Market Overview

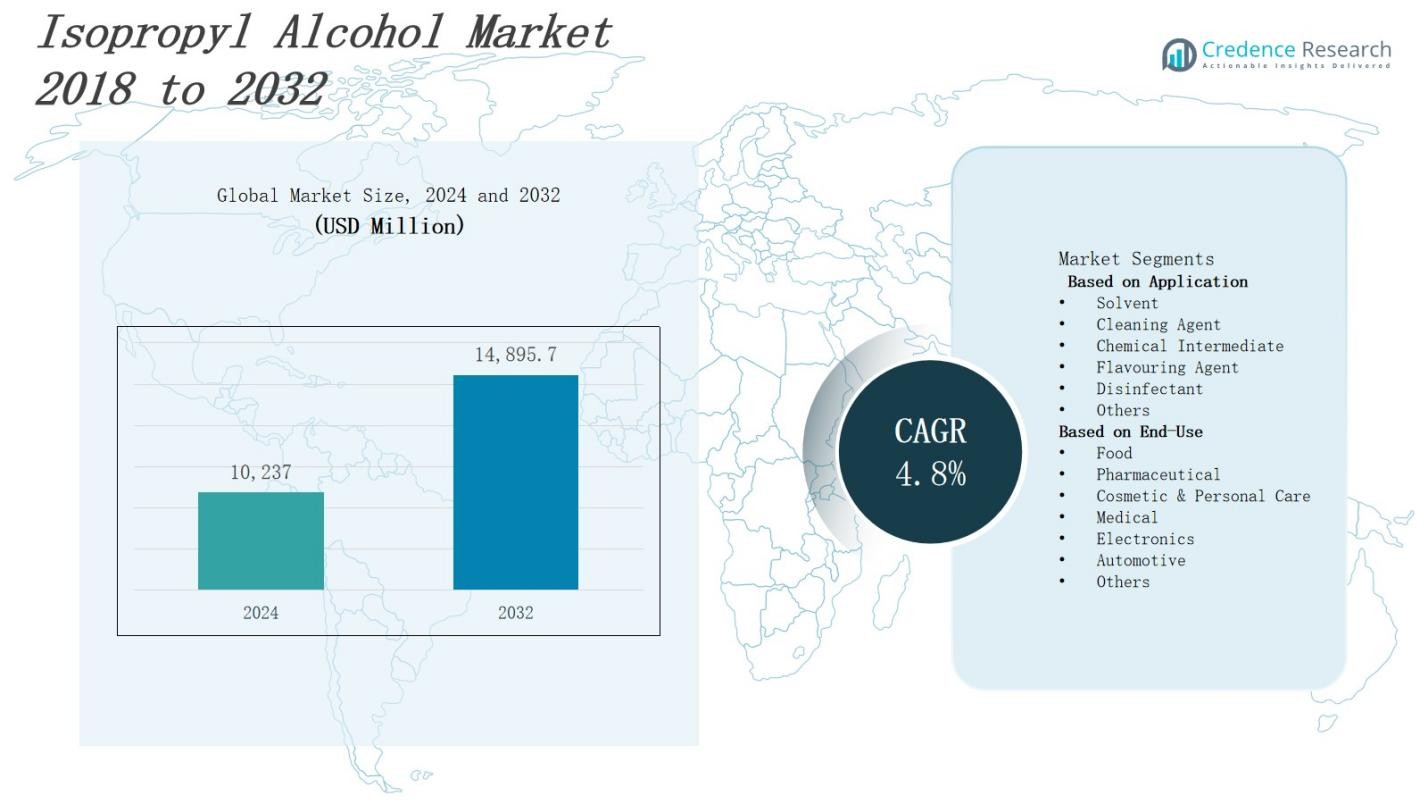

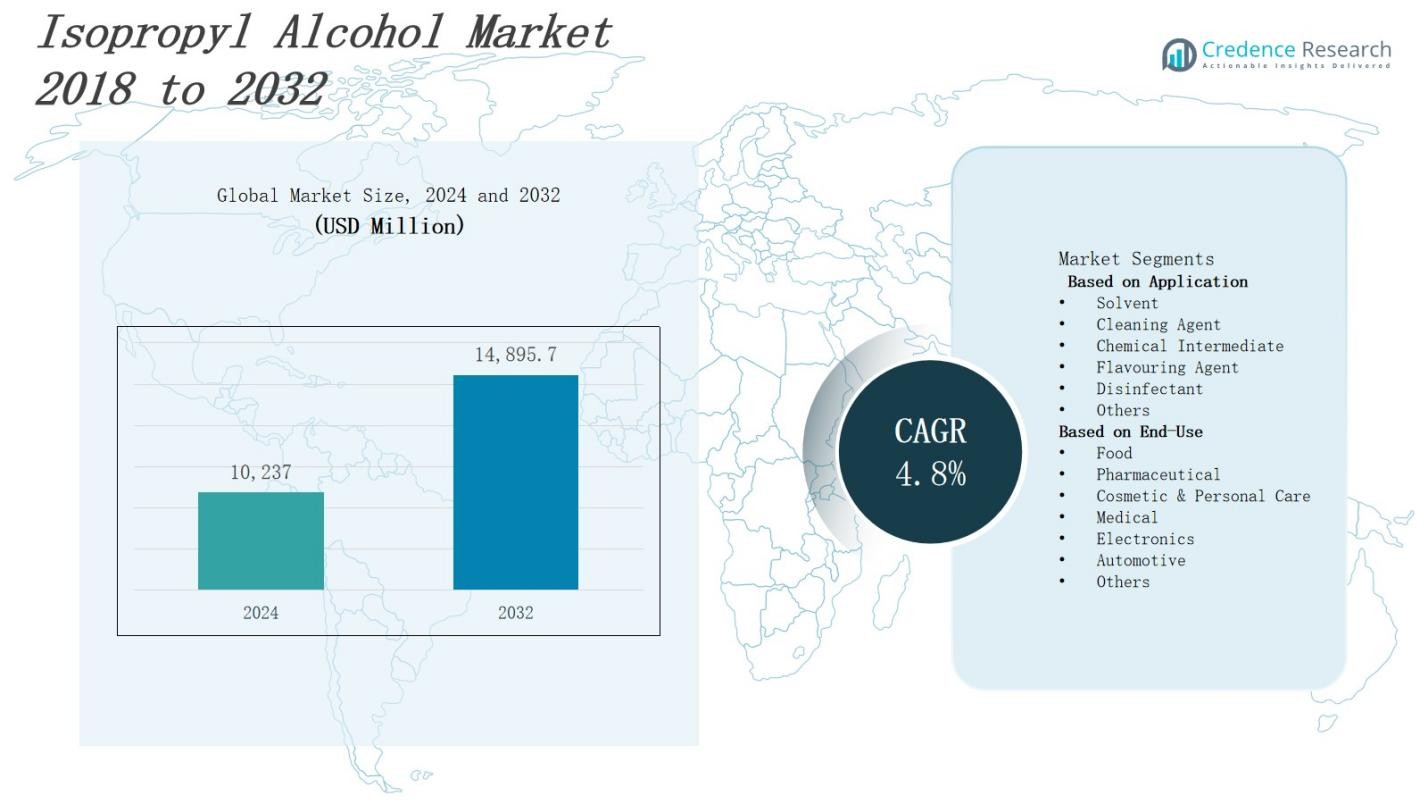

The Isopropyl Alcohol market is projected to grow from USD 10,237 million in 2024 to USD 14,895.7 million by 2032, registering a compound annual growth rate (CAGR) of 4.8%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Isopropyl Alcohol Market Size 2024 |

USD 10,237 Million |

| Isopropyl Alcohol Market, CAGR |

4.8% |

| Isopropyl Alcohol Market Size 2032 |

USD 14,895.7 Million |

The Isopropyl Alcohol market growth is driven by rising demand across pharmaceutical, personal care, and industrial cleaning applications due to its effective disinfectant and solvent properties. Increasing awareness of hygiene and sanitation, especially in healthcare settings, boosts its usage globally. Growing adoption in cosmetics and pharmaceuticals further supports market expansion. Technological advancements in production processes reduce costs and improve purity, enhancing product appeal. Trends include rising preference for eco-friendly and sustainable chemicals, alongside expanding applications in electronics cleaning and chemical manufacturing. These factors collectively accelerate market growth and broaden its application scope across multiple industries.

The Isopropyl alcohol market spans key regions including North America, Europe, Asia-Pacific, and the Rest of the World, each contributing significantly to global demand. North America leads with 35% market share, followed by Europe at 28%, Asia-Pacific at 25%, and the Rest of the World holding 12%. Leading key players driving the market include Dow Chemical, ExxonMobil, Shell, INEOS, LG Chem, LCY Chemical, Kellin Chemical, Super Chemical, and Galaxy Chemicals. These companies focus on expanding regional presence through innovation and capacity enhancements.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Isopropyl Alcohol market is projected to grow from USD 10,237 million in 2024 to USD 14,895.7 million by 2032, registering a CAGR of 4.8%.

- Rising demand in pharmaceutical, personal care, and industrial cleaning applications drives market growth due to its disinfectant and solvent properties.

- Increasing hygiene awareness, especially in healthcare, boosts global usage and expands adoption in cosmetics and pharmaceuticals.

- Technological advancements reduce production costs and improve purity, enhancing product appeal and broadening application scope.

- The market spans North America (35%), Europe (28%), Asia-Pacific (25%), and the Rest of the World (12%), each contributing significantly to demand.

- Key players like Dow Chemical, ExxonMobil, Shell, INEOS, and LG Chem focus on innovation, capacity expansion, and regional presence to maintain competitiveness.

- Challenges include raw material price volatility, supply chain disruptions, and stringent regulatory compliance related to safety and environmental standards.

Market Drivers

Increasing Demand from Healthcare and Personal Care Sectors

The Isopropyl alcohol market experiences significant growth due to its widespread use in healthcare and personal care industries. It serves as an effective antiseptic and disinfectant, crucial for infection control in hospitals and clinics. Rising global awareness about hygiene, especially post-pandemic, strengthens demand. Personal care products such as hand sanitizers, lotions, and cosmetics increasingly incorporate it for its solvent and antimicrobial properties. These factors contribute to sustained expansion in this sector.

- For instance, DFPCL is the largest manufacturer and supplier of isopropyl alcohol in India, producing high-purity IPA that meets stringent pharmacopeia standards such as IP, BP, USP, and Chinese Pharmacopeia.

Growing Industrial Applications and Cleaning Uses

The industrial sector drives demand for isopropyl alcohol by utilizing it as a solvent and cleaning agent. It plays a vital role in electronics manufacturing, pharmaceuticals, and automotive industries for surface cleaning and degreasing. The market benefits from increased industrial automation requiring precise cleaning solutions. Rising production in emerging economies further supports demand. It also finds use in chemical synthesis and formulation, broadening its industrial relevance.

- For instance, Purosolv Chemical Manufacturing in Navi Mumbai produces pharmaceutical-grade isopropyl alcohol certified by USP, IP, EP, BP, CP, and JP standards.

Technological Advancements and Production Efficiency

Improvements in production technologies positively impact the Isopropyl alcohol market by lowering costs and enhancing product purity. Manufacturers implement advanced distillation and purification techniques to meet stringent quality standards. It enables the production of high-grade isopropyl alcohol suitable for pharmaceutical and electronic applications. Enhanced efficiency supports scalability and supply reliability. This progress encourages wider adoption across various end-use industries.

Rising Focus on Sustainability and Eco-friendly Products

The market observes a shift towards sustainable and environmentally friendly chemical products. It reflects in increasing preference for biodegradable and non-toxic solvents like isopropyl alcohol. Manufacturers invest in green production methods and renewable raw materials. Regulatory frameworks promoting sustainable chemicals stimulate market growth. This trend strengthens its position as a preferred solvent in personal care and industrial applications. It aligns with global efforts to reduce environmental impact.

Market Trends

Expansion of Applications in Healthcare and Personal Care Industries

The Isopropyl alcohol market shows a clear trend toward expanding applications in healthcare and personal care. It increasingly serves as a key ingredient in hand sanitizers, disinfectants, and topical antiseptics. Rising consumer awareness about personal hygiene fuels demand for safe and effective products containing it. Manufacturers innovate to improve formulations with enhanced skin compatibility and faster evaporation rates. This trend supports broader acceptance in both professional medical settings and everyday consumer use.

- For instance, Eastman Chemical Company introduced EastaPure IPA in 2024, an ultra-pure solvent designed to enhance the quality and safety of medical and electronic manufacturing processes, demonstrating innovation driven by application-specific needs.

Adoption of Advanced Formulation Technologies

The market witnesses growing adoption of advanced formulation technologies to enhance product performance and safety. It enables manufacturers to develop isopropyl alcohol-based products with improved stability and reduced skin irritation. Encapsulation and controlled-release formulations emerge to provide sustained antimicrobial effects. Innovation in blending it with other compatible compounds expands its utility across various industries. These technological developments drive product differentiation and competitive advantage.

- For instance, 3M introduced a controlled-release hand sanitizer that maintains antimicrobial efficacy for up to 6 hours.

Rising Emphasis on Sustainable and Green Chemistry Practices

Sustainability remains a significant trend influencing the Isopropyl alcohol market, with increasing focus on green chemistry principles. Manufacturers invest in environmentally friendly production methods to reduce waste and energy consumption. It encourages the use of renewable feedstocks and biodegradable formulations. Regulatory pressure to minimize environmental impact compels compliance with stricter standards. This trend strengthens market positioning by appealing to eco-conscious consumers and industrial buyers.

Growth in E-commerce and Digital Sales Channels

The Isopropyl alcohol market benefits from the rapid expansion of e-commerce platforms and digital sales channels. It improves product accessibility and consumer reach, particularly for personal care and household disinfectant products. Online retail enables brands to offer customized packaging and bundle offers targeting diverse customer needs. This trend supports faster market penetration and real-time consumer feedback collection. It also drives innovation in marketing and distribution strategies.

Market Challenges Analysis

Volatility in Raw Material Prices and Supply Chain Disruptions

The Isopropyl alcohol market faces challenges related to fluctuations in raw material costs, particularly propylene and other petrochemical derivatives. Volatile pricing impacts production expenses and profit margins for manufacturers. Supply chain disruptions due to geopolitical tensions, transportation bottlenecks, or regulatory changes create uncertainties in availability. It complicates inventory management and forces companies to adapt procurement strategies frequently. These factors increase operational risks and may delay deliveries, affecting customer satisfaction and market stability.

Stringent Regulatory Compliance and Safety Concerns

Strict regulations governing the production, storage, and transportation of isopropyl alcohol pose significant challenges to the market. It requires manufacturers to comply with hazardous material handling standards and environmental protection laws, increasing operational complexity and costs. Safety concerns related to its flammability and potential misuse necessitate rigorous quality control and monitoring protocols. Non-compliance risks fines and reputational damage. Meeting these regulatory demands demands continuous investment in technology and staff training, which can strain smaller market participants.

Market Opportunities

Expansion into Emerging Markets and Untapped Industries

The Isopropyl alcohol market holds significant opportunities in emerging economies where industrialization and healthcare infrastructure are rapidly developing. It can capitalize on growing demand in regions with increasing urbanization and rising disposable incomes. New applications in electronics cleaning, pharmaceuticals, and personal care products present avenues for growth. It can leverage partnerships with local distributors to expand market penetration. Entry into untapped industries such as food processing and agriculture also offers potential. Strategic investments in these markets can drive long-term revenue gains.

Innovation in Sustainable Production and Product Development

There is substantial opportunity in developing eco-friendly and sustainable isopropyl alcohol products. It can benefit from advances in green chemistry and bio-based raw materials to reduce environmental impact. Manufacturers who innovate in biodegradable formulations and energy-efficient production methods will gain competitive advantages. It offers potential to meet increasing consumer demand for environmentally responsible products. Expanding the product portfolio to include specialty grades tailored for specific industrial or medical uses further broadens market reach. Continuous innovation supports differentiation and growth in a competitive landscape.

Market Segmentation Analysis:

By Application

The Isopropyl alcohol market segments its applications across solvents, cleaning agents, chemical intermediates, flavoring agents, disinfectants, and others. It finds major demand in disinfectant and cleaning agent applications due to its effective antimicrobial and solvent properties. The solvent segment supports pharmaceutical and cosmetic formulations, driving consistent growth. Chemical intermediate usage extends its role in producing acetone and other chemicals. Flavoring agent applications remain niche but contribute to product diversity. This broad application base ensures steady demand across industries.

- For instance, ExxonMobil leverages a broad global supply chain to ensure steady supply and competitive pricing for uses like disinfectants and chemical intermediates.

By End-Use

The market categorizes end-use into food, pharmaceutical, cosmetic and personal care, medical, electronics, automotive, and others. It experiences strong consumption in pharmaceutical and medical sectors for sanitization and formulation purposes. Cosmetic and personal care sectors utilize it in lotions, sanitizers, and cleansers. The electronics industry relies on it for precision cleaning of components and circuit boards. Automotive applications involve degreasing and surface treatment. Food industry use includes flavor extraction and sanitization, expanding its scope. This segmentation highlights the market’s wide industrial relevance.

- For instance, the University of Tennessee Health Science Center’s Plough Center employs a validated triple disinfectant process involving phenolic and sporicidal agents to maintain cleanroom sterility in pharmaceutical manufacturing.

Segments:

Based on Application

- Solvent

- Cleaning Agent

- Chemical Intermediate

- Flavouring Agent

- Disinfectant

- Others

Based on End-Use

- Food

- Pharmaceutical

- Cosmetic & Personal Care

- Medical

- Electronics

- Automotive

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

The North American region commands a substantial share of the Isopropyl alcohol market, holding 35% of the global market. It benefits from strong demand in healthcare, pharmaceuticals, and personal care industries driven by high consumer awareness and stringent hygiene standards. The presence of key manufacturers and advanced production facilities supports steady supply and innovation. Widespread adoption in medical and industrial applications reinforces its market position. Increasing investments in research and development further propel growth. It remains a critical market due to regulatory support and well-established distribution networks.

Europe

Europe accounts for 28% of the Isopropyl alcohol market, driven by rising usage in pharmaceutical manufacturing and cosmetics. It demonstrates significant demand for high-purity grades to meet stringent regulatory requirements. The region emphasizes sustainable and eco-friendly production methods, influencing market dynamics. Industrial sectors such as automotive and electronics further stimulate demand for isopropyl alcohol-based cleaning agents. Strong government initiatives promoting hygiene and sanitation in medical facilities boost consumption. It maintains a competitive landscape with numerous established players.

Asia-Pacific

Asia-Pacific represents 25% of the global Isopropyl alcohol market, exhibiting rapid growth due to industrialization and expanding healthcare infrastructure. It benefits from increasing disposable incomes and urbanization across countries like China, India, and Japan. Growing pharmaceutical production and personal care product demand support market expansion. Emerging economies focus on improving sanitation standards and hygiene awareness, driving consumption. The region experiences rising investments in manufacturing capacity and technological upgrades. It presents significant opportunities for market players targeting long-term growth.

Rest of the World

The Rest of the World region holds 12% of the Isopropyl alcohol market, supported by growing demand in Latin America, the Middle East, and Africa. It witnesses increasing adoption in medical, pharmaceutical, and industrial cleaning applications. Economic development and urbanization contribute to rising hygiene awareness and product penetration. The region faces challenges such as supply chain limitations but offers growth potential through infrastructure development. Expanding healthcare services and regulatory improvements further enhance market prospects. It remains an important area for strategic market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- LCY Chemical

- INEOS

- Galaxy Chemicals

- Dow Chemical

- ExxonMobil

- Kellin Chemical

- Shell

- Super Chemical

- INEOS

- LCY Chemical Corporation

- LG Chem

Competitive Analysis

The Isopropyl alcohol market features intense competition among major global and regional players. Leading companies such as Dow Chemical, ExxonMobil, Shell, INEOS, and LG Chem dominate through extensive production capacities and advanced technologies. It faces constant pressure to innovate in product quality, sustainability, and cost efficiency to maintain market share. Companies invest heavily in research and development to create eco-friendly and high-purity grades that meet diverse industry requirements. Strategic partnerships, capacity expansions, and acquisitions serve as key tactics to strengthen market presence. Regional players also compete by focusing on localized demand and customized solutions. The market’s competitive landscape encourages continuous improvement in supply chain efficiency and customer service. It remains critical for manufacturers to balance pricing strategies with compliance to stringent regulations to sustain profitability. Competitive agility determines success in capturing emerging opportunities and adapting to evolving industry trends.

Recent Developments

- In August 2024, Eastman introduced a new electronic-grade solvent for superior quality. The electronic-grade isopropyl alcohol (IPA), part of the EastaPure line, provides U.S. semiconductor manufacturers with a reliable and domestically made solvent.

- In June 2024, Cepsa began constructing Spain’s first isopropyl alcohol (IPA) plant, diversifying its chemicals business. The new plant will produce IPA for use in hydroalcoholic gels and household and industrial cleaning products.

- In February 2024, Dow Chemical entered a strategic partnership with Siemens to integrate AI-powered process automation into Dow’s IPA production facilities.

Market Concentration & Characteristics

The Isopropyl alcohol market exhibits moderate to high concentration, dominated by several large multinational corporations including Dow Chemical, ExxonMobil, Shell, INEOS, and LG Chem. It relies heavily on extensive production capacities, technological expertise, and strong distribution networks to maintain competitive advantages. These key players invest significantly in research and development to improve product purity, sustainability, and cost efficiency. The market also features numerous regional and local manufacturers catering to niche demands and specific applications. It balances between high-volume bulk production for industrial use and specialized formulations for pharmaceutical and personal care sectors. The presence of stringent regulatory requirements influences market dynamics, compelling companies to ensure compliance while maintaining operational efficiency. Competitive pressures drive continuous innovation and capacity expansion. This market structure supports steady growth but demands agility from smaller players to differentiate through customization and service. It reflects a blend of scale, quality focus, and evolving customer needs across industries.

Report Coverage

The research report offers an in-depth analysis based on Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Isopropyl alcohol market will expand due to increased demand in healthcare and personal care products.

- Manufacturers will focus on developing eco-friendly and sustainable production processes.

- Technological advancements will enhance product purity and reduce manufacturing costs.

- The market will see growth in electronic and pharmaceutical cleaning applications.

- Emerging economies will drive demand through expanding industrial and healthcare infrastructure.

- Regulatory frameworks will become stricter, influencing production and distribution practices.

- Companies will invest in research to create specialized grades for diverse end uses.

- Digital sales channels will gain importance for wider product accessibility.

- Partnerships and acquisitions will increase to strengthen regional market presence.

- Innovation in formulation will address consumer preferences for safer and more effective products.