Market Overview

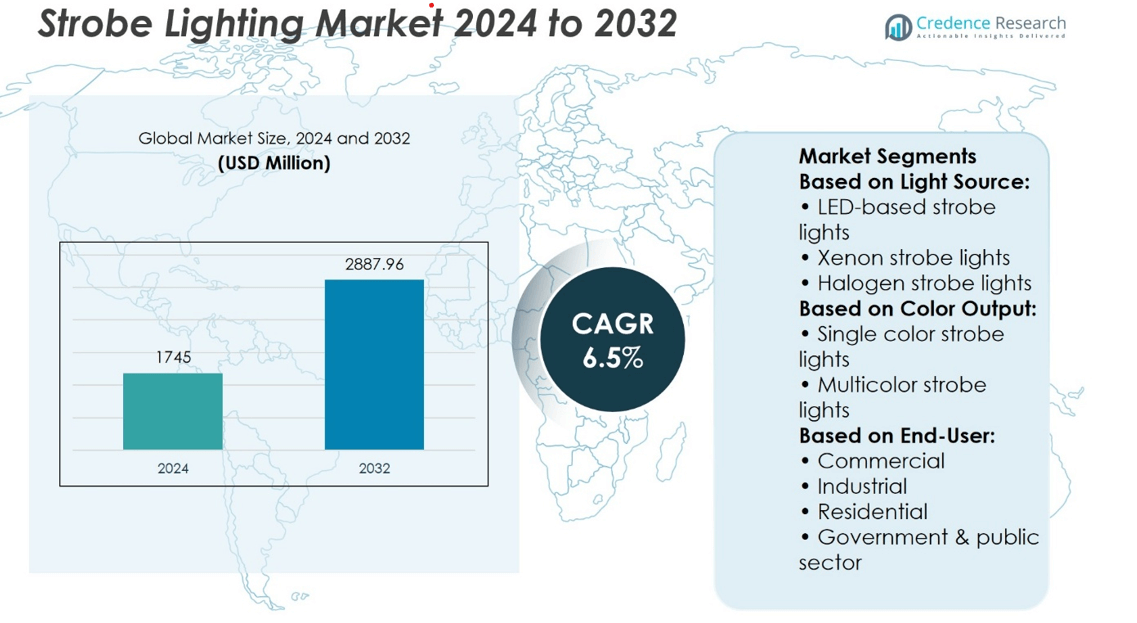

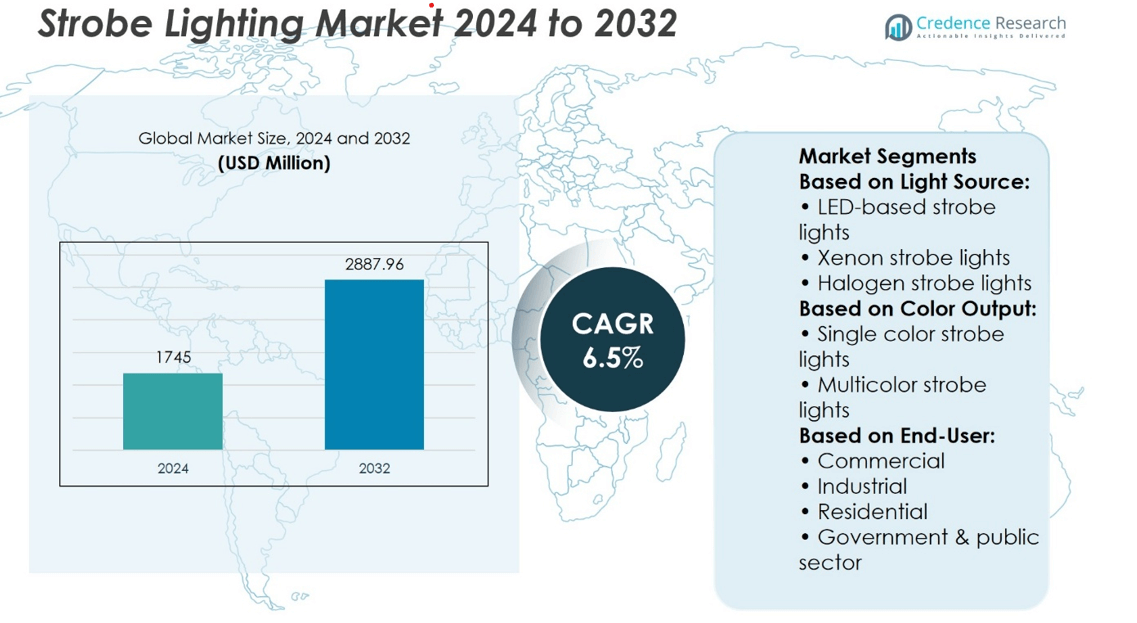

Strobe Lighting Market size was valued at USD 1745 million in 2024 and is anticipated to reach USD 2887.96 million by 2032, at a CAGR of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Strobe Lighting Market Size 2024 |

USD 1745 million |

| Strobe Lighting Market, CAGR |

6.5% |

| Strobe Lighting Market Size 2032 |

USD 2887.96 million |

The strobe lighting market grows due to rising demand for advanced safety signaling systems and increasing adoption across entertainment, industrial, and emergency services. It benefits from rapid advancements in LED technology, offering improved energy efficiency and longer operational life. Trends indicate a shift toward compact, wireless, and smart-enabled strobe lights with remote control features. Manufacturers focus on product innovation and compliance with safety standards across regions. The market also sees traction in automotive and aviation sectors, where visibility and quick signaling are critical. Growing urban infrastructure and public safety initiatives further support consistent market expansion.

The strobe lighting market sees strong presence across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, with North America leading in adoption due to technological innovation and regulatory standards. Asia Pacific shows rapid growth driven by industrial expansion and smart city development. Key players include Elation Professional, GLP, ROBE Lighting, Prolights, Martin, Jands, Eternal Lighting, PR Lighting, SpeedTechLight, Klarna, and Lightbar UK, each competing on innovation, product range, and distribution reach.

Market Insights

- The strobe lighting market was valued at USD 1745 million in 2024 and is expected to reach USD 2887.96 million by 2032, registering a CAGR of 6.5%.

- Rising demand for advanced safety signaling systems and emergency response applications drives market growth.

- Rapid advancements in LED technology improve energy efficiency and extend product lifespan.

- Compact, wireless, and smart-enabled strobe lighting systems with remote control gain popularity across multiple sectors.

- Key players compete through innovation, diverse product portfolios, and expanded distribution networks across global markets.

- High initial installation cost and integration challenges in legacy systems restrain adoption in certain sectors.

- North America leads in market share due to innovation and strict regulations, while Asia Pacific shows strong growth with expanding industrial and smart infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Increasing Demand from Entertainment and Stage Production Sectors Fuels Product Deployment

The strobe lighting market benefits significantly from its growing use in concerts, theaters, and live events. Event organizers and production houses prioritize visual impact, and strobe lights provide dramatic lighting effects that enhance audience experience. High-profile music festivals and global tours regularly deploy advanced strobe systems to elevate visual appeal. The integration of DMX controls and synchronized lighting sequences strengthens its utility in stage environments. Manufacturers focus on compact designs and high-output models to meet the demands of dynamic lighting shows. The entertainment industry continues to drive large-scale adoption of strobe lighting systems across key global markets.

- For instance, GLP JDC1 hybrid strobe features 1,440 high-performance white SMD LEDs and a separate RGB face with 1,080 RGB SMD LEDs, providing a total of 2,520 LEDs

Expanding Usage in Emergency and Warning Applications Drives Steady Adoption

Law enforcement, fire safety, and industrial sectors increasingly rely on strobe lighting for signaling and alert systems. These lights ensure high visibility in hazardous conditions, contributing to improved safety protocols. The strobe lighting market supports applications in public safety vehicles, construction zones, and warning systems in industrial sites. Regulatory standards across regions mandate the use of high-intensity strobe signals for hazard communication. It provides rapid attention-grabbing flashes, crucial in critical response scenarios. Product innovations include multi-color capabilities and integrated battery systems for portable emergency units.

- For instance, Whelen Engineering L31 beacon strobe incorporated 12 Super-LED modules capable of generating 3,600 effective candela and operates at 125 flashes

Technological Advancements in LED Integration Improve Energy Efficiency and Product Lifespan

The transition from xenon-based to LED-based strobe lights continues to reshape the market landscape. LEDs offer lower power consumption, reduced heat emission, and longer operational life compared to traditional systems. The strobe lighting market increasingly includes smart lighting features, such as programmable flash sequences and wireless control. Manufacturers develop units with rugged enclosures and waterproof designs to suit diverse environments. It ensures consistent performance in both indoor and outdoor settings. Product development aligns with sustainability goals, attracting investment from energy-conscious users.

Growing Demand in Automotive and Aviation Sectors Supports Market Growth

Strobe lighting plays a vital role in signaling and visibility functions within vehicles and aircraft. The automotive sector adopts it in headlight systems, hazard signals, and auxiliary lights for off-road use. Aviation regulations mandate strobe lights for runway visibility and anti-collision warning, making it a standard component in aircraft lighting systems. The strobe lighting market supports these applications through compact, high-lumen output models with long service life. It contributes to improved operational safety in transport applications. Advances in optical lens design and thermal management further increase reliability in harsh operating conditions.

Market Trends

Widespread Integration of LED Technology Continues to Replace Conventional Xenon Systems

The strobe lighting market is witnessing a shift from xenon-based systems to LED-integrated solutions. LEDs offer longer service life, reduced energy consumption, and improved flash response time. Manufacturers prioritize LED modules to meet demand for compact, low-maintenance lighting systems across industries. It enables higher durability in demanding environments, including emergency services and industrial safety systems. LED strobe lights also support advanced features like variable flash rates and color customization. This trend reflects a broader industry push toward energy-efficient, sustainable technologies.

- For instance, Whelen L31 Series Super-LED beacon is a high-intensity, 360-degree warning light known for its brightness and multiple flash patterns. It features 12 high-intensity LEDs per unit and a built-in flasher with selectable patterns, including Hi/Low intensity and synchronization capabilities.

Adoption of Smart and Programmable Strobe Systems Expands Across Applications

Manufacturers are introducing strobe lights with programmable settings, wireless control, and integration with digital control protocols. The strobe lighting market now includes products compatible with DMX and IoT systems, allowing for remote management and real-time adjustments. It improves flexibility for users in entertainment, security, and transportation sectors. Event production companies use programmable features to synchronize lighting effects with music or visual content. Smart strobe lights support both standalone and networked operation modes. This trend enhances functionality and extends usage beyond traditional fixed installations.

- For instance, Federal Signal Pathfinder Smart System, specifically the PF400 model, is a programmable siren and light controller that supports up to 400 watts of audio output (4 x 100-watt speakers) and integrates

Increasing Use of Strobe Lights in Industrial Automation and Safety Protocols

Industrial environments increasingly implement strobe lights in machine status indicators, hazard warnings, and process control systems. The strobe lighting market supports automation systems by offering lights that can signal machine faults or process stages through rapid flashes. It allows operators to respond quickly to potential issues on the production floor. Manufacturers design strobe units with high ingress protection ratings and vibration resistance to suit harsh settings. Integration with PLCs and SCADA systems improves workflow visibility. This trend supports operational efficiency and worker safety in modern facilities.

Customization Demand Rises with Industry-Specific Lighting Requirements

End users across sectors now seek strobe lighting tailored to their operational environments and regulatory needs. The strobe lighting market responds with products offering adjustable brightness, flash frequency, and mounting configurations. It helps meet varying compliance standards in aviation, maritime, and public safety sectors. Custom lens designs and enclosure materials address diverse application challenges. Manufacturers provide solutions optimized for visibility range, color coding, and thermal stability. This trend reflects growing expectations for application-specific performance in professional lighting systems.

Market Challenges Analysis

High Compliance Requirements and Regulatory Complexity Limit Market Flexibility

Manufacturers in the strobe lighting market face challenges in meeting strict safety, environmental, and performance regulations. Different regions enforce varying standards for brightness, flash rate, and electromagnetic compatibility. It complicates product development and increases time-to-market for new models. Companies must invest in testing and certification processes for each target region, raising operational costs. Frequent updates in regulations also require design modifications, which disrupt production schedules. These compliance burdens can hinder the introduction of innovative lighting technologies across international markets.

Product Reliability Concerns and Harsh Environmental Conditions Affect Performance

Strobe lights often operate in demanding conditions such as extreme temperatures, vibration, and high humidity, which can impact long-term reliability. The strobe lighting market must address failures caused by moisture ingress, thermal degradation, and power fluctuations. It increases pressure on manufacturers to develop rugged, sealed enclosures and robust internal components. Field failures in safety-critical environments, such as industrial or emergency applications, can result in downtime and liability issues. Cost constraints may prevent some end users from investing in higher-grade products that offer better durability. These technical challenges reduce customer confidence and limit adoption in risk-sensitive applications.

Market Opportunities

Growing Integration of Strobe Lights in Industrial Safety and Smart Infrastructure Applications

The strobe lighting market benefits from rising demand for visual signaling systems in industrial automation and workplace safety. Manufacturing plants, warehouses, and refineries require robust warning lights to alert workers during equipment malfunctions or hazardous events. It supports safety compliance and minimizes risks in high-noise environments where audible alarms may fail. Smart cities also deploy strobe lights in public safety systems, such as emergency response coordination and traffic management. Urban planners and facility managers favor these solutions for their high visibility and instant communication. This growing role in safety-critical applications presents a strong opportunity for manufacturers to offer feature-rich, durable solutions.

Increased Demand for Energy-Efficient and Wireless-Enabled Lighting Solutions

Energy-saving strobe lights with LED technology create new opportunities for product innovation and expansion. Compact designs with low power consumption meet sustainability goals across sectors like automotive, aviation, and marine. It allows broader use in portable systems, battery-powered devices, and solar-integrated units. Wireless control features, including remote operation and integration with IoT platforms, further enhance product appeal. End users in event production and facility management seek customizable and easily deployable strobe solutions. These evolving preferences open avenues for manufacturers to differentiate through smart lighting features and efficient design.

Market Segmentation Analysis:

By Light Source

LED-based strobe lights lead due to their energy efficiency, longer operational life, and low maintenance needs. Their compact design and resistance to vibration make them ideal for demanding environments. Xenon strobe lights follow closely, preferred in scenarios requiring high-intensity flashes, especially in aviation, photography, and emergency vehicles. Halogen strobe lights continue to serve legacy applications but have seen a decline due to higher heat output and energy consumption. Other light sources, including laser-based or hybrid systems, remain niche but show potential in specialized security and entertainment installations. The strobe lighting market reflects a clear shift toward LED-based innovations driven by performance and sustainability goals.

- For instance, Whelen Engineering IN Series Super‑LED light head, specifically the one with 6 Generation III Super-LEDs, draws 1.0 amps at peak and 0.4 amps on average. This light head is known for its compact size and bright illumination

By Color Output

Single color strobe lights dominate installations where clarity and quick signal recognition are critical, such as emergency signaling, industrial alerts, and vehicular applications. Red, blue, and amber remain the most deployed colors due to standardized safety protocols. Multicolor strobe lights find increasing adoption in entertainment, stage production, and smart building applications. It enables dynamic lighting effects and user-controlled customization through digital systems. This flexibility appeals to sectors seeking both visual impact and functional communication. The expanding demand for intelligent lighting control continues to push innovation in multicolor systems.

- For instance, Federal Signal’s Model 121XST single-color strobe light produces a peak intensity of 1,000,000 candela with a flash rate of 80 flashes per minute

By End User

Commercial end users adopt strobe lights in retail stores, entertainment venues, and office buildings for both ambiance and signaling functions. It enhances customer experience and emergency preparedness. The industrial segment uses strobe lights extensively for machine status alerts, safety warnings, and process monitoring. In hazardous zones, their visibility under adverse conditions supports worker protection. The residential sector remains limited but sees gradual integration in smart home systems, especially in hearing-impaired alert setups. Government and public sector demand includes law enforcement, transportation infrastructure, and emergency response services. These users require durable, weather-resistant, and compliant strobe lighting systems to ensure public safety and operational efficiency.

Segments:

Based on Light Source:

- LED-based strobe lights

- Xenon strobe lights

- Halogen strobe lights

Based on Color Output:

- Single color strobe lights

- Multicolor strobe lights

Based on End-User:

- Commercial

- Industrial

- Residential

- Government & public sector

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds around 32% share of the global strobe lighting market, supported by strict compliance requirements and early technology adoption. The United States leads the region due to robust implementation of OSHA safety regulations across construction, mining, emergency services, and industrial automation. Strobe lights are commonly used in fire alarms, evacuation systems, and service vehicles. Canada supports regional growth through investment in smart buildings and public infrastructure. LED variants dominate the market due to energy-saving incentives and long operational lifespans. U.S.-based manufacturers continue to lead in innovation, offering products with wireless control, synchronized flashing, and smart integration. The mature regulatory environment sustains consistent demand across public and private sectors.

Europe

Europe contributes 28% to the global strobe lighting market, with Germany, the United Kingdom, France, and Italy driving demand. Industrial sectors rely heavily on visual signaling systems for safety, especially in manufacturing and logistics automation. EU regulations, including workplace safety and CE conformity, have made strobe lighting mandatory in many applications. Germany integrates strobe lights in production lines and robotic systems, while the UK uses them widely in transport infrastructure and emergency vehicles. The region has also seen rapid transition to LED-based strobe lighting aligned with its energy efficiency goals. Eastern European countries show rising adoption through expanding industrial zones. The market remains highly regulated and innovation-focused.

Asia Pacific

Asia Pacific accounts for approximately 34% of the global strobe lighting market, establishing it as the leading regional contributor. Countries such as China, India, Japan, and South Korea lead adoption due to ongoing industrialization, urbanization, and government infrastructure investments. China continues to dominate in manufacturing and logistics sectors, where strobe lights are installed in factories, warehouses, and transport hubs. India’s smart city initiatives and focus on industrial safety drive adoption across construction and government projects. LED-based strobe lights remain in high demand due to energy efficiency and cost-effectiveness. Local manufacturers benefit from scalable production and lower costs, making the technology more accessible. This region is expected to maintain its lead due to population density, increasing safety awareness, and large-scale public projects.

Latin America:

Latin America accounts for 3.5% of the global strobe lighting market, with Brazil and Mexico dominating regional demand. The expansion of smart city projects and upgrades in public infrastructure are key growth enablers. In Brazil, the deployment of strobe lighting in transportation networks—such as railway crossings and airport signaling systems—has increased steadily. Mexico sees strong adoption in industrial zones, where strobe lights are integrated into safety systems in warehouses and assembly lines to ensure compliance with occupational safety standards.

Middle East & Africa

Middle East & Africa holds 3.2% of the global strobe lighting market, supported by large-scale infrastructure projects and a growing emphasis on industrial safety. Countries such as the United Arab Emirates, Saudi Arabia, and Qatar have adopted strobe lighting in public infrastructure, including airports, metro systems, and oil and gas facilities. In Saudi Arabia, the Vision 2030 initiative drives technological modernization, increasing demand for durable and energy-efficient strobe lights in smart city and industrial applications.The oil and gas sector, a dominant industry in the region, uses strobe lights for hazardous area signaling. Products compliant with ATEX and IECEx certifications are in demand for explosion-proof zones. LED-based strobe lights with high IP ratings and heat resistance are gaining traction due to their performance under extreme temperatures. Smart integration with control systems for real-time fault detection further supports the deployment of advanced strobe lighting systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Klarna

- PR Lighting

- Lightbar UK

- Martin

- SpeedTechLight

- Eternal Lighting

- GLP (German Light Products)

- ROBE Lighting

- Jands

- Elation Professional

Competitive Analysis

The strobe lighting market includes Elation Professional, Eternal Lighting, GLP (German Light Products), Jands, Klarna, Lightbar UK, Martin, PR Lighting, Prolights, ROBE Lighting, and SpeedTechLight. The strobe lighting market remains highly competitive, driven by innovation in lighting technologies and increasing demand across entertainment, industrial, and emergency applications. Companies focus on delivering products with improved energy efficiency, higher brightness, and better control interfaces to meet diverse customer needs. Advancements in LED technology continue to reshape product development, offering longer lifespan and lower power consumption. Manufacturers invest in R&D to integrate smart features such as DMX control, wireless connectivity, and programmable effects. The market also sees rising adoption of compact and modular designs, suitable for mobile setups and temporary installations. Regulatory compliance and product durability further influence purchasing decisions, especially in industrial and public safety sectors.

Recent Developments

- In February 2025, Claypaky Introduced at ProLight+Sound 2025, this hybrid bar delivers powerful graphical strobe effects with pixel-perfect control, enhancing immersive lighting experiences.

- In May 2024, AgriEyes introduces the W12R Magnetic Strobe Light, a versatile and easy-to-install safety device for enhanced vehicle visibility. Its magnetic base allows quick attachment to any metal surface, eliminating the need for tools or permanent modifications.

Market Concentration & Characteristics

The strobe lighting market shows moderate concentration, with a mix of global manufacturers and specialized regional players competing across multiple end-use industries. It includes both long-established lighting brands and newer companies focused on advanced LED and smart control technologies. The market values innovation, energy efficiency, and product durability, with strong demand from entertainment, industrial safety, and emergency response sectors. It continues to evolve with the integration of digital controls and wireless capabilities that enhance functionality and ease of use. Companies differentiate through product performance, customization options, and rapid adaptation to regulatory standards. It demonstrates high product diversity, covering a wide range of brightness outputs, beam angles, and housing designs tailored to varied installation requirements. The strobe lighting market rewards manufacturers that combine technical reliability with design flexibility and responsive service.

Report Coverage

The research report offers an in-depth analysis based on Light Source, Color Output, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for energy-efficient strobe lighting solutions is expected to rise due to stricter global energy regulations.

- Advancements in LED technology will continue to replace traditional light sources in strobe systems.

- Integration of wireless control and smart features will enhance operational flexibility across applications.

- Safety and emergency signalling applications will drive steady adoption in industrial and public infrastructure sectors.

- Manufacturers will focus on product miniaturization without compromising brightness or durability.

- Growth in the entertainment and live event industry will sustain demand for high-performance lighting solutions.

- OEMs are likely to invest more in R&D to develop customizable strobe lighting for niche markets.

- Regulatory compliance will shape product design, especially in automotive and aviation sectors.

- The market will see higher penetration in developing regions supported by infrastructure upgrades.

- Competitive pricing and technological differentiation will remain crucial for market expansion.