1. Preface

1.1. Report Description

1.1.1. Purpose of the Report

1.1.2. Target Audience

1.1.3. USP and Key Offerings

1.2. Research Scope

1.3. Research Methodology

1.3.1. Phase I – Secondary Research

1.3.2. Phase II – Primary Research

1.3.3. Phase III – Expert Panel Review

1.3.4. Approach Adopted

1.3.4.1. Top-Down Approach

1.3.4.2. Bottom-Up Approach

1.3.5. Assumptions

1.4. Market Segmentation

2. Executive Summary

2.1. Market Snapshot: Global Legal Cannabis Market

3. Market Dynamics & Factors Analysis

3.1. Introduction

3.1.1. Global Legal Cannabis Market Value, 2016-2028, (US$ Bn)

3.2. Market Dynamics

3.2.1. Key Growth Trends

3.2.2. Major Industry Challenges

3.2.3. Key Growth Pockets

3.3. Attractive Investment Proposition,2021

3.3.1. Type

3.3.2. Application

3.3.3. Geography

3.4. Porter’s Five Forces Analysis

3.4.1. Threat of New Entrants

3.4.2. Bargaining Power of Buyers/Consumers

3.4.3. Bargaining Power of Suppliers

3.4.4. Threat of Substitute Types

3.4.5. Intensity of Competitive Rivalry

3.5. Value Chain Analysis

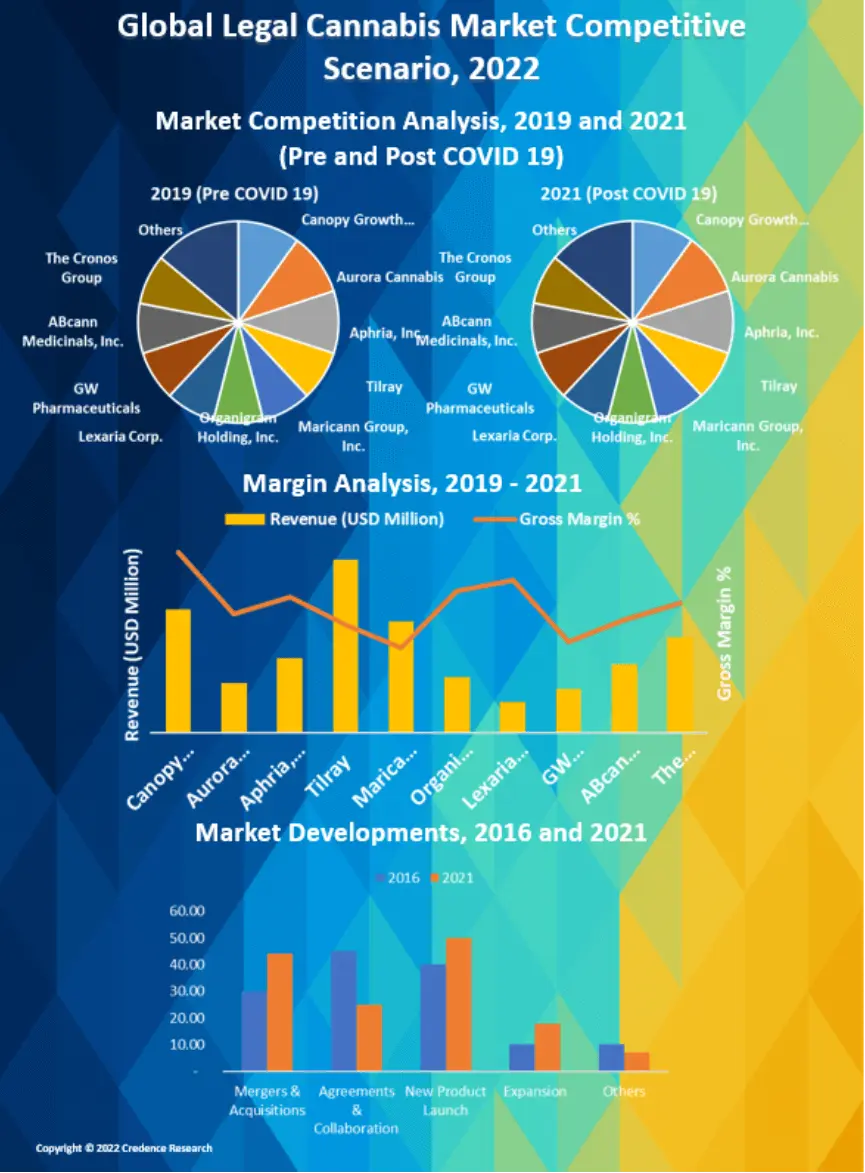

4. Market Positioning of Key Players, 2021

4.1. Company market share of key players, 2021

4.2. Top 6 Players

4.3. Top 3 Players

4.4. Major Strategies Adopted by Key Players

5. COVID 19 Impact Analysis

5.1. Global Legal Cannabis Market Pre Vs Post COVID 19, 2019 – 2028

5.2. Impact on Import & Export

5.3. Impact on Demand & Supply

6. North America

6.1. North America Legal Cannabis Market, by Country, 2016-2028(US$ Bn)

6.1.1. U.S.

6.1.2. Canada

6.1.3. Mexico

6.2. North America Legal Cannabis Market, by Type, 2016-2028(US$ Bn)

6.2.1. Overview

6.2.2. Flower

6.2.3. Oil and Tinctures

6.2.4. Others

6.3. North America Legal Cannabis Market, by Application, 2016-2028(US$ Bn)

6.3.1. Overview

6.3.2. Medical

6.3.3. Adult Use

6.3.4. Others

7. Europe

7.1. Europe Legal Cannabis Market, by Country, 2016-2028(US$ Bn)

7.1.1. UK

7.1.2. France

7.1.3. Germany

7.1.4. Italy

7.1.5. Russia

7.1.6. Ukraine

7.1.7. Spain

7.1.8. Belgium

7.1.9. Netherland

7.1.10. Austria

7.1.11. Sweden

7.1.12. Poland

7.1.13. Denmark

7.1.14. Switzerland

7.1.15. Rest of Europe

7.2. Europe Legal Cannabis Market, by Type, 2016-2028(US$ Bn)

7.2.1. Overview

7.2.2. Flower

7.2.3. Oil and Tinctures

7.2.4. Others

7.3. Europe Legal Cannabis Market, by Application, 2016-2028(US$ Bn)

7.3.1. Overview

7.3.2. Medical

7.3.3. Adult Use

7.3.4. Others

8. Asia Pacific

8.1. Asia Pacific Legal Cannabis Market, by Country, 2016-2028(US$ Bn)

8.1.1. China

8.1.2. Japan

8.1.3. South Korea

8.1.4. India

8.1.5. Australia

8.1.6. New Zealand

8.1.7. Taiwan

8.1.8. Indonesia

8.1.9. Malaysia

8.1.10. Philippine

8.1.11. Rest of Asia Pacific

8.2. Asia Pacific Legal Cannabis Market, by Type, 2016-2028(US$ Bn)

8.2.1. Overview

8.2.2. Flower

8.2.3. Oil and Tinctures

8.2.4. Others

8.3. Asia Pacific Legal Cannabis Market, by Application, 2016-2028(US$ Bn)

8.3.1. Overview

8.3.2. Medical

8.3.3. Adult Use

8.3.4. Others

9. Latin America

9.1. Latin America Legal Cannabis Market, by Country, 2016-2028(US$ Bn)

9.1.1. Brazil

9.1.2. Argentina

9.1.3. Peru

9.1.4. Chile

9.1.5. Colombia

9.1.6. Rest of Latin America

9.2. Latin America Legal Cannabis Market, by Type, 2016-2028(US$ Bn)

9.2.1. Overview

9.2.2. Flower

9.2.3. Oil and Tinctures

9.2.4. Others

9.3. Latin America Legal Cannabis Market, by Application, 2016-2028(US$ Bn)

9.3.1. Overview

9.3.2. Medical

9.3.3. Adult Use

9.3.4. Others

10. Middle East

10.1. Middle East Legal Cannabis Market, by Country, 2016-2028(US$ Bn)

10.1.1. UAE

10.1.2. KSA

10.1.3. Israel

10.1.4. Turkey

10.1.5. Iran

10.1.6. Rest of Middle East

10.2. Middle East Legal Cannabis Market, by Type, 2016-2028(US$ Bn)

10.2.1. Overview

10.2.2. Flower

10.2.3. Oil and Tinctures

10.2.4. Others

10.3. Middle East Legal Cannabis Market, by Application, 2016-2028(US$ Bn)

10.3.1. Overview

10.3.2. Medical

10.3.3. Adult Use

10.3.4. Others

11. Africa

11.1. Africa Legal Cannabis Market, by Country, 2016-2028(US$ Bn)

11.1.1. South Africa

11.1.2. Egypt

11.1.3. Nigeria

11.1.4. Rest of Africa

11.2. Africa Legal Cannabis Market, by Type, 2016-2028(US$ Bn)

11.2.1. Overview

11.2.2. Flower

11.2.3. Oil and Tinctures

11.2.4. Others

11.3. Africa Legal Cannabis Market, by Application, 2016-2028(US$ Bn)

11.3.1. Overview

11.3.2. Medical

11.3.3. Adult Use

11.3.4. Others

12. Global

12.1. Global Legal Cannabis Market, by Type, 2016-2028(US$ Bn)

12.1.1. Overview

12.1.2. Flower

12.1.3. Oil and Tinctures

12.1.4. Others

12.2. Global Legal Cannabis Market, by Application, 2016-2028(US$ Bn)

12.2.1. Overview

12.2.2. Medical

12.2.3. Adult Use

12.2.4. Others

13. Company Profiles

13.1. Canopy Growth Corporation

13.2. Aurora Cannabis

13.3. Aphria, Inc.

13.4. Tilray

13.5. Maricann Group, Inc.

13.6. Organigram Holding, Inc.

13.7. Lexaria Corp.

13.8. GW Pharmaceuticals

13.9. ABcann Medicinals, Inc.

13.10. The Cronos Group

13.11. United Cannabis Corporation

13.12. Tikun Olam, Ltd

13.13. Others

List of Figures

FIG. 1 Global Legal Cannabis Market: Research Methodology

FIG. 2 Market Size Estimation – Top Down & Bottom up Approach

FIG. 3 Global Legal Cannabis Market Segmentation

FIG. 4 Global Legal Cannabis Market, by Type, 2019 (US$ Bn)

FIG. 5 Global Legal Cannabis Market, by Application, 2021 (US$ Bn)

FIG. 6 Global Legal Cannabis Market, by Geography, 2021 (US$ Bn)

FIG. 7 Attractive Investment Proposition, by Geography, 2021

FIG. 8 Global Market Positioning of Key Legal Cannabis Market Manufacturers, 2019

FIG. 9 Global Legal Cannabis Market Value Contribution, By Type, 2021 & 2028 (Value %)

FIG. 10 Global Legal Cannabis Market, by Flower, Value, 2016-2028 (US$ Bn)

FIG. 11 Global Legal Cannabis Market, by Oil and Tinctures, Value, 2016-2028 (US$ Bn)

FIG. 12 Global Legal Cannabis Market, by Others, Value, 2016-2028 (US$ Bn)

FIG. 13 Global Legal Cannabis Market Value Contribution, By Application, 2021 & 2028 (Value %)

FIG. 14 Global Legal Cannabis Market, by Medical, Value, 2016-2028 (US$ Bn)

FIG. 15 Global Legal Cannabis Market, by Adult Use, Value, 2016-2028 (US$ Bn)

FIG. 16 U.S. Legal Cannabis Market, 2016-2028 (US$ Bn)

FIG. 17 Rest of North America Legal Cannabis Market, 2016-2028 (US$ Bn)

FIG. 18 U.K. Legal Cannabis Market, 2016-2028 (US$ Bn)

FIG. 19 Germany Legal Cannabis Market, 2016-2028 (US$ Bn)

FIG. 20 France Legal Cannabis Market, 2016-2028 (US$ Bn)

FIG. 21 Italy Legal Cannabis Market, 2016-2028 (US$ Bn)

FIG. 22 Spain Legal Cannabis Market, 2016-2028 (US$ Bn)

FIG. 23 Russia Legal Cannabis Market, 2016-2028 (US$ Bn)

FIG. 24 BENELUX Legal Cannabis Market, 2016-2028 (US$ Bn)

FIG. 25 Poland Legal Cannabis Market, 2016-2028 (US$ Bn)

FIG. 26 Austria Legal Cannabis Market, 2016-2028 (US$ Bn)

FIG. 27 Rest of Europe Legal Cannabis Market, 2016-2028 (US$ Bn)

FIG. 28 Japan Legal Cannabis Market, 2016-2028 (US$ Bn)

FIG. 29 China Legal Cannabis Market, 2016-2028 (US$ Bn)

FIG. 30 India Legal Cannabis Market, 2016-2028 (US$ Bn)

FIG. 31 South Korea Legal Cannabis Market, 2016-2028 (US$ Bn)

FIG. 32 Australia Legal Cannabis Market, 2016-2028 (US$ Bn)

FIG. 33 Southeast Asia Legal Cannabis Market, 2016-2028 (US$ Bn)

FIG. 34 Rest of Asia Pacific Legal Cannabis Market, 2016-2028 (US$ Bn)

FIG. 35 Middle East & Africa Legal Cannabis Market, 2016-2028 (US$ Bn)

FIG. 36 South Africa Legal Cannabis Market, 2016-2028 (US$ Bn)

FIG. 37 Nigeria Legal Cannabis Market, 2016-2028 (US$ Bn)

FIG. 38 Egypt Legal Cannabis Market, 2016-2028 (US$ Bn)

FIG. 39 GCC Legal Cannabis Market, 2016-2028 (US$ Bn)

FIG. 40 Israel Legal Cannabis Market, 2016-2028 (US$ Bn)

FIG. 41 Latin America Legal Cannabis Market, 2016-2028 (US$ Bn)

FIG. 42 Mechanicalzil Legal Cannabis Market, 2016-2028 (US$ Bn)

FIG. 43 Argentina Legal Cannabis Market, 2016-2028 (US$ Bn)

FIG. 44 Colombia Legal Cannabis Market, 2016-2028 (US$ Bn)

FIG. 45 Peru Legal Cannabis Market, 2016-2028 (US$ Bn)

FIG. 46 Chile Legal Cannabis Market, 2016-2028 (US$ Bn)

List of Tables

TABLE 1 Market Snapshot: Global Legal Cannabis Market

TABLE 2 Global Legal Cannabis Market, by Type, 2016-2028 (US$ Bn)

TABLE 3 Global Legal Cannabis Market, by Application, 2016-2028 (US$ Bn)

TABLE 4 Global Legal Cannabis Market, by Geography, 2016-2028 (US$ Bn)

TABLE 5 North America Legal Cannabis Market, by Type, 2016-2028 (US$ Bn)

TABLE 6 North America Legal Cannabis Market, by Application, 2016-2028 (US$ Bn)

TABLE 7 North America Legal Cannabis Market, by Country, 2016-2028 (US$ Bn)

TABLE 8 Europe Legal Cannabis Market, by Type, 2016-2028 (US$ Bn)

TABLE 9 Europe Legal Cannabis Market, by Application, 2016-2028 (US$ Bn)

TABLE 10 Europe Legal Cannabis Market, by Country/Region, 2016-2028 (US$ Bn)

TABLE 11 Asia Pacific Legal Cannabis Market, by Type, 2016-2028 (US$ Bn)

TABLE 12 Asia Pacific Legal Cannabis Market, by Application, 2016-2028 (US$ Bn)

TABLE 13 Asia Pacific Legal Cannabis Market, by Country/Region, 2016-2028 (US$ Bn)

TABLE 14 Latin America Legal Cannabis Market, by Type, 2016-2028 (US$ Bn)

TABLE 15 Latin America Legal Cannabis Market, by Application, 2016-2028 (US$ Bn)

TABLE 16 Latin America Legal Cannabis Market, by Country/Region, 2016-2028 (US$ Bn)

TABLE 17 Middle East Legal Cannabis Market, by Type, 2016-2028 (US$ Bn)

TABLE 18 Middle East Legal Cannabis Market, by Application, 2016-2028 (US$ Bn)

TABLE 19 Middle East Legal Cannabis Market, by Country/Region, 2016-2028 (US$ Bn)

TABLE 20 Africa Legal Cannabis Market, by Type, 2016-2028 (US$ Bn)

TABLE 21 Africa Legal Cannabis Market, by Application, 2016-2028 (US$ Bn)

TABLE 22 Africa Legal Cannabis Market, by Country/Region, 2016-2028 (US$ Bn)