Market Overview

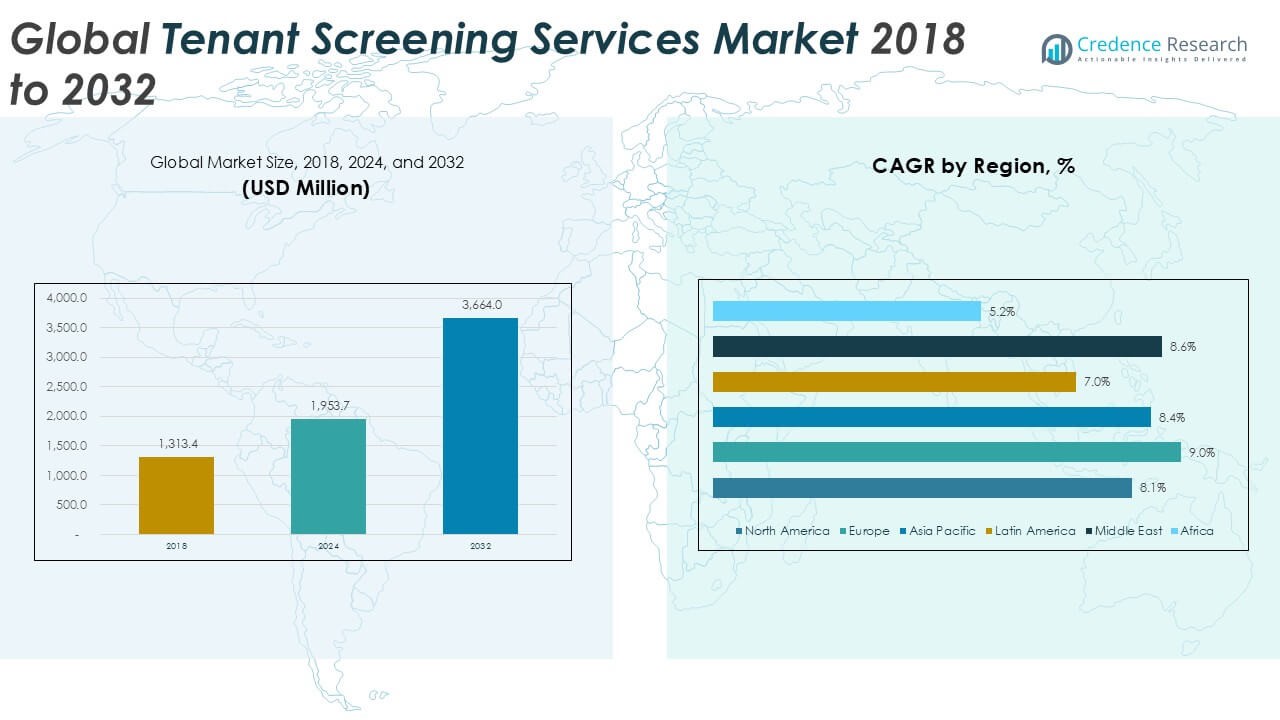

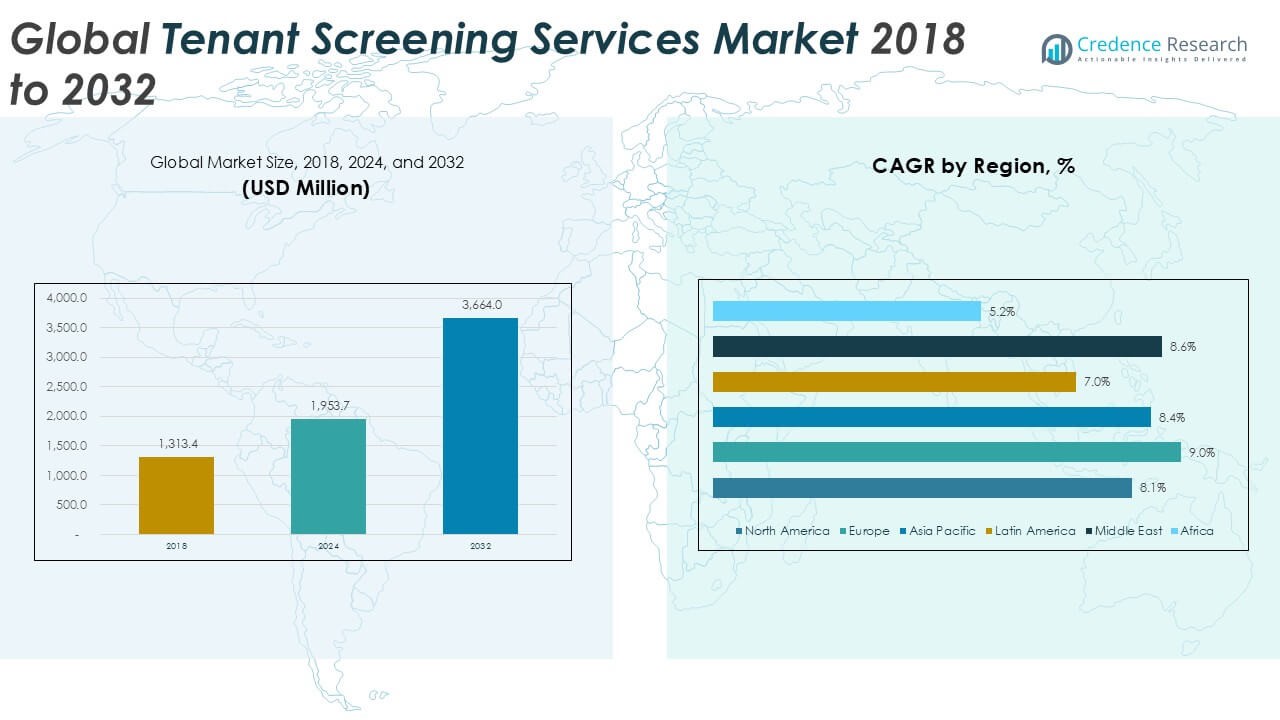

The Tenant Screening Services market size was valued at USD 1,313.4 million in 2018 and USD 1,953.7 million in 2024, and is anticipated to reach USD 3,664.0 million by 2032, at a CAGR of 8.29% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tenant Screening Services Market Size 2024 |

USD 1,953.7 Million |

| Tenant Screening Services Market, CAGR |

8.29% |

| Tenant Screening Services Market Size 2032 |

USD 3,664.0 Million |

The Tenant Screening Services market is dominated by established players such as TransUnion, Experian, Equifax, and CoreLogic, which hold a significant share due to their extensive databases, advanced analytics capabilities, and strong brand recognition. These companies offer integrated solutions covering credit checks, background verification, and rental history assessments, making them preferred partners for large property management firms. Emerging players like RentSpree, TurboTenant, and TenantCloud are gaining traction by offering flexible, cloud-based platforms tailored to small landlords and independent agents. Regionally, Asia Pacific leads the global market, accounting for 31.7% of the total market share in 2024, driven by rapid urbanization, increasing rental demand, and digital transformation in countries like China and India. North America and Europe follow closely, with 27.2% and 24.7% market shares respectively, supported by regulatory compliance and widespread use of structured tenant evaluation processes across rental housing sectors.

Market Insights

- The Tenant Screening Services market was valued at USD 1,953.7 million in 2024 and is projected to reach USD 3,664.0 million by 2032, growing at a CAGR of 8.29% during the forecast period.

- Growth is driven by rising rental housing demand, increasing need for risk mitigation by landlords, and regulatory compliance requirements encouraging structured screening processes.

- Trends include growing adoption of cloud-based platforms, expansion of AI-powered screening tools, and the shift toward mobile-friendly solutions for individual landlords.

- Key players such as TransUnion, Experian, and Equifax dominate the market, while new entrants like TurboTenant and RentSpree are gaining ground through tech-enabled offerings; however, data privacy concerns and lack of standardized databases in some regions limit market expansion.

- Asia Pacific leads with a 31.7% market share in 2024, followed by North America (27.2%) and Europe (24.7%); by segment, Credit Checks and Cloud-based technology remain dominant due to their reliability and scalability.

Market Segmentation Analysis:

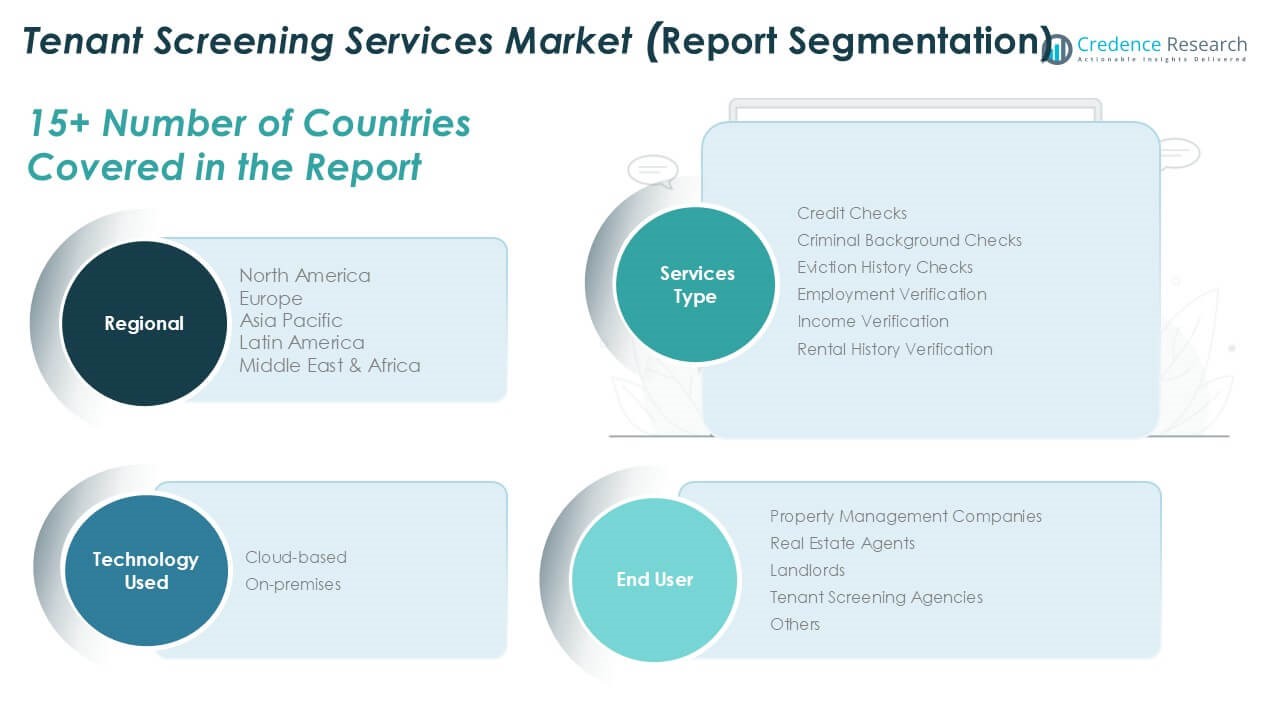

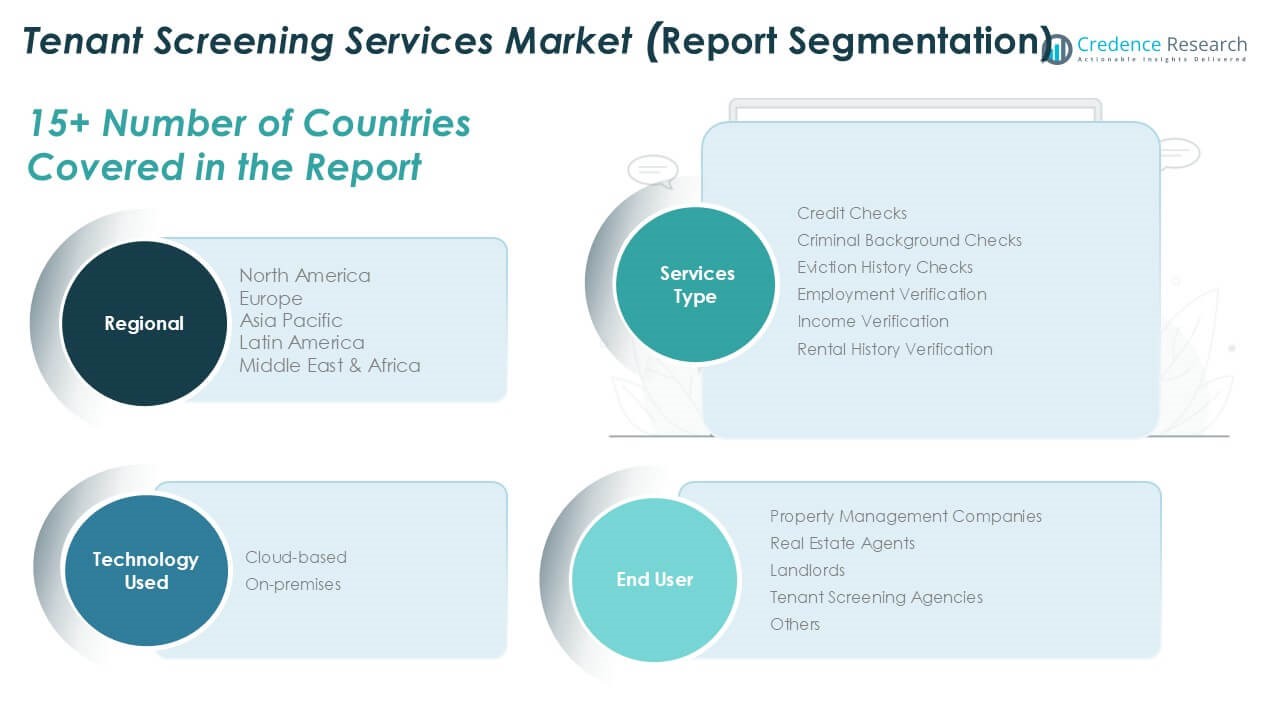

By Service Type

The Tenant Screening Services market by service type is led by Credit Checks, accounting for the largest market share in 2024. This dominance is attributed to landlords’ increasing reliance on financial background data to evaluate tenant reliability and mitigate default risks. Credit checks serve as a fundamental screening step, offering insights into payment history, debt levels, and financial behavior. Rising rental defaults and the growing importance of financial trustworthiness in high-demand housing markets continue to drive demand for this service. Additionally, increased automation in report generation has made credit checks faster and more accessible to landlords and agencies.

- For instance, TransUnion SmartMove processed over 3.1 million screening reports in a single year, with credit checks being the most requested service, helping landlords make decisions in under 10 minutes through automated workflows.

By Technology Used

In terms of technology, the Cloud-based segment holds the largest revenue share in 2024 and is projected to maintain its dominance through the forecast period. The growth of cloud-based tenant screening solutions is driven by their scalability, ease of integration, and cost-efficiency for users of all sizes. Property managers and landlords increasingly prefer cloud-based platforms due to their ability to access real-time data, automate verification processes, and ensure regulatory compliance across multiple properties. The increasing digital transformation of the real estate sector further supports the adoption of cloud-based technologies over traditional on-premises systems.

- For instance, AppFolio Property Manager, a cloud-based solution, supported 17,500+ real estate customers with tenant screening tools embedded in its platform, processing over 1.5 million screening requests through its integrated system in the past year.

By End User

Among end users, Property Management Companies emerged as the dominant segment in 2024, holding the highest market share. This leadership position is driven by their widespread use of comprehensive tenant screening services across diverse residential and commercial property portfolios. These companies prioritize efficiency and risk minimization, making tenant verification processes such as credit, income, and rental history checks essential. Their reliance on technology-enabled screening platforms supports consistent decision-making and tenant quality. Additionally, growing urbanization and the expansion of professionally managed rental properties further fuel the demand for robust tenant screening among property management firms.

Key Growth Drivers

Rising Rental Housing Demand

The global surge in urbanization and housing affordability challenges has significantly increased demand for rental properties, thereby boosting the need for tenant screening services. As rental markets expand, landlords and property managers are prioritizing reliable tenant selection to reduce risks associated with non-payment, property damage, or legal disputes. This shift towards structured and data-driven rental decisions has accelerated the adoption of professional screening solutions, particularly in urban centers and multi-family housing developments. The growth of short-term rentals has also contributed to the broader usage of screening services.

- For instance, TurboTenant, a platform serving small landlords, experienced growth to 550,000+ active landlords, with over 5 million tenant applications screened as of the latest reporting year, reflecting this rising demand.

Regulatory Compliance and Risk Mitigation

Stricter regulations around fair housing, background checks, and data privacy have prompted landlords and property managers to adopt compliant, standardized tenant screening solutions. These services help mitigate legal risks by ensuring consistent and unbiased application of screening criteria. With increasing awareness of tenant rights and data protection laws, professional services offer structured workflows that align with compliance requirements. Moreover, tenant screening platforms help minimize financial losses by identifying high-risk applicants, which is particularly critical for large-scale property owners and institutional landlords operating across jurisdictions.

- For instance, First Advantage maintains operations in over 30 countries, processes 71 million background checks annually, and has built automated compliance frameworks that align with both FCRA and GDPR standards, helping multinational clients manage tenant risks legally and efficiently.

Digital Transformation of Property Management

The integration of digital tools in real estate management has accelerated the use of automated tenant screening services. Landlords and agencies are increasingly adopting cloud-based platforms that enable faster, more accurate, and remote verification processes. These technologies offer user-friendly interfaces, data analytics, and integration with listing platforms and property management software, creating a seamless end-to-end solution. Digitalization also improves operational efficiency, scalability, and customer experience. As tech-savvy landlords and tenants seek convenience and speed, the digital transformation continues to act as a strong growth catalyst in the tenant screening services market.

Key Trends & Opportunities

AI-Powered Screening Tools

Artificial intelligence and machine learning are transforming tenant screening by enabling more nuanced risk assessments and fraud detection. AI tools analyze vast datasets including behavioral patterns, financial history, and rental behavior, improving accuracy in tenant evaluations. This technology also supports predictive scoring models that offer landlords deeper insights into a tenant’s future reliability. The growing interest in data-driven decision-making, coupled with the need for speed and compliance, creates a significant opportunity for AI-powered platforms to gain market share and set new standards in screening services.

- For instance, Checkr, which specializes in AI-driven background checks, completed more than 30 million screenings in a single year using AI to flag potential risks and streamline turnaround time to under 24 hours for 90% of its screenings.

Expansion of DIY and Mobile Platforms

An increasing number of landlords, especially small property owners, are adopting do-it-yourself (DIY) and mobile-friendly tenant screening solutions. These platforms offer ease of use, quick report generation, and affordability. With mobile apps and digital onboarding tools, landlords can screen tenants remotely, aligning with modern tenant expectations for digital interactions. This trend is driving growth in flexible, subscription-based screening services targeted at individual property owners, creating new market opportunities outside traditional institutional user bases.

- For instance, RentSpree, a mobile-compatible DIY platform, has partnered with over 250 MLSs and Realtor associations and processed over 2 million applications, positioning itself as a go-to solution for independent landlords seeking simple, mobile-first screening tools.

Key Challenges

Data Privacy and Legal Compliance

Tenant screening services operate in a highly regulated environment, facing challenges related to data privacy laws such as GDPR, FCRA, and other local legislation. Non-compliance can result in legal liabilities and reputational damage. Managing tenant consent, data accuracy, and secure data storage are critical yet complex tasks. As regulations evolve, screening service providers must continuously update their systems and policies, increasing operational costs and legal oversight requirements. Ensuring compliance across multiple jurisdictions remains a persistent challenge for global and regional market players.

Risk of Discrimination and Bias

Despite efforts to standardize screening practices, there remains a concern about potential bias or unintentional discrimination in tenant selection. Algorithms and scoring systems, if not carefully designed, can lead to disparate impacts on protected groups, exposing landlords and screening agencies to legal action. Balancing effective risk assessment with fair housing compliance is a key challenge. Service providers must invest in transparent algorithms, human oversight, and periodic audits to ensure ethical practices, which can complicate product development and increase resource demands.

Limited Access to Verifiable Data

In some regions, the lack of centralized or verifiable databases on tenant behavior, income, or employment history limits the effectiveness of screening tools. Small landlords and agencies may struggle to access comprehensive data due to fragmented reporting systems or privacy restrictions. Inconsistent or outdated data sources can lead to inaccurate assessments, increasing the risk of rental defaults or disputes. Overcoming this challenge requires strategic partnerships with financial institutions, credit bureaus, and employment databases, which can be difficult to establish and maintain.

Regional Analysis

North America

North America held a significant share of the Tenant Screening Services market in 2024, valued at USD 531.49 million, up from USD 361.96 million in 2018, and is projected to reach USD 979.37 million by 2032, registering a CAGR of 8.1%. The region accounted for approximately 27.2% of the global market in 2024. This growth is driven by a mature rental housing sector, widespread adoption of digital screening tools, and strict tenant verification regulations. High landlord awareness regarding risk mitigation and financial assessments continues to fuel demand, especially across the United States and Canada.

Europe

Europe represented about 24.7% of the global Tenant Screening Services market in 2024, with a valuation of USD 481.95 million, rising from USD 310.87 million in 2018, and projected to reach USD 952.63 million by 2032, at a CAGR of 9.0%. This robust growth is supported by increased professionalization of the rental market and stricter compliance with tenant rights and data protection laws. European landlords and agencies are adopting standardized screening protocols and leveraging digital platforms to meet evolving regulatory standards, particularly in the UK, Germany, and France.

Asia Pacific

Asia Pacific dominated the global Tenant Screening Services market in 2024 with the highest regional share of 31.7%, valued at USD 619.04 million, up from USD 413.05 million in 2018, and forecasted to reach USD 1,172.46 million by 2032, growing at a CAGR of 8.4%. Rapid urbanization, a growing middle class, and increasing cross-border migration have intensified rental housing demand, particularly in countries like China, India, and Australia. This has driven landlords and property firms to invest in efficient, scalable tenant screening solutions to reduce risk and improve tenant quality.

Latin America

Latin America accounted for around 9.5% of the global Tenant Screening Services market in 2024, with market size reaching USD 186.58 million, up from USD 134.09 million in 2018, and projected to hit USD 317.66 million by 2032 at a CAGR of 7.0%. The growth is primarily fueled by increased activity in urban real estate markets in Brazil, Mexico, and Chile, where rental housing demand is on the rise. Although adoption rates are relatively lower compared to developed markets, growing awareness about tenant verification and risk management is gradually improving market penetration.

Middle East

The Middle East Tenant Screening Services market reached USD 95.23 million in 2024, up from USD 62.78 million in 2018, and is anticipated to reach USD 183.20 million by 2032, expanding at a CAGR of 8.6%. The region held approximately 4.9% of the global market share in 2024. Demand is increasing due to expanding rental housing in urban centers such as Dubai, Riyadh, and Doha. As more expatriates and international tenants enter the market, property managers are adopting screening tools to ensure tenant reliability and support regulatory transparency.

Africa

Africa contributed the smallest share to the global Tenant Screening Services market in 2024, with a market size of USD 39.41 million, up from USD 30.60 million in 2018, and forecasted to reach USD 58.62 million by 2032, growing at a CAGR of 5.2%. The region held just 2.0% of the market in 2024. Limited awareness, infrastructure gaps, and informal rental arrangements constrain growth. However, rising urbanization and property investment in South Africa, Nigeria, and Kenya are gradually creating opportunities for structured tenant screening services across both residential and commercial segments.

Market Segmentations:

By Service Type

- Credit Checks

- Criminal Background Checks

- Eviction History Checks

- Employment Verification

- Income Verification

- Rental History Verification

By Technology Used

By End User

- Property Management Companies

- Real Estate Agents

- Landlords

- Tenant Screening Agencies

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Tenant Screening Services market features a moderately consolidated competitive landscape, with key players such as TransUnion, Experian, Equifax, and CoreLogic leading the market due to their expansive data capabilities, technological infrastructure, and global presence. These companies offer comprehensive service portfolios, including credit reports, background checks, and rental history verifications, often integrated with digital platforms to enhance user experience. Emerging players like RentSpree, TurboTenant, and Checkr are disrupting the market through cloud-based, mobile-friendly solutions tailored to individual landlords and small property managers. Market competition is fueled by advancements in AI, automation, and predictive analytics, prompting firms to invest in technology upgrades and strategic partnerships. Additionally, data privacy compliance and user-friendly platforms have become crucial differentiators. Mergers, acquisitions, and service diversification remain central to growth strategies, as firms seek to expand customer bases and service reach across residential and commercial segments. Overall, innovation and compliance drive competition in this dynamic market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- TransUnion

- Experian

- Equifax

- CoreLogic

- First Advantage

- RentSpree

- SmartMove

- TenantCloud

- MyRental

- TurboTenant

- Checkr

- LeaseRunner

- RentPrep

- AppFolio

Recent Developments

- In January 2025, Experian offers tenant screening solutions that leverage credit data, rental history, income, and employment verification to provide landlords with tailored insights. This allows landlords to make informed decisions when selecting tenants. Experian also focuses on providing renters with access to their screening reports, empowering them to review and manage their information.

- In January 2025, Zillow and Experian partnered to offer a comprehensive application process for rentals that includes an Experian credit check and background check.

- In March 2022, the tenant screening market has witnessed considerable traits in latest years, pushed with the aid of improvements in generation, regulatory modifications, and evolving market needs. One of the most notable trends is the integration of synthetic intelligence (AI) and gadget mastering into screening procedures. These technologies allow more accurate and efficient evaluations of potential tenants via reading widespread quantities of records, along with credit score histories, criminal records, and apartment backgrounds. AI-powered systems can expect tenant behavior, assisting landlords make knowledgeable decisions and reduce risks related to leasing properties.

Market Concentration & Characteristics

The Tenant Screening Services Market demonstrates a moderately concentrated structure, led by a few major players such as TransUnion, Experian, and Equifax. These companies hold a strong competitive position due to extensive databases, integrated service offerings, and established client relationships. It exhibits characteristics of steady demand growth, driven by rising rental activity, heightened landlord focus on tenant quality, and growing adoption of automated verification solutions. The market serves both large-scale property management companies and individual landlords, creating a mix of enterprise-level and DIY-focused offerings. Cloud-based platforms and mobile accessibility continue to reshape how services are delivered, particularly for small landlords seeking efficiency and affordability. Technology integration, particularly in AI and analytics, plays a key role in shaping competition and service differentiation. Regulatory compliance and data privacy remain core operational priorities. It reflects a growing reliance on digital, scalable solutions while maintaining sensitivity to regional legal frameworks and varying levels of market maturity.

Report Coverage

The research report offers an in-depth analysis based on Service Type, Technology Used, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The tenant screening services market will continue to grow steadily, driven by the rising global demand for rental housing.

- Digital transformation in property management will enhance the adoption of automated and cloud-based screening solutions.

- AI and machine learning technologies will increasingly power predictive tenant scoring and fraud detection systems.

- Landlords and property managers will rely more on integrated platforms offering end-to-end screening and lease management tools.

- Regulatory compliance and data privacy laws will shape service design and operational strategies across regions.

- Demand for mobile-friendly and self-service screening platforms will rise, especially among independent landlords.

- Expansion into emerging markets will create new growth opportunities as rental markets formalize.

- Strategic partnerships between screening service providers and property listing platforms will become more common.

- Competition will intensify as startups introduce niche and affordable solutions tailored to small-scale users.

- Data accuracy, transparency, and ethical use of tenant information will become key competitive differentiators.