate lung disease diagnosis. Innovations such as robotic-assisted bronchoscopy enhance reach to peripheral lung nodules, boosting diagnostic yield for early-stage cancer. Digital video bronchoscopes, disposable bronchoscopy systems, and AI-integrated imaging tools improve procedural efficiency and infection control. Electromagnetic navigation bronchoscopy (ENB) and virtual bronchoscopy streamline complex navigation, enabling minimally invasive access where traditional approaches are limited. These technologies reduce dependency on invasive surgical biopsies and support broader adoption across high-volume medical centers. Enhanced material durability, ergonomic device design, and real-time lesion localization capabilities continue to improve clinical workflows. As hospitals modernize procedural suites, the integration of robotics, AI-enabled imaging, and smart respiratory endotherapy platforms becomes central to improving outcomes, thereby driving significant market penetration across established and emerging healthcare systems.

- For instance, Auris Health Monarch Robotic Bronchoscopy Platform received FDA clearance, offering enhanced reach into peripheral lung regions and real-time vision for guided biopsy.

Growing Adoption of Minimally Invasive Procedures in Respiratory Care

The global shift toward minimally invasive pulmonary interventions serves as a major driver, driven by faster recovery, reduced hospitalization, and lower complication rates compared to open surgical approaches. Interventional pulmonology techniques such as airway stenting, bronchoscopic lung volume reduction, ablative therapies, and transbronchial biopsies increasingly replace conventional surgical procedures. Health systems prioritize patient comfort and cost savings, further supporting adoption. Advancements in flexible instruments, single-use bronchoscopes, and endotherapy devices streamline procedural safety and accessibility. The push for outpatient-based respiratory interventions boosts demand within ambulatory surgical centers. Additionally, minimally invasive options enable physicians to treat high-risk patients who are unsuitable for surgery, expanding the eligible patient population. Rising awareness of early diagnosis, increasing clinical guideline recommendations, and expanding reimbursement coverage collectively reinforce sustained growth. As clinical outcomes improve, minimally invasive pulmonology continues to gain acceptance as a standard component of modern respiratory care.

Key Trends & Opportunities

Expansion of Robotic-Assisted and AI-Enhanced Interventional Pulmonology

Robotics and artificial intelligence represent transformative trends that open substantial opportunities for next-generation pulmonary interventions. Robotic bronchoscopy improves precision, stability, and peripheral lung nodule access beyond the limitations of manual scopes, significantly enhancing biopsy success rates. AI-powered imaging and navigation systems support real-time lesion analysis, automatic pathway generation, and decision support, elevating diagnostic accuracy. These capabilities enable early cancer detection, a top priority for global health systems. Integration of machine learning with OCT, EBUS, and CT imaging unlocks deeper insights for complex airway assessments. Vendors increasingly develop interoperable platforms that connect robotic systems with hospital data ecosystems, enabling workflow automation and remote procedural support. As hospitals invest in digital transformation and advanced procedural infrastructure, AI-driven and robotic solutions emerge as high-value opportunities for manufacturers seeking long-term differentiation.

- For instance, Intuitive launched its Ion Endoluminal System 1.2 software update, enhancing real-time navigation accuracy and enabling more reliable access to small pulmonary nodules.

Growing Demand for Disposable Devices and Infection-Control Solutions

Increasing global focus on infection prevention, accelerated by hospital-acquired infection risks and post-pandemic protocols, drives strong demand for disposable bronchoscopes, biopsy tools, and airway management devices. Single-use bronchoscopes eliminate cross-contamination risks, reduce reprocessing costs, and support streamlined workflow efficiency, making them attractive for emergency, ICU, and outpatient settings. Healthcare facilities increasingly adopt disposable solutions to meet infection-control standards mandated by regulatory bodies. This shift opens major commercial opportunities for manufacturers expanding sterile, cost-optimized product portfolios. Additionally, disposable devices support safe procedural scalability in developing markets where sterilization infrastructure is limited. As patient and provider expectations for hygiene and operational reliability increase, disposable interventional pulmonology tools continue to gain momentum, reshaping purchasing patterns across hospitals and ambulatory centers.

- For instance, Boston Scientific received FDA 510(k) clearance for its EXALT Model B single-use bronchoscope designed for ICU and OR use, eliminating reprocessing and contamination risks.

Key Challenges

High Cost of Advanced Interventional Pulmonology Technologies

The adoption of advanced bronchoscopes, ENB platforms, robotic systems, and AI-integrated imaging tools presents a significant cost challenge for healthcare providers, especially in developing regions. High capital expenditure, maintenance requirements, and consumable costs limit access for smaller hospitals and diagnostic centers. Reimbursement limitations and procedural cost pressures further restrict adoption, particularly for emerging technologies such as robotic bronchoscopy and peripheral nodule navigation systems. Budget-constrained institutions may delay modernization despite rising disease burden. Additionally, training requirements and operational complexities increase indirect costs, posing barriers to widespread utilization. Without improved financing models, reimbursement reforms, and cost-effective product innovations, market expansion may slow among low- and middle-income healthcare systems. Manufacturers must address affordability to unlock broader global access.

Shortage of Skilled Interventional Pulmonologists and Training Barriers

The market faces a structural challenge due to the limited availability of trained interventional pulmonologists capable of performing advanced procedures such as robotic bronchoscopy, cryobiopsy, and complex airway interventions. Many regions lack standardized training programs, resulting in uneven clinical expertise and procedural capacity. Steep learning curves associated with new technologies hinder rapid adoption, while high patient volumes in major centers often strain existing clinical resources. Limited access to simulation platforms and hands-on training environments further exacerbates skill gaps. This shortage restricts market penetration in emerging regions and slows the integration of innovative systems into routine practice. Expanding specialized training, digital education platforms, and collaborative clinical programs will be essential to overcoming workforce limitations and supporting long-term market growth.

Regional Analysis

North America

North America dominated the Interventional Pulmonology Market with 38.6% share in 2024, driven by the high prevalence of lung cancer, COPD, and asthma, along with strong adoption of advanced diagnostic technologies such as robotic bronchoscopy and ENB systems. The U.S. benefits from well-established healthcare infrastructure, widespread use of disposable bronchoscopes, and favorable reimbursement policies supporting minimally invasive pulmonary procedures. Major industry players maintain strong operational presence, accelerating product availability. Continued investments in AI-enhanced imaging, outpatient care expansion, and early cancer screening programs solidify North America’s leadership during the forecast period.

Europe

Europe accounted for 27.4% of the market in 2024, supported by rising incidence of respiratory diseases, strong clinical emphasis on early lung cancer diagnosis, and increased adoption of image-guided bronchoscopic tools. Countries such as Germany, the U.K., and France lead regional growth due to robust hospital networks and high procedural volumes. Advancements in endoscopy technologies, structured training programs for interventional pulmonologists, and expanding adoption of disposable scopes promote market expansion. Additionally, government-led initiatives addressing air pollution and smoking-related diseases strengthen demand, ensuring Europe remains a key contributor to global market development.

Asia Pacific

Asia Pacific captured 23.1% share in 2024 and represents the fastest-growing regional market, driven by increasing awareness of minimally invasive pulmonology, expanding healthcare infrastructure, and rising lung cancer burden across China, India, and Southeast Asia. Growing investments in diagnostic centers, adoption of digital bronchoscopy platforms, and improving access to specialty care support rapid expansion. Local manufacturers are increasing their footprint, offering cost-effective devices that widen adoption in emerging economies. Government-supported screening programs for chronic respiratory diseases further accelerate procedural volumes, positioning Asia Pacific as a major future growth engine in interventional pulmonology.

Latin America

Latin America held 6.8% of the market in 2024, influenced by growing demand for advanced respiratory diagnostics and expanding healthcare modernization efforts across Brazil, Mexico, and Argentina. Rising rates of COPD, smoking prevalence, and pollution-related respiratory conditions drive the need for bronchoscopy, airway stenting, and minimally invasive therapeutic procedures. Limited reimbursement structures and uneven access to specialized pulmonology services pose challenges, yet increased private-sector investments and training initiatives strengthen regional adoption. As hospitals upgrade endoscopic capabilities, Latin America shows consistent growth potential within the global market.

Middle East & Africa

The Middle East & Africa region accounted for 4.1% share in 2024, with growth supported by increasing healthcare investments, rising burden of chronic respiratory diseases, and expanding adoption of minimally invasive pulmonology techniques. Countries such as Saudi Arabia, the UAE, and South Africa are prioritizing early cancer detection and hospital infrastructure upgrades, driving demand for bronchoscopy, ENB systems, and therapeutic endoscopy tools. Challenges include limited specialist availability and high device costs; however, training partnerships and public–private collaborations are improving access. Growing awareness of advanced pulmonary care positions the region for steady long-term expansion.

Market Segmentations

By Product Type

- Bronchoscopes

- Electromagnetic Navigation Bronchoscopy Systems

- Pleuroscopes

- Respiratory Endotherapy Devices

- Airway Stents

By Indication

- COPD

- Asthma

- Lung Cancer

- Tracheal & Bronchial Stenosis

- Others

By End User

- Hospitals

- Ambulatory Surgical Centers

- Diagnostic Centers

- Specialty Clinics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Interventional Pulmonology market features a diverse and innovation-driven competitive landscape, with global and regional players focusing on advanced visualization, navigation, and therapeutic technologies. Leading companies such as Medtronic Plc, Boston Scientific Corporation, Olympus Corporation, FUJIFILM Corporation, and Becton, Dickinson and Company continue to expand their portfolios through robotic bronchoscopy systems, disposable scopes, and precision-guided diagnostic tools. Smith’s Group Plc, Cook Medical, Vygon, Clarus Medical LLC, and Huger Medical Instrument Co. Ltd strengthen competition by offering cost-effective airway management and endotherapy devices tailored for emerging markets. Strategic initiatives, including product launches, clinical collaborations, and investment in AI-enhanced imaging, reinforce market positioning. Companies increasingly focus on expanding global distribution networks and developing training programs to support adoption of minimally invasive technologies. As demand grows for early lung cancer detection and infection-control solutions, manufacturers compete on technological differentiation, procedural accuracy, and workflow efficiency to capture greater market share.\

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Clarus Medical LLC

- Cook Medical

- Olympus Corporation

- Medtronic Plc

- Vygon

- Smith’s Group Plc

- Becton, Dickinson and Company

- FUJIFILM Corporation

- Huger Medical Instrument Co. Ltd

- Boston Scientific Corporation

Recent Developments

- In November 2025, Yashoda Hospital (Hitech City) in partnership with Qure.ai and AstraZeneca launched an advanced AI-enabled Lung Nodule Clinic aimed at accelerating early detection and management of lung cancer and other respiratory diseases

- In September 2025, A robotic-assisted bronchoscope with integrated cone-beam CT (CBCT) demonstrated in a trial the ability to biopsy small, hard-to-reach lung tumors reaching more than 84% of peripheral lesions vs ~23% with standard bronchoscopy.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Indication, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience strong growth as early lung cancer detection becomes a global healthcare priority.

- Adoption of robotic-assisted bronchoscopy will expand, improving access to peripheral lung nodules.

- AI-driven imaging and navigation tools will enhance diagnostic precision and streamline clinical decision-making.

- Disposable bronchoscopes will gain wider use due to rising infection-control requirements.

- Hospitals and ambulatory centers will increasingly shift toward minimally invasive pulmonary procedures.

- Advancements in cryobiopsy and ablative therapies will support broader use in complex airway conditions.

- Emerging markets will accelerate adoption as healthcare infrastructure and screening programs expand.

- Training programs and simulation platforms will help reduce the shortage of skilled interventional pulmonologists.

- Manufacturers will invest more in integrated platforms combining visualization, robotics, and data analytics.

- Collaborations between hospitals and technology companies will drive faster commercialization of next-generation pulmonary devices.