Chapter No. 1 :……….. Introduction.. 14

1.1. Report Description. 14

Purpose of the Report. 14

USP & Key Offerings. 14

1.2. Key Benefits for Stakeholders. 14

1.3. Target Audience. 15

1.4. Report Scope 15

Chapter No. 2 :……….. Executive Summary. 16

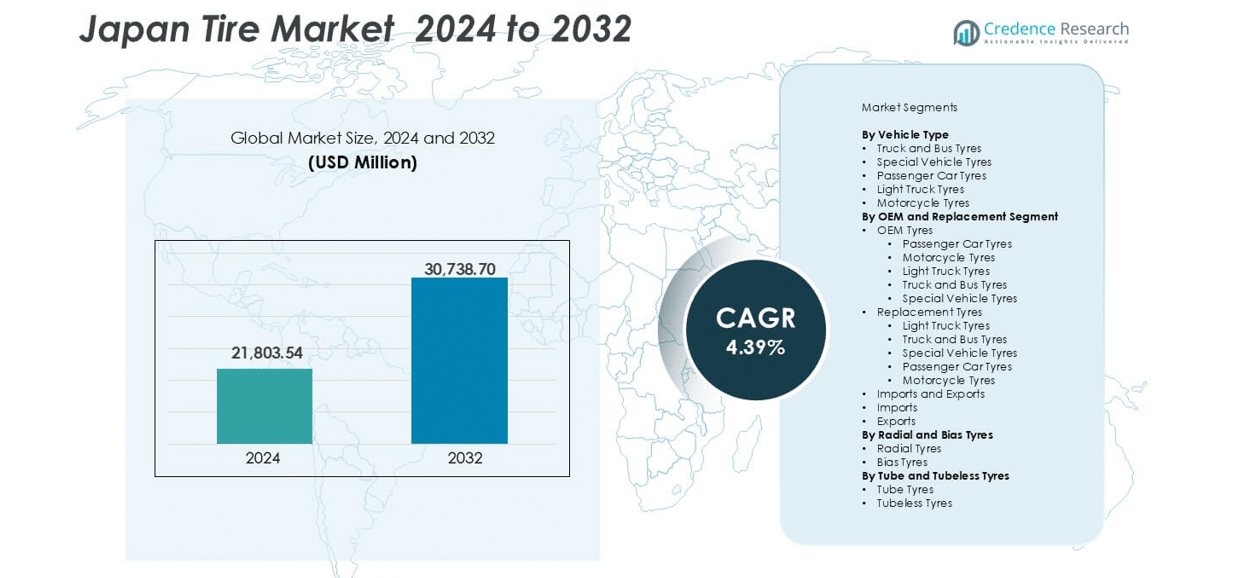

2.1. Tire Market Snapshot. 16

2.2. Japan Tire Market, Volume (Units) & Revenue (USD Million) 2018 – 2032. 18

2.3. Insights from Primary Respondents. 19

Chapter No. 3 :……….. Geopolitical Crisis Impact Analysis. 20

3.1. Russia-Ukraine and Israel-Palestine War Impacts. 20

Chapter No. 4 :……….. Tire Market – Industry Analysis. 21

4.1. Introduction 21

4.2. Market Drivers 22

4.3. Driving Factor 1 Analysis. 22

4.4. Driving Factor 2 Analysis. 23

4.5. Market Restraints. 24

4.6. Restraining Factor Analysis. 24

4.7. Market Opportunities. 25

4.8. Market Opportunity Analysis. 25

4.9. Porter’s Five Forces Analysis. 26

4.10. Value Chain Analysis. 27

4.11. Buying Criteria 28

Chapter No. 5 :……….. Price Analysis. 29

5.1. Price Analysis by Vehicle Type. 29

5.1.1. Japan Tire Market Price, By Vehicle Type, 2018 – 2023. 29

Chapter No. 6 :……….. Manufacturing Cost Analysis. 30

6.1. Manufacturing Cost Analysis. 30

6.2. Manufacturing Process. 30

Chapter No. 7 :……….. Analysis Competitive Landscape. 31

7.1. Company Market Share Analysis – 2023. 31

7.1.1. Japan Tire Market: Company Market Share, by Revenue, 2023. 31

7.1.2. Japan Tire Market: Company Market Share, by Revenue, 2023. 32

7.1.3. Japan Tire Market: Top 6 Company Market Share, by Revenue, 2023. 32

7.1.4. Japan Tire Market: Top 3 Company Market Share, by Revenue, 2023. 33

7.2. Japan Tire Market Company Volume Market Share, 2023. 34

7.3. Japan Tire Market Company Revenue Market Share, 2023. 35

7.4. Company Assessment Metrics, 2023. 36

7.4.1. Stars 36

7.4.2. Emerging Leaders. 36

7.4.3. Pervasive Players. 36

7.4.4. Participants 36

7.5. Start-ups /SMEs Assessment Metrics, 2023. 36

7.5.1. Progressive Companies. 36

7.5.2. Responsive Companies. 36

7.5.3. Dynamic Companies. 36

7.5.4. Starting Blocks 36

7.6. Strategic Developments. 37

7.6.1. Acquisitions & Mergers. 37

New Product Launch. 37

Regional Expansion. 37

7.7. Key Players Product Matrix. 38

Chapter No. 8 :……….. PESTEL & Adjacent Market Analysis. 39

8.1. PESTEL 39

8.1.1. Political Factors. 39

8.1.2. Economic Factors. 39

8.1.3. Social Factors 39

8.1.4. Technological Factors. 39

8.1.5. Environmental Factors. 39

8.1.6. Legal Factors 39

8.2. Adjacent Market Analysis. 39

Chapter No. 9 :……….. Tire Market – By Vehicle Type Segment Analysis. 40

9.1. Tire Market Overview, by Vehicle Type Segment. 40

9.1.1. Tire Market Revenue Share, By Vehicle Type, 2023 & 2032. 41

9.1.2. Tire Market Attractiveness Analysis, By Vehicle Type. 42

9.1.3. Incremental Revenue Growth Opportunity, by Vehicle Type, 2024 – 2032. 42

9.1.4. Tire Market Revenue, By Vehicle Type, 2018, 2023, 2027 & 2032. 43

9.2. Truck and Bus Tyres. 44

9.3. Special Vehicle Tyres. 45

9.4. Passenger Car Tyres. 45

9.5. Light Truck Tyres. 46

9.6. Motorcycle Tyres. 46

Chapter No. 10 :……… Tire Market – By OEM and Replacement Segment Analysis. 47

10.1. Tire Market Overview, by OEM and Replacement Segment. 47

10.1.1. Tire Market Revenue Share, By OEM and Replacement , 2023 & 2032. 48

10.1.2. Tire Market Attractiveness Analysis, By OEM and Replacement. 49

10.1.3. Incremental Revenue Growth Opportunity, by OEM and Replacement , 2024 – 2032. 49

10.1.4. Tire Market Revenue, By OEM and Replacement , 2018, 2023, 2027 & 2032. 50

10.2. OEM Tyres 51

10.3. Replacement Tyres. 52

10.4. Imports and Exports. 53

Chapter No. 11 :……… Tire Market – By Radial and Bias Tyres Segment Analysis. 54

11.1. Tire Market Overview, by Radial and Bias Tyres Segment. 54

11.1.1. Tire Market Revenue Share, By Radial and Bias Tyres, 2023 & 2032. 55

11.1.2. Tire Market Attractiveness Analysis, By Radial and Bias Tyres. 56

11.1.3. Incremental Revenue Growth Opportunity, by Radial and Bias Tyres, 2024 – 2032. 56

11.1.4. Tire Market Revenue, By Radial and Bias Tyres, 2018, 2023, 2027 & 2032. 57

11.2. Radial Tyres 58

11.3. Bias Tyres 59

Chapter No. 12 :……… Tire Market – By Tube and Tubeless Tyres Segment Analysis. 60

12.1. Tire Market Overview, by Tube and Tubeless Tyres Segment. 60

12.1.1. Tire Market Revenue Share, By Tube and Tubeless Tyres, 2023 & 2032. 61

12.1.2. Tire Market Attractiveness Analysis, By Tube and Tubeless Tyres. 62

12.1.3. Incremental Revenue Growth Opportunity, by Tube and Tubeless Tyres, 2024 – 2032. 62

12.1.4. Tire Market Revenue, By Tube and Tubeless Tyres, 2018, 2023, 2027 & 2032. 63

12.2. Tube Tyres 64

12.3. Tubeless Tyres 65

Chapter No. 13 :……… Company Profiles. 66

13.1. Bridgestone Corporation. 66

13.1.1. Company Overview.. 66

13.1.2. Product Portfolio. 66

13.1.3. Swot Analysis 66

13.1.4. Business Strategy. 67

13.1.5. Financial Overview.. 67

13.2. Yokohama Rubber Company. 68

13.3. Sumitomo Rubber Industries. 68

13.4. Toyo Tire Corporation. 68

13.5. Nitto Tire 68

13.6. Dunlop Tires 68

13.7. Michelin 68

13.8. Goodyear 68

13.9. Continental AG 68

13.10. Pirelli 68

Chapter No. 14 :……… Research Methodology. 69

14.1. Research Methodology. 69

14.2. Phase I – Secondary Research. 70

14.3. Phase II – Data Modeling. 70

Company Share Analysis Model 71

Revenue Based Modeling. 71

14.4. Phase III – Primary Research. 72

14.5. Research Limitations. 73

Assumptions. 73

List of Figures

FIG NO. 1……….. Japan Tire Market, Volume (Units) & Revenue (USD Million) 2018 – 2032. 19

FIG NO. 2……….. Porter’s Five Forces Analysis for Japan Tire Market 27

FIG NO. 3……….. Value Chain Analysis for Japan Tire Market 28

FIG NO. 4……….. Japan Tire Market Price, By Vehicle Type, 2018 – 2023. 30

FIG NO. 5……….. Manufacturing Cost Analysis. 31

FIG NO. 6……….. Manufacturing Process. 31

FIG NO. 7……….. Company Share Analysis, 2023. 32

FIG NO. 8……….. Company Share Analysis, 2023. 33

FIG NO. 9……….. Company Share Analysis, 2023. 33

FIG NO. 10……… Company Share Analysis, 2023. 34

FIG NO. 11……… Tire Market – Company Volume Market Share, 2023. 35

FIG NO. 12……… Tire Market – Company Revenue Market Share, 2023. 36

FIG NO. 13……… Tire Market Revenue Share, By Vehicle Type, 2023 & 2032. 42

FIG NO. 14……… Market Attractiveness Analysis, By Vehicle Type. 43

FIG NO. 15……… Incremental Revenue Growth Opportunity by Vehicle Type, 2024 – 2032. 43

FIG NO. 16……… Tire Market Revenue, By Vehicle Type, 2018, 2023, 2027 & 2032. 44

FIG NO. 17……… Japan Tire Market for Truck and Bus Tyres, Volume (Units) & Revenue (USD Million) 2018 – 2032 45

FIG NO. 18……… Japan Tire Market for Special Vehicle Tyres, Volume (Units) & Revenue (USD Million) 2018 – 2032 46

FIG NO. 19……… Japan Tire Market for Passenger Car Tyres, Volume (Units) & Revenue (USD Million) 2018 – 2032 46

FIG NO. 20……… Japan Tire Market for Light Truck Tyres, Volume (Units) & Revenue (USD Million) 2018 – 2032. 47

FIG NO. 21……… Japan Tire Market for Motorcycle Tyres, Volume (Units) & Revenue (USD Million) 2018 – 2032. 47

FIG NO. 22……… Tire Market Revenue Share, By OEM and Replacement , 2023 & 2032. 49

FIG NO. 23……… Market Attractiveness Analysis, By OEM and Replacement 50

FIG NO. 24……… Incremental Revenue Growth Opportunity by OEM and Replacement , 2024 – 2032. 50

FIG NO. 25……… Tire Market Revenue, By OEM and Replacement , 2018, 2023, 2027 & 2032. 51

FIG NO. 26……… Japan Tire Market for OEM Tyres , Volume (Units) & Revenue (USD Million) 2018 – 2032. 52

FIG NO. 27……… Japan Tire Market for Replacement Tyres, Volume (Units) & Revenue (USD Million) 2018 – 2032 53

FIG NO. 28……… Japan Tire Market for Imports and Exports , Volume (Units) & Revenue (USD Million) 2018 – 2032 54

FIG NO. 29……… Tire Market Revenue Share, By Radial and Bias Tyres, 2023 & 2032. 56

FIG NO. 30……… Market Attractiveness Analysis, By Radial and Bias Tyres. 57

FIG NO. 31……… Incremental Revenue Growth Opportunity by Radial and Bias Tyres, 2024 – 2032. 57

FIG NO. 32……… Tire Market Revenue, By Radial and Bias Tyres, 2018, 2023, 2027 & 2032. 58

FIG NO. 33……… Japan Tire Market for Radial Tyres, Volume (Units) & Revenue (USD Million) 2018 – 2032. 59

FIG NO. 34……… Japan Tire Market for Bias Tyres, Volume (Units) & Revenue (USD Million) 2018 – 2032. 60

FIG NO. 35……… Tire Market Revenue Share, By Tube and Tubeless Tyres, 2023 & 2032. 62

FIG NO. 36……… Market Attractiveness Analysis, By Tube and Tubeless Tyres. 63

FIG NO. 37……… Incremental Revenue Growth Opportunity by Tube and Tubeless Tyres, 2024 – 2032. 63

FIG NO. 38……… Tire Market Revenue, By Tube and Tubeless Tyres, 2018, 2023, 2027 & 2032. 64

FIG NO. 39……… Japan Tire Market for additional supplements, Volume (Units) & Revenue (USD Million) 2018 – 2032 65

FIG NO. 40……… Japan Tire Market for Tubeless Tyres, Volume (Units) & Revenue (USD Million) 2018 – 2032. 66

FIG NO. 41……… Research Methodology – Detailed View.. 70

FIG NO. 42……… Research Methodology. 71

List of Tables

TABLE NO. 1. :…. Japan Tire Market: Snapshot 17

TABLE NO. 2. :…. Drivers for the Tire Market: Impact Analysis. 23

TABLE NO. 3. :…. Restraints for the Tire Market: Impact Analysis. 25