Market Overview

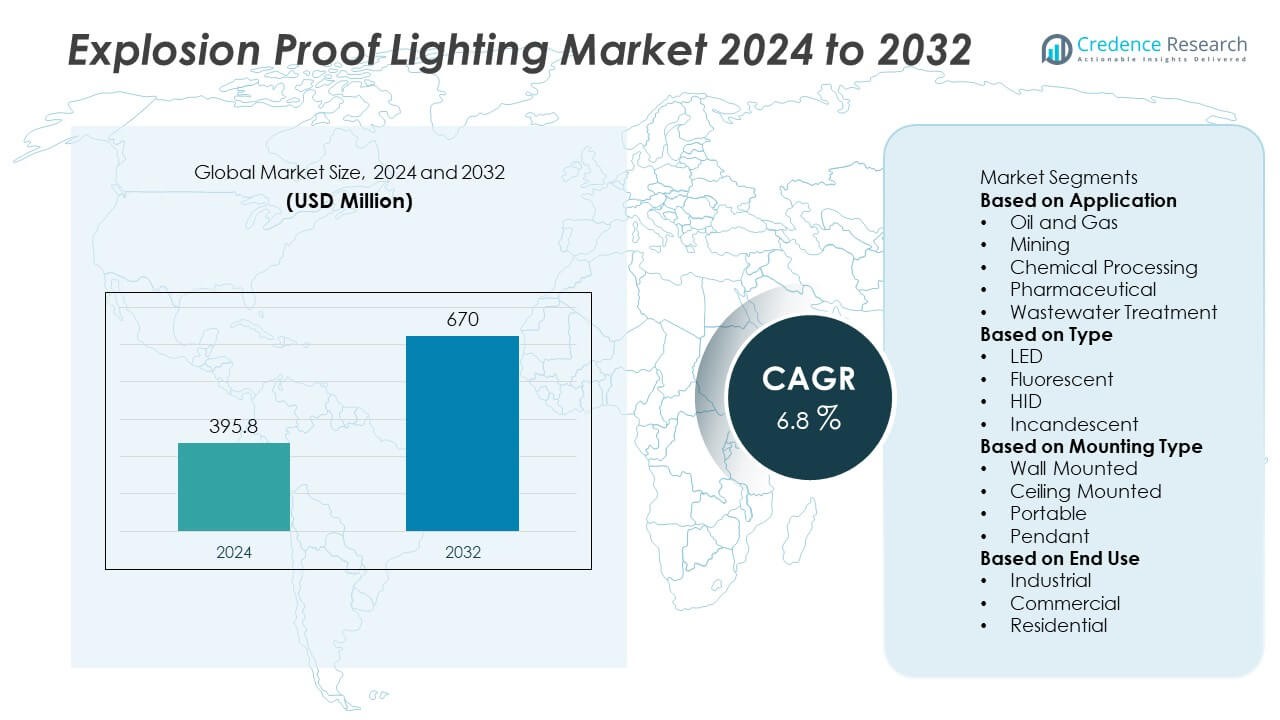

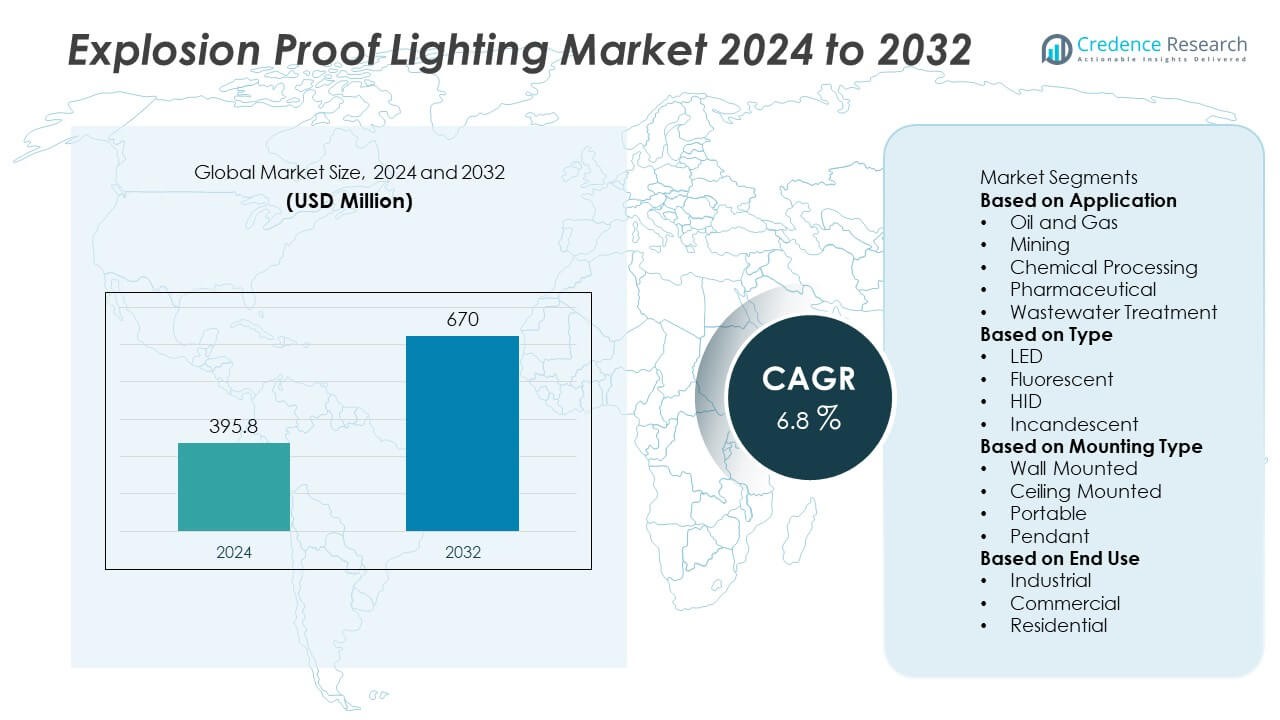

The Explosion Proof Lighting Market was valued at USD 395.8 million in 2024 and is projected to reach USD 670 million by 2032, registering a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Explosion Proof Lighting Market Size 2024 |

USD 395.8 Million |

| Explosion Proof Lighting Market, CAGR |

6.8% |

| Explosion Proof Lighting Market Size 2032 |

USD 670 Million |

The Explosion Proof Lighting Market grows on rising demand for worker safety, strict regulatory compliance, and the need to prevent ignition risks in hazardous environments such as oil and gas, mining, and chemical industries. It benefits from the shift toward LED-based systems that deliver long service life, energy efficiency, and reduced maintenance in extreme conditions.

The Explosion Proof Lighting Market demonstrates strong geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with adoption patterns shaped by industry concentration and regulatory frameworks. North America emphasizes compliance with OSHA and UL standards, supporting demand from oil, gas, and petrochemical sectors. Europe drives growth through strict ATEX directives and investments in energy-efficient technologies. Asia-Pacific emerges as the fastest-growing region with expanding industrial infrastructure, offshore drilling, and mining activities across China, India, and Southeast Asia. Latin America and the Middle East & Africa contribute steadily through refinery expansions, mining projects, and offshore developments that require certified lighting systems. Key players influencing this market include Eaton, Hubbell Lighting, Dialight, and General Electric, all of whom focus on advanced LED solutions, regulatory compliance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Explosion Proof Lighting Market was valued at USD 395.8 million in 2024 and is projected to reach USD 670 million by 2032, registering a CAGR of 6.8% during the forecast period.

- Rising demand for safety-certified lighting solutions in hazardous environments drives adoption, with industries such as oil and gas, mining, and chemicals requiring systems that prevent ignition risks and comply with international standards.

- Market trends highlight the growing shift toward LED-based explosion-proof fixtures that offer energy efficiency, extended operational lifespans exceeding 50,000 hours, and reduced maintenance in extreme industrial conditions.

- Competition is defined by global players such as Eaton, Hubbell Lighting, Dialight, and General Electric, who invest in advanced LED technologies, smart-enabled features, and compliance certifications to expand market presence across diverse regions.

- High initial installation costs and complex regulatory approval processes act as restraints, particularly for small and medium enterprises in emerging economies, slowing large-scale adoption.

- North America leads adoption with strong regulatory enforcement and modernization of refinery infrastructure, while Europe advances through ATEX-driven initiatives and energy-efficient upgrades in industrial hubs.

- Asia-Pacific shows the fastest growth fueled by rapid industrialization, petrochemical expansion, and offshore drilling, while Latin America and the Middle East & Africa expand steadily through mining projects, oilfield developments, and refinery upgrades.

Market Drivers

Growing Demand for Worker Safety and Compliance with Stringent Regulations

The Explosion Proof Lighting Market advances with rising emphasis on workplace safety across hazardous industrial environments. Oil and gas, mining, and chemical sectors require lighting solutions that prevent ignition risks in explosive atmospheres. Governments and regulatory bodies enforce strict safety standards such as ATEX, IECEx, and UL certifications, which mandate the use of explosion-proof systems in high-risk facilities. It drives demand for certified lighting products that ensure operational safety and reduce liability for operators. Manufacturers respond with compliant solutions tailored for both new installations and retrofitting projects. This regulatory push strengthens the role of explosion-proof lighting in ensuring worker protection.

- For instance, Eaton’s Crouse-Hinds series provided 1,850 ATEX- and UL-certified LED explosion-proof fixtures to the Chevron Richmond Refinery in California, ensuring compliance in flammable gas zones and improving worker safety across multiple processing units.

Expanding Industrialization in High-Risk Sectors

Rapid growth in heavy industries and energy-intensive operations stimulates adoption of explosion-proof systems. The Explosion Proof Lighting Market benefits from expansion in oil refineries, petrochemical plants, and mining facilities that operate under hazardous conditions. It supports uninterrupted workflows in environments where flammable gases, vapors, or dust pose constant risks. Rising infrastructure investments in Asia-Pacific and the Middle East amplify product demand, particularly in industrial hubs and offshore platforms. Increasing deployment of LNG terminals and pipelines also creates new opportunities. Manufacturers introduce robust lighting systems to withstand vibrations, temperature extremes, and corrosive environments.

- For instance, R. Stahl deployed 1,200 explosion-proof luminaires across the Qatargas LNG terminal, designed to operate in corrosive and high-vibration environments while maintaining ATEX compliance.

Technological Advancements in LED-Based Solutions

The transition from conventional lighting technologies to advanced LED-based systems drives efficiency gains. The Explosion Proof Lighting Market shifts toward LED products that deliver higher energy savings, longer lifespans, and reduced maintenance requirements compared to fluorescent or HID options. It enables facilities to lower operating costs while ensuring compliance with strict safety guidelines. Smart lighting features such as remote monitoring, dimming controls, and IoT integration improve flexibility for industrial users. Enhanced durability and shock resistance of LEDs extend performance in extreme operating environments. Companies invest heavily in R&D to integrate these innovations into certified explosion-proof fixtures.

Rising Focus on Energy Efficiency and Sustainability

Energy conservation initiatives across industries push the adoption of sustainable lighting solutions. The Explosion Proof Lighting Market aligns with global efforts to reduce carbon emissions and meet sustainability goals. It offers energy-efficient alternatives that reduce power consumption without compromising safety standards. Governments and corporations prioritize lighting systems that contribute to green building certifications and lower lifecycle costs. LED-based explosion-proof fixtures address both environmental concerns and operational efficiency. The trend reinforces long-term demand by linking safety compliance with sustainability commitments.

Market Trends

Increasing Adoption of LED-Based Explosion Proof Solutions

The Explosion Proof Lighting Market shows a clear transition from traditional lighting technologies to LED-based solutions. LEDs offer longer operational lifespans, superior energy efficiency, and lower maintenance needs compared to HID and fluorescent fixtures. It supports cost savings while ensuring compliance with safety standards in hazardous environments. The compact design of LEDs allows manufacturers to create versatile lighting formats for diverse industrial applications. Strong resistance to shock and vibration enhances durability in offshore, mining, and petrochemical sectors. The growing preference for LED technology shapes the future landscape of explosion-proof lighting systems.

- For instance, R. Stahl implemented a significant safety upgrade on North Sea oil platforms by deploying over 2,300 LED explosion-proof fixtures, resulting in a 35-hour reduction in annual maintenance per site.

Integration of Smart Lighting and IoT Capabilities

Smart technology integration emerges as a major trend in industrial lighting. The Explosion Proof Lighting Market incorporates IoT-enabled features such as wireless controls, automated dimming, and predictive maintenance alerts. It enhances operational efficiency by allowing remote monitoring and control of lighting systems in high-risk facilities. Cloud-based platforms connect multiple sites, ensuring optimized energy use and reduced downtime. Real-time diagnostics improve asset management and safety compliance. Industrial operators embrace these solutions to gain visibility and control over critical infrastructure.

- For instance, Cooper Lighting Solutions recently implemented IoT-enabled, explosion-proof lighting at 15 chemical processing facilities. This project involved integrating smart lighting with Industrial IoT (IIoT) systems, offering advanced features like remote control, automation, and real-time monitoring.

Growing Emphasis on Modular and Portable Designs

The demand for flexible and modular solutions strengthens across hazardous industries. The Explosion Proof Lighting Market benefits from portable fixtures, modular floodlights, and compact hand-held units designed for temporary or task-specific use. It supports quick installation, reduced downtime, and adaptability across mining shafts, shipyards, and offshore rigs. Lightweight yet durable designs improve worker mobility and safety in confined environments. Manufacturers expand product lines with adjustable mounting systems and interchangeable modules. This trend reflects the industry’s shift toward practical, user-focused innovations.

Rising Focus on Sustainability and Eco-Friendly Materials

Environmental considerations continue to influence product design and adoption. The Explosion Proof Lighting Market advances with fixtures that combine energy efficiency with recyclable materials and eco-friendly production methods. It reduces the overall environmental footprint of industrial operations without compromising safety standards. Green manufacturing practices and compliance with environmental certifications add competitive advantages. Companies highlight sustainability in product portfolios to align with customer and regulatory expectations. This trend underscores the convergence of safety, performance, and environmental responsibility in industrial lighting solutions.

Market Challenges Analysis

High Initial Costs and Limited Awareness in Emerging Economies

The Explosion Proof Lighting Market faces significant challenges due to high upfront costs compared to conventional lighting systems. Advanced LED-based explosion-proof fixtures require specialized components, certifications, and testing that increase product prices. It limits adoption in small and medium enterprises operating under budget constraints, particularly in emerging economies. Limited awareness about the long-term benefits, such as lower maintenance and energy savings, further slows penetration. Some buyers remain reluctant to replace traditional systems despite safety risks. Manufacturers must address this gap by offering cost-efficient designs, training programs, and awareness initiatives to support wider adoption.

Complex Regulatory Compliance and Performance Concerns

Strict compliance with international safety certifications presents another major barrier. The Explosion Proof Lighting Market must align with ATEX, IECEx, UL, and other region-specific standards, creating additional testing and certification costs for manufacturers. It complicates entry for smaller firms that lack the resources to meet diverse regulatory frameworks. Concerns also persist regarding performance in extreme conditions such as high temperatures, corrosive environments, and continuous vibrations. Failure to ensure reliability under these circumstances can reduce trust among industrial users. Industry players must continue to invest in R&D and certification partnerships to maintain quality consistency and meet global compliance requirements.

Market Opportunities

Expansion Through Industrial Growth and Infrastructure Investments

The Explosion Proof Lighting Market presents strong opportunities through the expansion of oil and gas, petrochemical, and mining industries that require continuous safety-focused infrastructure. Rising investments in offshore drilling, LNG terminals, and chemical processing plants create steady demand for certified lighting systems. It benefits from large-scale modernization projects across Asia-Pacific and the Middle East, where industrial hubs continue to expand. The growing construction of pipelines, refineries, and hazardous manufacturing units further strengthens adoption potential. Manufacturers that align their offerings with high-capacity industrial projects stand to capture significant opportunities. Public and private sector funding ensures a consistent flow of projects requiring explosion-proof lighting installations.

Opportunities in LED Innovation and Smart Lighting Integration

Technological innovation opens another avenue for growth in the Explosion Proof Lighting Market. LED advancements allow longer lifespans exceeding 50,000 operational hours, with reduced maintenance costs for industries working in hazardous zones. It enables operators to achieve both safety compliance and energy efficiency targets. Integration of IoT-enabled monitoring, wireless controls, and predictive maintenance capabilities adds further value in modern facilities. Industries transitioning to sustainable operations will increasingly demand eco-friendly and energy-saving lighting systems. Companies that focus on hybrid solutions combining safety certification, digital connectivity, and energy conservation will unlock new market opportunities.

Market Segmentation Analysis:

By Application

The Explosion Proof Lighting Market divides by application into oil and gas, mining, chemical and petrochemical, marine, and manufacturing sectors. Oil and gas facilities represent the largest share due to continuous operations in hazardous environments where safety standards are strict. Mining applications adopt robust fixtures that can withstand dust, vibration, and moisture. The chemical and petrochemical industries demand lighting capable of resisting corrosive gases and extreme temperatures. Marine and offshore platforms require saltwater-resistant fixtures that maintain performance under constant exposure to harsh weather conditions. It benefits from wide-scale deployment across industrial and hazardous sites, strengthening demand for certified lighting products.

- For instance, R. STAHL provided over 900 explosion-proof LED luminaires to the Total Energies Jubail Chemical Plant in Saudi Arabia, ensuring compliance with ATEX and IECEx standards. This installation improved operational safety and reduced the frequency of lamp replacements from 150 to 30 annually.

By Type

Segmentation by type includes LED, fluorescent, and high-intensity discharge (HID) lighting. The Explosion Proof Lighting Market shifts strongly toward LED solutions due to their long operational life, energy efficiency, and low maintenance requirements. LEDs provide clear illumination, withstand shock and vibration, and offer higher durability compared to fluorescent and HID models. Fluorescent lighting still finds use in older installations where retrofitting has not yet occurred, while HID lights are used in specific high-intensity applications. It evolves rapidly as companies replace legacy technologies with LED systems that meet international certification standards. The trend ensures LEDs remain the dominant type in future deployments.

- For instance, R. Stahl deployed 3,200 LED explosion-proof units across mining operations in Australia, extending operational lifespan by 50,000 hours per fixture and reducing energy consumption by 15,000 kWh annually.

By Mounting Type

Mounting configurations include ceiling-mounted, wall-mounted, pendant-mounted, and portable fixtures. The Explosion Proof Lighting Market shows strong preference for ceiling-mounted units in large industrial halls, refineries, and warehouses where uniform illumination is critical. Wall-mounted and pendant-mounted systems provide flexibility for task-specific applications, especially in chemical plants and marine environments. Portable explosion-proof lighting gains traction in maintenance operations, confined spaces, and emergency use cases. It supports industries requiring mobility without compromising safety standards. Manufacturers expand their product ranges to address the need for diverse mounting options across sectors, ensuring reliable solutions for both permanent and temporary installations.

Segments:

Based on Application

- Oil and Gas

- Mining

- Chemical Processing

- Pharmaceutical

- Wastewater Treatment

Based on Type

- LED

- Fluorescent

- HID

- Incandescent

Based on Mounting Type

- Wall Mounted

- Ceiling Mounted

- Portable

- Pendant

Based on End Use

- Industrial

- Commercial

- Residential

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a 29% market share in the Explosion Proof Lighting Market, supported by strong demand from oil and gas exploration, petrochemical plants, and mining operations. The United States leads the region due to extensive refinery networks and offshore drilling activities that require certified explosion-proof systems to comply with OSHA and UL standards. Canada contributes through growing investments in oil sands and mining projects, where durability and safety are paramount. Mexico’s industrial expansion in petrochemicals and manufacturing also supports steady adoption. It benefits from the presence of key manufacturers and distributors who provide products certified to ATEX and IECEx standards, ensuring compliance across industries. Ongoing modernization of refineries and the replacement of traditional HID lights with LED-based systems reinforce market growth across North America.

Europe

Europe accounts for a 23% market share, driven by strict environmental and workplace safety regulations under ATEX directives. Germany, the United Kingdom, and France lead adoption with investments in chemical processing, automotive manufacturing, and offshore wind projects. Eastern European nations also contribute through modernization of mining and energy infrastructure. The Explosion Proof Lighting Market in this region emphasizes sustainable and energy-efficient products, aligning with the European Green Deal and carbon reduction goals. It experiences strong replacement demand as industries move from fluorescent and HID to LED systems that meet both safety and energy standards. European manufacturers remain at the forefront of innovation, with smart-enabled solutions gaining traction across industrial hubs.

Asia-Pacific

Asia-Pacific commands the largest share at 32%, fueled by rapid industrialization, urban expansion, and massive infrastructure investments. China leads adoption due to its extensive oil refining capacity, large-scale chemical plants, and growing marine industry. India shows strong demand with increasing refinery capacity, petrochemical investments, and coal mining projects that require explosion-proof systems. Southeast Asian countries including Indonesia, Malaysia, and Vietnam adopt these solutions in offshore drilling platforms and LNG terminals. The Explosion Proof Lighting Market in Asia-Pacific grows rapidly as industries prioritize safety compliance under expanding regulatory frameworks. It benefits from the availability of cost-effective LED fixtures manufactured locally, strengthening accessibility for small and large enterprises.

Latin America

Latin America represents a 9% market share, with Brazil and Mexico as the key contributors. Brazil’s oil and gas sector, particularly offshore exploration in the pre-salt reserves, drives significant demand. Mexico supports adoption through its petrochemical and mining sectors, while Argentina and Chile expand deployment in industrial hubs. The Explosion Proof Lighting Market grows gradually here, with replacement of conventional lighting systems by certified LED solutions. It is further supported by public-private investments in safety and infrastructure upgrades. Market penetration remains moderate due to budget constraints, but regulatory pressure continues to accelerate adoption in hazardous environments.

Middle East & Africa

The Middle East & Africa accounts for a 7% market share, strongly driven by oil, gas, and petrochemical industries in the Gulf Cooperation Council (GCC) countries. Saudi Arabia, UAE, and Qatar lead with large-scale refinery projects, LNG terminals, and offshore drilling activities requiring explosion-proof lighting systems. Africa contributes through mining operations in South Africa, Nigeria, and Zambia, where portable and heavy-duty fixtures support worker safety. The Explosion Proof Lighting Market benefits from rising adoption of LED systems that reduce energy consumption in regions with high operating costs. It gains traction through strategic partnerships between international suppliers and regional distributors. Continued investments in oil and gas infrastructure ensure steady demand across this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dialight

- Atlas Copco

- General Electric

- STAHL

- Cree

- Thorn Lighting

- Atexor

- Venture Lighting

- Solara

- Hubbell Lighting

Competitive Analysis

The competitive landscape of the Explosion Proof Lighting Market is defined by global leaders such as Eaton, Hubbell Lighting, Dialight, General Electric, Thorn Lighting, Atexor, Venture Lighting, STAHL, Solara, Atlas Copco, and Cree, who compete on innovation, compliance, and energy efficiency. Eaton leverages its strong presence in oil and gas with certified LED fixtures engineered for harsh offshore and refinery environments, while Hubbell Lighting focuses on smart-enabled solutions with wireless control systems for industrial safety. Dialight specializes in LED-based explosion-proof products with lifespans exceeding 150,000 hours, offering significant reductions in maintenance downtime. General Electric integrates advanced optics and IoT-ready designs into its lighting systems to support predictive maintenance and energy management. Thorn Lighting emphasizes modular solutions tailored for mining and chemical sectors, while STAHL strengthens its market position with ATEX- and IECEx-certified luminaires for global compliance. Cree focuses on high-output, energy-saving LEDs with superior thermal management, while Atexor delivers portable and task-specific explosion-proof lighting tailored for confined spaces. Venture Lighting and Solara target industrial retrofitting with durable, cost-effective LED fixtures, while Atlas Copco integrates lighting into its broader portfolio of mining and energy equipment. Collectively, these companies drive the market forward by prioritizing safety certifications, technological upgrades, and region-specific solutions to meet evolving industrial requirements.

Recent Developments

- In August 2025, R. STAHL launched a Pro upgrade for its EXLUX 6002 and 6009 linear luminaires, targeting improved efficiency in hazardous-area lighting.

- In July 2025, Dialight introduced its new Battery Backup ProSite LED Streetlight model for hazardous and non‑hazardous applications, expanding its ProSite lighting platform portfolio

- In August 2024, Dialight expanded its ProSite Platform series with a new streetlight model designed for both hazardous and general applications

Market Concentration & Characteristics

The Explosion Proof Lighting Market reflects moderate concentration, with global leaders and specialized regional players competing on technology, certification, and distribution strength. Large companies focus on LED innovation, IoT integration, and ATEX or IECEx compliance to address stringent safety standards in oil, gas, chemical, and mining sectors. Regional manufacturers position themselves through cost-effective solutions and tailored designs suited for local infrastructure needs. It demonstrates characteristics of a safety-critical industry where reliability, durability, and lifecycle efficiency define product differentiation. The market shows strong emphasis on long operational lifespans, reduced maintenance, and high resistance to shock, vibration, and corrosive environments. Companies invest heavily in research, automation, and partnerships to strengthen product portfolios and meet global compliance requirements. It continues to evolve as demand for energy-efficient, smart-enabled, and sustainable lighting solutions expands across industrial hubs and hazardous environments worldwide.

Report Coverage

The research report offers an in-depth analysis based on Application, Type, Mounting Type End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for certified lighting in oil, gas, and chemical industries will continue to expand.

- LED-based fixtures will dominate due to long service life and reduced maintenance.

- Smart-enabled solutions with IoT integration will gain wider adoption in industrial hubs.

- Energy efficiency requirements will push industries to replace older HID and fluorescent systems.

- Asia-Pacific will lead growth with large-scale industrial and infrastructure investments.

- Europe will strengthen adoption under strict ATEX and environmental compliance directives.

- North America will focus on modernization of refineries and mining facilities with advanced lighting systems.

- Latin America and the Middle East & Africa will gradually expand adoption through refinery, mining, and offshore projects.

- Competitive intensity will rise as global players introduce modular and portable solutions.

- Sustainability goals will drive innovation in recyclable materials and eco-friendly lighting designs.