Market Overview:

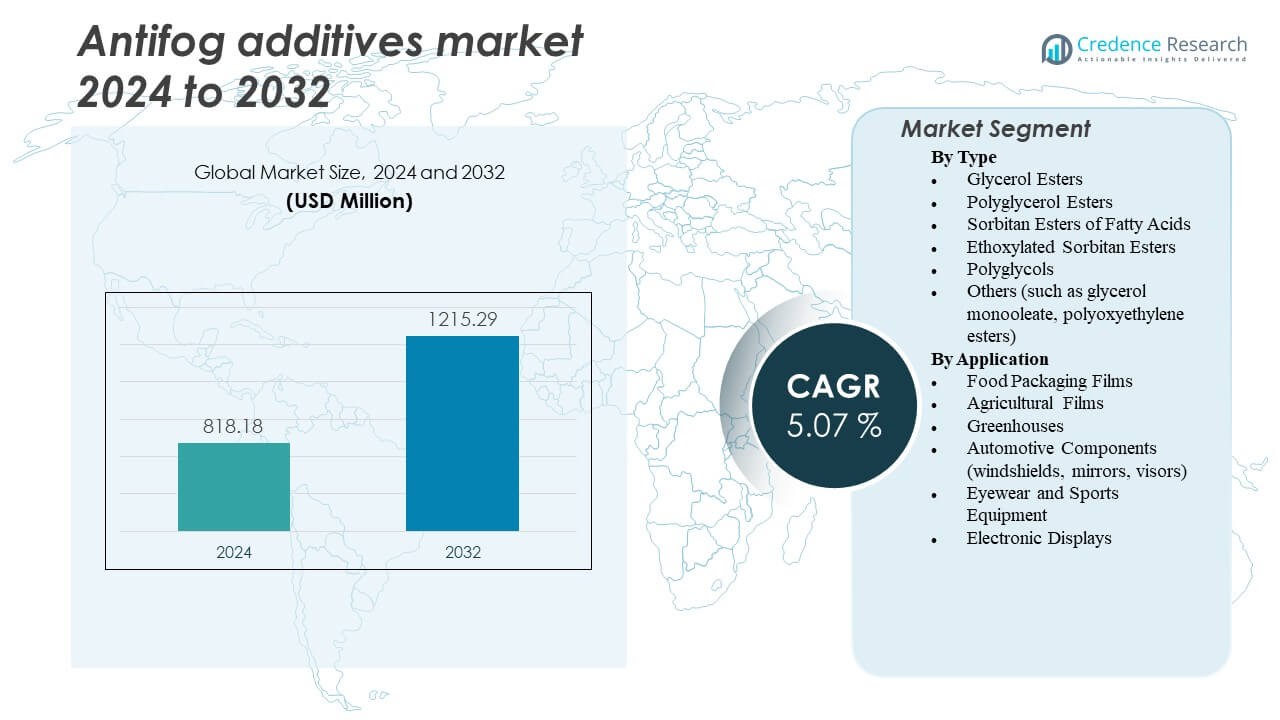

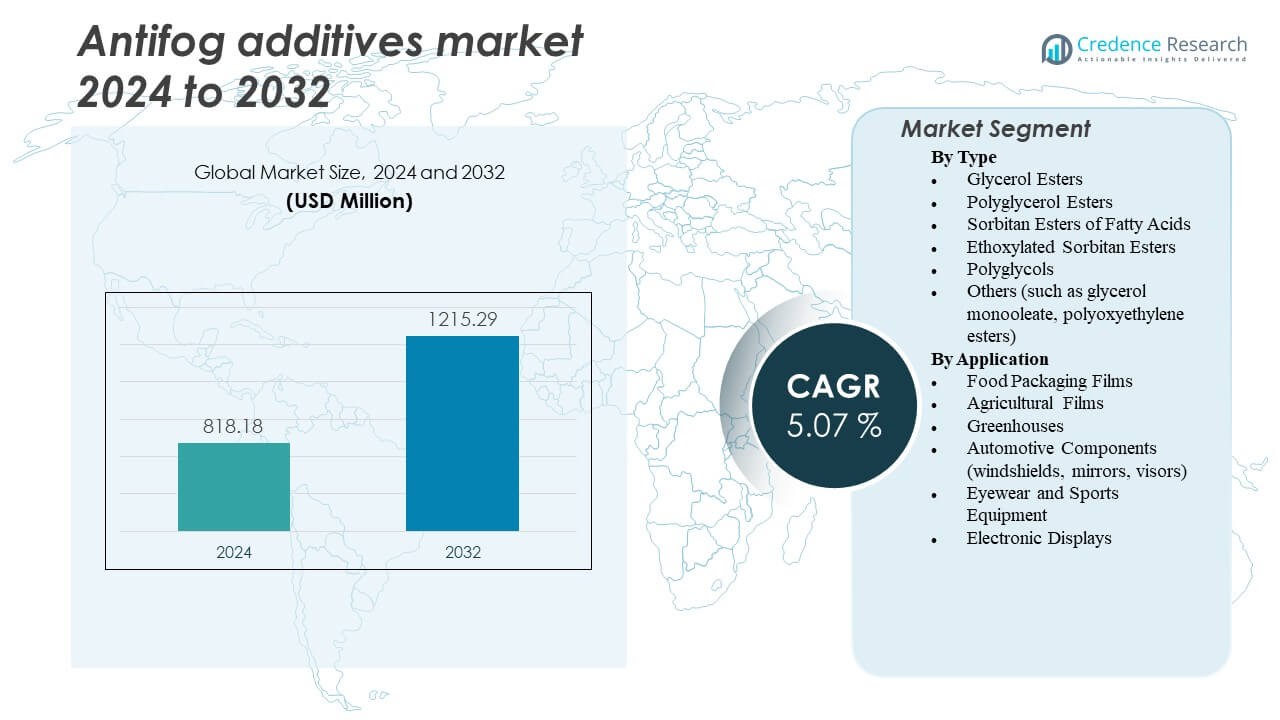

The Antifog Additives Market is projected to grow from USD 818.18 million in 2024 to an estimated USD 1,215.29 million by 2032, with a compound annual growth rate (CAGR) of 5.07% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Antifog Additives Market Size 2024 |

USD 818.18 Million |

| Antifog Additives Market, CAGR |

5.07% |

| Antifog Additives Market Size 2032 |

USD 1,215.29 Million |

Growing demand for clear and moisture-free packaging across food, agriculture, and consumer goods sectors is driving market growth. The rise in consumption of packaged foods and the expansion of greenhouse cultivation boost the need for antifog films. Manufacturers develop high-performance additives that maintain film clarity, extend shelf life, and improve product presentation. The shift toward bio-based formulations and compliance with packaging safety regulations also strengthens market expansion.

North America and Europe dominate the market due to advanced packaging technologies and high consumer standards for food visibility. Asia-Pacific is emerging as the fastest-growing region, supported by industrialization, rising food exports, and agricultural modernization. Countries like China and India lead in production and consumption, while Latin America and the Middle East & Africa show potential growth through expanding greenhouse farming and food processing industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Antifog Additives Market is valued at USD 818.18 million in 2024 and is projected to reach USD 1,215.29 million by 2032, growing at a CAGR of 5.07%.

- Rising demand for clear and condensation-free packaging in food and agriculture drives strong product adoption.

- Expanding use of antifog films in greenhouses and refrigerated storage enhances crop yield and food visibility.

- Manufacturers invest in bio-based and non-migratory additives to meet sustainability and safety regulations.

- High production costs and compatibility challenges with different polymers limit adoption among small producers.

- North America and Europe lead due to established packaging industries and advanced additive technologies.

- Asia-Pacific emerges as the fastest-growing region, driven by industrial expansion and agricultural modernization.

Market Drivers

Rising Demand for Clear Packaging in Food and Agricultural Applications

The growing focus on product visibility in packaged foods is driving steady adoption of antifog additives. Food producers use these additives in films to prevent condensation that can blur product appearance. It helps maintain transparency in packaging for vegetables, meat, and dairy products. Retailers benefit from enhanced shelf presentation and consumer appeal. The use of antifog films also supports extended product freshness by preventing moisture accumulation. Agricultural applications such as greenhouse films use these additives to maintain light transmission. Increased greenhouse cultivation across Asia and Europe strengthens product adoption. The Antifog Additives Market benefits from ongoing modernization in food storage and farming systems.

- For instance, Mitsubishi Chemical’s DIACLEAR™ polyethylene-based antifog films are designed for greenhouse applications, offering high light transmission and effective moisture control. These films help reduce condensation and support stable crop growth under humid environmental conditions.

Technological Advancements in Polymer and Film Manufacturing Processes

The development of advanced polymer blends and improved film extrusion processes supports antifog additive efficiency. Manufacturers invest in formulation technologies that enhance dispersion and long-term stability. Modern additive solutions now offer high compatibility with polyethylene, polypropylene, and PET films. It promotes consistent performance under diverse humidity and temperature conditions. Packaging producers seek additives that minimize film haze without affecting mechanical strength. R&D activities focus on non-migratory and bio-based solutions to align with sustainability goals. Strong collaboration between packaging firms and chemical companies drives innovation cycles. The Antifog Additives Market benefits from these ongoing product improvements and tailored formulations.

- For instance, AFFINITY™ GA polyolefin elastomers from Dow deliver exceptional film optics and seal-layer performance in packaging applications. These elastomers help film producers achieve improved clarity and visual appeal while supporting efficient processing on standard polyolefin extrusion lines.

Increasing Preference for Hygienic and Moisture-Resistant Packaging Solutions

Consumer awareness toward food hygiene has created demand for packaging that resists fogging and microbial growth. Antifog additives enable moisture control, preventing internal condensation during storage and transportation. It helps food processors maintain product quality and reduce spoilage risks. The pandemic reinforced the importance of safe and visible packaging for perishable items. Regulatory standards for clean labeling and packaging transparency also influence market expansion. Manufacturers integrate antifog materials into multilayer films for refrigerated and frozen products. Demand from ready-to-eat and convenience food packaging continues to rise. The Antifog Additives Market experiences strong traction from shifting consumer habits toward safety and quality assurance.

Growing Application in Optical, Automotive, and Industrial Films

Beyond food packaging, antifog technology finds new uses in optical lenses, automotive interiors, and protective films. It helps maintain visibility in instrument panels, windshields, and camera lenses exposed to temperature changes. Optical film manufacturers adopt antifog coatings to reduce distortion and condensation effects. Industrial users apply these additives in safety visors, medical face shields, and transparent covers. The demand for performance stability under varying humidity conditions drives material innovation. Enhanced adhesion and long-lasting antifog layers support extended product lifecycles. Collaboration with automotive and electronics sectors widens application reach. The Antifog Additives Market benefits from diversification across multiple high-value end uses.

Market Trends

Emergence of Sustainable and Bio-Based Antifog Additive Solutions

Sustainability drives material innovation, leading to greater demand for eco-friendly antifog additives. Packaging manufacturers prefer plant-derived or biodegradable components that meet environmental goals. It aligns with industry efforts to reduce reliance on petroleum-based polymers. Research focuses on improving performance consistency while maintaining low migration levels. Consumers and regulators favor packaging made with safer, greener materials. Film producers integrate bio-based antifog compounds into recyclable substrates. The trend supports circular economy practices across the packaging chain. The Antifog Additives Market shifts toward environmentally responsible alternatives to maintain compliance and brand reputation.

Expansion of High-Performance Antifog Additives for Cold Chain Logistics

Cold chain operations require packaging that prevents condensation during refrigeration and transport. High-performance antifog additives help preserve visibility in temperature-controlled food and pharmaceutical shipments. It enables consistent clarity under varying humidity and cooling cycles. Suppliers introduce new formulations with improved migration resistance and thermal durability. The trend supports extended shelf life and enhanced hygiene in packaged goods. Cold storage growth across developing economies increases demand for reliable antifog films. Advanced distribution systems further integrate these materials for operational efficiency. The Antifog Additives Market gains momentum from expansion in cold logistics infrastructure worldwide.

- For instance, Clariant AG’s Licocare RBW Vita series, derived from renewable rice bran wax, supports sustainable film production through high renewable carbon content. BASF’s ecovio biodegradable polymer meets EN 13432 compostability standards, reflecting the industry’s shift toward eco-friendly film materials compatible with antifog additive technologies.

Integration of Smart Additive Technologies in Functional Films

The packaging industry adopts multifunctional additives that combine antifog, antistatic, and UV-resistant properties. It enhances film utility while optimizing production costs. Smart additives support precision control over surface energy and optical performance. Producers use digital monitoring systems to maintain formulation consistency during processing. The approach enables better control of transparency and long-term performance. Growing use in smart packaging with sensors and QR-enabled films fuels product integration. Advanced material compatibility with coextruded films strengthens manufacturing flexibility. The Antifog Additives Market evolves with rising investment in intelligent material engineering.

Customization of Additive Formulations for Region-Specific Packaging Needs

Packaging manufacturers demand customized antifog solutions to suit climatic and operational variations. Tropical regions need faster-acting additives to handle high humidity levels. Cold regions prefer long-duration antifog films for refrigerated storage. It pushes producers to design regional formulations with optimized surfactant balances. The shift toward tailored solutions strengthens supplier partnerships and market localization. Regional packaging regulations also influence product composition and compliance standards. Producers expand R&D centers to support country-specific film applications. The Antifog Additives Market demonstrates flexibility through regional customization and climate-adapted innovation.

- For instance, A. Schulman, now part of LyondellBasell, has developed Polybatch Antifog masterbatches tailored for diverse climatic conditions in packaging applications. RTP Company supports regional customization through its R&D centers in Singapore and Minnesota, focusing on additive solutions that enhance film performance and clarity.

Market Challenges Analysis

High Production Costs and Complex Compatibility Issues with Polymers

Manufacturers face challenges related to the high cost of developing efficient antifog formulations. The need for compatibility with multiple polymer types complicates production. It increases testing and formulation costs, slowing scalability. Certain additives affect film clarity or mechanical strength, reducing product performance. Market competition pressures companies to maintain low-cost offerings while ensuring reliability. Small packaging firms often avoid advanced antifog materials due to budget constraints. The balance between cost-effectiveness and performance consistency remains difficult. The Antifog Additives Market experiences limitations in rapid mass adoption due to these technical and economic factors.

Regulatory Barriers and Limited Awareness in Developing Regions

Stringent regulatory guidelines on additive migration and safety compliance challenge product approval. It requires extensive documentation and region-specific certification before commercialization. Lack of awareness among small manufacturers in emerging markets slows adoption. Some industries rely on low-cost, unregulated coatings that fail to meet quality standards. This limits global uniformity in antifog additive usage and testing. Supply chain fragmentation also restricts knowledge transfer and technical training. Local producers struggle to match the sophistication of global formulations. The Antifog Additives Market faces delays in standardization and expansion within low-awareness markets.

Market Opportunities

Rising Scope in Biodegradable and High-Barrier Packaging Films

Growing preference for sustainable materials encourages antifog integration into biodegradable packaging. It supports film manufacturers aiming for eco-label certifications and recyclability compliance. Demand from organic food and health-conscious product brands fuels interest in non-toxic additives. High-barrier films that maintain freshness and prevent contamination also gain prominence. The combination of antifog and oxygen barrier properties enhances product shelf life. Manufacturers invest in advanced coatings compatible with compostable polymers. Innovation in hybrid materials widens market reach across new product categories. The Antifog Additives Market holds long-term opportunities through sustainability-driven packaging advancements.

Adoption Across Electronics, Healthcare, and Precision Optical Applications

Expanding use of transparent films in electronics and medical equipment creates new growth avenues. It enables fog-free performance in displays, sensors, and protective lenses. Healthcare devices such as face shields and diagnostic covers rely on antifog coatings for clarity. Demand from laboratory and optical instrument makers further boosts usage. Manufacturers explore nano-structured surface additives to enhance moisture control. The electronics sector values optical stability under fluctuating environmental conditions. Partnerships between chemical producers and tech firms accelerate product innovation cycles. The Antifog Additives Market expands through diversification into precision and high-tech applications.

Market Segmentation Analysis:

By Type

The Antifog Additives Market features diverse product categories, each tailored for specific performance needs. Glycerol esters hold a significant share due to their efficiency in maintaining film transparency under humidity. Polyglycerol esters offer superior compatibility with polyolefin-based films, supporting their growing use in packaging. Sorbitan esters of fatty acids are widely adopted for food applications because of their low toxicity and good emulsifying properties. Ethoxylated sorbitan esters provide long-lasting antifog effects in both cold and warm storage conditions. Polyglycols deliver high stability and uniform dispersion, making them suitable for complex film processing. The “Others” category, including glycerol monooleate and polyoxyethylene esters, caters to niche applications requiring customized formulations. The demand across all types reflects continuous improvements in additive performance and cost efficiency.

- For instance, glycerol monooleate and polyoxyethylene esters are widely used in antifog additive formulations for polyolefin films, offering effective surface tension control and clear visibility under humid conditions. These compounds are preferred for customized applications in food and agricultural packaging due to their strong compatibility and stability.

By Application

Food packaging films dominate the Antifog Additives Market due to the need for clear visibility and product preservation. It enhances transparency and prevents condensation in refrigerated and fresh food packaging. Agricultural films represent another strong application, driven by rising greenhouse and crop protection usage. Greenhouse films benefit from improved light transmission and reduced water droplet formation. Automotive components such as mirrors, visors, and windshields utilize antifog materials to enhance driver visibility and safety. Eyewear and sports equipment integrate antifog coatings to prevent lens fogging during high activity or temperature variation. Electronic displays adopt these additives for clarity and moisture resistance in humid environments. Expanding use across industries shows the growing importance of antifog performance in improving functionality and consumer experience.

- For instance, Clariant’s AddWorks® AF series provides durable antifog performance in polyolefin-based packaging and agricultural films. These additives help prevent moisture condensation, ensuring film clarity and improved visibility for food and greenhouse applications.

Segmentation:

By Type

- Glycerol Esters

- Polyglycerol Esters

- Sorbitan Esters of Fatty Acids

- Ethoxylated Sorbitan Esters

- Polyglycols

- Others (such as glycerol monooleate, polyoxyethylene esters)

By Application

- Food Packaging Films

- Agricultural Films

- Greenhouses

- Automotive Components (windshields, mirrors, visors)

- Eyewear and Sports Equipment

- Electronic Displays

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds a 32% share of the Antifog Additives Market, driven by strong demand from the food packaging and automotive sectors. The region benefits from advanced manufacturing capabilities and strict quality standards that promote the use of high-performance additives. The United States leads market adoption with its developed packaging infrastructure and widespread use of refrigerated food products. Canada contributes through growing agricultural film applications and expanding cold chain logistics. It shows consistent investment in research and development to enhance polymer compatibility and reduce additive migration. Leading suppliers in this region focus on sustainability and innovation, introducing bio-based antifog materials for eco-conscious manufacturers.

Europe

Europe accounts for 28% of the Antifog Additives Market, supported by stringent packaging regulations and growing sustainability mandates. Countries such as Germany, France, and Italy drive the adoption of eco-friendly additives in food and agricultural packaging. It benefits from strong consumer preference for clear packaging that maintains product freshness and visual appeal. The region also exhibits advanced technological integration across packaging lines, increasing efficiency and output. European firms focus on developing non-toxic, compliant formulations aligned with REACH and EFSA standards. Expanding greenhouse cultivation and demand for transparent agricultural films continue to strengthen regional growth.

Asia-Pacific

Asia-Pacific dominates the Antifog Additives Market with a 36% share, driven by rapid industrialization and expanding packaging and agriculture sectors. China and India lead consumption due to high population density and increased packaged food demand. It experiences significant growth in greenhouse films and cold chain applications, supported by government incentives for modern agriculture. Japan and South Korea contribute through technological innovation and production of high-clarity optical films. Regional manufacturers invest in cost-effective and scalable additive solutions to meet diverse industrial needs. Rising disposable incomes and expanding retail networks continue to accelerate the adoption of antifog additives across end-use industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Clariant AG

- AkzoNobel N.V.

- Ashland Global Holdings Inc.

- Croda International PLC

- Evonik Industries AG

- BASF SE

- DuPont

- Avient Corporation (formerly PolyOne)

- Corbion N.V.

- Emery Oleochemicals

- Ampacet Corporation

- Palsgaard

- Fine Organics

- Addcomp Holland

- PCC Chemax Inc.

- LyondellBasell Industries Holdings B.V.

Competitive Analysis:

The Antifog Additives Market is highly competitive, featuring global and regional players focusing on innovation, performance, and sustainability. Leading companies such as BASF SE, Clariant AG, Croda International PLC, and Evonik Industries AG emphasize advanced polymer formulations that enhance transparency and durability. It witnesses strong competition in bio-based and non-migratory additive segments, driven by environmental regulations and packaging trends. Firms like Ampacet Corporation, Avient Corporation, and Fine Organics expand product portfolios through new masterbatch technologies and customized solutions. Strategic collaborations and R&D investments remain key to maintaining market leadership. Companies also target growth in emerging regions through partnerships and regional manufacturing facilities to improve cost efficiency and supply reliability.

Recent Developments:

- In July 2025, Tosaf launched its FogFree™ portfolio, a new line of antifog masterbatch solutions designed for extremely challenging packaging polymers, specifically aiming to address high-performance requirements in food and agricultural packaging applications.

Report Coverage:

The research report offers an in-depth analysis based on Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for transparent and hygienic food packaging will continue to drive antifog additive adoption.

- Development of bio-based and non-migratory formulations will strengthen sustainability initiatives across packaging industries.

- Expanding use in agricultural films and greenhouses will enhance crop visibility and productivity.

- Continuous R&D in polymer chemistry will improve film performance and long-term clarity under varying climates.

- Growth in cold chain logistics and frozen food distribution will boost need for high-performance antifog films.

- Increasing integration of antifog technology in automotive, optical, and electronic applications will broaden market reach.

- Regional manufacturers in Asia-Pacific will strengthen supply chains and reduce dependency on imports.

- Strategic mergers and collaborations among key chemical producers will accelerate innovation and portfolio expansion.

- Regulatory shifts promoting eco-friendly packaging materials will favor advanced antifog formulations.

- Rising awareness of food safety and consumer appeal will reinforce the long-term growth trajectory of the Antifog Additives Market.