Market Overview

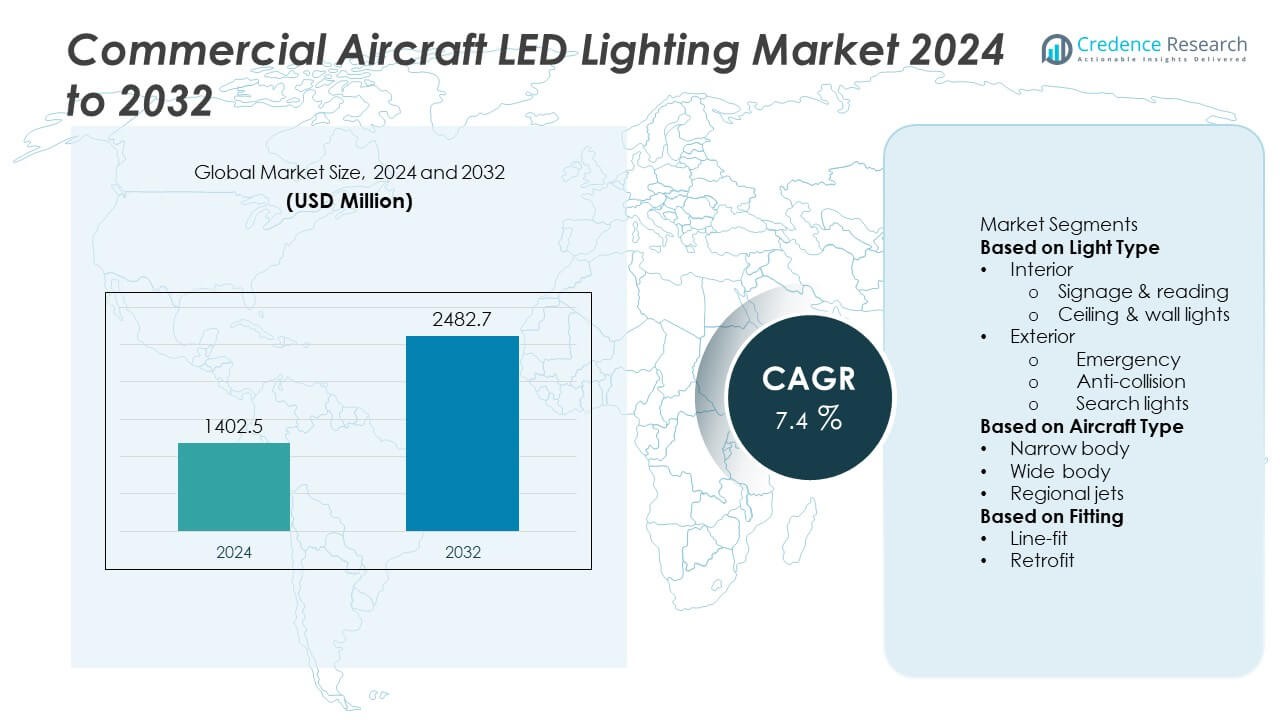

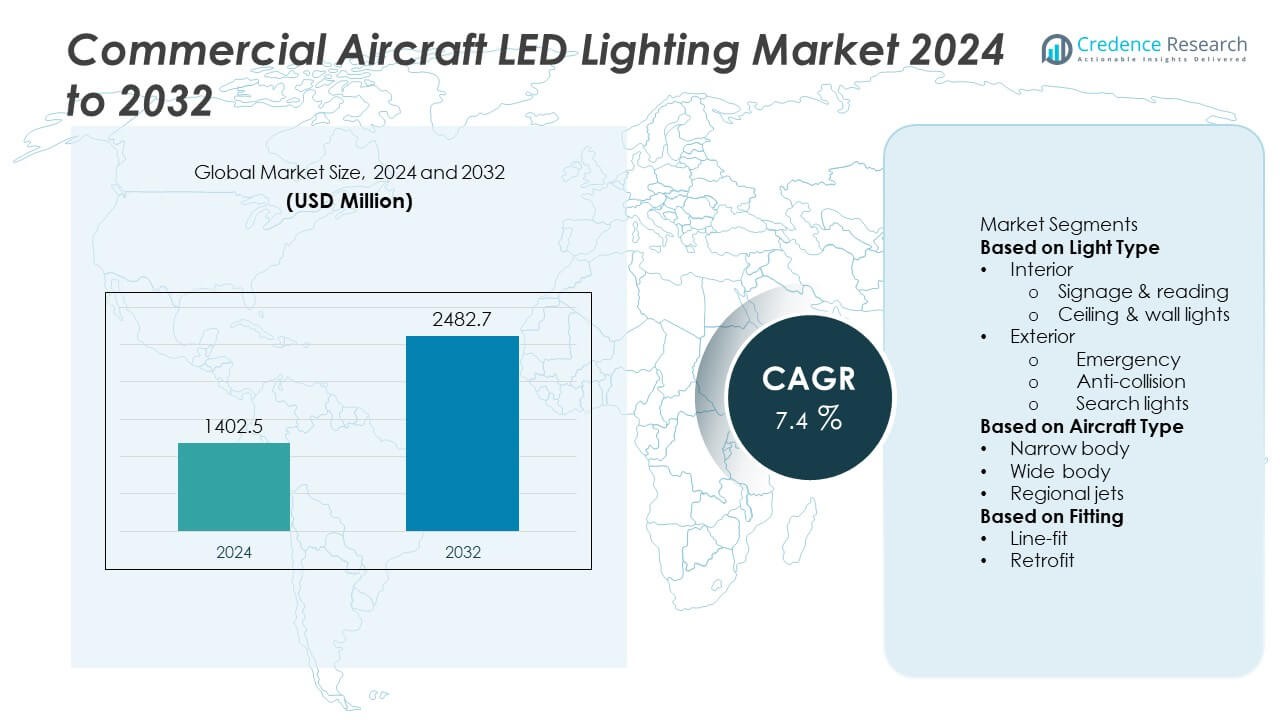

Commercial Aircraft LED Lighting Market size was valued at USD 1,402.5 million in 2024 and is anticipated to reach USD 2,482.7 million by 2032, growing at a CAGR of 7.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Commercial Aircraft LED Lighting Market Size 2024 |

USD 1,402.5 Million |

| Commercial Aircraft LED Lighting Market, CAGR |

7.4% |

| Commercial Aircraft LED Lighting Market Size 2032 |

USD 2,482.7 Million |

The Commercial Aircraft LED Lighting Market grows steadily, driven by airlines demand for energy-efficient systems, lower maintenance costs, and enhanced passenger experience. LED technology offers long service life, reduced power consumption, and customizable cabin ambiance, aligning with operational efficiency and brand differentiation goals.

The geographical landscape of the Commercial Aircraft LED Lighting Market reflects strong demand across North America, Europe, Asia-Pacific, and emerging regions such as the Middle East, Africa, and Latin America. North America leads with its advanced aerospace manufacturing base and high retrofit activity, supported by technological innovation. Europe benefits from established aviation hubs in Germany, France, and the United Kingdom, with a strong focus on sustainability and premium passenger services. Asia-Pacific experiences rapid growth due to fleet expansion, modernization programs, and rising passenger traffic in China, India, and Japan. Emerging markets in the Middle East and Latin America focus on premium cabin enhancements and operational upgrades. Key players shaping the competitive landscape include Honeywell International Inc., Collins Aerospace, Safran S.A., and Astronics Corporation, all investing in advanced.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Commercial Aircraft LED Lighting Market was valued at USD 1,402.5 million in 2024 and is projected to reach USD 2,482.7 million by 2032, at a CAGR of 7.4% during the forecast period.

- The market reflects steady expansion driven by rising adoption of LED technology in both new aircraft production and retrofit programs, supported by airlines’ focus on operational efficiency, safety, and passenger comfort.

- Key drivers include demand for energy-efficient lighting systems, reduced maintenance requirements, enhanced cabin aesthetics, and the ability to customize lighting for branding and passenger wellness.

- Prominent trends involve integration of LED lighting with smart cabin management systems, use of human-centric designs to support passenger well-being, and development of lightweight, modular lighting solutions that improve aircraft fuel efficiency.

- The competitive landscape features leading players such as Honeywell International Inc., Collins Aerospace, Safran S.A., and Astronics Corporation, which invest in product innovation, certification compliance, and global supply chain capabilities.

- Market restraints include high initial installation costs, complex retrofit procedures for older fleets, and regulatory approval timelines that can slow product launches and fleet upgrades.

- Regionally, North America leads with strong manufacturing and aftermarket demand, Europe follows with a focus on sustainability and premium cabin experiences, Asia-Pacific grows rapidly through fleet expansion in China, India, and Japan, while the Middle East, Africa, and Latin America present emerging opportunities through luxury-focused upgrades and modernization initiatives.

Market Drivers

Rising Demand for Fuel Efficiency and Lower Maintenance Costs

The Commercial Aircraft LED Lighting Market benefits from airlines’ focus on reducing operational costs. LED systems consume less power than conventional lighting, contributing to improved fuel efficiency. It offers longer service life, which reduces the frequency of replacements and maintenance downtime. Airlines value the durability and consistent performance of LEDs under demanding operating conditions. The reduced heat output from LED systems enhances overall cabin comfort and safety. Operators adopt it to align with long-term cost optimization strategies.

- For instance, Honeywell International’s High-Output LED Landing Light delivers a lifespan of over 50,000 hours compared to traditional halogen lights averaging 1,000 hours, resulting in substantially fewer replacements and reduced maintenance intervals.

Enhanced Passenger Experience and Cabin Aesthetics

The Commercial Aircraft LED Lighting Market gains momentum from airlines’ efforts to improve passenger comfort and satisfaction. LED technology enables customizable color schemes and intensity levels to create appealing cabin atmospheres. It supports dynamic lighting scenarios that adapt to different flight phases, improving passenger relaxation. Airlines use advanced lighting to differentiate their brand and elevate onboard service quality. The ability to simulate natural daylight helps minimize passenger fatigue during long-haul flights. The market benefits from growing interest in premium travel experiences.

- For instance, Collins Aerospace’s µLED Reading Light system integrates over 200 micro-LEDs in a single unit, providing precise beam control and uniform illumination, which enhances reading comfort without disturbing nearby passengers.

Compliance with Safety Regulations and Industry Standards

The Commercial Aircraft LED Lighting Market expands due to stringent aviation safety requirements. LED systems meet rigorous standards for brightness, reliability, and emergency readiness. It offers consistent illumination that enhances visibility for passengers and crew during critical situations. Manufacturers design products to comply with evolving aerospace certification processes. Airlines replace legacy systems to ensure adherence to current safety regulations. Compliance-driven upgrades contribute to steady market growth.

Technological Advancements and Integration with Smart Systems

The Commercial Aircraft LED Lighting Market experiences growth from rapid advancements in smart lighting technologies. Integration with aircraft control systems allows real-time adjustments and monitoring. It supports energy optimization and predictive maintenance functions. Manufacturers invest in developing lightweight designs that align with overall aircraft efficiency goals. Enhanced durability and performance in diverse operating conditions drive adoption. The trend toward connected and intelligent cabin environments strengthens the demand for advanced LED lighting solutions.

Market Trends

Growing Adoption of Human-Centric and Mood Lighting Solutions

The Commercial Aircraft LED Lighting Market witnesses rising demand for human-centric lighting designs that enhance passenger well-being. Airlines implement LED systems capable of simulating natural daylight to support circadian rhythm alignment. It allows dynamic adjustments in brightness and color temperature during different flight stages. Mood lighting features create immersive travel experiences and reinforce airline branding. The trend supports both premium and economy cabin upgrades. Airlines view advanced lighting as a competitive tool for passenger loyalty.

- For instance, STG Aerospace’s liTeMood® LED cabin lighting system offers over 4,000 programmable color variations and smooth dimming from 100% to 0% in under two seconds, enabling precise mood and circadian lighting transitions.

Expansion of Retrofit Programs Across Existing Fleets

The Commercial Aircraft LED Lighting Market benefits from an increasing focus on retrofitting older aircraft with modern LED systems. Airlines seek upgrades to improve energy efficiency, reduce maintenance costs, and meet evolving safety standards. It offers a straightforward path to enhancing cabin aesthetics without major structural changes. Retrofit projects extend the operational life of aging fleets while aligning them with modern passenger expectations. The demand grows in both commercial and regional aircraft segments. This trend supports sustained aftermarket growth for LED lighting manufacturers.

- For instance, Collins Aerospace’s μLED Reading Light delivers significantly extended operational life—reported as 40,000 hours longer than standard reading lights—and offers full-color, dimmable functionality that can replace multiple legacy fixtures with a single unit, reducing component count and installed weight.

Integration with Advanced Cabin Management and IoT Systems

The Commercial Aircraft LED Lighting Market advances through integration with digital cabin management platforms. LED systems now connect with in-flight entertainment, environmental controls, and crew service applications. It enables centralized operation, real-time monitoring, and data-driven maintenance. The use of IoT-enabled lighting supports predictive analytics for performance optimization. Airlines adopt connected lighting solutions to enhance operational efficiency and passenger personalization. The convergence of lighting technology with smart cabin ecosystems continues to expand.

Shift Toward Lightweight, Energy-Optimized Lighting Designs

The Commercial Aircraft LED Lighting Market evolves with a focus on reducing weight and maximizing energy efficiency. Manufacturers develop compact, modular designs that fit diverse aircraft interiors. It contributes to lower fuel consumption and operational costs. Advanced materials and engineering techniques ensure durability without compromising visual quality. Airlines favor solutions that balance performance with sustainability goals. The trend reinforces the role of LED lighting in next-generation aircraft design strategies.

Market Challenges Analysis

High Initial Costs and Complex Retrofit Procedures

The Commercial Aircraft LED Lighting Market faces resistance due to significant upfront investment requirements. Airlines often prioritize other operational upgrades over cabin lighting replacements. It requires specialized components and compliance with stringent aerospace certification, which increases installation expenses. Retrofit projects for older aircraft may involve complex wiring adaptations and structural modifications. Smaller operators find it challenging to justify the cost without clear short-term returns. The financial barrier slows adoption, especially in cost-sensitive markets.

Stringent Regulatory Approvals and Supply Chain Constraints

The Commercial Aircraft LED Lighting Market experiences delays due to rigorous regulatory approval processes. Aviation authorities enforce strict testing protocols for safety, durability, and performance. It extends product development timelines and increases compliance costs for manufacturers. Disruptions in the supply chain for electronic components and advanced materials create additional challenges. Global events and manufacturing capacity limits can delay delivery schedules for new systems. These constraints affect the ability of airlines to plan and execute large-scale lighting upgrades.

Market Opportunities

Rising Demand for Next-Generation Aircraft and Fleet Expansion

The Commercial Aircraft LED Lighting Market gains growth potential from the increasing production of next-generation aircraft. Airlines are expanding fleets to meet growing passenger traffic and replace aging models. It opens opportunities for manufacturers to supply advanced lighting systems during line-fit installations. LED solutions that combine energy efficiency with design flexibility attract strong interest from original equipment manufacturers. Expanding routes in emerging economies further boost demand for new aircraft equipped with modern cabin lighting. The trend positions LED technology as a standard feature in future aviation builds.

Advancements in Customizable and Smart Lighting Technologies

The Commercial Aircraft LED Lighting Market benefits from continuous innovation in intelligent lighting control systems. Airlines seek solutions that allow personalized passenger experiences through adjustable brightness, color, and dynamic effects. It creates opportunities for integration with in-flight entertainment and wellness-focused cabin environments. IoT-enabled systems enhance operational efficiency through remote monitoring and predictive maintenance. Growing emphasis on brand differentiation through cabin ambiance strengthens the appeal of customizable LED solutions. These advancements expand the scope for premium product offerings in both commercial and regional aircraft segments.

Market Segmentation Analysis:

By Light Type

The Commercial Aircraft LED Lighting Market is segmented into interior lighting and exterior lighting. Interior lighting dominates due to its critical role in enhancing passenger comfort and cabin aesthetics. It includes ceiling lights, sidewall lights, reading lights, lavatory lights, and mood lighting systems. Airlines invest heavily in cabin illumination to support brand identity and improve in-flight experience. Exterior lighting, including navigation, landing, and taxi lights, holds steady demand driven by safety and operational visibility requirements. LED adoption in exterior applications continues to grow as operators seek energy efficiency and longer service life. Both segments benefit from advancements in smart control systems and lightweight materials.

- For instance, IFPL’s Cobalt Spectrum was selected for cabin refresh work on both the Airbus A330-200 and A330-300 platforms, demonstrating practical deployment of drop-in LED mood systems. On the exterior side, LED navigation and landing fixtures now carry published reliability and physical metrics.

By Aircraft Type

The Commercial Aircraft LED Lighting Market is classified into narrow-body, wide-body, and regional aircraft. Narrow-body aircraft lead the market due to their high production volumes and frequent use in short-to-medium-haul routes. It drives consistent demand for LED systems that balance efficiency with durability under frequent flight cycles. Wide-body aircraft, used for long-haul operations, favor advanced cabin lighting technologies that support passenger wellness on extended journeys. Regional aircraft adoption rises steadily as operators modernize interiors to match passenger expectations in competitive markets. LED solutions tailored to specific aircraft configurations help maximize installation efficiency and performance outcomes. Each category benefits from fleet expansion strategies by major and regional airlines.

- For instance, PWI’s LED cabin lighting earned regulatory approvals for the Beechcraft King Air 300/B300/350 series, ensuring compliance while enhancing cabin aesthetics. Suppliers also publish component-level metrics.

By Fitting

The Commercial Aircraft LED Lighting Market is segmented into line-fit and retrofit installations. Line-fit holds a strong share as original equipment manufacturers integrate LED systems during new aircraft production. It enables seamless integration with aircraft control systems and reduces installation complexity. Retrofit demand grows as airlines upgrade older fleets to meet efficiency, safety, and aesthetic standards. The aftermarket segment attracts attention from operators seeking quick cabin enhancements without extensive downtime. Retrofit projects also provide opportunities for suppliers to introduce modular and customizable LED designs. Both fitting types support market growth through evolving technology and regulatory alignment.

Segments:

Based on Light Type

- Interior

- Signage & reading

- Ceiling & wall lights

- Exterior

- Emergency

- Anti-collision

- Search lights

Based on Aircraft Type

- Narrow body

- Wide body

- Regional jets

Based on Fitting

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America leads the global market due to strong aircraft manufacturing infrastructure and a large aftermarket demand base. The United States drives this leadership through Boeing’s high production volumes and extensive retrofit programs across major airlines. Technological innovations, such as human-centric and mood-adaptive lighting, continue to strengthen the region’s position. It benefits from robust regulatory frameworks, high R&D investment, and early adoption of advanced cabin technologies. LED adoption is high in both line-fit and retrofit applications, with airlines prioritizing systems that enhance operational efficiency and passenger comfort. The region’s mature aviation ecosystem ensures consistent demand for both new installations and upgrades.

Europe

Europe maintains a significant share, estimated at around 30% of the global market, supported by major aerospace hubs in Germany, France, and the United Kingdom. Regional manufacturers play a key role in designing and producing innovative LED-based cabin lighting solutions. Airlines in Europe focus on ambient and energy-efficient systems to improve passenger experience and meet strict environmental regulations. Germany benefits from Airbus-led line-fit programs, while other European nations support strong retrofit activity. Sustainability goals in line with EU policies accelerate adoption of LED lighting in both new and existing fleets. The combination of premium passenger service standards and environmental compliance continues to drive demand.

Asia-Pacific

Asia-Pacific is a fast-growing region, accounting for around 25% of the market. China leads within the region, with approximately 30% share of Asia-Pacific’s cabin lighting market. Fleet expansion, modernization programs, and government support for aviation infrastructure drive demand. India is among the fastest-growing countries, with projected annual growth exceeding 11%, while Japan holds about 7.9% of the market. Rising passenger volumes, new aircraft programs such as COMAC’s C919, and increasing demand for premium cabin features strengthen the market. Airlines across the region adopt wellness-focused and mood lighting to meet evolving passenger expectations.

Middle East, Africa & Latin America

These regions hold smaller shares but show growing potential. In the Middle East, airlines invest heavily in premium cabin designs with advanced LED systems to enhance luxury travel experiences. Africa and Latin America gradually increase adoption rates through fleet modernization and compliance with updated safety standards. Brazil benefits from regional aircraft upgrades and a strong maintenance, repair, and overhaul sector. While overall demand remains lower than in other regions, targeted investments in passenger experience and efficiency-oriented upgrades are creating new opportunities for suppliers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Honeywell International Inc.

- Oxley Group

- Heads Up Technologies, Inc.

- Astronics Corporation

- Soderberg Manufacturing Company Inc.

- STG Aerospace Limited

- Safran S.A.

- Collins Aerospace

- Diehl Stiftung & Co. KG

- Luminator Technology Group

Competitive Analysis

The competitive landscape of the Commercial Aircraft LED Lighting Market is defined by technological innovation, regulatory compliance, and global supply capabilities. Leading players such as Honeywell International Inc., Collins Aerospace, Safran S.A., Astronics Corporation, Diehl Stiftung & Co. KG, Luminator Technology Group, Oxley Group, STG Aerospace Limited, Soderberg Manufacturing Company Inc., and Heads Up Technologies, Inc. hold strong positions through diversified product portfolios and strategic partnerships with aircraft manufacturers and airlines. These companies focus on developing energy-efficient, durable, and customizable LED solutions that meet stringent aviation safety and performance standards. They invest heavily in research and development to integrate advanced features such as human-centric lighting, IoT-enabled controls, and lightweight designs. Global distribution networks and established aftermarket service capabilities allow these players to maintain a strong presence in both line-fit and retrofit segments. Competitive strategies include expanding production capacity, securing long-term OEM contracts, and targeting emerging markets with tailored solutions that address regional requirements and operational needs.

Recent Developments

- In May 2025, Honeywell introduced its LED wingtip navigation lighting as a standard feature on the new Airbus A320 Family aircraft, delivering longer life and reduced maintenance costs.

- In April 2025, the Collins aerospace company joined the Digital Alliance for Aviation to advance predictive health monitoring systems for airlines

- In March 2025, Collins opened a new Engineering Development and Test Center in Bengaluru, India, to accelerate testing and certification of aerospace technologies.

Market Concentration & Characteristics

The Commercial Aircraft LED Lighting Market demonstrates moderate to high concentration, with a limited number of global manufacturers dominating supply across both line-fit and retrofit segments. It is characterized by strong technological entry barriers, stringent certification requirements, and the need for extensive collaboration with aircraft OEMs and airlines. Leading players compete on innovation, product reliability, and compliance with international aviation safety standards. The market emphasizes advanced LED solutions offering energy efficiency, extended service life, and customizable cabin ambiance to enhance passenger comfort and operational performance. It relies heavily on long-term supply agreements, strategic partnerships, and continuous investment in R&D to maintain a competitive edge. Regional demand patterns reflect varying priorities, from premium cabin enhancements in developed markets to fleet modernization in emerging regions. The pace of innovation, integration with smart cabin management systems, and the ability to meet evolving airline and regulatory demands define competitive differentiation within this market.

Report Coverage

The research report offers an in-depth analysis based on Light Type, Aircraft Type, Fitting and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with growing adoption of LED solutions in new aircraft and retrofit programs.

- Airlines will prioritize energy-efficient lighting systems to reduce operational costs and environmental impact.

- Integration of LED lighting with smart cabin control systems will become more widespread.

- Human-centric lighting designs will gain traction to enhance passenger comfort on long-haul flights.

- Lightweight and modular lighting products will see higher demand to support fuel efficiency goals.

- Manufacturers will invest more in advanced materials and designs to extend product life and reduce maintenance needs.

- Asia-Pacific will witness significant growth driven by rapid fleet expansion and modernization programs.

- Partnerships between OEMs and lighting suppliers will strengthen to ensure faster product certification and delivery.

- Customizable cabin lighting solutions will be increasingly used for airline branding and passenger experience differentiation.

- Sustainability regulations will push suppliers to develop recyclable and eco-friendly lighting components.