Market Overview

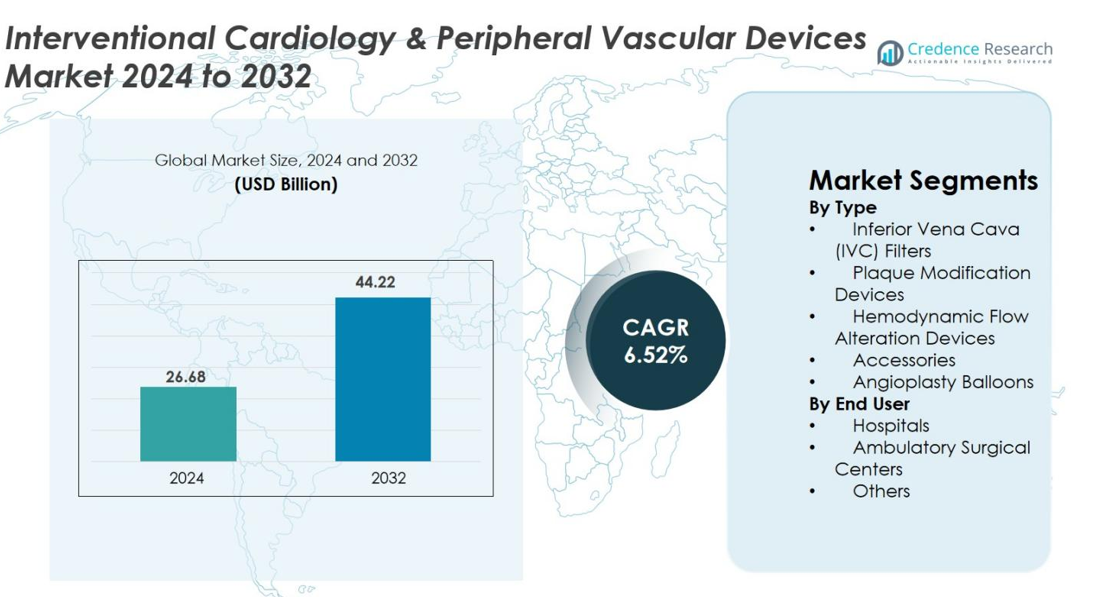

Interventional Cardiology & Peripheral Vascular Devices Market size was valued at USD 26.68 Billion in 2024 and is anticipated to reach USD 44.22 Billion by 2032, at a CAGR of 6.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Interventional Cardiology & Peripheral Vascular Devices Market Size 2024 |

USD 26.68 Billion |

| Interventional Cardiology & Peripheral Vascular Devices Market, CAGR |

6.52% |

| Interventional Cardiology & Peripheral Vascular Devices Market Size 2032 |

USD 44.22 Billion |

Interventional Cardiology & Peripheral Vascular Devices Market is shaped by leading players such as Medtronic, Boston Scientific, Abbott, Johnson & Johnson, Terumo Corporation, Cordis Corporation, Siemens Healthineers, Koninklijke Philips N.V., B. Braun Melsungen AG, and Edwards Lifesciences, all of which drive innovation through advanced angioplasty, imaging, and vascular intervention technologies. These companies strengthen their positions by expanding product portfolios, enhancing material performance, and integrating AI-enabled imaging and minimally invasive solutions. Regionally, North America led the market in 2024 with a 38.6% share, supported by strong healthcare infrastructure and high adoption rates, while Europe and Asia-Pacific followed with rising procedural volumes and increasing investment in interventional care capabilities.

Market Insights

- Interventional Cardiology & Peripheral Vascular Devices Market was valued at USD 26.68 Billion in 2024 and is projected to reach USD 44.22 Billion by 2032, growing at a CAGR of 6.52%.

- The market is driven by rising cardiovascular and peripheral vascular disease prevalence, increasing preference for minimally invasive angioplasty procedures, and strong demand for angioplasty balloons, which held a 36.4% share as the dominant product segment.

- Key trends include rapid adoption of drug-coated balloons, AI-enabled intravascular imaging, and growing use of outpatient and ambulatory settings for interventional procedures.

- Leading players such as Medtronic, Boston Scientific, Abbott, Johnson & Johnson, and Terumo strengthen market presence through innovation, robotics integration, and expanding vascular intervention portfolios, while cost constraints in emerging markets act as a restraint.

- Regionally, North America led with 38.6% share in 2024, followed by Europe at 29.4% and Asia-Pacific at 23.7%, supported by rising procedural volumes and expanding interventional cardiology infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type

The Interventional Cardiology & Peripheral Vascular Devices Market by type is led by angioplasty balloons, which accounted for 36.4% share in 2024 owing to their wide adoption in coronary and peripheral revascularization. Growth is driven by rising cardiovascular disease prevalence, increasing use of minimally invasive angioplasty procedures, and technological enhancements such as drug-coated, scoring, and high-pressure balloons. Plaque modification devices and IVC filters continue to gain clinical relevance, while accessories and hemodynamic flow alteration devices support procedural efficiency, contributing to the overall advancement of interventional care.

- For instance, Medtronic’s IN.PACT Admiral drug-coated balloon demonstrated about 82% primary patency at 12 months versus roughly 52% with standard angioplasty in the IN.PACT SFA trial, alongside sharply reduced reintervention rates, underscoring the durability of advanced balloon technology.

By End User

Hospitals dominated the market in 2024 with a 68.7% share due to their advanced cath lab facilities, higher procedural volume, and availability of trained interventional specialists. Their leadership is reinforced by the capability to handle complex angioplasty, peripheral interventions, and emergency cardiac procedures. Ambulatory surgical centers are growing steadily, supported by shorter recovery times and lower costs, while the other end users category which includes specialty and vascular clinics benefits from increasing adoption of image-guided and minimally invasive vascular procedures.

- For instance, outpatient cardiac cath programs such as those implemented at Sutter Health demonstrated safe same-day discharge for selected PCI patients, reducing hospital stays while maintaining clinical outcomes.

Key Growth Drivers

Rising Burden of Cardiovascular and Peripheral Vascular Diseases

The global surge in cardiovascular and peripheral vascular diseases remains the strongest demand driver for interventional cardiology and vascular devices. Rising incidences of coronary artery disease, peripheral artery disease, stroke, hypertension, diabetes, obesity, and lifestyle-related risk factors significantly increase the need for minimally invasive vascular interventions. Aging populations further amplify procedural volumes as elderly patients require angioplasty, stenting, thrombectomy, and plaque modification more frequently. Early diagnosis through advanced imaging accelerates treatment adoption, and growing preference for minimally invasive procedures offering shorter recovery and reduced hospital stays supports continued market expansion.

- For instance, the American Heart Association notes that over 200 million people worldwide are living with peripheral artery disease, directly increasing demand for angioplasty balloons, atherectomy devices, and stent technologies.

Technological Advancements in Device Design and Imaging

Continuous innovation in device materials, delivery systems, and intravascular imaging fuels strong market growth. Advancements such as drug-coated balloons, intravascular lithotripsy, atherectomy systems, and hemodynamic flow-altering technologies enhance procedural precision, safety, and long-term outcomes. Improvements in guidewires, catheters, and stent coatings enable smoother navigation through complex anatomies. OCT, IVUS, and AI-driven imaging provide high-accuracy lesion assessment, optimizing treatment strategies. Robotics and automation enhance operator control and reduce radiation exposure. Intensified R&D efforts continue to produce next-generation devices that are reshaping interventional cardiology and peripheral vascular therapy.

- For instance, Shockwave Medical’s Intravascular Lithotripsy (IVL) has shown high procedural success in heavily calcified coronary lesions, with clinical studies reporting greater than 92% device success, making it a key innovation for complex PCI cases.

Increasing Preference for Minimally Invasive and Outpatient Procedures

The shift toward minimally invasive vascular interventions is a key growth catalyst, driven by faster recovery, lower complication risks, and overall cost savings. Procedures such as angioplasty, balloon dilation, and peripheral vascular interventions are increasingly preferred over conventional surgery. Technological improvements now enable many interventions to be performed safely in ambulatory surgical centers, reducing pressure on hospitals and improving patient convenience. Favorable reimbursement policies, adoption of radial access techniques, and broader physician expertise further increase procedural volume. These factors collectively strengthen market penetration across both advanced healthcare systems and emerging economies.

Key Trends & Opportunities

Expansion of Drug-Based and Bioabsorbable Interventional Technologies

A major market-shaping trend is the evolution of drug-based and bioabsorbable devices that enhance long-term patient outcomes. Drug-coated balloons, drug-eluting platforms, and advanced polymer technologies significantly reduce restenosis rates and the need for repeat interventions. Bioabsorbable scaffolds present substantial opportunities in peripheral applications where permanent implants can cause complications. Continuous improvements in material durability and controlled degradation are increasing physician confidence. Regulatory approvals and expanding clinical evidence accelerate adoption in complex lesions, small vessels, and restenosis management, creating strong commercial opportunities for manufacturers focused on next-generation device innovation.

- For instance, BIOTRONIK’s bioabsorbable magnesium scaffold (Magmaris) has exhibited high device success and endothelialization within months, demonstrating the expanding role of bioresorbable scaffolds in cases where avoiding a permanent implant is clinically advantageous.

Integration of Digital Health, Robotics, and AI-Driven Decision Support

Digital transformation is unlocking new possibilities in interventional cardiology and peripheral vascular care. AI-powered imaging analysis enhances diagnostic precision and treatment planning using OCT and IVUS data. Robotics-assisted procedures improve catheter navigation and reduce radiation exposure for clinicians. Digital platforms enable remote case support, workflow automation, and real-time data interpretation, optimizing operational efficiency. These technologies also help address workforce shortages and support complex interventions in high-volume centers. As hospitals modernize cath labs, the integration of AI, robotics, and connected-health tools presents significant long-term opportunities for market expansion.

- For instance, Philips’ Image-Guided Therapy (Azurion) platform supports real-time data integration and remote clinical collaboration, enabling improved workflow efficiency and reduced procedure times in busy cardiac centers.

Key Challenges

High Device Costs and Limited Accessibility in Emerging Markets

High costs associated with advanced interventional devices continue to restrict adoption across low- and middle-income regions. Drug-coated balloons, atherectomy devices, and sophisticated intravascular imaging systems require substantial capital and specialized infrastructure. Limited reimbursement coverage and budget constraints in emerging markets further hinder widespread use. Many facilities lack catheterization labs or trained personnel, delaying expansion of minimally invasive treatments. Manufacturers face increasing pressure to offer cost-effective solutions without compromising innovation. This economic divide remains a significant barrier to achieving uniform global penetration of interventional cardiology and vascular technologies.

Regulatory Complexities and Clinical Risk Management

Regulatory hurdles and clinical safety concerns remain major challenges for the industry. Interventional devices must undergo rigorous testing and long-term performance validation to meet global safety standards, extending approval timelines and increasing development costs. Complications such as restenosis, thrombosis, or device failure require ongoing technological refinements. Frequent regulatory updates, stringent post-market surveillance, and varying global compliance requirements create operational complexity for manufacturers. Additionally, inconsistent physician training and experience levels contribute to procedural risk, highlighting the need for expanded education and certification programs. These factors collectively add friction to market growth and product commercialization.

Regional Analysis

North America

North America dominated the Interventional Cardiology & Peripheral Vascular Devices market in 2024 with a 38.6% share, supported by high adoption of minimally invasive cardiovascular procedures, strong reimbursement frameworks, and the presence of leading device manufacturers. The region benefits from advanced cath lab infrastructure, rapid uptake of AI-enabled imaging, and increasing procedural volumes for angioplasty and peripheral interventions. Rising incidence of coronary artery disease and obesity further drives device utilization. Growing preference for outpatient cardiac procedures and continuous technological innovation strengthen North America’s position as the primary revenue contributor.

Europe

Europe accounted for 29.4% of the market in 2024, driven by expanding use of innovative interventional technologies, increasing burden of cardiovascular diseases, and supportive regulatory pathways that encourage early adoption of advanced devices. Strong healthcare infrastructure, rising peripheral artery disease prevalence, and broader use of drug-coated balloons contribute to market resilience. Germany, France, and the U.K. lead in procedural volumes, while Eastern Europe shows growing demand due to improving access to catheterization facilities. The region’s focus on value-based care, clinical safety, and harmonized device standards supports steady market expansion.

Asia-Pacific

Asia-Pacific represented 23.7% of the market in 2024, emerging as the fastest-growing region due to rapid healthcare modernization, increasing cardiovascular disease prevalence, and expanding investment in interventional cardiology infrastructure. China, Japan, and India are key contributors, driven by rising procedural volumes, growing awareness of minimally invasive treatments, and improving reimbursement systems. The region benefits from growing adoption of drug-coated balloons, imaging advancements, and local manufacturing initiatives that enhance device availability. Rising urbanization, lifestyle risk factors, and expanding private healthcare facilities continue to elevate Asia-Pacific’s share and growth trajectory.

Latin America

Latin America captured 5.1% of the market in 2024, supported by increasing cardiac care awareness, expanding availability of minimally invasive procedures, and gradual improvements in hospital infrastructure. Brazil, Mexico, and Argentina lead the region due to rising prevalence of coronary artery disease and growing investments in cath lab modernization. However, limited reimbursement coverage and budget constraints slow adoption of advanced devices. Despite these challenges, demand for angioplasty balloons, stents, and peripheral intervention tools is rising as governments prioritize cardiovascular health and expand access to diagnostic and interventional services.

Middle East & Africa

The Middle East & Africa region held a 3.2% market share in 2024, largely driven by improving healthcare infrastructure, growing burden of cardiac and peripheral vascular diseases, and increased investments in specialty cardiac centers. Gulf Cooperation Council (GCC) countries contribute significantly due to strong healthcare spending and higher adoption of modern interventional technologies. Africa shows increasing procedural demand but remains constrained by limited access to advanced devices and skilled specialists. Despite infrastructure gaps, rising government initiatives and private-sector partnerships are gradually enhancing the region’s interventional cardiology capabilities.

Market Segmentations

By Type

- Inferior Vena Cava (IVC) Filters

- Plaque Modification Devices

- Hemodynamic Flow Alteration Devices

- Accessories

- Angioplasty Balloons

By End User

- Hospitals

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Interventional Cardiology & Peripheral Vascular Devices market is characterized by strong participation from leading global players, including Medtronic, Boston Scientific, Abbott, Johnson & Johnson, Terumo Corporation, Cordis Corporation, Siemens Healthineers, Koninklijke Philips N.V., B. Braun Melsungen AG, and Edwards Lifesciences. These companies compete through continuous product innovation, extensive R&D investments, and differentiated portfolios spanning angioplasty balloons, imaging systems, plaque modification devices, and vascular access technologies. Market leaders focus on expanding their minimally invasive solutions, improving device durability, and enhancing procedural precision with AI-driven imaging and robotic-assisted platforms. Strategic collaborations, acquisitions, and regulatory approvals strengthen their global presence, while emerging players increasingly target cost-effective solutions to penetrate price-sensitive markets. Competition intensifies as companies expand into outpatient and ambulatory care settings, optimize clinician training programs, and address unmet needs in complex peripheral vascular interventions, reinforcing a dynamic and innovation-driven market environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Teleflex completed the acquisition of BIOTRONIK’s Vascular Intervention business earlier than expected, enhancing its global presence in cath labs and expanding its interventional portfolio.

- In February 2025, Teleflex Incorporated announced a definitive agreement to acquire substantially all of the Vascular Intervention business of BIOTRONIK SE & Co. KG covering a broad portfolio of coronary and peripheral vascular intervention devices.

- In January 2025, Boston Scientific Corporation entered into a definitive agreement to acquire Bolt Medical, Inc., a developer of an intravascular lithotripsy (IVL) platform for treatment of coronary and peripheral artery disease.

Report Coverage

The research report offers an in-depth analysis based on Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as minimally invasive cardiovascular and peripheral interventions become the global standard of care.

- Advancements in drug-coated balloons, atherectomy systems, and bioabsorbable technologies will significantly improve long-term patient outcomes.

- AI-powered intravascular imaging and decision-support tools will increasingly guide real-time diagnosis and treatment planning.

- Robotic-assisted interventional systems will gain broader adoption, enhancing procedural precision and reducing operator fatigue.

- Outpatient and ambulatory surgical centers will conduct a growing share of angioplasty and peripheral vascular procedures.

- Digital health integration will streamline procedural workflow, remote support, and post-procedure monitoring.

- Emerging markets will accelerate growth as healthcare infrastructure strengthens and access to advanced devices expands.

- Wider adoption of radial access techniques will enhance patient comfort, shorten recovery time, and reduce complications.

- Stronger collaboration between device manufacturers and healthcare providers will drive innovation and clinical skill development.

- Increasing regulatory emphasis on device safety, biocompatibility, and long-term performance will influence next-generation product design.