Market Overview

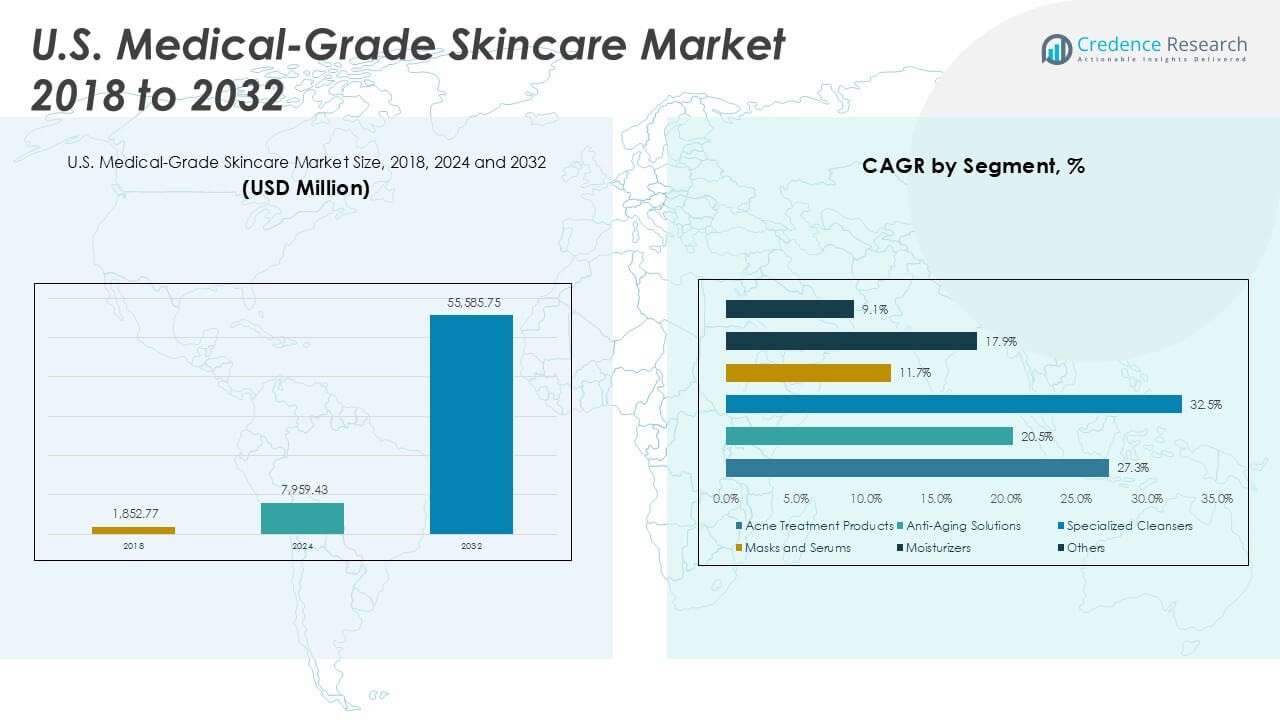

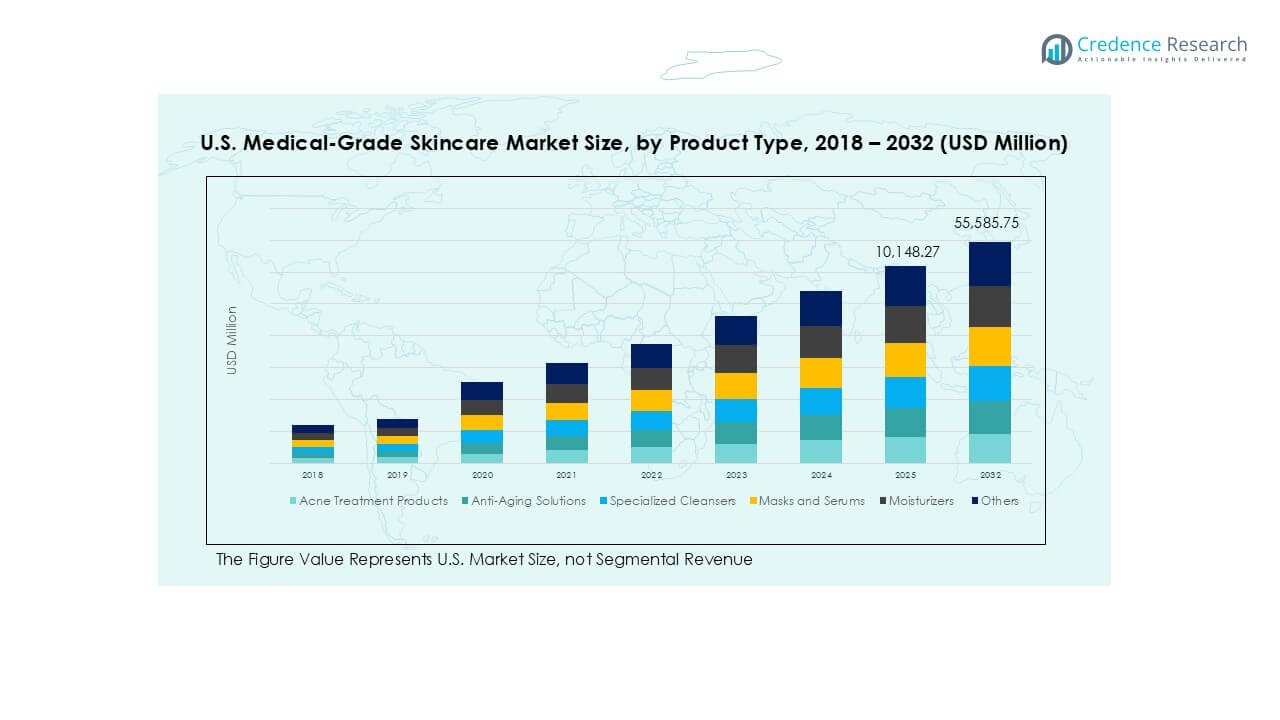

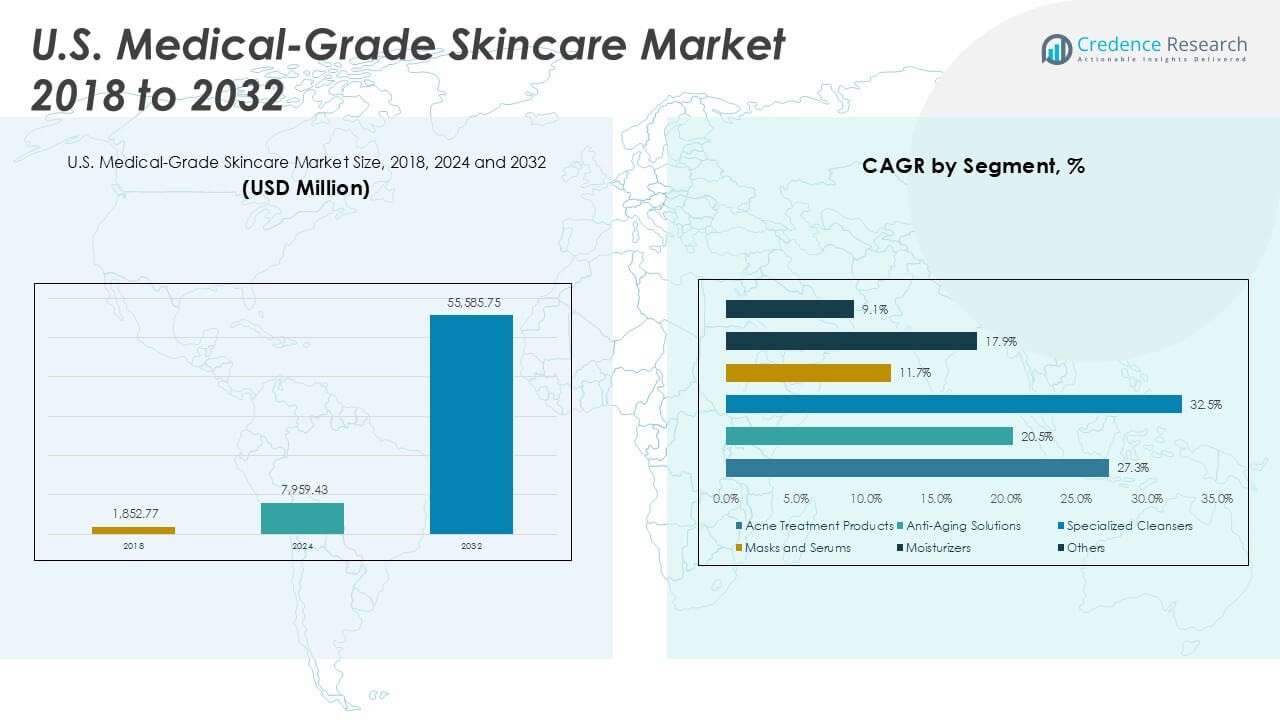

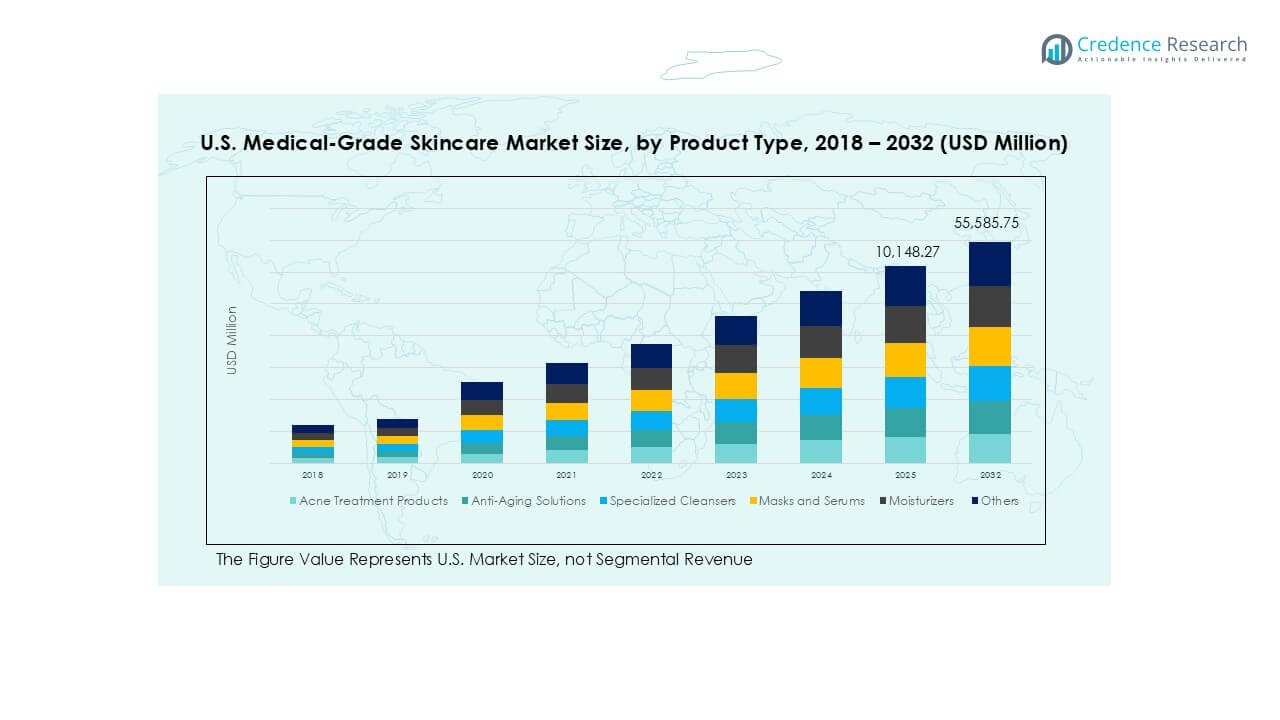

The U.S. Medical-Grade Skincare market size was valued at USD 1,852.77 million in 2018, increased to USD 7,959.43 million in 2024, and is anticipated to reach USD 55,585.75 million by 2032, growing at a CAGR of 27.50% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Medical-Grade Skincare Market Size 2024 |

USD 7,959.43 Million |

| U.S. Medical-Grade Skincare Market, CAGR |

27.50% |

| U.S. Medical-Grade Skincare Market Size 2032 |

USD 55,585.75 Million |

The U.S. medical-grade skincare market is led by key players such as Allergan (AbbVie Inc.), Galderma S.A., Johnson & Johnson, Bausch Health Companies Inc., and SkinCeuticals (L’Oréal). These companies maintain strong market positions through clinical efficacy, broad product portfolios, and strategic alliances with dermatologists and aesthetic professionals. Emerging brands like Revance Therapeutics, Prollenium Medical Technologies, and Suneva Medical are gaining traction with targeted innovations. Regionally, the West holds the largest share, accounting for 29% of the market in 2024, driven by a strong cosmetic culture, high disposable income, and concentration of aesthetic clinics and skincare innovators.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. medical-grade skincare market was valued at USD 7,959.43 million in 2024 and is projected to reach USD 55,585.75 million by 2032, growing at a CAGR of 27.50% during the forecast period.

- Growth is driven by increasing consumer preference for dermatologist-recommended products, rising skin health awareness, and expanding demand for anti-aging and sensitive skin solutions.

- Key trends include the rise of direct-to-consumer online models, growing interest in preventive skincare, and the integration of advanced ingredients and delivery systems in product formulations.

- The market is dominated by leading players such as Allergan (AbbVie Inc.), Galderma S.A., Johnson & Johnson, and SkinCeuticals (L’Oréal), with intense competition from emerging innovators like Revance Therapeutics and Suneva Medical.

- Regionally, the West holds the largest share at 29%, followed by the Northeast at 28%, while anti-aging solutions lead the product type segment due to high demand for youthful, clinically effective skincare.

Market Segmentation Analysis:

By Product Type

In the U.S. medical-grade skincare market, anti-aging solutions emerged as the dominant product type, accounting for the highest market share in 2024. This segment continues to grow due to increasing consumer demand for youthful skin, rising awareness about early signs of aging, and the availability of high-performance formulations containing retinol, peptides, and antioxidants. Additionally, the aging population and heightened focus on preventive skincare have contributed to robust demand. Acne treatment products and specialized cleansers also follow closely, driven by the prevalence of skin conditions among both adolescents and adults and the shift toward dermatologist-recommended products.

- For instance, SkinCeuticals, a L’Oréal brand, launched its Triple Lipid Restore 2:4:2 with a patented ratio of 2% ceramides, 4% cholesterol, and 2% fatty acids—clinically shown to improve skin smoothness by 66% in 8 weeks.

By Skin Type and Application Area

Among skin types, sensitive skin held the largest market share, reflecting a surge in consumer preference for hypoallergenic, fragrance-free, and dermatologist-tested formulations. Growing awareness of skin sensitivities, especially due to environmental stressors and lifestyle changes, has fueled this segment’s growth. In terms of application area, the face segment led the market with a significant revenue share, as facial skincare remains the focal point of both corrective and preventive routines. Increasing adoption of serums, moisturizers, and targeted treatments for fine lines, pigmentation, and acne has significantly boosted this segment’s expansion.

- For instance, Cetaphil, a Galderma brand, reformulated 5 of its core products in 2021 with dermatologically supported blends that include niacinamide, panthenol, and glycerin—used in over 70 clinical studies involving more than 32,000 patients globally.

By Distribution Channel

Dermatology clinics and hospitals dominated the distribution channel segment, holding the highest share in 2024. These professional settings ensure credibility and product efficacy, making them a trusted source for medical-grade skincare. The segment’s growth is supported by increased dermatologist consultations, especially for chronic or aging-related skin concerns. Online retail also witnessed rapid expansion due to growing digital penetration, convenience, and access to professional-grade products directly from brands or authorized sellers. Meanwhile, medical spas continue gaining traction for offering skincare under expert supervision in a wellness-focused environment.

Key Growth Drivers

Rising Consumer Demand for Dermatologist-Recommended Products

The growing awareness of skin health and efficacy of medically tested products has fueled demand for dermatologist-recommended skincare solutions in the U.S. market. Consumers increasingly prioritize formulations that address specific concerns such as aging, acne, and sensitivity, with proven clinical results. This demand is particularly strong among urban, middle-to-high-income demographics who seek personalized treatments with assured safety and effectiveness. The shift from cosmetic to therapeutic skincare, supported by endorsements from skin professionals, continues to drive market expansion and consumer trust in medical-grade product offerings.

- For instance, Allergan’s SkinMedica TNS Advanced+ Serum, backed by 30+ clinical studies, has been shown to improve coarse wrinkles in 6 weeks and lift sagging skin in 8 weeks, based on measurable dermatological assessments.

Expansion of Aesthetic and Dermatological Services

The proliferation of dermatology clinics, aesthetic centers, and medical spas across the U.S. has significantly boosted the visibility and accessibility of medical-grade skincare products. These facilities often serve as key distribution channels and promote product adoption by integrating them into post-procedure regimens and ongoing skincare maintenance routines. Increasing demand for non-invasive cosmetic procedures and preventive skin treatments is further encouraging professionals to recommend medically backed skincare. As patient volume rises, so does the retail potential of medical-grade lines, enhancing growth across both clinical and retail environments.

- For instance, Revance Therapeutics partnered with over 1,500 aesthetic practices across the U.S. for its RHA Collection of dermal fillers, incorporating skincare integration into facial treatment plans with measurable patient retention improvements.

Technological Advancements in Skincare Formulations

Ongoing innovation in skincare technology, such as encapsulation, time-release actives, and bioengineered ingredients, is advancing the efficacy of medical-grade products. Brands are investing in R&D to develop formulations that deliver targeted results while minimizing irritation, thereby appealing to consumers with sensitive skin or complex needs. Enhanced delivery systems and data-driven personalization tools are creating opportunities for better user experiences and increased product adoption. These technological improvements also enable differentiation in a competitive market, reinforcing brand credibility and expanding product portfolios tailored to various skin conditions.

Key Trends & Opportunities

Growth of E-Commerce and Direct-to-Consumer Models

The digital transformation of retail has opened new avenues for medical-grade skincare brands to reach consumers directly through online platforms. Increased comfort with e-commerce, especially post-pandemic, allows consumers to access clinically proven products without visiting a clinic. Brands are leveraging teleconsultation, subscription models, and personalized regimens to build lasting relationships and ensure repeat purchases. This trend offers significant scalability and market penetration opportunities, particularly for emerging brands and those targeting tech-savvy consumers seeking convenient, professional-grade skincare solutions from home.

- For instance, PCA Skin reported a 43% increase in direct-to-consumer online sales after launching its virtual skin consultation program, which matched over 20,000 customers with customized skincare routines within the first 6 months.

Rising Interest in Preventive and Holistic Skincare

A shift toward preventive skincare and holistic wellness is creating demand for products that not only treat but also preserve skin health over time. Consumers are more focused on early intervention, lifestyle-aligned ingredients, and integrative approaches combining nutrition, stress management, and skincare. Medical-grade products that include multifunctional benefits—such as hydration, antioxidant protection, and barrier repair—are particularly appealing. This trend is encouraging product innovation across anti-aging, sensitive skin, and daily care lines, positioning the market for long-term growth through proactive skincare routines.

Key Challenges

High Product Cost and Limited Insurance Coverage

Medical-grade skincare products often come with premium pricing due to high-quality ingredients, clinical testing, and brand positioning. These costs can limit accessibility for broader demographics, especially since such products are typically not covered by insurance plans. Price-sensitive consumers may opt for over-the-counter alternatives or forego consistent use, impacting market growth. Addressing this challenge will require strategic pricing, bundling, or loyalty programs to retain customers and expand reach across income segments.

- For instance, Bausch Health introduced a tiered pricing model for select Obagi Medical products in the U.S., offering clinic-based loyalty discounts, which resulted in over 12,000 enrollments within the first quarter of 2023.

Regulatory and Labeling Constraints

The U.S. market faces regulatory ambiguity regarding the classification of medical-grade skincare, which falls between cosmetics and pharmaceuticals. This gray area can lead to inconsistent labeling, marketing claims, and distribution challenges. Companies must navigate FDA guidelines carefully to avoid compliance issues while maintaining product efficacy and marketing appeal. The need for transparent and accurate product representation, along with evolving regulatory standards, poses a challenge for new entrants and established brands alike in maintaining credibility and operational efficiency.

Intense Market Competition and Brand Proliferation

The medical-grade skincare segment is becoming increasingly crowded, with numerous established brands and new entrants vying for market share. This saturation can make it difficult for consumers to differentiate between products, leading to brand fatigue and diluted customer loyalty. Furthermore, larger players with substantial marketing budgets can overshadow smaller brands, making it challenging to sustain visibility and customer acquisition. To overcome this, companies must focus on unique value propositions, targeted marketing strategies, and strong partnerships with healthcare professionals.

Regional Analysis

Northeast

The Northeast region holds a significant share of the U.S. medical-grade skincare market, accounting for approximately 28% of total revenue in 2024. The presence of top-tier dermatology clinics, high consumer awareness, and a dense urban population drive strong demand in this region. Cities like New York and Boston serve as key hubs for both innovation and consumption, supported by a strong network of medical spas and specialty retailers. Additionally, higher disposable incomes and a strong preference for science-backed skincare products contribute to the region’s robust market performance, particularly in anti-aging and sensitive skin product categories.

- For instance, Galderma operates a flagship U.S. dermatology R&D hub in Princeton, New Jersey, where more than 120 skin-focused clinical studies were initiated between 2021 and 2023.

Midwest

The Midwest region captured around 17% of the U.S. medical-grade skincare market share in 2024. While traditionally more conservative in skincare spending, this region has shown steady growth driven by increasing access to dermatological services and expanding online retail penetration. Key metropolitan areas such as Chicago, Minneapolis, and Detroit are witnessing rising consumer interest in professional skincare, particularly among aging populations and individuals with chronic skin conditions. Growing adoption of dermatologist-recommended products and rising influence of wellness trends are helping to shape market dynamics in this region, albeit at a slower pace compared to coastal areas.

- For instance, Johnson & Johnson’s Neutrogena Skin360 digital skin assessment app has been downloaded over 500,000 times across Midwest states, offering customized regimens that integrate with medical-grade skincare recommendations.

South

The South accounted for nearly 26% of the U.S. medical-grade skincare market share in 2024. States like Florida and Texas are leading contributors due to their large, diverse populations, higher exposure to UV-related skin damage, and well-established cosmetic procedure markets. The region is experiencing growing demand for both anti-aging and acne-related solutions, particularly in urban centers where aesthetic treatments are widely available. Medical-grade product sales are further supported by a growing number of dermatology clinics, med-spas, and physician-owned skincare lines. The rising popularity of non-invasive skincare procedures and wellness-focused lifestyles continues to propel market expansion in this region.

West

The West region holds the largest market share, approximately 29% in 2024, making it the leading contributor to the U.S. medical-grade skincare market. California dominates this regional performance due to its progressive beauty culture, strong focus on skincare innovation, and concentration of top aesthetic dermatology practices. The region’s affluent and health-conscious consumer base actively seeks advanced skincare products and personalized regimens. Additionally, the growing presence of direct-to-consumer medical-grade skincare startups headquartered in this region strengthens its leadership. Demand for holistic, clean, and clinically tested formulations continues to shape product offerings and sustain market leadership in the West.

Market Segmentations:

By Product Type

- Acne Treatment Products

- Anti-Aging Solutions

- Specialized Cleansers

- Masks and Serums

- Moisturizers

- Others

By Skin Type

- Combination Skin

- Dry Skin

- Oily Skin

- Sensitive Skin

- Others

By Application Area

- Face

- Eye Area

- Lips

- Neck

- Others

By Distribution Channel

- Dermatology Clinics and Hospitals

- Medical Spas

- Online Retail

- Beauty Retail Stores

- Pharmacies

- Supermarkets

By Geography

- Northeast Region

- Midwest Region

- South Region

- West Region

Competitive Landscape

The U.S. medical-grade skincare market exhibits a moderately consolidated competitive landscape, with a mix of established pharmaceutical companies, dermatology-focused firms, and emerging skincare brands. Key players such as Allergan (AbbVie Inc.), Galderma S.A., Johnson & Johnson, and L’Oréal’s SkinCeuticals dominate market share through extensive product portfolios, strong brand recognition, and strategic collaborations with dermatology professionals. These companies leverage advanced R&D capabilities, robust distribution networks, and clinical backing to maintain competitive advantages. Market competition is intensifying due to increasing consumer demand, product innovation, and the rise of e-commerce, prompting firms to invest in technology-driven solutions and targeted marketing strategies. Mergers, acquisitions, and partnerships with medical professionals are common growth strategies, enabling companies to expand their reach and enhance product credibility. As regulatory scrutiny increases, compliance and product transparency remain critical factors influencing competitive positioning.

- For instance, in 2023, L’Oréal acquired California-based biotech firm Functionalab Group, expanding SkinCeuticals’ U.S. reach by adding over 500 medical spa partners and strengthening its clinical distribution footprint.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Allergan (AbbVie Inc.)

- Galderma S.A.

- Johnson & Johnson

- Bausch Health Companies Inc.

- Revance Therapeutics

- Suneva Medical

- Prollenium Medical Technologies

- SkinCeuticals (L’Oréal)

- Zelens

- PCA Skin

Recent Developments

- In June 2025, the FDA accepted Allergan’s supplemental premarket approval (sPMA) application for SKINVIVE by JUVÉDERM®, aiming to expand its use to include improvement of neck appearance. If approved, SKINVIVE would be the first hyaluronic acid injectable specifically indicated for neck line treatment.

- In July 2025, Solta Medical, a division of Bausch Health Companies Inc., launched Fraxel FTX™, a new fractional laser device for skin rejuvenation. The device features a redesigned ergonomic handpiece and dual-wavelength technology. The US market launch is targeting dermatologists and aesthetic clinics nationwide, with plans to expand globally.

- In March 2025, Galderma S.A. showcased updates at AAD 2025, including new data for Nemluvio® (nemolizumab) for prurigo nodularis/atopic dermatitis, ready-to-use liquid neuromodulator Relfydess®, and new acne/sensitive skin solutions.

- In January 2025, Allergan (now part of AbbVie) launched the AA Signature Program at the IMCAS World Congress 2025. This program focuses on providing healthcare providers with a personalized, holistic approach to skincare treatment planning using Allergan Aesthetics’ product portfolio. The program aims to address key patient needs, including lift, definition, and skin quality, and offers advanced training and education for practitioners.

Market Concentration & Characteristics

The U.S. Medical-Grade Skincare Market exhibits moderate to high market concentration, with a few dominant players accounting for a significant share of total revenue. Large pharmaceutical and dermatology-focused companies such as Allergan (AbbVie Inc.), Galderma S.A., and Johnson & Johnson lead the market due to their established brand reputation, clinical expertise, and extensive distribution networks. It features strong affiliations with dermatologists, medical spas, and aesthetic clinics, which influence product adoption and consumer trust. The market is characterized by high product differentiation based on skin concerns, active ingredients, and formulation technologies. Companies compete through innovation, product efficacy, and professional endorsements rather than price. Consumer preference for clinically tested, dermatologist-recommended solutions creates entry barriers for non-medical brands. It also experiences rising competition from emerging players offering targeted, niche solutions through digital and direct-to-consumer channels. Regulatory compliance, ingredient transparency, and scientific validation remain essential for sustained competitiveness. The market supports high margins due to the premium nature of the products and patient loyalty driven by professional consultation.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Skin Type, Application Area, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The U.S. medical-grade skincare market is expected to maintain strong growth driven by rising demand for clinically proven skincare solutions.

- Anti-aging and sensitive skin products will continue to dominate as consumers prioritize long-term skin health and safety.

- Technological innovation in ingredient delivery and personalized skincare will shape new product development.

- Dermatologist and aesthetic professional partnerships will remain critical to driving product credibility and adoption.

- Online and direct-to-consumer channels will gain greater traction, expanding access beyond clinical settings.

- Preventive skincare trends will push demand for early-intervention and multi-functional skincare solutions.

- Companies will invest more in clean, transparent formulations that meet both regulatory and consumer expectations.

- Expansion of medical spas and aesthetic clinics will further enhance product reach and visibility.

- Competitive pressure will intensify, encouraging both established players and startups to innovate faster.

- Regional growth will remain strongest in the West and Northeast, supported by higher awareness and disposable income.