| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Legal AI Software Market Size 2024 |

USD 1,818.81 million |

| Legal AI Software Market, CAGR |

17.01% |

| Legal AI Software MarketSize 2032 |

USD 6,375.51 million |

Market Overview

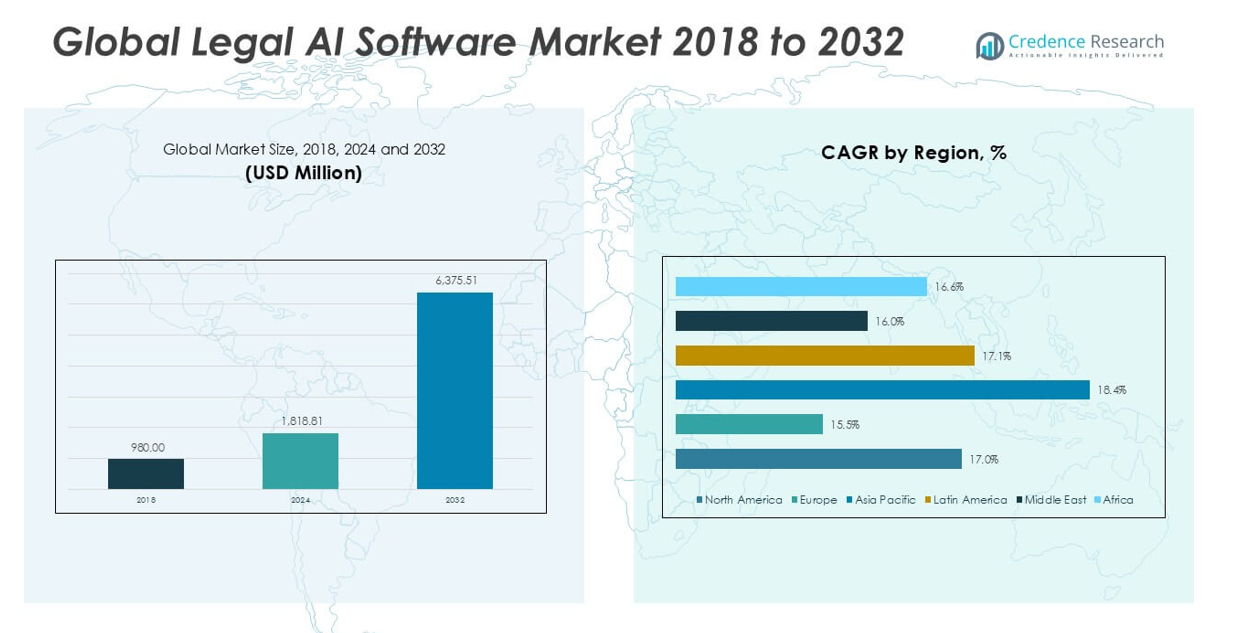

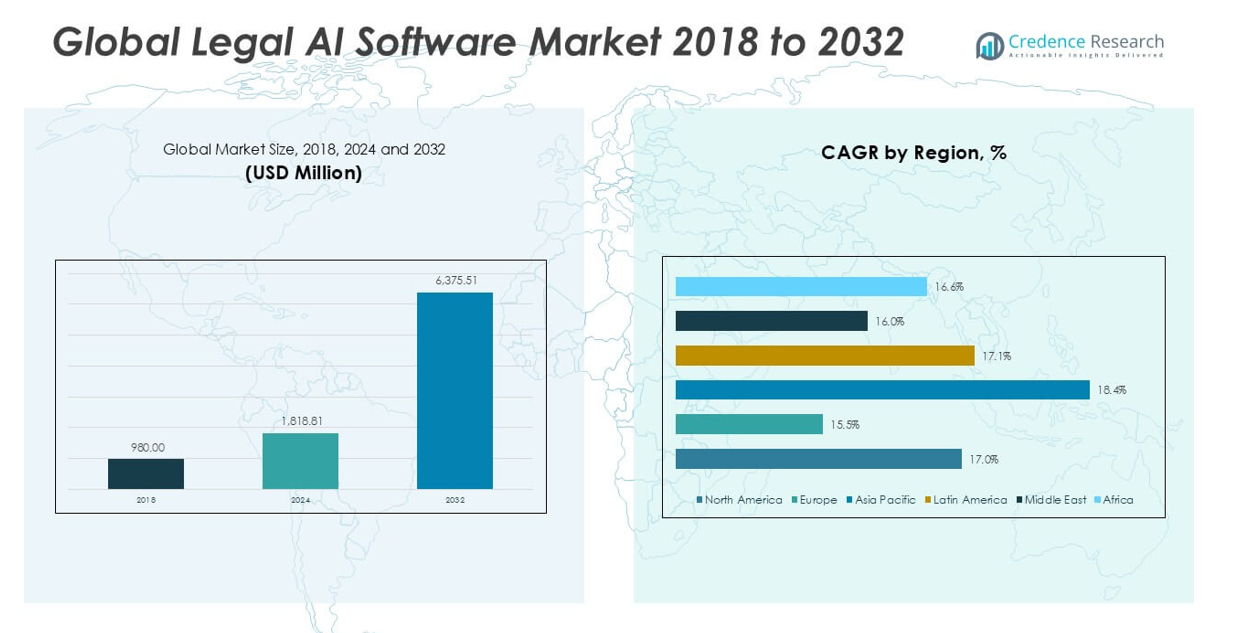

Legal AI Software Market size was valued at USD 980.00 million in 2018, reached USD 1,818.81 million in 2024, and is anticipated to reach USD 6,375.51 million by 2032, at a CAGR of 17.01% during the forecast period.

The Legal AI Software market is experiencing strong growth due to increasing demand for automation and efficiency in legal processes, as law firms and corporate legal departments seek to streamline document review, contract analysis, and legal research. The adoption of artificial intelligence enables faster, more accurate results, helping professionals manage rising workloads and complex regulatory environments. Growing investments in legal technology, rising pressure to reduce operational costs, and the need for improved client service further accelerate market expansion. Advancements in natural language processing and machine learning have enhanced the capabilities of legal AI solutions, driving greater adoption across small, medium, and large enterprises. As data privacy and compliance regulations become more stringent, organizations are leveraging AI-powered tools to ensure accuracy and mitigate risks. The trend toward digital transformation within the legal industry is expected to continue, creating sustained opportunities for market growth in the coming years.

The Legal AI Software Market demonstrates significant regional adoption, with North America, Europe, and Asia Pacific emerging as major hubs for innovation and implementation. North America leads in terms of advanced infrastructure and technology integration, driven by strong demand in the United States and Canada. Europe exhibits rapid uptake due to strict regulatory standards and a push for digital transformation across law firms in the UK, Germany, and France. Asia Pacific displays robust growth fueled by increasing technology investments and legal sector modernization in China, Japan, and India. Key players shaping the Legal AI Software Market include IBM Corporation, Casetext Inc., and Luminance Technologies Ltd., each known for their cutting-edge solutions and strong industry presence. Companies such as Docusign, Inc. and Everlaw, Inc. also play a crucial role in advancing the capabilities and global reach of AI-driven legal technology.

Market Insights

- The Legal AI Software Market reached USD 1,818.81 million in 2024 and is expected to grow to USD 6,375.51 million by 2032, with a CAGR of 17.01%.

- Automation of legal workflows and demand for operational efficiency are driving the adoption of AI-powered solutions across law firms and corporate legal departments.

- Advanced technologies such as natural language processing and machine learning enable rapid document analysis, predictive analytics, and improved compliance, shaping the market’s evolving landscape.

- The market is witnessing rising investments in cloud-based platforms, workflow automation, and AI-driven e-discovery, with digital transformation initiatives reshaping traditional legal practices.

- Leading players include IBM Corporation, Casetext Inc., and Luminance Technologies Ltd., who continue to innovate and expand their product portfolios to meet diverse client needs.

- Challenges such as data privacy concerns, regulatory complexities, and resistance to technological change hinder the pace of AI integration, especially among smaller law firms and emerging markets.

- North America, Europe, and Asia Pacific dominate regional growth, with strong adoption in the United States, United Kingdom, China, and Japan, while Latin America, the Middle East, and Africa present emerging opportunities driven by legal sector modernization and increasing digital literacy

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Operational Efficiency and Automation in Legal Services

Legal AI Software Market growth is largely fueled by the legal industry’s urgent need for improved efficiency and automation in routine tasks. Law firms and in-house legal departments face mounting workloads and increasingly complex client requirements. AI-powered solutions offer significant time savings by automating document review, contract analysis, and due diligence. These efficiencies help organizations reduce manual errors, improve turnaround times, and free up legal professionals for higher-value activities. Competitive pressures are forcing firms to adopt advanced technologies to stay relevant. Legal AI Software enables smarter resource allocation and supports strategic decision-making, making it a critical asset in the modern legal landscape.

- For instance, the International Legal Technology Association found that more than 7 out of 10 legal professionals now use AI tools for document review and due diligence.

Advancements in Artificial Intelligence Technologies and Natural Language Processing

The evolution of artificial intelligence technologies, including advanced natural language processing and machine learning, is driving rapid innovation in the Legal AI Software Market. Modern AI platforms can accurately interpret legal language, analyze large volumes of case data, and generate actionable insights. Enhanced capabilities enable legal teams to conduct faster, more precise research and risk assessments. Law firms can now handle complex regulatory environments and cross-border matters with greater confidence. AI’s ability to adapt and learn from new data improves the software’s value over time. These technical advancements make AI solutions increasingly indispensable in legal practice.

- For instance, according to a survey by the American Bar Association, more than 6 in 10 law firms reported using AI-driven legal research tools to access and process thousands of legal documents within minutes.

Increasing Focus on Compliance and Data Security in Legal Operations

Legal AI Software Market expansion is also shaped by the growing emphasis on compliance, risk mitigation, and data security within the legal sector. Law firms must adhere to evolving regulations and privacy standards that require secure handling of sensitive client information. AI-driven platforms provide robust compliance tools that monitor changes in law, automate updates to processes, and track regulatory requirements. Enhanced security features ensure data integrity and confidentiality, building client trust. Organizations turn to AI solutions to mitigate exposure to legal risks and maintain a strong compliance posture.

Growing Investments and Digital Transformation Across the Legal Sector

Market players are investing heavily in the development and deployment of Legal AI Software, recognizing its role in digital transformation strategies. Leading law firms, corporate legal departments, and technology vendors allocate significant budgets to adopt and integrate AI-based tools. Demand for improved client service, operational agility, and competitive differentiation motivates these investments. The Legal AI Software Market benefits from increased funding for research and partnerships with technology providers. Digital transformation initiatives are reshaping traditional workflows and enabling data-driven decision-making, accelerating the adoption of legal AI solutions industry-wide.

Market Trends

Growing Adoption of AI-Powered Document Review and E-Discovery Solutions

Legal AI Software Market shows a clear shift toward AI-powered document review and e-discovery solutions that help law firms and legal departments manage vast volumes of information. Automation of document-intensive processes is reducing human error and accelerating case preparation. AI-driven platforms extract relevant data, flag inconsistencies, and identify potential risks with increased accuracy. Law firms leverage these capabilities to improve client service and operational efficiency. E-discovery solutions equipped with machine learning can process large datasets rapidly, transforming how organizations respond to litigation and regulatory inquiries. The trend toward digital case management reinforces the role of AI in handling high-stakes legal matters.

- For instance, a government legal innovation survey revealed that firms adopting AI for document review saw an average reduction of 12 days in litigation response times.

Expansion of Predictive Analytics and Legal Research Tools

Legal AI Software Market demonstrates strong momentum in predictive analytics and advanced legal research tools. Predictive analytics software enables law firms to forecast litigation outcomes, assess case strengths, and identify optimal strategies. AI-powered legal research tools provide faster, more precise results by analyzing statutes, precedents, and court opinions. These platforms help legal professionals deliver higher value to clients by supporting data-driven decisions. Law firms rely on real-time analytics to guide negotiations, settlements, and compliance strategies. Widespread adoption of predictive and research tools is changing traditional legal practices and encouraging greater reliance on technology.

- For instance, a legal tech company found that law firms using AI-driven analytics tools reported preparing case strategies two to four times faster compared to traditional approaches.

Integration of AI with Case Management and Workflow Automation Platforms

Integration of AI within case management and workflow automation platforms marks a key trend in the Legal AI Software Market. AI-driven tools streamline routine administrative tasks, automate scheduling, and manage deadlines for legal professionals. It also assists with billing, time tracking, and resource allocation, which improves transparency and accountability. Advanced workflow automation ensures that legal processes remain consistent and compliant with regulatory requirements. Seamless integration with other enterprise systems allows legal teams to collaborate more effectively and scale operations. These developments support a more agile and responsive legal environment.

Emphasis on Data Privacy, Security, and Ethical AI Practices

Legal AI Software Market reflects a rising emphasis on data privacy, security, and ethical AI adoption. Law firms face increasing scrutiny over the protection of sensitive data and responsible use of AI algorithms. AI vendors implement robust security protocols and transparent practices to address client concerns about data misuse or bias. Regulatory bodies are establishing frameworks to ensure that AI-driven legal solutions operate within ethical boundaries. Firms must align their AI deployments with industry standards and privacy laws to safeguard client interests. Ongoing focus on ethical and secure AI practices builds confidence in technology adoption within the legal sector.

Market Challenges Analysis

Complexities in Data Privacy, Security, and Regulatory Compliance

Legal AI Software Market faces significant challenges related to data privacy, security, and regulatory compliance. Law firms and corporate legal departments handle highly sensitive information, making robust protection against cyber threats and data breaches essential. Many organizations struggle to align AI adoption with evolving data protection regulations, particularly across different jurisdictions. The risk of inadvertent disclosure or misuse of client information remains a key concern, which slows the pace of technology integration. AI vendors must constantly update software to address new legal and regulatory requirements, placing pressure on both development and implementation teams. These complexities increase the cost and effort required to deploy AI-driven solutions securely and compliantly.

Resistance to Technological Change and Gaps in AI Expertise

Legal AI Software Market also encounters resistance to technological change within the traditionally conservative legal sector. Many legal professionals hesitate to trust AI-driven processes for critical decisions, fearing errors, loss of control, or ethical concerns. Firms often lack in-house expertise to assess, implement, and manage advanced AI systems effectively. High upfront costs for software acquisition, integration, and ongoing maintenance present financial barriers, especially for smaller practices. Integration challenges with legacy systems can cause disruptions in workflows, undermining efficiency gains. Overcoming these obstacles requires significant investment in change management and continuous education to build trust and proficiency in legal AI technologies.

Market Opportunities

Expansion into Untapped Markets and Small to Mid-Sized Law Firms

Legal AI Software Market holds strong potential for expansion into untapped regions and small to mid-sized law firms. Many legal practices in emerging markets and underserved segments seek digital tools that enhance efficiency and competitiveness. Vendors can tailor affordable, scalable AI solutions for firms with limited resources, creating new revenue streams and broader market reach. Cloud-based platforms and subscription models lower entry barriers and simplify deployment, allowing smaller firms to adopt advanced technologies without heavy capital investment. Increased digital literacy and remote working trends are driving interest in legal AI, helping it gain traction outside traditional urban centers. Expansion into these areas can accelerate market growth and diversify the client base for technology providers.

Development of Advanced AI Applications for Specialized Legal Services

Legal AI Software Market presents opportunities through the development of advanced AI applications tailored to specialized legal services such as intellectual property, compliance, and litigation support. Law firms and in-house legal teams require customized solutions that address complex, industry-specific needs. AI vendors who innovate in predictive analytics, contract lifecycle management, and real-time legal research can differentiate their offerings and capture higher-value segments. Strategic partnerships with legal professionals and technology companies can support the creation of purpose-built tools for niche markets. These advancements enable firms to deliver more personalized, efficient, and high-quality legal services, positioning AI providers for long-term growth and leadership in the evolving legal landscape.

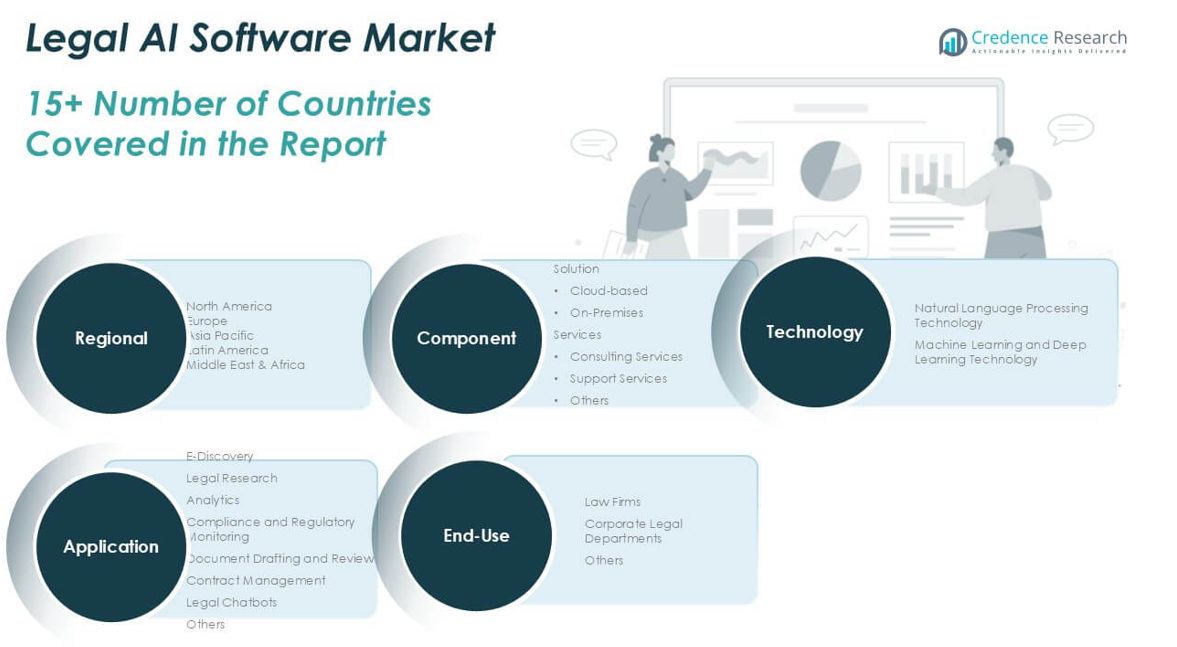

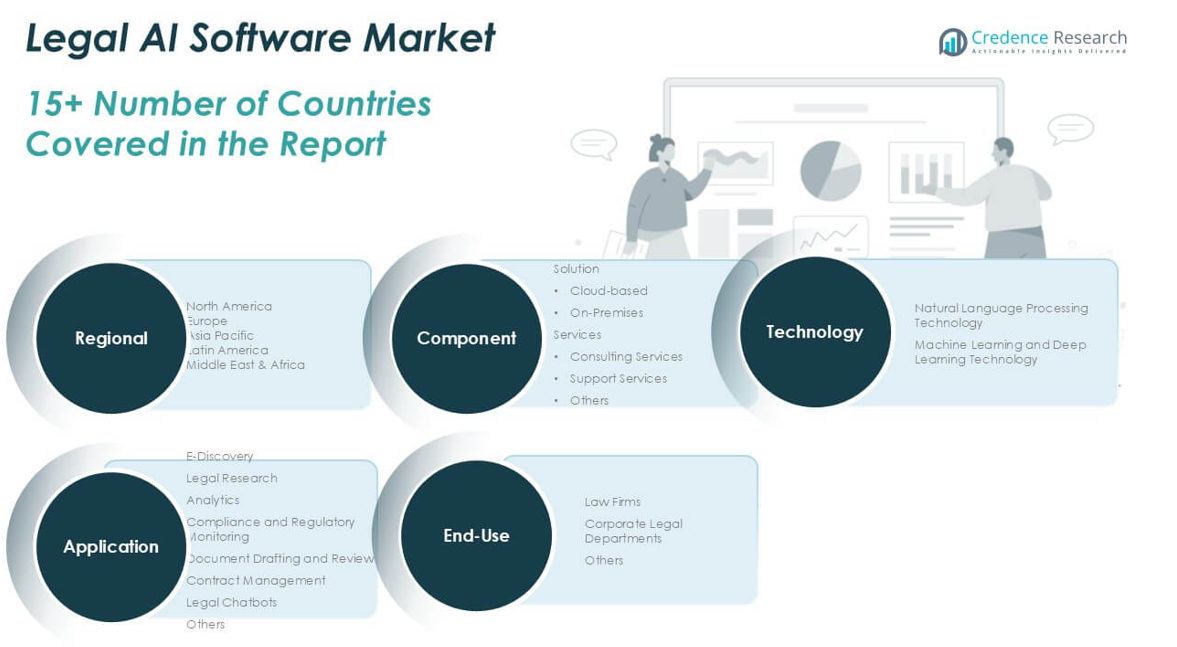

Market Segmentation Analysis:

By Component:

The Legal AI Software Market features a dynamic component segment, comprising solutions and services that cater to evolving demands in the legal sector. Solution offerings dominate the landscape, driven by the widespread adoption of cloud-based platforms, which deliver scalability, flexibility, and ease of integration for law firms and corporate legal departments. On-premises solutions remain relevant for organizations that prioritize data security and regulatory compliance, particularly in regions with stringent data protection laws. Services play a critical role in enabling successful AI adoption, with consulting services guiding implementation strategies, support services ensuring seamless operations, and other value-added offerings addressing specialized needs.

- For instance, a government digital transformation highlighted that out of every 10 law firms surveyed, 8 preferred cloud-based solutions for new deployments, citing quicker setup times and fewer IT resource requirements.

By Application:

The Legal AI Software Market spans a diverse range of use cases that reflect the complexity of modern legal work. E-discovery stands out for its ability to automate the identification, collection, and review of digital information for litigation and investigations. Legal research applications empower professionals to quickly analyze statutes, case law, and precedents, enabling more informed decision-making. Analytics platforms provide actionable insights from large datasets, helping firms anticipate trends and assess risks. Compliance and regulatory monitoring solutions keep organizations up to date with changing laws, while document drafting and review tools accelerate the creation and verification of legal documents. Contract management applications streamline contract lifecycle activities, and legal chatbots enhance client interaction and support. The “Others” category covers emerging use cases and niche applications, supporting continuous innovation in legal technology.

- For instance, the International Legal Technology Association found that law firms using AI-enabled e-discovery tools reviewed up to 50,000 documents per day, while those using manual processes managed fewer than 6,000.

By End-Use:

End-use segmentation in the Legal AI Software Market highlights the distinct requirements of law firms, corporate legal departments, and other end users. Law firms lead adoption by leveraging AI software to improve efficiency, accuracy, and client service in legal proceedings. Corporate legal departments deploy these solutions to optimize internal workflows, manage risk, and ensure regulatory compliance across multiple jurisdictions. Other end users include government agencies, non-profit organizations, and alternative legal service providers, each seeking tailored AI tools to meet their unique operational needs. The ability to serve a wide range of end users positions the Legal AI Software Market for sustained expansion and long-term relevance in the global legal ecosystem.

Segments:

Based on Component:

- Solution

- Services

- Consulting Services

- Support Services

- Others

Based on Application:

- E-Discovery

- Legal Research

- Analytics

- Compliance and Regulatory Monitoring

- Document Drafting and Review

- Contract Management

- Legal Chatbots

- Others

Based on End-Use:

- Law Firms

- Corporate Legal Departments

- Others

Based on Technology:

- Natural Language Processing Technology

- Machine Learning and Deep Learning Technology

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Legal AI Software Market

North America Legal AI Software Market grew from USD 459.13 million in 2018 to USD 852.16 million in 2024 and is projected to reach USD 2,986.86 million by 2032, reflecting a compound annual growth rate (CAGR) of 17.0%. North America is holding a 32% market share. The United States leads regional adoption, with Canada following as legal firms and corporate legal departments rapidly integrate AI solutions to enhance efficiency and manage complex regulatory demands. The region’s advanced technology infrastructure and strong investment climate foster the rapid deployment of cloud-based platforms. Robust demand for AI-driven e-discovery and compliance solutions propels further growth. Industry collaboration between tech vendors and legal practitioners accelerates innovation, ensuring continued leadership in legal technology adoption.

Europe Legal AI Software Market

Europe Legal AI Software Market grew from USD 180.81 million in 2018 to USD 316.66 million in 2024 and is forecasted to reach USD 1,004.79 million by 2032, at a CAGR of 15.5%. Europe holds a 11% market share. Germany, the UK, and France represent major contributors to regional growth as law firms and corporate legal departments prioritize digital transformation. Regulatory frameworks such as GDPR increase the focus on data privacy, driving investment in secure AI solutions. Regional law societies support the adoption of advanced legal technologies. It benefits from a skilled workforce and increasing collaboration between local legal technology startups and established firms.

Asia Pacific Legal AI Software Market

Asia Pacific Legal AI Software Market grew from USD 196.98 million in 2018 to USD 378.89 million in 2024 and is set to reach USD 1,455.77 million by 2032, posting the highest CAGR of 18.4%. Asia Pacific holds a 16% market share. Key countries include China, Japan, and India, where law firms and corporate legal departments actively pursue AI-enabled transformation. Growing legal complexity, rapid urbanization, and strong technology adoption support robust market expansion. Multinational firms and local startups alike invest in advanced analytics, contract management, and compliance monitoring solutions. Regulatory reforms and increased investment in legal infrastructure propel adoption across the region.

Latin America Legal AI Software Market

Latin America Legal AI Software Market grew from USD 63.21 million in 2018 to USD 117.54 million in 2024 and is expected to reach USD 415.61 million by 2032, with a CAGR of 17.1%. Latin America accounts for a 4% market share. Brazil and Mexico lead growth due to rising legal sector modernization and a shift toward cloud-based legal solutions. Legal service providers focus on automating document management and regulatory compliance, supporting market expansion. Collaboration with international technology providers fuels innovation. Government initiatives for digital transformation create new opportunities in the legal sector.

Middle East Legal AI Software Market

Middle East Legal AI Software Market grew from USD 49.98 million in 2018 to USD 87.97 million in 2024 and will reach USD 287.62 million by 2032, growing at a CAGR of 16.0%. The Middle East represents a 3% market share. The United Arab Emirates and Saudi Arabia drive regional adoption, focusing on judicial modernization and smart city initiatives. Investment in legal tech startups and digital government programs creates a supportive environment for AI adoption. Law firms leverage AI to streamline litigation support and enhance compliance. The region’s technology-driven legal reforms underpin ongoing market growth.

Africa Legal AI Software Market

Africa Legal AI Software Market grew from USD 29.89 million in 2018 to USD 65.59 million in 2024 and is projected to reach USD 224.86 million by 2032, with a CAGR of 16.6%. Africa holds a 2% market share. South Africa and Nigeria are central to regional expansion, with local law firms and multinational organizations investing in AI-enabled legal research and document automation. The continent’s growing legal complexity and increased awareness of technology benefits support market uptake. Challenges such as infrastructure and skills gaps remain, but ongoing initiatives to strengthen digital literacy create pathways for adoption. The market stands poised for gradual yet sustained growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Casetext Inc.

- CosmoLex Cloud, LLC

- Docusign, Inc.

- Everlaw, Inc.

- Filevine, Inc.

- IBM Corporation

- Icertis, Inc.

- Knovos LLC

- LegalSifter

- Luminance Technologies Ltd.

- Neota Logic Inc.

- LAWYAW (Mystacks, Inc.)

- Veritone, Inc.

- TimeSolv Corporation

Competitive Analysis

The Legal AI Software Market features a competitive landscape shaped by leading technology providers that continuously innovate to address evolving client requirements. Key players such as IBM Corporation, Casetext Inc., Luminance Technologies Ltd., Docusign, Inc., Everlaw, Inc., Filevine, Inc., and Icertis, Inc. focus on delivering advanced AI-driven solutions that streamline legal research, document review, contract management, and compliance monitoring. These companies leverage expertise in artificial intelligence, natural language processing, and cloud computing to offer robust platforms tailored for law firms, corporate legal departments, and legal service providers. Strategic partnerships, product launches, and acquisitions are common strategies used to expand their global reach and enhance solution portfolios. Many leaders invest heavily in R&D to improve predictive analytics, workflow automation, and data security features, responding to the sector’s growing demand for efficiency and accuracy. Market competition is further intensified by emerging players and startups introducing innovative tools designed for niche legal applications. The ongoing emphasis on technology integration and customer-centric product development ensures that these leading companies maintain strong positions in the Legal AI Software Market while supporting the legal sector’s broader digital transformation.

Recent Developments

- In December 2024, RelativityOne enhanced its platform with new features aimed at improving user experience and efficiency in the legal AI landscape. Notably, the Import/Export functionality now allows users to rename workspace field names during export, streamlining data management processes.

- In November 2024, Litera acquired Office & Dragons, a platform for mass document drafting and editing, to streamline document workflows and enhance its drafting capabilities through automation and generative AI.

- In October 2024, Thomson Reuters acquired Materia, a specialist in agentic AI tailored for the tax, audit, and accounting sectors. The acquisition aims to transform customer experiences across Thomson Reuters’ tax, audit, and accounting portfolio by eliminating low-value tasks and allowing teams to focus on higher-value advisory work.

- In October 2024, CS DISCO launched its Cecilia AI platform in Europe, marking a significant milestone as it introduced a suite of generative AI legal solutions to the region. This platform aims to assist legal professionals in efficiently identifying and analyzing relevant documents, thereby streamlining the eDiscovery process

- In September 2024, IBM acquired Accelalpha, a leading Oracle consultancy, to significantly enhance its legal AI offerings. By integrating Accelalpha’s expertise in legal practice management systems, IBM aims to strengthen its consulting capabilities, enabling law firms to leverage advanced AI solutions for improved document management and analytics. This strategic move underscores IBM’s commitment to advancing technology in the legal sector.

- In May 2024, Microsoft collaborated with Litera to streamline lawyers’ workflows, improving efficiency and accuracy by providing an intelligent experience within Microsoft 365. By leveraging Litera’s expertise in legal workflows and Microsoft’s AI capabilities, the collaboration will significantly benefit the legal AI software market, enabling lawyers to focus on high-quality work and client service.

Market Concentration & Characteristics

The Legal AI Software Market displays moderate to high concentration, with a select group of established technology firms and innovative startups capturing significant market share. It is characterized by rapid technological advancements, frequent product upgrades, and a strong focus on artificial intelligence, natural language processing, and machine learning capabilities. Leading providers deliver comprehensive platforms that address diverse legal functions, from e-discovery and legal research to contract management and compliance. The market values integration with existing legal technology infrastructure, user-friendly interfaces, and robust data security features. Customers prioritize reliability, customization, and scalability when selecting solutions, driving providers to invest in continuous development and responsive support. It attracts significant investment from both venture capital and large technology firms, reflecting confidence in long-term growth and the ongoing digital transformation of the legal sector. Barriers to entry remain moderate, with technical expertise and regulatory compliance representing key challenges for new entrants.

Report Coverage

The research report offers an in-depth analysis based on Component, Application, End-Use, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Legal AI Software Market will experience sustained growth driven by rising adoption among law firms and corporate legal departments.

- AI-powered tools will further automate legal research, document review, and contract analysis, enhancing productivity.

- Natural language processing and machine learning technologies will advance, enabling more accurate and sophisticated legal insights.

- Cloud-based platforms will gain preference for their flexibility, scalability, and ease of integration with existing systems.

- Demand for robust data security and compliance features will increase as regulations become more complex.

- Legal service providers will seek greater customization and user-friendly interfaces in AI solutions.

- Strategic partnerships between technology vendors and legal organizations will accelerate product innovation.

- The market will see more investments from established tech companies and venture capital funds.

- Resistance to technological change will decline as digital literacy improves across the legal sector.

- Expansion into emerging markets will create new growth opportunities for providers of legal AI software.