Market Overview

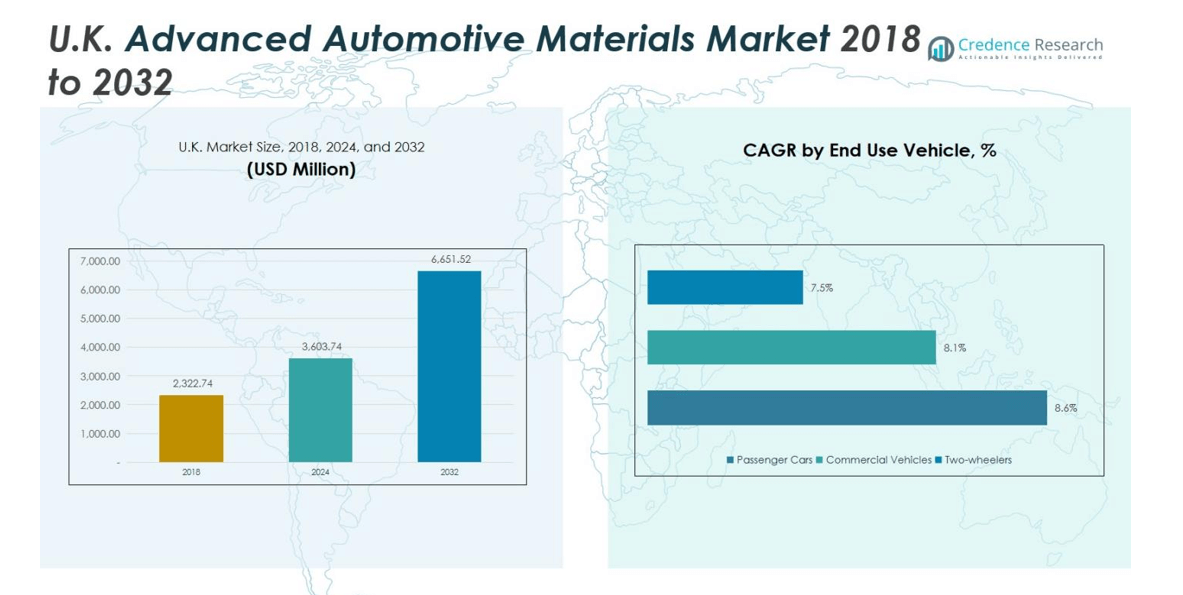

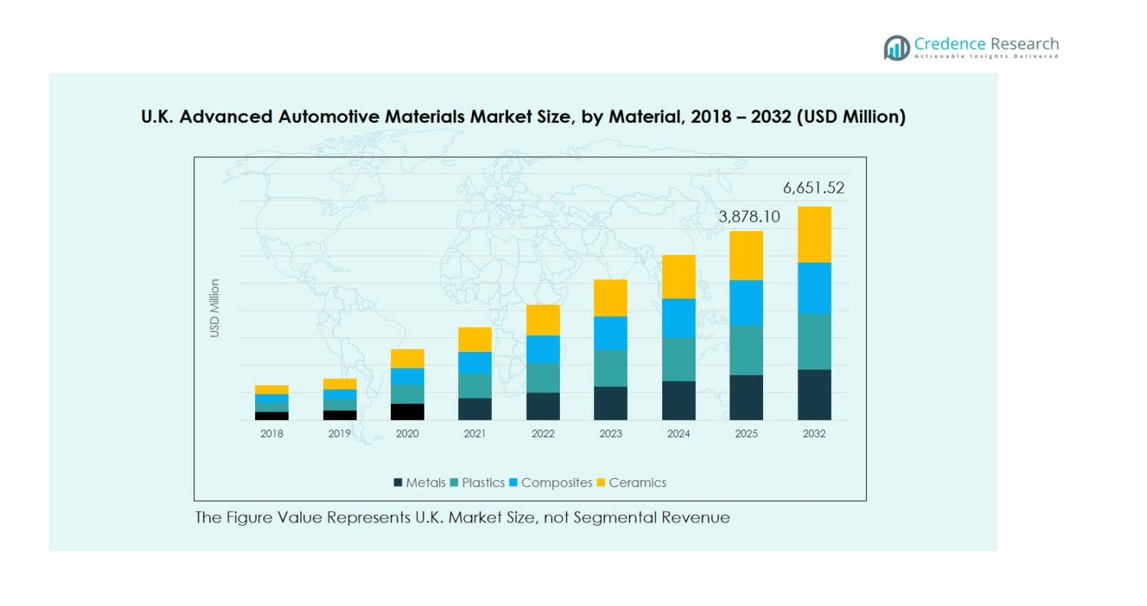

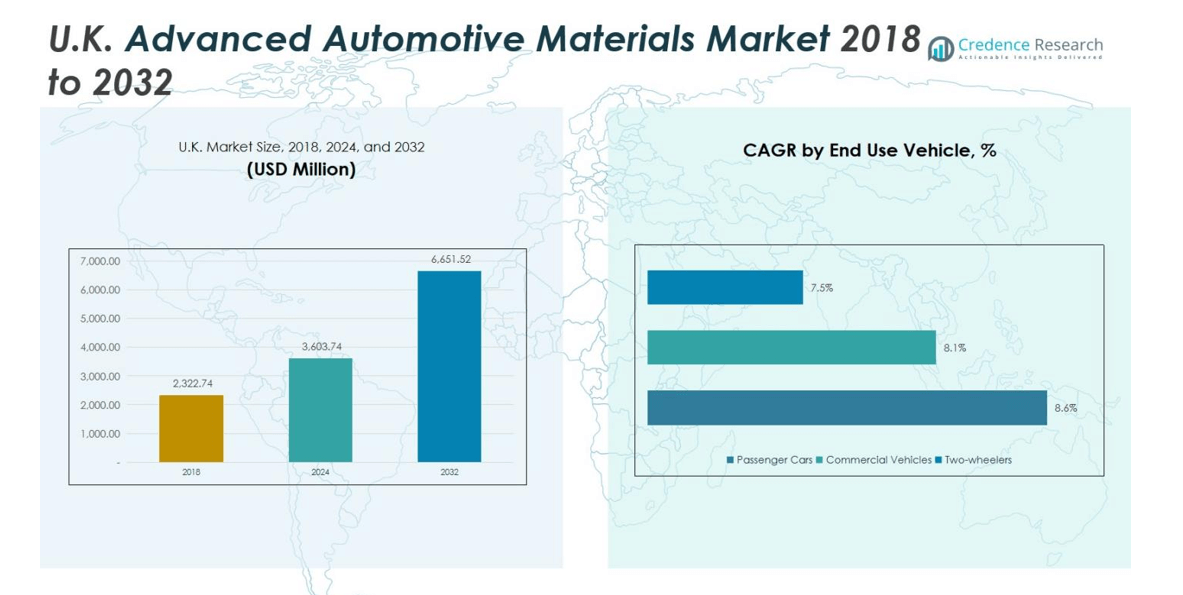

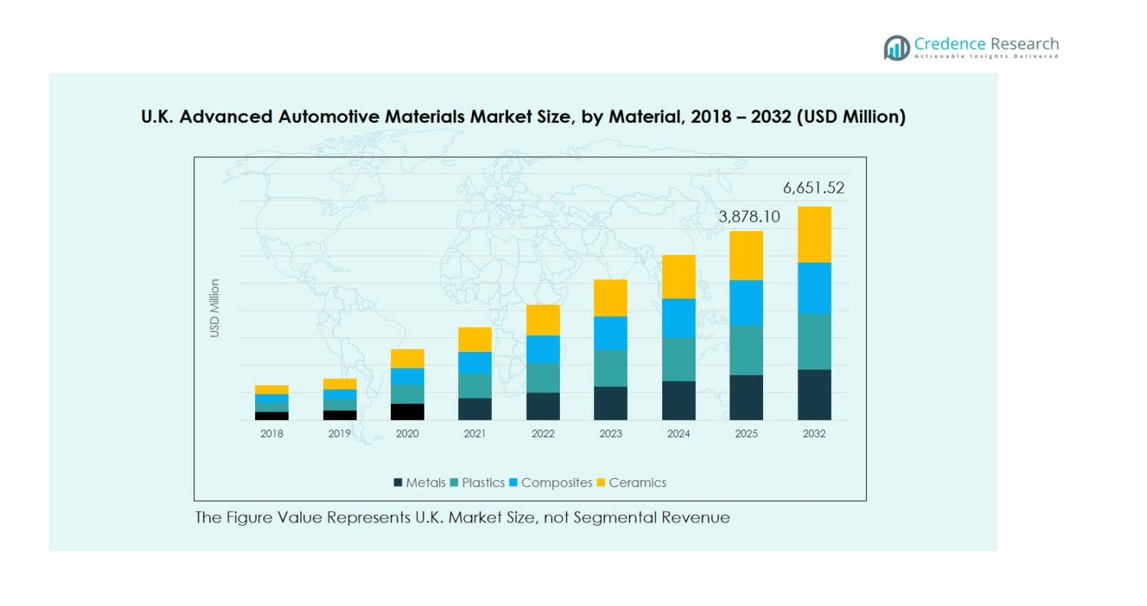

U.K. Advanced Automotive Materials Market size was valued at USD 2,322.74 Million in 2018, USD 3,603.74 Million in 2024, and is anticipated to reach USD 6,651.52 Million by 2032, at a CAGR of 7.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.K. Advanced Automotive Materials Market Size 2024 |

USD 3,603.74 Million |

| U.K. Advanced Automotive Materials Market, CAGR |

7.7% |

| U.K. Advanced Automotive Materials Market Size 2032 |

USD 6,651.52 Million |

The U.K. Advanced Automotive Materials Market is highly competitive, with top players including Piran Composites, Toray Industries, DuPont de Nemours, Novelis Inc., Wolverine Advanced Materials, Permali Gloucester, Mitsubishi Chemical Corporation, ArcelorMittal, and 3M Company. These companies focus on innovation, R&D investment, and strategic collaborations with OEMs to supply lightweight metals, high-performance plastics, composites, and ceramics for passenger cars, commercial vehicles, and two-wheelers. England emerges as the leading region, commanding 45% market share, supported by established automotive manufacturing hubs, advanced R&D facilities, and government initiatives promoting electric mobility and fuel efficiency. The combination of strong regional infrastructure and the presence of key players ensures accelerated adoption of advanced materials, particularly in lightweighting, structural components, and safety-enhancing applications, positioning the U.K. market for sustained growth in the coming years.

Market Insights

- The U.K. Advanced Automotive Materials Market was valued at USD 3,603.74 Million in 2024 and is projected to reach USD 6,651.52 Million by 2032, growing at a CAGR of 7.7%.

- Growth is driven by lightweighting initiatives, rising demand for fuel-efficient vehicles, and increased adoption of electric vehicles, boosting metals, plastics, and composites usage.

- Advanced composites are gaining traction in premium and performance vehicles, while structural and safety-focused materials see growing demand across all vehicle types.

- Key players, including Piran Composites, Toray Industries, DuPont de Nemours, Novelis Inc., and Wolverine Advanced Materials, focus on innovation, R&D, and partnerships with OEMs to maintain competitive advantage.

- England leads the market with 45% share, followed by Scotland (20%), Wales (15%), Northern Ireland (10%), and the rest of the U.K. (10%), with metals holding 38% share, plastics 28%, composites 22%, and ceramics 12%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

In the U.K. Advanced Automotive Materials Market, metals dominate the material segment, accounting for 38% market share. Metals, particularly high-strength steel and aluminum alloys, are favored for their durability, lightweight properties, and cost-effectiveness. Plastics hold around 28% share, driven by their flexibility, weight reduction potential, and corrosion resistance. Composites, representing 22%, are increasingly adopted in high-performance vehicles due to superior strength-to-weight ratios. Ceramics, although a smaller segment with 12% share, are growing in applications such as brake systems and engine components due to heat resistance and wear properties. Demand is driven by lightweighting and fuel efficiency initiatives.

- For instance, companies like MTL Advanced collaborate with global OEMs to supply high-strength steel for vehicle chassis, roofs, and floors, enabling lighter yet stronger vehicle structures that improve fuel efficiency and payload capacity.

By Application

Within application segments, structural components lead with a 35% market share, as automakers focus on vehicle safety and weight reduction. Body panels follow at 30%, supported by the growing use of aluminum, plastics, and composites to enhance aesthetics and fuel efficiency. Interior components account for 20%, driven by lightweight plastics and advanced polymers to improve passenger comfort. Electrical components, holding 15%, are expanding with the rise of electric vehicles, which require specialized insulating and heat-resistant materials. Innovation in lightweighting, durability, and electric mobility are key drivers across applications.

- For instance, 3M’s structural adhesives are widely used to bond aluminum, high-strength steel, and lightweight composites in primary vehicle structures like doors, hoods, and tailgates, enhancing stiffness while reducing emissions in the manufacturing process.

By End-Use Vehicle

In terms of end-use vehicles, passenger cars dominate with 55% market share, reflecting the largest adoption of advanced materials for lightweighting, safety, and fuel efficiency. Commercial vehicles account for 30%, driven by the need for durable materials to enhance payload efficiency and reduce operating costs. Two-wheelers, with 15% share, increasingly use plastics and composites to improve performance, handling, and fuel economy. Growth is primarily fueled by environmental regulations, consumer demand for fuel-efficient vehicles, and technological adoption in lightweight and high-performance materials.

Key Growth Drivers

Lightweighting and Fuel Efficiency Initiatives

The U.K. automotive sector is increasingly adopting advanced materials to meet strict fuel efficiency and emission reduction targets. Lightweight metals, plastics, and composites reduce vehicle mass, enhancing fuel economy while maintaining structural integrity. Automakers focus on materials that balance performance with cost-effectiveness, particularly in passenger cars and commercial vehicles. Government regulations, including CO₂ emission standards, further drive the adoption of high-strength steel, aluminum alloys, and composites. These initiatives improve vehicle efficiency and support sustainability goals, making lightweighting a critical growth driver.

- For instance, Jaguar Land Rover’s use of a lightweight aluminum alloy in the Range Rover, achieving weight reductions over 180 kilograms, significantly improving fuel economy and reducing tailpipe CO₂ emissions.

Electrification and Electric Vehicle Adoption

The rapid transition toward electric mobility is accelerating demand for advanced automotive materials in the U.K. EV market. Lightweight components, high-performance plastics, and composites are essential to offset battery weight and extend driving range. Electrical components, heat-resistant ceramics, and insulating materials are increasingly integrated into EV drivetrains and power electronics. OEMs invest in R&D to optimize material usage, durability, and thermal management, fueling market growth. Rising EV adoption, government incentives, and charging infrastructure expansion further amplify this trend.

- For instance, Zircotec’s CeraBEV project developed innovative ceramic coatings that enable the use of lightweight aluminum and plastic composites in EV battery enclosures, replacing heavy steel without compromising safety or thermal management.

Enhanced Safety and Structural Performance

Vehicle safety regulations and consumer demand for crash-resistant vehicles are promoting the use of advanced metals, composites, and ceramics. High-strength steel and aluminum alloys in structural components provide impact protection while reducing weight, and composites enhance energy absorption in body panels. Materials for interior components also improve passenger safety and comfort. Manufacturers leverage material innovations to meet Euro NCAP and U.K. safety standards, supporting steady market growth.

Key Trends & Opportunities

Integration of Composites in Premium and Performance Vehicles

Composites are increasingly used in high-end passenger cars and sports vehicles due to superior strength-to-weight ratios and design flexibility. Automakers in the U.K. are expanding composite applications in body panels, structural components, and interior elements to improve performance, reduce weight, and enhance fuel efficiency. Advancements in manufacturing technologies such as resin transfer molding and 3D printing support this trend. As production costs decline, composites offer opportunities for differentiation and broader adoption in mid-market segments.

- For instance, Volkswagen’s use of metal binder jetting 3D printing to produce lighter A-pillar components, reducing weight by almost 50% compared to steel counterparts, enhancing vehicle performance and efficiency.

Expansion of Electric Vehicle Supply Chain

The growing EV ecosystem in the U.K. presents opportunities for advanced materials suppliers. High-performance plastics, lightweight metals, and ceramics are critical for battery casings, structural supports, and thermal management systems. Strategic partnerships with EV manufacturers and R&D investment can strengthen market presence. Expanding EV production facilities, government incentives, and rising consumer demand create a favorable environment for material innovation, enabling companies to capture a larger market share while supporting sustainability objectives.

- For instance, the DRIVE35 programme, backed by a £2.5 billion government investment, supports innovation and infrastructure development across the UK’s EV manufacturing sector, accelerating the transition to zero-emission vehicles and bolstering supply chain capabilities.

Key Challenges

High Material Costs and Supply Chain Constraints

Advanced metals, composites, and specialty plastics often incur higher costs compared to traditional materials, challenging manufacturers to balance performance with affordability. Supply chain disruptions, including raw material shortages, geopolitical factors, and logistics delays, can affect production. Fluctuating prices of aluminum, high-strength steel, and composite resins add pressure. Manufacturers must optimize sourcing, develop cost-effective alternatives, and maintain production efficiency while meeting regulatory and performance standards.

Technological Complexity and Manufacturing Limitations

Integrating advanced materials into automotive designs involves complex processes such as forming, joining, and surface treatment. Composites, ceramics, and high-strength metals require specialized equipment and skilled labor, increasing production time and cost. Compatibility issues in multi-material assemblies can affect durability. OEMs must invest in R&D, training, and process optimization to overcome these limitations. Technological complexity may slow adoption in mass-market vehicles, restricting the growth pace of the U.K. advanced automotive materials market.

Regional Analysis

England

England leads the U.K. Advanced Automotive Materials Market, holding 45% market share, driven by its well-established automotive manufacturing hubs in the West Midlands, South East, and North East. The region benefits from strong OEM presence, advanced R&D facilities, and skilled labor, supporting the adoption of lightweight metals, plastics, and composites. Government incentives for clean mobility and fuel efficiency further stimulate demand. Major players focus on developing innovative materials for passenger cars and commercial vehicles. Growing electric vehicle production, lightweighting initiatives, and structural safety requirements are key factors driving regional market growth.

Scotland

Scotland accounts for 20% market share in the U.K. advanced automotive materials market. The region’s growth is fueled by expanding EV production and investments in lightweight composites and high-strength metals. Scotland’s focus on sustainability and low-emission vehicles encourages adoption of advanced plastics and ceramics, particularly in structural and electrical components. Strategic partnerships between local OEMs, research institutions, and material suppliers accelerate innovation and product development. Government support for clean mobility projects, along with increasing demand for commercial vehicles and premium passenger cars, underpins the region’s contribution to overall market expansion.

Wales

Wales holds 15% market share in the U.K. Advanced Automotive Materials Market, supported by automotive clusters in South Wales and North Wales. The region emphasizes lightweight metals, plastics, and composites for body panels, structural components, and interiors. Manufacturers focus on durability, fuel efficiency, and regulatory compliance, driving material adoption. Government-backed initiatives to enhance EV infrastructure and low-emission vehicles strengthen market growth. Collaboration between OEMs and material suppliers enables cost-effective solutions for commercial and passenger vehicles. Wales’ automotive ecosystem, combined with research-driven material innovation, positions the region as a growing contributor to the national advanced automotive materials market.

Northern Ireland

Northern Ireland represents 10% market share in the U.K. Advanced Automotive Materials Market. Growth is driven by the adoption of lightweight metals, composites, and plastics in small-scale automotive manufacturing and assembly plants. Focus on EV components, electrical systems, and structural enhancements promotes demand for high-performance materials. Local government incentives for clean energy and electric mobility support market expansion. Strategic collaborations between manufacturers, material suppliers, and research institutions accelerate innovation and reduce production costs. While smaller than other regions, Northern Ireland benefits from increasing investments in vehicle lightweighting, safety standards, and sustainable transportation solutions, contributing steadily to the national market.

Rest of U.K.

The rest of the U.K., including smaller automotive clusters and offshore manufacturing units, holds 10% market share. Growth in these regions is driven by niche applications of advanced materials in specialty vehicles, commercial fleets, and EV components. Demand for lightweight metals, composites, and high-performance plastics supports regional market adoption. Investment in R&D centers, government-backed clean mobility projects, and collaborations with leading OEMs enable technology-driven material integration. While comparatively smaller, these regions contribute to the U.K. market by catering to emerging automotive segments and offering innovative material solutions for lightweighting, safety, and fuel efficiency.

Market Segmentations:

By Material

- Metals

- Plastics

- Composites

- Ceramics

By Application

- Structural Components

- Body Panels

- Interior Components

- Electrical Components

By End-Use Vehicles

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers

By Region

- England

- Scotland

- Wales

- Northern Ireland

- Rest of U.K.

Competitive Landscape

The competitive landscape of the U.K. Advanced Automotive Materials Market features key players including Piran Composites, Toray Industries, DuPont de Nemours, Novelis Inc., Wolverine Advanced Materials, Permali Gloucester, Mitsubishi Chemical Corporation, ArcelorMittal, and 3M Company. These companies focus on innovation, strategic partnerships, and expanding production capabilities to maintain a strong market presence. Competition is driven by the need to supply lightweight metals, high-performance plastics, composites, and ceramics for passenger cars, commercial vehicles, and two-wheelers. Firms are investing in R&D to develop durable, cost-effective, and environmentally friendly materials while optimizing manufacturing processes. Collaborations with OEMs and material technology providers enable faster adoption of advanced materials in EVs and next-generation vehicles. The market remains dynamic, with companies leveraging mergers, acquisitions, and technological advancements to gain competitive advantage and cater to increasing demand for lightweighting, fuel efficiency, and enhanced vehicle safety.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Piran Composites

- Toray Industries, Inc.

- DuPont de Nemours, Inc.

- Novelis Inc.

- Wolverine Advanced Materials LLC

- Permali Gloucester Ltd.

- Mitsubishi Chemical Corporation

- ArcelorMittal

- 3M Company

- Other Key Players

Recent Developments

- On October 23, 2025, Novelis announced that its Oswego, New York plant, which supplies approximately 40% of automotive-grade aluminum, will resume operations by the end of December 2025.

- On August 29, 2025, DuPont announced a definitive agreement to sell its Aramids business including the Kevlar® and Nomex® brands to Arclin for approximately $1.8 billion

- In 2024, Zircotec announced advancements in ceramic coatings for electric vehicle (EV) battery enclosures and cooling plates. The company led the CeraBEV project, a U.K. government-supported initiative in collaboration with Cranfield University and MIRA Ltd., aiming to enable the use of lightweight materials in EV battery systems.

- On February 6, 2025, ArcelorMittal announced plans to construct an advanced steel manufacturing facility in Calvert, Alabama, to meet U.S. automotive sector demand

Report Coverage

The research report offers an in-depth analysis based on Material, Application, End Use Vehicle and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow with increasing adoption of lightweight metals and composites.

- Expansion of electric vehicle production will drive demand for advanced plastics and ceramics.

- OEMs will increasingly focus on materials that improve fuel efficiency and reduce emissions.

- Advanced composites will see higher adoption in premium and performance vehicles.

- Structural and safety-focused materials will remain a key growth area due to stricter regulations.

- R&D investment in sustainable and recyclable materials will accelerate market innovation.

- Partnerships between material suppliers and automotive manufacturers will enhance technology integration.

- Demand for multi-material assemblies combining metals, plastics, and composites will rise.

- Growth in commercial vehicles and two-wheelers will create new material application opportunities.

- Lightweighting initiatives and technological advancements will continue to shape market strategies.