Market Overview:

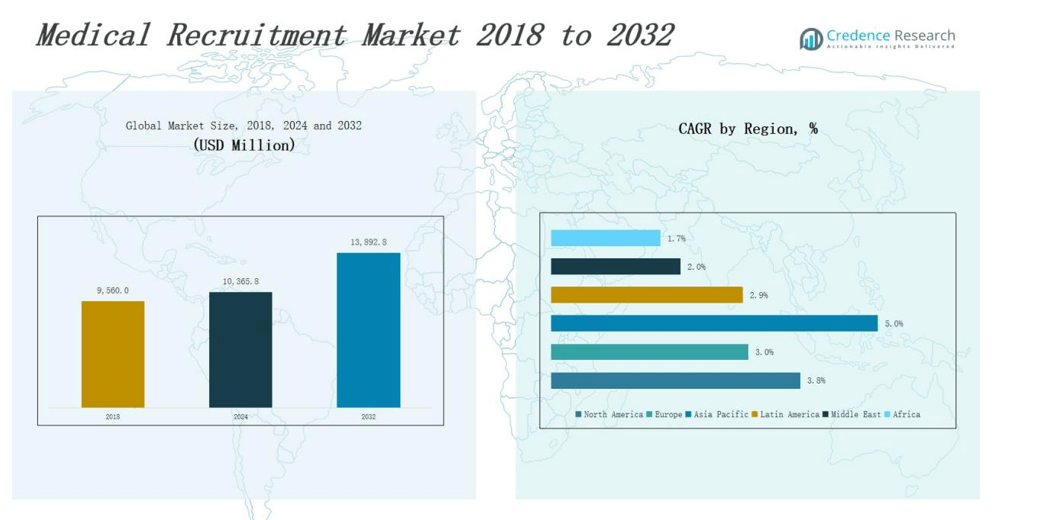

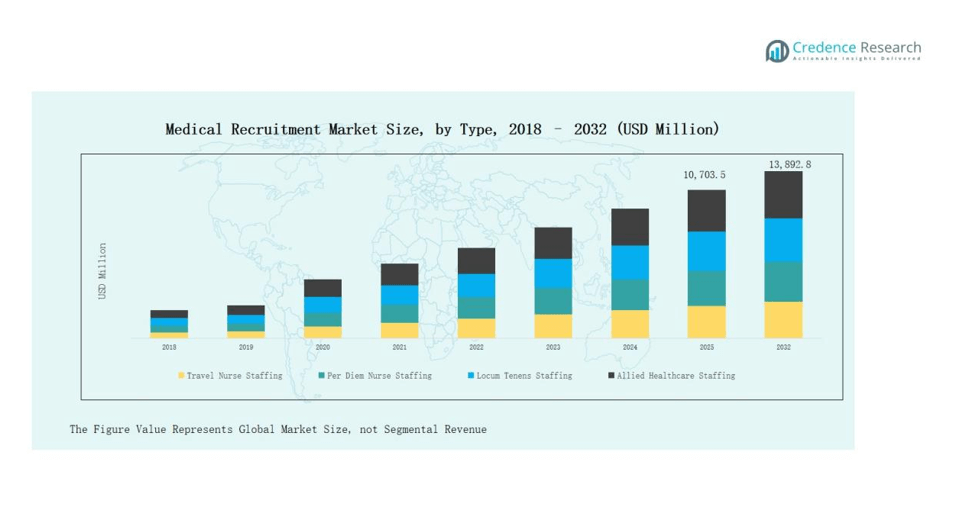

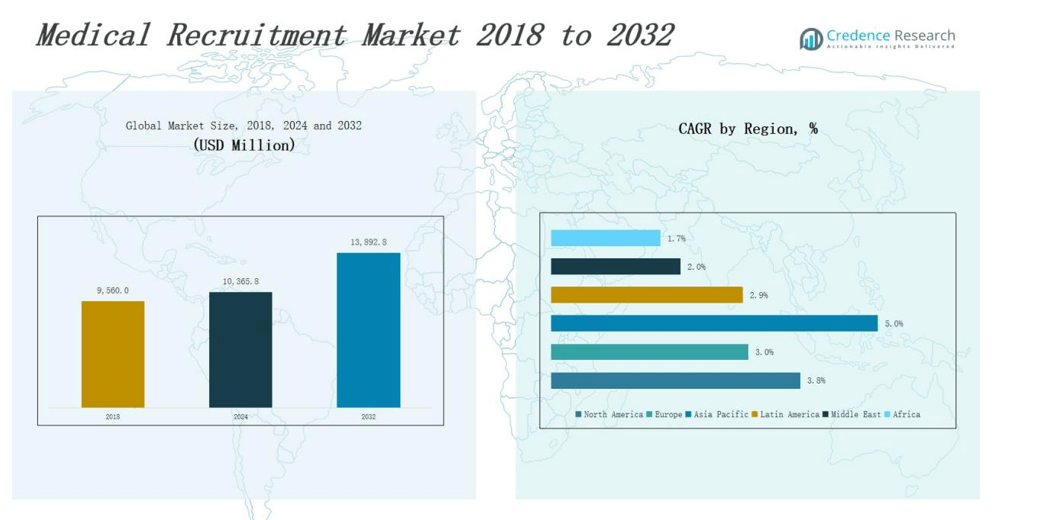

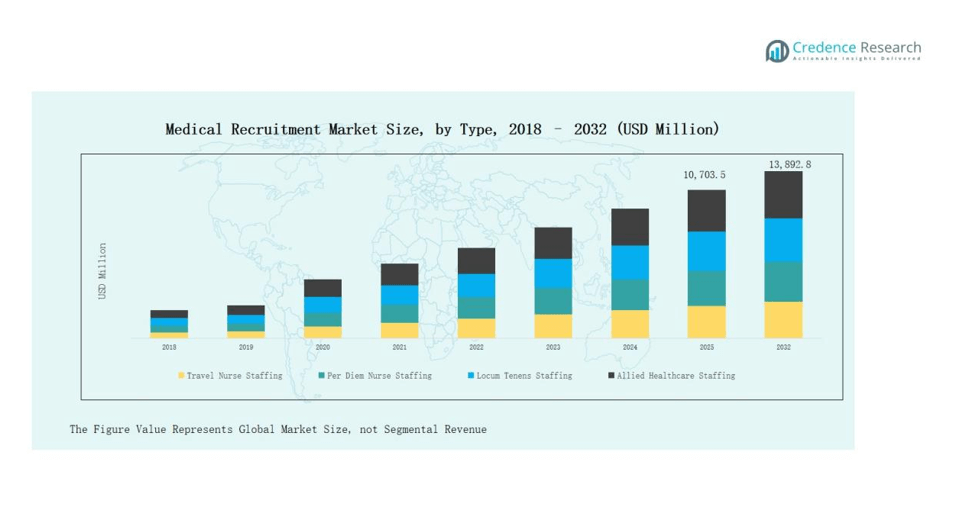

Medical Recruitment Market size was valued at USD 9,560.0 million in 2018 to USD 10,365.8 million in 2024 and is anticipated to reach USD 13,892.8 million by 2032, at a CAGR of 3.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medical Recruitment Market Size 2024 |

USD 10,365.8 million |

| Medical Recruitment Market , CAGR |

3.8% |

| Medical Recruitment Market Size 2032 |

USD 13,892.8 million |

The medical recruitment market is shaped by prominent players including AMN Healthcare, CHG Healthcare, Maxim Healthcare Services, LocumTenens.com, and Cross Country Healthcare. These companies focus on providing tailored staffing solutions, digital recruitment platforms, and global placement services to meet rising healthcare workforce needs. Strategic mergers, technology integration, and specialty-focused hiring strengthen their market presence. Regionally, North America dominates the medical recruitment market with a 41 percent share, supported by advanced healthcare infrastructure, high demand for skilled professionals, and strong adoption of recruitment process outsourcing models.

Market Insights

- The Medical Recruitment Market grew from USD 9,560.0 million in 2018 to USD 10,365.8 million in 2024, projected at USD 13,892.8 million by 2032.

- Travel nurse staffing dominates type segmentation with 38% share, followed by per diem at 24%, locum tenens at 21%, and allied healthcare staffing at 17%.

- Hospitals lead the end-use segment with 46% share, clinics hold 26%, ambulatory facilities 18%, and others including long-term care and home healthcare account for 10%.

- North America commands 34% share, Europe 21%, Asia Pacific 23%, Latin America 8%, Middle East 7%, and Africa 7% of the global market in 2024.

- Leading players such as AMN Healthcare, CHG Healthcare, Maxim Healthcare Services, LocumTenens.com, and Cross Country Healthcare drive market growth through staffing solutions, technology integration, and global placement services.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Type

The type segment of the medical recruitment market is dominated by travel nurse staffing, which holds a 38% share. Rising nurse shortages, demand for flexibility, and seasonal workforce needs make this the leading category. Per diem nurse staffing accounts for 24%, driven by cost flexibility and short-term coverage requirements. Locum tenens staffing captures 21%, addressing physician shortages, especially in rural areas, while allied healthcare staffing holds 17%, supported by growing demand for therapists, technicians, and diagnostic specialists.

- For instance, Cross Country Healthcare expanded its allied staffing services in 2022 to meet rising demand for physical therapists as outpatient rehabilitation volumes grew post-pandemic.

By End-Use

Hospitals lead the end-use segment with a 46% share, supported by high patient volumes and acute care needs. Clinics follow with 26%, benefiting from demand for outpatient services and cost-effective care delivery. Ambulatory facilities represent 18%, reflecting the shift toward outpatient surgeries and minimally invasive procedures. The “Others” category, including long-term care and home healthcare, holds 10% of the market, supported by aging populations and growing demand for chronic disease management and home-based services.

- For instance, the Mayo Clinic (U.S.) reports over 1.3 million unique patients annually, reflecting the scale of hospital-based care.

Market Overview

Rising Healthcare Workforce Shortages

The medical recruitment market is driven by significant shortages of healthcare professionals across hospitals, clinics, and long-term care facilities. Aging populations, rising chronic disease prevalence, and expanding healthcare infrastructure create unprecedented demand for skilled staff. Countries face shortages of physicians and nurses, prompting facilities to rely on recruitment firms and staffing solutions to close workforce gaps. This imbalance drives consistent demand for medical recruitment services worldwide.

- For instance, the World Health Organization (2023) estimated a projected shortfall of 10 million health workers by 2030, disproportionately affecting low- and middle-income countries.

Increasing Demand for Flexible Staffing Models

Healthcare systems increasingly prefer flexible staffing solutions to manage unpredictable patient inflows and seasonal demands. Models such as travel nurse staffing, per diem assignments, and locum tenens are widely adopted. These approaches provide cost efficiency while ensuring continuity of patient care. Professionals also favor flexible roles for better work-life balance, creating a sustainable supply-demand cycle. The adaptability of these models strengthens their role as a major driver for the medical recruitment market.

Government Initiatives and Healthcare Spending

Growing government support for healthcare infrastructure expansion and staffing programs accelerates market growth. Developed nations implement policies to address workforce shortages, while emerging economies invest heavily in healthcare modernization. Rising public and private healthcare spending boosts recruitment demand, particularly in specialized areas such as critical care and diagnostics. Incentives for international recruitment and mobility also expand opportunities, making regulatory support a key driver of market expansion.

- For instance, the UK National Health Service (NHS) introduced its Long Term Workforce Plan (2023), targeting the largest-ever expansion in medical training, including doubling medical school places by 2031, to ensure sustainable staffing.

Key Trends & Opportunities

Integration of Digital Recruitment Platforms

A major trend shaping the medical recruitment market is the adoption of digital hiring platforms and AI-driven tools. Online systems streamline candidate sourcing, credential verification, and job-matching processes. These technologies improve efficiency, reduce hiring times, and ensure compliance with regulatory standards. As healthcare providers seek faster recruitment to address staff shortages, digital platforms present a strong opportunity for market players to differentiate and expand their reach.

- For instance, AMN Healthcare launched its AMN Passport app in 2021, enabling clinicians to search, apply, and onboard for travel nursing jobs directly from a mobile platform, significantly reducing application turnaround times.

Rising Demand for Allied Healthcare Professionals

Opportunities are emerging from the growing need for allied healthcare staff such as therapists, lab technicians, and diagnostic specialists. Expansion of ambulatory facilities, rehabilitation centers, and home healthcare services is driving this demand. Advances in medical technology and diagnostic equipment increase the reliance on skilled allied professionals. Recruitment firms that expand their services beyond physicians and nurses to include these roles are positioned to capture new growth opportunities in the market.

- For instance, Encompass Health, one of the largest rehabilitation providers, owns more than 160 inpatient rehabilitation hospitals staffed heavily with physical therapists, occupational therapists, and speech-language pathologists to support recovery and continuity of care.

Key Challenges

Regulatory and Compliance Barriers

The medical recruitment market faces significant regulatory challenges, including licensing requirements, cross-border credentialing, and varying labor laws. These complexities slow down recruitment processes and increase administrative costs for staffing agencies. Ensuring compliance with strict healthcare standards also demands investment in verification and monitoring systems. Such barriers limit operational efficiency and pose hurdles to international recruitment efforts.

High Attrition and Burnout Among Professionals

High turnover rates and professional burnout present major challenges in sustaining the healthcare workforce. Long working hours, stress, and limited incentives often lead to workforce dissatisfaction. Recruitment agencies face difficulties in retaining professionals once placed, resulting in repeated hiring cycles. This increases costs for providers and slows long-term workforce stabilization. Addressing burnout is critical for improving retention and ensuring consistent staffing availability.

Intense Market Competition

The medical recruitment market is highly competitive, with global firms and regional players competing for contracts. Price-based competition often reduces profit margins for staffing agencies. Established players leverage technology and global networks, making it harder for smaller firms to compete. At the same time, healthcare providers demand cost-effective solutions, pushing recruiters to deliver value-added services. This intense rivalry creates challenges in sustaining differentiation and profitability.

Regional Analysis

North America

North America leads the medical recruitment market with a 34% share in 2024, supported by advanced healthcare infrastructure and strong demand for skilled professionals. The region recorded revenues of USD 3,999.1 million in 2024, projected to reach USD 5,351.9 million by 2032 at a CAGR of 3.8%. The U.S. remains the largest contributor, driven by aging populations, high healthcare expenditure, and persistent staffing shortages across hospitals. Growing reliance on travel nurse staffing and locum tenens continues to fuel recruitment demand in this region.

Europe

Europe holds a 21% share of the medical recruitment market in 2024, with revenues of USD 2,412.9 million. The market is expected to grow moderately, reaching USD 3,039.1 million by 2032 at a CAGR of 3.0%. The region’s demand is shaped by aging demographics, government-backed healthcare initiatives, and workforce mobility across EU countries. Key markets such as Germany, the UK, and France lead recruitment activities, while southern European nations experience growing needs for allied healthcare professionals.

Asia Pacific

Asia Pacific captures a 23% share of the medical recruitment market in 2024, reporting revenues of USD 2,735.0 million. It is projected to expand strongly to USD 4,021.0 million by 2032, growing at a CAGR of 5.0%, the highest among all regions. Rapid urbanization, increasing healthcare investments, and shortages of skilled staff across China, India, and Southeast Asia drive this growth. The region offers opportunities for international recruitment agencies as demand for both physicians and allied healthcare staff surges.

Latin America

Latin America accounts for an 8% share of the medical recruitment market, generating USD 698.5 million in 2024. It is forecasted to reach USD 873.6 million by 2032, growing at a CAGR of 2.9%. Brazil and Argentina lead the regional market, supported by expanding private healthcare networks and rising medical tourism. However, shortages of qualified professionals and uneven healthcare infrastructure create persistent recruitment challenges, which increase reliance on staffing agencies.

Middle East

The Middle East holds a 7% share of the medical recruitment market in 2024, valued at USD 270.5 million. The market is projected to grow modestly to USD 314.1 million by 2032 at a CAGR of 2.0%. Strong demand for international professionals, particularly in GCC countries, drives market growth. Investments in advanced hospitals and specialty care facilities increase staffing requirements. However, regulatory barriers and regional instability limit faster expansion.

Africa

Africa represents a 7% share of the medical recruitment market in 2024, with revenues of USD 249.9 million. By 2032, the market is forecasted to reach USD 293.2 million, growing at a CAGR of 1.7%. The region’s growth is constrained by limited healthcare funding, infrastructure gaps, and brain drain of skilled professionals to developed economies. Nonetheless, rising investments in healthcare modernization and government support for training programs create gradual opportunities for recruitment agencies.

Market Segmentations:

By Type

- Travel Nurse Staffing

- Per Diem Nurse Staffing

- Locum Tenens Staffing

- Allied Healthcare Staffing

By End-Use

- Hospitals

- Clinics

- Ambulatory Facilities

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The medical recruitment market is highly competitive, with a mix of global staffing firms and specialized healthcare recruitment agencies shaping industry dynamics. Leading players include Adecco Group, Randstad N.V., AMN Healthcare, CHG Healthcare, Maxim Healthcare Services, and ManpowerGroup, alongside regional specialists such as Medacs Healthcare, Hays plc, and Robert Walters. These companies focus on expanding service portfolios covering travel nurse staffing, locum tenens, allied healthcare, and per diem placements to address diverse workforce demands. Strategic growth is driven by technology adoption, including AI-enabled recruitment platforms and digital workforce management tools, which streamline hiring processes and credential verification. Partnerships with healthcare providers and cross-border recruitment initiatives further enhance market presence. Intense competition encourages firms to differentiate through tailored solutions, faster placement services, and compliance expertise. Market leaders also invest in mergers, acquisitions, and international expansions to strengthen geographic reach and secure long-term contracts with hospitals, clinics, and ambulatory facilities worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Adecco Group

- Randstad N.V. (Netherlands)

- Kelly Services Inc. (U.S.)

- ManpowerGroup (U.S.)

- Recruit Holdings Co., Ltd. (Japan)

- Hays plc (U.K.)

- Maxim Healthcare Services (U.S.)

- CHG Management, Inc. (U.S.)

- Medacs Healthcare (U.K.)

- Barton Associates (U.S.)

- Allegis Group (U.S.)

- Morgan McKinley (Ireland)

- Robert Walters Plc. (U.K.)

- Korn Ferry (U.S.)

- Jackson Healthcare (U.S.)

- TeamHealth (U.S.)

- AMN Healthcare (U.S.)

Recent Developments

- In August 2025, Workday announced its acquisition of Paradox, an AI-powered conversational recruitment platform. The deal aims to enhance Workday’s talent acquisition tools by improving candidate engagement with instant response, self-scheduling, and 24/7 support.

- In November 2024, GQR Life Sciences partnered with Nebula, an AI-driven talent platform. The partnership focuses on integrating advanced AI tools, including natural language processing, into recruitment processes. It provides biopharma clients access to over 180 million profiles and automated sourcing to reduce time-to-hire.

- on August 13, 2025, StaffDNA® launched DNAInsights, a new technology providing real-time market data and pay rate comparisons to help healthcare organizations track workforce trends and improve hiring efficiency.

- In November 2024, HealthEdge partnered with Codoxo. This strategic partnership focuses on bringing next-generation GenAI tools to healthcare payers and recruiters

Market Concentration & Characteristics

The medical recruitment market demonstrates moderate concentration, with a few global firms holding significant shares alongside numerous regional and niche agencies. Large players such as Adecco Group, Randstad N.V., AMN Healthcare, and ManpowerGroup dominate through extensive networks, diversified staffing solutions, and strong client relationships. It is characterized by high competition, where technology adoption and international reach serve as key differentiators. Specialized firms focus on locum tenens, travel nurses, and allied healthcare to capture growing demand in specific segments. The market reflects a strong dependence on demographic trends, including aging populations and rising chronic disease prevalence, which sustain the need for continuous staffing. Healthcare providers seek cost-efficient and flexible workforce models, reinforcing the importance of contract-based placements. Regulatory compliance, licensing requirements, and cross-border recruitment policies shape operational strategies. The industry exhibits steady growth potential, with digital recruitment platforms and global mobility driving structural shifts in service delivery and client engagement.

Report Coverage

The research report offers an in-depth analysis based on Type, End-Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Travel nurse staffing demand will rise further, driven by shortages and increasing healthcare service pressures.

- Digital recruitment platforms will streamline hiring, offering faster placements and improved compliance for healthcare providers.

- International recruitment will expand significantly, filling workforce gaps in regions facing acute shortages of professionals

- Allied healthcare staffing will grow steadily, supported by rising rehabilitation, diagnostics, and specialized outpatient service needs.

- Hospitals will remain the primary recruiters, requiring continuous staffing to manage acute and critical patient care.

- Clinics and ambulatory facilities will increasingly adopt flexible staffing models to meet fluctuating patient demands.

- Regulatory compliance will strongly influence recruitment processes, requiring agencies to adapt quickly to evolving standards.

- Strategic mergers and acquisitions will help leading players expand global presence and service delivery capabilities.

- Workforce retention strategies will gain importance, aiming to address burnout and reduce frequent staff turnover.

- Emerging markets will create opportunities for global recruitment firms as healthcare investments and infrastructure expand.