Market Overview:

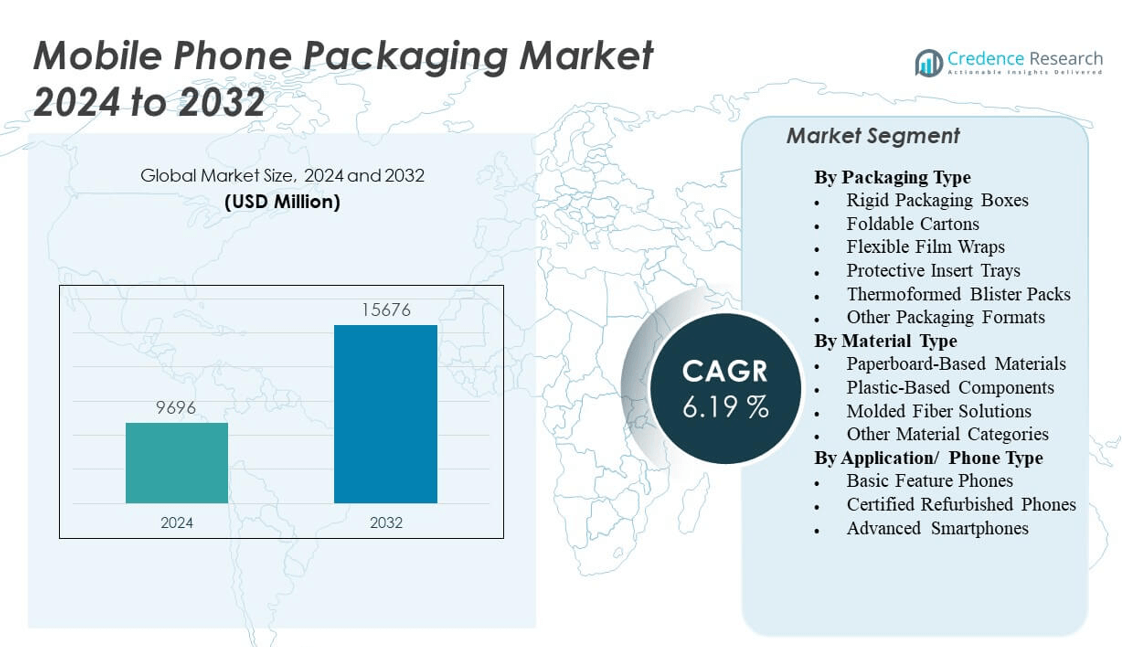

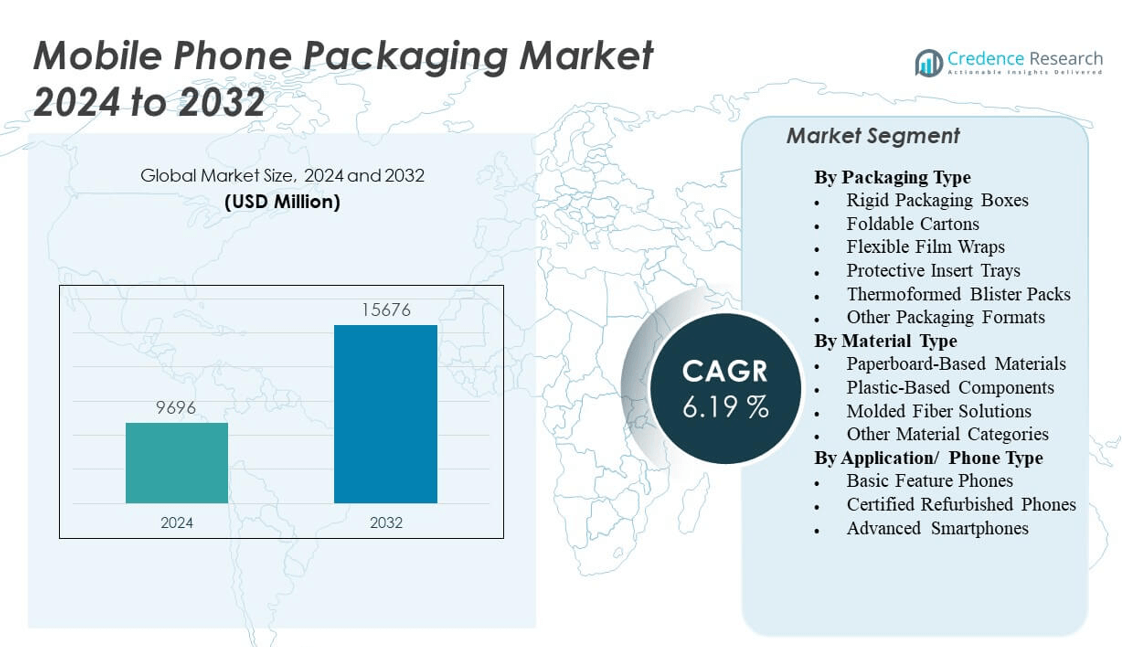

The Mobile Phone Packaging Market is projected to grow from USD 9,696 million in 2024 to an estimated USD 15,676 million by 2032, with a compound annual growth rate (CAGR) of 6.19% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mobile Phone Packaging Market Size 2024 |

USD 9,696 million |

| Mobile Phone Packaging Market, CAGR |

6.19% |

| Mobile Phone Packaging Market Size 2032 |

USD 15,676 million |

Growth in the mobile phone packaging market is driven by rising smartphone penetration, increasing consumer demand for protective and aesthetically appealing packaging, and the growing influence of e-commerce. As mobile devices become more fragile and high-end, manufacturers are investing in durable, lightweight, and eco-friendly packaging to ensure product safety during transit and appeal to environmentally conscious buyers. Technological innovations in printing and design also enhance brand visibility and consumer engagement, fueling competitive differentiation.

Regionally, Asia Pacific dominates the mobile phone packaging market due to its strong manufacturing base, growing smartphone user base, and rapid urbanization across countries like China, India, and South Korea. North America and Europe follow, driven by demand for premium mobile devices and high standards in sustainable packaging. Meanwhile, Latin America and the Middle East & Africa are emerging as promising markets, spurred by increasing mobile phone adoption, infrastructure development, and expanding retail channels.

Market Insights:

- The Mobile Phone Packaging Market is projected to grow from USD 9,696 million in 2024 to USD 15,676 million by 2032, registering a CAGR of 6.19%.

- High global smartphone penetration continues to drive packaging demand across premium and budget segments.

- Sustainability regulations are pushing manufacturers to adopt recyclable and biodegradable packaging materials.

- Volatility in raw material prices and supply chain disruptions present key challenges for packaging producers.

- Asia Pacific holds the largest market share at 49%, supported by strong manufacturing bases and rising smartphone consumption.

- North America accounts for 24% of the market, driven by premium device demand and sustainable packaging adoption.

- Europe holds an 18% share, with strict environmental regulations accelerating use of molded fiber and paperboard solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

High Global Smartphone Penetration Accelerates Packaging Demand Across Regions

The growing global adoption of smartphones fuels sustained demand for mobile phone packaging solutions. Rising consumer affordability and increased digital connectivity contribute to smartphone purchases across developing and developed economies. Manufacturers respond to the volume surge by adopting scalable, cost-efficient packaging materials. It necessitates protection during long-distance logistics and storage, boosting the usage of shock-resistant and tamper-evident designs. The Mobile Phone Packaging Market benefits from this growth trend by aligning packaging formats with evolving mobile device dimensions and shapes. Companies introduce compact, damage-resistant cartons to meet growing distribution requirements. Consumer expectations around sleek presentation also influence premium packaging choices. This broadens demand beyond functionality to encompass branding and unboxing experiences.

- For instance, Samsung, in response to higher shipment volumes, has reduced the packaging volume for its Galaxy Z Fold4 model by 58.2% compared to its first-generation foldable, resulting in a projected reduction of 10,000 tons of transportation carbon emissions by the end of 2022 due to enhanced logistics efficiency.

Sustainability Mandates and Eco-Friendly Materials Drive Industry Shifts

Environmental regulations and corporate sustainability targets are transforming packaging strategies. It compels manufacturers to replace traditional plastic-based solutions with biodegradable, recyclable, or compostable materials. The Mobile Phone Packaging Market sees a rising influx of paperboard, molded fiber, and plant-based alternatives. Brands respond by redesigning structural formats to minimize waste and carbon impact. These changes support green certifications and resonate with eco-conscious consumers, especially in Europe and North America. Retailers and e-commerce platforms are also applying pressure by demanding sustainable packaging compliance. Regulatory bodies tighten waste management and extended producer responsibility (EPR) frameworks. These collective pressures push innovation in low-impact packaging without compromising on durability or presentation.

E-Commerce and Direct-to-Consumer Channels Expand Packaging Requirements

The rapid rise of online mobile phone sales expands the logistical role of packaging. It must ensure product safety through various transit stages and protect against environmental damage. The Mobile Phone Packaging Market experiences heightened demand for packaging that meets both retail shelf appeal and shipping resilience. Brands now focus on formats that combine lightweight structure with shock absorption and waterproofing. The growth of direct-to-consumer models increases reliance on secondary and tertiary packaging layers. QR codes, tamper seals, and authentication labels also become essential to address fraud and traceability. The unboxing experience emerges as a critical marketing touchpoint, reinforcing brand identity. Custom inserts and branded sleeves are developed to enhance visual and tactile appeal.

Brand Differentiation and Visual Design Influence Consumer Decision-Making

Aesthetics and tactile quality play a central role in packaging design, influencing brand value perception. It creates opportunities for companies to invest in premium finishes, embossing, and textured surfaces. The Mobile Phone Packaging Market sees expanded use of rigid boxes, magnetic closures, and smart-print finishes to convey sophistication. Packaging serves as an extension of the product, especially for flagship and luxury models. Visual consistency across the brand’s product range reinforces identity and recall. Minimalist layouts and innovative fold styles differentiate premium devices from entry-level models. Consumer preferences for sleek and clutter-free design push innovation in folding techniques and interior arrangement. Strategic design also reduces shelf footprint while enhancing display visibility.

- For example, Huawei’s Mate XT | ULTIMATE DESIGN employs premium materials with ultra-thin aerospace-grade fiber leather (as thin as 0.47mm) for its packaging and device surfaces, paired with the industry’s first Advanced Precision Hinge System to ensure that visual and tactile appeal are delivered without compromising structural integrity.

Market Trends

Smart Packaging Integration Enhances Consumer Engagement and Security

Technological integration is transforming the packaging experience across the mobile industry. It enables real-time product interaction through features like NFC tags, QR codes, and RFID tracking. The Mobile Phone Packaging Market sees rising adoption of smart packaging to verify authenticity and reduce counterfeiting risks. It supports traceability throughout the supply chain, which is crucial for warranty validation and returns. Brands use digital features to provide interactive manuals or promotional content, enhancing customer engagement. Smart codes also facilitate inventory management and logistics optimization. It allows seamless tracking from warehouse to doorstep. Smart packaging brings value beyond protection, becoming a digital interface between consumer and brand.

- For instance, most Samsung Galaxy smartphones support NFC Forum–compliant NTAG213, NTAG215, NTAG216, and NTAG424 tags operating at 13.56 MHz, enabling secure product authentication and post-purchase digital engagement. These tags enhance interactivity and brand protection across millions of NFC-enabled devices sold annually.

Customization and Limited Editions Cater to Evolving Consumer Preferences

Market competition and personalization trends drive the rise of tailored packaging. It compels brands to offer customized and collectible editions aligned with product launches or collaborations. The Mobile Phone Packaging Market evolves to meet niche demands through digitally printed short runs and modular packaging formats. Custom sleeves, fold-outs, and inserts support exclusive designs for specific geographies or events. Manufacturers scale their capabilities to handle frequent design iterations with minimal lead time. Consumers respond positively to unique packaging formats that reflect individualism. Personalization extends beyond the external box to internal graphics and messaging. The trend appeals to younger demographics, especially in the online retail segment.

- Xiaomi, for example, introduced special edition emoji-themed packaging for its Mi 10 Youth Edition, designed for younger demographics. This approach drove user-generated content, as customers used the box as a selfie prop, increasing engagement on social platforms and distinguishing the product during launch periods

Minimalist and Compact Designs Reduce Material Use and Improve Efficiency

Packaging formats are undergoing structural refinement to balance sustainability and efficiency. It encourages brands to eliminate excess components and optimize internal space usage. The Mobile Phone Packaging Market reflects this shift with slimmer boxes, flat-packed inserts, and efficient filler materials. It enables lower freight costs and faster handling across distribution networks. Minimalist design aligns with modern aesthetic preferences while reducing visual clutter. Brands eliminate manuals and plastic accessories, replacing them with QR-based digital resources. This design direction streamlines packaging production and waste management. It simplifies assembly, reduces printing steps, and aligns with zero-waste packaging initiatives.

Premiumization of Mid-Tier Devices Raises Packaging Quality Standards

Smartphone manufacturers elevate their packaging strategy for mid-tier products to bridge premium perception gaps. It elevates packaging design across all price points to meet rising consumer expectations. The Mobile Phone Packaging Market adapts to this trend by offering cost-efficient premium finishes. Features such as magnetic lids, debossed logos, and velvet inserts migrate from luxury tiers to mainstream models. These enhancements allow mid-segment phones to compete on shelf presence. Uniformity in packaging across product lines improves brand consistency. This shift requires supply chain upgrades to ensure uniform quality at scale. Packaging now plays a central role in driving product value perception.

Market Challenges Analysis

Balancing Sustainability with Cost and Material Performance Constraints

The push toward sustainable packaging imposes material and cost challenges on manufacturers. It limits options for protective, moisture-resistant, and lightweight solutions that remain environmentally compliant. The Mobile Phone Packaging Market must reconcile high performance with recyclability and biodegradability. Many sustainable alternatives cost more or lack durability for global shipping. Suppliers also face limited access to certified green materials at scale. Companies investing in sustainable packaging may encounter budget pressures or limited economies of scale. New materials often require updated equipment or additional processing steps. Testing for compliance, safety, and shelf-life performance adds time and cost to development. These complexities slow adoption for smaller or price-sensitive brands.

Global Supply Chain Disruptions and Raw Material Volatility Affect Output

Unpredictable supply chain dynamics disrupt packaging production timelines and material availability. It exposes manufacturers to risks in sourcing paper, board, adhesives, and specialty coatings. The Mobile Phone Packaging Market faces supply shortages and pricing fluctuations driven by geopolitical conflicts, transportation bottlenecks, and currency instability. These disruptions increase lead times and reduce flexibility in meeting urgent demand spikes. Small and medium enterprises struggle to secure raw materials on par with larger competitors. Fluctuating resin or paper prices reduce cost predictability, challenging procurement teams. Import-export restrictions further complicate cross-border packaging operations. Companies must invest in localized or diversified sourcing strategies to manage supply continuity.

Market Opportunities

Growing Demand for Eco-Conscious Packaging Unlocks New Business Potential

Widening consumer demand for sustainable packaging offers strong growth prospects for innovation. It opens the door for companies to commercialize biodegradable, compostable, and recyclable packaging at scale. The Mobile Phone Packaging Market can capitalize on shifting sentiment by offering carbon-neutral and plastic-free alternatives. Brands investing in eco-labeling and environmental claims gain trust and market advantage. Government regulations reinforce this shift by mandating green compliance. Packaging firms that adopt circular economy models and close-loop systems can unlock loyalty from both retailers and customers. This transition allows differentiation through product stewardship and corporate responsibility. Packaging startups focused on biomaterials stand to attract investor interest.

Innovation in Protective Design and Printing Drives Product Differentiation

Packaging innovations that combine protection with visual impact open new revenue streams. It encourages suppliers to introduce impact-resistant laminates, anti-scratch coatings, and multi-layer constructions. The Mobile Phone Packaging Market can benefit from such enhancements by supporting evolving device designs. Packaging tailored to foldables, large-screen models, or modular components offers niche opportunities. Advanced printing technologies such as UV spot, 3D varnish, and holographic film elevate shelf appeal. These solutions enhance brand storytelling while ensuring product safety in transit. Investment in tactile design and durable outer layers improves unboxing experiences. Brands that integrate function with aesthetics position themselves as premium choices.

Market Segmentation Analysis:

The Mobile Phone Packaging Market is segmented by packaging type, material type, and phone type, each contributing to market dynamics and innovation.

By packaging types, rigid packaging boxes lead due to their premium appeal and structural strength, widely used for flagship and mid-tier smartphones. Foldable cartons and flexible film wraps support cost-effective and lightweight packaging, preferred for budget models and retail bundling. Protective insert trays and thermoformed blister packs enhance product safety during transit and are often used for accessories and refurbished devices. Other formats include hybrid structures that blend aesthetics with functionality.

- For instance, Apple uses rigid board boxes exclusively for its iPhone range, combining a two-piece telescoping structure with high-density fiberboard, tested to withstand over 100 lbs of compression to survive international shipping and retail display handling.

By material type, paperboard-based materials dominate due to sustainability, printability, and regulatory compliance. Plastic-based components retain relevance for their protective properties and design flexibility. Molded fiber solutions gain momentum in markets with strict environmental standards, offering biodegradable alternatives. Other material categories include composites that balance durability and eco-responsibility.

- For example, Google achieved 99% plastic-free packaging for all consumer electronics (including Pixel phones launched and manufactured in 2023), and the Pixel 8 and 8 Pro debuted in 100% plastic-free packaging by August 2024

By application/phone types, the Mobile Phone Packaging Market sees highest adoption in the advanced smartphone segment, which demands branded, secure, and visually refined packaging. Certified refurbished phones emphasize cost-efficient and protective solutions, while basic feature phones rely on minimal packaging for mass distribution. Each segment aligns packaging with device positioning and end-user expectations.

Segmentation:

By Packaging Type

- Rigid Packaging Boxes

- Foldable Cartons

- Flexible Film Wraps

- Protective Insert Trays

- Thermoformed Blister Packs

- Other Packaging Formats

By Material Type

- Paperboard-Based Materials

- Plastic-Based Components

- Molded Fiber Solutions

- Other Material Categories

By Application/ Phone Type

- Basic Feature Phones

- Certified Refurbished Phones

- Advanced Smartphones

By Regional

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific dominates the Mobile Phone Packaging Market with a 49% market share, driven by large-scale smartphone manufacturing hubs and rising consumer electronics demand. China, India, South Korea, and Vietnam lead production, supported by cost-effective labor and advanced supply chain infrastructure. Local packaging manufacturers benefit from proximity to device assembly centers, enabling faster delivery and reduced logistics costs. The region’s rising middle-class population continues to fuel smartphone consumption, creating steady demand for protective and visually appealing packaging. It also shows strong growth in sustainable packaging adoption due to policy mandates and corporate responsibility goals. Brands in the region invest in material innovations and automation to meet bulk production volumes and evolving environmental standards.

North America holds a 24% share of the Mobile Phone Packaging Market, supported by strong purchasing power, premium smartphone penetration, and a robust e-commerce ecosystem. The U.S. leads regional growth, driven by consumer preferences for eco-friendly, compact, and tech-integrated packaging formats. Companies prioritize packaging design as part of brand identity and customer experience, especially for flagship models. It emphasizes smart packaging features such as QR codes and product verification layers. Regulatory frameworks around plastic reduction and sustainable sourcing push manufacturers to adopt recyclable or reusable formats. Strategic partnerships between packaging suppliers and tech companies also support innovation in digital customization and anti-counterfeiting.

Europe accounts for 18% of the market, shaped by stringent environmental regulations and a mature consumer electronics sector. Germany, France, and the U.K. are key contributors, focusing on reducing packaging waste and embracing green certification standards. It promotes the use of molded fiber, paperboard, and compostable materials in device packaging. European consumers expect high-quality, minimalistic, and functional designs that align with the region’s sustainability values. Brands in the region balance aesthetic expectations with compliance, investing in R&D for recyclable structural integrity. The shift toward circular packaging practices presents growth opportunities for companies aligned with EU Green Deal objectives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amcor plc

- Mondi plc

- International Paper Company

- WestRock Company

- Smurfit Kappa Group

- Sonoco Products Company

- Plastic Ingenuity, Inc.

- Dordan Manufacturing Company

- Hip Lik Packaging Products

- Cellpaks Solutions Ltd.

- Pragati Pack Pvt. Ltd.

- Any Graphics Private Limited

- Dongguan City Luheng

- Mister Blister

Competitive Analysis:

The Mobile Phone Packaging Market is highly competitive, with key players focusing on material innovation, cost optimization, and sustainability. Leading companies such as Amcor plc, Sonoco Products Company, Smurfit Kappa, and DS Smith dominate with global supply capabilities and strong R&D infrastructure. It drives competition by pushing customized solutions, lightweight designs, and recyclable packaging formats to meet OEM requirements. Regional players offer localized support, faster lead times, and flexible manufacturing, appealing to mid-sized smartphone brands. Strategic collaborations with electronics manufacturers enable co-development of packaging aligned with device specifications. The market sees active investments in automation, digital printing, and smart packaging features. Mergers and acquisitions help companies expand capabilities and regional reach, particularly in Asia and North America. Packaging firms compete on pricing, turnaround speed, and the ability to support diverse device models with scalable solutions. Competitive pressure fosters continuous innovation and portfolio diversification across all tiers.

Recent Developments:

- In July 2025, Amcor plc highlighted its ongoing innovations in packaging, introducing new pouches that utilize less plastic and surpass EU regulatory requirements for recyclability. These advancements have been designed to enhance both sustainability and consumer appeal, with applications including tech and electronics packaging.

- In April 2025, Sonoco Products Company finalized the sale of its Thermoformed and Flexibles packaging (TFP) business in the US to TOPPAN Holdings for $1.8billion, reflecting ongoing shifts in strategic alliances and market positioning for high-value packaging, which can impact supply chains for mobile phone manufacturers

- In July 2024, Mondi plc formed a partnership with CMC Packaging Automation to pioneer sustainable packaging solutions for e-commerce, which has direct relevance to the mobile phone segment as demand for eco-friendly mailers and tech packaging grows

- In September 2023, Smurfit Kappa Group and WestRock Company announced a transaction to create a global leader in sustainable packaging, consolidating their expertise and resources to deliver cutting-edge solutions for diverse packaging needs, including those in the technology sector.

Market Concentration & Characteristics:

The Mobile Phone Packaging Market exhibits moderate to high market concentration, with a few large players holding significant shares and numerous regional firms catering to localized demand. It is characterized by strong vertical integration, with leading companies managing design, material sourcing, and production in-house to ensure quality and cost control. The market favors long-term contracts with smartphone manufacturers, emphasizing reliability, scalability, and innovation. It demands rapid adaptation to changes in device specifications, sustainability mandates, and consumer preferences. Product differentiation often relies on design aesthetics, protective performance, and material compliance. Companies leverage automation and digital technologies to meet high-volume requirements and reduce lead times. Barriers to entry remain moderate due to material sourcing complexities and capital investment needs.

Report Coverage:

The research report offers an in-depth analysis based on packaging type, material type, and phone type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for sustainable and recyclable packaging materials will rise due to regulatory pressure and consumer awareness.

- Smart packaging integration will expand, supporting authentication, traceability, and digital engagement.

- Customized and limited-edition packaging will gain traction among brands targeting younger demographics.

- Growth of e-commerce will increase the need for packaging with enhanced protection and minimal shipping footprint.

- Automation in packaging production will improve scalability and reduce lead times across global supply chains.

- Lightweight and compact packaging formats will dominate to reduce logistics costs and environmental impact.

- Adoption of molded fiber and paperboard alternatives will accelerate in response to plastic reduction mandates.

- Packaging for foldable and modular smartphones will create new structural design opportunities.

- Strategic partnerships between OEMs and packaging firms will drive innovation in branded experiences.

- Investment in circular economy practices will influence packaging lifecycle management and design innovation.