Market Overview:

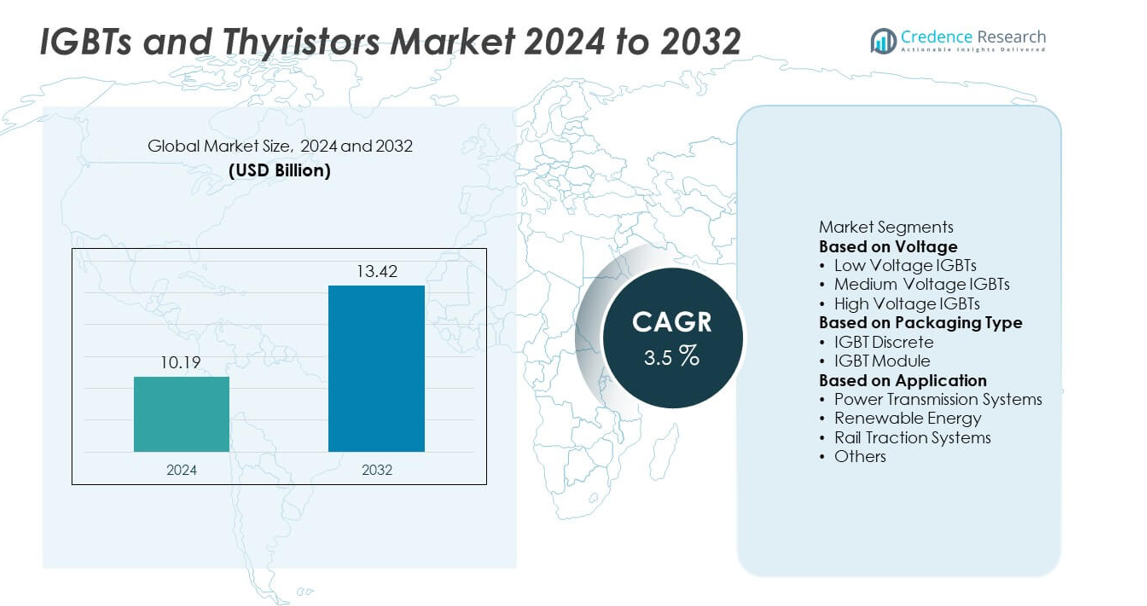

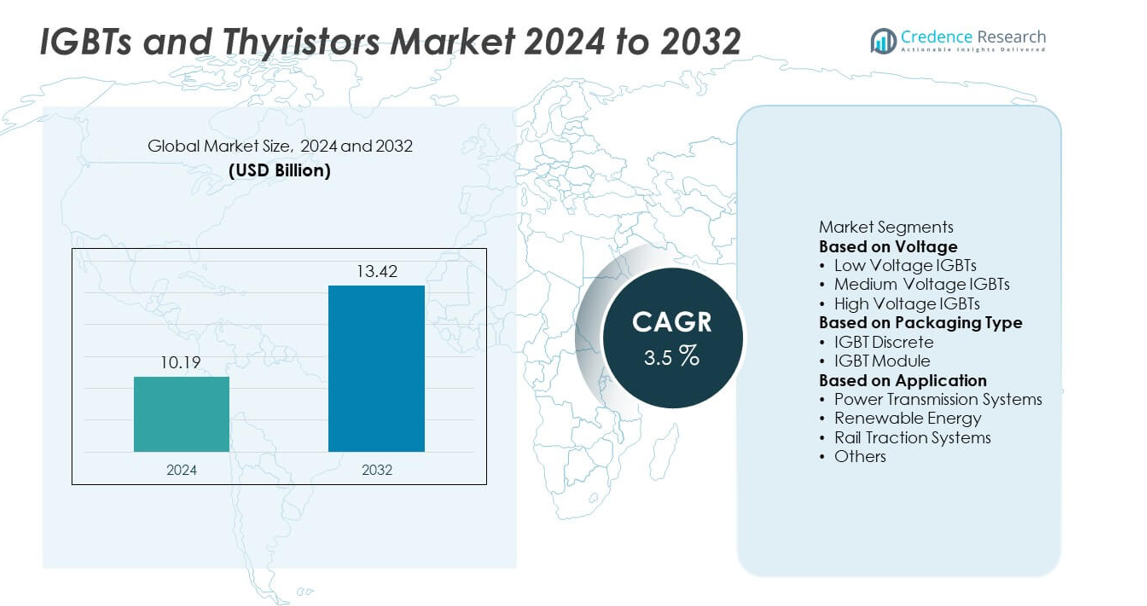

The global IGBTs and Thyristors market was valued at USD 10.19 billion in 2024 and is projected to reach USD 13.42 billion by 2032, growing at a CAGR of 3.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| IGBTs and Thyristors Market Size 2024 |

USD 10.19 billion |

| IGBTs and Thyristors Market, CAGR |

3.5% |

| IGBTs and Thyristors Market Size 2032 |

USD 13.42 billion |

The IGBTs and Thyristors market is led by top players such as Fuji Electric Co., Ltd., Renesas Electronics Corporation, Hitachi Energy Ltd., Semikron Danfoss, Dynex Semiconductor Ltd., Infineon Technologies AG, Diodes Incorporated, Toshiba Corporation, ON Semiconductor, and Mitsubishi Electric Corporation. These companies focus on high-performance semiconductor solutions for renewable energy, power transmission, industrial automation, and electric transportation. Regionally, Asia-Pacific held the largest share at 30% in 2024, driven by rapid renewable integration and EV production. North America accounted for 32% share, supported by investments in smart grids and clean energy projects, while Europe captured 28% share, led by strong regulatory frameworks and renewable adoption.

Market Insights

- The global IGBTs and Thyristors market was valued at USD 10.19 billion in 2024 and is projected to reach USD 13.42 billion by 2032, growing at a CAGR of 3.5% during the forecast period.

- Rising demand for efficient power transmission systems and renewable integration drives adoption, with high-voltage IGBTs leading the market at 47% share due to their critical role in HVDC and large-scale infrastructure.

- Key trends include advancements in wide bandgap semiconductors such as SiC and GaN, alongside growing deployment in electric vehicles, rail traction, and industrial automation.

- Major players including Infineon Technologies, Mitsubishi Electric, Fuji Electric, ON Semiconductor, and Toshiba dominate the competitive landscape, focusing on innovation, cost efficiency, and global partnerships, while high manufacturing costs and competition from alternative technologies act as restraints.

- Regionally, North America leads with 32% share, followed by Europe at 28% and Asia-Pacific at 30%, while Latin America (6%) and Middle East & Africa (4%) show gradual but steady adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Voltage

In 2024, the high voltage IGBTs segment dominated the market with 47% share, driven by their critical role in high-power applications such as grid infrastructure, industrial drives, and electric locomotives. High voltage IGBTs offer superior efficiency and reliability, making them indispensable in long-distance power transmission and large renewable projects like offshore wind. The rising global demand for stable power networks and the integration of high-capacity renewable sources reinforce their leadership. Medium and low voltage IGBTs continue to support automotive and consumer applications, but large-scale infrastructure remains the core driver for high voltage adoption.

- For instance, Hitachi Energy has integrated more than 150 gigawatts (GW) of high-voltage direct current (HVDC) links into power systems worldwide to stabilize and enable long-distance power transmission.

By Packaging Type

The IGBT module segment held 64% share in 2024, leading the market due to its superior power density, thermal performance, and compact design. Modules are widely used in renewable energy inverters, rail traction systems, and industrial motor drives where high efficiency and durability are essential. Their ability to integrate multiple chips enhances functionality, driving widespread use in high-power applications. IGBT discretes, while cost-effective and useful for low-to-medium power devices, remain secondary. The growing preference for modules aligns with the increasing demand for high-performance solutions across energy, transportation, and industrial automation sectors.

- For instance, Semikron Danfoss produces SKiiP 4 modules that handle current ratings up to 3,600 A and are used in wind turbine converters, rail traction systems, and other industrial applications.

By Application

In 2024, power transmission systems accounted for 41% share, establishing themselves as the dominant application segment in the IGBTs and Thyristors market. These components are crucial for improving grid reliability, reducing transmission losses, and managing reactive power in long-distance electricity transmission. Rising investments in smart grids and high-voltage direct current (HVDC) systems further fuel this demand. Renewable energy applications also represent a fast-growing area, particularly in wind and solar inverters, while rail traction systems rely heavily on IGBTs for efficiency and durability. However, the scale and necessity of power transmission sustain its leading position globally.

Key Growth Drivers

Rising Demand for Efficient Power Transmission

The increasing need for efficient power transmission and distribution systems is a major driver of the IGBTs and Thyristors market. These devices enhance grid stability, reduce transmission losses, and support high-voltage direct current (HVDC) projects. With global electricity demand rising and grids expanding, utilities are investing in advanced semiconductor technologies to improve reliability. IGBTs and thyristors enable dynamic voltage control and energy efficiency, making them essential for modernizing power infrastructure and integrating renewable energy into long-distance transmission networks.

- For instance, the Hokkaido–Honshu link in Japan utilizes a system of HVDC converters to transmit power at a voltage of 250 kV, with its total capacity expanded to 900 MW by a new 300 MW link that was commissioned in March 2019, improving interregional grid stability.

Growth of Renewable Energy Installations

The rapid expansion of renewable energy projects, particularly solar and wind, is fueling demand for IGBTs and thyristors. These components are vital for inverters and converters that convert and regulate electricity in variable renewable systems. Governments worldwide are promoting renewable adoption through policies and subsidies, which has accelerated installations. The ability of IGBTs to provide efficient switching and of thyristors to manage high voltages ensures their role in meeting clean energy goals. This trend positions renewable integration as a key growth driver for the market.

- For instance, Infineon’s PrimePACK IGBT modules are designed for high-power applications like wind and solar inverters. The product family covers a broad range of currents and voltages, making it suitable for various power output levels.

Electrification of Transportation Systems

The growing adoption of electric and hybrid vehicles, along with electrified rail traction systems, significantly drives the demand for IGBTs and thyristors. IGBTs are integral to vehicle power electronics, managing battery charging, motor control, and energy efficiency. In railways, thyristors and IGBT modules enhance traction performance and reduce operational costs. As governments push for cleaner mobility solutions, the reliance on efficient semiconductor devices in transport systems continues to expand. This electrification trend ensures consistent growth opportunities for IGBT and thyristor manufacturers.

Key Trends & Opportunities

Advancements in Wide Bandgap Semiconductors

The development of wide bandgap semiconductors such as silicon carbide (SiC) and gallium nitride (GaN) is creating opportunities for the IGBTs and Thyristors market. These materials offer higher efficiency, faster switching, and reduced thermal losses compared to conventional silicon-based devices. As industries demand compact, energy-efficient solutions, the integration of SiC-based IGBTs in power electronics is growing. This trend aligns with the shift toward higher energy efficiency standards and supports adoption in sectors like renewable energy, electric vehicles, and industrial automation.

- For instance, onsemi expanded its SiC manufacturing capacity to produce more than 1 million 200 mm SiC wafers annually, enabling the supply of SiC power devices that operate at voltages exceeding 1,200 V for EV inverters and renewable systems.

Expansion of Smart Grids and Industrial Automation

The global shift toward smart grids and Industry 4.0 initiatives is driving demand for advanced power electronics, creating opportunities for IGBT and thyristor adoption. Smart grids rely on these devices for voltage regulation, energy flow optimization, and real-time monitoring. Similarly, industrial automation requires high-performance power modules to ensure efficient operation of motors, drives, and machinery. As automation technologies expand, the use of IGBTs and thyristors will increase, providing vendors opportunities to capture demand from energy-intensive manufacturing and infrastructure modernization projects.

- For instance, Toshiba continued to supply IGBT modules for industrial motor drives and other applications in 2023, with products including a new 650V-rated discrete IGBT. Toshiba’s IGBT offerings cover a broad range of voltages and current ratings, with products used in applications such as industrial equipment and factory automation.

Key Challenges

High Manufacturing and Integration Costs

The production of advanced IGBTs and thyristors involves complex processes and expensive raw materials, leading to high costs. Integration into power systems also requires specialized expertise, raising overall expenses for end-users. This cost barrier particularly impacts adoption in price-sensitive markets and among small utilities or manufacturers. While long-term efficiency gains are significant, upfront investments remain a major restraint to broader adoption, limiting growth potential in developing economies.

Competition from Alternative Technologies

The emergence of wide bandgap technologies such as SiC and GaN poses a challenge to the traditional IGBT and thyristor market. These alternatives provide superior efficiency, reduced size, and better performance at high frequencies, making them increasingly attractive in power electronics. While IGBTs and thyristors remain dominant in high-power applications, the rapid commercialization of wide bandgap devices could shift market preferences. Manufacturers must adapt by integrating these materials or risk losing market share in fast-evolving sectors.

Regional Analysis

North America

North America accounted for 32% share of the IGBTs and Thyristors market in 2024, driven by strong adoption in renewable energy projects, industrial automation, and transportation electrification. The United States leads the region, with significant investments in smart grids, electric vehicles, and high-voltage direct current (HVDC) transmission systems. Government incentives for clean energy and the expansion of electric vehicle infrastructure further strengthen demand. Canada contributes through hydropower integration and energy-efficient industrial operations. The presence of leading technology providers and rapid modernization of grid infrastructure continue to make North America a key market for advanced power semiconductors.

Europe

Europe held 28% share of the IGBTs and Thyristors market in 2024, supported by strict energy efficiency regulations and large-scale renewable integration. Countries like Germany, France, and the U.K. are driving adoption through wind and solar power expansion, as well as investment in rail electrification. The European Union’s Green Deal and carbon neutrality goals encourage the deployment of energy-efficient semiconductor technologies. Rail traction and industrial automation are also significant growth areas. With strong policy backing and technological innovation, Europe remains one of the leading markets for IGBTs and thyristors in power and mobility applications.

Asia-Pacific

Asia-Pacific captured 30% share of the IGBTs and Thyristors market in 2024, making it the fastest-growing region. China leads with massive investments in renewable energy, HVDC transmission, and high-speed rail projects. India and Japan are also significant contributors, focusing on solar and wind energy adoption and the electrification of transport systems. Rapid industrialization, urbanization, and rising electricity demand across the region fuel strong adoption of power electronics. Expanding electric vehicle production in China, South Korea, and Japan further accelerates market growth. Asia-Pacific continues to emerge as a critical hub for manufacturing and deployment of IGBTs and thyristors.

Latin America

Latin America accounted for 6% share of the IGBTs and Thyristors market in 2024, with Brazil and Mexico as primary contributors. Growing adoption of renewable energy, particularly hydropower and solar, drives the demand for advanced semiconductor devices. Governments are investing in energy-efficient technologies to modernize outdated grid systems and reduce transmission losses. Rail electrification and industrial applications are emerging segments supporting steady growth. However, high costs and limited local manufacturing capabilities restrain faster adoption. International partnerships and infrastructure projects are expected to expand the region’s role in the global IGBTs and thyristors market.

Middle East & Africa

The Middle East & Africa represented 4% share of the IGBTs and Thyristors market in 2024, reflecting steady but limited adoption. GCC countries, especially Saudi Arabia and the UAE, are investing in renewable energy projects, including solar power plants, that require efficient semiconductor devices. In Africa, South Africa drives adoption with grid modernization and renewable initiatives, though affordability challenges limit broader penetration. Industrial and utility-scale applications are gradually expanding as governments prioritize sustainable energy and infrastructure development. Rising electricity demand and energy diversification strategies create long-term opportunities for IGBT and thyristor adoption in the region.

Market Segmentations:

By Voltage

- Low Voltage IGBTs

- Medium Voltage IGBTs

- High Voltage IGBTs

By Packaging Type

- IGBT Discrete

- IGBT Module

By Application

- Power Transmission Systems

- Renewable Energy

- Rail Traction Systems

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Lanscape

The competitive landscape of the IGBTs and Thyristors market is shaped by major players including Fuji Electric Co., Ltd., Renesas Electronics Corporation, Hitachi Energy Ltd., Semikron Danfoss, Dynex Semiconductor Ltd., Infineon Technologies AG, Diodes Incorporated, Toshiba Corporation, ON Semiconductor, and Mitsubishi Electric Corporation. These companies drive market growth through innovations in power semiconductors, focusing on efficiency, reliability, and scalability for high-power applications. Leading vendors emphasize advancements in IGBT modules and high-voltage thyristors to meet the rising demand in renewable energy, power transmission, and electric transportation systems. Strategic initiatives such as mergers, acquisitions, and partnerships strengthen their global presence and enhance technological capabilities. Many companies are also investing in wide bandgap semiconductor integration, such as SiC and GaN, to deliver superior switching performance and thermal efficiency. Growing competition is pushing manufacturers to balance performance with cost-effectiveness, while expanding their product portfolios to capture emerging opportunities across industrial automation and smart grid projects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fuji Electric Co., Ltd.

- Renesas Electronics Corporation

- Hitachi Energy Ltd.

- Semikron Danfoss

- Dynex Semiconductor Ltd.

- Infineon Technologies AG

- Diodes Incorporated

- Toshiba Corporation

- ON Semiconductor (onsemi)

- Mitsubishi Electric Corporation

Recent Developments

- In April 2025, Infineon introduced a new generation of power-efficient IGBT and RC-IGBT devices for electric vehicles.

- In March 2025, onsemi introduced its EliteSiC SPM 31 intelligent power modules, offering current ratings of 40 A to 70 A in a compact form factor.

- In March 2025, Infineon advanced its TRENCHSTOP™ H7 IGBTs by packaging them in the DTO247 form factor to enhance power performance.

- In April 2024, Fuji Electric launched its HPnC series large-capacity industrial IGBT modules designed for renewable energy conversions, reaching a rated current of 1800 A and voltage breakdown of 2300 V

Report Coverage

The research report offers an in-depth analysis based on Voltage, Application, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising demand for energy-efficient power electronics.

- High-voltage IGBTs will remain dominant due to their role in transmission and industrial systems.

- Renewable energy adoption will accelerate demand for IGBT modules and thyristors in inverters.

- Rail traction and electric vehicles will continue driving growth in transport applications.

- Wide bandgap semiconductors such as SiC and GaN will reshape competitive strategies.

- Asia-Pacific will remain the fastest-growing region with strong manufacturing and adoption.

- North America and Europe will maintain leadership through grid modernization and regulations.

- Companies will focus on compact, high-performance modules to enhance efficiency and reliability.

- Strategic partnerships and acquisitions will intensify to expand technological capabilities.

- Cost reduction and sustainable designs will become key priorities for wider market penetration.