| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Generic Oncology Drugs Market Size 2024 |

USD 21,790.60 million |

| Generic Oncology Drugs Market, CAGR |

3.01% |

| Generic Oncology Drugs Market Size 2032 |

USD 27,543.99 million |

Market Overview:

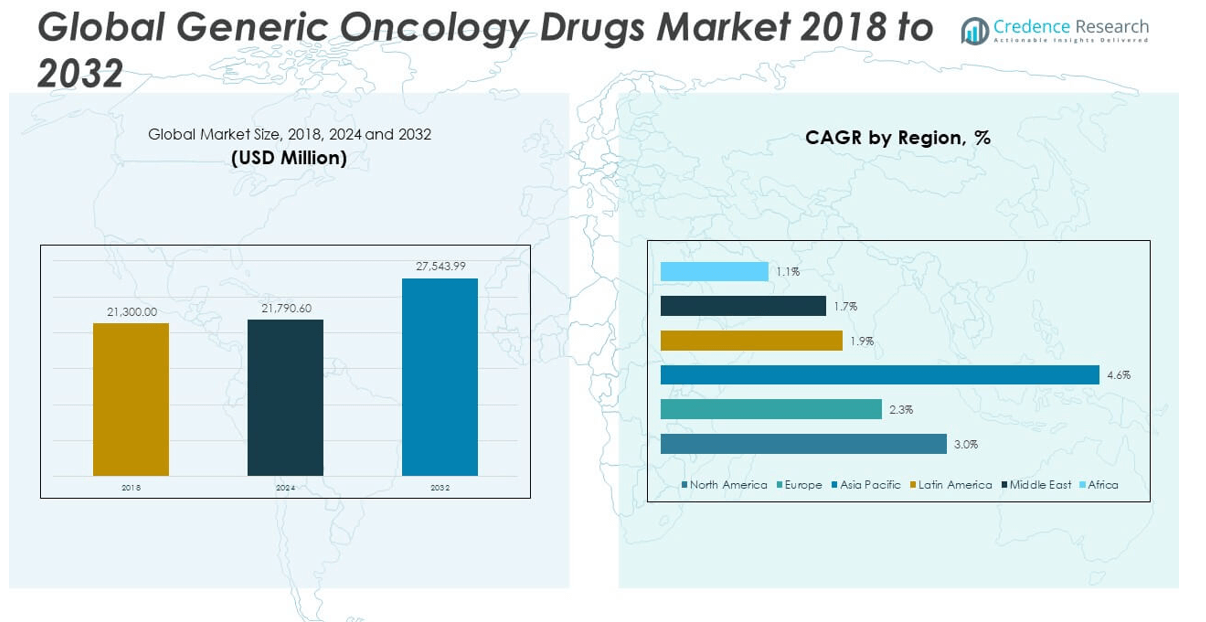

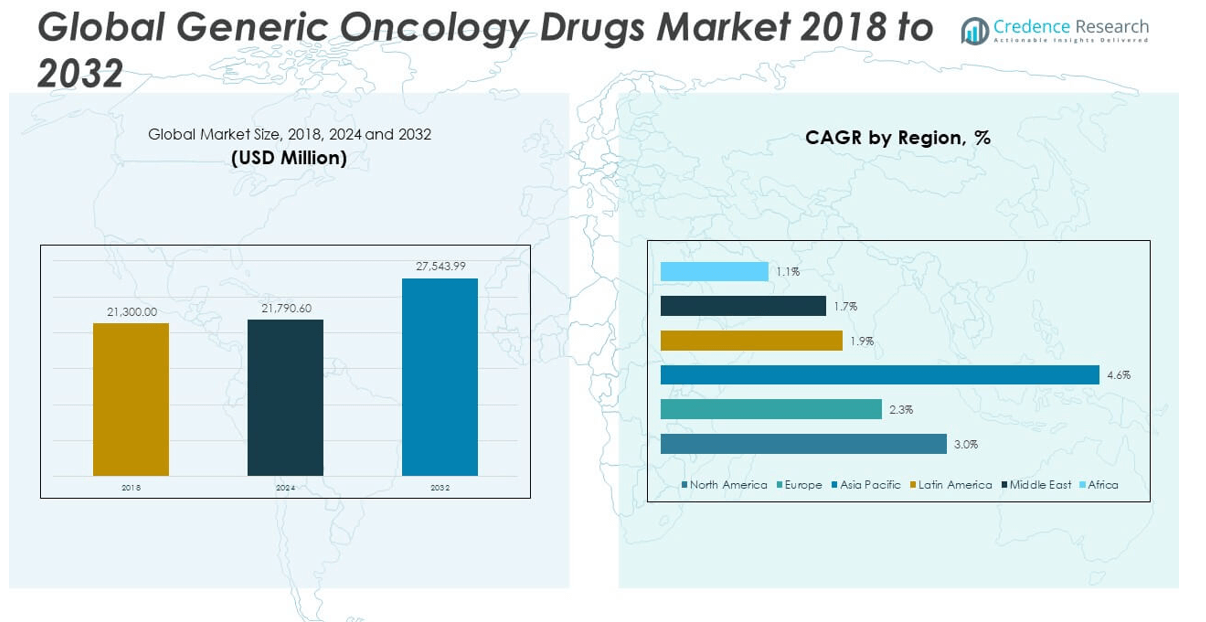

The Generic Oncology Drugs Market size was valued at USD 21,300.00 million in 2018 to USD 21,790.60 million in 2024 and is anticipated to reach USD 27,543.99 million by 2032, at a CAGR of 3.01% during the forecast period.

The generic oncology drugs market is driven by several interconnected factors that are reshaping cancer care globally. A primary catalyst is the increasing number of patent expirations for branded oncology medications, which creates an open pathway for generic manufacturers to introduce cost-effective alternatives. This shift is helping healthcare systems reduce treatment expenses while maintaining therapeutic efficacy. As cancer cases continue to rise across all demographics, there is a growing need for more accessible and affordable treatment options, especially in developing economies. The emergence of biosimilars generic versions of biologic therapies—further expands the market by offering lower-cost alternatives to complex and expensive cancer drugs. Healthcare providers are also embracing generics to align with value-based care models, which emphasize clinical outcomes and cost efficiency. Technological advancements in pharmaceutical manufacturing and regulatory support for fast-track approvals have made it easier for companies to bring safe and effective generics to market, accelerating global adoption.

North America holds a dominant position in the generic oncology drugs market due to its advanced healthcare infrastructure, strong regulatory framework, and widespread acceptance of generic treatments. Europe follows closely, driven by national healthcare systems that prioritize affordability and accessibility through generic substitution policies and centralized procurement processes. However, reliance on tender-based purchasing has led to concerns about drug availability and supply continuity, prompting regulatory bodies to reconsider procurement criteria. Asia-Pacific is emerging as the fastest-growing region, supported by large patient populations, expanding healthcare investments, and robust manufacturing capabilities in countries like India and China. Governments in these regions are actively promoting generic drug use to enhance treatment access. Meanwhile, Latin America and the Middle East & Africa are witnessing gradual growth, supported by ongoing efforts to improve healthcare infrastructure and regulatory alignment.

Market Insights:

- The Generic Oncology Drugs Market is projected to grow from USD 21,790.60 million in 2024 to USD 27,543.99 million by 2032, driven by a steady CAGR of 3.01%.

- Patent expirations of leading branded oncology drugs are enabling generic manufacturers to enter the market with cost-effective alternatives, expanding treatment accessibility.

- Rising global cancer incidence is increasing demand for affordable therapies, particularly in low- and middle-income countries where healthcare budgets remain constrained.

- Value-based healthcare models are accelerating generic drug adoption, aligning treatment affordability with desired clinical outcomes across public and private health systems.

- Advanced manufacturing processes and faster regulatory approvals are making it easier for companies to launch complex generics and biosimilars at scale.

- Intense price competition and margin pressure are challenging market sustainability, especially for smaller players and low-volume oncology drug segments.

- North America leads the market due to its strong infrastructure and regulatory framework, while Asia-Pacific emerges as the fastest-growing region with expanding healthcare access.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Patent Expirations of Blockbuster Oncology Drugs Are Opening Competitive Pathways

The expiration of patents for several high-revenue branded oncology drugs is creating favorable conditions for generic drug manufacturers. These patent cliffs are allowing generic companies to enter the oncology space with bioequivalent products that offer the same therapeutic benefits at significantly reduced costs. This shift is encouraging healthcare providers and payers to adopt generic alternatives in an effort to reduce oncology treatment expenditures. The Generic Oncology Drugs Market is benefiting directly from this trend, with a growing pipeline of generic formulations targeting previously protected molecules. The availability of generics is also improving patient access to critical therapies, especially in regions with constrained healthcare budgets. It is influencing procurement strategies across hospitals and pharmacies, leading to broader market penetration. Companies that can rapidly commercialize high-quality generics are securing competitive advantages.

Rising Global Cancer Burden Is Intensifying Demand for Affordable Treatments

The increasing incidence of cancer worldwide is putting pressure on healthcare systems to deliver effective yet affordable treatment options. Longer life expectancy, urbanization, and environmental exposures are contributing to a growing population of oncology patients. Governments and healthcare institutions are under pressure to manage this demand without compromising care standards. The rising patient volume is driving interest in generic oncology drugs as viable, lower-cost alternatives to expensive branded therapies. In the Generic Oncology Drugs Market, demand is especially strong for drugs treating common cancers such as breast, lung, and colorectal. It supports health ministries and insurance providers in expanding coverage while controlling cost growth. Generic drugs are thus emerging as essential tools in national cancer control strategies.

- For example, in the United States alone, the American Cancer Society estimates 2,001,140 new cancer cases and 611,720 deaths in 2024.

Shift Toward Value-Based Healthcare Is Supporting Generic Adoption

Healthcare systems across both developed and developing nations are undergoing a strategic shift toward value-based care models. These models prioritize cost efficiency, therapeutic outcomes, and long-term sustainability over brand loyalty or high-cost innovation. Generic oncology drugs fit well within this framework by delivering clinically effective results without inflating treatment costs. Hospitals and insurers are adopting generics to meet budgetary targets while ensuring uninterrupted patient care. It is reinforcing institutional trust in the efficacy of approved generic products. Regulatory agencies are also aligning their policies to support generic uptake through fast-track approvals and simplified pathways.

- For example, in March 2024, Zydus Lifesciences launched olaparib (a PARP inhibitor) under the brand name IBYRA in India, expanding access to advanced cancer therapies.

Advances in Manufacturing and Regulatory Efficiency Are Enabling Market Expansion

Continuous improvements in pharmaceutical manufacturing technologies are making it easier to produce complex generic oncology drugs with high consistency and quality. Process innovations are reducing production timelines and enabling scale-up to meet growing demand. These developments are lowering barriers to entry and expanding the number of firms capable of manufacturing competitive oncology generics. The Generic Oncology Drugs Market is also benefiting from evolving regulatory frameworks that facilitate faster drug approvals without compromising safety or efficacy. It is helping manufacturers navigate compliance while reaching markets more efficiently. As governments continue to emphasize affordability, streamlined regulations are accelerating the commercialization of new generics.

Market Trends:

Growing Focus on Complex Generics and Non-Biological Complex Drugs Is Reshaping the Competitive Landscape

Pharmaceutical companies are shifting their attention toward complex generics and non-biological complex drugs (NBCDs), which require advanced formulation techniques and regulatory clarity. These drugs often include injectable oncology treatments and modified-release oral formulations that present technical barriers for standard manufacturers. Complex generics are attracting investment due to their relatively lower competition and high therapeutic demand. The Generic Oncology Drugs Market is witnessing increased development activity in this segment, where success depends on both formulation expertise and regulatory navigation. It creates opportunities for differentiation, even within a price-sensitive environment. Manufacturers capable of overcoming technical and regulatory hurdles are positioning themselves as leaders in high-value product niches. This trend is gradually elevating the complexity profile of generics across the oncology space.

Rising Preference for Oral Chemotherapy Agents Is Shaping Product Development Strategies

There is a noticeable shift in treatment practices toward oral chemotherapy agents, reflecting both physician and patient preferences for ease of use and home-based therapy. Oral drugs reduce hospital dependency and help improve patient adherence, especially during long-term cancer treatment regimens. Drug developers are increasingly focusing on expanding their portfolios with generic versions of oral oncology therapies. The Generic Oncology Drugs Market is aligning with this trend by prioritizing solid dosage forms across a wide range of tumor types. It signals a transformation in how generic companies allocate their research and manufacturing capabilities. The trend also complements telemedicine and homecare models, which are becoming more prevalent in cancer care. Demand for convenient, patient-friendly treatment formats is guiding strategic decisions.

Strategic Collaborations and Licensing Agreements Are Gaining Momentum

Global and regional pharmaceutical players are increasingly entering strategic partnerships to share risk, pool expertise, and accelerate time-to-market. Licensing agreements between innovator firms and generic manufacturers are becoming more common, especially in markets with strict intellectual property enforcement. The Generic Oncology Drugs Market is experiencing heightened activity in co-development and out-licensing deals that involve pipeline products and regional distribution rights. It enables faster market access and enhances supply chain efficiency without building extensive infrastructure from scratch. Companies are also leveraging contract manufacturing and external regulatory support to streamline operations. It reflects a broader trend toward collaboration-driven growth rather than purely organic expansion. Strategic alliances are becoming a cornerstone of competitive advantage.

- For example, in October 2024, Teva Pharmaceuticals and mAbxienceexpanded their strategic partnership to include the development and global licensing of an anti-PD-1 oncology biosimilar candidate. Under this agreement, mAbxience leads development and production at its cGMP-compliant facilities, while Teva manages regulatory approvals and commercialization in key markets.

Digitalization and Data-Driven Supply Chains Are Enhancing Operational Efficiency

Pharmaceutical companies are investing in digital tools and data analytics to improve visibility, efficiency, and compliance across their supply chains. Real-time data tracking, AI-powered forecasting, and inventory optimization are being integrated into production and distribution systems. The Generic Oncology Drugs Market is gradually adopting these technologies to reduce stockouts, manage cost fluctuations, and enhance regulatory reporting accuracy. It creates a more resilient infrastructure, especially for injectable drugs that require cold-chain logistics and precise quality control. Automation in packaging, serialization, and warehouse management is also helping generic manufacturers streamline operations. The trend points toward a digital-first approach in pharmaceutical manufacturing and logistics.

- For example, major pharmaceutical companies are deploying real-time temperature monitoring, RFID tagging, and data loggersto maintain product integrity especially for temperature-sensitive injectable oncology drugs that often require storage between 2°C and 8°C, or even cryogenic conditions as low as -70°C for certain biologics and gene therapies.

Market Challenges Analysis:

Intense Price Competition and Margin Pressure Are Impacting Market Sustainability

The generic pharmaceutical landscape is marked by aggressive price competition, which is particularly severe in the oncology segment. Multiple manufacturers often target the same molecules once patents expire, leading to rapid price erosion and shrinking profit margins. This environment makes it difficult for smaller companies to sustain operations, especially when manufacturing costs and compliance expenses remain high. The Generic Oncology Drugs Market faces a constant battle between affordability and profitability, where cost-cutting pressures often impact quality, supply continuity, or investment in innovation. It also discourages market participation in low-volume or high-risk oncology drug segments. Pricing constraints from public procurement and insurance reimbursement systems further compound the issue. Long-term viability in this market increasingly depends on operational efficiency and differentiated product offerings.

Regulatory and Quality Compliance Barriers Are Slowing Product Launch Timelines

Oncology generics often involve complex manufacturing processes, strict sterility standards, and rigorous bioequivalence requirements. Regulatory authorities demand extensive documentation and clinical validation before approving generic oncology formulations, especially injectables and biosimilars. These compliance expectations extend development timelines and raise entry barriers for new players. The Generic Oncology Drugs Market encounters delays due to evolving regulatory frameworks, varied international guidelines, and inconsistent review timelines. It places additional strain on companies seeking to launch products across multiple geographies. Any deviation or deficiency in compliance can trigger warning letters, import bans, or product recalls, which damage brand reputation and disrupt supply. Building global regulatory expertise has become essential for sustained market access.

Market Opportunities:

Emerging Markets and Expanding Healthcare Access Are Creating Growth Potential

Rapid urbanization, improving healthcare infrastructure, and increasing government focus on affordable treatment are opening new avenues in emerging economies. Countries across Asia-Pacific, Latin America, and Africa are actively integrating generics into national cancer care programs. The Generic Oncology Drugs Market stands to benefit from rising demand in these regions, where branded therapies remain out of financial reach for many patients. It offers manufacturers a chance to expand geographic reach while supporting public health goals. Local partnerships, regulatory alignment, and technology transfer programs can accelerate entry into underserved markets. Companies that adapt to local needs and pricing models will gain early-mover advantages.

Biosimilar Oncology Drugs Are Unlocking High-Value Product Segments

The rising acceptance of biosimilars is creating new opportunities in complex, high-cost therapeutic areas. Oncology biosimilars for monoclonal antibodies and targeted therapies are gaining traction in both developed and developing regions. The Generic Oncology Drugs Market is evolving to include biosimilars as an essential growth category. It allows companies to diversify portfolios and tap into specialty drug segments previously dominated by branded biologics. Streamlined regulatory pathways and physician confidence in biosimilar efficacy are accelerating adoption. Strategic investment in biosimilar development can position firms as leaders in next-generation generics.

Market Segmentation Analysis:

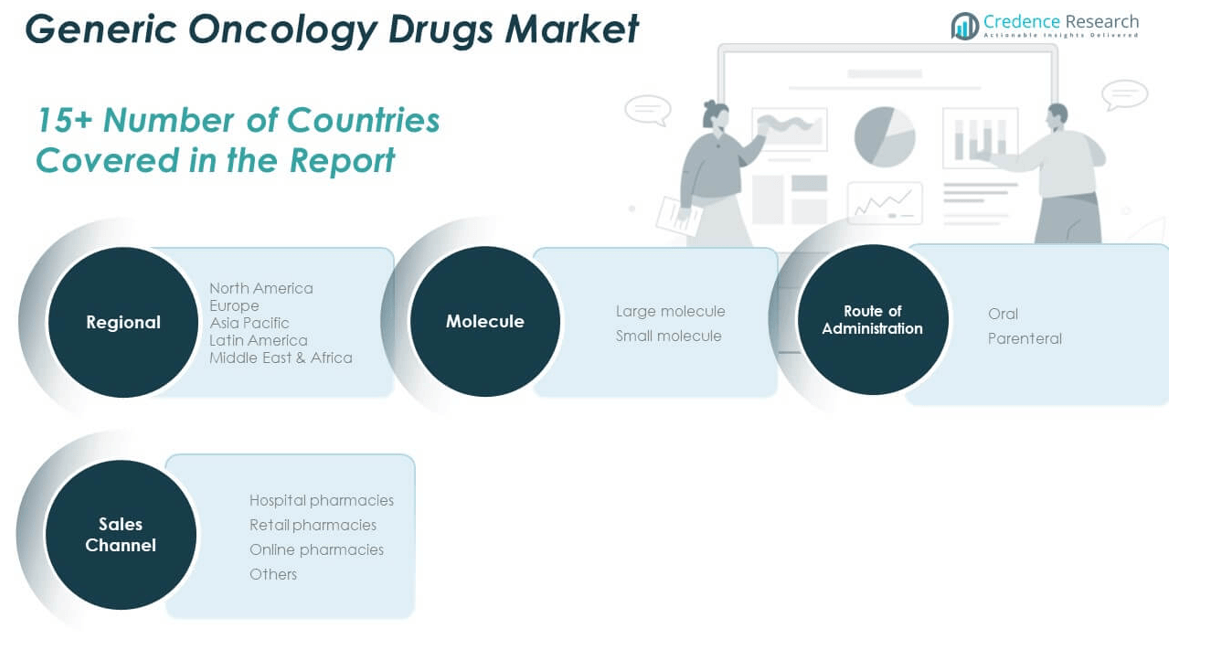

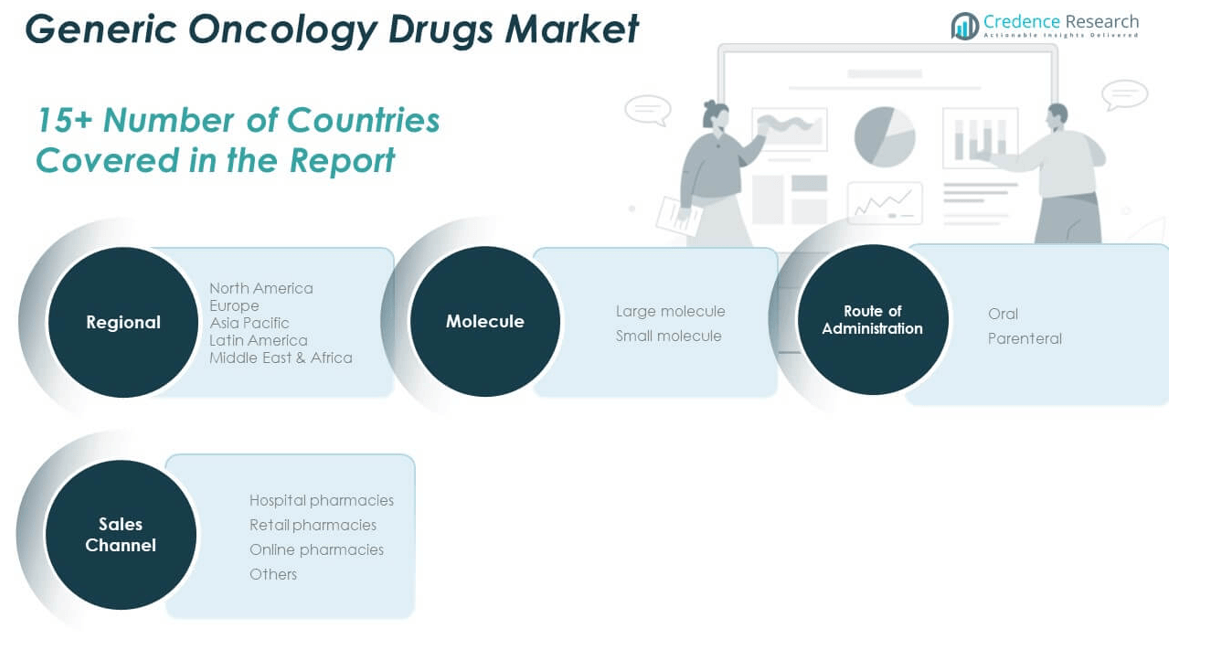

The Generic Oncology Drugs Market is segmented

By molecule into large and small molecules. Small molecules dominate the market due to their simpler structure, oral bioavailability, and easier manufacturing processes. These drugs are widely used in treating common cancers, offering effective and low-cost solutions for large patient populations. Large molecules, including biosimilars, are gaining traction as they target complex cancers with high precision, especially in the case of monoclonal antibodies and hormone therapies. Their adoption is steadily increasing with improved regulatory pathways and growing acceptance among clinicians.

By route of administration, the market is divided into oral and parenteral segments. Oral drugs lead in terms of patient preference and convenience, supporting outpatient care and improving treatment adherence. The parenteral segment remains essential for delivering high-potency or biologic-based therapies in clinical settings, particularly for advanced-stage cancers. It requires cold-chain logistics and specialized handling, favoring hospital-based care.

- For example, Capecitabine is an orally-administered chemotherapeutic agent used in the treatment of metastatic breast and colorectal cancers.

By sales channel, hospital pharmacies hold the largest share due to centralized cancer treatment delivery. Retail pharmacies contribute significantly in regions with strong outpatient services and prescription reimbursement systems. Online pharmacies are expanding steadily, driven by rising digital adoption and demand for home-delivered oncology medications. Others include specialty drug distributors and institutional supply chains supporting niche patient segments.

- For example, Walgreens Boots Alliance dispenses oral oncology drugs such as tamoxifen and imatinib through its specialty pharmacy network.

Segmentation:

By Molecule:

- Large Molecule

- Small Molecule

By Route of Administration:

By Sales Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

The North America Generic Oncology Drugs Market size was valued at USD 8,801.16 million in 2018 to USD 8,907.87 million in 2024 and is anticipated to reach USD 11,246.26 million by 2032, at a CAGR of 3.0% during the forecast period. North America holds the largest share of the global market, accounting for 34%. The region benefits from strong healthcare infrastructure, widespread insurance coverage, and consistent demand for cost-effective cancer treatments. The Generic Oncology Drugs Market in this region is supported by a high level of generic drug adoption, driven by healthcare cost containment strategies. It also benefits from regulatory efficiency through frameworks like the U.S. FDA’s Abbreviated New Drug Application (ANDA) process. The presence of major pharmaceutical players and ongoing product approvals strengthen regional market dynamics. Market growth is also influenced by patent expirations and a well-established hospital network capable of rapid generic integration.

The Europe Generic Oncology Drugs Market size was valued at USD 5,921.40 million in 2018 to USD 5,834.93 million in 2024 and is anticipated to reach USD 6,989.36million by 2032, at a CAGR of 4.6% during the forecast period. Europe represents 22% of the global market share, shaped by government-driven price control mechanisms and public healthcare systems. Generic oncology drug use is well institutionalized across countries like Germany, France, and the UK, where centralized tendering processes dominate procurement. The Generic Oncology Drugs Market in this region faces pricing pressures, yet demand remains stable due to strong policy support for generics. It is reinforced by regulatory harmonization through the European Medicines Agency (EMA), enabling streamlined approvals. However, concerns around supply continuity during tender cycles are prompting policymakers to consider new criteria beyond price alone. Multinational firms often use Europe as a strategic base for launching generic oncology portfolios.

The Asia Pacific Generic Oncology Drugs Market size was valued at USD 3,993.75 million in 2018 to USD 4,322.07 million in 2024 and is anticipated to reach USD 6,191.91 million by 2032, at a CAGR of 4.6% during the forecast period. Asia Pacific holds 17% of the global market and is the fastest-growing region, supported by a rising cancer burden and expanding healthcare access. Countries such as India and China are leading the region’s generic manufacturing capabilities, offering cost advantages and large-scale distribution. The Generic Oncology Drugs Market in Asia Pacific is gaining traction from public health programs focused on affordability. It is also witnessing increased investment in biosimilars and complex injectable generics. Government reforms to improve regulatory transparency and speed up drug approvals are enabling market entry. The presence of large patient pools and local demand for cost-effective treatments continues to drive regional expansion.

The Latin America Generic Oncology Drugs Market size was valued at USD 1,160.85 million in 2018 to USD 1,174.30 million in 2024 and is anticipated to reach USD 1,359.85 million by 2032, at a CAGR of 1.9% during the forecast period. Latin America accounts for 4% of the global market and is steadily expanding due to broader access to oncology services and growing use of generics in national health systems. Countries like Brazil and Mexico are actively promoting domestic production to lower dependence on imports. The Generic Oncology Drugs Market in Latin America is supported by policy measures that encourage cost-effective treatments. It benefits from rising cancer awareness and improving insurance coverage. Regulatory barriers, however, vary significantly across countries and impact product approval timelines. Local partnerships and public-private initiatives are helping companies navigate market entry and build long-term presence.

The Middle East Generic Oncology Drugs Market size was valued at USD 828.57 million in 2018 to USD 795.22 million in 2024 and is anticipated to reach USD 909.10 million by 2032, at a CAGR of 1.1% during the forecast period. The Middle East represents 3% of the global market, with growth supported by government-led efforts to localize pharmaceutical production and reduce reliance on imports. Wealthier countries in the Gulf region are investing in oncology infrastructure and expanding access to generic therapies. The Generic Oncology Drugs Market in the Middle East is influenced by efforts to streamline regulatory pathways and ensure supply security. It benefits from centralized healthcare purchasing and gradual acceptance of biosimilars. Variability in pricing policies and public reimbursement structures can pose challenges. Regional collaborations and international partnerships are emerging to meet local demand efficiently.

The Africa Generic Oncology Drugs Market size was valued at USD 594.27 million in 2018 to USD 756.22 million in 2024 and is anticipated to reach USD 847.51 million by 2032, at a CAGR of 1.1% during the forecast period. Africa accounts for 2% of the global market and is gradually evolving with improved access to diagnostics and oncology services. Public health campaigns and donor-funded programs are driving the inclusion of generics in essential medicine lists. The Generic Oncology Drugs Market in Africa is in the early growth phase, constrained by infrastructure gaps and supply chain limitations. It is gaining momentum as international organizations support cancer care programs across the continent. Variations in regulatory standards and procurement mechanisms create hurdles for consistent access. Local manufacturing and regional harmonization initiatives are likely to shape long-term market development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Cipla

- Eli Lilly & Co.

- GlaxoSmithKline Plc.

- Sanofi S.A.

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Ltd.

- Lupin Ltd.

- Hikma Pharmaceuticals PLC

- Viatris Inc. (Mylan N.V.)

- Johnson & Johnson

- Takeda Pharmaceutical Company Limited

Competitive Analysis:

The Generic Oncology Drugs Market features intense competition driven by cost-efficiency, manufacturing scale, and regulatory compliance. Key players include Teva Pharmaceuticals, Mylan, Sandoz, Dr. Reddy’s Laboratories, Cipla, Sun Pharma, and Aurobindo Pharma. These companies focus on expanding portfolios with high-demand molecules, particularly in injectables and complex generics. The market favors firms with robust supply chains, proven bioequivalence data, and the ability to navigate diverse regulatory frameworks. It also rewards those investing in biosimilars, which offer higher margins and less pricing pressure. Strategic partnerships, co-development deals, and geographic diversification have become common tactics to secure long-term contracts and reduce operational risk. The Generic Oncology Drugs Market continues to attract new entrants, but sustained success depends on scale, speed to market, and consistent product quality.

Recent Developments:

- In May 2025, Teva Pharmaceuticals announced the launch of a new generic version of lenalidomide capsules in the United States.

This launch is significant as lenalidomide is widely used in the treatment of multiple myeloma and certain types of lymphoma. Teva’s entry into this market is expected to improve patient access to affordable oncology treatments and strengthen the company’s portfolio in generic cancer therapies.

- In April 2025, Cipla received final approval from the US Food and Drug Administration (USFDA) for its generic version of the cancer drug Abraxane, known as protein-bound paclitaxel (100 mg/vial). This injectable formulation, a therapeutic equivalent to Bristol Myers Squibb’s Abraxane, is indicated for metastatic breast cancer, locally advanced or metastatic non-small cell lung cancer, and metastatic pancreatic adenocarcinoma.

- In January 2025, GlaxoSmithKline (GSK) entered into an agreement to acquire IDRx, a clinical-stage biopharmaceutical company focused on precision therapies for gastrointestinal stromal tumors (GIST). The acquisition, valued at up to $1.15 billion including milestones, gives GSK ownership of IDRX-42, a highly selective KIT tyrosine kinase inhibitor designed to treat GIST by targeting key mutations driving tumor growth.

Market Concentration & Characteristics:

The Generic Oncology Drugs Market exhibits moderate to high concentration, with a few large players holding significant market share due to their scale, regulatory expertise, and manufacturing capabilities. It is characterized by high barriers to entry, driven by stringent regulatory requirements, complex manufacturing processes, and the need for clinical validation. Cost competitiveness and supply reliability are critical differentiators, especially in tender-driven markets. The market shows strong price sensitivity, frequent consolidation, and increasing interest in biosimilars and complex generics. It relies heavily on volume sales and operational efficiency to sustain margins. Companies with global distribution networks and diversified portfolios maintain a competitive edge.

Report Coverage:

The research report offers an in-depth analysis based on Molecule, Route of Administration

and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Patent expirations of key oncology drugs will continue to open entry points for generic manufacturers.

- Rising cancer prevalence in emerging markets will drive sustained demand for affordable treatments.

- Expansion of biosimilars in oncology will diversify product portfolios and boost revenue potential.

- Regulatory streamlining in major markets will shorten approval timelines for generic oncology drugs.

- Technological advancements in sterile manufacturing will support growth in injectable generics.

- Increasing healthcare expenditure in developing countries will enhance generic drug accessibility.

- Strategic collaborations and licensing deals will accelerate market entry and global reach.

- Shift toward oral oncology therapies will reshape formulation priorities for generic firms.

- Digital integration in supply chains will improve distribution efficiency and reduce disruptions.

- Focus on local manufacturing in underserved regions will strengthen supply resilience and market presence.