Market Overview

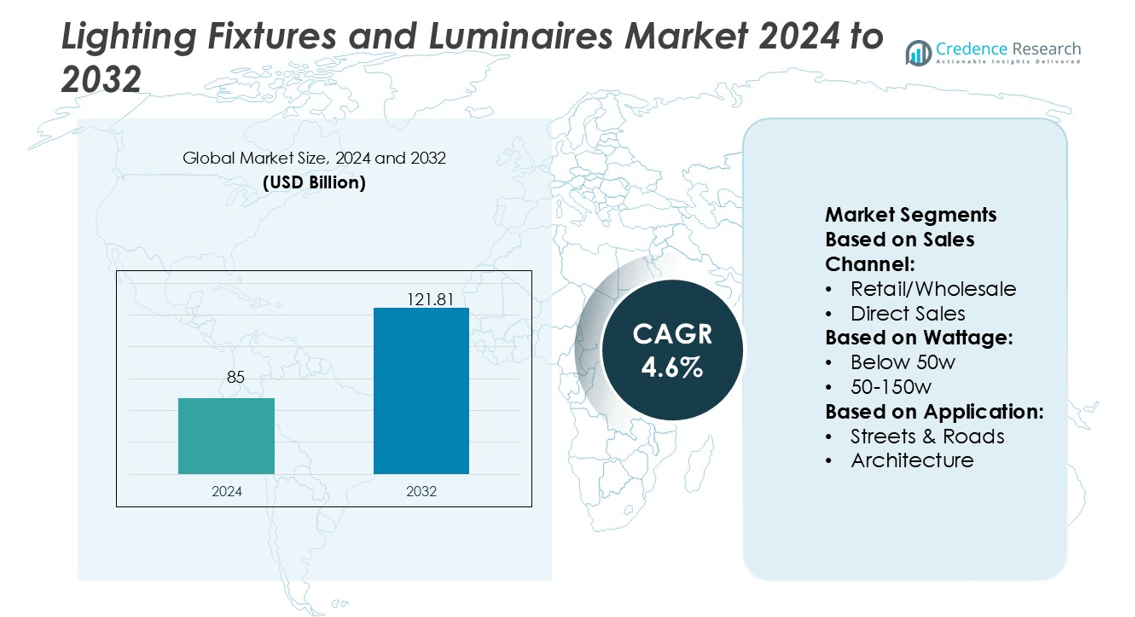

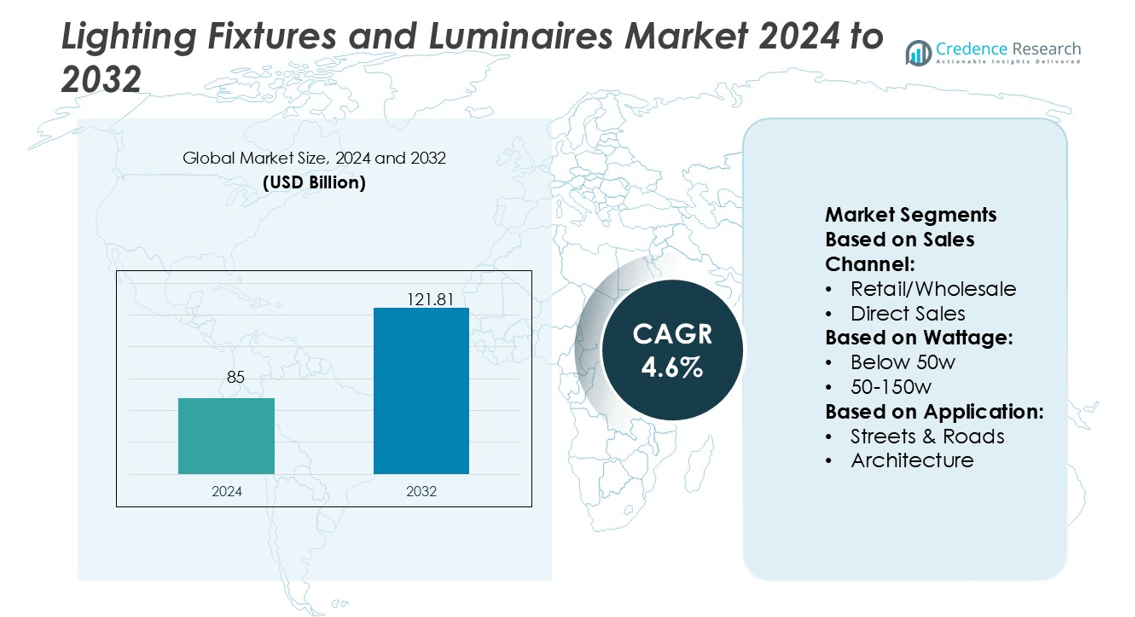

Lighting Fixtures and Luminaires Market size was valued USD 85 billion in 2024 and is anticipated to reach USD 121.81 billion by 2032, at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Lighting Fixtures and Luminaires Market Size 2024 |

USD 85 billion |

| Lighting Fixtures and Luminaires Market, CAGR |

4.6% |

| Lighting Fixtures and Luminaires Market Size 2032 |

USD 121.81 billion |

The lighting fixtures and luminaires market is highly competitive, with key players including Signify N.V., Osram Licht AG, Acuity Brands Lighting Inc., Panasonic Corporation, Eaton Corporation, Hubbell Inc., Zumtobel Group AG, Dialight PLC, Syska Led Lights Pvt. Ltd., and General Electric Co. Ltd. These companies focus on product innovation, energy-efficient technologies, and strategic expansions to strengthen global presence. Signify N.V. and Osram lead in smart and connected lighting, while Acuity Brands and Zumtobel emphasize sustainable solutions. Regionally, Asia-Pacific dominates the market, accounting for 34% share in 2024, driven by rapid urbanization, large-scale infrastructure projects, and government-backed energy efficiency initiatives.

Market Insights

- The lighting fixtures and luminaires market was valued at USD 85 billion in 2024 and is expected to reach USD 121.81 billion by 2032, registering a CAGR of 4.6%.

- Market growth is driven by increasing demand for energy-efficient lighting, government policies promoting LED adoption, and rising investments in smart city infrastructure worldwide.

- Key trends include the adoption of smart and connected lighting systems, expansion of human-centric lighting solutions, and the use of sustainable materials to align with global green building standards.

- The competitive landscape features players such as Signify N.V., Osram Licht AG, Acuity Brands, Panasonic Corporation, Eaton Corporation, Hubbell Inc., Zumtobel Group, Dialight PLC, Syska Led Lights, and General Electric, focusing on innovation and strategic global expansion.

- Regionally, Asia-Pacific dominates with 34% market share in 2024, supported by rapid urbanization and infrastructure projects, while the 50-150W wattage segment leads the market with widespread adoption across commercial and industrial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Sales Channel

Retail/wholesale leads the lighting fixtures and luminaires market, holding 42% share in 2024. The dominance stems from widespread availability in physical outlets and established distributor networks. Retail channels provide customers with access to product variety, price comparisons, and installation support, which strengthens consumer confidence. Wholesale supply also ensures bulk purchases for large-scale projects, particularly in commercial and residential sectors. While e-commerce adoption grows, retail/wholesale remains dominant due to consumer preference for physical inspection before purchase and established trust with distributors.

- For instance, Inventronics (the company that now owns the former Osram HubSense product line) offers the QBM IoT Gateway, which supports up to 200 nodes (including LED drivers and sensors) in a single qualified Bluetooth mesh network, enabling robust control in wholesale-scale lighting installations.

By Wattage

The 50-150W segment dominates the wattage category with 47% market share in 2024. This range is widely used across commercial buildings, outdoor lighting, and industrial spaces, balancing efficiency and brightness. The segment’s growth is supported by replacement demand for conventional high-intensity discharge lamps. Manufacturers increasingly develop LED-based luminaires within this range, delivering up to 60% energy savings and longer lifespans. Urban infrastructure upgrades and stringent efficiency standards also drive adoption. The below 50W segment grows steadily with residential demand, but mid-range wattage leads in large-scale installations.

- For instance, Dialight’s Vigilant® High Bay offers lumen outputs between 11,000 and 41,300 lumens with efficacies reaching up to 155 lm/W, making it highly competitive in the 50–150 W class.

By Application

Streets and roads form the leading application, commanding 39% market share in 2024. Governments and municipalities prioritize smart street lighting projects to reduce energy costs and enhance safety. Street and road applications benefit from large-scale replacement of traditional lamps with LEDs, offering reduced maintenance and extended service life of over 50,000 hours. Smart controls, such as motion sensors and adaptive dimming, further accelerate adoption. Infrastructure investments in urban and semi-urban areas continue to strengthen this segment’s dominance. Other applications, including architecture and sports lighting, grow, but remain secondary in scale.

Key Growth Drivers

Rising Demand for Energy Efficiency

The global shift toward energy-efficient solutions drives strong adoption of LED-based fixtures and luminaires. Governments enforce stringent efficiency standards and phase out traditional lighting systems, creating replacement demand across residential, commercial, and industrial sectors. LEDs consume up to 60% less energy than conventional lamps, significantly reducing electricity costs. Additionally, smart lighting integration enhances efficiency through adaptive controls and sensors. This dual benefit of cost savings and sustainability cements energy efficiency as a major driver fueling long-term growth in the lighting fixtures and luminaires market.

- For instance, Zumtobel LINARIA LED system achieves system efficiencies of approximately 140 lm/W, enabling high output with lower energy use.

Rapid Urbanization and Infrastructure Development

Ongoing urbanization and infrastructure expansion strengthen demand for modern lighting fixtures across streets, commercial spaces, and public areas. Smart city projects accelerate installation of connected and intelligent luminaires for improved safety and operational efficiency. Infrastructure upgrades in developing nations prioritize long-lasting, low-maintenance LED systems to reduce lifecycle costs. Roadways, tunnels, and public facilities increasingly adopt advanced luminaires with smart controls, creating consistent procurement pipelines. These infrastructure-led initiatives position lighting solutions as critical enablers of urban growth, supporting sustainable development goals and enhancing quality of life.

- For instance, Syska’s IP65 LED street light delivers around 4,000 lumens output at a rated power (e.g. 40 W variant), offering reliable brightness under harsh outdoor conditions.

Technological Advancements in Smart Lighting

Smart lighting technologies are reshaping the luminaires market with IoT, wireless controls, and automation. Connected systems enable real-time monitoring, remote access, and energy optimization, aligning with smart building standards. Integration with voice assistants, occupancy sensors, and daylight harvesting improves user convenience and operational savings. Commercial buildings, industrial facilities, and households adopt smart luminaires for better flexibility and control. The growing focus on data-driven lighting solutions, offering both sustainability and productivity benefits, makes technological innovation a key driver for expanding global adoption in the lighting fixtures and luminaires market.

Key Trends & Opportunities

Growing Popularity of Human-Centric Lighting

Human-centric lighting is gaining traction as businesses and institutions recognize its health and productivity benefits. Tunable white LEDs and circadian lighting systems replicate natural daylight patterns, improving employee focus and reducing fatigue. Healthcare facilities and educational institutions increasingly integrate such solutions to support wellness and cognitive performance. This trend opens opportunities for manufacturers to design advanced luminaires that cater to human biological needs while also aligning with green building certifications and ESG goals. Demand for wellness-driven lighting is expected to expand significantly in coming years.

- For instance, Eaton’s WaveStream LED system achieves optical efficiencies where 85 % to 95 % of light produced is delivered outward (i.e. “light in = light out”), reducing internal loss significantly.

Expansion of E-commerce Distribution Channels

E-commerce emerges as a fast-growing distribution channel for lighting fixtures and luminaires. Online platforms provide consumers with extensive product comparisons, competitive pricing, and doorstep delivery, making them highly attractive for residential buyers. B2B portals also enable bulk purchases and supply chain efficiency for contractors and project developers. Increasing digitalization and omnichannel strategies by major manufacturers accelerate online penetration. This trend creates opportunities for brands to expand their global reach, leverage data-driven insights, and target new customer segments through advanced online marketing and digital engagement.

- For instance, Signify India launched its Philips direct-to-consumer e-shop offering over 1,000 SKUs in lighting and connected products, enabling direct access to consumers without intermediary retail.

Key Challenges

High Initial Installation Costs

Despite long-term savings, LED-based luminaires and advanced smart lighting systems involve higher upfront investment. Costs include not only fixtures but also control systems, sensors, and installation services. For small enterprises, residential buyers, and developing regions, these expenses act as a significant barrier. Limited financing options and low awareness of lifecycle benefits further slow adoption. Manufacturers must balance innovation with affordability to address this challenge. Expanding leasing models, subsidies, or energy performance contracts could help mitigate high initial costs and accelerate adoption rates globally.

Complexities in System Integration

The growing shift toward connected and smart lighting creates challenges in system integration and interoperability. Compatibility issues between hardware, software platforms, and communication protocols often complicate deployment. End-users face difficulties in managing multiple vendor solutions, leading to inefficiencies and higher maintenance requirements. Security risks related to connected systems further add concerns. To overcome this challenge, manufacturers must adopt open standards, ensure cross-platform integration, and provide end-to-end solutions. Addressing these complexities will be critical to achieving seamless adoption of intelligent lighting systems in commercial and industrial settings.

Regional Analysis

North America

North America holds 27% share of the lighting fixtures and luminaires market in 2024, driven by strong adoption of energy-efficient LED systems. The U.S. leads the region with government-backed initiatives promoting smart building standards and sustainability goals. Replacement of outdated lighting in commercial complexes, streets, and residential areas continues to generate significant demand. The presence of leading manufacturers and technology innovators accelerates deployment of advanced smart lighting solutions. Increasing investment in smart city infrastructure further strengthens market potential, positioning North America as a mature yet growing hub for connected and energy-efficient luminaires.

Europe

Europe accounts for 24% of the global market share in 2024, supported by stringent energy regulations and eco-design directives. Countries such as Germany, the UK, and France actively promote LED adoption under climate-focused policies. The region’s construction industry integrates smart and human-centric lighting solutions to comply with green building standards. Architectural and decorative applications drive premium product demand, especially in high-end residential and commercial spaces. Ongoing urban renewal projects and a focus on sustainable lighting solutions reinforce Europe’s position as a leading innovator in the global lighting fixtures and luminaires market.

Asia-Pacific

Asia-Pacific dominates the market with a 34% share in 2024, fueled by rapid urbanization, large-scale infrastructure development, and government-driven efficiency programs. China, India, and Japan drive regional demand through extensive investments in smart cities, street lighting upgrades, and industrial facilities. Low-cost manufacturing capabilities combined with high-volume exports position Asia-Pacific as a global production hub. Rising disposable incomes and residential construction growth further expand adoption. The region also leads in technological advancements, with manufacturers integrating IoT-enabled luminaires at competitive costs. This dominance highlights Asia-Pacific as the central growth engine for the global market.

Latin America

Latin America represents 8% of the lighting fixtures and luminaires market in 2024, driven by gradual adoption of energy-efficient lighting systems. Brazil and Mexico lead the region with growing demand from residential and commercial construction projects. Government programs encouraging LED adoption in public infrastructure projects contribute to market expansion. However, limited financing options and uneven distribution networks slow overall penetration. Rising e-commerce platforms and partnerships with international players create new opportunities for growth. Despite challenges, increasing awareness of lifecycle cost savings positions Latin America as an emerging market with steady long-term potential.

Middle East & Africa

The Middle East & Africa region holds a 7% share of the global market in 2024. Growth is driven by large-scale infrastructure projects, urban expansion, and smart city initiatives across the UAE, Saudi Arabia, and South Africa. Demand for tunnel, roadway, and architectural lighting remains strong, fueled by both government investments and private sector developments. However, higher upfront costs and limited technical expertise present barriers in some countries. Rising energy efficiency mandates and the growing focus on sustainable construction projects offer opportunities, positioning the region as a promising but developing market for advanced luminaires.

Market Segmentations:

By Sales Channel:

- Retail/Wholesale

- Direct Sales

By Wattage:

By Application:

- Streets & Roads

- Architecture

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the lighting fixtures and luminaires market players such as Hubbell Inc., Osram Licht AG, Dialight PLC, Zumtobel Group AG, Syska Led Lights Pvt. Ltd., Panasonic Corporation, Eaton Corporation, Signify N.V., General Electric Co. Ltd., and Acuity Brands Lighting Inc. The lighting fixtures and luminaires market is defined by continuous innovation, sustainability initiatives, and the rapid adoption of smart technologies. Companies are increasingly focusing on developing energy-efficient LED solutions integrated with IoT, automation, and wireless connectivity to address growing demand for smart buildings and cities. Sustainability also plays a central role, with manufacturers adopting recyclable materials, eco-friendly packaging, and circular economy practices to meet stringent regulations and consumer preferences. Additionally, firms expand their global presence through mergers, acquisitions, and partnerships, enabling stronger distribution networks and regional penetration. The focus on differentiation through advanced features, design aesthetics, and cost efficiency remains critical to maintaining competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hubbell Inc.

- Osram Licht AG

- Dialight PLC

- Zumtobel Group AG

- Syska Led Lights Pvt. Ltd.

- Panasonic Corporation

- Eaton Corporation

- Signify N.V.

- General Electric Co. Ltd.

- Acuity Brands Lighting Inc.

Recent Developments

- In January 2025, Philips Hue launched four Impress smart outdoor lights in the U.S. and Canada. The company describes these products as modern, and they are already on sale in other markets like Europe. There are floor and wall lighting solutions, each offering white and colored lighting as well as app-based controls.

- In August 2024, Govee, a leader in the smart home lighting sector, launched the Permanent Outdoor Lights 2 its second generation of Permanent Outdoor Lights. This new version offers enhanced brightness, improved reliability, and new Matter capability, all at the same price as the original Permanent Outdoor Lights.

- In April 2024, Hama launched its new Neon LED light strip in Europe for indoor and outdoor use. The RGB smart light offers various colors and lighting effects with remote app-based controls or voice commands. The Hama RGB smart light is fully customizable in the Hama Smart Home app.

- In April 2024, LSI Industries, Inc. acquired EMI Industries for an all-cash purchase price of USD 50 million by increasing the food service and store fixtures equipment business. The partnership serves a growing portfolio of national retail chains that value an integrated, solutions-based approach that emphasizes reliability, quality, and technical expertise.

Report Coverage

The research report offers an in-depth analysis based on Sales Channel, Wattage, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow with rising demand for energy-efficient lighting.

- Smart lighting adoption will accelerate through IoT integration and automation features.

- Human-centric lighting will gain importance in workplaces, healthcare, and education.

- Sustainability will shape product design with recyclable materials and eco-friendly packaging.

- Governments will drive growth through stricter energy regulations and smart city programs.

- E-commerce channels will expand, offering greater accessibility and price competitiveness.

- Wireless and connected luminaires will dominate over conventional wired systems.

- Emerging economies will see strong demand due to urbanization and infrastructure projects.

- Advanced sensor-based lighting will support adaptive and personalized illumination.

- Competition will intensify as companies invest in innovation and regional expansion.