Market Overview

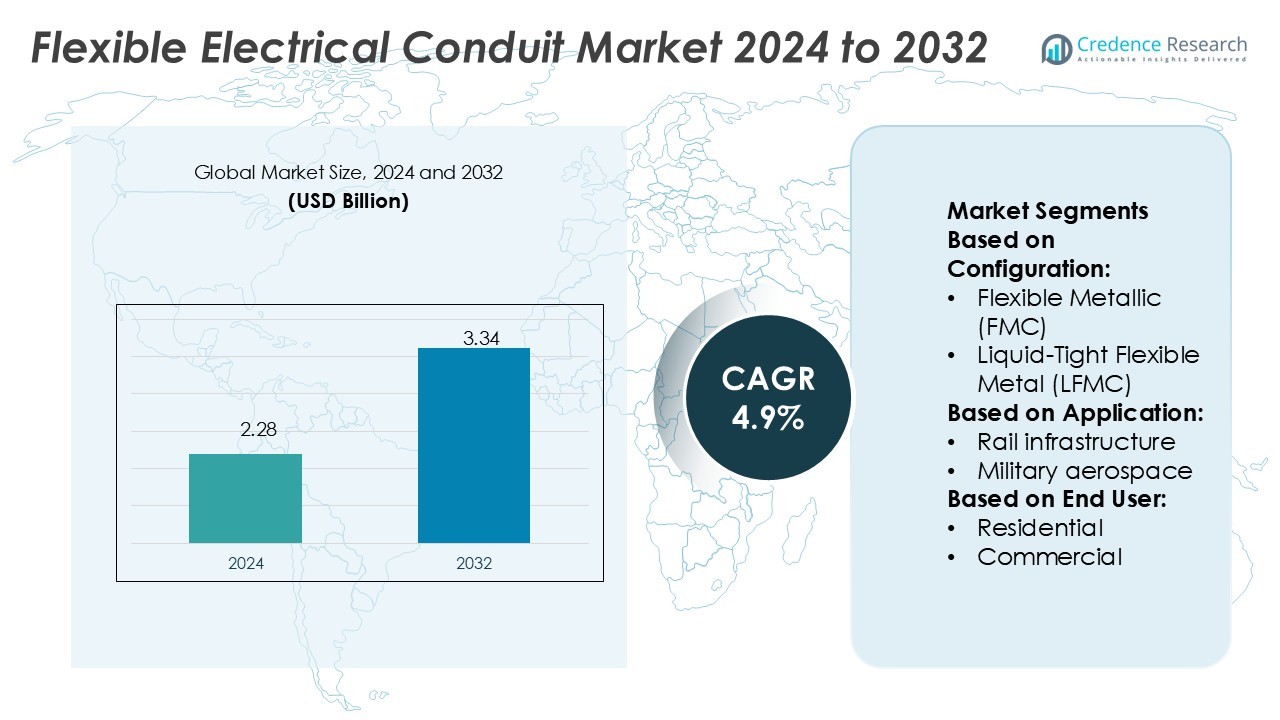

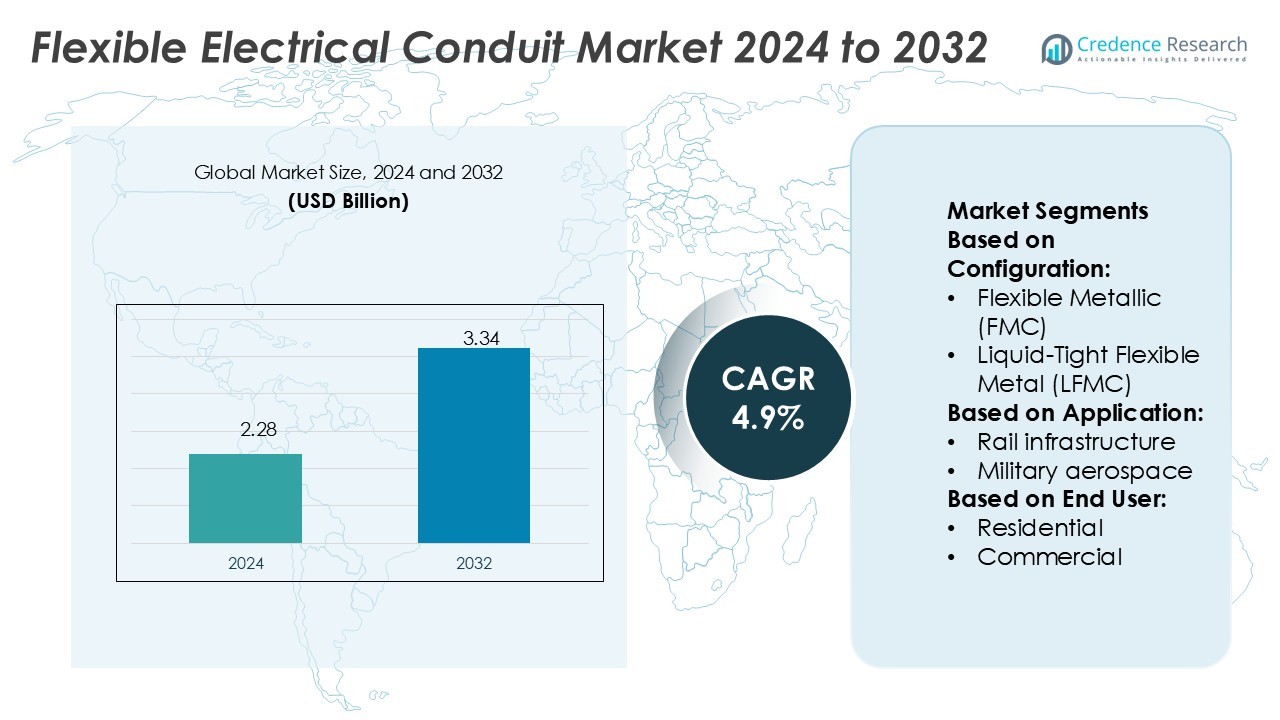

Flexible Electrical Conduit Market size was valued USD 2.28 billion in 2024 and is anticipated to reach USD 3.34 billion by 2032, at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flexible Electrical Conduit Market Size 2024 |

USD 2.28 Billion |

| Flexible Electrical Conduit Market, CAGR |

4.9% |

| Flexible Electrical Conduit Market Size 2032 |

USD 3.34 Billion |

The flexible electrical conduit market is shaped by prominent players including ABB, Atkore, Legrand, Hubbell, Electri-Flex Company, Anamet Electrical, HellermannTyton, CANTEX, Kaiphone Technology, and Dongguan FlexGlory Machinery Accessories. These companies compete through product innovation, compliance with safety standards, and expansion into emerging markets. Global leaders emphasize sustainable materials, advanced conduit designs, and automation-ready solutions to strengthen their market positions. Regionally, Asia-Pacific leads the market with a 35% share, driven by rapid urbanization, infrastructure investments, and strong manufacturing capabilities in countries such as China, India, and Japan. This dominance reflects both scale and growth momentum, positioning the region as the key driver of global demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The flexible electrical conduit market was valued at USD 2.28 billion in 2024 and is projected to reach USD 3.34 billion by 2032, growing at a CAGR of 4.9%.

- Market growth is driven by rising infrastructure development, industrial automation, and stringent safety regulations that increase the adoption of advanced conduit systems across industries.

- Trends such as the use of sustainable, halogen-free materials and the emergence of smart conduits with monitoring capabilities are reshaping product innovation and boosting long-term adoption.

- Competition is strong, with key players including ABB, Atkore, Legrand, Hubbell, Electri-Flex Company, Anamet Electrical, HellermannTyton, CANTEX, Kaiphone Technology, and Dongguan FlexGlory Machinery Accessories, each focusing on product differentiation and global expansion.

- Asia-Pacific leads the market with a 35% share, followed by North America and Europe, while the industrial end-user segment dominates overall adoption due to high demand from manufacturing, process plants, and energy infrastructure.

Market Segmentation Analysis:

By Configuration

Flexible Metallic Conduit (FMC) dominates the configuration segment with the largest market share, supported by widespread use in commercial and industrial facilities. FMC’s durability, ease of installation, and strong mechanical protection drive its preference in electrical wiring systems. Liquid-Tight Flexible Metal Conduit (LFMC) follows, mainly used in wet or outdoor environments due to its moisture-resistant jacket. Flexible Metallic Tubing (FMT) and Liquid-Tight Flexible Non-Metallic Conduit (LFNC) serve niche applications where lightweight, corrosion resistance, and cost-effectiveness are critical. Increasing safety standards and construction demand further strengthen FMC’s dominance in this segment.

- For instance, CANTEX manufactures Schedule 40 and Schedule 80 PVC conduits, which are certified to UL 651 standards. These products undergo standardized impact resistance testing and are durable for many industrial applications.

By Application

The process plants segment leads with the highest share in application, reflecting strict requirements for safety, reliability, and corrosion resistance in industrial operations. Extensive use of conduits in oil, gas, and chemical facilities highlights their role in protecting electrical circuits from harsh environments. Rail infrastructure and energy sectors also represent significant demand, driven by modernization projects and rising investments in renewable energy. Healthcare facilities and military aerospace adopt conduits to meet compliance and safety standards. Overall, process plants dominate due to their high operational risks and continuous expansion in global industrial sectors.

- For instance, Kaiphone’s production facilities deploy ISO 9001-certified processes, and the company supplies flexible conduit globally for industrial applications, including industrial automation, transportation, and construction.

By End User

The industrial sector holds the largest share by end user, driven by extensive use of conduits in manufacturing, process plants, and heavy industries. Growth in automation and the need for reliable wiring protection in harsh operating conditions further support demand. Commercial usage follows, supported by the rise of smart buildings, office complexes, and retail infrastructure requiring efficient cabling management. Residential adoption continues to expand with urbanization and new housing developments, though at a smaller scale. Utilities also contribute steadily, driven by investments in grid modernization. Industrial dominance stems from its scale, compliance needs, and safety-driven adoption.

Key Growth Drivers

Rising Infrastructure Development and Urbanization

The growing demand for modern infrastructure drives the adoption of flexible electrical conduits. Expanding urban housing projects, commercial complexes, and industrial facilities require efficient wiring solutions that ensure durability and safety. Governments worldwide are investing heavily in smart city projects, rail networks, and energy infrastructure, which boosts conduit installations. Flexible conduits offer adaptability, quick installation, and reliable protection against environmental factors, making them preferred for large-scale projects. This ongoing infrastructure expansion directly accelerates market growth across residential, commercial, and industrial sectors.

- For instance, Electri-Flex manufactures the Shield-Flex® series of EMI/RFI Shielded Conduits, including types SLA, EMS, and EMCS. The description for Type SLA states it offers “good” shielding and uses a tinned copper braid with a minimum of 90% coverage.

Stringent Safety Standards and Regulatory Compliance

Global emphasis on workplace safety and regulatory compliance has become a major growth driver. Flexible electrical conduits protect wiring from abrasion, moisture, and chemical exposure, reducing risks of short circuits and fire hazards. Regulatory bodies in North America, Europe, and Asia enforce strict codes for electrical installations, encouraging higher adoption of certified conduit systems. Industries such as healthcare, aerospace, and energy prioritize advanced conduit solutions to ensure operational safety. Compliance-driven demand ensures steady growth, as businesses upgrade legacy wiring systems to meet evolving safety benchmarks.

- For instance, Anamet Electrical, Inc. manufactures UL-listed liquid-tight conduits, including non-metallic Type B (LFNC-B), which conforms to the UL 1660 standard, and metallic Type A (LFMC-A), which conforms to the UL 360 standard.

Expansion of Industrial Automation and Energy Projects

The rapid rise of industrial automation and renewable energy projects fuels significant demand for flexible conduits. Manufacturing plants and process industries require robust wiring protection to support automated systems and high-voltage applications. Similarly, renewable energy projects, including solar and wind farms, demand conduits that withstand harsh weather and mechanical stress. Utilities also rely on conduits to safeguard transmission and distribution networks. The combined momentum from industrial automation and clean energy transition creates sustained opportunities, positioning flexible conduits as vital components in energy-efficient and resilient infrastructure.

Key Trends & Opportunities

Adoption of Smart and Sustainable Materials

Manufacturers are focusing on eco-friendly and high-performance materials for conduit production. Lightweight, halogen-free, and recyclable materials are gaining attention due to sustainability goals and stricter environmental regulations. Smart conduits with embedded sensors are emerging, allowing real-time monitoring of wiring conditions and predictive maintenance. This trend aligns with the global shift toward sustainable construction practices and smart infrastructure. Companies investing in material innovation and smart technology integration are expected to gain a competitive edge in meeting evolving customer and regulatory expectations.

- For instance, Legrand’s LCS³ conduit systems utilize halogen-free, low-smoke (LSZH) materials that are tested to meet IEC standards, such as IEC 60754-2, for resistance to fire and emission of corrosive gases.

Growth of E-Commerce Distribution and Aftermarket Demand

The expansion of e-commerce platforms has created new opportunities for conduit manufacturers to reach wider customer bases. Online distribution channels make flexible conduits more accessible for contractors, small businesses, and individual users, especially in emerging economies. The aftermarket segment is also growing, as retrofitting projects in older buildings drive demand for easy-to-install solutions. E-commerce simplifies bulk procurement for industrial buyers while enabling manufacturers to showcase product innovation directly to end-users. This trend enhances market visibility and accelerates global adoption of flexible conduit solutions.

- For instance, HellermannTyton manufactures HelaGuard® corrugated conduits that are certified to EN 61386 standards. The products are tested for characteristics such as crush resistance, but the specific performance ratings vary depending on the product series.

Key Challenges

Volatility in Raw Material Prices

The flexible conduit market faces challenges from fluctuations in raw material prices, particularly steel, aluminum, and PVC. Rising costs directly impact manufacturing margins, forcing companies to adjust pricing strategies. Smaller players find it difficult to absorb price hikes, reducing competitiveness against larger manufacturers with stronger supply chains. Currency fluctuations and trade restrictions further add to cost instability. This price volatility poses a barrier to steady growth, compelling companies to focus on alternative materials and efficiency-driven production methods to mitigate risks.

Competition from Substitutes and Low-Cost Alternatives

Flexible conduits face strong competition from alternative wiring protection methods, including rigid conduits and cable trays, which often provide cost-effective solutions. Low-cost, locally manufactured products in emerging markets further intensify price pressure. These alternatives can limit adoption, particularly in cost-sensitive residential and small-scale commercial projects. Additionally, the availability of counterfeit products undermines brand reliability and creates safety risks. To counter this challenge, established players are investing in quality certification, product differentiation, and awareness campaigns to highlight the long-term benefits of flexible conduit systems.

Regional Analysis

North America

North America holds a significant share of the flexible electrical conduit market, accounting for nearly 32% of the global revenue. The region’s dominance is supported by strict safety regulations, robust construction activity, and advanced industrial infrastructure. The U.S. leads due to ongoing investments in smart buildings, data centers, and renewable energy projects, while Canada shows steady demand from commercial and residential sectors. The adoption of automation in industrial facilities further drives usage. Continuous retrofitting of outdated wiring systems also supports growth, reinforcing North America’s leadership in safety-focused and technologically advanced conduit applications.

Europe

Europe represents 27% of the flexible electrical conduit market, driven by strong regulatory frameworks emphasizing safety, sustainability, and energy efficiency. Countries such as Germany, the UK, and France dominate with large-scale investments in rail infrastructure, renewable energy, and healthcare facilities. Demand for halogen-free and recyclable conduit solutions aligns with the EU’s strict environmental policies. The region’s focus on modernization of military and aerospace facilities also adds to growth. With established construction practices and sustainability initiatives, Europe remains a mature yet steadily growing market for high-performance conduit systems across diverse end-use sectors.

Asia-Pacific

Asia-Pacific leads the global flexible electrical conduit market with the largest share of 35%, fueled by rapid urbanization, industrialization, and infrastructure expansion. China, India, and Japan drive demand through large-scale investments in housing, commercial complexes, and manufacturing facilities. The region’s booming e-commerce, data center growth, and energy projects further boost adoption. Increasing disposable incomes and government-backed smart city projects add momentum. Asia-Pacific also benefits from a strong manufacturing base, enabling cost-efficient production. The region’s high growth potential makes it the most dynamic market, with expanding opportunities in both residential and industrial applications.

Latin America

Latin America holds 4% of the global flexible electrical conduit market, supported by gradual improvements in construction and energy infrastructure. Brazil and Mexico lead adoption, with growing investments in industrial facilities, oil and gas plants, and urban development projects. Economic reforms and regional government initiatives to modernize utilities encourage steady demand. However, limited local manufacturing capacity and reliance on imports constrain faster growth. The aftermarket segment, driven by retrofitting of outdated electrical systems, offers notable opportunities. With increasing urbanization and energy diversification, Latin America continues to emerge as a niche yet promising market for conduit systems.

Middle East & Africa

The Middle East & Africa account for 2% of the global market share, primarily driven by large-scale energy and infrastructure projects. The Gulf countries, particularly the UAE and Saudi Arabia, lead demand due to smart city developments, industrial diversification, and high investments in utilities. Africa is witnessing growth from rising urban housing and expanding energy grids. However, limited awareness, price sensitivity, and infrastructural challenges hinder broader adoption. Despite these constraints, government-backed mega projects and increasing focus on renewable energy create long-term opportunities for flexible conduit adoption in this region.

Market Segmentations:

By Configuration:

- Flexible Metallic (FMC)

- Liquid-Tight Flexible Metal (LFMC)

By Application:

- Rail infrastructure

- Military aerospace

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the flexible electrical conduit market features key players such as Hubbell, CANTEX, Kaiphone Technology, Electri-Flex Company, Anamet Electrical, Legrand, HellermannTyton, ABB, Dongguan FlexGlory Machinery Accessories, and Atkore. The flexible electrical conduit market is defined by strong emphasis on innovation, regulatory compliance, and regional expansion strategies. Companies compete by developing advanced conduit systems that enhance safety, durability, and flexibility, while also aligning with sustainability goals. The market is influenced by rising demand across industrial, commercial, and residential applications, encouraging manufacturers to expand product portfolios and strengthen supply chains. Strategic initiatives such as mergers, acquisitions, and partnerships are widely adopted to gain a competitive edge. Additionally, growing investments in smart materials, automation-ready solutions, and eco-friendly designs are shaping future competition.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hubbell

- CANTEX

- Kaiphone Technology

- Electri-Flex Company

- Anamet Electrical

- Legrand

- HellermannTyton

- ABB

- Dongguan FlexGlory Machinery Accessories

- Atkore

Recent Developments

- In July 2025, Scientists at KAIST and Seoul National University developed an electronic ink” that can be printed into circuits that switch between hard and soft, simply by changing the temperature.

- In October 2024, Caparo Middle East inaugurated a fully integrated manufacturing plant in Dammam, Saudi Arabia, in collaboration with Engineer Sinan Ali Ahmed Bukhamseen. This 30,000-sq-ft facility, built with an investment of SAR 25 million, aims to produce half a million electrical conduits monthly to meet regional demand and support Saudi Arabia’s goal of self-sufficiency in industrial products.

- In March 2024, CANTEX INC. announced C.C. Pierce Company as their new sales representative for PVC electrical pipe, fittings, and boxes for the northern region of the state of NY. Pierce Company represents its line of PVC electrical products due to their admirable levels of service, amazing longevity, and established relationships.

- In February 2024, ABB announced that it has entered into a partnership to acquire SEAM Group, a major provider of energized asset management and advisory services to clients across industrial and commercial building markets.

Report Coverage

The research report offers an in-depth analysis based on Configuration, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising investments in infrastructure and smart cities.

- Demand for eco-friendly and recyclable conduit solutions will continue to increase.

- Industrial automation will drive adoption of high-performance conduit systems.

- Renewable energy projects will expand conduit usage in solar and wind installations.

- Strict safety regulations will encourage modernization of legacy electrical systems.

- Emerging economies will witness rapid demand growth from urbanization and construction.

- Smart conduit systems with monitoring features will gain market traction.

- E-commerce distribution will expand access to conduit products globally.

- Strategic partnerships and acquisitions will strengthen competitive positioning.

- Continuous innovation in materials and designs will define long-term growth.Top of Form