Market Overview:

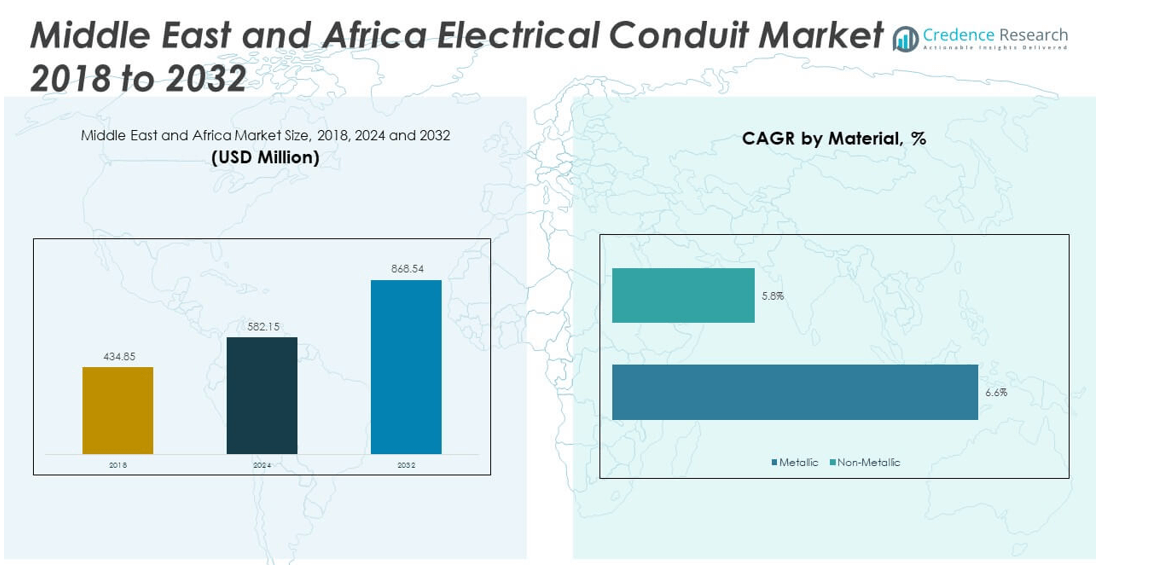

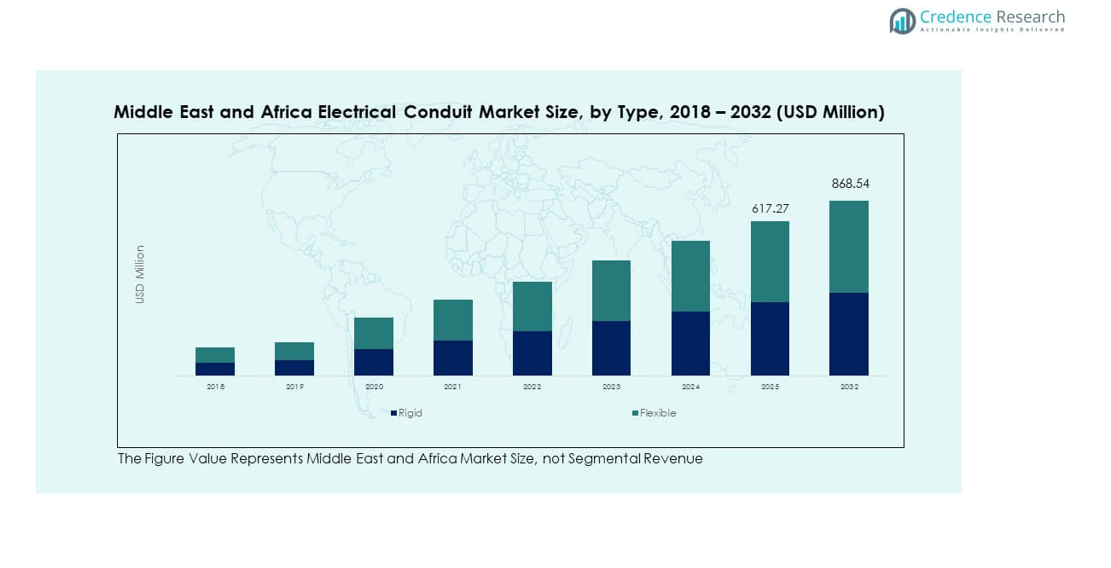

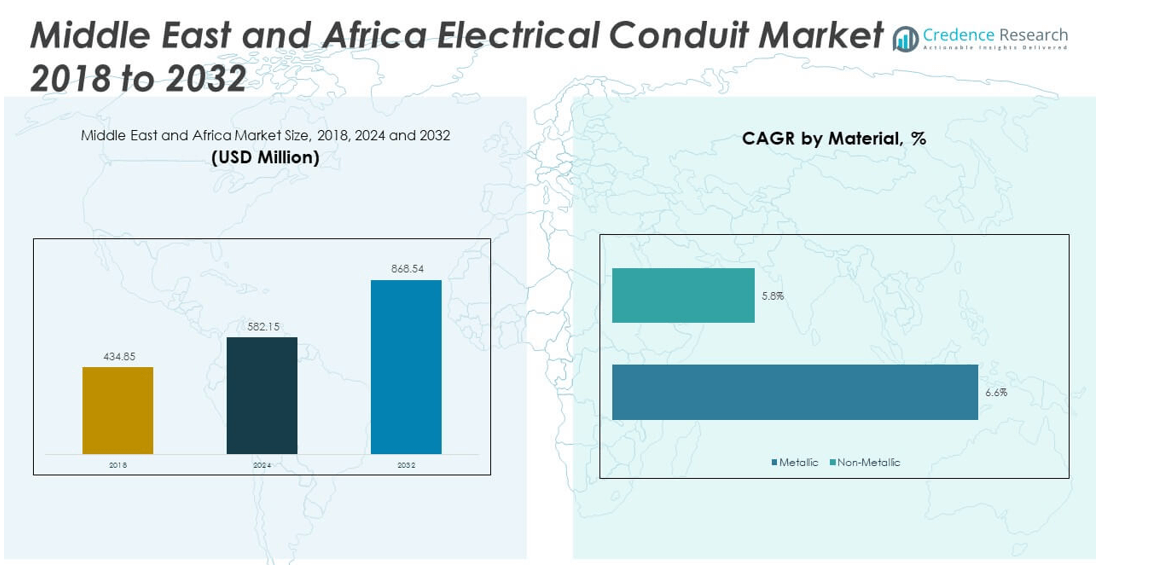

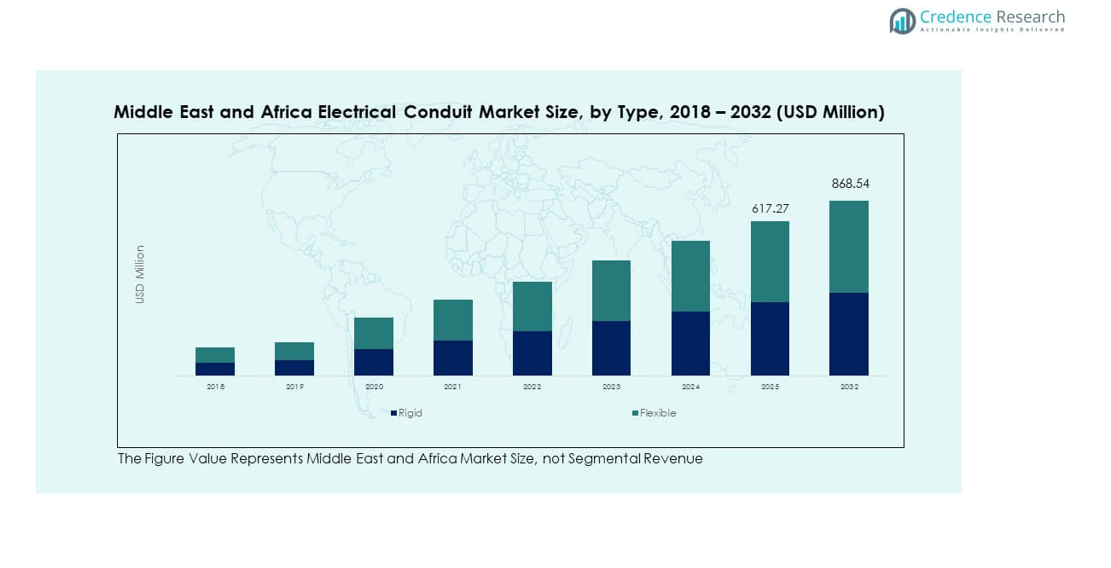

The Middle East and Africa Electrical Conduits Market size was valued at USD 434.85 million in 2018 to USD 582.15 million in 2024 and is anticipated to reach USD 868.54 million by 2032, at a CAGR of 5.24% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Middle East and Africa Electrical Conduits Market Size 2024 |

USD 582.15 million |

| Middle East and Africa Electrical Conduits Market, CAGR |

5.24% |

| Middle East and Africa Electrical Conduits Market Size 2032 |

USD 868.54 million |

Market drivers include rapid urbanization, expanding industrial hubs, and rising investments in real estate and public infrastructure. Governments across the region are focusing on smart city projects and renewable energy developments, creating strong demand for reliable electrical conduits. The adoption of advanced materials such as PVC and HDPE supports higher safety, sustainability, and durability. Increasing awareness of fire-resistant and corrosion-resistant solutions also fuels demand, while compliance with stricter safety regulations further strengthens growth opportunities.

Regionally, the Gulf Cooperation Council (GCC) countries lead the market due to strong investments in construction, oil, and gas projects. The United Arab Emirates and Saudi Arabia are at the forefront, driven by mega infrastructure developments and energy diversification plans. South Africa also shows steady demand supported by urban infrastructure growth. Emerging countries in North and East Africa are witnessing rising opportunities as electricity access expands and modernization efforts accelerate, positioning them as future growth contributors in the electrical conduits market.

Market Insights:

- The Middle East and Africa Electrical Conduits Market was valued at USD 434.85 million in 2018, estimated at USD 582.15 million in 2024, and is projected to reach USD 868.54 million by 2032, growing at a CAGR of 5.24%.

- The Gulf Cooperation Council (GCC) leads with 42% share, driven by large-scale infrastructure, smart city projects, and oil & gas sector demand.

- North Africa follows with 28% share, supported by housing programs, renewable energy projects, and transportation upgrades, while South Africa holds 18% due to urban redevelopment and industrial projects.

- East Africa is the fastest-growing region with 12% share, driven by rapid electrification, expanding industrial hubs, and rising investment in public infrastructure.

- By type, rigid conduits hold the dominant share at 58%, preferred in industrial and commercial projects, while flexible conduits account for 42% and are growing steadily due to demand in residential and retrofit applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rapid Urbanization and Large-Scale Infrastructure Expansion Across the Region

The Middle East and Africa Electrical Conduits Market is strongly supported by rapid urbanization and continuous infrastructure development. Large-scale housing, commercial buildings, and industrial zones require advanced conduit systems to ensure safe and reliable electrical installations. Governments are investing heavily in smart city projects, transportation networks, and public infrastructure, driving significant demand for electrical conduits. It is gaining momentum as construction firms prioritize modern and durable wiring solutions. The rising pace of urban migration adds more pressure on cities to adopt safe and efficient electrical systems. This expansion highlights the importance of flexible, corrosion-resistant, and cost-effective conduits. Growing collaborations between governments and private developers further enhance the outlook. Increasing population density strengthens the need for modernized electrical networks in both new and existing projects.

- For instance, Ducab supplied 90% of the cables used for Expo 2020 Dubai, supporting major electrical infrastructure across hundreds of buildings and public spaces in partnership with UAE government-backed development teams.

Industrial Growth and Strong Adoption of Conduits in Manufacturing Hubs

Industrial development is another major factor boosting the Middle East and Africa Electrical Conduits Market. With manufacturing hubs growing rapidly across the region, demand for safe electrical infrastructure continues to rise. Factories, logistics centers, and energy facilities require conduits that ensure protection against fire, heat, and mechanical damage. It is becoming essential for industries that depend on uninterrupted power supply and compliance with strict safety standards. The surge in foreign direct investment and government-led industrial initiatives supports market expansion. Electrical conduits play a vital role in reducing risks of downtime, protecting sensitive machinery, and ensuring worker safety. The oil and gas sector in the Gulf and mining operations in Africa contribute significantly to this demand. Expanding industrial corridors across Africa highlight the growing reliance on modern conduit solutions.

- For instance, Eaton’s Dammam manufacturing facility passed strict Saudi Aramco quality management audits and supplied B-Line series cable management systems to multiple major projects such as King Fahad Sea Port and Jazan Refinery, utilizing over 50,000 square feet of local production capacity for robust fire- and corrosion-resistant conduit installations.

Rising Safety Standards and Regulations in the Construction Industry

The enforcement of strict building codes and safety regulations drives the demand for quality conduit systems. The Middle East and Africa Electrical Conduits Market benefits from government emphasis on compliance with fire safety, electrical standards, and energy efficiency. Builders and contractors prefer conduits that are durable, resistant to heat, and cost-effective. It is increasingly seen as a reliable solution for ensuring long-term safety in residential and commercial spaces. Growing awareness among property owners about the risks of poor wiring infrastructure strengthens adoption. Insurance companies and regulatory authorities also encourage the use of certified conduit systems. These standards push manufacturers to innovate and introduce advanced PVC and HDPE conduit materials. The focus on safer and sustainable infrastructure is a direct driver of growth.

Energy Diversification and Renewable Energy Projects Stimulating Conduit Demand

The Middle East and Africa Electrical Conduits Market benefits significantly from the region’s focus on energy diversification. Countries are investing heavily in renewable energy projects, including solar and wind farms, which require robust conduit systems. Electrical conduits protect cables from harsh environmental conditions, ensuring reliability in renewable installations. It has become a critical element in projects that expand grid networks and improve rural electrification. Rising investments in solar parks across the Middle East further accelerate demand for durable conduit systems. Africa’s focus on electrification and renewable expansion also strengthens adoption. Conduits designed for outdoor, underground, and harsh conditions are in high demand. Growing partnerships between governments, utilities, and private firms amplify growth prospects. The alignment with sustainability goals supports long-term market expansion.

Market Trends:

Shift Toward Smart Electrical Infrastructure and Digital Integration

A major trend shaping the Middle East and Africa Electrical Conduits Market is the shift toward smart electrical infrastructure. Construction projects are increasingly integrating digital monitoring and automation, requiring advanced conduit solutions. These conduits support smart sensors, energy-efficient systems, and IoT-enabled networks in both commercial and residential spaces. It is driving growth in specialized conduits designed to handle higher connectivity demands. Smart buildings across the Gulf countries adopt solutions that balance performance, safety, and sustainability. The use of conduits in smart grids is also expanding to improve reliability. Governments’ push toward smart city initiatives further accelerates this shift. Demand for conduits that support future-ready electrical networks continues to rise across the region.

- For instance, Schneider Electric’s new Dubai headquarters integrated EcoStruxure smart building technologies and achieved a 37% reduction in energy consumption within the first year, while the facility aims to cut over 700 metric tons of CO₂e emissions per year by 2026, illustrating the adoption of digital and IoT-enabled conduit solutions in real-world smart infrastructure projects.

Emergence of Sustainable and Eco-Friendly Conduit Materials

Sustainability is becoming a defining trend in the Middle East and Africa Electrical Conduits Market. Manufacturers are introducing eco-friendly and recyclable conduit materials to align with environmental regulations. PVC alternatives and advanced composites are gaining acceptance in construction projects across both urban and rural settings. It is increasingly important for governments and developers focused on reducing environmental footprints. Green building certifications drive higher demand for low-impact conduit solutions. Contractors prefer products that meet energy efficiency standards and reduce waste generation. This trend creates opportunities for innovation in biodegradable and recyclable conduit materials. With sustainability targets expanding across the Gulf and African nations, eco-friendly conduits gain stronger market presence. Demand for green construction supports continued adoption of these materials.

- For instance, Schneider Electric Middle East’s “The NEST” facility deployed sustainable building materials, achieved carbon neutrality just three months after opening in 2025, and implemented EcoStruxure energy management with the goal of reducing emissions by over 700 tCO₂e annually, in alignment with the UAE Net Zero 2050 strategy.

Growing Adoption of Modular and Pre-Engineered Construction Solutions

The increasing shift toward modular and pre-engineered construction is influencing conduit demand. Developers prefer prefabricated conduit systems that reduce installation time and labor costs. The Middle East and Africa Electrical Conduits Market is benefiting from these approaches in large-scale housing, commercial complexes, and industrial facilities. It ensures faster delivery of safe and reliable electrical infrastructure. Modular conduit solutions improve consistency, reduce project delays, and minimize on-site risks. Pre-assembled conduit kits are particularly popular in projects where speed and quality are critical. The rise of industrial parks and economic zones further supports modular adoption. Growing urbanization requires quick solutions, making modular conduits a preferred choice. This approach aligns with efficiency-driven construction methods in the region.

Increased Focus on High-Performance and Corrosion-Resistant Solutions

Another key trend is the rising preference for high-performance conduit systems designed for harsh environments. The Middle East and Africa Electrical Conduits Market witnesses strong adoption in areas prone to heat, dust, and corrosion. It is especially relevant for oil, gas, mining, and marine projects that demand durable solutions. Stainless steel, coated metal, and advanced polymer conduits are gaining traction. These products provide long-term protection and reduce maintenance costs in challenging environments. Construction in coastal and desert regions further drives demand for specialized conduit systems. Manufacturers are focusing on innovation to enhance resilience and durability. Rising customer expectations around product lifespan and reliability encourage wider use of high-grade conduits. Demand for such systems is steadily increasing across industries.

Market Challenges Analysis:

High Cost of Advanced Conduits and Limited Local Manufacturing Capabilities

One major challenge facing the Middle East and Africa Electrical Conduits Market is the high cost of advanced conduit solutions. Imported products with advanced features such as fire resistance or eco-friendly materials are expensive. It limits adoption in cost-sensitive projects, particularly in developing African nations. Local manufacturing capacity remains limited, which increases reliance on imported conduits. This dependence raises overall project costs and reduces accessibility for smaller contractors. High logistics expenses also add to the pricing pressure. The gap between supply and demand affects project timelines. Limited research and development in regional markets further slows innovation and availability. Balancing cost and performance continues to challenge widespread adoption.

Infrastructure Gaps, Regulatory Differences, and Lack of Skilled Workforce

The Middle East and Africa Electrical Conduits Market also faces challenges from infrastructure and regulatory gaps. Differences in building codes across countries create inconsistencies in conduit adoption. It restricts the uniform use of advanced solutions across the region. Some areas lack strong regulatory enforcement, leading to substandard installations. A shortage of skilled electricians and contractors adds complexity to maintaining quality standards. Many rural areas still face limited awareness about advanced conduit systems. Infrastructure deficits in remote regions hinder proper installation and maintenance. Political instability in certain regions also disrupts steady market growth. These factors together limit smooth development across the broader market.

Market Opportunities:

Expansion of Renewable Energy Projects and National Electrification Programs

The Middle East and Africa Electrical Conduits Market presents significant opportunities in renewable energy and electrification projects. Governments are investing heavily in solar, wind, and hydropower projects that demand reliable conduits. It supports grid expansion, rural electrification, and large-scale energy diversification initiatives. Durable conduit systems that withstand harsh outdoor conditions gain strong demand. Contractors prefer products that balance cost and longevity. This focus creates opportunities for conduit manufacturers to strengthen their presence in energy infrastructure. Partnerships between public and private sectors enhance growth prospects across multiple nations. Innovation in conduit designs further boosts adoption.

Rising Demand for Smart Cities and Technologically Advanced Construction Solutions

Smart city projects across the Middle East drive opportunities for advanced conduit solutions. The Middle East and Africa Electrical Conduits Market benefits from smart buildings, digital infrastructure, and urban connectivity plans. It supports IoT integration, energy efficiency, and high-performance electrical systems. Developers prefer conduits that enhance safety while aligning with future-ready designs. Africa’s growing urbanization also opens opportunities for modern conduit systems. The demand for eco-friendly and modular solutions expands with rising green construction. Manufacturers focusing on smart-ready and sustainable designs gain competitive advantage. These trends highlight strong opportunities for long-term market expansion.

Market Segmentation Analysis:

By Type

The Middle East and Africa Electrical Conduits Market is divided into rigid and flexible conduits. Rigid conduits dominate due to their strength, durability, and widespread use in large commercial and industrial projects. Flexible conduits are gaining traction for applications requiring adaptability, especially in residential spaces and retrofit projects. It supports both heavy-duty and lightweight installations, balancing reliability with flexibility.

- For instance, ABB provided a comprehensive range of metallic and non-metallic conduit systems, including flexible solutions and fire-resistant rigid conduits, which were deployed across numerous manufacturing and industrial sites in Saudi Arabia, supporting both new installations and heavy-duty retrofits.

By Material

PVC holds the largest share owing to its cost-effectiveness, easy installation, and resistance to moisture and corrosion. HDPE is expanding rapidly, favored in underground and outdoor applications where durability and weather resistance are critical. Steel conduits remain essential in industries requiring fire resistance and mechanical protection. Aluminum conduits are valued for lightweight installations and corrosion resistance in coastal environments. Others, including composite and advanced polymer materials, serve niche applications requiring specialized performance.

- For instance, Oman’s Sohar Port signed an agreement in October 2023 with Universal Fine Chemicals SPC to establish a $300 million polymer manufacturing facility spanning 240,000 square meters. The facility will produce polyacrylamide and related monomers for applications in the energy, agriculture, wastewater management, and paper industries, with the goal of supplying markets across the GCC, North and South America, and the European Union.

By End-User Industry

Residential and commercial segments contribute significantly with rising urbanization and smart building projects. Industrial demand is strong due to manufacturing hubs and logistics facilities requiring reliable electrical safety. Utility infrastructure projects drive the adoption of durable conduits for grid expansion and electrification. Oil and gas applications in the Gulf region emphasize robust and corrosion-resistant solutions. Others, including institutional and public infrastructure projects, further expand the market footprint.

Segmentation:

By Type

- Rigid Conduits

- Flexible Conduits

By Material

- PVC (Polyvinyl Chloride)

- HDPE (High-Density Polyethylene)

- Steel

- Aluminum

- Others

By End-User Industry

- Residential

- Commercial

- Industrial

- Utility Infrastructure

- Oil & Gas

- Others

Regional Analysis:

Dominance of the Gulf Cooperation Council (GCC) Countries

The Gulf Cooperation Council countries hold the largest share of the Middle East and Africa Electrical Conduits Market, accounting for around 42%. Strong investments in infrastructure, smart city developments, and energy diversification projects fuel demand. Saudi Arabia leads with Vision 2030 projects, while the United Arab Emirates invests heavily in commercial and residential construction. The oil and gas sector in Qatar and Kuwait further boosts demand for corrosion-resistant and fire-safe conduit systems. It continues to attract manufacturers offering high-quality and technologically advanced solutions. Rising demand for modern housing and premium commercial projects sustains strong growth momentum in this sub-region.

Steady Growth Across North and East Africa

North Africa captures about 28% of the market, driven by infrastructure modernization in Egypt, Morocco, and Algeria. Mega housing schemes, transportation projects, and renewable energy developments create solid demand for conduits. East Africa, including Kenya and Ethiopia, is emerging as a promising sub-region with growing electrification and industrialization projects. It highlights the role of conduits in expanding grid networks and safe installations in high-growth economies. The focus on urban infrastructure and public utilities supports the adoption of PVC and HDPE conduits. Regional governments actively promote energy access, which strengthens long-term growth opportunities.

Rising Demand in South Africa and Rest of Middle East

South Africa represents nearly 18% of the Middle East and Africa Electrical Conduits Market, supported by urban redevelopment and growing commercial construction. Industrial corridors, mining projects, and modernization of public infrastructure sustain conduit adoption. The rest of the Middle East, including countries such as Jordan and Oman, accounts for about 12% share. It demonstrates growing interest in sustainable housing and mid-scale industrial projects. Increasing government spending on energy and public utilities drives further opportunities. These regions show rising acceptance of both rigid and flexible conduits depending on project scale and environment. Expanding demand across diverse sectors ensures continued relevance of conduit systems in these markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Middle East and Africa Electrical Conduits Market is highly competitive, with global leaders and regional players expanding their presence. Companies such as Schneider Electric, ABB, Legrand, Hubbell, Eaton, and Atkore International dominate through strong product portfolios, innovation, and established distribution networks. It is characterized by strategic mergers, product launches, and partnerships aimed at strengthening market reach. Local manufacturers focus on cost-effective solutions to capture demand in emerging African economies. Global players emphasize quality, durability, and compliance with international standards to maintain their competitive edge. Competitive intensity remains high as both multinational and regional firms compete across industrial, residential, and utility applications.

Recent Developments:

- In September 2025, Schneider Electric SE launched eight new “Saudi Made” energy management and automation products during its Innovation Summit in Riyadh, in support of Saudi Vision 2030 and regional growth in sectors such as infrastructure and data centers for the Middle East and Africa Electrical Conduits Market.

- In December 2024, ABB Ltd. formed a strategic partnership with Times Developments (Egypt) to supply advanced power distribution and medium-voltage solutions for Avelin and Aster smart projects in New Cairo, aiming to boost energy efficiency in smart infrastructure across the Middle East and Africa.

Report Coverage:

The research report offers an in-depth analysis based on type, material, and end-user industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing urbanization will continue to drive demand for advanced conduit systems across residential and commercial sectors.

- Rising investment in renewable energy projects will strengthen demand for durable conduits in outdoor and utility installations.

- Industrial corridors in Africa will expand adoption of heavy-duty conduits for safe and reliable electrical infrastructure.

- GCC countries will lead smart city projects, creating opportunities for advanced conduit solutions supporting IoT integration.

- The oil and gas sector will sustain demand for fire-resistant and corrosion-proof conduit systems.

- Modular and pre-engineered construction projects will accelerate the use of prefabricated conduit solutions.

- Growing regulatory compliance will push manufacturers to innovate with eco-friendly and recyclable materials.

- Infrastructure modernization across North and East Africa will fuel adoption of PVC and HDPE conduits.

- Competition between multinational and regional players will remain strong, fostering product diversification.

- Rising focus on sustainability will expand opportunities for green-certified conduit systems in construction projects.