Market Overview

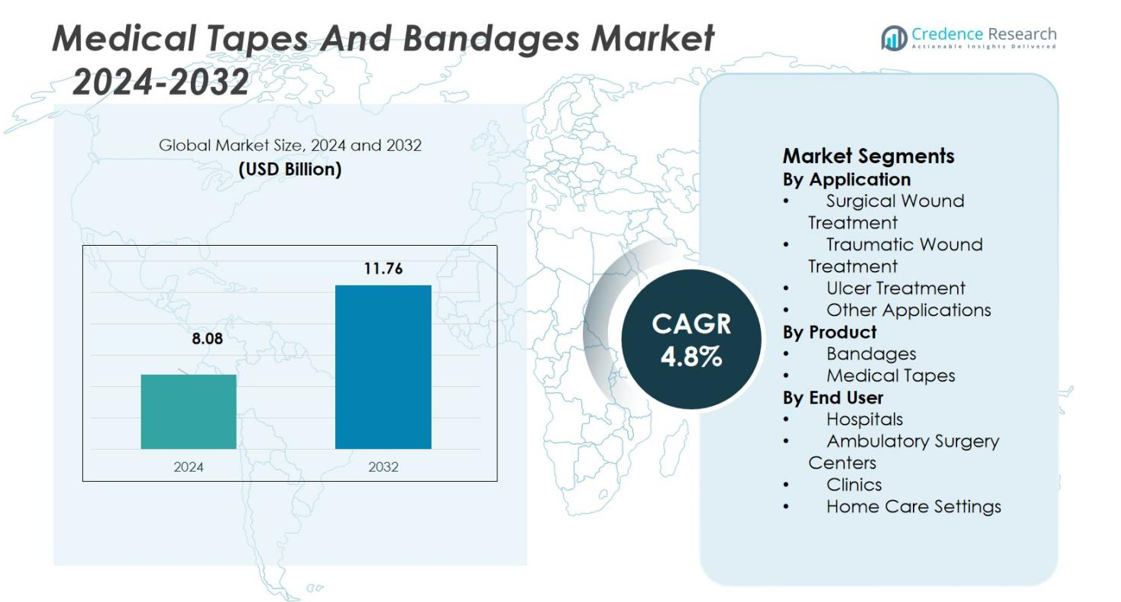

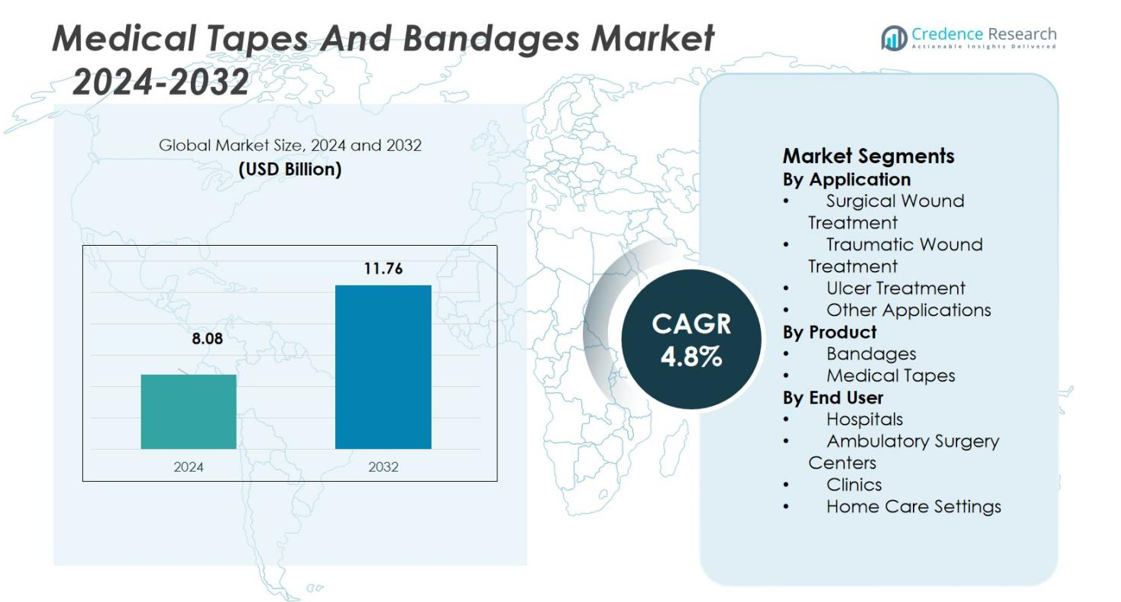

The Medical Tapes and Bandages Market size was valued at USD 8.08 Billion in 2024 and is anticipated to reach USD 11.76 Billion by 2032, at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medical Tapes and Bandages Market Size 2024 |

USD 8.08 Billion |

| Medical Tapes and Bandages Market, CAGR |

4.8% |

| Medical Tapes and Bandages Market Size 2032 |

USD 11.76 Billion |

The Medical Tapes and Bandages Market feature prominent players such as 3M Company, Johnson&Johnson, Cardinal Health Inc., Medline Industries Inc., Essity, McKesson Corporation, Integra Lifesciences Holdings Corporation, Smith & Nephew Plc., B. Braun Melsungen AG and PAUL HARTMANN AG actively advancing product portfolios through innovation and geographic expansion. Regionally, North America leads with a market share of 45.5% driven by robust surgical volumes and well-established healthcare infrastructure. Europe follows with a 28.2% share supported by mature systems and high wound care awareness. Asia Pacific holds an 18.9% share and presents the fastest growth potential due to rising healthcare investment and expanding access in emerging markets.

Market Insights

- The Medical Tapes and Bandages Market was valued at USD 8.08 Billion in 2024 and is projected to reach USD 11.76 Billion by 2032, growing at a CAGR of 4.8%.

- Increasing surgical procedures globally and the rising prevalence of chronic and traumatic wounds are the primary growth drivers, boosting the demand for Medical Tapes and Bandages.

- Innovations in wound-care products, including antimicrobial and hypoallergenic features, are transforming the market, offering opportunities for advanced product adoption.

- Price sensitivity and regulatory hurdles are key restraints, limiting the growth of high-end, innovative products in emerging markets and requiring manufacturers to focus on cost-effective solutions.

- North America holds the largest market share at 45.5%, driven by high surgical volumes and healthcare infrastructure, followed by Europe at 28.2% and Asia Pacific at 18.9%, with rapid growth expected in emerging economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

The Medical Tapes and Bandages Market is segmented by application into Surgical Wound Treatment, Traumatic Wound Treatment, Ulcer Treatment, and Other Applications. In 2024, the Surgical Wound Treatment segment holds the dominant share, accounting for 38.5% of the market. This dominance is driven by the increasing number of surgical procedures globally, which necessitate the use of Medical Tapes and Bandages for wound closure and protection. The growing demand for surgical treatments, coupled with advancements in surgical techniques, is propelling the segment’s growth.

- For instance, Ethicon (Johnson & Johnson MedTech) reported that its SURGICEL absorbable hemostatic products have been used in more than 100 million surgical procedures worldwide, supporting incision management and reducing intraoperative bleeding across diverse specialties.

By Product

The market is divided into Bandages and Medical Tapes, with the Medical Tapes segment leading, holding a 56.7% share in 2024. Medical tapes are essential for wound securing and post-operative care, driving their significant demand across healthcare settings. Their versatility, adhesive strength, and ease of use make them the preferred choice for medical professionals, especially in surgical and traumatic wound care. The ongoing trend toward advanced, skin-friendly, and hypoallergenic tapes further fuels the segment’s growth.

- For instance, Nitto Denko is a major manufacturer of medical adhesive products and tapes, recognized as one of the key global players in the medical adhesive tapes market.

By End-User

The Medical Tapes and Bandages Market is categorized into Hospitals, Ambulatory Surgery Centers, Clinics, and Home Care Settings. The Hospitals segment dominates with a market share of 43.2% in 2024. This is primarily driven by the high volume of wound care treatments and surgeries conducted in hospitals, which require a steady supply of Medical Tapes and Bandages. The continuous advancements in hospital infrastructure, along with increased patient admissions, contribute to the strong growth of this segment.

Key Growth Drivers

Rising Surgical Procedures

The increasing frequency of surgical procedures globally is a key growth driver for the Medical Tapes and Bandages Market. As the number of surgeries continues to rise due to an aging population, lifestyle-related diseases, and advancements in medical technology, the demand for Medical Tapes and Bandages to secure and protect wounds post-surgery is growing. Hospitals and surgical centers rely heavily on these products to ensure proper healing and reduce complications, further contributing to the market’s expansion.

- For instance, the International Society of Aesthetic Plastic Surgery (ISAPS) 2024 Global Survey reported more than 17.4 million surgical cosmetic procedures performed worldwide in 2024, all requiring postoperative wound management materials such as tapes and bandages.

Traumatic and Chronic Wound Care

The growing prevalence of traumatic injuries and chronic conditions, such as diabetes-related wounds and ulcers, significantly drives the demand for Medical Tapes and Bandages. As the global incidence of these conditions rises, especially in older populations, there is an increasing need for effective wound care solutions. Medical Tapes and Bandages play a crucial role in managing these wounds, promoting faster healing, and preventing infection, boosting the market’s growth in both healthcare facilities and home care settings.

- For instance, the World Health Organization reports that road traffic accidents cause around 50 million non-fatal injuries each year, creating a substantial volume of cases requiring wound dressing and securement materials.

Advancements in Product Innovation

Innovations in Medical Tapes and Bandages are another major growth driver for the market. Companies are continuously developing products with advanced features, such as antimicrobial properties, breathability, and hypoallergenic adhesives, to cater to evolving healthcare needs. These advancements not only enhance the healing process but also improve patient comfort and reduce complications. The development of smart bandages that can monitor wound healing and deliver medication is expected to further boost demand, driving growth in the market.

Key Trends & Opportunities

Shift Toward Home Care Settings

The increasing shift toward home care and self-management of wounds presents a significant opportunity for growth in the Medical Tapes and Bandages Market. As healthcare systems worldwide focus on reducing costs and improving patient outcomes, more patients are being treated in home care settings. This trend is creating a growing demand for easy-to-use, effective wound care products, such as Medical Tapes and Bandages, that can be used independently by patients or caregivers at home.

- For instance, the U.S. Centers for Medicare & Medicaid Services reported that over 3.5 million patients receive home health services annually, many of whom require regular wound dressing and securement materials.

Adoption of Eco-friendly and Biodegradable Products

Sustainability is becoming a prominent trend in the medical products market. The demand for eco-friendly and biodegradable Medical Tapes and Bandages is increasing as consumers and healthcare providers are more focused on reducing environmental impact. Companies are responding by developing products made from sustainable materials that offer the same performance as traditional products, providing a significant growth opportunity in the market as eco-conscious consumers seek greener alternatives.

- For instance, Lohmann & Rauscher developed biodegradable nonwoven materials capable of decomposing in under 90 days under industrial composting conditions, advancing the use of sustainable substrates in medical bandages.

Key Challenges

High Costs of Advanced Products

The high cost of advanced Medical Tapes and Bandages, particularly those with added features such as antimicrobial properties or smart bandage technology, presents a significant challenge in the market. These products often come with a higher price tag, which can limit their adoption, especially in emerging markets where healthcare budgets are more constrained. The cost disparity between basic and advanced products may also hinder widespread use in some healthcare settings, posing a challenge to market growth.

Regulatory Hurdles and Product Approval

Another major challenge in the Medical Tapes and Bandages Market is navigating complex regulatory requirements for product approval. Manufacturers must adhere to stringent regulations and obtain approvals from health authorities such as the FDA and EMA, which can delay product launches and increase costs. This regulatory burden, coupled with the varying standards across different regions, can slow the market’s expansion and pose a barrier to entry for new and innovative products.

Regional Analysis

North America

The North America region holds a dominant market share of 45.5% in the global Medical Tapes and Bandages market for 2023. This commanding share reflects the region’s advanced healthcare infrastructure, high volumes of surgical procedures, and widespread utilization of wound‑care products in post‑operative and trauma settings. A well‑established reimbursement landscape and the strong presence of key industry players further support this leadership. The prevalence of chronic conditions such as diabetes and obesity in the region drives demand for dressings and secure tapes, reinforcing North America’s position as the largest regional market.

Europe

In Europe, the Medical Tapes and Bandages market holds a market share of 28.2%, benefiting from mature health systems and strong regulatory oversight. The region’s share aligns closely behind North America, with high volumes of surgical wound care, trauma treatment, and ulcer management. Growth stems from the ageing population and increasing rates of chronic wound cases, prompting healthcare providers to invest in advanced dressings and adhesives. Manufacturers are targeting European tenders with innovations such as antimicrobial bandages and skin‑friendly tapes, enabling the region to sustain steady demand and maintain a substantial portion of the global market.

Asia Pacific

The Asia Pacific region accounts for 18.9% of the global market, emerging as a high‑growth area driven by rising healthcare spending, expanding infrastructure, and increasing incidence of trauma and chronic wounds. While its market share remains lower than that of North America or Europe, rapid expansion in countries like China, India, and Southeast Asia is accelerating its contribution. Key drivers include growing surgical volumes, a rising geriatric population, and expanding access to outpatient wound‑care services. The region offers substantial upside potential, with local manufacturers partnering with global players to serve rising demand.

Latin America

Latin America holds a market share of 4.3% in the global Medical Tapes and Bandages market, with growth driven by expanding surgical interventions and trauma care. Although its market share is smaller compared to major markets, factors such as increasing healthcare expenditure, improving access to wound‑care products, and rising awareness of chronic wound management are boosting regional demand. Hospitals and ambulatory care centers in Brazil, Mexico, and other countries are increasingly adopting advanced bandages and medical tapes, creating growth opportunities for both global and regional suppliers to establish stronger footholds.

Middle East & Africa

The Middle East & Africa region holds a modest share of 3.1% in the global Medical Tapes and Bandages market but is poised for steady growth as healthcare infrastructure improves and surgical volumes increase. Demand is being supported by expanding hospital networks, rising incidence of diabetes‑related ulcers, and an enhanced focus on wound care services in emerging markets. Although per‑capita adoption remains lower than in developed regions, international players are increasingly engaging with regional distributors and government hospital systems to gain entry, positioning the region as a future growth frontier for wound‑care products.

Market Segmentations

By Application

- Surgical Wound Treatment

- Traumatic Wound Treatment

- Ulcer Treatment

- Other Applications

By Product

By End User

- Hospitals

- Ambulatory Surgery Centers

- Clinics

- Home Care Settings

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Medical Tapes and Bandages market features major key players such as 3M Company, Johnson & Johnson, Cardinal Health Inc., Medline Industries Inc., Essity, McKesson Corporation, Integra Lifesciences Holdings Corporation, Smith & Nephew Plc., B. Braun Melsungen AG and PAUL HARTMANN AG. These firms are actively competing via product innovation, strategic partnerships and geographic expansion to strengthen their position in this highly competitive arena. The market is characterized by high entry barriers owing to regulatory requirements and strong brand reputations, compelling smaller players to focus on niche innovations or regional growth. Companies are increasingly investing in advanced adhesive technologies, antimicrobial dressings and sustainable materials to differentiate their offerings and capture greater market share. They also emphasise cost‑efficiencies and value‑based products to address price‑sensitive markets while maintaining margins.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Medline Industries Inc.

- PAUL HARTMANN AG

- Cardinal Health Inc.

- McKesson Corporation

- Integra Lifesciences Holdings Corporation

- B. Braun Melsungen AG

- Essity

- Smith & Nephew Plc.

- 3M Company

- Johnson & Johnson

Recent Developments

- In March 2025, Medline launched the Synthetic Ligament Augmentation implant, targeting orthopaedic surgery centers

- In December 2023, Lohmann & Rauscher (L&R) shared a social media post related to Rosidal K and creativity for Christmas, but did not launch a new “Smart” system.

- In February 2023, 3M Company launched its new medical adhesive tape product 3M Medical Tape 4578, which supports up to 28‑day wear time for skin‑attached medical devices, doubling the previous industry standard.

Report Coverage

The research report offers an in-depth analysis based on Application, Product, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will benefit from the increasing global geriatric population, which will drive higher demand for wound care‑related supplies including tapes and bandages.

- Surgeons and healthcare systems will perform more operative procedures worldwide, increasing the use of Medical Tapes and Bandages for surgical wound management and post‑operative care.

- Adoption of advanced wound‑care products featuring antimicrobial properties, moisture management and skin‑friendly adhesives will accelerate, pushing market growth.

- Expansion of home‑care and ambulatory settings will open new channels for tapes and bandages as patients shift from hospital‑based to self‑managed wound care.

- Sustainable and eco‑friendly product variants such as biodegradable backings and solvent‑free adhesives will gain traction as healthcare providers prioritise environmental impact.

- Emerging markets in Asia‑Pacific, Latin America and Middle East & Africa will offer strong growth opportunities as healthcare infrastructure improves and awareness of wound‑care needs rises.

- Digital integration and “smart” bandages with sensors or connectivity will transform the tape and bandage space, enabling monitoring of wound healing and improving outcomes.

- Price pressure and reimbursement constraints will prompt manufacturers to optimise cost‑effective solutions and value‑based products to secure adoption across diverse healthcare settings.

- Regulatory frameworks and quality standards will tighten, encouraging healthcare providers to shift toward certified and high‑performance tapes and bandages, raising the barrier for low‑quality imports.

- Consolidation and strategic partnerships among key industry participants and regional players will increase, driving innovation, distribution strength and global reach for differentiated products.