Market Overview

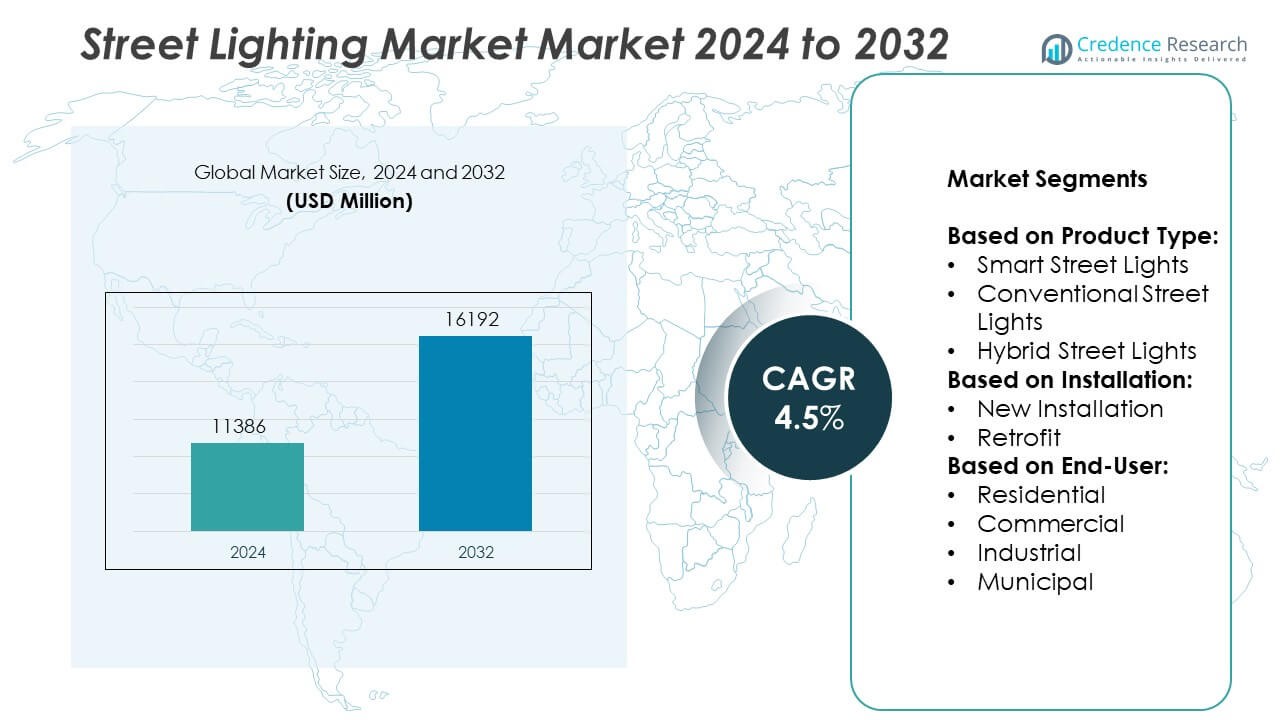

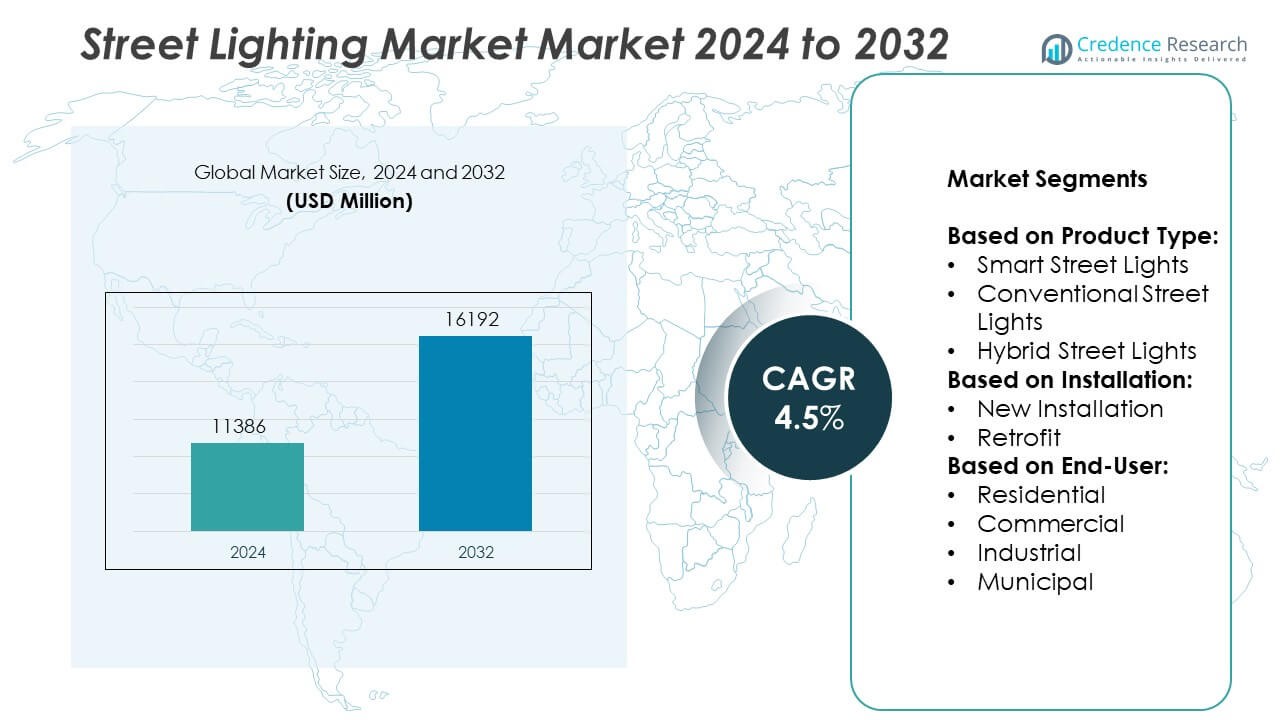

The street lighting market was valued at USD 11,386 million in 2024 and is projected to reach USD 16,192 million by 2032, growing at a CAGR of 4.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Street Lighting Market Size 2024 |

USD 11,386 Million |

| Street Lighting Market, CAGR |

4.5% |

| Street Lighting Market Size 2032 |

USD 16,192 Million |

The street lighting market is driven by rapid urbanization, government investments in smart city infrastructure, and rising demand for energy-efficient solutions. Municipalities are prioritizing LED and solar lighting to reduce energy consumption and lower maintenance costs. Integration of smart technologies such as IoT and adaptive lighting systems further accelerates market growth. Urban planners seek connected and sustainable lighting systems that enhance public safety and improve operational efficiency.

The street lighting market shows strong geographical presence across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe leads in adoption of smart and energy-efficient lighting due to supportive regulations, sustainability goals, and advanced infrastructure. North America follows closely with significant investments in smart city programs and retrofitting initiatives. Asia Pacific is the fastest-growing region, supported by rapid urbanization, government-led development schemes, and large-scale infrastructure expansion in countries like China and IndiaKey players shaping the global street lighting market include Signify (formerly Philips Lighting), Acuity Brands, and Eaton.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The street lighting market was valued at USD 11,386 million in 2024 and is expected to reach USD 16,192 million by 2032, growing at a CAGR of 4.5% during the forecast period.

- Rising urbanization, infrastructure expansion, and government funding for smart city development are primary drivers pushing demand for advanced street lighting systems.

- A significant trend is the widespread adoption of LED and solar-powered street lights, along with integration of IoT and remote management technologies for improved energy efficiency and real-time monitoring.

- Leading players such as Signify, Acuity Brands, Eaton, and Schneider Electric maintain market dominance through strong R&D, smart product portfolios, and strategic collaborations with municipalities and utility providers.

- High upfront installation costs, technical integration issues in legacy systems, and limited funding in underdeveloped regions remain key restraints affecting market scalability.

- Europe leads in implementation of intelligent and sustainable lighting systems due to stringent regulations and infrastructure readiness, while North America follows closely with strong federal and municipal initiatives.

- Asia Pacific shows the highest growth potential, driven by rapid urban development and government-supported smart infrastructure programs in countries like China and India, while Latin America and MEA gradually adopt energy-efficient lighting solutions aligned with economic capacity and urban priorities.

Market Drivers

Government Investments in Smart City Infrastructure Drive Demand

Governments across the globe are heavily investing in smart city infrastructure, where advanced street lighting systems form a fundamental component. These initiatives focus on improving public safety, energy conservation, and operational efficiency. The Street Lighting Market benefits from policies that support intelligent lighting solutions integrated with sensors and IoT. Municipalities are actively replacing conventional systems with automated, remotely controlled LED lights. These efforts align with broader goals of sustainability and digital transformation. It supports consistent demand for technologically advanced lighting systems in urban development projects.

- For instance, Signify and Imtac deployed over 13,000 smart LED luminaires in Muscat, Oman, with remote controls covering more than 20,000 installations under the Interact City system.

Growing Need for Energy Efficiency Supports LED Adoption

The global push toward energy efficiency directly influences the evolution of street lighting systems. Traditional lighting technologies consume more power and require frequent maintenance. The Street Lighting Market has responded by shifting toward LED-based solutions, known for their longer lifespan and lower energy use. It reduces electricity costs for municipalities and contributes to environmental goals. Governments offer subsidies and incentives to encourage this transition. Energy-efficient lighting plays a critical role in achieving national energy conservation targets.

- For instance, Signify has implemented Interact City solutions across 30 million light points worldwide, enabling centralized control and monitoring.

Rising Urbanization Increases Infrastructure Requirements

Urban population growth contributes to increased infrastructure development across emerging and developed regions. This includes expansion of roads, highways, and public spaces, all of which require adequate lighting. The Street Lighting Market supports this demand by supplying scalable lighting systems for diverse urban applications. It ensures safety, improves visibility, and enhances the overall quality of urban life. Real estate and commercial development projects also create new opportunities. Infrastructure expansion continues to stimulate steady demand for modern lighting solutions.

Technological Advancements Enable Smart Lighting Features

Advancements in automation, connectivity, and data analytics have transformed traditional lighting into intelligent systems. Features such as motion sensing, dimming, and remote monitoring now define modern installations. The Street Lighting Market incorporates these technologies to improve efficiency and reduce operational costs. It allows for predictive maintenance, fault detection, and real-time control. The integration of AI and cloud platforms further enhances system performance. These innovations align with growing expectations for smart and responsive urban infrastructure.

Market Trends

Widespread Shift Toward LED and Solar Lighting Technologies

LED and solar-powered systems are rapidly replacing conventional lighting across urban and rural areas. Cities are adopting these technologies to cut energy costs and reduce environmental impact. The Street Lighting Market reflects this shift by focusing on sustainable and long-lasting solutions. It supports public and private initiatives aimed at reducing carbon footprints. Solar lighting also offers off-grid capabilities, making it suitable for remote or underdeveloped regions. LED systems provide better luminosity, durability, and cost-effectiveness over time.

- For instance, Signify installed over 5,000 LED and solar street lights across 300 forest villages in Uttar Pradesh under its Har Gaon Roshan initiative, enhancing rural safety and accessibility.

Integration of IoT and Smart Control Features Gains Momentum

The integration of smart technologies such as IoT, AI, and cloud computing continues to influence product development and deployment. Smart lighting systems offer remote monitoring, fault detection, and adaptive brightness control. The Street Lighting Market increasingly supports urban infrastructure with intelligent lighting networks. It allows municipalities to manage energy consumption more efficiently and respond to outages in real time. The trend toward connected infrastructure aligns with broader smart city goals. These systems also help in data collection for traffic and pedestrian management.

- For instance, in partnership with the city of Pune, Signify replaced over 80,000 halogen poles with smart LED fixtures that include integrated emergency buttons and cameras, enhancing surveillance.

Rising Focus on Public Safety and Urban Aesthetics

Cities are emphasizing the role of lighting in improving public safety and enhancing urban design. Well-lit streets reduce crime rates and contribute to a sense of security among residents. The Street Lighting Market aligns with these goals by offering customizable and visually appealing lighting options. It provides solutions that balance functionality with architectural integration. Planners are selecting lighting systems not only for utility but also for aesthetic enhancement. Demand for decorative and smart pole designs is rising across city centers.

Standardization and Policy Frameworks Shape Future Adoption

Regulatory frameworks and standardization efforts are influencing the way lighting systems are deployed and maintained. Governments and agencies are setting guidelines for energy efficiency, durability, and safety. The Street Lighting Market responds by aligning product offerings with regional and international standards. It ensures long-term reliability and reduces maintenance liabilities for public authorities. Clear policies accelerate project approvals and increase investor confidence. These frameworks guide municipalities toward uniform and sustainable lighting practices.

Market Challenges Analysis

High Initial Costs and Budget Constraints Limit Adoption

The upfront investment required for advanced street lighting systems, particularly smart and solar-integrated solutions, remains a significant barrier. Many municipalities, especially in developing regions, face budget limitations that delay modernization projects. The Street Lighting Market must navigate these financial challenges while promoting long-term cost savings. It often requires public-private partnerships or government subsidies to accelerate deployment. Small towns and rural areas struggle to justify high initial costs despite future operational savings. The lack of flexible financing models restricts broader adoption across less developed regions.

Complex Integration and Maintenance Hinder Operational Efficiency

Integrating smart lighting into existing urban infrastructure involves technical complexities and coordination across multiple stakeholders. Network connectivity, data management, and software compatibility pose frequent challenges. The Street Lighting Market must address these integration issues to ensure smooth implementation. It also faces concerns around long-term maintenance, especially for connected systems that depend on continuous updates and monitoring. Limited technical expertise in local authorities further complicates management. These operational difficulties can slow project timelines and impact system reliability.

Market Opportunities

Growing Smart City Projects Unlock Large-Scale Implementation Potential

Smart city initiatives across the globe present a strong growth avenue for next-generation lighting infrastructure. These projects demand intelligent, energy-efficient, and remotely managed lighting systems to enhance urban services. The Street Lighting Market stands to benefit from this global transition toward connected and data-driven urban environments. It supports municipalities in achieving energy goals and improving service delivery through real-time monitoring. Urban planners are prioritizing infrastructure that integrates seamlessly with broader digital ecosystems. Large-scale adoption is expected in both newly developed and retrofitted city spaces.

Expansion in Off-Grid and Remote Area Lighting Creates New Demand

Rural electrification and the need for reliable lighting in remote areas are opening new market segments. Solar-powered street lights offer a practical solution where traditional grid infrastructure is absent or unreliable. The Street Lighting Market can serve this demand by offering low-maintenance, autonomous systems designed for diverse environments. It enables governments and NGOs to enhance safety and mobility in underserved communities. Product innovation targeting off-grid functionality will further expand application areas. These opportunities align with sustainability goals and global development initiatives.

Market Segmentation Analysis:

By Product Type:

Smart street lights, conventional street lights, and hybrid street lights. Smart street lights lead the segment due to rising demand for energy-efficient and connected infrastructure. These systems support real-time monitoring, dimming control, and remote access, making them ideal for smart city projects. Conventional street lights still hold a substantial share in regions where infrastructure upgrades are slower or where budgets remain limited. Hybrid street lights, which combine solar and grid energy sources, are gaining traction in areas with unreliable power supply and sustainability goals. The segment reflects a growing shift toward intelligent and environmentally conscious lighting solutions.

- For instance, street lighting using a model of a city with 50,000 lights, an energy cost of $0.07/kWh, a replacement of all lights over 2 years, and a total lifetime cost of ownership over 20 years.

By Installation:

The market is divided into new installation and retrofit. New installations dominate in developing regions with expanding urban landscapes and infrastructure development. Governments are allocating significant budgets for building road networks and public facilities, supporting this segment. Retrofit projects are increasing in mature economies where cities aim to replace outdated systems with energy-efficient alternatives. The Street Lighting Market benefits from both segments as infrastructure demand rises globally. It supports smart upgrades and large-scale deployments across municipal and commercial sectors. Retrofit initiatives also align with policy goals for energy savings and emissions control.

- For instance, Schneider Electric installed over 5,400 hybrid solar street lighting systems across off-grid regions in sub-Saharan Africa, ensuring operational continuity in areas with limited access to power grids.

By End-User:

The market includes residential, commercial, industrial, and municipal segments. The municipal segment holds the largest share due to continuous government-led investments in urban safety and public infrastructure. Municipalities seek reliable, low-maintenance lighting systems that improve visibility and lower operational costs. The commercial segment is growing steadily, driven by demand from business parks, shopping districts, and real estate projects. Industrial users adopt robust lighting systems for facility perimeters and operational safety. The residential segment is expanding in gated communities and housing developments that prioritize well-lit surroundings. It meets diverse lighting needs across sectors while aligning with energy efficiency and safety standards

Segments:

Based on Product Type:

- Smart Street Lights

- Conventional Street Lights

- Hybrid Street Lights

Based on Installation:

- New Installation

- Retrofit

Based on End-User:

- Residential

- Commercial

- Industrial

- Municipal

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounted for approximately 24% of the global street lighting market share in 2024. The region demonstrates steady demand driven by smart city programs and modernization of outdated lighting infrastructure. The United States leads in terms of market size, fueled by federal funding, energy-efficiency mandates, and widespread adoption of smart LED systems in urban and suburban areas. Canada also contributes significantly through its focus on sustainability and urban safety. Public-private partnerships and infrastructure development grants support the deployment of intelligent street lighting systems across highways, city streets, and residential neighborhoods. It reflects growing interest in adaptive lighting, motion-sensor integration, and IoT-enabled management platforms. Local governments prioritize low-emission lighting solutions, aligning with net-zero emission targets.

Europe

Europe captured the largest market share at 31% in 2024, supported by stringent energy regulations, aggressive climate policies, and early adoption of smart infrastructure. Germany, the United Kingdom, France, and the Netherlands are at the forefront of installing intelligent lighting systems that enhance visibility, reduce energy consumption, and allow real-time monitoring. The European Union promotes LED upgrades and retrofitting through energy performance contracts and green public procurement practices. It benefits from consistent funding and structured municipal frameworks that prioritize sustainable urban lighting. European cities are also deploying solar-powered lighting in rural and heritage zones, where grid expansion is limited. This region continues to innovate through collaborations between public authorities, lighting manufacturers, and technology providers.

Asia Pacific

Asia Pacific held 29% of the global street lighting market share in 2024 and is the fastest-growing regional market. Countries such as China, India, Japan, and South Korea are leading extensive urbanization efforts, resulting in large-scale installation of new street lighting infrastructure. China dominates in both production and deployment of smart and solar-powered street lighting, supported by domestic manufacturing capabilities and government subsidies. India’s Smart Cities Mission and urban renewal programs drive strong demand for LED retrofits and hybrid lighting systems. Japan and South Korea focus on high-efficiency lighting integrated with surveillance and traffic systems. It plays a vital role in ensuring safety, improving mobility, and reducing power grid load. Expanding road networks, rapid population growth, and technological readiness support long-term regional growth.

Latin America

Latin America contributed 8% to the global market share in 2024, led by Brazil, Mexico, and Colombia. The region is gradually modernizing its public lighting infrastructure, though economic constraints and uneven urban development slow progress. Governments are prioritizing energy efficiency, cost savings, and urban safety in densely populated areas. International funding, energy service company (ESCO) models, and smart pilot projects are supporting adoption. It reflects growing interest in solar-powered lighting systems, especially in remote and underserved communities. Local initiatives focus on public parks, transport corridors, and tourist zones.

The Middle East and Africa

The Middle East and Africa (MEA) accounted for 8% of the global street lighting market share in 2024. Gulf Cooperation Council (GCC) countries, particularly the UAE and Saudi Arabia, invest in smart urban development that includes integrated street lighting systems. National visions and tourism-focused infrastructure planning continue to drive upgrades. In Africa, adoption is lower due to limited grid access and financial constraints, though solar lighting is expanding in rural areas. It serves critical needs in improving public safety and supporting mobility after dark. Government collaborations with development agencies and global technology providers are gradually enhancing lighting infrastructure across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Eaton

- Philips

- Legrand

- Osram

- Havells

- Schneider Electric

- LSIS

- Acuity Brands

- Sylvania

Competitive Analysis

The Street Lighting Market is highly competitive, with key players including Philips, Osram, Acuity Brands, Eaton, Schneider Electric, Sylvania, Havells, LSIS, and Legrand. These companies focus on product innovation, strategic partnerships, and smart technology integration to maintain their market position. They actively invest in research and development to improve energy efficiency, durability, and connectivity of their lighting solutions. Companies compete by offering integrated systems that support smart city infrastructure, including remote monitoring, adaptive lighting, and IoT compatibility. Market leaders target both developed and emerging regions through customized offerings aligned with regional standards and government initiatives. They also expand their presence through acquisitions and collaborations with municipal authorities and utility service providers. Price competitiveness, technological superiority, and service reliability remain critical to gaining contracts in large-scale public lighting projects. Sustainability and compliance with global energy efficiency regulations further influence buyer preferences. To sustain growth, leading firms continuously adapt to evolving urban infrastructure needs and shifting policy landscapes.

Recent Developments

- In July 2025, Acuity Brands introduced new products expanding color temperature and Color Rendering Index (CRI) options on their 3” and 4” lighting platforms, enhancing customization and lighting quality.

- In June 2025, Philips planned to expand its LED street lighting market presence in India by aiming to replace over 30 million traditional street lamps with connectable LED street lights following a major contract win.

- In February 2025, Schneider Electric showcased a comprehensive range of electrical and automation products and solutions at ELECRAMA 2025.

Market Concentration & Characteristics

The street lighting market is moderately concentrated, with a mix of global leaders and regional players competing across diverse application areas. Major companies such as Signify, Acuity Brands, Eaton, and Schneider Electric dominate through strong product portfolios, extensive distribution networks, and advanced smart lighting technologies. The market features a high level of innovation, driven by growing demand for energy efficiency, automation, and integrated lighting control systems. It reflects characteristics of a technology-driven sector where product differentiation, compliance with energy regulations, and after-sales service play critical roles in gaining contracts. Manufacturers compete on the basis of cost-efficiency, reliability, and adaptability to urban planning needs. The street lighting market is also characterized by long project lifecycles, with procurement heavily influenced by government tenders and infrastructure budgets. It continues to evolve with increasing emphasis on IoT connectivity, sustainable materials, and low-maintenance systems to meet modern urban infrastructure goals.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Installation, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue shifting toward smart and connected lighting systems across urban areas.

- Governments will prioritize LED and solar street lights to meet energy efficiency and sustainability targets.

- Smart city projects will drive demand for intelligent lighting with IoT, motion sensors, and adaptive controls.

- Public-private partnerships will expand to fund large-scale infrastructure and retrofitting programs.

- Manufacturers will focus on integrating AI and cloud-based monitoring into street lighting systems.

- Demand will rise for low-maintenance, weather-resistant lighting in both developed and emerging markets.

- Modular and aesthetically designed lighting will gain popularity in modern urban planning.

- Investment in off-grid lighting solutions will increase in rural and underserved regions.

- Regulatory frameworks will influence product development and accelerate technology standardization.

- The market will witness steady growth through innovation, urbanization, and environmental policy support.