| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Soy-Based Chemicals Market Size 2024 |

USD 1,786.04 Million |

| Japan Soy-Based Chemicals Market, CAGR |

7.97% |

| Japan Soy-Based Chemicals Market Size 2032 |

USD 3,297.59 Million |

Market Overview

The Japan Soy-Based Chemicals Market is projected to grow from USD 1,786.04 million in 2024 to an estimated USD 3,297.59 million by 2032, with a compound annual growth rate (CAGR) of 7.97% from 2025 to 2032. This growth is driven by the increasing demand for sustainable and bio-based alternatives across various industries.

Key drivers of this market include the rising consumer preference for eco-friendly products, advancements in biotechnology, and supportive government policies promoting renewable resources. Technological innovations are leading to the development of high-performance soy-based chemicals, opening new applications in industries such as bioplastics and high-performance coatings. Additionally, the increasing demand for biodiesel and renewable plastics is contributing to the market’s growth.

Geographically, the Asia-Pacific region, particularly Japan, is witnessing significant growth in the soy-based chemicals market. Japan’s strong agrarian economy, large consumer base, and growing demand for eco-friendly biofuels and soy-based food products are key factors driving this growth. Major players in the global soy-based chemicals market include Dow, Archer Daniels Midland Company, BioBased Technologies LLC, Bunge Limited, Ag Processing Inc., Cargill Inc., LANXESS, Vertec BioSolvents, Eco Safety Products, and Elevance Renewable Sciences, Inc.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Japan Soy-Based Chemicals Market is projected to grow from USD 1,786.04 million in 2024 to USD 3,297.59 million by 2032, with a CAGR of 7.97% from 2025 to 2032.

- The Global Soy-Based Chemicals Market is projected to grow from USD 28,996.80 million in 2024 to USD 52,069.72 million by 2032, with a CAGR of 7.59% from 2025 to 2032.

- Increasing demand for sustainable and eco-friendly products, along with advancements in biotechnology, is fueling the growth of soy-based chemicals.

- Government policies promoting renewable resources and eco-friendly solutions are acting as key drivers, encouraging industries to adopt soy-based alternatives.

- Continuous technological innovations are enhancing the production of high-performance soy-based chemicals, making them more competitive and versatile across industries.

- Price volatility of raw materials such as soybeans and competition from cheaper petroleum-derived chemicals pose challenges to market growth.

- Japan, part of the Asia-Pacific region, is witnessing significant growth, driven by its strong agrarian economy and rising consumer demand for biofuels and soy-based products.

- Major players such as Dow, Archer Daniels Midland Company, and Bunge Limited are leading the market by offering a wide range of soy-based products and maintaining strong R&D capabilities.

Market Drivers

Environmental Sustainability and Regulatory Support

The growing emphasis on environmental sustainability is a primary driver for the Japan Soy-Based Chemicals Market. As global concerns over climate change intensify, there is a significant shift towards reducing carbon footprints and reliance on fossil fuels. Soy-based chemicals, being biodegradable and renewable, present an eco-friendly alternative to traditional petroleum-derived products. This transition is further supported by stringent government regulations and policies promoting the use of bio-based chemicals, incentivizing industries to adopt sustainable practices. In Japan, such initiatives align with national goals to reduce greenhouse gas emissions and promote renewable resources, thereby accelerating the adoption of soy-based chemicals across various sectors.

Technological Advancements and Product Innovation

Advancements in biotechnology and chemical engineering are significantly enhancing the production of soy-based chemicals. For instance, ADM announced the opening of a new facility dedicated to soy-based biomaterials in 2023, focusing on the development of innovative, high-performance soy-based products. Cargill has invested in research and development for soy-based plastics, resulting in improved extraction and processing technologies that have led to soy-based chemicals with enhanced durability, stability, and biodegradability. Techniques such as enzymatic hydrolysis, solvent extraction, and supercritical fluid extraction have been refined to extract specific components from soybeans with higher purity and reduced environmental impact. These technological improvements are enabling the creation of specialized soy-based chemicals that meet the evolving demands of industries such as bioplastics, cosmetics, and paints & coatings. In Japan, research centers are actively developing soybean varieties tailored for different climatic conditions, which supports innovation in soy-based chemical applications. Companies like Dow Chemical, Cargill, ADM, and Bunge Limited are actively driving innovation in the sector, with a focus on developing higher-value products such as bio-based polymers and specialty chemicals for personal care and industrial uses.

Economic Viability and Supply Chain Stability

The economic attractiveness of soy-based chemicals is another significant driver. Compared to the volatility of crude oil prices, soy prices have shown greater stability, offering a more predictable cost structure for manufacturers. In Japan, the Ministry of Agriculture, Forestry and Fisheries (MAFF) oversees the production and distribution of domestically produced soybeans, with 89 primary food-grade soybean varieties cultivated as of 2019. For instance the top five varieties accounted for about three quarters of Japanese soybean sales in 2019, ensuring a stable and diverse supply base. To further ensure supply chain stability, Japanese food processors and wholesalers procure domestic soybeans through pre-planting contracts, post-harvest auctions, and bilateral contracts, as prescribed by MAFF. This established infrastructure for soybean cultivation and processing reduces dependence on imported raw materials and enhances the economic feasibility of soy-based chemical production. Additionally, U.S. soybeans, which make up 73% of Japan’s imported soybeans, are SSAP-certified, providing transparency and stability in the supply chain for Japanese companies. Companies like Marubeni, Mitsui, and Itochu have made strategic investments in the United States and Brazil to secure reliable soybean supplies, further strengthening the supply chain for soy-based chemicals in Japan.

Consumer Demand for Eco-Friendly Products

There is a rising consumer preference for eco-friendly and sustainable products, influencing market dynamics across various sectors. In Japan, consumers are increasingly aware of the environmental impact of their purchasing decisions, leading to a higher demand for products made from renewable resources. Soy-based chemicals, being derived from a renewable resource and offering biodegradable properties, align with consumer values, driving their adoption in industries such as personal care, food and beverages, and packaging. This shift in consumer behavior is compelling companies to incorporate soy-based ingredients into their product offerings to meet market expectations and enhance brand reputation.

Market Trends

Integration of Soy-Based Chemicals in Personal Care Products

The personal care industry in Japan is increasingly incorporating soy-based chemicals, such as soy lecithin and soy proteins, into skincare and cosmetic products. These ingredients are valued for their moisturizing, anti-aging, and skin-conditioning properties. The shift towards natural and plant-derived components in personal care formulations aligns with consumer preferences for clean and sustainable products. Japanese consumers’ growing awareness of environmental and health considerations is driving this trend, prompting manufacturers to innovate and include soy-based ingredients in their product lines. This movement reflects a broader global shift towards natural personal care solutions.

Technological Advancements in Soy-Based Chemical Production

Advancements in biotechnology and chemical engineering are enhancing the efficiency and scalability of soy-based chemical production in Japan. Innovations in extraction and processing technologies are improving yield, purity, and cost-effectiveness of soy-derived chemicals. These technological improvements are enabling the development of high-performance soy-based products with broader applications across various industries. The continuous research and development efforts are positioning Japan as a leader in the production of sustainable and bio-based chemicals, aligning with global trends towards renewable resources and environmental stewardship.

Expansion of Soy-Based Polymers in Industrial Applications

The increasing adoption of soy-based polyols in the production of polyurethane foams is a significant trend in Japan’s soy-based chemicals market. These polyols are utilized in manufacturing lightweight, durable, and cost-effective foams for applications in automotive interiors, construction materials, and packaging. For instance, Toyota has successfully integrated soy-based polyurethane foams into its vehicle interiors, reducing component weight by 8% and improving thermal stability. Their renewable nature and reduced environmental impact compared to traditional petrochemical-based polyols are driving their popularity. This shift aligns with Japan’s commitment to sustainability and reducing greenhouse gas emissions.

Growth of Soy-Based Biodiesel Production

Soy-based biodiesel is experiencing significant growth in Japan due to its renewable and biodegradable properties. Methyl soyate, derived from soybean oil, is a primary component used in biodiesel production. The Japanese government’s initiatives to promote renewable energy sources and reduce carbon emissions are contributing to the increased adoption of soy-based biodiesel. Advancements in biodiesel production technologies, such as improved feedstock selection and processing methods, are enhancing efficiency and reducing costs. For instance, advancements in catalysts have improved the efficiency of biodiesel production, supporting Japan’s goal of a greener energy mix. As Japan continues to prioritize sustainable energy solutions, the role of soy-based biodiesel in the country’s energy mix is expected to expand.

Market Challenges

Price Volatility of Soybean Feedstock

One of the significant challenges faced by the Italy Soy-Based Chemicals Market is the limited and fluctuating supply of raw materials. Soybeans, the primary source for producing soy-based chemicals, are subject to agricultural conditions and seasonal variations, which can lead to supply disruptions. For instance, Italy imported 1.8 million tons of soybeans in 2016, highlighting its dependence on imports for raw materials. Additionally, soy cultivation is highly dependent on global agricultural markets, with factors such as weather conditions, crop diseases, and geopolitical factors affecting the availability of raw materials. This volatility in supply impacts the cost of production for soy-based chemicals, making them less price-competitive compared to conventional petrochemical alternatives. As soybeans are primarily grown for food production, the allocation of crops for industrial uses further intensifies competition for raw materials. To maintain cost efficiency, manufacturers in Italy must navigate these supply chain complexities, which can increase operational costs and affect profit margins. Furthermore, any disruption in the soybean supply chain can lead to production delays and affect market stability. As demand for soy-based chemicals grows, addressing the issue of raw material availability and ensuring a steady supply will be crucial for sustaining long-term growth in the market.

Competition from Petroleum-Derived Chemicals

The soy-based chemicals market faces stiff competition from well-established petroleum-derived chemicals. Petrochemical products often benefit from economies of scale, established infrastructure, and lower production costs, making them more price-competitive. This price advantage can deter industries from transitioning to more expensive soy-based alternatives, even when considering environmental benefits. Overcoming this challenge requires continuous innovation to enhance the performance and cost-effectiveness of soy-based chemicals, as well as strategic marketing to highlight their environmental advantages. Additionally, government incentives and policies promoting the use of bio-based products can play a crucial role in leveling the playing field between soy-based and petroleum-derived chemicals.

Market Opportunities

Expansion of Soy-Based Polymers and Bioplastics

The increasing demand for sustainable and bio-based alternatives presents a significant opportunity for the Japan soy-based chemicals market. Soy-based polyols are increasingly being utilized in the production of polyurethane foams, which are essential in automotive interiors, construction materials, and packaging. These foams offer lightweight, durable, and cost-effective solutions, aligning with Japan’s commitment to sustainability and reducing greenhouse gas emissions. As industries seek eco-friendly alternatives, the demand for soy-based polyols is expected to continue growing, positioning them as a key component in Japan’s industrial sector.

Integration of Soy-Based Chemicals in Personal Care Products

The personal care industry in Japan is increasingly incorporating soy-based chemicals, such as soy lecithin and soy proteins, into skincare and cosmetic products. These ingredients are valued for their moisturizing, anti-aging, and skin-conditioning properties. The shift towards natural and plant-derived components in personal care formulations aligns with consumer preferences for clean and sustainable products. Japanese consumers’ growing awareness of environmental and health considerations is driving this trend, prompting manufacturers to innovate and include soy-based ingredients in their product lines.

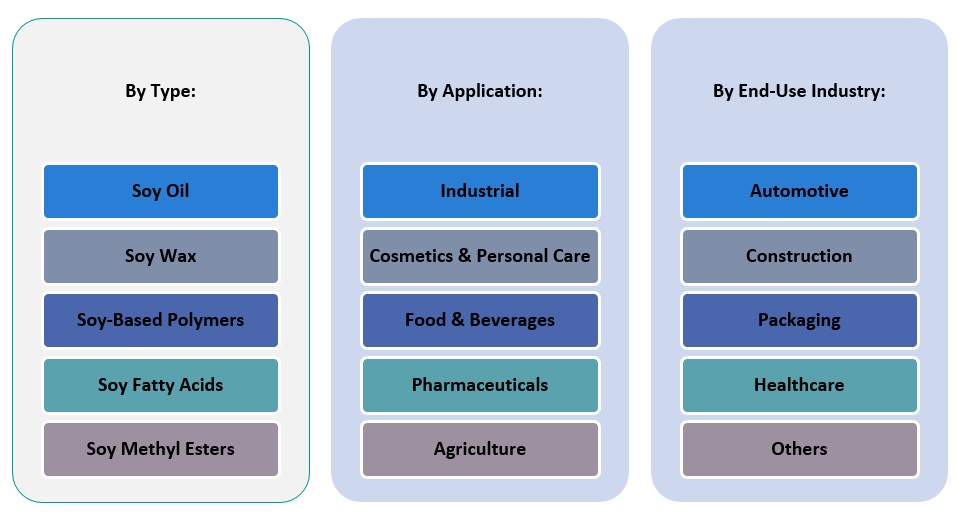

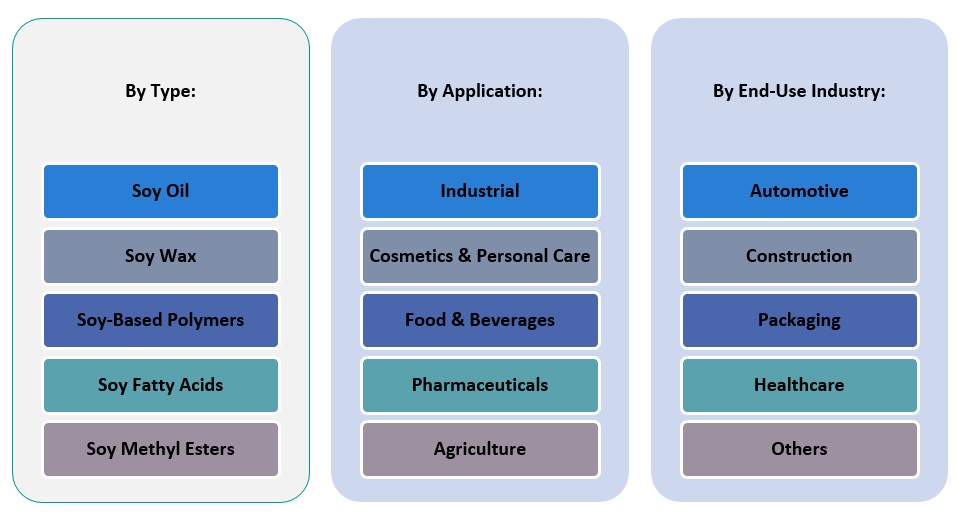

Market Segmentation Analysis

By Type:

The Japan soy-based chemicals market includes key product segments such as soy oil, soy wax, soy-based polymers, soy fatty acids, and soy methyl esters. Soy oil holds a dominant position due to its widespread application in biodiesel production, food processing, and industrial lubricants. The segment benefits from Japan’s growing focus on renewable energy and sustainable inputs. Soy wax, known for its biodegradable nature and clean-burning properties, is increasingly adopted in candle manufacturing and cosmetics. Soy-based polymers are gaining traction in applications requiring lightweight and sustainable materials, particularly in automotive and construction sectors. Meanwhile, soy fatty acids and soy methyl esters are witnessing increased use in soaps, lubricants, and biofuels, supported by technological advancements in bio-based chemical processing.

By Application:

The major application areas of soy-based chemicals in Japan include industrial, cosmetics and personal care, food and beverages, pharmaceuticals, and agriculture. Industrial applications lead due to their versatility in lubricants, adhesives, and coatings. The cosmetics and personal care segment is expanding rapidly as Japanese consumers increasingly prefer natural and eco-friendly products, promoting the use of soy-based ingredients in skin and hair care items. The food and beverage industry utilizes soy-based chemicals like soy lecithin as emulsifiers and stabilizers. In pharmaceuticals, soy-based compounds serve as carriers in drug formulations, while in agriculture, soy derivatives are used in eco-friendly pesticides and soil conditioners.

Segments

Based on Type

- Soy Oil

- Soy Wax

- Soy-Based Polymers

- Soy Fatty Acids

- Soy Methyl Esters

Based on Application

- Industrial

- Cosmetics & Personal Care

- Food & Beverages

- Pharmaceuticals

- Agriculture

Based on End Use Industry

- Automotive

- Construction

- Packaging

- Healthcare

- Others

Based on Region

Regional Analysis

Kanto Region (35%):

The Kanto region, encompassing Tokyo and its surrounding areas, holds the largest market share in Japan’s soy-based chemicals sector. This dominance is attributed to a high concentration of urban consumers who are increasingly adopting plant-based diets driven by health and environmental concerns. Additionally, Kanto serves as a hub for food manufacturing and retail, fueling demand for soy-based products across various sectors. The presence of multinational companies, research institutions, and advanced logistics further supports market growth, making Kanto the leading region for innovation and distribution in the Japanese soy-based chemicals market.

Kansai/Kinki Region (25%):

The Kansai region, including major cities like Osaka, Kyoto, and Kobe, accounts for a significant portion of the market. This area is a well-established food and beverage hub, with manufacturers focusing on creating plant-based alternatives. Retailers are actively increasing their procurement of soy-based chemicals to meet the demands of sustainability-minded consumers. The region’s strong association with agricultural areas enhances its capability to produce soy-based products, further bolstering its market share.

Key players

- Wilmar International Limited

- IOI Corporation Berhad

- Godrej Agrovet Ltd.

- PT SMART Tbk

- KLK OLEO

- Shandong Yuwang Industrial Co., Ltd.

- Nihon Emulsion Co., Ltd.

- Fuji Oil Holdings Inc.

- Sime Darby Oils

- Toyo Kagaku Co., Ltd.

Competitive Analysis

The Japan soy-based chemicals market is highly competitive, with key players leveraging their extensive product portfolios, technological expertise, and strategic partnerships to gain market share. Companies such as Wilmar International Limited and IOI Corporation Berhad lead the market, offering a wide range of bio-based products that cater to various sectors, including food, cosmetics, and industrial applications. Firms like KLK OLEO and Fuji Oil Holdings Inc. are also prominent, focusing on product innovation and sustainability to align with the growing demand for eco-friendly alternatives. Regional players like Nihon Emulsion Co., Ltd. and Toyo Kagaku Co., Ltd. are competitive in the domestic market, emphasizing their strong local presence and tailored offerings. These players consistently adapt their strategies, ensuring they meet evolving consumer preferences and regulatory standards while enhancing their market positioning through innovation and sustainability initiatives.

Recent Developments

- On October 7, 2024, Evonik and BASF agreed on the first delivery of biomass-balanced ammonia, achieving a product carbon footprint reduction of over 65%. This collaboration supports Evonik’s sustainable product lines like VESTAMIN IPD eCO and VESTAMID eCO.

- On February 26, 2025, Arkema announced a 15% expansion of its polyvinylidene fluoride (PVDF) production capacity at its Calvert City, Kentucky plant. This $20 million investment aims to meet the growing demand for high-performance resins in electric vehicles and energy storage systems.

- On February 25, 2025, AkzoNobel offered to acquire powder coatings assets and the International Research Center from its subsidiary in India. This move is part of the company’s strategy to focus more on liquid paints and coatings in the Indian market.

- In February 2025, Perstorp Holding AB began ester production at its Amsterdam plant, marking a significant step in expanding its product offerings in the sustainable chemicals sector.

Market Concentration and Characteristics

The Japan soy-based chemicals market exhibits moderate concentration, with a mix of large multinational corporations and regional players actively participating in the sector. Leading companies such as Wilmar International Limited, IOI Corporation Berhad, and Fuji Oil Holdings Inc. dominate the market, leveraging their vast product portfolios, advanced technological capabilities, and global supply chains. However, regional players like Nihon Emulsion Co., Ltd. and Toyo Kagaku Co., Ltd. maintain a strong foothold, focusing on innovation and local consumer demands. The market is characterized by a growing shift toward sustainable and eco-friendly products, driven by consumer preferences for bio-based alternatives and government regulations promoting renewable resources. Competition is primarily centered on product innovation, cost-effectiveness, and the ability to adapt to changing market trends, with a strong emphasis on quality and performance in various applications, including food, cosmetics, and industrial sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End Use Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The increasing emphasis on reducing carbon emissions is driving the adoption of soy-based biodiesel in Japan’s energy sector. This shift supports the nation’s commitment to renewable energy sources.

- With rising environmental concerns, there’s a notable shift towards soy-based bioplastics in packaging and consumer goods. This transition aligns with global sustainability goals.

- Innovations in soy protein processing are enhancing its use in food, beverages, and animal feed. This development caters to the growing demand for plant-based protein sources.

- Soy-derived ingredients are gaining popularity in skincare and cosmetic products. Their natural properties appeal to health-conscious consumers seeking eco-friendly options.

- Advancements in biotechnology and chemical engineering are improving the efficiency of soy-based chemical production. These innovations make soy-based products more competitive with traditional petrochemicals.

- Japanese government initiatives promoting renewable resources are encouraging industries to adopt soy-based chemicals. These policies aim to reduce reliance on fossil fuels.

- There’s a growing consumer preference for products made from renewable resources. This trend is driving demand for soy-based chemicals across various sectors.

- Soy-based chemicals are increasingly used in agriculture as natural pesticides and soil conditioners. This application supports sustainable farming practices.

- Soy-based chemicals are finding new applications in industrial sectors, including lubricants and coatings. Their biodegradability and performance characteristics make them attractive alternatives.

- Collaborations between industry players and research institutions are fostering innovation in soy-based chemical products. These partnerships aim to meet evolving market demands and regulatory standards.