Market Overview

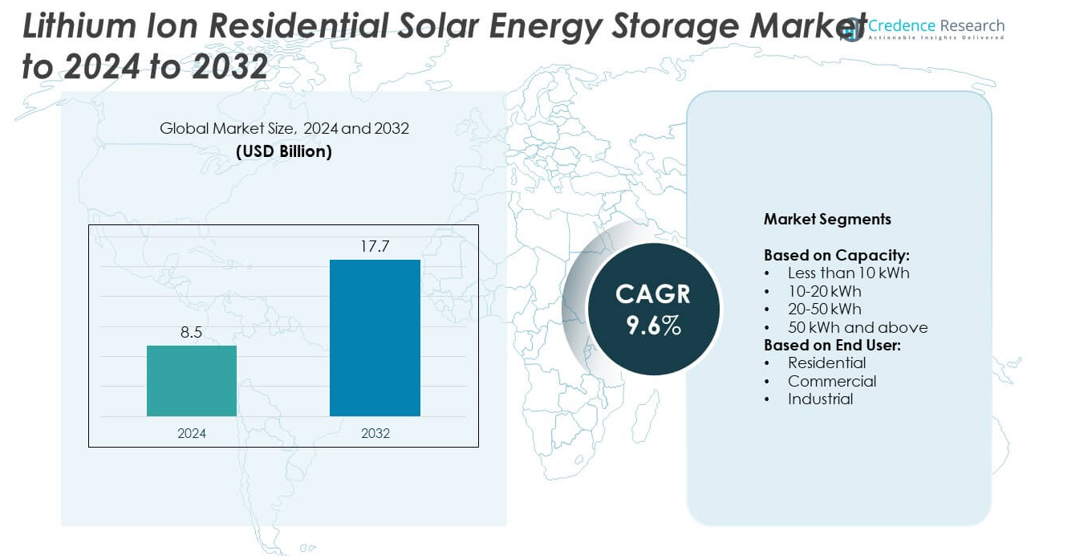

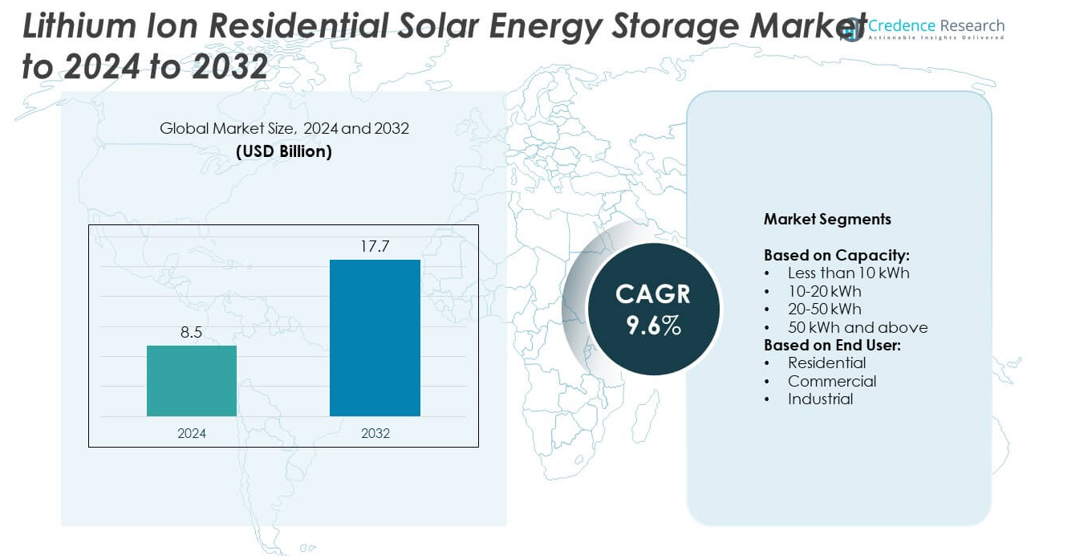

The Lithium Ion Residential Solar Energy Storage Market size was valued at USD 8.5 Billion in 2024 and is anticipated to reach USD 17.7 Billion by 2032, at a CAGR of 9.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Lithium Ion Residential Solar Energy Storage Market Size 2024 |

USD 8.5 Billion |

| Lithium Ion Residential Solar Energy Storage Market, CAGR |

9.6% |

| Lithium Ion Residential Solar Energy Storage Market Size 2032 |

USD 17.7 Billion |

The lithium-ion residential solar energy storage market is shaped by leading players such as Toshiba Corporation, Enphase Energy, Schneider Electric, Tesla, Johnson Controls, Huawei Technologies, LG Electronics, Samsung SDI, Fluence, and ABB. These companies focus on innovation in battery performance, integration with smart home technologies, and expansion across emerging markets to strengthen their competitive positions. North America emerged as the leading region in 2024, commanding a 35% share, driven by strong policy support, high rooftop solar adoption, and frequent grid outages. Europe followed with 28% share, supported by carbon neutrality targets, while Asia-Pacific held 25%, reflecting rapid solar deployment and favorable government incentives.

Market Insights

- The lithium-ion residential solar energy storage market was valued at USD 8.5 Billion in 2024 and is projected to reach USD 17.7 Billion by 2032, growing at a CAGR of 9.6%.

- Rising rooftop solar adoption, government incentives, and technological advancements in lithium-ion batteries are driving strong demand in residential applications.

- Key trends include integration with smart home systems, participation in virtual power plants, and increasing focus on recycling and sustainability for long-term growth.

- The market is competitive with global players focusing on product innovation, partnerships, and regional expansion to capture growing opportunities, particularly in North America, Europe, and Asia-Pacific.

- North America led with 35% share in 2024, followed by Europe at 28% and Asia-Pacific at 25%, while the 10–20 kWh capacity segment dominated with over 40% share due to strong adoption in single-family households seeking reliable energy storage solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Capacity

In 2024, the 10–20 kWh segment dominated the lithium-ion residential solar energy storage market with over 40% share. Its leadership is attributed to strong adoption in single-family households that require moderate backup capacity for lighting, appliances, and EV charging. These systems balance affordability with performance, making them ideal for mainstream residential users. The growth of rooftop solar installations, coupled with rising electricity tariffs and increasing demand for self-sufficiency, further drives adoption. Larger segments like 20–50 kWh are gaining traction in premium homes, but remain secondary to 10–20 kWh solutions.

- For instance, Sonnen manufactures a range of home battery solutions, including the SonnenCore and SonnenBatterie, with scalable storage options. The SonnenCore is built around 5 kWh battery modules, allowing for various system capacities.

By End User

The residential segment accounted for more than 65% share of the market in 2024, leading over commercial and industrial users. Rising consumer focus on energy independence, combined with incentives for solar-plus-storage installations, has accelerated residential uptake. Government subsidies, net metering programs, and smart home integration support market penetration. Consumers increasingly seek systems that reduce reliance on grids, especially during outages and peak demand periods. While commercial and industrial applications are growing, residential demand remains dominant due to widespread adoption of rooftop solar and advancements in compact lithium-ion storage systems.

- For instance, in 2023, Hanwha Qcells demonstrated strong leadership in the U.S. residential solar market by achieving a 35% market share for the first quarter, according to a Wood Mackenzie report.

Key Growth Drivers

Rising Residential Solar Installations

The rapid adoption of rooftop solar systems is the key growth driver for the lithium-ion residential solar energy storage market. Homeowners are increasingly investing in solar-plus-storage solutions to maximize self-consumption and reduce dependency on traditional power grids. Declining solar panel costs, favorable policies, and growing awareness of renewable energy benefits support this trend. As more households adopt distributed solar energy systems, the demand for lithium-ion storage rises significantly. This integration ensures reliable backup power, enhances energy security, and reduces electricity bills, making it a central driver of market expansion.

- For instance, Sunrun significantly increased its storage installations in 2023, with its total installed storage capacity reaching 1.3 gigawatt-hours by the end of the year, representing an increase from 1.1 gigawatt-hours in Q3.

Government Incentives and Energy Policies

Supportive policies and subsidies are vital in accelerating market penetration of lithium-ion residential solar storage. Many governments provide tax credits, feed-in tariffs, and net metering programs that lower the upfront cost of installations. These incentives make storage solutions more affordable for residential consumers while encouraging sustainable energy practices. Strong policy support in regions like North America, Europe, and Asia-Pacific enhances adoption. Additionally, decarbonization targets and climate action plans push households toward storage adoption. These initiatives continue to position lithium-ion storage as a practical and attractive investment.

- For instance, according to a SunWiz report, a record 57,000 residential battery energy storage systems were installed in Australian homes in 2023, up 21% from the previous year, with a combined capacity of 656 MWh.

Advancements in Lithium-Ion Technology

Continuous improvements in lithium-ion battery technology drive cost reductions and performance enhancements. Higher energy density, longer cycle life, and compact designs make these systems increasingly suitable for residential use. Manufacturers are investing heavily in R&D to deliver efficient, safe, and reliable storage solutions. Falling battery costs over the past decade have made lithium-ion more competitive compared to alternatives like lead-acid. These advancements ensure broader accessibility for homeowners and stimulate market growth. The combination of efficiency improvements and declining costs makes technology development a crucial growth driver.

Key Trends & Opportunities

Integration with Smart Homes and IoT

The integration of lithium-ion storage with smart home systems presents significant opportunities. Advanced monitoring platforms allow homeowners to optimize energy usage, track consumption patterns, and control storage through mobile apps. IoT-enabled solutions enhance user experience and enable predictive maintenance. This trend aligns with the rise of connected living and energy-efficient smart homes. The ability to integrate storage with EV charging infrastructure further broadens opportunities. As digital technologies expand, the convergence of storage with smart platforms strengthens adoption and creates new growth avenues in residential energy markets.

- For instance, Huawei reported in 2023 that its FusionSolar Smart PV Management system connected over 3.3 million residential units globally, integrating storage and monitoring functions.

Emergence of Virtual Power Plants (VPPs)

The growing adoption of virtual power plants represents a key trend shaping the market. Residential lithium-ion storage systems can be aggregated into VPPs, allowing households to sell excess power back to the grid. This model increases grid stability, reduces peak demand, and generates additional income for homeowners. Utilities are increasingly encouraging participation in VPP programs, creating financial incentives for residential users. The rise of decentralized energy management and demand response initiatives makes VPPs a promising opportunity. This trend supports grid modernization and enhances the value proposition of home storage systems.

- For instance, Octopus Energy’s Kraken platform significantly expanded its management of distributed energy resources in 2023. By April 2023, KrakenFlex (now part of the Kraken platform) had increased the number of assets it managed by more than fourfold, from 37,000 to 212,000, contributing to nearly 2.9 GW of flexible capacity.

Key Challenges

High Upfront Costs

Despite falling battery prices, high upfront costs remain a major barrier to widespread adoption. The initial investment in solar-plus-storage systems often exceeds affordability for average households, particularly in emerging economies. Financing solutions, leasing models, and subsidies help bridge this gap, but cost remains a limiting factor. Price sensitivity among residential consumers slows adoption, even in regions with strong policy support. Overcoming this challenge requires further price reductions, innovative financing, and expanded government support to make lithium-ion storage solutions more accessible to middle-income households.

Battery Recycling and Environmental Concerns

The challenge of recycling lithium-ion batteries raises sustainability and environmental concerns. Growing adoption leads to an increase in end-of-life storage systems, which require safe disposal or recycling. The limited availability of large-scale recycling infrastructure and the environmental impact of mining lithium and cobalt intensify the issue. Without effective recycling processes, the market faces criticism over its long-term sustainability. Addressing this challenge requires advancements in recycling technologies, regulatory frameworks, and circular economy practices to ensure environmentally responsible growth of the lithium-ion residential solar energy storage market.

Regional Analysis

North America

North America held the largest share of the lithium-ion residential solar energy storage market in 2024, accounting for around 35%. The region benefits from strong government incentives, net metering policies, and rising adoption of rooftop solar. The U.S. leads demand, supported by programs like the Investment Tax Credit (ITC) that reduce installation costs. Growing energy independence concerns, frequent grid outages, and integration with smart home systems further fuel adoption. Canada is also witnessing steady growth, driven by decarbonization targets and supportive renewable energy initiatives. The region’s focus on sustainability and advanced technologies ensures continued market leadership.

Europe

Europe accounted for nearly 28% share of the market in 2024, driven by stringent renewable energy targets and strong policy support. Countries such as Germany, Italy, and the UK lead adoption, supported by subsidies and feed-in tariffs. The push for carbon neutrality by 2050 accelerates residential solar-plus-storage deployment. Homeowners adopt lithium-ion storage to optimize self-consumption and reduce reliance on centralized grids. Growing interest in virtual power plants and energy communities enhances uptake. The region’s mature renewable infrastructure and regulatory frameworks position Europe as a key growth hub, with rising demand expected over the forecast period.

Asia-Pacific

Asia-Pacific captured about 25% share in 2024, emerging as one of the fastest-growing regions. Strong demand in countries like China, Japan, Australia, and India drives the market. Rising electricity costs, high rooftop solar installations, and government-backed incentives encourage households to adopt lithium-ion storage. Australia leads in residential adoption, with widespread deployment supported by battery rebate programs. China’s growing renewable energy push and Japan’s emphasis on energy security further expand the market. Increasing urbanization and frequent power outages in developing nations also support growth. Asia-Pacific is expected to record the fastest CAGR through 2032.

Latin America

Latin America held an 8% market share in 2024, with growth led by countries like Brazil, Mexico, and Chile. Rising electricity prices and increasing solar adoption drive the uptake of lithium-ion residential storage systems. Governments are expanding renewable energy programs and offering incentives to encourage household adoption. Brazil leads installations with strong solar potential and favorable regulations, while Mexico benefits from community-based solar initiatives. Although adoption is lower compared to developed regions, growing awareness of energy independence and decreasing storage costs provide opportunities. The region is set to witness steady growth during the forecast period.

Middle East and Africa

The Middle East and Africa accounted for 4% share of the market in 2024, representing the smallest but steadily growing region. High solar potential across countries like the UAE, Saudi Arabia, and South Africa drives demand. Governments are investing in residential solar projects as part of diversification and sustainability strategies. Energy security concerns and frequent power outages, particularly in parts of Africa, push adoption. However, high upfront costs and limited policy support restrain faster penetration. As financing solutions expand and technology costs decline, the region is expected to gain traction in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Capacity:

- Less than 10 kWh

- 10-20 kWh

- 20-50 kWh

- 50 kWh and above

By End User:

- Residential

- Commercial

- Industrial

By Geography:

- orth America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the lithium-ion residential solar energy storage market features prominent players such as Toshiba Corporation, Enphase Energy, Schneider Electric, Tesla, Johnson Controls, Maxwell Technologies, Huawei Technologies, LG Electronics, Saft, EnerSys, SolarEdge Technologies, Honeywell International, Primus Power, Samsung SDI, Uniper, Leclanché, Fluence, Siemens Energy, and ABB. These companies are focusing on advancing lithium-ion battery technologies with higher efficiency, longer life cycles, and compact designs to meet residential demands. Strategic initiatives include product innovations, collaborations with solar providers, and integration of storage systems with smart home solutions. Many players are also leveraging government policies and incentives to expand their footprint in high-growth regions like North America, Europe, and Asia-Pacific. Sustainability efforts, including recycling solutions and environmentally responsible supply chains, are gaining momentum. The competition remains intense, with companies striving to balance affordability, performance, and reliability while catering to the increasing global demand for decentralized clean energy solutions.

Key Player Analysis

- Toshiba Corporation

- Enphase Energy

- Schneider Electric

- Tesla

- Johnson Controls

- Maxwell Technologies

- Huawei Technologies

- LG Electronics

- Saft

- EnerSys

- SolarEdge Technologies

- Honeywell International

- Primus Power

- Samsung SDI

- Uniper

- Leclanché

- Fluence

- Siemens Energy

- ABB

Recent Developments

- In 2025, LG Energy Announced a major supply deal with Tesla in the U.S. for LFP batteries for energy storage systems (ESS).

- In 2025, Enphase Energy Introduced the IQ Battery 5P with FlexPhase in numerous European market, to offer flexible backup and phase-switching capabilities.

- In 2024, Tesla’s strategy in the integrated residential solar energy storage market focused on launching the Powerwall 3 and expanding its flexibility to capture more market share amidst increased competition and a contracting US solar market.

Report Coverage

The research report offers an in-depth analysis based on Capacity, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily, supported by rising rooftop solar adoption worldwide.

- Residential demand will dominate as households seek energy independence and backup power.

- Advancements in lithium-ion technology will lower costs and improve storage efficiency.

- Government incentives and renewable energy policies will continue to accelerate adoption.

- Integration with smart home systems will enhance monitoring and energy management.

- Virtual power plant participation will provide homeowners with new revenue opportunities.

- Recycling and sustainability practices will become critical for long-term market growth.

- Asia-Pacific will record the fastest growth, driven by strong policy and solar adoption.

- North America and Europe will remain major markets due to mature infrastructure.

- Financing models and leasing programs will make storage systems more accessible.