Market Overviews

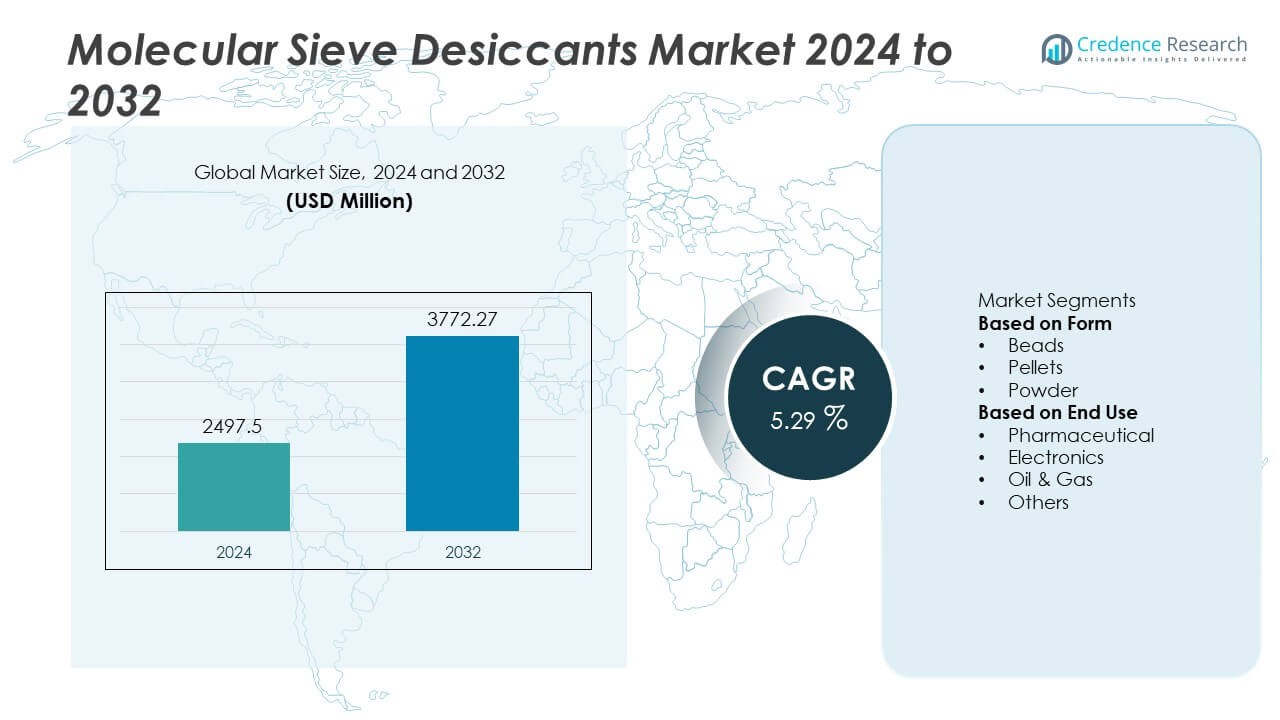

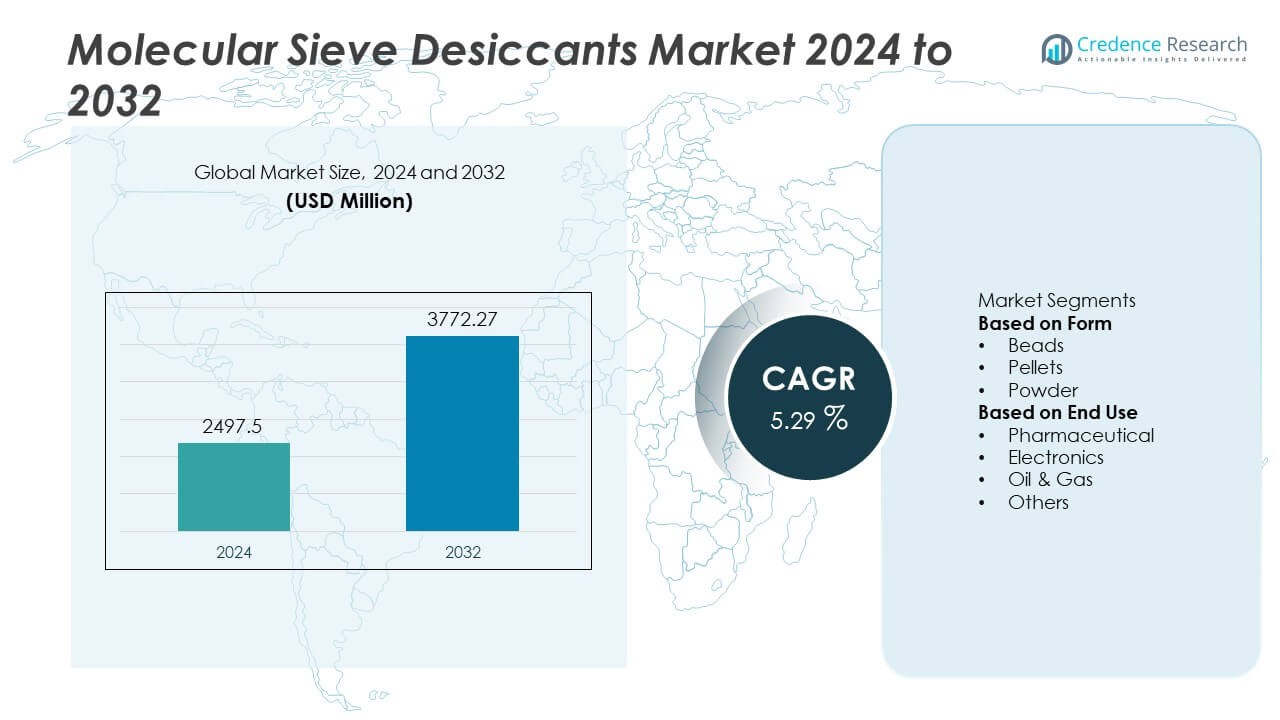

The Molecular Sieve Desiccants market reached USD 2,497.5 million in 2024. The market is projected to hit USD 3,772.27 million by 2032, supported by a CAGR of 5.29% through the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Molecular Sieve Desiccants Market Size 2024 |

USD 2,497.5 Million |

| Molecular Sieve Desiccants Market, CAGR |

5.29% |

| Molecular Sieve Desiccants Market Size 2032 |

USD 3,772.27 Million |

The Molecular Sieve Desiccants market features leading players such as Arkema Group, BASF SE, Honeywell International Inc., Grace Materials Technologies, Zeochem AG, Sorbead India, KNT Group, Jalon Group, Hengye Inc., and Axens Group, each competing through advanced adsorption materials and strong global distribution. These companies focus on high-performance sieve grades for gas processing, pharmaceuticals, electronics, and packaging applications. Asia Pacific remains the leading region with a 34% market share, supported by rapid industrialization, strong semiconductor manufacturing, and expanding petrochemical capacity. North America and Europe follow, driven by strict purity standards, strong pharmaceutical output, and steady investment in industrial gas processing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market reached USD 2,497.5 million in 2024 and is set to reach USD 3,772.27 million by 2032, expanding at a 5.29% CAGR during the forecast period.

- Demand rises due to strong adoption in gas drying, petrochemicals, pharmaceuticals, and electronics, supported by the growing need for precise moisture control across critical industrial processes.

- Beads hold the dominant form share at 46%, while the pharmaceutical sector leads end-use adoption with a 38% share, driven by strict humidity-control standards and rising formulation output.

- Asia Pacific leads the regional landscape with a 34% share, followed by North America at 28% and Europe at 24%, reflecting strong industrial gas processing and expanding semiconductor production.

- Competition intensifies as top players improve adsorption efficiency, but high production and regeneration costs, along with pressure from lower-cost alternatives like silica gel, restrain wider adoption.

Market Segmentation Analysis:

By Form:

Beads hold the dominant position in the form segment with a 46% market share. Beads support strong adoption due to uniform pore distribution, high crush strength, and stable performance in continuous drying operations. Manufacturers in petrochemicals, natural gas processing, and industrial packaging prefer bead structures for longer service life and faster regeneration cycles. Pellets follow due to their suitability in high-pressure gas treatment plants that require controlled flow resistance. Powder forms gain traction in coatings, adhesives, and polymer processing lines where fine moisture scavenging is essential. Growth remains steady as end users seek reliable adsorption media for large-scale moisture control.

- For instance, BASF SE’s Sorbead R products have a high resistance to crushing, with specific grades like Sorbead R and Sorbead Air R typically having a crush strength of 200 N and 180-200 N per bead, respectively. These materials are used to enable longer operating runs in gas treatment units due to their durability and high capacity.

By End Use:

The pharmaceutical sector leads the end-use segment with a 38% market share, driven by strict moisture-control needs in drug formulations, APIs, and diagnostic kits. Molecules remain stable when stored with 3A and 4A sieve grades that maintain low residual humidity. Electronics manufacturing follows due to rising demand for desiccant integration in IC packaging, circuit assemblies, and precision optical devices. Oil and gas facilities rely on molecular sieves for dehydration of natural gas streams and refinery feedstocks. Other sectors, including chemicals and food processing, adopt sieves to improve production consistency and shelf-life stability across diverse industrial setups.

- For instance, Zeochem AG supplies 4A sieves for various industrial drying applications, including the removal of moisture from gas and liquid streams. Molecular sieves are used to achieve very low moisture levels, often down to 0.1-1.0 ppmv or less, in applications such as natural gas processing and petrochemical production.

Key Growth Drivers

Growing Demand for High-Purity Gas and Industrial Drying

Rising adoption of high-purity gas across petrochemical, natural gas processing, and industrial manufacturing drives strong uptake of molecular sieve desiccants. Companies depend on these materials to remove moisture, CO₂, and sulfur compounds with high adsorption efficiency. The push toward cleaner fuels and stricter dehydration standards in LNG, hydrogen, and refinery operations supports wider deployment. Manufacturers prefer molecular sieves because they maintain stable performance across variable temperatures and pressures. Expanding investments in gas treatment and air-separation units continue to reinforce long-term demand for advanced desiccant systems.

- For instance, Zeochem AG operates production lines that manufacture various grades of molecular sieves, including grades used in high-load gas dehydration units. The company’s 13X sieves are specifically designed with high capacity and enhanced adsorption properties for removing water and other impurities in natural gas treatment plants.

Expansion of Pharmaceutical and Diagnostic Production

Pharmaceutical companies rely on molecular sieve desiccants to stabilize moisture-sensitive formulations, diagnostic kits, and active ingredients. Rising production of biologics, vaccines, and rapid diagnostic devices increases the need for precise humidity control. Growth in blister packaging and controlled packaging environments further supports wider use of 3A and 4A sieves. Regulatory bodies mandate strict moisture-protection standards, which pushes manufacturers to adopt desiccants with consistent adsorption capacity. Rising pharmaceutical manufacturing in India, China, and Southeast Asia strengthens the segment, supported by expanding export-oriented drug facilities.

- For instance, Honeywell’s UOP molecular sieve units can be used to support humidity control in a variety of manufacturing and packaging facilities by removing trace amounts of moisture and other contaminants.

Rapid Growth of Electronics and Semiconductor Manufacturing

The electronics sector uses molecular sieve desiccants to protect integrated circuits, displays, sensors, and optical components from failure caused by humidity. Manufacturers adopt sieves to maintain reliability in chip packaging, wafer processing, and precision assembly lines. Growing production of high-density chips, 5G infrastructure, and automotive electronics drives higher moisture-control requirements. The rising shift to miniaturized components increases the risk of moisture-related corrosion, boosting adoption of advanced adsorption media. Expanding semiconductor fabrication capacity in Asia Pacific plays a central role in sustaining market expansion.

Key Trends & Opportunities

Shift Toward High-Capacity and Regenerable Adsorbents

Producers develop sieves with improved pore uniformity, stronger mechanical stability, and longer regeneration cycles. These enhancements appeal to users seeking reduced downtime and lower operational costs. Regenerable desiccants support sustainability goals by reducing waste generated from single-use moisture absorbers. The trend benefits gas treatment, petrochemical plants, and electronic packaging operations that require dependable long-term performance. Companies also integrate advanced quality-control systems to produce sieves with tighter particle size distribution, creating new opportunities for precision-demanding applications.

- For instance, Grace Materials Technologies developed high-strength 4A and 13X grades that withstand compressive loads exceeding 120 newtons per bead, supporting long regeneration cycles in refinery dehydration units. The company uses automated optical inspection systems capable of screening more than 50 million beads per day to maintain narrow size tolerances.

Rising Adoption in Sustainable and Circular Packaging Solutions

Growing demand for eco-friendly packaging creates opportunities for molecular sieves in food, pharma, and electronic packaging. Manufacturers introduce lightweight desiccant units for recyclable and biodegradable materials. Demand rises as brand owners seek materials that extend shelf life without adding chemical preservatives. Growth in e-commerce and cold-chain logistics also increases desiccant use for long-distance shipping. Opportunities strengthen as companies explore hybrid moisture-control solutions that combine molecular sieves with bio-based packaging technologies.

- For instance, Sorbead India produces compact desiccant canisters weighing as low as 0.5 grams for sustainable packaging lines, supporting moisture control for more than 200 million units each year. The company’s plant integrates ISO-certified automated filling systems that maintain dosage accuracy within ±0.02 grams.

Key Challenges

High Production and Regeneration Costs

The manufacturing of molecular sieves requires controlled synthesis conditions, precise pore structure formation, and high-temperature activation, leading to elevated production costs. End users in cost-sensitive industries may switch to cheaper alternatives such as silica gel or activated alumina, especially for low-precision drying tasks. Regeneration cycles also require significant energy input, adding to operational expenses. These cost pressures limit adoption in small facilities and low-margin industrial applications. Manufacturers must optimize processes to stay competitive in price-driven markets.

Competition from Alternative Desiccant Technologies

Silica gel, activated carbon, and alumina continue to challenge molecular sieve adoption in markets that do not require tight moisture control. These substitutes offer lower cost, simpler handling, and wider availability, making them preferred choices for general drying applications. Their presence restricts molecular sieves to high-precision environments where stringent adsorption performance is necessary. Industries lacking advanced moisture-sensitivity may avoid shifting to molecular sieves due to higher material and regeneration costs. This competitive landscape requires manufacturers to highlight performance advantages clearly.

Regional Analysis

North America

North America accounts for a 28% market share, supported by strong demand from natural gas processing, petrochemicals, and pharmaceutical packaging. The region benefits from large LNG exports, which require high-efficiency dehydration units using molecular sieve desiccants. Growth in semiconductor fabrication across the United States drives further adoption, as electronics manufacturers rely on precise moisture control. Rising investments in biopharmaceutical plants strengthen long-term usage in drug formulation and diagnostic kit packaging. Regulatory standards for industrial air quality and refinery processing also reinforce steady consumption across major industries.

Europe

Europe holds a 24% market share, driven by strict environmental regulations and advanced manufacturing systems across Germany, France, and the United Kingdom. Chemical plants, air-separation units, and specialty gas suppliers adopt molecular sieve desiccants to ensure consistent purity levels. The pharmaceutical sector remains a major consumer due to high production of APIs and moisture-sensitive formulations. Growth in renewable hydrogen projects and industrial gas recycling increases demand for robust adsorption technologies. Expansion of electronics assembly and precision optical manufacturing also contributes to long-term stability across the region.

Asia Pacific

Asia Pacific leads with a 34% market share, supported by rapid industrialization and high consumption across China, India, Japan, and South Korea. Expanding petrochemical complexes and natural gas processing plants drive large-scale deployment of molecular sieve desiccants. Strong electronics and semiconductor manufacturing in countries like China and South Korea boosts demand for moisture-control solutions. Pharmaceutical production grows steadily as regional companies scale exports of formulations and diagnostic devices. Rising investments in LNG terminals, industrial gases, and chemical processing reinforce the region’s dominant position.

Latin America

Latin America holds an 8% market share, driven by increasing demand from oil and gas operations in Brazil, Argentina, and Mexico. Molecular sieve desiccants support dehydration of natural gas streams and refinery feedstocks in expanding midstream and downstream sectors. Pharmaceutical packaging adoption grows as regional drug manufacturers scale export-focused production. Food processing, chemical blending, and industrial drying applications also strengthen market penetration. Infrastructure modernization and rising imports of specialty gases help sustain long-term demand across multiple industries in the region.

Middle East & Africa

The Middle East & Africa region accounts for a 6% market share, supported by strong investment in natural gas processing, petrochemical facilities, and refinery expansions. Countries such as Saudi Arabia, Qatar, and the United Arab Emirates use molecular sieve desiccants for large-scale gas dehydration and sulfur removal applications. Industrial gas producers adopt advanced sieve grades to maintain consistency in purification systems. Pharmaceutical packaging and electronics assembly gain momentum in emerging African markets. Growing energy diversification initiatives further boost adoption across critical industrial applications.

Market Segmentations:

By Form

By End Use

- Pharmaceutical

- Electronics

- Oil & Gas

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape includes major participants such as Arkema Group, BASF SE, Honeywell International Inc., Grace Materials Technologies, Zeochem AG, Sorbead India, KNT Group, Jalon Group, Hengye Inc., and Axens Group. These companies compete through product innovation, advanced adsorption technologies, and expanded manufacturing capabilities across high-purity and industrial-grade molecular sieves. Global suppliers focus on optimizing pore structures, improving regeneration efficiency, and enhancing mechanical strength to meet rising demand in gas processing, pharmaceuticals, electronics, and packaging applications. Strategic partnerships with petrochemical plants, LNG facilities, and pharmaceutical manufacturers help strengthen long-term supply agreements. Firms also invest in capacity expansion across Asia Pacific to meet strong growth in semiconductor and industrial gas markets. Sustainability initiatives gain traction as producers develop energy-efficient activation processes and explore eco-friendly adsorbent formulations. Competitive intensity remains high as regional players scale cost-effective products, prompting leading companies to differentiate through quality, consistency, and application-specific performance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Zeochem AG acquired the key assets of SiliCycle Inc., establishing Zeochem Silica Materials Inc., thereby expanding its materials/adsorbents offering.

- In 2025, Axens Group continues development and supply of molecular sieve products tailored for separation and drying in refining and petrochemical industries, focusing on performance and operational efficiency.

Report Coverage

The research report offers an in-depth analysis based on Form, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-capacity molecular sieves will rise as gas processing plants expand.

- Adoption in pharmaceutical packaging will grow due to stricter humidity-control standards.

- Electronics and semiconductor production growth will increase the need for advanced desiccants.

- New regeneration-efficient sieve grades will reduce operating costs for industrial users.

- LNG, hydrogen, and refinery projects will drive higher consumption in dehydration systems.

- Asia Pacific will strengthen its leadership as manufacturing capacity continues to expand.

- Producers will focus on energy-efficient activation technologies to support sustainability goals.

- Adoption in specialty packaging for diagnostics and medical devices will accelerate.

- Competition will intensify as regional manufacturers scale cost-effective adsorption products.

- Integration with smart monitoring systems will create new opportunities for performance tracking.