Market overview

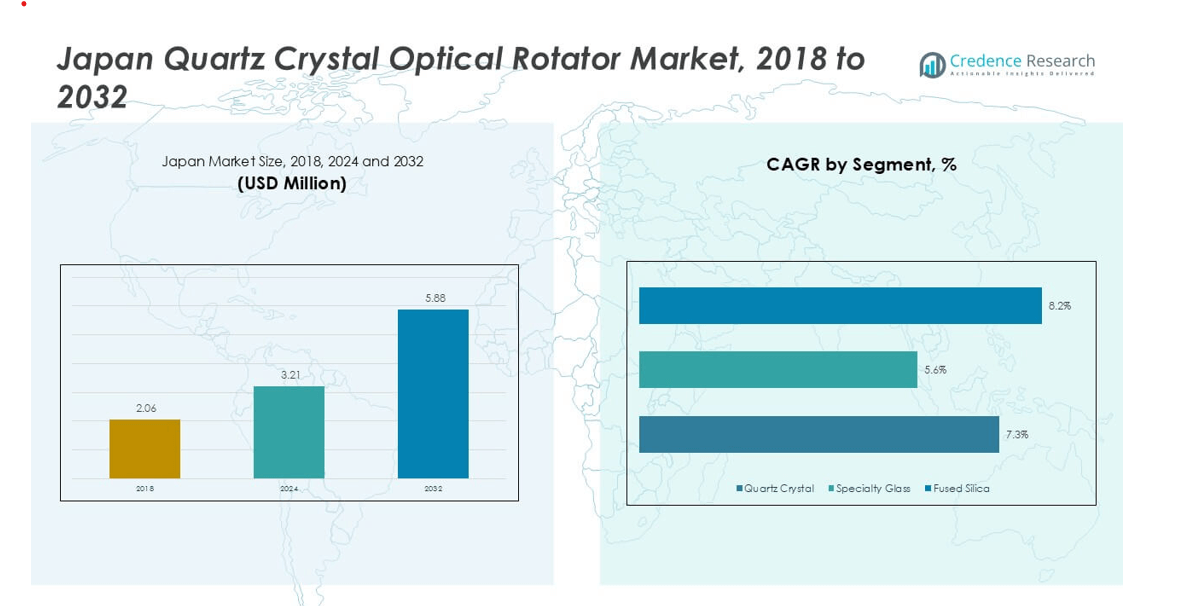

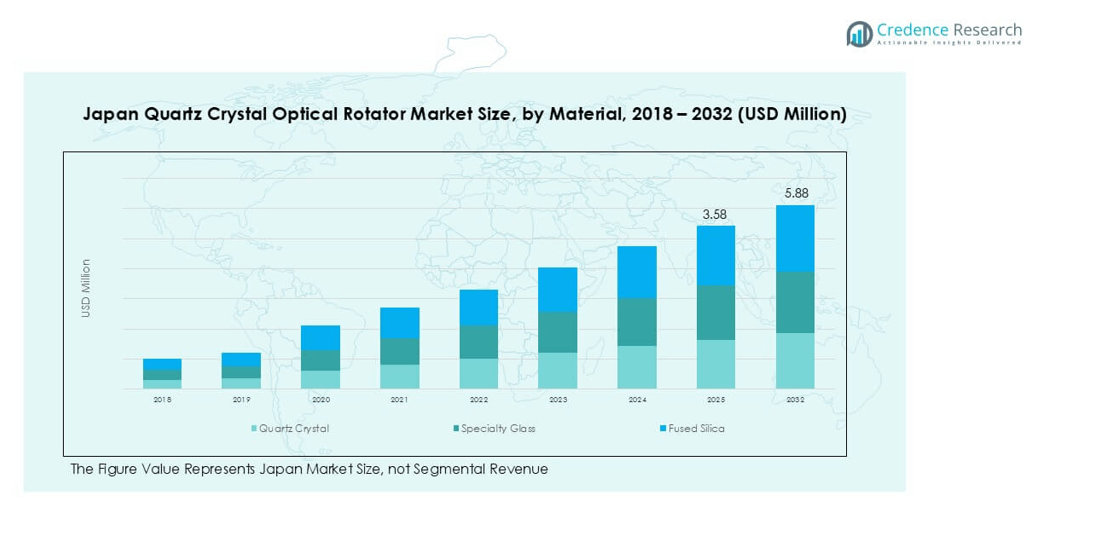

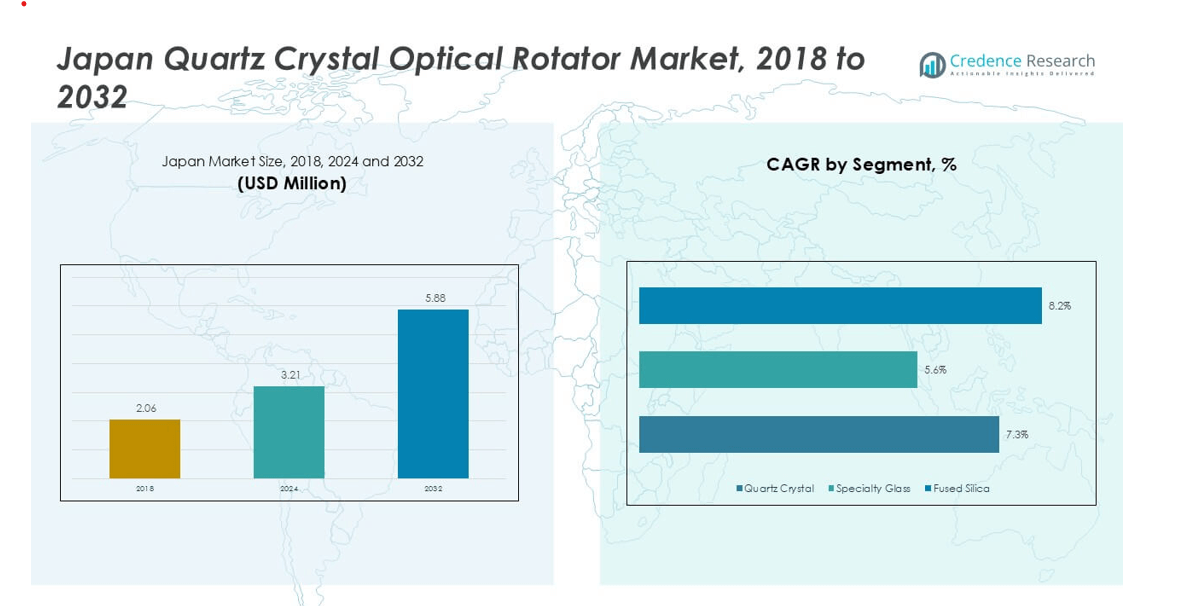

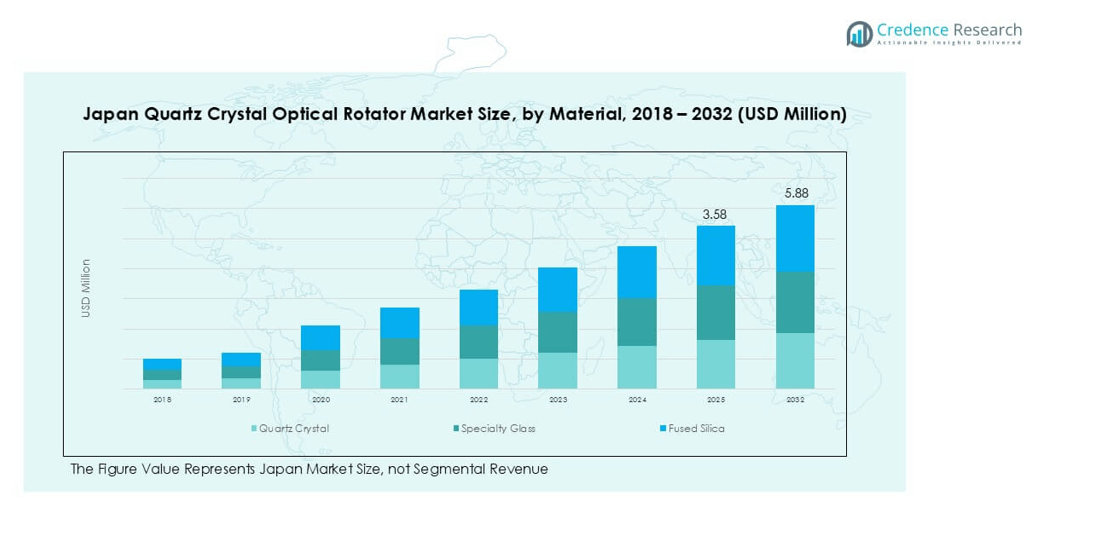

The Japan Quartz Crystal Optical Rotator market size was valued at USD 2.06 million in 2018 and grew to USD 3.21 million in 2024. It is anticipated to reach USD 5.88 million by 2032, expanding at a CAGR of 7.33% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Quartz Crystal Optical Rotator Market Size 2024 |

USD 3.21 million |

| Japan Quartz Crystal Optical Rotator Market, CAGR |

7.33% |

| Japan Quartz Crystal Optical Rotator Market Size 2032 |

USD 5.88 million |

The Japan quartz crystal optical rotator market is led by prominent players such as Crystal Innovations Ltd, Crystal Dynamics Inc, Optical Engineering Dynamics LLC, CrystalPro Technologies LLC, Photon Rotor Technologies LLC, and NexQuartz Optics Inc. These companies maintain strong positions through advanced product portfolios, strategic R&D investments, and partnerships with research institutions and telecom providers. Among regions, Kanto dominates the market with a 32% share in 2024, supported by its concentration of technology firms, medical institutions, and research centers driving high adoption. Kansai and Chubu follow as key contributors, benefiting from industrial automation and strong academic-industry collaborations. The competitive landscape remains innovation-driven, with companies focusing on miniaturization, precision, and integration into next-generation applications across telecommunications, medical imaging, and scientific research.

Market Insights

- The Japan quartz crystal optical rotator market was valued at USD 3.21 million in 2024 and is projected to reach USD 5.88 million by 2032, growing at a CAGR of 7.33%.

- Market growth is driven by rising demand in telecommunications and medical imaging, where quartz crystal leads the material segment with over 55% share due to its optical stability and cost efficiency.

- Key trends include miniaturization of optical components for compact devices and expanding opportunities in quantum computing and photonics research, fueling adoption across advanced applications.

- The competitive landscape is shaped by companies like Crystal Innovations Ltd, Crystal Dynamics Inc, CrystalPro Technologies LLC, and NexQuartz Optics Inc, focusing on product innovation, partnerships, and miniaturized solutions to expand market presence.

- Regionally, Kanto dominates with 32% share, followed by Kansai at 20% and Chubu at 15%, while Kyushu, Hokkaido-Tohoku, and Chugoku-Shikoku collectively contribute the remaining market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

In 2024, quartz crystal dominated the Japan quartz crystal optical rotator market, holding over 55% share. Its leadership stems from superior optical purity, stability, and cost-effectiveness compared to specialty glass and fused silica. Quartz crystals are widely used in precision instruments and optical systems due to their high birefringence and durability. Specialty glass follows as a niche material for custom optical components in research applications, while fused silica gains steady adoption in high-performance scientific instruments requiring minimal thermal expansion. Demand for quartz crystal remains strong, supported by telecommunications and medical device integration.

- For instance, Edmund Optics offers a 90° Crystalline Quartz Polarization Rotator (1064 nm) with parallelism < 10 arcsec and rotational accuracy < 5 arcmin, often used in high-precision laser systems.

By Rotation Type

The fixed rotation segment accounted for more than 60% share of the market in 2024, establishing itself as the leading sub-segment. Fixed rotation optical rotators are preferred in telecommunications and imaging systems for their stability, precise polarization control, and lower maintenance. Their reliability makes them a cost-efficient solution across standardized industrial processes. Variable rotation rotators, though smaller in share, are gaining traction in advanced scientific research and experimental setups requiring adjustable rotation angles. Rising investments in R&D and the expansion of photonic research labs continue to support adoption of variable rotation systems.

- For instance, manufacturers often specify fixed rotators with rotatory tolerance ±0.1° and wavefront distortion ≤ λ/8 for stable performance in long-term systems.

By Application

Telecommunications emerged as the dominant application, capturing around 40% share of the market in 2024. The segment benefits from rising demand for high-speed optical communication systems, where rotators enhance signal stability and polarization management. Medical imaging follows as a fast-growing segment, driven by the need for precise optical alignment in diagnostic equipment such as MRI and optical tomography devices. Industrial automation also contributes steadily, using rotators in machine vision and precision sensors. Meanwhile, scientific research and other niche applications support market expansion through innovations in photonics and quantum optics research.

Key Growth Drivers

Expanding Telecommunications Infrastructure

The rapid expansion of Japan’s telecommunications infrastructure serves as a primary growth driver for quartz crystal optical rotators. With rising demand for high-speed internet, 5G rollouts, and fiber optic communication systems, the need for precise polarization control components has increased significantly. Optical rotators ensure signal integrity by stabilizing polarization states, reducing interference, and supporting efficient long-distance data transmission. Quartz crystal’s inherent optical stability and cost efficiency make it the preferred material for mass deployment in telecom equipment. Japan’s continued investment in 5G networks and data center connectivity further accelerates adoption, positioning quartz crystal rotators as critical components in next-generation communication technologies.

- For instance, PMOptics offers quartz rotators with polarization angle rotation tolerance ± 0.1° and parallelism < 30 arcseconds across 240–2100 nm.

Rising Adoption in Medical Imaging Technologies

The medical imaging industry in Japan is driving steady demand for quartz crystal optical rotators. These devices play a vital role in advanced imaging systems such as MRI, optical coherence tomography (OCT), and laser-based diagnostic tools. The rotators improve image clarity and diagnostic accuracy by ensuring precise polarization alignment and reducing optical noise. With Japan’s healthcare sector investing heavily in diagnostic innovations and early disease detection technologies, the demand for optical rotators has grown consistently. Furthermore, the country’s aging population fuels demand for high-quality medical imaging solutions, where rotators enhance performance and reliability. Continuous upgrades in imaging technologies and integration of photonics in medical devices provide strong long-term growth prospects.

- For instance, Thorlabs’ Z-cut quartz polarization rotator (25.4 mm diameter) maintains surface flatness λ/10 at 633 nm, parallelism ≤ 0.5 arcseconds, and rotational tolerance ±0.5°.

Growth of Industrial Automation and Photonics Research

Japan’s increasing focus on industrial automation and photonics research contributes significantly to market growth. In industrial automation, optical rotators are used in precision sensing, machine vision, and robotic systems that require accurate optical signal control. Quartz crystal rotators deliver stability and cost-effectiveness, making them a reliable choice for automated production environments. Simultaneously, Japan’s strong research ecosystem in optics and photonics supports adoption in laboratories and universities. Rotators are essential for experiments in quantum optics, spectroscopy, and advanced material research, where polarization control is critical. Government-backed R&D investments, academic collaborations, and the rising role of photonics in industrial and scientific applications ensure continued demand, reinforcing the long-term market trajectory.

Key Trends & Opportunities

Miniaturization of Optical Components

A major trend shaping the Japan quartz crystal optical rotator market is the miniaturization of optical components for integration into compact devices. As industries like telecommunications and medical imaging shift toward portable, space-saving solutions, demand for smaller and more efficient rotators has increased. Advances in nanofabrication and material science allow manufacturers to design compact quartz crystal rotators without compromising precision. Miniaturization not only reduces equipment size but also enhances compatibility with modern photonic systems. This trend presents opportunities for companies to innovate lightweight, high-performance rotators suited for portable medical devices, telecom modules, and integrated research equipment.

- For instance, a recent study demonstrated a double-pass rotating z-cut quartz plate able to function as a variable waveplate with lateral beam shift kept under 10 µm, suitable for fiber coupling in compact systems.

Opportunities in Quantum Computing and Advanced Photonics

The rising focus on quantum computing and advanced photonics in Japan creates new opportunities for quartz crystal optical rotators. These devices are vital for polarization control in quantum experiments and secure communication systems, where signal stability is essential. Japan’s government and private institutions are investing heavily in quantum technology development, providing a fertile ground for adoption. Optical rotators find applications in experimental setups for quantum key distribution, cryptography, and high-precision measurement systems. As the quantum ecosystem matures, manufacturers can tap into this opportunity by supplying advanced, research-grade rotators tailored for cutting-edge applications, expanding their presence beyond traditional telecom and medical sectors.

Key Challenges

High Production and Material Costs

One of the key challenges facing the Japan quartz crystal optical rotator market is high production and material costs. The precision required in cutting, shaping, and aligning quartz crystals increases manufacturing complexity, leading to higher prices compared to alternative optical components. Additionally, specialty glass and fused silica are emerging as competing materials in certain applications, offering cost advantages for research and niche uses. These factors make it challenging for manufacturers to maintain competitive pricing while sustaining profitability. Companies must focus on process optimization and cost-efficient production techniques to overcome this barrier and expand adoption across industries.

Limited Awareness in Emerging Applications

Despite strong demand in telecommunications and medical imaging, the market faces challenges due to limited awareness of optical rotators in emerging applications. Many industrial automation and scientific research users still rely on conventional optical solutions, underutilizing advanced rotator technologies. The lack of standardized adoption guidelines and limited technical knowledge among smaller enterprises slows market penetration. Additionally, competing optical solutions like wave plates and polarizers often serve as substitutes, reducing uptake in cost-sensitive industries. Addressing this challenge requires targeted education, demonstration of technical benefits, and collaboration with industry associations to increase awareness and accelerate adoption of quartz crystal optical rotators in new fields.

Regional Analysis

Kanto

Kanto led the Japan quartz crystal optical rotator market in 2024, accounting for nearly 32% share. The region benefits from strong demand in telecommunications and medical imaging, supported by the presence of major technology companies and advanced healthcare institutions. Tokyo and surrounding prefectures serve as hubs for research and industrial automation, creating steady adoption of optical rotators in both commercial and scientific applications. Government-backed initiatives in photonics and digital infrastructure further enhance the region’s leadership. With continued investment in 5G networks and R&D, Kanto is expected to retain its dominant role throughout the forecast period.

Kansai

Kansai captured around 20% share of the Japan quartz crystal optical rotator market in 2024, driven by its strong industrial base and thriving research ecosystem. Osaka and Kyoto host prominent universities and research institutes, making the region a center for photonics and optical technology advancements. The medical device manufacturing industry in Kansai further strengthens demand, with rotators integrated into diagnostic and imaging equipment. Rising adoption in industrial automation also contributes to market expansion. The combination of strong academic-industry collaboration and growing healthcare applications supports Kansai’s role as the second-largest market region.

Chubu

Chubu held approximately 15% market share in 2024, supported by its industrial strength and advanced manufacturing sector. The region is home to major automotive and electronics companies, which drive adoption of optical rotators in automation, robotics, and machine vision systems. Nagoya, as a central hub, plays a key role in integrating optical technologies across precision industries. Scientific research facilities in Chubu also contribute to demand, particularly in optics and materials research. With steady investment in smart manufacturing and automation, Chubu continues to establish itself as a key growth contributor to the national market.

Kyushu

Kyushu accounted for nearly 12% share of the Japan quartz crystal optical rotator market in 2024. The region’s semiconductor and electronics manufacturing industries create consistent demand for high-precision optical components, including rotators. Fukuoka and Kumamoto, known for their technology clusters, support growth through innovation in optics and photonics. Additionally, Kyushu’s growing role in renewable energy research and smart grid development enhances applications of optical rotators in scientific and industrial settings. The region benefits from government support for technology-driven industries, positioning Kyushu as an important contributor to future market expansion.

Hokkaido and Tohoku

Hokkaido and Tohoku together captured around 11% market share in 2024, with demand largely driven by scientific research and telecommunications. Universities and research institutes in the region actively explore advanced photonics, supporting adoption in experimental setups and optical laboratories. The rollout of communication networks in rural areas of Tohoku further increases the use of optical rotators in telecommunications infrastructure. While industrial automation adoption remains limited compared to other regions, ongoing academic research and government-led innovation programs are expected to enhance demand. The region holds long-term growth potential through continued research activities and connectivity expansion.

Chugoku and Shikoku

Chugoku and Shikoku collectively represented about 10% share of the Japan quartz crystal optical rotator market in 2024. Hiroshima and Okayama drive regional adoption through industrial manufacturing and automation systems requiring optical components for precision control. Shikoku’s role in energy research and electronics production also contributes to demand. The market in this region is relatively smaller compared to Kanto and Kansai but is growing steadily with increased adoption of optical rotators in industrial automation and scientific research. Continued investment in regional innovation hubs and collaborations with universities are expected to support gradual market expansion.

Market Segmentations:

By Material

- Quartz Crystal

- Specialty Glass

- Fused Silica

By Rotation Type

- Fixed Rotation

- Variable Rotation

By Application

- Telecommunications

- Medical Imaging

- Industrial Automation

- Scientific Research

- Others

By Geography

- Kanto

- Kansai

- Chubu

- Kyushu

- Hokkaido and Tohoku

- Chugoku and Shikoku

Competitive Landscape

The competitive landscape of the Japan quartz crystal optical rotator market is characterized by a mix of domestic players and global optical technology firms striving to strengthen their positions through innovation, partnerships, and expansion. Leading companies such as Crystal Innovations Ltd, Crystal Dynamics Inc, Optical Engineering Dynamics LLC, CrystalPro Technologies LLC, and Photon Rotor Technologies LLC dominate the market with established product portfolios and strong research capabilities. These firms focus on developing high-precision rotators tailored for telecommunications, medical imaging, and industrial automation applications. Emerging players like NexQuartz Optics Inc and OptiQuartz Inc emphasize miniaturized and cost-efficient solutions to capture niche segments, particularly in scientific research and portable medical devices. Strategic growth initiatives include collaborations with research institutions, expansion into quantum optics applications, and investments in R&D for advanced material integration. The market remains highly competitive, with differentiation driven by product reliability, technological innovation, and alignment with Japan’s strong photonics and automation ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Crystal Innovations Ltd

- Crystal Dynamics Inc

- Optical Engineering Dynamics LLC

- CrystalPro Technologies LLC

- Photon Rotor Technologies LLC

- Photonium Technologies Inc

- NexQuartz Optics Inc

- OptiQuartz Inc

- OptiReflect Technologies LLC

- HighPrecision Optics Corp

Recent Developments

- In June 2025, major showcasing of advanced photonics and optical systems occurred at the Laser World of Photonics event, featuring innovations relevant to high-precision optical manipulation

Report Coverage

The research report offers an in-depth analysis based on Material, Rotation Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising adoption in telecommunications infrastructure.

- Medical imaging applications will drive strong demand for precision optical rotators.

- Industrial automation will increasingly integrate rotators in machine vision and robotics.

- Research institutes will boost usage in photonics and quantum optics experiments.

- Miniaturized optical rotators will gain traction in compact devices and portable systems.

- Leading companies will focus on R&D to improve performance and stability.

- Collaborations between academia and industry will accelerate technological innovation.

- Competition will intensify as new players enter with cost-efficient solutions.

- Regional growth will remain concentrated in Kanto, Kansai, and Chubu.

- Long-term opportunities will arise from quantum computing and advanced photonics.